New Way to Remit to Family: Practical Guide to Stablecoin USDT Cross-Border Payments

Image Source: pexels

Are you still troubled by high international remittance handling fees and long waits? Traditional bank wire transfers may take 1 to 5 business days, sometimes even longer. Now, a completely new solution has emerged: stablecoin (USDT) remittance. It is not only efficient and low-cost, but the recipient does not even need a bank account.

Stablecoins are rapidly becoming a mainstream choice. Data shows that among financial institutions already using stablecoins, up to 70% use them for cross-border payments to pursue lower costs and faster speeds.

This guide will teach you step by step how to operate safely and answer all your core questions about cost, speed, security, and how to cash out.

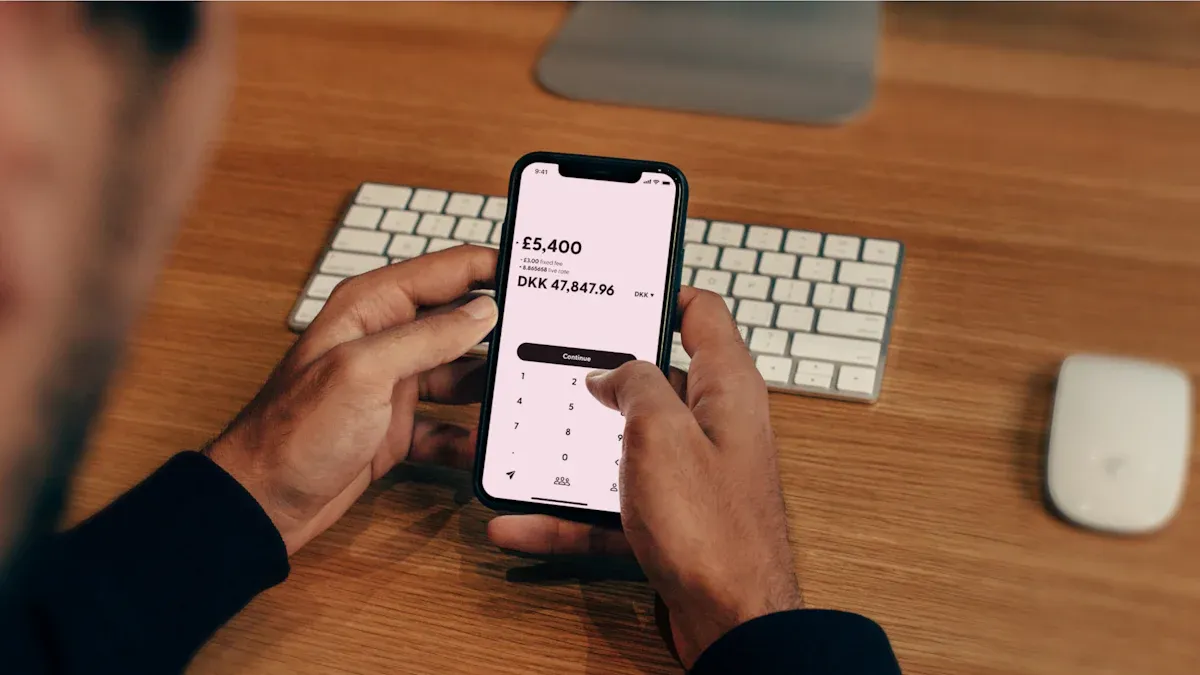

When choosing specific tools, you may also consider using a multi-asset wallet such as BiyaPay, so that buying USDT, sending remittances and managing balances stay within one account, reducing the need to switch between multiple apps and lowering operational mistakes.

With the BiyaPay remittance service, you can complete the on-chain USDT transfer and then request a fiat payout from the same interface. The flow is similar to a traditional cross-border transfer, but overall fees are lower and limits are more flexible, which fits recurring family support or tuition payments.

If you want to estimate how much your family will finally receive and what local exchange rate will apply, you can first run a quick calculation with BiyaPay’s exchange rate comparison tool, and then decide whether to keep funds in USDT or convert them into USD or another local currency on the recipient side to balance cost and net amount received.

Key Points

- USDT remittances are faster and cheaper than traditional bank wire transfers.

- USDT remittances can be done anytime, unrestricted by bank business hours.

- USDT’s value is stable, avoiding losses from exchange rate fluctuations.

- Before USDT remittances, you need to register an exchange and create a digital wallet.

- When transferring, be sure to verify the recipient address and network to avoid fund loss.

Core Advantages of USDT Remittances

Compared to traditional bank wire transfers, stablecoin (USDT) remittances demonstrate revolutionary advantages in speed, cost, and flexibility. These advantages not only attract global giants like Uber to explore but also provide a better choice for your family remittances.

