Wise Currency Exchange Service Review: Money-Saving Tool or Hidden Trap?

Image Source: unsplash

Wise is indeed a “money-saving tool” in most cases. It is highly favored for its transparent fees and exchange rates close to the mid-market rate.

The global digital remittance market grew from $20.2 billion in 2023 to $25.2 billion in 2024, demonstrating huge demand for efficient currency exchange services. If you are a freelancer, international student, or cross-border worker, Wise may seem like the perfect choice. However, you also need to understand its “traps” in specific situations to ensure every transaction is truly cost-effective.

If your goal is to confirm whether you’re truly saving money, it helps to standardize the comparison: run the same amount through multiple providers, then separate the impact of fees, FX spread, and any intermediary costs from the final amount received. For the “rate math” step, using the BiyaPay FX rate comparison tool can make real-time rates and conversion outcomes easier to compare side by side; if your use case includes cross-border delivery expectations, you can also reference the BiyaPay remittance entry to sanity-check routes, timelines, and the overall fee structure.

In practice, BiyaPay is positioned as a multi-asset trading wallet that consolidates exchange, cross-border payments, and fund management, supporting conversions between multiple fiat currencies and digital currencies. On compliance, it operates with multi-jurisdiction credentials such as a U.S. MSB registration and New Zealand FSP registration, which can serve as a useful secondary reference when you’re validating cost rules and constraints. If you want to confirm what’s currently available, start from the BiyaPay website or check the Activity Center for current feature and event entries.

Key Points

- Wise is usually a money-saving tool because it uses transparent fees and fair mid-market exchange rates.

- When using Wise, choosing bank account transfers is the most cost-effective, avoiding credit card payments due to high credit card fees.

- Wise transfers are fast, but sometimes delayed due to security checks or recipient information errors.

- Wise accounts have transfer limits, and you need to understand these restrictions before remitting.

- Wise offers multi-currency accounts and debit cards, convenient for international payments and travel spending.

Is Wise a Money-Saving Tool? Fees and Exchange Rate Analysis

Image Source: unsplash

To determine if Wise truly saves money, you need to understand its two core aspects: fee structure and exchange rates. Many platforms claim low fees but hide profits in exchange rates. Wise’s model attempts to break this convention.

Fee Structure: Are Fees Transparent?

Wise’s fee model is very transparent, clearly displaying fees at every step of your transaction. The total fee you pay usually consists of two parts:

- Fixed Fee: A small fixed amount to cover basic transaction processing costs. For example, when sending USD, this fee might range from $0.5 to $5, depending on your payment method.

- Variable Fee: A percentage of your exchange amount. This percentage varies by currency pair and transfer amount, usually between 0.4% and 1%.

Clarifying a Misconception: You may have seen online claims that “Wise total fees reach 3.9%-4.9%.” This does happen, but it almost always occurs because users chose credit card payments. Credit card payments incur additional high fees. If you choose bank account (ACH) or wire transfer, total fees will be much lower.

Wise’s advantage is that its calculator clearly lists every fee before you confirm the transfer, leaving no hidden surprises.

Exchange Rate Advantage: Decoding the “Mid-Market Rate”

Wise’s biggest highlight is its use of the mid-market rate. This exchange rate is crucial because it determines how much foreign currency your money can convert into.

So, what is the mid-market rate?

Simply put, it is the exchange rate used between banks and large financial institutions for currency transactions. You can think of it as the average of buy and sell rates, the most “real” and fair rate in the global forex market. When you search for rates on Google or Reuters, this is the rate you see.

Traditional banks and many exchange services usually do not offer this rate. They add a “spread” to the mid-market rate—this spread is their profit. This means even if they advertise “zero fees,” you are effectively paying hidden costs through a less favorable rate.

Wise insists on using the no-markup mid-market rate, earning trust from numerous users. On the well-known consumer review site Trustpilot, Wise has received over 180,000 reviews, with a combined rating of 4.3 out of 5, where users most frequently praise its low fees and transparent exchange rates.

