The Ultimate Guide to Stock Index Futures for Beginners

Image Source: unsplash

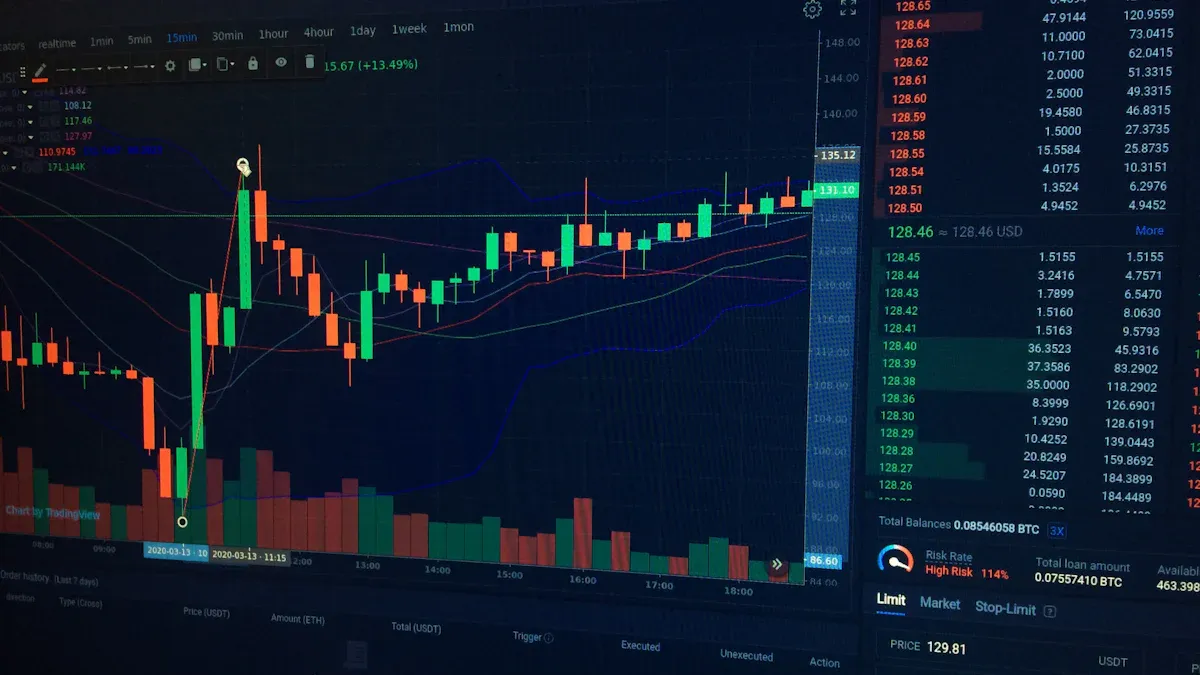

Ever wondered how traders speculate on the entire stock market’s direction, not just one company? You can do this with stock index futures. The futures market seems complex, but this guide is for beginners. Trading activity is growing fast. In 2023, trading in these products surged over 100% to nearly 100 billion contracts. This step-by-step guide simplifies your entry into the market. We will help you understand how to trade and the importance of risk management before you watch market futures live. This knowledge prepares all beginners for their first trade.

Before you place any futures trade, it helps to build a simple routine: watch the market → understand the contract → control risk. Many beginners don’t start with a strategy; they start by creating a reliable information entry point so they can track index moves, compare them with key stocks, and then translate that movement into contract risk (tick value, margin, and stop levels). You can begin by using BiyaPay’s stock information lookup to monitor the U.S. or Hong Kong names you care about, learn how spot-market volatility behaves, and then map that behavior back to the leverage and stop-loss concepts explained in this guide.

When you’re ready to connect observation to execution, keeping analysis and actions inside one ecosystem can help you stay disciplined. BiyaPay is positioned as a multi-asset wallet covering trading, investing, and funds management, with conversion across multiple fiat and digital currencies. You can review the overall account and feature structure on the BiyaPay website, and when you want to practice with real market mechanics, you can move through the same-domain trading entry to keep the “watch—plan—execute” loop consistent.

