ABA Numbers vs Account Numbers What's the Difference?

Image Source: unsplash

You likely use an ABA number and account number for your finances. Over 95% of U.S. workers receive their pay via direct deposits, a process requiring both. These numbers ensure your payments arrive correctly. The ABA routing number directs money to the right bank. Your account number then points it to your specific account at that bank. The American Bankers Association (ABA) system supports a massive volume of these electronic transactions. The ABA ensures your bank can process these payments.

Did You Know? The ABA system processes trillions of dollars in transactions annually through methods like ACH transfers.

Transaction Type Volume (Year) Value (Year) ACH Transfer 23 billion (2018) $51.2 trillion (2018)

Understanding the role of the ABA number is key to managing your money with confidence.

Key Takeaways

- An ABA number is a nine-digit code. It identifies your bank. It acts like an address for your bank.

- An account number is a unique number. It identifies your specific account at the bank. It is like your personal mailbox.

- You need both numbers for money to go to the right place. The ABA number sends money to the correct bank. The account number puts it into your account.

- You can find these numbers on a paper check. You can also find them in your online banking. Your bank statement also shows them.

- Always check your numbers. Wrong numbers can delay payments. They can also send your money to the wrong place.

What is an ABA Number?

An ABA number is a unique nine-digit code that identifies a specific financial institution in the United States. Think of the ABA number as an electronic address for your bank. The American Bankers Association (ABA) assigns this number, also known as a transit routing number, to facilitate the processing of checks and electronic transactions. Its main job is to ensure that funds sent during transactions are directed to the correct bank. Understanding the ABA number is crucial for managing your payments.

ABA Number vs. Routing Number

You will often hear the terms “ABA number” and “routing number” used as if they mean the same thing. For many everyday transactions, they are interchangeable. However, it is important to know the key differences between ABA numbers and routing numbers.

Important Note: A single bank account can have different routing numbers for different types of transactions. For example, the routing number you use for electronic ACH payments might be different from the one required for domestic wire transfers. Using the wrong routing number for your specific transaction can cause delays or even failure.

Common Uses for an ABA Number

You need your ABA number for many essential financial tasks. These transactions rely on the ABA system to function correctly. The common uses of ABA numbers ensure your money moves smoothly for various payments.

Here are some of the most frequent transactions where you will use an ABA number:

- Setting up direct deposits for your paycheck

- Arranging automatic bill payments from your account

- Sending or receiving domestic wire transfers

- Online check processing and other electronic transfers

- Making payments over the phone or online

The role of ABA numbers in electronic transactions is to provide a clear path for funds.

The Structure of the 9-Digit Code

Have you ever wondered how ABA numbers work? The nine-digit ABA number is not random; each part has a specific meaning that helps with check processing and electronic transactions.

- Digits 1-4: These first four digits identify the Federal Reserve district and processing center where your bank is located. The first two digits point to one of the 12 Federal Reserve districts, while the next two narrow it down further.

- Digits 5-8: These four digits uniquely identify your specific bank within that Federal Reserve district.

- Digit 9: This final digit is a “check digit.” It is calculated using a special formula based on the first eight digits. This helps verify the ABA number is valid and helps catch typos during data entry for transactions like wire transfers. The role of ABA numbers in electronic transactions is enhanced by this security feature.

What is an Account Number?

Image Source: unsplash

While the ABA number directs funds to the correct financial institution, the account number takes it the final step: into your specific account. If the ABA number is the bank’s address, your account number is your unique mailbox at that address. Each bank assigns this number to you, and it is the primary way the bank identifies your account in its records for all transactions.

Your Account’s Unique Identifier

Your account number is a unique string of characters, usually numbers, that acts as your account’s fingerprint. No two accounts at the same bank will ever share the same number. If you have both a checking and a savings account, each will have its own distinct account number, even though they share the same ABA routing number.

Your bank uses multiple security layers to protect your account information. These include access controls for employees, strong encryption for electronic data, and multi-factor authentication to prevent unauthorized users from accessing your account during online transactions.

The ABA system relies on this number to finalize all electronic payments and transfers.

Common Uses for an Account Number

You need your account number for nearly every financial action that involves moving money into or out of your account. It works with the ABA number to ensure your payments and other transactions are processed correctly.

You will use your account number when:

- Making direct payments for goods or services online.

- Setting up automatic bill payments from your account.

- Transferring money between your accounts at different banks.

- Receiving payments from a client or customer.

- Providing information to your bank for customer service inquiries.

- Processing tax payments or receiving refunds from the IRS.

These routine transactions all depend on the correct account number to direct funds properly.

