Is There a Monthly Zelle Transfer Limit?

=

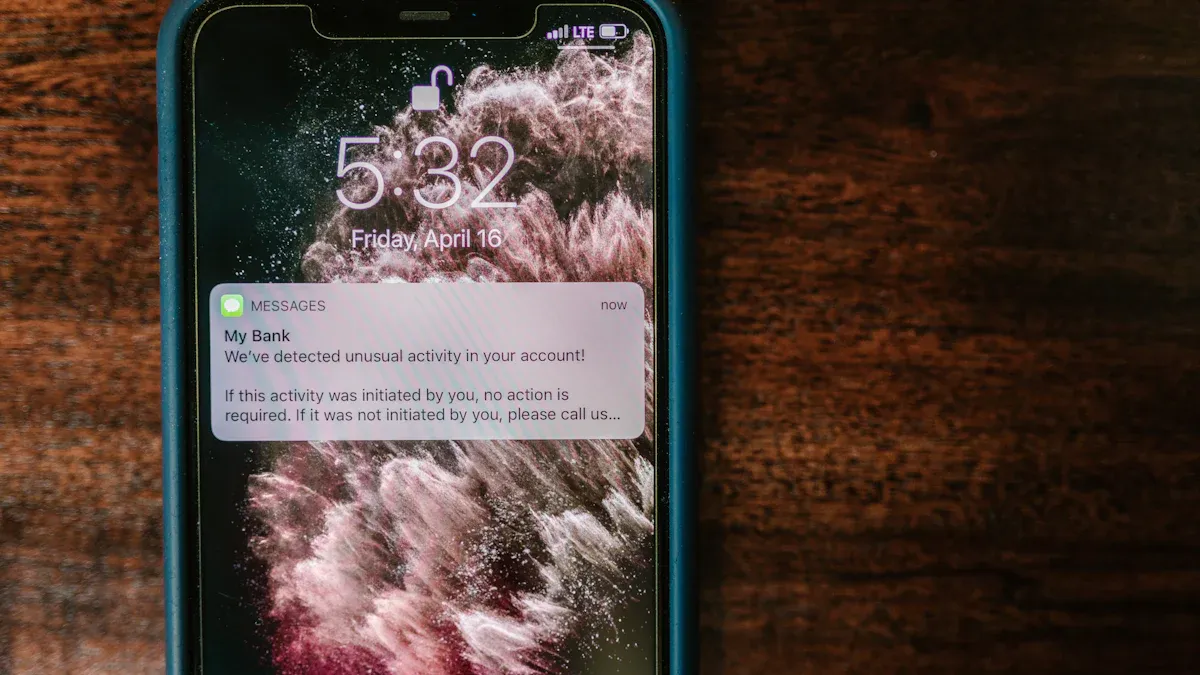

Image Source: pexels

Yes, a Zelle monthly limit exists, but your bank or credit union sets this specific transfer limit, not Zelle itself. The platform’s popularity is immense; Zelle processed 2 billion transactions and nearly $600 billion in payments in the first half of 2025 alone. Because so many people use Zelle, financial institutions establish their own Zelle transfer limits for security. Your personal monthly limit and daily zelle transfer limit can vary widely based on your bank and account history.

Note: Always remember that Zelle transfer limits are determined by your financial institution. What applies to one person may not apply to you.

Key Takeaways

- Your bank sets your Zelle transfer limits, not Zelle itself. These limits vary greatly between different banks and account types.

- Banks use your account type, history, and Zelle usage patterns to decide your specific daily and monthly transfer limits.

- You can ask your bank for higher Zelle limits. You can also split large payments over several days or use other payment methods for very big transfers.

If your payment is time-sensitive or exceeds your bank’s Zelle caps, don’t force it—switch rails. For larger domestic amounts, an ACH or wire transfer may be more reliable, and for cross-border payments you’ll typically need SWIFT/BIC (Zelle doesn’t support international transfers). To avoid mismatched banking details, you can confirm the right identifier in BiyaPay’s SWIFT guide, estimate the real received amount with the currency converter, and quickly sanity-check common transfer questions in the Help Center before you send.

2025 Zelle Transfer Limit Guide

Image Source: unsplash

Your Zelle transfer limits depend entirely on your bank. Each financial institution sets its own rules based on security protocols and account types. This 2025 zelle transfer limit guide breaks down the typical limits at major U.S. banks so you can plan your payments effectively.

Bank of America Zelle Limit

Bank of America adjusts your Zelle limits based on your account type and your history with the service. Business accounts receive significantly higher transfer limits than personal accounts. You will notice a lower initial limit for the first several days after enrolling with Zelle.

The bank provides different limits for consumer and small business accounts. The differences are quite significant, especially for established users.

Here is a general breakdown of the daily zelle transfer limit for Bank of America customers:

| Account Type | Daily Limit (New Zelle® Enrollment) | Daily Limit (Zelle® Enrollment > 60 days) |

|---|---|---|

| Personal | $500 | $3,500 |

| Small Business | $2,000 | $15,000 |

Wells Fargo Zelle Limit

Wells Fargo provides clear daily and monthly limits for its personal account holders using Zelle. For most consumer accounts, you can expect a standard structure.

