- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Tencent Holdings Company Background and Latest Financial Analysis

Image Source: pexels

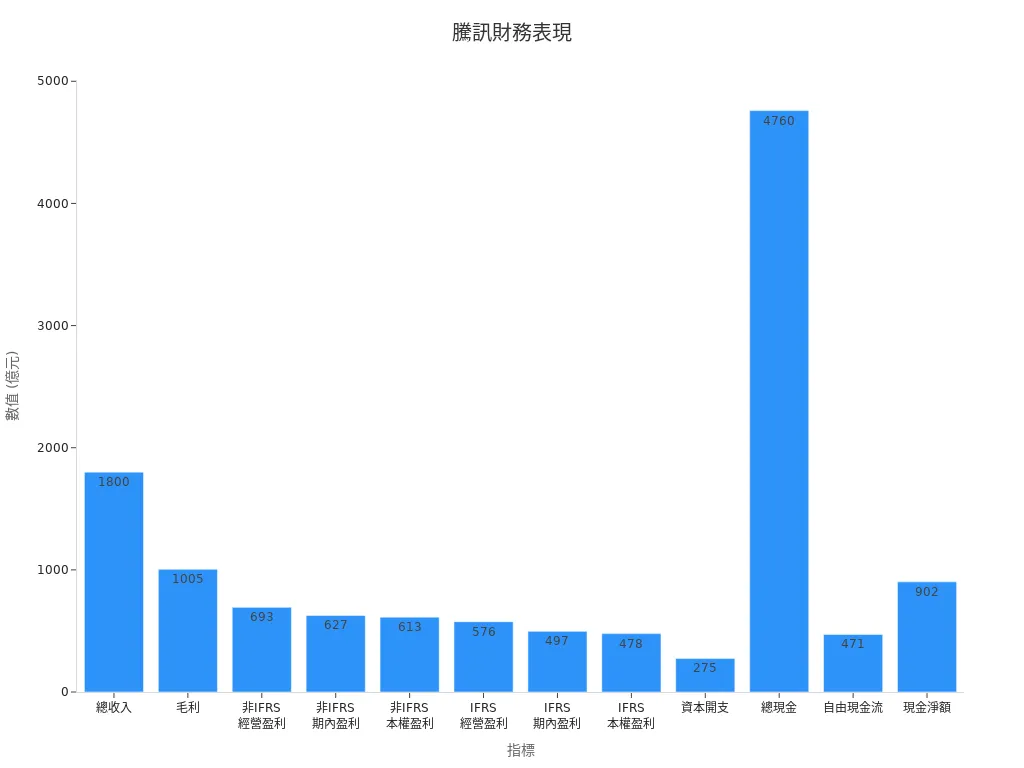

Tencent Holdings Company was established in 1998, headquartered in Shenzhen, and has become a leading internet technology company in China and globally. The company’s mission is “user-centric, technology for good,” actively promoting technological innovation. According to the Q1 2025 financial report, Tencent’s total revenue was approximately USD 25.2 billion (at 1 USD = 7.15 CNY), with a gross profit of USD 14 billion, demonstrating stable growth. The table below lists the latest financial data, with the market closely monitoring Tencent’s Hong Kong stock price.

| Indicator | Value (CNY) | Year-on-Year Growth | Remarks |

|---|---|---|---|

| Total Revenue | 180 billion | 13% | Q1 2025 |

| Gross Profit | 100.5 billion | 20% | |

| Non-IFRS Operating Profit | 69.3 billion | 18% | Operating margin increased from 37% to 39% |

| Non-IFRS Profit for the Period | 62.7 billion | 22% | |

| Non-IFRS Profit Attributable to Equity Holders | 61.3 billion | 22% | |

| Basic Earnings per Share | 6.735 | N/A | |

| IFRS Operating Profit | 57.6 billion | 10% | Operating margin decreased from 33% to 32% |

| IFRS Profit for the Period | 49.7 billion | 17% | |

| IFRS Profit Attributable to Equity Holders | 47.8 billion | 14% | |

| Basic Earnings per Share | 5.252 | N/A | |

| Capital Expenditure | 27.5 billion | 91% | |

| Total Cash | 476 billion | N/A | |

| Free Cash Flow | 47.1 billion | -9% | |

| Net Cash | 90.2 billion | N/A |

Key Points

- Tencent Holdings, founded in 1998, is a leading internet technology company in China and globally, with a vast user base and diversified businesses.