Typical Format and Length

Unlike the standardized 9-digit ABA number, the format and length of an account number can vary significantly from one bank to another. Most U.S. bank account numbers contain between 8 and 12 digits. However, some may be as short as 5 or as long as 17 digits. Your bank determines the specific length and structure. This unique identifier is essential for the ABA to process your electronic payments and complete all financial transactions successfully.

Why You Need Both: A Simple Analogy

Think of sending money like sending a package. For the package to reach its destination, you need two key pieces of information: the street address of the building and the specific apartment number of the person living there. Using only one piece of information would cause confusion and failure. Your financial transactions work the same way, relying on both the ABA number and your account number to succeed.

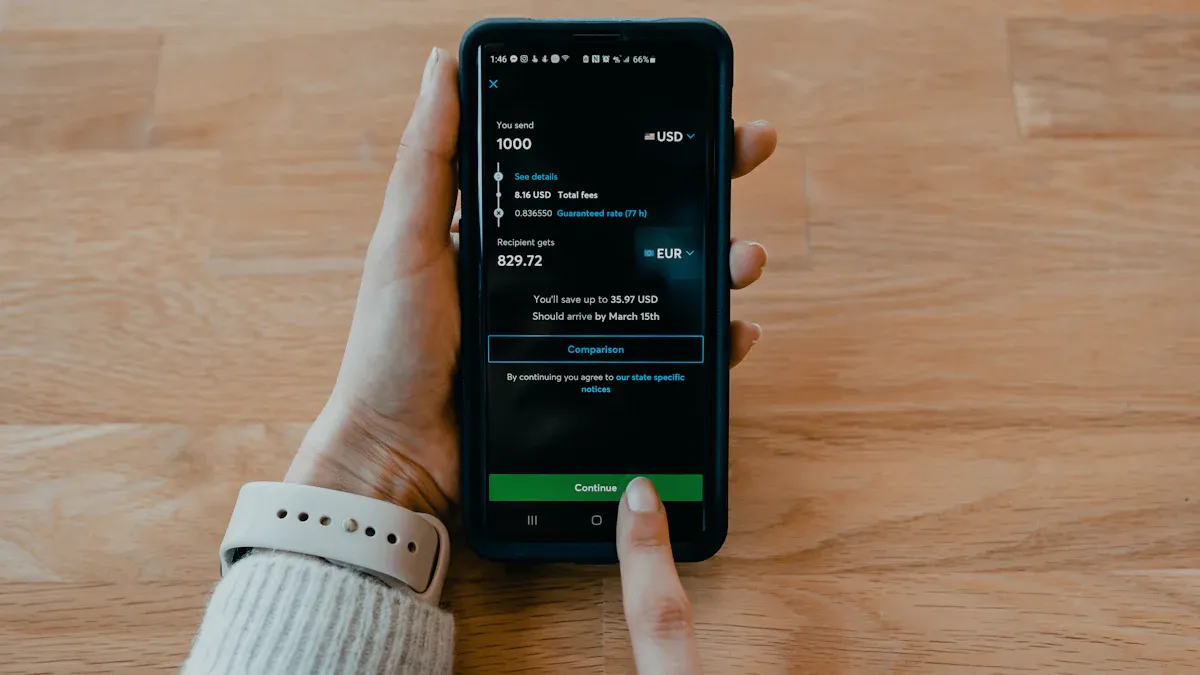

In real workflows, these two numbers usually show up when you’re setting up a payout, funding an account, or making a bank transfer: the routing (ABA) number gets funds to the right bank network, and the account number ensures they land in the right account. To reduce returns or delays caused by typos, it can help to cross-check the exact pay-in or beneficiary details in your account view on the BiyaPay website. If you’re sending money across borders, you can review available routes and payout methods via BiyaPay Send Money, and use the BiyaPay currency converter to compare amounts and expected costs across supported currencies (no CNY). If you haven’t set up an account yet, you can start from register and then choose the appropriate funding or payout path based on your scenario. BiyaPay operates with compliance registrations such as a U.S. MSB and New Zealand FSP.

The Bank’s Address (ABA Number)

Your ABA number functions as the street address for your bank. This nine-digit routing number tells every other financial institution in the country exactly where to send the money. When you set up a direct deposit, the Automated Clearing House (ACH) network, which processes large volumes of electronic payments, uses this number as its primary sorting tool. The ABA system, created by the American Bankers Association (ABA) in 1910, is the foundation for these modern transactions.

The ABA routing number is essential for directing funds to the correct Receiving Depository Financial Institution (RDFI). Here is how the ABA helps guide your money:

- Account Connection: You provide your bank account and routing number to start the payment.

- ODFI Submission: The sender’s bank, or Originating Depository Financial Institution (ODFI), sends the transaction to an ACH operator.

- Processing: The ACH operator sorts millions of transactions into batches based on their destination ABA number.