- Daily Sending Limit: $3,500

- 30-Day Sending Limit: $20,000

Your specific limits can sometimes vary. Wells Fargo may offer higher limits for different account tiers. Upgrading to a premium or business account often provides increased Zelle transfer limits to accommodate different financial needs.

Chase Zelle Limit

Chase takes a unique, dynamic approach to Zelle limits. The bank does not set a fixed daily or monthly limit for all users. Instead, Chase determines your limit for each transaction at the moment you set it up. This calculation considers factors like your account history and the recipient. You can see the applicable limit for a transaction directly in the Chase Mobile app or on the Chase website when you initiate the payment. This flexible system is designed to protect your account.

Citibank Zelle Limit

Citibank’s Zelle limits depend on your relationship with the bank. Your limits increase after you have been enrolled in Zelle for more than 30 days. Citibank also offers higher limits to customers in its premium banking tiers.

| Enrollment Status | Daily Limit | Monthly Limit |

|---|---|---|

| Enrolled < 30 days | $500 | $2,500 |

| Enrolled > 30 days | $2,500 - $5,000 | $15,000 - $20,000 |

Customers with a checking account in the Citi Priority, Citigold, or Citigold Private Client tiers are eligible for the higher end of these ranges. This is a key benefit for those with premium banking relationships.

Navy Federal Zelle Limit

Navy Federal Credit Union offers straightforward Zelle limits for its members. The structure is simple and easy to track.

- Daily Sending Limit: $3,000

- 30-Day Sending Limit: $3,000

Note that for Navy Federal, the daily and 30-day limits are the same. This is an important detail to remember when planning multiple large transfers within a month.

Standalone Zelle App Limits

Important 2025 Update: Zelle is discontinuing its standalone app. After March 31, 2025, you will no longer be able to send or receive money using the standalone Zelle app.

Previously, if your bank did not offer Zelle, you could use the standalone app by linking a debit card. This version had much lower limits, typically around $500 per week for sending money. For 2025, you must access Zelle through a participating bank or credit union’s mobile app. This change makes it essential to use Zelle directly through your financial institution.

Daily vs. Monthly Zelle Transfer Limits

Image Source: unsplash

Understanding the difference between daily and monthly transfer limits is key to using Zelle effectively. Your bank sets these rules to protect your account. The limits are not always based on the calendar month but often use a “rolling” period.

The 30-Day Rolling Period Explained

Many banks calculate your monthly zelle transfer limit using a 30-day rolling period. This is different from a calendar month that resets on the first. Instead, your limit is based on the total amount you have sent in the last 30 days. If you send money today, that transaction counts toward your limit for the next 30 days. Once a transaction is more than 30 days old, it no longer counts against your total, freeing up that amount for you to send again. This system continuously updates your available zelle maximum amount.

How Daily Caps Affect Your Monthly Total

Your zelle daily limit directly impacts how quickly you reach your monthly cap. Every payment you make counts toward both your daily and 30-day transfer limits. Consistently hitting your daily limit will cause you to reach your 30-day zelle sending limit much faster.

For example, look at how these two limits work together for some account types:

| Account Type | Daily Limit (24-hour rolling) | 30-Day Limit (30-day rolling) |

|---|---|---|

| Consumer | $3,500 | $20,000 |

| Business | $15,000 | $60,000 |

If you have a consumer account and send the zelle maximum amount of $3,500 for six consecutive days, you will have sent $21,000. This exceeds the $20,000 30-day limit, and you will be unable to send more money with Zelle until some of those earlier transactions fall outside the 30-day window.

Understanding Zelle Send Limits

Your zelle sending limits can vary significantly from one bank to another. The zelle daily limit is often the most immediate zelle transaction limit you will encounter. These zelle payment limits are designed for security.

Here is a look at the typical zelle daily limit at several major US banks:

As you can see, your zelle daily limit depends entirely on where you bank. A Chase customer might have a zelle daily limit of $2,000, while a Bank of America customer could have a zelle daily limit of $3,500.

Are There Limits on Receiving Money?

Generally, there are no limits on the amount of money you can receive with Zelle. Most banks allow you to receive payments without a specific zelle transaction limit. However, this can differ for business accounts. Some banks, like Synovus, apply the same zelle payment limits to both sending and receiving for business accounts.

Tip: While you can usually receive any amount with Zelle, the sender is always restricted by their own zelle sending limit. This is the most important factor determining the zelle maximum amount you can receive in a single transaction. Always check with your bank to confirm its specific policies on receiving funds via Zelle.

Factors Affecting Your Zelle Transfer Limits

You might notice that your Zelle transfer limits differ from a friend’s, even if you both use the same bank. Financial institutions use several factors to determine your specific transfer limits. Understanding these elements helps you know what to expect from your Zelle account.

Bank Account Type

The type of bank account you hold is one of the biggest factors. Banks typically offer much higher transfer limits for business accounts compared to personal checking accounts. This is because businesses often need to move larger sums of money for payroll, vendor payments, or other operational costs. If you use Zelle for your small business, upgrading to a business account could significantly increase your sending capacity.