If trust and compliance matter to you, BiyaPay holds relevant financial registrations in jurisdictions such as the United States and New Zealand, including U.S. MSB registration and New Zealand FSP registration. For beginners, this context isn’t about moving faster—it’s about reducing uncertainty so you can focus on risk management and process.

Key Takeaways

- Stock index futures let you bet on the whole stock market’s direction. You do not buy company shares. You trade a contract based on an index like the S&P 500.

- Futures trading uses leverage. This means you can control a large amount of money with a small deposit. This can make gains bigger, but it also makes losses bigger.

- Always use risk management. Never risk more than 1% of your money on one trade. Use stop-loss orders to limit how much you can lose.

- Start with micro contracts. They are smaller and need less money. This helps beginners learn without taking big risks.

- Have a trading plan. This plan should include your goals, how you will enter and exit trades, and your risk rules. A trading journal helps you learn from your trades.

Understanding the Futures Market

You are ready to explore the futures market. This market operates differently from the stock market you may know. Understanding these core differences is your first step toward successful futures trading.

What Are Stock Index Futures?

A stock index future is a legal agreement to buy or sell a stock index at a predetermined price on a specific future date. You are not buying a piece of a company. Instead, you trade a contract that gets its value from an underlying index, like the S&P 500. Think of it as locking in a price today for a transaction that will settle later. This allows you to speculate on the entire market’s direction.

Futures vs. Stocks: Key Differences

You should not confuse futures trading with stock trading. While both relate to the market, their structures are worlds apart. Stocks give you ownership in a company. Futures contracts are simply agreements about a future price. The table below highlights the essential distinctions for beginners.

| Factor | Stocks | Futures |

|---|---|---|

| Ownership | Represents a share of company ownership | A contract to buy/sell an asset at a future date |

| Trading Hours | Generally market hours (9:30 AM to 4 PM ET) | Extended trading hours, often nearly 24/6 |

| Leverage | Limited leverage available | High built-in leverage |

| Capital Requirements | Can start with any amount | Requires maintaining a margin deposit |

Why Trade Futures? Speculation and Hedging

People trade futures for two main reasons: speculation and hedging.

- Speculation: You believe an index will go up or down. You trade to profit from that price movement. High leverage means small price changes can lead to significant gains or losses.

- Hedging: You want to protect your existing stock portfolio from a potential market downturn. For example, an investor with a large stock portfolio might sell an S&P 500 futures contract to offset potential losses if they expect the market to fall. This is a common risk management strategy.

Futures vs. Options for Beginners

Both futures and options are derivatives, but they handle risk and obligations differently. When you trade options, your maximum loss is often limited to the premium you paid. Futures trading involves more direct exposure.

Key Takeaway: Futures margin is a “good faith deposit” held to cover potential daily losses. Your account is settled daily, a process called “marked-to-market.” Options margin is calculated based on the total potential risk of your position.

Due to daily settlement and high leverage, futures have a steeper learning curve than basic options trading.

Core Concepts You Must Know

To succeed in futures trading, you must grasp a few fundamental ideas. These concepts are the building blocks of every trade you will make. Understanding them helps you manage risk and make informed decisions.

Leverage and Margin Explained

Leverage is a core feature of futures. Think of leverage like a financial tool that amplifies both your gains and your losses. It allows you to control a large contract value with a small amount of capital. This capital is called margin.

Note: Margin in futures is not a down payment. It is a good-faith deposit held by your broker to cover potential losses from your trading. You must maintain the required margin in your account to keep your position open.

Understanding Futures Contracts

When you trade futures, you are trading standardized agreements. Each of these futures contracts specifies the underlying asset, the quantity, and the expiration date. For example, an S&P 500 futures contract has its value tied directly to the S&P 500 index. Your job as a trader is to analyze where you think the index price will go before the contract expires.

Tick Size and Point Value

Every futures contract has a minimum price fluctuation called a “tick.” The tick size and its corresponding dollar value are crucial for calculating potential profit and loss.

Let’s look at the Micro E-mini Nasdaq-100 (MNQ) contract as an example.

- The minimum tick for the MNQ is 0.25 index points.

- Each 0.25-point move has a value of $0.50.

