2025 Guide to Staying Safe with Cashback Services

Image Source: pexels

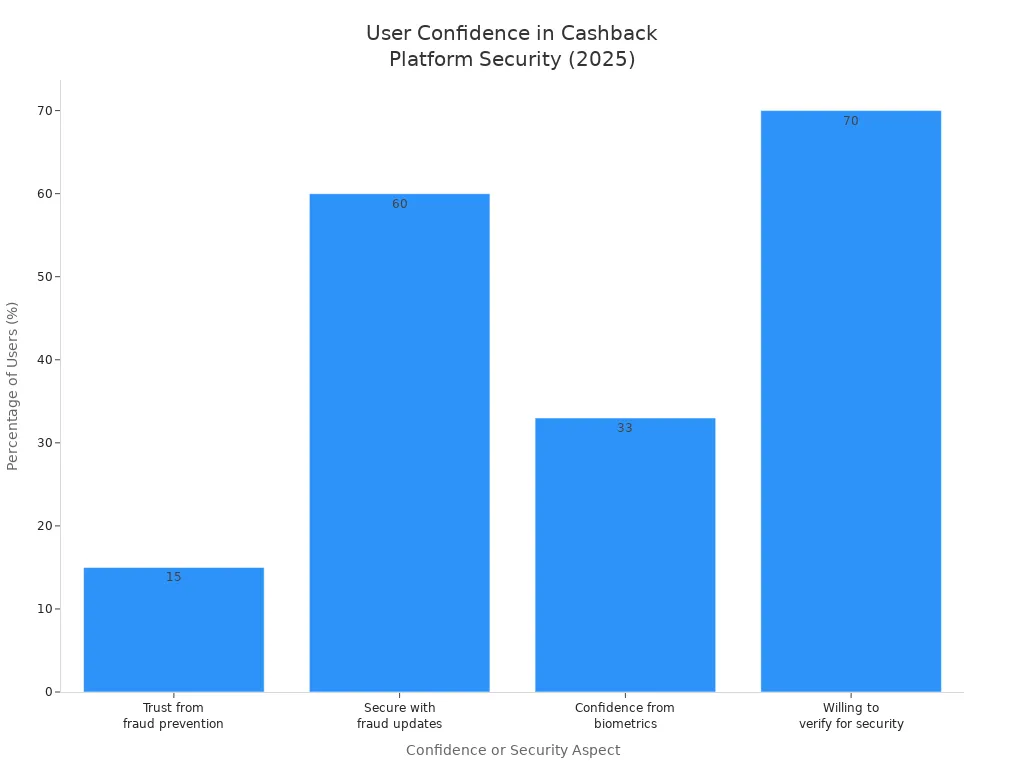

You may wonder if cashback services remain safe in 2025. Many platforms use advanced fraud prevention, but some risks still exist. About 60% of users feel more secure thanks to regular fraud prevention updates. Over 80% believe that secure and transparent redemption is crucial for trust. The table below shows how people view different security measures for cashback apps.

| Aspect of User Confidence or Security Measure | Percentage Reported |

|---|---|

| Increase in user trust due to fraud prevention measures | 15% |

| Users feeling more secure with frequent fraud prevention updates | 60% |

| Increase in confidence from biometric authentication | 33% |

| Users who believe secure and transparent redemption is crucial | Over 80% |

| Users willing to undergo additional verification for better security | 70% |

You should always check if a platform is legit and keep your personal information safe. Cashback Safety means staying alert to scams and data breaches when using cashback apps or websites.

Key Takeaways

- Always use cashback platforms that show strong security, like HTTPS encryption and clear privacy policies.

- Protect your personal data by sharing only what is necessary and using strong, unique passwords with two-factor authentication.

- Download cashback apps only from official stores to avoid fake apps and malware.

- Watch for red flags such as unrealistic rewards, requests for sensitive information, or poor customer support before joining any platform.

- Regularly monitor your cashback and bank accounts for unusual activity and report any suspicious behavior immediately.