Your Account History

Your history with the bank plays a crucial role. Many banks, including Bank of America and Citibank, set a lower initial zelle transfer limit for new customers or those newly enrolled in Zelle. This is a security measure.

Your relationship with the bank matters. Banks often increase Zelle limits over time if you have a long account history and maintain a good transaction history.

As you build a longer, positive relationship with your bank, your transfer limits may increase. Institutions may automatically raise limits for accounts that demonstrate consistent, low-risk behavior. A long-standing account in good standing signals to the bank that you are a reliable customer, which can unlock higher limits for Zelle.

Zelle Usage Patterns

How you use Zelle also influences your limits. Your transaction patterns help the bank assess your risk profile. If you consistently send small, regular payments, your activity is seen as predictable and safe. On the other hand, suddenly attempting to send the maximum amount multiple times might trigger a security review or temporary restriction on your Zelle account. Banks monitor your Zelle usage to protect you from potential fraud, and this monitoring can affect your immediate sending ability.

How to Manage and Increase Your Limit

While Zelle transfer limits are set for security, you are not always stuck with them. You have options for managing large payments and can sometimes request higher limits. Understanding these strategies helps you use Zelle more effectively for your financial needs.

Requesting Higher Transfer Limits

You can directly ask your bank for a higher limit, though success is not guaranteed. The process usually involves contacting customer service. Banks like Wells Fargo and Bank of America will review your account history and relationship before making a decision.

To improve your chances, you should follow a few key steps:

- Verify Your Account: Ensure your bank has all your current identification and documentation.

- Maintain a Good History: Keep a positive account balance and avoid overdrafts to show you are a reliable customer.

- Contact Customer Service: Call your bank to explain why you need a higher limit. Be ready to justify the request, whether for a large one-time purchase or a business need. You may need to provide extra proof of identity, like a driver’s license.

Planning for Large Payments

If you need to send more money than your daily Zelle limit allows, planning is essential. A simple and effective strategy is to split the payment into smaller amounts over several days.

Example: You need to pay someone $3,000, but your daily limit is $1,000. You can send $1,000 each day for three consecutive days. Always communicate this plan to the recipient to avoid any confusion.

Some banking apps also let you schedule future Zelle payments. This feature allows you to set up all the partial payments at once, so you do not forget.

Alternatives for Exceeding Your Limit

Sometimes, Zelle is not the right tool for a very large payment. When you exceed your transfer limits, you have several other reliable options. Each method has different speeds, costs, and use cases.

| Payment Method | Key Features | Transfer Speed | Typical Fees (Outgoing) |

|---|---|---|---|

| ACH Transfer | Low cost, good for recurring bills | 1-3 business days | Usually free or under $3 |

| Wire Transfer | Fast, secure, high limit | Same-day | $25 - $35 (domestic) |

| PayPal / Venmo | Higher limits than Zelle, fees for speed | Instant (with fee) or 1-3 days | 1.75% for instant transfers |

| Cashier’s Check | No amount limit, very secure | Depends on mail/deposit | $10 - $15 |

- Wire transfers are ideal for urgent, high-value transactions like a down payment on a house.

- ACH transfers work well for planned payments where speed is not the top priority.

- A cashier’s check offers maximum security for major purchases, such as buying a car, because the bank’s funds back it.

Choosing the right alternative ensures your money gets where it needs to go safely, even when you cannot use Zelle.

Your bank determines your Zelle transfer limit, not Zelle itself. The typical zelle monthly limit ranges from $10,000 to $20,000. However, your specific cap can be much lower based on your account history and type. This system ensures your transactions with Zelle remain secure.

For the most accurate information, you should always check your personal limit. Open your banking or zelle app to find the details. You can also contact your bank’s customer service directly.

FAQ

How can I check my specific Zelle limit?

You can find your exact Zelle transfer limit inside your bank’s mobile app or website. The information is often located in the Zelle section. If you cannot find it, contact your bank’s customer service directly for the most accurate details about your account.

Do business accounts have a higher Zelle limit?

Yes, banks almost always provide higher Zelle limits for business accounts. These accounts are designed for larger transaction volumes. For example, a Bank of America business account may have a daily limit of $15,000, far exceeding the limit for personal accounts.

Why do Zelle limits exist?

Banks implement Zelle limits to protect you and your money from fraud. These caps help minimize potential losses if your account is ever compromised. The limits are a key security feature that adds a layer of protection to your instant payments.

Can I send money internationally with Zelle?

No, you cannot use Zelle for international transfers. The service only works with U.S. bank accounts and U.S. phone numbers. You will need to use an alternative like a wire transfer or a third-party service for sending money to another country.

Remember: Your Zelle limits are not permanent. They can change based on your account history and relationship with your bank. Always verify your current limit before planning a large payment.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Zelle Wire Transfer or ACH? Clearing Up the Confusion

Why Is Canada's Country Code 1

How to Fill Out a CVS Money Order A 2026 Guide

SoFi Checking and Savings A Deep Dive Review

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.