Demystifying the ABA Number A 2025 Guide for Everyone

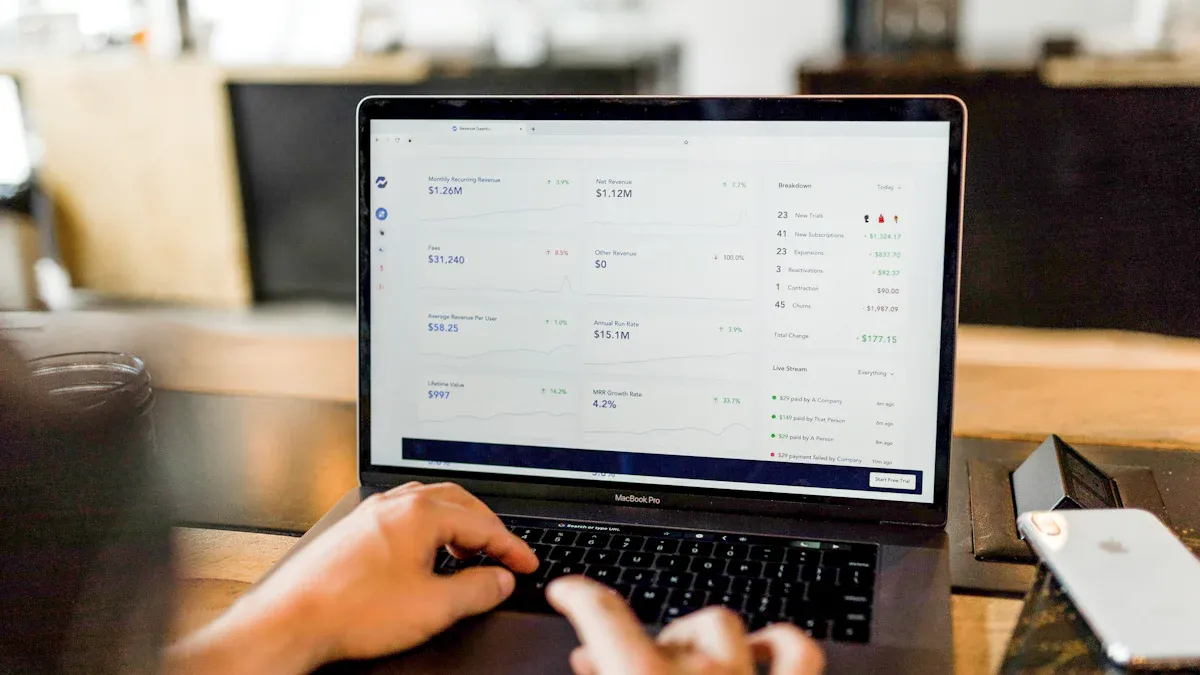

Image Source: unsplash

An ABA number is your bank’s nine-digit address for money transfers inside the U.S. You need this ABA for crucial tasks, as over 95% of workers use an ABA for direct deposits. This powerful ABA system processes a massive volume of payments and transactions. This guide simplifies finding the correct ABA number from your bank for all your financial transactions.

Did You Know? One of the most common uses of ABA numbers is setting up automatic bill payments. This category alone accounts for over 16 billion electronic payments annually. This makes the ABA essential for managing your finances.

Key Takeaways

- An ABA number is a nine-digit code. It helps send money to the right bank in the U.S.

- ABA numbers and routing numbers are the same thing. You can use them for tasks like direct deposit.

- You can find your ABA number on checks, bank statements, or in your online banking account.

- Banks use different ABA numbers for wire transfers and regular electronic payments. Always check which one you need.

- An ABA number is for U.S. money transfers. A SWIFT code is for sending money to other countries.

A common first-time mistake is treating an ABA/routing number as “universal bank details” and entering it on an international transfer form, which can trigger returns or delays. A safer workflow is to decide whether the transfer stays inside the U.S.: use ABA for domestic ACH/wires as this guide explains; for cross-border transfers, follow the recipient bank’s SWIFT/BIC requirements instead.

To reduce back-and-forth, you can start on the BiyaPay website to cross-check the bank identifier via its SWIFT lookup, then use the rate converter & comparison tool to estimate what the recipient may receive after conversion. When you’re ready to send, the remittance page can help you review available routes and fee structures—while the bank’s final instructions should remain the source of truth.