Cashback Safety in 2025

Are Cashback Websites Safe?

You may ask, “Are cashback websites safe in 2025?” Most cashback websites use strong security measures to protect your information. Many of these platforms are legit and have built trust with users over time. You can find rewards-based websites that offer real cashback and follow strict privacy rules. These sites often use encryption, regular security updates, and clear privacy policies.

However, not every cashback website is safe. Some fake sites try to steal your data or trick you into sharing sensitive information. You should always check if a platform is legit before signing up. Look for reviews and ratings from other users. A legit cashback website will never ask for your Social Security number or other sensitive details.

Note: Always download cashback apps from trusted app stores. This helps you avoid malware or fake versions that can put your data at risk.

Common Concerns

Cashback safety remains a top concern for many users. Even though most platforms are legit, scams and fraud still exist. Some websites may promise high rewards but never pay out. Others might collect your data and sell it without your knowledge. You may also face risks like phishing emails or fake customer service contacts.

To stay safe, you need to stay alert and know what to watch for. Here are some common steps that help protect your cashback safety:

- Download apps only from trusted app stores.

- Read privacy policies to see how your data gets used.

- Use strong, unique passwords for each cashback account.

- Monitor your bank and credit card accounts for any strange activity.

- Limit the personal information you share, especially sensitive data.

- Review and remove app permissions you do not need.

- Check app reviews and ratings before you sign up or share information.

You should also remember that even legit cashback websites can face data breaches. No system is perfect. If you notice delayed payouts or requests for extra personal information, take extra care.

Tip: If a cashback offer sounds too good to be true, it probably is. Trust your instincts and do your research before joining any new platform.

Cashback safety in 2025 depends on your vigilance. You can enjoy the benefits of cashback while keeping your information safe. Stay informed, use secure practices, and always check if a platform is legit before you trust it with your data.

How It Works

Cashback Process

You can earn cashback by following a simple process on most leading platforms in 2025. Here is how the journey usually looks:

- Sign up with your phone, email, or social account. Set up your profile and payment method.

- Search for cashback offers using filters, location tools, or smart sorting.

- Earn cashback by linking your card for automatic tracking or by uploading your receipts.

- Track your cashback in real time. You can see your progress and transaction history right away.

- Redeem your cashback through bank transfers, gift cards, or wallet credits. Many platforms let you choose the best way for you.

- Merchants create and manage offers, then validate your redemptions. This helps keep the process smooth.

- Platform admins watch over users, merchants, and offers. They also handle security and prevent fraud.

- The technology behind these platforms uses secure payments and real-time updates. This keeps your experience safe and fast.

Note: Many platforms now use AI to show you the best deals and blockchain to keep your transactions secure.

You can earn cashback on both online and in-store purchases. Some platforms even give you cash rewards for special promotions or referrals.

Platform Types

You have several ways to access cashback services. Each type offers different features and safety measures. The table below compares some popular options:

| Platform | Type | Safety & Privacy Highlights | Trust Factors | Mobile Support & Usage |

|---|---|---|---|---|

| Rakuten | Browser extension + app | Does not collect passwords or payment info; uses anonymized shopping data; clear affiliate marketing | Publicly traded; strong reputation | Mobile app; Safari extension; supports in-store cashback with linked cards |

| Honey | Browser extension + app | Needs browser permissions; does not collect sensitive info; collects shopping data | Trusted by millions; some past commission claims | Mobile app; Safari extension; integrated with PayPal; limited mobile browser support |

| Capital One Shopping | Browser extension | Needs permissions; collects shopping data; does not collect sensitive info | Backed by Capital One bank | No dedicated app; mobile-friendly site; some Android browser extension support |

You should always install these apps or extensions from official sources. This helps protect your data and ensures you earn cashback safely. Some platforms work best on mobile, while others fit better with desktop browsers. You can choose the one that matches your shopping habits.

Risks

Image Source: pexels

Fraud and Scams

You face several types of fraud when using cashback services in 2025. Criminals use many tricks to steal your rewards or personal information. Here are some of the most common fraud methods:

- Account takeover: Hackers use stolen passwords or phishing to access your account and steal your loyalty points.