- The company’s Q1 2025 financial performance was stable, with sustained revenue and profit growth, ample cash flow, and significantly increased capital investment to support AI and technological innovation.

- Tencent’s core businesses include social platforms, gaming, financial technology, and cloud computing, collectively driving sustained growth and market competitiveness.

- The company actively expands into global markets, prioritizes technological innovation and user needs, and is committed to ensuring data security and user privacy.

- Investors should monitor Tencent’s financial performance, policy risks, and industry trends, as the company has long-term growth potential but needs to flexibly address market challenges.

Company Background

Image Source: pexels

Establishment and Development

Tencent Holdings Company was founded in 1998 in Shenzhen, China. The company adopted a Variable Interest Entity (VIE) structure to facilitate its listing in Hong Kong. Over the years, Tencent has expanded its businesses, becoming a global leader in technology. In 2024, Tencent’s total revenue reached approximately USD 92.3 billion (at 1 USD = 7.15 CNY), up 8% year-on-year. The company’s annual profit was about USD 31.8 billion, up 40%. Tencent Video’s paid subscribers reached 113 million, and Tencent Music’s paid subscribers reached 121 million. The activity of WeChat Mini Stores and Video Accounts continued to grow, demonstrating Tencent’s strong influence in digital content and social sectors.

Tencent actively promotes product innovation, increasing its evergreen game portfolio from 12 to 14 titles, with its公益 platform connecting over 280 million users, collaborating with more than 2,200公益 organizations and 20,000 companies, reflecting its diversified development.

| Indicator Category | 2024 Annual Data and Year-on-Year Growth |

|---|---|

| Total Revenue | USD 92.3 billion, up 8% |

| Annual Profit | USD 31.8 billion, up 40% |

| Capital Expenditure | USD 10.7 billion, up 221% |

| Total Cash | USD 58.1 billion |

Corporate Mission

Tencent’s corporate mission is “user-centric, technology for good.” The company prioritizes user needs, committed to improving lives through technology. Tencent holds a leading position in China’s internet industry, actively participates in公益 initiatives, and promotes data security and user privacy protection. The company aims to create positive societal impact through innovative technology.

Shareholder Structure

Tencent’s major shareholders include South Africa’s Naspers Group (via Prosus) and several international investment institutions. The company is listed on the Hong Kong Stock Exchange under the stock code 0700. Tencent prioritizes data security policies, strictly complying with relevant regulations to safeguard user data. The company continues share buybacks, repurchasing approximately 307 million shares in 2024 for a total cost of about USD 15.7 billion, further enhancing shareholder value.

Core Businesses

Social Platforms

Tencent’s social platforms are primarily WeChat and QQ. WeChat and WeChat combined have 1.402 billion monthly active users, demonstrating a massive user base. By the end of 2023, WeChat had 1.343 billion monthly active users, with a net increase of 7 million in a single quarter. Since its launch in 2014, the WeChat Red Packet feature saw over 11 billion downloads on Lunar New Year’s Day, with over 2.2 billion red packets sent and received, becoming a key tool for daily social interactions. WeChat Video Accounts doubled user engagement time, with annual GMV of approximately USD 490 million (at 1 USD = 7.15 CNY), and advertising revenue exceeding USD 210 million. QQ continues to attract younger users, maintaining stable activity. Tencent’s social platforms provide a vast traffic pool for advertisers, driving advertising business growth.