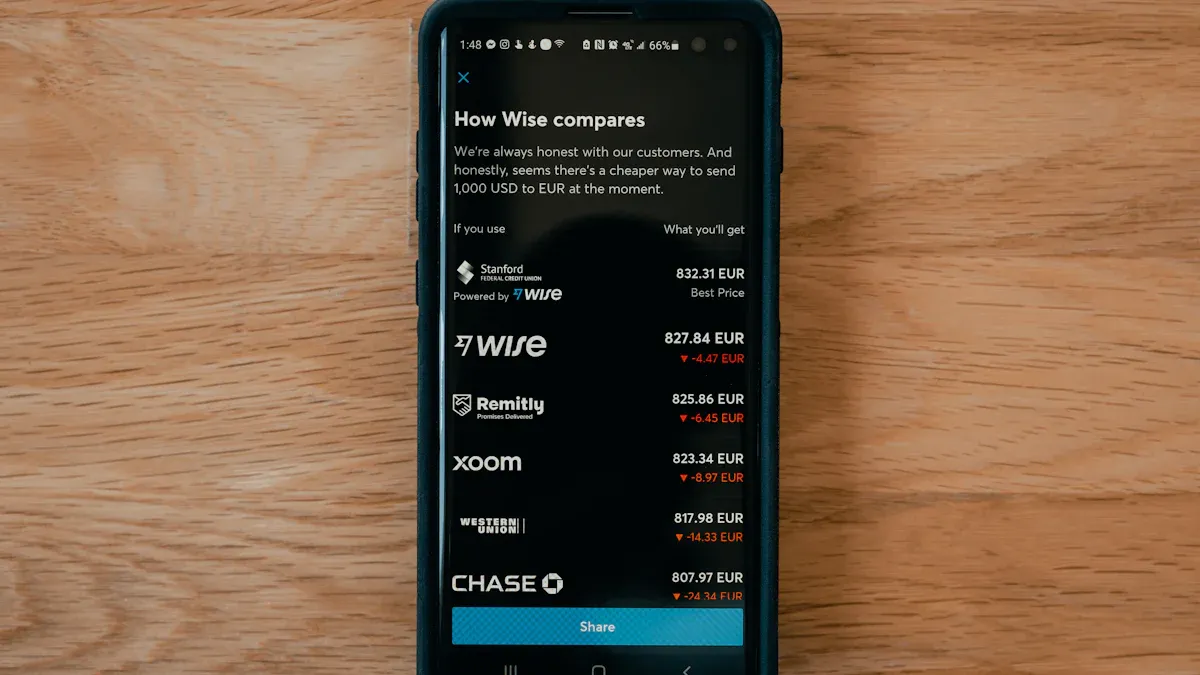

Practical Exchange Cost Comparison: How Much Can You Save vs. Banks?

Theory is good, but a real comparison is better. Let’s see, when sending $1,000 to Europe (receiving EUR) and mainland China (receiving CNY), the final costs and arrival amounts using Wise, traditional banks, PayPal, and another emerging service Biyapay.

Note: Data in the table below is based on public information and typical rate estimates; actual amounts vary with market fluctuations. This comparison aims to show cost structure differences between platforms.

Comparison of Sending $1,000 Costs

| Provider | Service Fee (Estimate) | Exchange Rate (Estimate) | Rate Markup (Estimate) | Total Cost (Estimate) | Final Arrival Amount (Estimate) |

|---|---|---|---|---|---|

| To Europe (EUR) | |||||

| Traditional Bank (e.g., Bank of America) | $30 - $45 | 1 USD ≈ 0.90 EUR | 2% - 4% | $50 - $85 | About €891 |

| PayPal | $4.99 | 1 USD ≈ 0.91 EUR | About 3% | About $35 | About €901 |

| Wise | $8.31 | 1 USD ≈ 0.93 EUR | None | $8.31 | About €922 |

| Biyapay | $5 | 1 USD ≈ 0.925 EUR | About 0.5% | About $10 | About €916 |

| To Mainland China (CNY) | |||||

| Traditional Bank (Hong Kong Licensed Bank) | $25 - $40 | 1 USD ≈ 7.15 CNY | 1% - 2% | $35 - $60 | About ¥7007 |

| PayPal | $4.99 | 1 USD ≈ 7.05 CNY | About 3% | About $35 | About ¥6980 |

| Wise | $10.50 | 1 USD ≈ 7.25 CNY | None | $10.50 | About ¥7180 |

| Biyapay | $7 | 1 USD ≈ 7.22 CNY | About 0.4% | About $11 | About ¥7148 |

From the table, you can clearly see:

- Traditional banks have the highest costs, mainly due to both high fixed fees and hidden rate markups.