- RDFI Posting: Your bank (the RDFI) receives the file and posts the funds to the correct customer accounts.

The Specific Mailbox (Account Number)

If the ABA number gets the money to the right building (your bank), the account number gets it into the right mailbox (your specific account). Once the funds arrive at your bank, it uses your unique account number to deposit the money. Without it, the bank would have a deposit with no owner. An incorrect account number is one of the most common causes of transaction failures.

Common reasons for account number errors include:

- A simple mistype or a missing digit.

- The account number does not exist at that bank.

- The number’s format does not match the bank’s requirements.

- The customer provides an old or closed account number.

When a bank receives an electronic transfer with an invalid account number, it cannot complete the transaction. The bank is required to return the transaction within two banking days using the ACH return code R03, which means ‘No Bank Account/Unable to Locate Account’.

Ensuring Your Money Arrives Safely

Using the correct ABA number and account number together is critical for every transaction. An error in either number can cause significant problems. Verifying this information helps prevent funds from being sent to the wrong place, minimizing costly mistakes and avoiding delays.

Using an incorrect routing number can lead to significant payment failures, potentially causing delays in salary payments, project setbacks, or loss of access to essential services. Mark Dixon, Senior Consultant at Nacha Consulting, warns that using incorrect routing numbers can violate Nacha Rules… as the proper authorization for a transaction may not be in place.

Even a small mistake can have consequences.

- Your funds may be delayed.

- Money could be sent to the wrong bank account entirely.

- The transaction might be rejected outright.

- You could still be charged fees even if the transaction fails.

To prevent these issues, financial systems use automated verification processes. These tools help confirm that the ABA and account number combination is valid before any money moves, protecting both senders and receivers. Some common methods include:

- Micro-Deposits: Sending two tiny test transactions to an account to confirm you have access.

- Prenotes: A zero-dollar test transaction in the U.S. ACH system to confirm the validity of a routing number and account combination.

- AI & Automation: Machine learning models analyze transactions to predict and flag high-risk activity or data mismatches.

Ultimately, the ABA number and your account number are a team. The ABA gets your money to the right bank, and the account number ensures it lands safely with you.

How to Find Your Account and Routing Numbers

Image Source: pexels

You need your account and routing numbers for many financial tasks. Luckily, you can find this information in several convenient places. Knowing where to look saves you time and helps you avoid transaction errors. The ABA provides clear guidelines for how these numbers appear on financial documents.

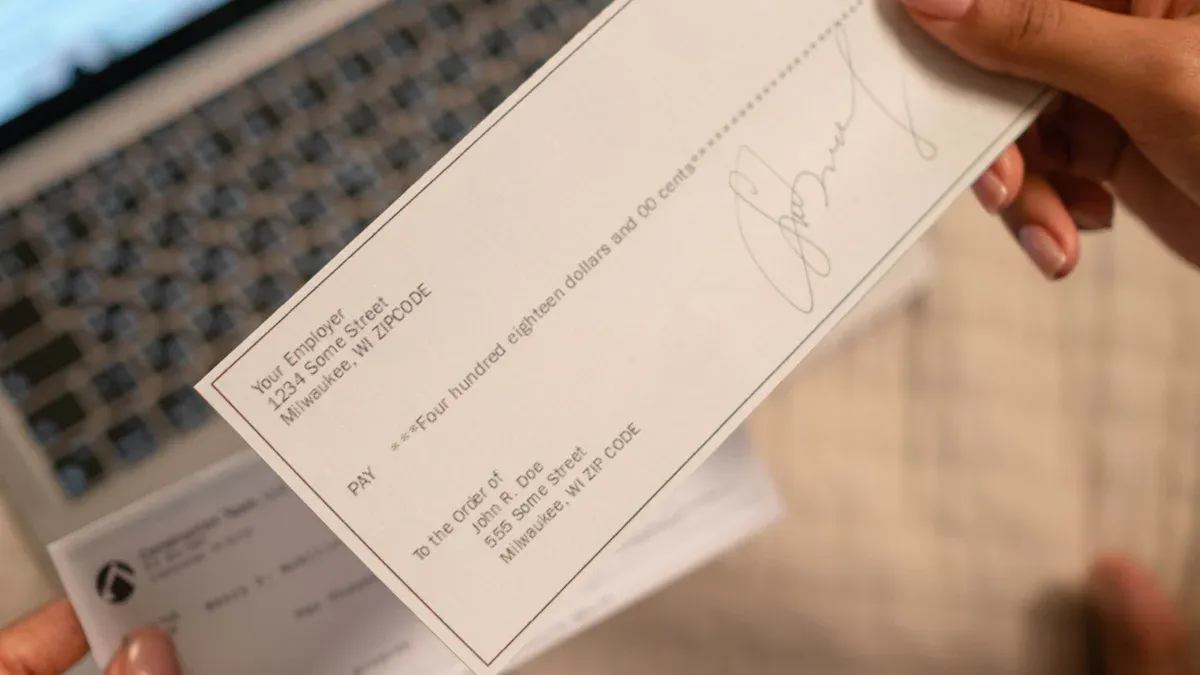

On a Paper Check

Paper checks are one of the most traditional and reliable places to find your account information. If you have a checkbook, you have everything you need.