- Promo abuse: People create fake accounts or use stolen identities to claim sign-up bonuses and promotions.

- Social engineering: Scammers trick customer service into resetting your password or transferring your points.

- Gift card fraud: Thieves buy gift cards with stolen credit cards and turn them into loyalty points.

- Point theft and redemption fraud: Criminals exploit system weaknesses to steal and redeem points.

- Synthetic identity fraud: Fraudsters use fake identities to collect and cash out rewards.

- Friendly fraud: Some users falsely claim rewards or dispute transactions to get extra cashback.

- Insider threats: Employees may misuse their access to steal points or manipulate accounts.

- Cross-border syndicates: Organized groups target cashback platforms across countries.

Loyalty points and cashback rewards are valuable. They are easy to transfer and often less protected than your bank account. You should stay alert for suspicious activity and always use strong passwords.

Data Privacy

Cashback platforms collect a lot of personal information. They may ask for your banking details, purchase history, and even your location. Many users worry about how these platforms use and protect their data. About 59% of people feel uneasy sharing personal information on cashback apps. Around 41% do not fully trust app providers because of past data misuse. Nearly half of users want clear data policies before they join a cashback program.

Some platforms share your data with third parties for marketing. Data leaks can hurt your trust and damage a company’s reputation. You should avoid using social media sign-ins, limit the data you share, and review privacy settings often. Choose cashback sites that follow strict privacy laws and use strong encryption. Always monitor your account for strange activity.

Overpayment Scams

Overpayment scams can trick you into losing money. Scammers may offer to pay more than the price of a product or service. They might then ask you to send the extra money to a third party. This is a major warning sign. You should only accept payments for the exact amount. Refunds must go back to the original payment card. Always check the customer’s name, phone number, and billing address. Use address verification services when possible.

Watch out if someone insists on using a specific payment processor or offers to pay transaction fees. These actions are not normal and may signal fraud. Take your time with large purchases and trust your instincts if something feels wrong.

Note: Cashback services can also encourage you to spend more than planned. Delayed payouts may cause frustration. Always track your spending and check payout timelines to avoid surprises.

Identifying Safe Platforms

Image Source: pexels

Red Flags

You need to watch for red flags when choosing a cashback platform. Some signs show a platform may not be trustworthy. If you see these warning signs, you should think twice before signing up:

- The website does not use HTTPS encryption. Your data could be at risk if you see “Not Secure” in the browser bar.

- The company does not list a real address or business registration. You cannot verify who owns the platform.

- Terms and conditions are missing or hard to find. You do not know what rules you agree to.

- The platform promises very high rewards that seem unrealistic. This can be a trick to get your information.

- Many users report account freezes or poor customer support. You may have trouble getting help if something goes wrong.

- The platform asks for sensitive information, like your Social Security number, without a clear reason.

- You see hidden fees or confusing payout rules. These can make it hard to get your cashback.

Tip: If you notice more than one of these red flags, you should look for another option.

What to Look For

You can spot a safe cashback platform by checking a few key indicators. Reliable platforms show clear signs of trust and security. The table below lists important features you should check:

| Indicator | Explanation |

|---|---|

| Legitimacy and Ownership | Platform owned by a registered company with a real address and business activities. |

| Data Security | Uses valid HTTPS encryption to keep your data safe. |

| Clear Terms and Conditions | Easy-to-read terms you can review before signing up. |

| Payment Methods | Offers trusted payout options like PayPal or bank transfer. |

| User Experience | Positive reviews about reliability and customer support. |

You should also look for platforms that use multi-factor authentication and real-time fraud detection. Experts recommend regular security audits and user education to keep your account safe. Always read recent user feedback and compare platforms before you join. If you follow these steps, you can enjoy cashback rewards with confidence.