Gaming Business

Tencent is a leading player in China’s gaming market, with a market share exceeding 50%. Tencent’s mobile gaming platform has over 2 billion registered accounts, with daily active accounts exceeding 170 million. In Q2 2023, gaming revenue exceeded USD 420 million. Tencent’s games occupy 6 to 7 spots in the App Store’s top 10 bestselling list, showing strong competitiveness. Approximately 30% of gaming revenue comes from international markets, reflecting overseas expansion potential. Tencent continues to launch innovative games and strengthen content development, solidifying its leadership in the global gaming industry.

Financial Technology

Tencent’s financial technology business is centered on WeChat Pay. WeChat Pay is China’s second-largest mobile payment platform, with 800 million monthly active users in Q2 2018. In Q3 2024, WeChat Mini Program transaction volume exceeded USD 28 billion, up by double-digit percentages year-on-year. Transaction growth came from scenarios like dining, electric vehicle charging, and healthcare services. In Q1 2022, financial technology and enterprise services revenue was USD 6 billion, accounting for 31.6% of total revenue. This segment’s gross margin is around 28%, with limited profit contribution but a vast user base. Through the WeChat Mini Store platform, Tencent provides traffic and transaction support for merchants, expanding transaction scale.

Cloud Computing and Video

Tencent Cloud has held the top market share in China for seven consecutive years. Cloud computing revenue accounts for about 20% of financial technology and enterprise services. Tencent Cloud continues to improve content generation efficiency and product features, driving rapid growth in AI-related revenue. Tencent Video has 113 million paid subscribers, with a content creation strategy focusing on self-produced dramas, variety shows, and sports events, attracting a large young audience. The Video Account team exceeds 300 members, with product policy announcements nearly doubling from 2022, indicating continued investment and optimization. Tencent Video’s ongoing innovation enhances user engagement, making it a key player in the digital content industry.

