Stop Worrying About Fees! Ultimate Guide to Buying US Stocks: Sub-Brokerage vs Overseas Broker Comparison

Image Source: pexels

Want to know the most cost-effective way to buy US stocks? The answer is simple. If you trade frequently, overseas brokers save you the most money. If you want maximum convenience, sub-brokerage is easier. The final choice depends entirely on your investing style and needs.

Key Takeaways

- There are two main ways to invest in US stocks: sub-brokerage and overseas brokers. The right one depends on your habits and needs.

- If you trade stocks often, overseas brokers usually offer zero commissions and save a lot. Sub-brokerage has minimum fees that make small trades expensive.

- If you’re a small investor who invests a fixed amount monthly, sub-brokerage dollar-cost averaging plans are very cost-effective. They avoid overseas wire fees and are simple to use.

- If you’re a long-term investor with large capital, both work. Overseas brokers have lower costs, but sub-brokerage has estate tax advantages and is more convenient.

- Overseas broker funds are protected by US SIPC; sub-brokerage is regulated by Taiwan’s FSC — both are very safe.

How to Buy US Stocks? Cost Comparison: Sub-Brokerage vs Overseas Broker

Image Source: unsplash

The first step in investing in US stocks is understanding where your money goes. Many people only look at trading commissions and ignore hidden costs like wires and FX spreads. To know how to buy US stocks cheapest, you must think in terms of total cost. Below we break down the cost structure from three core expense categories.

Trading Commissions & Minimum Fee Traps

Trading commissions are the most obvious cost. The two channels charge completely differently.

- Sub-brokerage: Beware the “minimum fee” trap

Placing US stock orders through a Taiwanese broker (sub-brokerage) usually costs 0.25% to 0.5% of the trade value. Sounds low, but the devil is in the minimum fee (often called “low consumption”).Most brokers can handle both Taiwan and US stocks, but local brokers’ “sub-brokerage” fees are shockingly high! Using sub-brokerage is not only troublesome but also extremely expensive — it makes all your effort feel wasted.

Minimum fees range from $1 to nearly $40 USD — a huge burden for small trades. Example: If the minimum is $35 and you buy only $500 worth of stock, you pay the full $35 — a 7% cost!

- Overseas brokers: Zero-commission is now mainstream

In contrast, the biggest attraction of overseas brokers is zero trading commissions. Major brokers like Charles Schwab and Interactive Brokers have introduced $0 commissions for online trades of US-listed stocks and ETFs. This means no commission regardless of size — a blessing for frequent traders or those buying in installments.