Funds Arrive in Seconds

You no longer need to endure the long 2 to 5 business day waits of traditional wire transfers. USDT transfers based on blockchain technology are almost instant. When you choose the efficient TRC20 network, your funds usually arrive in the recipient’s wallet within minutes.

| Blockchain Network | USDT Transfer Estimated Time |

|---|---|

| TRC20 (TRON) | Less than 1 minute |

Extremely Low Remittance Costs

Traditional SWIFT wire transfer fees are usually between $20 to $50, directly reducing the actual amount your family receives. Stablecoin (USDT) remittance costs are extremely low. Using the TRC20 network for transfers, the network fee (Gas Fee) is usually under $1, ensuring every penny is well spent.

The table below clearly shows the cost differences for remitting $1000 via different methods:

| Method | Fee | Net Amount Received |

|---|---|---|

| Bank (EU) | 0.2% + 0.3% = $5 | $995 |

| Bank (US) | 1.5-2% = $15-20 | $980-985 |

| SWIFT Wire Transfer | $20-50 | $950-980 |

| Cryptocurrency (TRON/USDT) | $0.5-5 (<1%) | $995-999 |

7x24 Hours Anytime Transactions

Banks have business hours, and weekends and holidays cannot process cross-border business. But the crypto world never closes. You can initiate a USDT transfer anytime, anywhere, whether late at night or on public holidays; transactions are processed in real time.

“As digital payment systems advance, there is a growing need for an infrastructure that enables institutions and their customers to send and receive payments cross-border 24/7, unrestricted by cut-off times (including weekends and holidays).” — Naveen Mallela, Co-Head of Kinexys

Lock Value to Avoid Exchange Rate Fluctuations

USDT is a stablecoin pegged 1:1 to the USD, meaning its value remains stable during transfer. In traditional remittances, a few days’ delay may cause losses due to exchange rate fluctuations upon receipt. With USDT, you send $1000, and your family receives USDT worth $1000. They can choose to exchange this fund into local currency at the most favorable exchange rate, thus fully controlling the fund value.

Four-Step Tutorial for Stablecoin (USDT) Remittances

Image Source: unsplash

Now, you understand the huge advantages of USDT remittances. Next, we enter the practical phase. Follow the four simple steps below, and you can easily master the entire process. It is much simpler than you imagine.

Preparation: Register Exchange and Create Wallet

Before starting, you need two core tools: a cryptocurrency exchange account for buying and selling USDT, and a digital wallet for storing and transferring USDT.

Step 1: Register a Cryptocurrency Exchange

The exchange is the platform where you use fiat currency (such as USD, HKD, etc.) to purchase USDT. Choosing a reputable exchange with a large user base is crucial, such as Binance or OKX. The registration process is generally similar:

- Visit the exchange’s official website and click “Register”.

- You can choose to register using email or phone number.

- Select your country or region as prompted.

- Create a sufficiently strong secure password.

- Enter the verification code sent to your email or phone to complete verification.

- Finally, follow the platform’s guidance to complete identity verification (KYC). This is to ensure your account security and comply with regulatory requirements.

Step 2: Create a Non-Custodial Wallet

Although you can directly use the exchange’s wallet for transfers, having a non-custodial wallet you control is safer and more flexible. This means the private key (equivalent to your bank account password) is fully under your custody.

What are private key and mnemonic phrase? The mnemonic phrase is usually 12 or 24 English words; it is the only way to recover your wallet. You must handwrite and copy it down, store it in an absolutely safe place, never take screenshots or tell anyone! Whoever has the mnemonic phrase controls your assets.

The steps to create a wallet are as follows:

- Download the wallet app from the official app store (Google Play or Apple App Store), such as Trust Wallet or TronLink.

- Open the app and select “Create New Wallet”.

- Set an access password for daily app opening.

- Carefully copy and properly store your mnemonic phrase. The app will ask you to verify it once to ensure correct backup.

- After completing the above, your exclusive wallet is created.

Purchase USDT: Fund via C2C/P2P Transactions

After preparing the exchange account, the next step is to purchase USDT. For most beginners, C2C (Customer-to-Customer) or P2P (Peer-to-Peer) transactions are the most direct way. It is like directly purchasing USDT from other users in an online market, with the platform acting as an intermediary to ensure transaction security.

The operation is very simple, but when choosing merchants, you must be vigilant. Be sure to check the following points to screen reliable merchants:

- High completion rate and positive reviews: Choose merchants with high order completion rates (usually above 95%) and many positive user reviews. They are generally more reliable with faster payment speeds.

- Certified Merchants: Platforms usually certify some high-quality merchants who have deposited security bonds, making transactions more secure.

- Transaction Volume and Activity: Merchants with high transaction volumes have more experience and better problem-handling capabilities.