Tencent Hong Kong Stock Price and Financial Condition

Image Source: unsplash

Financial Metrics

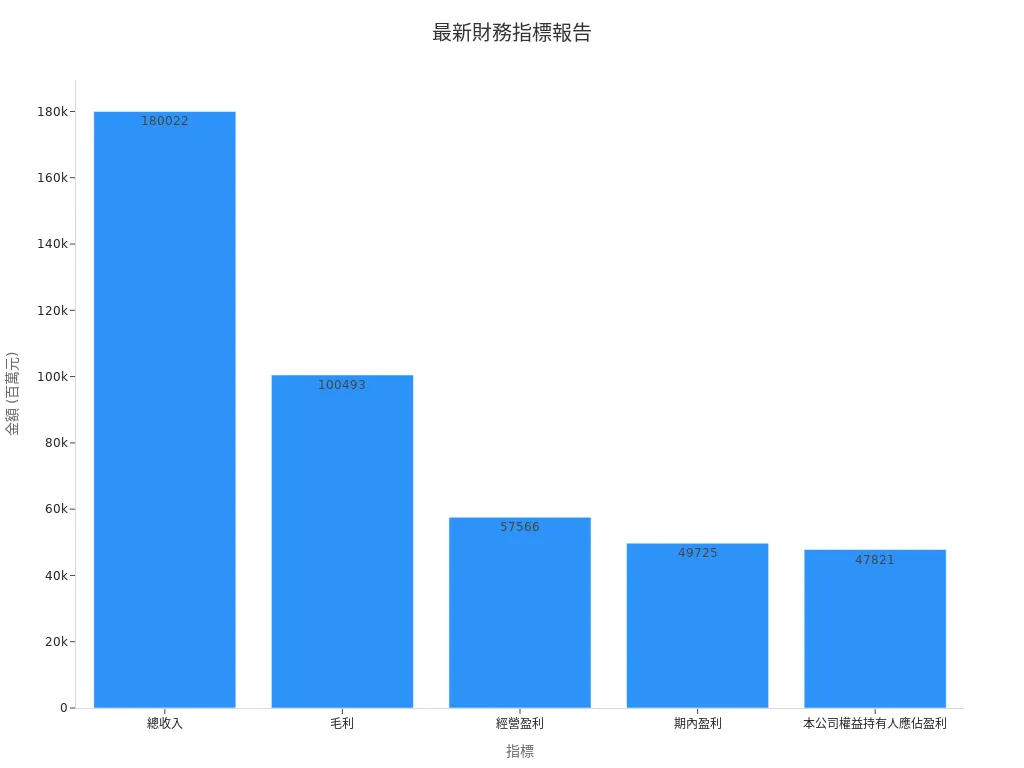

Tencent Holdings Company demonstrated stable financial performance in Q1 2025. The company’s total revenue reached approximately USD 25.2 billion (at 1 USD = 7.15 CNY), up 13% year-on-year. Gross profit was about USD 14 billion, with a gross margin of 56%. Operating profit was USD 5.76 billion, with an operating margin of 32%. Profit for the period reached USD 4.97 billion, up 17%. Basic earnings per share were CNY 5.252, equivalent to approximately USD 0.73. Diluted earnings per share were CNY 5.129, equivalent to approximately USD 0.72. These metrics reflect Tencent’s continued improvement in profitability, boosting investor confidence.

| Indicator | Q1 2025 (CNY Million) | Year-on-Year Growth | Remarks |

|---|---|---|---|

| Total Revenue | 180,022 | +13% | Per IFRS |

| Gross Profit | 100,493 | +20% | Gross margin 56% |

| Operating Profit | 57,566 | +10% | Operating margin 32% |

| Profit for the Period | 49,725 | +17% | |

| Profit Attributable to Equity Holders | 47,821 | +14% | |

| Basic Earnings per Share (CNY) | 5.252 | +17% | |

| Diluted Earnings per Share (CNY) | 5.129 | +17% |

Tencent’s Hong Kong stock price was active following the financial report release, with the market generally viewing the company’s fundamentals as stable, attracting long-term investor attention.

Price-to-earnings (P/E) ratio and return on investment (ROI) are key indicators for assessing Tencent’s Hong Kong stock price. Although the latest report did not directly disclose P/E and ROI, the increase in earnings per share (EPS) and operating margin reflects enhanced profitability. These data help investors judge the reasonable level of Tencent’s Hong Kong stock price.