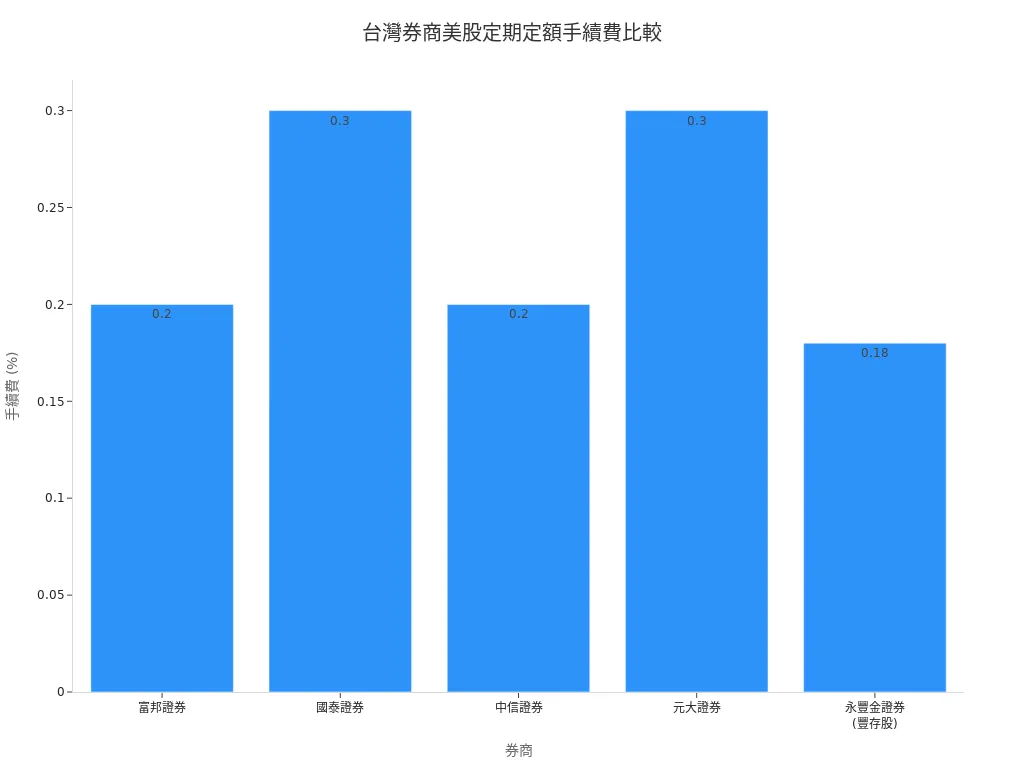

Tip for small investors! Sub-brokerage dollar-cost averaging discounts

In recent years, to attract small investors, some Taiwanese brokers launched US stock “dollar-cost averaging” plans with lower or even waived minimum fees. If you only want to invest small fixed amounts monthly and avoid international wires, this is a great compromise.

Fund Transfer Costs & FX Fees

Getting money into the account also costs money — and the difference is huge.

- Sub-brokerage: Simple FX, cost built-in

With sub-brokerage, funds are usually deducted directly from your TWD settlement account and the broker handles FX conversion. No need to deal with complicated international wires. The FX spread is baked into the rate — convenient but harder to see the true cost. - Overseas brokers: International wire fee is the main expense

To fund an overseas broker, you must use a bank “international wire transfer” that costs a flat $20–$50 USD (including sending bank and intermediary fees).

This fixed fee is the biggest cost for overseas brokers. The smart move is to wire a large amount at once — e.g., $10,000 makes the fee negligible. Wiring $1,000 each time makes the fee painfully high.

Use BiyaPay’s FX converter to compare rates before funding an overseas broker.

Then send money in fewer, larger batches to reduce flat wire fees.

Check tickers and market hours via Stock info.

When executing, use the trading entry for allocation.

BiyaPay is a multi-asset wallet for payments, investing and asset management, with compliance credentials such as US MSB and NZ FSP.

Service scope: official site.

If needed, register and follow the Event center.

Recently, new payment tools like Biyapay have emerged, offering more cost-effective FX and deposit/withdrawal options compared to traditional bank wires — another way to save.

Account Maintenance & Other Hidden Fees

Finally, watch for less common fees.

- Account maintenance fee: Fortunately, both sub-brokerage and mainstream overseas brokers now mostly waive this.

- Inactivity fee: Some brokers charge for dormant accounts. This is becoming rare — e.g., Interactive Brokers cancelled it recently. Always read the fee schedule before opening an account.

In summary, when thinking about how to buy US stocks cost-effectively, you must add up all these expenses to get the true “total cost of ownership.”

Convenience, Safety & Functionality: Ultimate Comparison

Beyond cost, you must consider which channel feels smoother and safer. When thinking how to buy US stocks, convenience and security often decide the final choice. Below is a full comparison from account opening, safety, taxes, to flexibility.

Account Opening & Interface Convenience

- Sub-brokerage: Easiest opening. You can usually just add the sub-brokerage feature to your existing Taiwan stock account — no extra documents, money flows between familiar TWD accounts and broker apps.

- Overseas brokers: A few more steps. You need documents and complete an online application. For Charles Schwab, you may need to provide:

- Form W-8BEN (proving non-US tax resident status)

- Valid passport copy

- Proof of address (utility bill)

Fund Safety: Taiwan FSC vs US SIPC

Where is your money kept and who protects it? Huge question.

- Sub-brokerage: Assets are regulated by Taiwan’s Financial Supervisory Commission (FSC). If the broker fails, you’re protected by the Securities Investor and Futures Trader Protection Act.

- Overseas brokers: Accounts are protected by the US Securities Investor Protection Corporation (SIPC). In bankruptcy, each account gets up to $500,000 protection ($250,000 cash cap).