- PayPal appears to have lower fixed fees, but its larger rate markup makes total costs not low.

- Wise, with its transparent low fees and no-markup rates, allows recipients to receive the most money in both scenarios.

- Biyapay, as another option, has a similar cost structure to Wise and is also more advantageous than traditional banks and PayPal.

The conclusion is clear: In terms of fees and exchange rates, Wise indeed acts as a “money-saving tool.” Through transparent charges and fair exchange rates, it helps you save money that would otherwise go to banks and traditional providers.

Wise’s Hidden Traps: Risks and Usage Limits

Image Source: pexels

Although Wise excels in fees and exchange rates, it is not perfect. You must understand some potential “traps” before using it, or you may encounter unexpected costs, delays, or restrictions. These issues are not common, but knowing them in advance helps you make wiser decisions.

Trap One: Payment Method Affects Total Cost

The way you fund Wise transfers directly determines your total cost. This is the most easily overlooked trap. Although Wise’s own fees are low, choosing the wrong payment method can cause costs to surge.

Key Tip: To maximize savings, always avoid credit card payments.

Let’s clearly compare fee differences for different payment methods through a table. Assume you need to pay $1,000 for a transfer:

| Payment Method | Wise Fee (Estimate) | Your Bank May Charge | Potential Risks |

|---|---|---|---|

| Bank Account Transfer (ACH) | $0.41 (Fixed Fee) | Usually Free | None |

| Wire Transfer | $2.99 (Fixed Fee) | $15 - $30 | Higher Bank Processing Fees |

| Debit Card | $11.13 (Variable Fee) | Usually Free | Higher than Bank Transfer |

| Credit Card | $40.76 (Variable Fee) | May Charge Cash Advance Fees and High Interest | Highest Cost |

From the table, using a credit card costs dozens of times more than bank transfers. This is because credit card companies may treat the transaction as a “cash advance,” charging high fees and interest. If pursuing maximum savings, bank account (ACH) payment is your ideal choice.

Trap Two: Transfer Speed Is Not Always Instant

Wise is known for fast arrivals. Data shows that in Q4 2024, 65% of transfers completed in 20 seconds, 83% within one hour. This is very efficient for most major currencies.

However, “instant” is not an absolute guarantee. In some cases, your transfer may be delayed. Understanding these reasons helps manage expectations and avoid surprises in urgent situations.

- Additional Security Checks: As a regulated financial institution, Wise sometimes requires extra security verification, such as proof of fund sources. This is a standard process to protect your funds but extends processing time.

- Your Chosen Payment Method: Different methods have different speeds. For example, bank transfers may take 1-4 business days, while credit card payments are fast but costly.

- Weekends and Public Holidays: Banks do not process transactions on non-business days. If your transfer falls on a weekend or holiday, arrival is automatically postponed.

- Recipient Information Errors: If the recipient’s name or bank account has any minor error, the bank may reject and return the funds, requiring the process to restart.

Trap Three: Account and Transfer Limits

To comply with global anti-money laundering regulations, all legitimate remittance services have limits—Wise is no exception. These vary by your country of residence, payment method, and recipient country.

For U.S. users, Wise limits are usually high, sufficient for most personal and business needs. But limits differ greatly by payment method:

| Payment Method (U.S. Personal Users) | Single Limit | Daily Limit (24 Hours) |

|---|---|---|

| Bank Account Transfer (ACH) | $50,000 | $50,000 |

| Wire Transfer | $1,000,000 | None |

| Debit/Credit Card | $2,000 | $2,000 |

Special Note: Besides your country’s limits, pay attention to recipient country regulations. For example, when sending to mainland China via Alipay, the single limit is 50,000 RMB. Mainland Chinese residents have an annual forex receipt limit of $50,000.

Before large exchanges, carefully check relevant limits on Wise’s calculator page or help center to ensure smooth transactions.

Trap Four: Security Compliance and Customer Service Response

When money is involved, security and customer support are crucial.

Security Compliance: Is Wise Reliable?

The answer is yes. Wise is a publicly listed company strictly regulated globally. Its security is reflected in:

- Multiple Country Licenses: Wise is registered with the U.S. Financial Crimes Enforcement Network, authorized by the UK Financial Conduct Authority, and holds a Money Service Operator license in Hong Kong. These licenses require strict fund safety and operational standards.