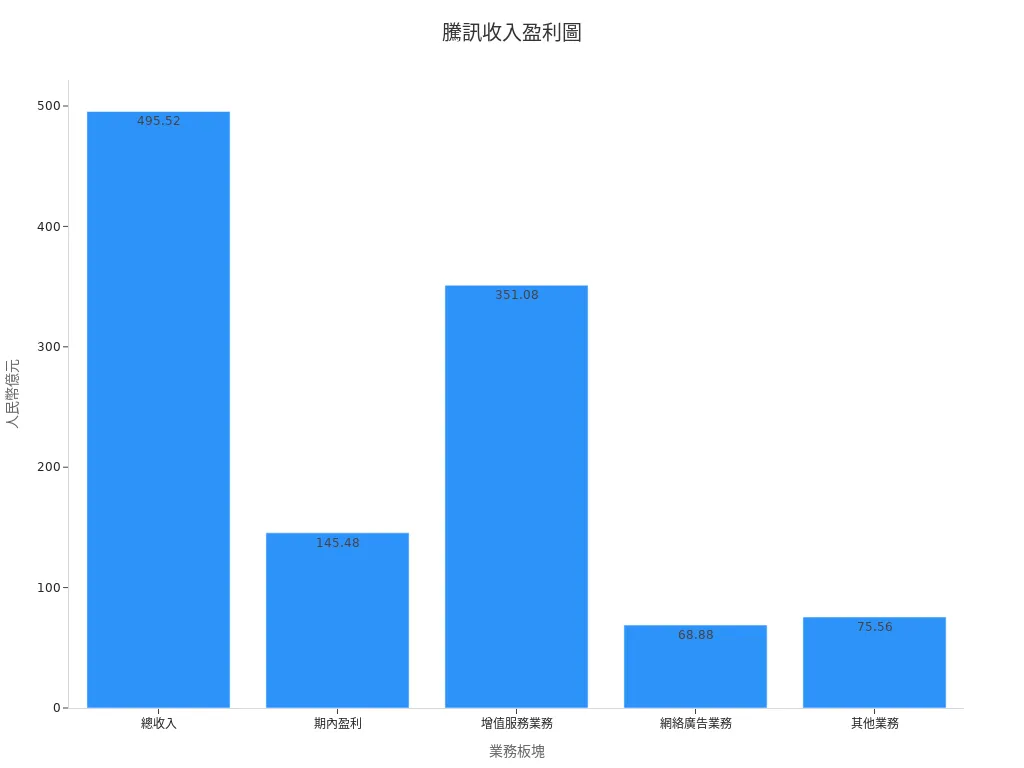

Revenue and Profit

Tencent’s revenue sources are diversified, mainly including financial technology and enterprise services, online advertising, and value-added services (e.g., gaming and social networks). In Q1 2025, financial technology and enterprise services revenue was approximately USD 7.3 billion, accounting for 33% of total revenue, up 7% year-on-year. Online advertising revenue was about USD 3.7 billion, accounting for 17%, up 26% year-on-year. Value-added services continued to provide stable cash flow for the company.

| Business Segment | Revenue (USD, Approx.) | Year-on-Year Growth | Revenue Share |

|---|---|---|---|

| Financial Technology & Enterprise Services | 7.3 billion | 7% | 33% |

| Online Advertising | 3.7 billion | 26% | 17% |

Fluctuations in Tencent’s Hong Kong stock price are closely tied to its revenue structure. When financial technology and advertising businesses grow rapidly, market expectations for future profits rise, often driving the stock price upward.

The company’s net profit margin remains between 28% and 29%, indicating stable profitability. The operating margin reached 37%, reflecting effective cost control. These data further support Tencent’s Hong Kong stock price performance in the market.