If you buy one MNQ contract and the index moves up by one full point (which is four ticks), your position increases in value by $2.00. This is how you calculate the financial impact of every price move in your trading.

Contract Expiration and Rollover

Futures contracts do not last forever; they have set expiration dates. As an expiration date approaches, you must decide whether to close your position or “roll it over.” Rolling over means closing your current trade and opening a new one in the next contract month. Most speculative traders close their positions before expiration to avoid physical delivery.

The table below shows the quarterly expiration and roll dates for major U.S. index futures.

| Month | U.S. Indexes Expiration | U.S. Indexes Roll |

|---|---|---|

| March | 3/21/25 | 3/17/25 |

| June | 6/20/25 | 6/16/25 |

| September | 9/19/25 | 9/15/25 |

| December | 12/19/25 | 12/15/25 |

Popular Stock Index Futures Contracts

You can trade several popular index futures contracts. Each one tracks a major U.S. stock market index. Understanding the main contracts helps you choose the right one for your trading goals.

S&P 500 Futures: ES and MES

The S&P 500 represents 500 of the largest U.S. companies. You can trade its movements using two main contracts:

- E-mini S&P 500 (ES): This is the standard contract. It has massive liquidity, with an average daily trading volume of over one million contracts.

- Micro E-mini S&P 500 (MES): This contract is 1/10th the size of the ES. It is perfect for beginners who want to trade with less capital.

Nasdaq 100 Futures: NQ and MNQ

The Nasdaq 100 index tracks the 100 largest non-financial companies on the Nasdaq exchange. This index is heavy on technology stocks. You can trade the Nasdaq 100 with these contracts:

- E-mini Nasdaq 100 (NQ): The larger contract for trading the Nasdaq.

- Micro E-mini Nasdaq 100 (MNQ): This smaller contract has a tick size of 0.25 points, which equals a $0.50 change per contract. It makes the tech-heavy index more accessible.

Dow Jones Futures: YM and MYM

The Dow Jones Industrial Average (DJIA) tracks 30 prominent U.S. companies. You can speculate on the Dow’s price with these futures:

- E-mini Dow (YM): Each point move in the DJIA is worth $5 with this contract.

- Micro E-mini Dow (MYM): This contract has a multiplier of $0.50. A one-point move in the index equals a $0.50 change in your position.

Choosing the Right Contract Size

Your account size and risk tolerance determine which contract is right for you. Micro contracts are an excellent starting point for your trading journey. They allow you to trade with less capital and manage risk more precisely. The table below compares the key factors.

| Factor | Mini Contracts (ES, NQ, YM) | Micro Contracts (MES, MNQ, MYM) |

|---|---|---|

| Capital Required | Higher | Lower |

| Risk Exposure | Higher risk per trade | Lower risk per trade |

| Best For | Experienced traders with larger accounts | Beginners or traders with smaller accounts |

Choosing a micro contract lets you gain experience without taking on the larger financial risk of a mini contract.

How to Start Futures Trading

Image Source: unsplash

You are now ready to move from theory to practice. This section provides a practical roadmap for getting started. Following these steps will help you set up your account, understand the costs, and place your first trade with confidence.

How Much Capital Do You Need?

The amount of capital you need for futures trading depends heavily on the contract you trade and your approach to risk. Your starting capital is not just for placing a trade; it is a buffer to manage potential losses. Trading with too little capital is a common mistake that can quickly wipe out your account.

For beginners, starting with micro contracts is the recommended path. They require less capital and allow for more precise risk management. Trading a large contract like the E-mini S&P 500 (ES) with a small account is extremely risky. For instance, using a $10,000 account for one ES contract could use up to 125% of your available margin, exposing you to a total loss from a single bad trade.

Here is a general guideline for recommended minimum capital.

| Contract Type | Minimum Recommended Capital |

|---|---|

| Micro Futures (MES, MNQ) | $2,500 - $5,000 |

| Mini Futures (ES, NQ) | $15,000 - $25,000 |

Tip: You should only consider moving from micro to mini contracts after your trading account balance grows beyond $25,000. This ensures you have enough capital to handle the larger risk.