For higher-assurance scenarios, it also helps to use services that disclose compliance footprints: as a multi-asset trading wallet covering cross-border payments and fund management, BiyaPay references licensing/registration frameworks such as U.S. MSB and New Zealand FSP as part of its operational disclosures, which can serve as a practical cross-check point while you prepare transfer details.

ABA Number vs. Routing Number: Are They the Same?

You have likely seen both “ABA number” and “routing number” on financial forms. This can be confusing. Are they different? The short answer is no—they are the same thing. This section will explain the official definition and why you encounter both terms.

The Official Definition

Yes, an aba number is a routing number. The term “ABA” is an abbreviation for the American Bankers Association. The ABA first developed these bank identifiers back in 1910. The association created the original aba routing number system to make paper check processing more reliable and efficient as it grew in popularity.

Today, the term routing number refers to the modern, nine-digit code that identifies your specific bank during a transaction. Every U.S. bank has at least one of these unique routing numbers. The ABA still manages the official list of all routing numbers, so the original name stuck. The core function of an aba number remains the same: to direct your money to the correct financial institution.

Why Both Terms Are Used

You see both terms because they are used interchangeably. Financial professionals and banking apps use “routing number” and “aba number” to refer to the exact same nine-digit code. The term aba routing number is a direct link to the system’s history. “Routing number” is simply the more common, modern term for the code’s function.

✅ The Bottom Line For all practical purposes like setting up direct deposit or paying bills, there are no differences between aba numbers and routing numbers. If a form asks for your ABA, you can provide your routing number.

Think of it like this:

- ABA Number: The official, historical name from the American Bankers Association (ABA).

- Routing Number: The common, functional name describing what the code does—it routes funds.

Knowing they are the same helps you fill out forms with confidence. You can always use your primary routing number when a form requests an aba number.

How to Find Your ABA Number

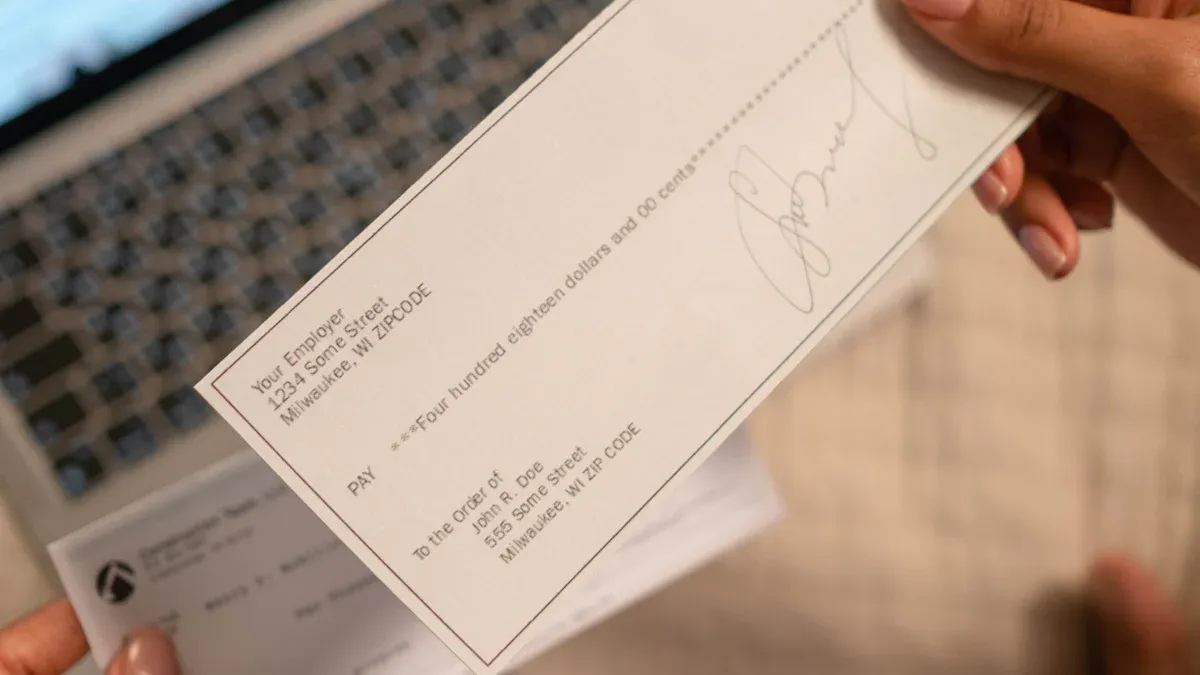

Image Source: pexels

You need your ABA number for many financial tasks. Finding it is simple once you know where to look. These methods are the quickest and most reliable ways to locate your number without any guesswork. Your bank provides this information in several convenient places.