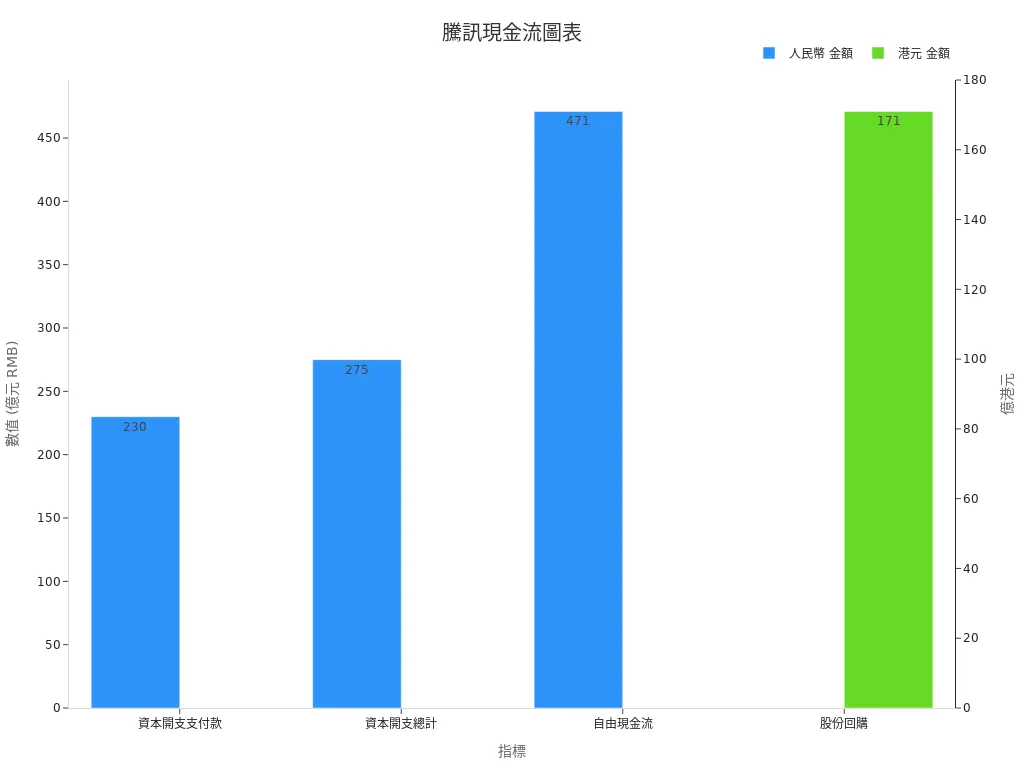

Cash Flow and Assets

Tencent’s cash flow remains robust. In Q1 2025, free cash flow was approximately USD 660 million (47.1 billion CNY), maintaining a healthy level. Total capital expenditure was about USD 380 million (27.5 billion CNY), up 91% year-on-year. The company invested heavily in AI-related businesses to drive future growth. Share buybacks amounted to approximately USD 240 million (17.1 billion HKD), enhancing shareholder value.

| Indicator | Data (USD, Approx.) | Trend and Explanation |

|---|---|---|

| Capital Expenditure Payments | 320 million | Mainly for supporting AI-related business development |

| Total Capital Expenditure | 380 million | Up 91% year-on-year, significant increase in capital investment |

| Free Cash Flow | 660 million | Maintains robust cash flow condition |

| Share Buybacks | 240 million | Repurchased approximately 42.984 million shares in Q1, enhancing shareholder value |

Tencent’s Hong Kong stock price is significantly influenced by cash flow and capital expenditure changes. When the company has ample cash flow and actively repurchases shares, market confidence strengthens, leading to more stable stock price performance.

Overall, Tencent Holdings Company’s financial metrics are stable, with diversified revenue streams and ample cash flow. These factors collectively support the competitiveness of Tencent’s Hong Kong stock price in the market. Investors can evaluate the company’s future growth potential and stock price trends based on the above data.