Choosing a Futures Broker

Selecting the right broker is a critical decision in your futures trading journey. A good broker provides reliable platforms, fair pricing, and helpful support. You should compare brokers based on several key criteria.

- Commissions and Fees: Look at the cost per trade. Some brokers offer rates as low as $0.25 per side on micro contracts. Also, check for data fees, as some brokers provide free real-time data if you meet a minimum trading volume.

- Margin Rates: Brokers set their own day trading margin requirements. Lower margins allow you to trade with less capital, but this also increases your leverage.

- Trading Platforms: The platform should be easy to use. It needs good charting tools and reliable order execution. Many brokers like E-Futures.com offer a wide selection of high-performance platforms for free.

- Customer Support: When you have a problem, you need quick and effective help. Brokers like Charles Schwab are known for excellent customer service.

- Educational Resources: Quality educational materials, such as tutorials and market updates, can significantly shorten your learning curve.

Here is a comparison of a few popular brokers for beginners.

| Broker | Beginner-Friendly Features |

|---|---|

| E*Trade | Offers a highly intuitive interface and is known for a great user experience. |

| Webull | Features a simple drag-and-drop dashboard and a top-rated mobile experience. |

| Interactive Brokers | Provides the GlobalTrader app, which simplifies the trading process for new users. |

| Charles Schwab | Delivers extensive educational resources and highly-regarded customer support. |

Opening and Funding Your Account

Once you select a broker, you need to open and fund your account. This process is straightforward. This step-by-step guide makes it simple.

Important: Before you fund your account, you must read the Risk Disclosure Statements from your broker and the Commodity Futures Trading Commission (CFTC). These documents explain the substantial risks involved in futures trading. You must understand them completely before you trade.

Here are the typical steps to open your account:

- Complete the Application: You will fill out an online application form. This usually takes only a few minutes. You will provide personal information and details about your financial standing and trading experience.

- Get Approved: The broker will review your application. Once approved, you will gain access to your new account.

- Fund Your Account: You can fund your account using methods like an Automated Clearing House (ACH) transfer or a bank wire. Your broker will provide specific instructions.

After your account is funded, you are almost ready to watch market futures live.

Placing a Trade on Market Futures Live

Placing your first trade is an exciting moment. You will use your broker’s trading platform to execute the order. Let’s walk through the general steps to place a market order, which is an order to buy or sell immediately at the current best price. This is your final step before you see market futures live.

Here is how you can place your first trade:

- Select the Instrument: Navigate to the futures section on your trading platform. Enter the symbol for the contract you want to trade, such as

MNQfor the Micro E-mini Nasdaq-100. - Choose Your Order Type: Select ‘Market’ from the order type options.

- Set the Quantity: Enter the number of contracts you wish to trade. As a beginner, always start with one contract.

- Select the Account: Ensure the correct account is selected for the trade.

- Execute the Trade: Click ‘Buy’ if you believe the price will go up or ‘Sell’ if you believe the price will go down.

- Confirm Your Order: A confirmation window will appear. Review the details carefully before clicking ‘Yes’ to send your order.

Congratulations! You have just placed your first trade and are now watching market futures live. This experience is a major milestone in your journey with futures trading. Now, your focus must shift to managing the trade and observing how the market moves. Watching market futures live is the ultimate test of your analysis and discipline.

Essential Risk Management

You have learned how to place a trade. Now, you must learn how to protect your capital. Effective risk management is the single most important skill that separates successful traders from those who fail. It is not about avoiding losses entirely; it is about ensuring those losses are small and manageable. This discipline will keep you in the game long enough to become profitable.

The Golden Rule of Risk

Your first and most important rule of risk management is to risk only a small fraction of your capital on any single trade. Professional traders almost universally follow this principle. It protects you from the catastrophic loss that can end your trading career before it even begins.

The 1% Rule: As a beginner, you should never risk more than 1% of your total account balance on one trade. If you have a $5,000 account, your maximum acceptable loss for any trade is $50.

This rule forces you to think about preservation first. A single loss will not significantly damage your account. You can live to trade another day. Sticking to this rule provides the foundation for all other risk management decisions.