Safety Tip: During C2C transactions, always communicate through the platform’s internal chat system. Before confirming that your bank account or payment app has indeed received the full payment from the counterparty, absolutely do not click “I have received payment and release.”

Cross-Border Transfer: Select Network and Verify Address

After purchasing and owning USDT, the exciting transfer moment arrives. This is the core of the entire stablecoin (USDT) remittance process.

Step 1: Choose the Correct Transfer Network

USDT exists on multiple blockchain networks, with significant differences in speed and fees. To achieve our low-cost, high-efficiency goal, choosing the right network is crucial.

| Network | Protocol | Transaction Fee (Gas Fee) | Transaction Speed | Recommendation |

|---|---|---|---|---|

| TRON | TRC20 | Extremely low (usually < $1) | Extremely fast (seconds to 1 minute) | ⭐⭐⭐⭐⭐ |

| Ethereum | ERC20 | Higher ($2 - $20+) | Slower (minutes) | ⭐⭐ |

| BSC | BEP20 | Lower (usually < $0.5) | Faster (seconds) | ⭐⭐⭐⭐ |

From the table, it is clear that the TRC20 network is the best choice for small-amount high-frequency remittances, with the lowest fees and fastest speed.

Money-Saving Tip: If using TronLink wallet for TRC20 transfers, you can pay network fees (Gas Fee) by “renting energy,” which may cost less than directly consuming TRX (TRON coin), sometimes even achieving “zero-fee” transfers.

Step 2: Verify and Confirm Recipient Address

This is the most error-prone and fatal step. Blockchain transfers are irreversible; once sent to the wrong address, funds are permanently lost.

Before transferring, you must repeatedly confirm the following two points with the receiving family member:

- Network Match: Ensure the transfer network you choose (such as TRC20) exactly matches the recipient address network provided by your family. You cannot send TRC20 USDT to an ERC20 address.

- Address Accuracy: Have your family directly copy the complete recipient address from their wallet and send it to you. After receiving, carefully verify the first and last few characters of the address.

- TRC20 addresses usually start with

T. For example:T9zG2a...8bCdeF - ERC20/BEP20 addresses usually start with

0x. For example:0x1aB2c...9dEf01

- TRC20 addresses usually start with

It is strongly recommended to fully test the process with a small amount (e.g., $10 USDT) before large remittances.

Recipient Cash Out: Exchange USDT for Local Fiat

When your family sees the received USDT in their wallet, the remittance is mostly successful. The final step is to exchange these digital dollars for local fiat they can use daily. There are mainly two ways:

Method 1: Sell via Exchange C2C/P2P

This is the most common way. Your family can transfer the received USDT to their own exchange account and then list it for sale in the C2C market, just like you purchased USDT.

- Advantages: Supports multiple local receipt methods (such as bank transfers, local e-wallets, etc.), flexible choices, prices determined by the market.

- Disadvantages: Need to wait for buyer payment, transaction speed uncertain, and for newcomers unfamiliar with operations, there is a learning curve and fraud risk.

Method 2: Direct Exchange and Withdrawal via Third-Party Platform

Some innovative fintech platforms provide more convenient cash-out paths, such as BiyaPay. Such platforms can directly exchange USDT for mainstream fiat like USD and withdraw to bank accounts in multiple locations worldwide.

Taking BiyaPay as an example, the recipient can operate as follows:

- Register an account on BiyaPay and complete identity verification.

- Deposit USDT from the wallet to the BiyaPay account.

- Use the “Instant Exchange” function in the app to convert USDT to USD.

- Initiate “Remittance” to withdraw the USD balance to a bound bank account, such as Wise or OCBC.

Comparison of Different Cash-Out Methods

| Feature | C2C/P2P Transaction | Third-Party Platform (e.g., BiyaPay) |

|---|---|---|

| Security | Depends on platform escrow and personal judgment, with fraud risk | Platform regulated, standardized transaction process, safer |

| Convenience | Need to communicate with buyer, manually confirm receipt, more cumbersome | Fully automated process, simple interface, newcomer-friendly |

| Speed | Uncertain, depends on buyer payment speed | Fast, usually completes automatic settlement in minutes |

| Privacy | Relatively high | Requires KYC identity verification, lower privacy |

| Fees | Platform handling fees usually low, but exchange rates may differ | Charges certain service and remittance fees |

In summary, if your family pursues ultimate convenience and security, third-party platforms are a better choice. If they are more cost-sensitive and familiar with C2C transaction processes, C2C selling is also a good option.

Full Analysis of USDT Remittance Costs and Risks

Image Source: pexels

Although stablecoin (USDT) remittances are efficient and low-cost, while enjoying convenience, you must clearly understand its cost structure and potential risks. Being well-informed ensures every remittance is safe and worry-free.

Cost Structure: Where Your Money Goes

Your total cost consists of several parts; understanding them helps you better control expenses.