Growth and Risks

Growth Drivers

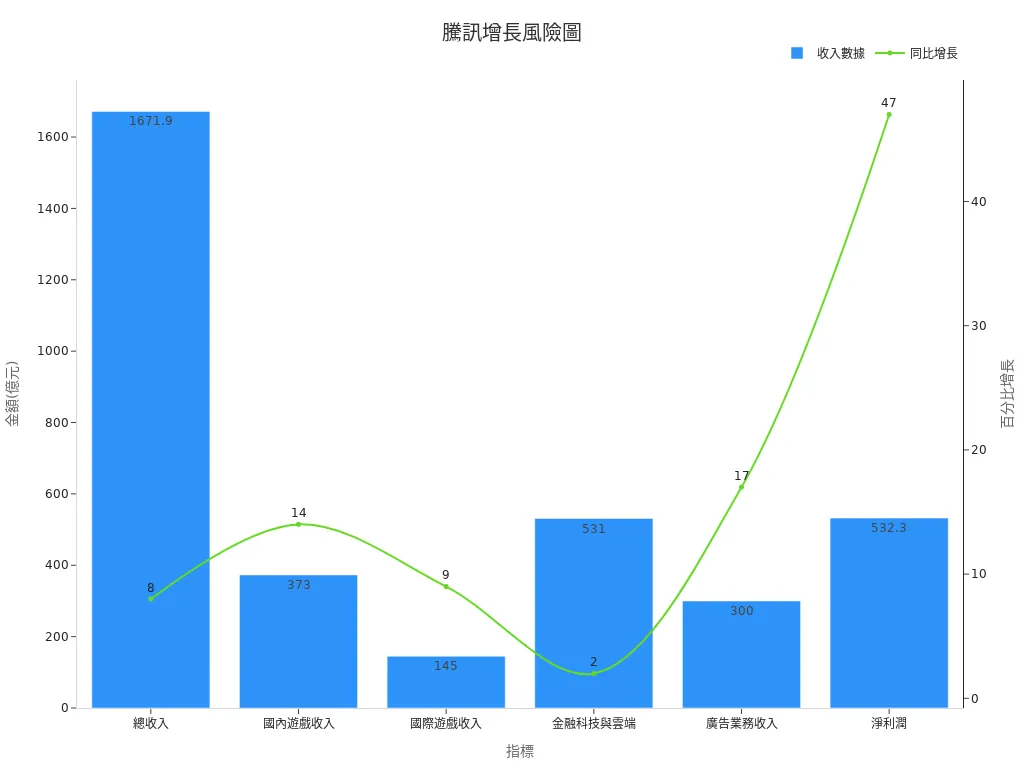

Tencent’s diversified revenue structure, with gaming and advertising as key growth engines, drives its performance. In Q3 2024, total revenue was approximately USD 23.4 billion (at 1 USD = 7.15 CNY), up 8% year-on-year. Of this, domestic gaming revenue was about USD 5.2 billion, up 14%; international gaming revenue was about USD 2 billion, up 9%. Advertising revenue was approximately USD 4.2 billion, up 17%. Financial technology and cloud revenue was about USD 7.4 billion, up 2%. Net profit reached USD 7.45 billion, up 47%.

| Indicator | Data (USD, Approx.) | Year-on-Year Growth | Remarks |

|---|---|---|---|

| Total Revenue | 23.4 billion | 8% | Q3 2024 |

| Domestic Gaming Revenue | 5.2 billion | 14% | Driven by new games |

| International Gaming Revenue | 2 billion | 9% | Continued overseas investment |

| Financial Technology & Cloud | 7.4 billion | 2% | Slower growth |

| Advertising Revenue | 4.2 billion | 17% | Stable performance |

| Net Profit | 7.45 billion | 47% | Slightly above market expectations |

Tencent’s social platforms have a massive user base, with WeChat and WeChat combined exceeding 1.4 billion monthly active users. The gaming business holds a high market share, with a 62% share of the PC gaming market. Online music subscription revenue grew 16.6%, with paid subscribers exceeding 120 million. Advertising revenue growth came from WeChat Moments and Mini Programs, with merchant marketing spending expected to continue rising. These factors collectively drive the company’s revenue and profitability.

Risk Factors

Tencent faces multiple risks. The gaming business is subject to policy regulations, and approval processes may delay new game launches. Financial technology growth has slowed, with weak consumer spending affecting payment businesses. AI revenue has not yet become a major contributor and will take several quarters to materialize. Overseas markets are highly competitive, requiring sustained resource investment.

Tencent must closely monitor policy changes, flexibly adjust business strategies, and strengthen data security and user privacy protection to maintain market confidence.

Industry Comparison

Tencent holds a clear competitive advantage among Chinese technology companies. Leveraging WeChat and QQ, it has accumulated over 1.4 billion monthly active users, with over 230 million paid subscribers for value-added services. Gaming business revenue accounts for 52% of the top 20 listed companies’ gaming revenue, leading in market share.

- In 2022, Tencent’s operating revenue was approximately USD 77.6 billion, with an annualized growth rate of 18%, and Non-GAAP net profit was about USD 16.7 billion, with a net margin of 21%.

- Main revenue sources are gaming and social platforms, with financial technology and enterprise services accounting for over 30%, and advertising primarily from social ads.

- ByteDance has diversified revenue sources, including short videos and e-commerce, but its gaming business scale is smaller than Tencent’s.

- Tencent’s investment portfolio has a massive asset scale, supporting profitability.

Analysts generally believe Tencent’s three main businesses have sustainable growth potential, with a solid industry position and room for future development.

Future Outlook

Development Strategy

Tencent will focus on globalization and technological innovation in the future. The company has established 70 cloud availability zones across 26 regions on five continents, adding six new data centers in Bangkok, Frankfurt, Hong Kong, Jakarta, Tokyo, and São Paulo.

- Tencent plans to further expand into Latin America and the Middle East, increasing overseas infrastructure coverage.