On a Physical Check

The easiest place to find your ABA number is on one of your personal checks. Look at the long string of numbers printed at the bottom. This special line of characters is designed for fast and accurate check processing.

On standard U.S. personal checks, you will see three sets of numbers. The ABA number is the first nine-digit number on the far left. The number in the middle is your unique account number, and the number on the right is the individual check number. These numbers use a special ink called Magnetic Ink Character Recognition (MICR). This technology helps computers with automated check processing. Using checks is a classic way to identify your bank’s ABA.

In Your Online Banking Portal

Your bank’s online portal or mobile app is another excellent source. After you log in, the routing number is usually easy to find. A common method is to navigate to your account summary or details page. Your ABA is typically listed right next to your account number.

While every bank interface is different, the general steps are similar.

- Log in to your online banking account or mobile app.

- Select the specific checking or savings account you want to use.

- Look for a link or tab labeled “Account Details,” “Account Info,” or “Show Details.”

For example, Chase Mobile App users can tap their account and select ‘Account Info’ to see the ABA. Bank of America users can find it in a similar section within Online Banking or their mobile app. This method ensures you get the correct ABA for that specific account.

On Your Bank Statement

If you do not have checks or cannot log in to your account, check your bank statement. Whether you receive paper statements in the mail or download them as PDFs, the statement contains all your key account information. Your ABA number is almost always printed on the statement, usually near your full account number. This makes your statement a reliable backup for finding your ABA.

Quick Tip Your digital bank statement (e-statement) is a fast way to find your ABA number. Just download the latest PDF from your online portal and look for your account details, which will include the necessary ABA.

On Your Bank’s Website

Most financial institutions list their ABA numbers on their public websites. You do not need to log in to find this information. This method is useful if you do not have an account yet or cannot access your personal details.

You can often locate your bank’s ABA number on its official website, frequently within the Frequently Asked Questions (FAQs) or customer support sections.

However, use this method with caution. Large national banks may have multiple ABA numbers that vary by state or the region where you opened your account. Always confirm you are using the correct routing number for your specific location to avoid errors in check processing. Getting the right ABA number is vital for smooth check processing.

Different Routing Numbers for Wires vs. ACH

You might assume your bank uses one routing number for all transactions. This is a common and critical mistake. Many banks use different routing numbers for different types of payments. Using the wrong number is a frequent error that causes significant transaction delays or even failures. Understanding this distinction is essential for ensuring your money moves correctly.

Why Banks Use Separate Numbers

Banks separate routing numbers to manage two very different systems for electronic transfers: the Automated Clearing House (ACH) network and the wire transfer system. Each system serves a unique purpose for transactions.

- ACH Routing Number: Your bank uses this number for routine, automated electronic payments. These transactions are processed in large batches through the Automated Clearing House. Think of it as the standard route for everyday electronic payments like direct deposits and bill pay. These transactions are reliable but can take one to three business days to complete.

- Wire Routing Number: Your bank uses this number for direct, urgent bank-to-bank transfers. Wire transfers move money in real-time and are typically used for large-value or time-sensitive payments, such as a down payment on a house. Because these transactions are handled individually and immediately, they require a specific routing number.

This separation helps your bank process millions of transactions efficiently and securely. The ACH system is built for high-volume, low-cost payments, while the wire system provides a direct and immediate path for high-priority transactions.

Finding the ACH Routing Number

You need the ACH routing number for most of your common electronic financial tasks. This is the number you will use most often for setting up automated payments and receiving funds into your account. The ACH system handles a vast range of electronic transactions.

Common examples of transactions that require an ACH routing number include:

- Direct Deposits: Companies use the ACH network to send payroll directly to your bank account. You also use it for other direct deposits, like government benefits, tax refunds, and pension payments.

- Recurring Bill Payments: You can set up automatic electronic payments for your mortgage, car loan, insurance premiums, and utility bills.

- Peer-to-Peer (P2P) Payments: Services like Venmo or Zelle often use the ACH network to move money between individuals.

- Account Funding: When you move money from an external bank account to fund a new checking, savings, or investment account, you use an ACH routing number.