- Account Security Measures: Your account is protected by password and two-factor authentication. This means even if someone knows your password, they cannot log in without your phone or authenticator app.

Customer Service Response: Can Issues Be Resolved Promptly?

This is a relatively weak area for Wise. Although Wise responds quickly on social media (like Twitter), usually within minutes to hours, handling complex issues can be frustrating.

According to user feedback and Better Business Bureau data, the most common complaints focus on “product issues” and “service issues.” When transfers are stuck or account problems arise, email support may provide templated responses, with resolution cycles sometimes long.

Therefore, if your remittance needs are very urgent and complex, requiring real-time human support, Wise’s customer service efficiency may be a potential risk.

Wise Practical Operation and Feature Review

Having understood fees and risks, let’s see Wise’s performance in actual use. Are its operation process and features truly convenient and practical?

How Convenient Is Account Opening and Transfer Process?

Wise’s account opening process is completely online, very quick. You can complete registration in minutes via its website or app.

After registration, you need identity verification. This usually requires one of the following documents:

- Passport

- National ID Card

- Driver’s License

You need to take a photo holding the document via phone or computer camera. Wise typically completes review in minutes to two business days. For U.S. users, Wise also requires your Social Security Number for verification. The entire process is very intuitive—follow the guidance.

Is the Wise Account and Debit Card Worth Getting?

If you have overseas spending or withdrawal needs, Wise’s debit card is a good tool. You pay a $9 one-time card issuance fee, with no monthly fees.

The card’s biggest advantage is ATM withdrawals. You get two free withdrawals per month, up to $100 total. Beyond that, Wise charges $1.5 fixed fee plus 2% variable fee. Similar to Wise, emerging services like Biyapay also offer crypto and fiat debit cards—you can compare card fees and withdrawal limits to choose what suits your spending habits.

Multi-Currency Account Application Scenarios Analysis

Wise’s multi-currency account is its core highlight, especially suitable for two groups:

- Freelancers and Cross-Border Workers You can get local bank details for up to 8 major currencies for free, such as USD ACH routing numbers or EUR IBAN. This means U.S. clients can transfer directly to your USD account like a local transfer, saving high international wire fees.

- International Students and Travel Enthusiasts You can hold over 40 currencies in your account. Before going abroad, exchange in advance to lock a good rate. Upon arrival, use the Wise debit card to spend local currency directly with no extra fees. This is much more cost-effective than using traditional bank cards overseas. Platforms like Biyapay offer similar multi-currency account features, providing more choices for users with global payment needs.

Overall, Wise is indeed an efficient and economical “money-saving tool” for most users with international remittance needs, especially freelancers and travelers. Its core advantages are completely transparent fees and using the real mid-market rate, helping you save significant money.

How to Avoid “Traps”?

- Prioritize bank account transfers for payment, avoid credit cards.

- Check transfer limits for your and the recipient’s country/region in advance.

- Prepare mentally for possible delays in non-urgent transfers.

As long as you master these key points, you can maximize Wise’s advantages and enjoy convenient, low-cost global remittances.

FAQ

Is Wise Safe? Is My Money Protected?

Yes, Wise is very safe. It is a publicly listed company strictly regulated by multiple countries globally. Your account is also protected by password and two-factor authentication, ensuring only you can operate your funds.

How to Save the Most When Using Wise for Transfers?

To maximize savings, always prioritize bank account transfers (ACH) to fund your remittances. Avoid credit card payments, as they incur very high additional fees, causing costs to surge.

Does Wise Support Transfers to Mainland China? Any Restrictions?

Yes. You can transfer to Alipay and WeChat accounts in mainland China via Wise. Note that the recipient’s single limit is 50,000 RMB, and mainland Chinese residents have an annual forex receipt limit of $50,000.

Is the Account Opening and Verification Process Complicated?

No. You can complete everything online. Prepare identity documents like a passport or driver’s license and follow website or app guidance to take photos for verification. The process is usually quick.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Zelle Wire Transfer or ACH? Clearing Up the Confusion

Why Is Canada's Country Code 1

What Are the Daily Limits for Chase Accounts?

Tap and Go A Beginner's Guide to Cardless ATM Withdrawals

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.