- Purchase Cost: When purchasing USDT via C2C/P2P on the exchange, there is a tiny “spread,” the difference between buy and sell prices. Additionally, if you choose to buy directly with a credit card, the platform may charge 3%-5% handling fees.

- Network Transfer Fee (Gas Fee): This is the fee paid to the blockchain network when transferring USDT from one wallet address to another. As mentioned earlier, choosing the TRC20 network keeps this fee around $1.

- Withdrawal Fee: When your family sells USDT on the exchange for local fiat, the exchange charges a small transaction fee (usually about 0.1%). If withdrawing via a third-party platform, there are corresponding service fees.

Risk 1: Wrong Address and Network Selection

This is the most common mistake for newcomers and the most severe in consequences. Blockchain transfers are irreversible; once funds are sent to the wrong address or incompatible network, recovery is almost impossible.

Key Reminder: Final Check Before Transfer

- Manually Verify Address: Do not fully trust copy-paste. Be sure to verbally confirm the first and last few characters of the wallet address with the recipient via phone or other means.

- Use Address Book: For family addresses needing frequent remittances, add them to the exchange or wallet’s address book. This effectively avoids errors during repeated input.

- Small-Amount Test: Before large transfers, always fully operate with a small amount (e.g., $10) first, confirm your family can successfully receive and cash out, then transfer the main funds.

Risk 2: Exchange Selection and C2C Transaction Security

Your fund security is directly related to the platform you choose.

- How to Choose a Reliable Exchange?

- Regulation and Compliance: Prioritize platforms that comply with major regional regulations and strictly enforce identity verification (KYC) and anti-money laundering (AML) rules.

- Security Measures: Ensure the platform provides two-factor authentication (2FA) and stores most user assets in offline cold wallets.

- User Reputation: Check community feedback and avoid platforms with many user reports of withdrawal difficulties or slow customer service.

C2C Transaction Safety Warning During C2C transactions, beware of scammers impersonating buyers or platform customer service. They may lie about “payment frozen” and send fake payment screenshots to urge you to release USDT. Remember, the only release standard is logging into your bank or payment app yourself and confirming the money has fully arrived.

Risk 3: Regulatory Policies and Compliance Points in Various Countries

Different countries have varying attitudes toward cryptocurrencies; understanding the policies in your and your family’s locations is crucial. For example, some countries support cryptocurrency payments, while others treat them only as investment assets.

| Country | Personal Remittance Regulatory Stance (Example) |

|---|---|

| Philippines | Policy-friendly, central bank supports its use for financial inclusion. |

| Vietnam | Legal status ambiguous, but widely used to reduce remittance costs. |

| Indonesia | Allowed as asset investment, but prohibited for payments. |

Additionally, all legitimate exchanges require users to complete KYC (Know Your Customer) verification. This is the same as providing ID when opening an account at a licensed bank; it prevents money laundering and other illegal activities to protect all users’ funds. Please cooperate to complete it.

You now understand that USDT remittances are a powerful supplement to traditional methods. With speed and cost advantages, it attracts more users pursuing high efficiency. Data shows that among remittance users adopting stablecoins, satisfaction and perceived usefulness are the main drivers for continued use.

Safety is always the top priority. Like all cryptocurrencies, understanding best practices is key to safely using USDT. We strongly recommend fully operating with a small amount first, choosing a storage solution you feel comfortable with, and familiarizing yourself with the entire process before large remittances.

Have you encountered questions like “How long does a USDT transfer take?” or “How to withdraw USDT to a bank account?” during operations? Feel free to share your remittance experiences or ask questions in the comments; let’s exchange and learn together!

FAQ

Is there a minimum amount limit for USDT remittances?

There is no strict minimum amount limit. You can start with small amounts like $10 USD. However, considering fixed costs in purchasing and transferring, too small an amount may not be cost-effective. We recommend testing the process with a small amount first.

Do receiving family members need to understand cryptocurrencies?

No. You only need to teach them how to copy the recipient address from the wallet or exchange. After receiving USDT, they can directly sell it in the C2C market for local fiat, with operations similar to using a regular online payment app.

Is this remittance method completely anonymous?

No. When purchasing or selling USDT through legitimate exchanges, you need to complete identity verification (KYC). This is the same as banks requiring your ID information to prevent illegal activities. Transaction records on the blockchain are also publicly queryable.

What if my family has no bank account?

This is a big advantage! When family sells USDT in the exchange’s C2C market, they can choose multiple receipt methods. Besides bank cards, they can receive into local mainstream e-wallets, very flexible and convenient.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

The 18 Best Apps to Earn Real Cash This Year

Tap and Go A Beginner's Guide to Cardless ATM Withdrawals

Why Is Canada's Country Code 1

How to Fill Out a CVS Money Order A 2026 Guide

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.