The most reliable place to find your ACH routing number is on a physical check. It is the nine-digit number printed on the bottom-left corner. You can also find this aba number in your online banking portal, usually listed under “Account Details” next to your account number. This is the primary aba you will use for most electronic transactions.

Finding the Wire Routing Number

You must use a specific wire routing number for all domestic wire transfers. Using the ACH aba number for a wire transfer will cause the transaction to fail. Wire transfers are a different class of electronic payments, so they need a different set of instructions.

To successfully send a wire, you need to provide the correct information for the recipient.

| Information Required for a Domestic Wire Transfer |

|---|

| Recipient’s Full Name and Physical Address |

| Recipient’s Bank Name and Address |

| Recipient’s Bank Account Number |

| The specific Wire Routing Number for the recipient’s bank |

⚠️ Important Note Never assume the routing number on your check is the same one used for wire transfers. Large national banks often have a single, dedicated aba number for all incoming domestic wire transfers, which is different from the state-specific routing numbers used for ACH transactions and checks.

The best way to find the correct wire routing number is to check your bank’s website directly. Look for a section on “wire transfers” or in the site’s FAQ. You can also call your bank’s customer service to confirm the correct number. Double-checking this detail is a crucial step for successful wire transfers and is a key part of understanding aba numbers in electronic transactions. This ensures your high-value payments are processed without any issues.

How to Verify Your ABA Number Correctly

Using the correct ABA number is crucial for successful financial transactions. A simple mistake can lead to delays or failed payments. You should always verify your ABA number before using it for important transactions. These steps will help you confirm your details with confidence and ensure your money goes to the right place. Learning how to verify your ABA number is a simple but essential skill.

Always Check with Your Bank First

The most reliable source for your ABA number is always your bank. Your bank provides the definitive information for your specific account and location. Before initiating critical transactions like setting up a direct deposit or sending a large payment, contact your bank. You can call their customer service line or visit a local branch. This direct confirmation from your bank eliminates any guesswork and is the best way to verify your ABA number. A quick call can prevent future headaches with your transactions.

Using the ABA’s Official Lookup Tool

The American Bankers Association (ABA) offers a public tool to look up any ABA. This is a great secondary method to verify your ABA number. You can use the official ABA routing number lookup tool, which is available at https://routingnumber.aba.com/. This website allows you to search for a bank and see its official ABA. While this tool is helpful, remember that a large bank may have multiple numbers. The tool confirms an ABA is valid, but your bank confirms which ABA to use for your specific transactions.

✅ Pro Tip Use the ABA lookup tool to double-check the number you found on your bank’s website or statement. This adds an extra layer of certainty before you finalize your transactions.

What to Do If Numbers Don’t Match

You might find that the ABA number on your checks is different from the one your bank provides for electronic transactions. This is a common situation, so do not panic. It usually means your bank uses separate numbers for different types of transactions. If you encounter a mismatch, you need to verify your ABA number for the specific task.

Follow these steps if you are unsure which ABA to use:

- Stop and do not proceed with the transaction. Using the wrong ABA will cause it to fail.

- Contact your bank directly. Explain the type of transaction you are making (e.g., direct deposit, wire transfer).

- Ask the bank representative to provide the correct ABA for that specific purpose.

For example, the routing number for ACH transactions is often different from the one for wire transfers. Always get the right ABA from your bank to ensure your transactions are processed smoothly.

ABA vs. SWIFT Code: Domestic vs. International

Image Source: unsplash

You can think of your bank’s identification codes like travel documents for your money. The ABA number is a local driver’s license for moving money within the U.S., while a SWIFT code is an international passport. Your U.S. bank has both, but you must use the right one for the right journey to avoid delays. Understanding the difference is key for successful transactions.

Use an ABA Number for U.S. Transfers

You use an aba number for all financial transactions that happen entirely within the United States. The ABA system is the backbone of the nation’s payment infrastructure. This nine-digit code, assigned by the American Bankers Association, directs funds to the correct domestic financial institution. The ABA is essential for many common tasks.

You need the correct ABA for:

- Direct deposit of your paycheck

- Automatic bill payments

- ACH transfers between U.S. accounts

- Domestic wire transfers

Did You Know? A transfer is considered domestic even if it goes to a U.S. territory. You use the same ABA system for transactions with banks in places like Puerto Rico, Guam, and the U.S. Virgin Islands.