Tips for Cashback Safety

Protecting Data

You should always protect your personal information when using cashback services. Limit the amount of data you share. Only enter details on secure websites that show a padlock icon and use “https” in the address. Never give out your login or account information to anyone you do not trust. Log out after each session, especially if you use a public or shared computer. Keep your software and security apps updated to block new threats.

Tip: Use a separate email address for cashback accounts. This helps keep your main inbox safe from spam and phishing attempts.

Strong Passwords

Create strong passwords for every cashback account. Use at least 10 characters, mixing uppercase and lowercase letters, numbers, and special symbols. Avoid using the same password for different accounts. Password managers can help you generate and store complex passwords safely. Enable two-factor authentication if the platform offers it. Change your password right away if you suspect a breach.

- Do not use personal information like birthdays or names.

- Make each password unique.

- Update passwords regularly.

Using Official Sources

Always download cashback apps from official app stores or the company’s website. Unofficial sources may offer fake apps that steal your data or do not pay out rewards. Read the privacy policy and terms before you sign up. Watch for red flags like deals that seem too good to be true or requests for payment by gift card or wire transfer.

Note: Apps with poor ratings or many complaints often fail to deliver promised rewards. Stick to trusted platforms to earn cashback safely.

Monitoring Accounts

Check your cashback and linked bank accounts often. Early detection of suspicious activity can prevent financial loss. Set up account alerts to track transactions. Review your statements to spot unauthorized charges or delayed payouts. If you see anything unusual, contact your bank or the cashback provider right away.

Treat cashback as a bonus, not a reason to overspend. Always read the terms, watch for payout delays, and avoid buying things you do not need just to earn cashback.

You can stay safe with cashback services in 2025 by following a few important steps:

- Learn the security features of your debit card, such as EMV chips and PINs.

- Remember that cashback rewards are a percentage of your spending, not free money.

- Check your account activity often to spot unauthorized transactions.

- Read the terms and conditions for each cashback program.

- Pick a cashback card that matches your spending habits.

- Watch out for fees that can lower your rewards.

- Focus your spending on categories with higher cashback rates.

- Choose cards with flexible redemption and no expiration on rewards.

- Set up alerts for cashback balances and redemption opportunities.

Cashback platforms improve safety by listening to your feedback and fixing confusing features. You help make these services better when you share your experiences or ask questions. Stay alert, use secure cards, and keep learning about new safety features to protect your information.

FAQ

How do you know if a cashback app is safe?

Check for HTTPS in the website address. Read user reviews. Look for clear privacy policies. Download only from official app stores. Avoid apps that ask for sensitive information like your Social Security number.

What should you do if your cashback payout is delayed?

Contact customer support through the app or website. Check your account for payout rules and timelines. Keep records of your transactions. If you do not get help, consider leaving a review to warn others.

Can you use more than one cashback platform at the same time?

Yes, you can use several platforms. Some users stack rewards by using multiple apps or browser extensions. Always check each platform’s rules to avoid breaking any terms.

What personal information do cashback platforms collect?

Most platforms collect your name, email, purchase history, and payment details. The table below shows common data types:

| Data Type | Example |

|---|---|

| Name | John Smith |

| john@email.com | |

| Purchase History | Store, date, amount |

| Payment Details | Card type, last 4 digits |

As cashback services grow, concerns like high fees, data privacy risks, and unreliable platforms highlight the need for secure financial solutions. BiyaPay offers a dependable alternative: real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies with flexible options, and remittance fees as low as 0.5% to save you money while ensuring fund safety. Plus, its quick registration and no-overseas-account-needed US/HK stock investment features simplify global finance management. Visit BiyaPay now to experience these benefits and leave traditional platform worries behind! For secure remittances or investments, start your journey with BiyaPay today!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Another Major Drop! Why Is the A-Share Index Falling Non-Stop – Where Exactly Is the Problem?

Beginner’s Guide: What to Do When a Stock Hits Limit-Down? Can You Still Trade?

A-Share Beginner’s Guide: Master Market Hours and Trading Rules in One Article

Want to Predict A-Share Market Moves? Understanding These 5 Macro Signals Is Enough

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.