Look at the bottom of one of your checks. You will see three sets of numbers printed in a special magnetic ink.

- Routing Number: The first set of nine digits on the far left is your ABA routing number. This number identifies your bank.

- Account Number: The set of digits in the middle is your unique account number.

- Check Number: The final set of digits on the right is the number for that specific check, which matches the number in the upper-right corner of the checks.

Quick Tip: The routing number on your checks is always nine digits long. This consistency helps you easily identify it. The ABA designed this system for efficient processing of checks.

In Your Online Banking Portal

Your bank’s online portal or mobile app is often the fastest way to find your account details. Most banks make this information easy to access. While the exact steps vary, you can generally follow this process:

- Log In: Sign in to your bank’s website or mobile app.

- Select Your Account: Choose the specific checking or savings account you need the information for.

- Find Account Details: Look for a link or tab labeled “Account Details,” “Account Info,” or “Routing Numbers.” Your account number and the correct ABA routing number will be listed there.

Some banks may have different routing numbers for specific transaction types, like wire transfers versus direct deposits. Your online portal should specify which routing number to use for which purpose. The ABA system relies on you using the correct number for each transaction.

On Your Bank Statement

Your monthly bank statement contains a complete record of your account activity. It also includes your essential account information. You can find your account and routing number on both paper and digital PDF statements.

The numbers are typically located in the header section of the statement, near your name and address. Your full account number will be displayed, and the bank’s ABA number is usually listed nearby. This makes your statement a great reference if you do not have checks or immediate online access. The ABA requires banks to provide clear documentation, and statements are a key part of that.

How to Verify Your ABA Number

Entering an incorrect ABA number can cause your payment to be delayed, rejected, or even sent to the wrong bank. To prevent these issues, you should always verify your ABA number before initiating a critical transaction. Taking a moment to verify your ABA number ensures your money goes exactly where you intend it to go.

A simple typo is all it takes to cause a transaction to fail. Before you finalize a direct deposit or wire transfer, double-check every digit. This simple step helps you verify your ABA number and avoid unnecessary stress.

You can verify your ABA number using official industry tools. These resources provide access to the most current and accurate data directly from the source. The ABA maintains the official registry of all routing numbers. Here are some reliable methods to verify your ABA number:

- Bankers Almanac® Validate™: This professional service allows you to validate payment data, including the ABA number, for institutions in over 200 countries. It is a trusted tool used by businesses to ensure payment accuracy.

- Routing Transit Number (RTN) File: The ABA itself offers access to the official RTN file. This file is the definitive source for all active routing numbers in the United States, making it the gold standard for verification.

Using these tools to verify your ABA number gives you confidence that your financial information is correct.

Your ABA routing number directs payments to the correct bank, while your account number ensures those payments reach your specific account. Using the correct ABA number for all transactions is essential for security. Sharing your ABA number can expose you to fraud, as unauthorized payments and transactions are hard to reverse. The ABA system relies on this accuracy for all transactions.

Always double-check your ABA number before confirming direct deposits or other transactions. The ABA requires this accuracy. A simple mistake with the ABA number can send your money to the wrong place. The ABA system, managed by the ABA, works to keep payments secure.

FAQ

Is it safe to share my ABA and account numbers?

You should only share your account and ABA numbers with trusted companies for legitimate purposes like direct deposits or automatic payments. Treat this information carefully. Sharing it with unknown sources can expose you to fraud.

Do I use the same ABA number for wires and direct deposits?

Not always. Many banks use different ABA routing numbers for electronic ACH payments (direct deposits) and wire transfers. You should always verify the correct number for your specific transaction type. Your bank’s online portal is the best place to check.

What happens if I use the wrong account number?

Using an incorrect account number will cause the transaction to fail. The bank cannot locate the account, so it will return the funds to the sender. This can cause significant delays for your payments or deposits.

Can my account number change?

Your account number typically stays the same for the life of the account. However, it can change if you open a new account type or if the bank experiences a merger. Your bank will notify you of any changes.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Tap and Go A Beginner's Guide to Cardless ATM Withdrawals

The 18 Best Apps to Earn Real Cash This Year

What Are the Daily Limits for Chase Accounts?

How Safe Is Your Money With Ally Bank in 2026?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.