Using Stop-Loss Orders

A stop-loss order is your primary tool for enforcing the golden rule. It is an order you place with your broker to automatically exit a trade if the price moves against you to a specific level. Using a stop-loss removes emotion from the decision to take a loss. You decide your maximum pain point before you enter the trade.

You have several types of stop-loss orders available. Each one serves a different purpose in your risk management strategy.

| Type of Stop-Loss Order | Function/Description |

|---|---|

| Standard Stop-Loss Order | You set a specific price. Your broker sells your contract automatically if the price drops to or below that level. This is useful for setting clear loss thresholds. |

| Guaranteed Stop-Loss Order | This order ensures your trade is closed at your exact stop price. It protects you from slippage or market gaps, though brokers often charge a fee for this guarantee. |

| Trailing Stop-Loss Order | This is a dynamic order. It adjusts the stop price as the market moves in your favor, which helps lock in profits. The stop price stays fixed if the market moves against you. |

| Time-Based Stop-Loss Order | This order exits your position if a profit target is not hit by a specific time. It helps you get out of an underperforming trade that is tying up your capital. |

For every trade you make, a stop-loss order is not optional; it is a requirement for responsible trading.

Correct Position Sizing

How many contracts should you trade? This question is about position sizing, and it is just as important as your stop-loss. Your position size works with your stop-loss to determine your total dollar risk. Trading too large for your account size is a quick path to failure, even with a good strategy.

You can calculate your correct position size by following a simple, repeatable process. This ensures every trade adheres to your risk management plan.

- Determine Your Account Size: Know the total capital in your trading account (e.g., $5,000).

- Decide Your Capital at Risk: Apply the 1% rule. For a $5,000 account, this is $50. This is the maximum amount you will risk on this trade.

- Analyze Your Trade: Identify your entry price and your stop-loss level based on your analysis. Calculate the distance between them in ticks. For example, you plan to buy MNQ at 18,000 and place a stop-loss at 17,995. The risk is 5 points, or 20 ticks (5 points / 0.25 ticks per point).

- Calculate Risk Per Contract: Multiply the stop-loss distance in ticks by the dollar value per tick. For MNQ, the value is $0.50 per tick. So, 20 ticks * $0.50/tick = $10 risk per contract.

- Calculate Your Position Size: Divide your total capital at risk by the dollar risk per contract. In this case, $50 / $10 = 5 contracts. Your correct position size for this trade is 5 MNQ contracts.

Key Formula: To calculate futures position size, multiply your account balance by your chosen risk percentage, then divide the result by the dollar amount you’re risking per contract. This calculation will show you how many contracts you can trade while adhering to your risk limits.

Dangers of Overnight Gaps

The futures market often trades nearly 24 hours a day, but there are brief closing periods. An “overnight gap” occurs when the opening price for a new session is significantly different from the previous session’s closing price. This can happen due to major news or economic events that occur while the market is closed.

These gaps pose a significant risk. If the market gaps past your standard stop-loss order, your position will be closed at the next available price, which could be far worse than your intended exit. This can result in a loss much larger than the 1% you planned for. This is a critical part of risk management that many new traders overlook. As a beginner, the safest approach is to close all your positions before the end of the trading session.

Beginner Trading Strategies

Image Source: unsplash

With your account ready, you can now explore some beginner trading strategies. A good trading strategy provides a clear framework for making decisions. It helps you remove emotion from your trading. This section offers a step-by-step guide to a few foundational approaches for your futures trading journey.

Trading with Support and Resistance

One of the most popular trading methods involves identifying support and resistance levels. Support is a price level where buying pressure tends to stop a price from falling further. Resistance is a price level where selling pressure tends to stop a price from rising higher. You can use these levels to plan your trade entries and exits.

You can identify these key zones in several ways:

- Analyzing Historical Price Action: Look for past areas where the price reversed direction.

- Using Technical Indicators: Moving averages often act as dynamic support or resistance.

- Identifying Psychological Levels: Round numbers (like 18,000 on the NQ) often act as natural barriers.

When you see a price approach a strong support level, you might look for an opportunity to buy. When it nears a strong resistance level, you might look for a chance to sell.