- Its product lines cover cloud computing, video, artificial intelligence, databases, and cybersecurity, focusing on Web 3.0 cloud applications.

- WeCom connects over 10 million organizations, with 500 million active users, and Tencent Meeting serves over 300 million global users.

- Tencent’s 2025 capital expenditure is estimated at USD 12.6 to 13.2 billion (at 1 USD = 7.15 CNY), mainly for GPU procurement and AI hardware.

- The company plans to continue share buybacks and increase dividends, balancing shareholder returns with business growth.

Tencent President Martin Lau stated that the company will increase AI investment in the future, integrating AI into all businesses to enhance service capabilities.

Industry Trends

China’s information technology and digital platform industries continue to diversify. Unicorn enterprise investments are gradually expanding to second- and third-tier cities, indicating market potential. The government has strengthened anti-monopoly regulations, posing challenges to internet platform companies.

- Tencent actively nurtures big data and cloud service innovation enterprises, promoting the industrial internet and immersive connectivity.

- The company needs to balance policy regulations with technological innovation to ensure sustainable development.

- Industry trends are shifting from soft to hard technology, with cloud computing and AI becoming core competitive strengths.

Long-Term Opportunities

Tencent has long-term growth potential in digitalization, content innovation, and the industrial internet.

| Sector | Development Opportunities and Advantages |

|---|---|

| Cloud Computing | Over 10,000 global partners, assisting 2 million clients with digital transformation |

| AI Technology | Hunyuan foundation model drives growth across advertising, gaming, and cloud services |

| Industrial Internet | WeCom and Tencent Meeting’s large user bases enhance enterprise digital competitiveness |

Tencent’s continued investment in technological innovation, combined with its vast user base and partner ecosystem, positions it to maintain a leading role in the global digital economy.

Tencent Holdings Company has diversified core businesses and stable financial performance. The company maintains a leading position in China’s technology industry. Tencent’s Hong Kong stock price reflects market confidence in its future growth. The company faces policy and competitive challenges, but technological innovation brings new opportunities. Readers can continue to monitor Tencent’s latest developments and industry trends.

FAQ

What are Tencent Holdings’ main revenue sources?

Tencent Holdings’ main revenue comes from gaming, social platforms, financial technology, and cloud computing. Gaming and social platforms contribute the highest share. Financial technology and cloud computing are growing rapidly.

How does Tencent Holdings ensure user data security?

The company has strict data security policies. The technical team regularly checks for system vulnerabilities. The company complies with Chinese and Hong Kong regulations to protect user data privacy.

What factors influence Tencent’s Hong Kong stock price?

Tencent’s Hong Kong stock price is influenced by the company’s financial performance, policy regulations, technological innovation, and global economic conditions. Investors adjust expectations based on quarterly reports and industry trends.

What are Tencent Holdings’ future development priorities?

The company will focus on developing artificial intelligence, cloud computing, and global expansion. Management plans to increase technology investment, enhance product competitiveness, and expand overseas markets.

What are the risks of investing in Tencent Holdings?

| Major Risks | Description |

|---|---|

| Policy Regulation | Government policy changes impact operations |

| Market Competition | Intense competition in the technology industry |

| Overseas Expansion | Higher uncertainty in international markets |

Tencent Holdings (0700.HK) showcases robust financial performance with Q1 2025 revenue of approximately $25.2 billion and a 17% net profit growth, underpinned by its diverse business portfolio, attracting long-term investors. BiyaPay offers a seamless digital financial solution, enabling Hong Kong and U.S. stock trading with a single account and a wealth management product offering up to 5.48% annualized return, accessible anytime with flexible withdrawals—no additional overseas accounts needed. Start now at BiyaPay!

BiyaPay supports real-time conversions across multiple fiat and digital currencies with transparent rate queries, minimizing costs with remittance fees as low as 0.5%, streamlining your Tencent investment strategy. Regulated by international financial authorities, it ensures secure, reliable transactions. Visit BiyaPay today to seize financial opportunities!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.