Your bank provides the correct ABA for all these domestic transactions.

Use a SWIFT Code for Global Transfers

When you need to send or receive money from another country, you must use a SWIFT code. SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. This code, also known as a Bank Identifier Code (BIC), acts as a global address for your bank. It ensures your international transactions are routed securely and accurately across borders.

A SWIFT code is not an aba number. It has a different format and purpose. While the ABA is strictly for U.S. transactions, the SWIFT network connects over 11,000 institutions in more than 200 countries. Using the wrong code will cause the transaction to fail.

| Feature | ABA Routing Number | SWIFT Code |

|---|---|---|

| Geographical Use | United States & its territories | Worldwide |

| Purpose | Domestic transactions | International transactions |

| Format | 9 digits | 8 or 11 alphanumeric characters |

Always confirm with your bank which code to use. Providing the right identifier—an aba number for U.S. payments and a SWIFT code for global ones—is a simple step that guarantees your money arrives without issues.

Understanding the 9-Digit Code

Your nine-digit ABA number is more than just a random code; it is a highly organized sequence. Each part of the number provides specific information that payment systems use to route your money correctly. Breaking down the code reveals how ABA numbers work and ensures every transaction is directed with precision.

Digits 1-4: Federal Reserve Identifier

The first four digits of your ABA identify the Federal Reserve district where your bank is located. The Federal Reserve uses these digits as a routing symbol based on the bank’s physical location and processing center. For example, if the first four digits are 0210, this tells the system the financial institution is in the New York Federal Reserve district.

The first two digits specifically point to one of the twelve Federal Reserve Districts, from 01 for Boston to 12 for San Francisco. Thrift institutions, like some savings and loans, follow a similar rule, but you add two to their district number (e.g., a thrift in the Boston district would start with 21). The number of routing prefixes varies significantly by district, reflecting the concentration of banking activity across the country.

Digits 5-8: Bank Identifier

The next four digits, from the fifth to the eighth position, uniquely identify your specific financial institution. Think of this as your bank’s unique ABA ID number within its Federal Reserve district. While the first four digits point to a general region, this middle section pinpoints the exact bank or credit union that holds your account. This ensures your funds are sent to the correct institution among the many that may operate in the same area.

Digit 9: The Verification Digit

The ninth and final digit is a special “check digit.” Its sole purpose is to validate the authenticity of the entire ABA. This single digit acts as a security check, confirming the first eight digits are correct and preventing typos. Payment systems use a complex mathematical formula to verify the ABA before processing a transaction.

How It Works The system uses a checksum formula to validate the ABA. It multiplies the first eight digits by a sequence of weights (

3, 7, 1, 3, 7, 1, 3, 7), adds the results, and performs a calculation. The final result must match the ninth digit. If it does not, the transaction is flagged for an error.

This built-in verification step is crucial for preventing payment failures and fraud.

The ABA number is a fundamental tool for U.S. banking payments that you can easily find. You can locate your primary ABA on your paper checks or within your online banking portal. These methods are best for setting up most electronic payments. This ABA ensures your electronic payments are processed correctly.

⚠️ Final Reminder A common error is using the wrong ABA for different types of payments. Always confirm if you need a specific ABA for wire transfers versus routine electronic payments. Using the ABA from your checks for wire transfers can cause your payments to fail. This simple check prevents delays with your important electronic payments.

FAQ

Can I use the same ABA number for all my accounts?

Not always. Large banks sometimes assign different ABA numbers based on the state where you opened the account. You should verify the correct number for each specific account to ensure your transactions are successful.

Do credit unions have ABA numbers?

Yes, they do. ✅ Credit unions, like banks, use the same nine-digit ABA routing number system for financial transactions. You can find this number on your checks or by contacting your credit union directly.

What happens if I use the wrong ABA number?

Using an incorrect ABA number will cause your transaction to be delayed or rejected entirely. Your funds will not reach the intended destination. You must always double-check the number before sending a payment.

Is my ABA number the same as my account number?

No, they are two separate and distinct numbers. Your ABA number identifies your bank, while your account number identifies your personal account at that bank. You need both for most electronic transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Zelle Wire Transfer or ACH? Clearing Up the Confusion

What Are the Daily Limits for Chase Accounts?

Tap and Go A Beginner's Guide to Cardless ATM Withdrawals

How to Fill Out a CVS Money Order A 2026 Guide

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.