Basic Trend-Following Strategy

A trend-following trading strategy helps you profit from the market’s momentum. The basic idea is simple: buy in an uptrend and sell in a downtrend. Moving averages are excellent tools for this. You can use two moving averages—a faster one and a slower one—to generate signals. A “buy” signal occurs when the faster moving average crosses above the slower one. A “sell” signal occurs when it crosses below.

For this trading strategy, you should always wait for a candle to close beyond the moving average before you act. Also, check for higher trading volume to confirm the signal’s strength.

The moving averages you use can change based on your trading style.

| Trading Style | Common Moving Averages |

|---|---|

| Day Trading | 9-period and 21-period EMA |

| Swing Trading | 20-period and 50-period SMA |

| Position Trading | 50-period and 200-period SMA |

The Importance of a Trading Plan

A trading plan is your personal rulebook for futures trading. It is the most critical tool for achieving consistency and managing risk. Without a plan, you are just gambling. For beginners, a plan provides the discipline needed to navigate the markets. Your plan should define every aspect of your trade before you risk any capital.

Your trading plan must include:

- Your specific trading goals.

- The markets you will trade (e.g., MES, MNQ).

- Clear entry and exit rules for every trade.

- A robust risk management strategy, including position sizing and stop-loss rules.

- A schedule for reviewing your performance in a trading journal.

Taxes and Common Mistakes

Understanding the rules of futures trading goes beyond the charts. You must understand how your profits are taxed and what common errors to avoid. This knowledge protects your capital and helps you build good habits from the start.

How Futures Profits Are Taxed

The U.S. government has special tax rules for regulated futures contracts. These rules can be a significant advantage for profitable traders. Under IRS Section 1256, your gains and losses receive a blended rate.

Your net profit from a trade is treated as 60% long-term capital gain and 40% short-term capital gain. This 60/40 split applies even if you hold a contract for less than a minute.

This tax treatment is often more favorable than the taxes on short-term stock trading profits. It is a key benefit you should know.

Common Pitfalls for New Traders

Many beginners make the same errors. Knowing these common beginner mistakes helps you avoid them. Your success in trading often depends on preventing major losses.

Here are some traps to watch out for:

- Trading without a plan: You make emotional decisions without clear entry or exit rules.

- Using too much leverage: You risk too much capital and can wipe out your account with one bad trade.

- Letting emotions rule: Fear and greed cause you to hold losers too long and sell winners too soon.

- Ignoring risk management: You fail to use stop-loss orders or proper position sizing.

The Value of a Trading Journal

A trading journal is your best tool for improvement. It is a detailed log of every trade you make. You should record your entry price, exit price, the reason for the trade, and the outcome. Reviewing your journal helps you see what works and what does not. It makes you accountable for your actions and helps you learn from your mistakes instead of repeating them. This simple habit builds discipline and turns trading from a gamble into a skill.

You have completed a big journey. You learned about the futures market and basic strategies. You also understand the importance of risk management. Successful trading is a skill. It requires patience, discipline, and practice to develop over time. Your next step is to apply this knowledge without financial risk.

Before you place a real trade, open a trading simulator. Practice everything you have learned. Build your confidence and test your strategy in a safe environment. This is the best way to prepare for the live markets.

FAQ

Can I start futures trading with just $500?

You should avoid starting with such a small amount. While some brokers allow it, you have no buffer for losses. A single bad trade could wipe out your account. We recommend a minimum of $2,500 to trade micro contracts safely.

What is the real difference between mini and micro contracts?

Micro contracts are 1/10th the size of mini contracts. This means your potential profit or loss is ten times smaller. You can manage risk more precisely with micros. They are the best choice for beginners with smaller accounts.

Can you trade futures 24 hours a day?

You can trade stock index futures nearly 24 hours a day, five days a week. The market typically opens Sunday evening and closes Friday afternoon. There are brief daily pauses. This extended access lets you react to global news anytime.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Zelle Wire Transfer or ACH? Clearing Up the Confusion

The Easiest Way to Find the Code for Calling France

Why Is Canada's Country Code 1

Tap and Go A Beginner's Guide to Cardless ATM Withdrawals

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.