Tax Issues: Dividend Tax vs Estate Tax Differences

Taxes are the hidden devil many overlook. No matter which channel, US stock dividends are withheld at 30% dividend tax. The broker deducts it automatically.

The real difference is estate tax. With overseas brokers, your US stock assets are fully subject to US estate tax rules. Non-US persons have only a $60,000 exemption — anything above can be taxed up to 40%. A serious consideration for high-net-worth investors.

Investment Flexibility: Dollar-Cost Averaging & DRIP

- Sub-brokerage: Biggest advantage is the familiar “dollar-cost averaging” function. Many brokers offer commission discounts for it — perfect for small investors.

- Overseas brokers: Offer more flexible “Dividend Reinvestment Plans” (DRIP). You can set dividends to automatically buy fractional shares of the same stock — commission-free compounding.

Investment Scenario Analysis: Which One Is Right for Me?

Image Source: pexels

Enough theory — let’s get practical. You’re probably still asking, “So which one should I pick?” Don’t worry — this section is tailor-made for you. We analyze the three most common investor types so you can find your perfect match.

Small Investors & Dollar-Cost Averagers

If your strategy is putting in a fixed amount every month (e.g., $100–$500) to build long-term wealth, you’re a classic small investor or dollar-cost averager.

For you, sub-brokerage dollar-cost averaging plans are almost always best.

Why? Cost structure. With overseas brokers you pay a wire fee every time you add money. If a wire costs $30 and you only add $300, that’s a 10% fee — terrible.

Taiwan brokers’ US stock dollar-cost averaging plans solve exactly this pain point. They offer very low rates and often waive minimum fees. You just set the date and ticker, everything else is automated, and money stays in your familiar TWD ecosystem.

Conclusion: If you want simple, brain-free monthly investing with modest amounts, sub-brokerage dollar-cost averaging beats overseas brokers on both convenience and cost.

Short-Term & High-Frequency Traders

If you trade actively — maybe several times a week — trying to capture short-term moves, you’re a short-term or high-frequency trader.

For this group the answer is crystal clear: Choose overseas brokers.

Sub-brokerage minimum fees are a killer. Every trade, no matter how small, can trigger a fixed charge that destroys profits or turns winners into losers.

Real example: Four small trades with gross profit $8.00 total. But if each has a $3.39 minimum fee, total commissions = $13.56. Net result: a $5.56 loss ($8.00 - $13.56).

Overseas brokers’ zero-commission policy eliminates this nightmare. Trade as often as you want without fees eating your profits.

Plus, overseas brokers offer far more powerful tools. You get more flexible leverage (like XM, FBS), professional platforms (Pepperstone, OctaFX supporting MT4/MT5), and some like eToro offer unique copy-trading (CopyTrader) to follow top traders.

Conclusion: For frequent traders, overseas brokers dominate on cost and functionality.

Long-Term Holders & Large Capital Investors

If you have substantial capital (tens of thousands USD per deposit) and plan to buy and hold long-term without frequent trading, you’re in the sweet spot — both channels work well.

Your choice now depends on priorities: absolute cost minimization or long-term convenience and tax planning?

- Choose overseas brokers if you want the absolute lowest cost. One large wire dilutes the fee, and zero commissions + potentially better FX rates save money long-term.

- Choose sub-brokerage if you value maximum convenience and worry about US estate tax. No international wires, everything stays in Taiwan’s system. More importantly, US stocks held via sub-brokerage follow Taiwan inheritance tax rules with much higher exemptions than the US’s $60,000 for foreigners — a major consideration for wealthy investors.

When thinking how to buy US stocks best for you, refer to the table below:

| Feature | Overseas Broker | Sub-Brokerage |

|---|---|---|

| Total Cost | Lowest (large one-time deposit) | Higher (but less impact on large trades) |

| Convenience | More complex (international wires) | Extremely high (domestic flow) |

| Estate Tax Risk | High ($60,000 exemption only) | Low (Taiwan rules apply) |

| Best For | Cost-obsessed | Convenience & tax planning |

Conclusion: Large investors can choose the channel that best matches their priorities on cost, convenience, and estate planning.

After all this analysis, you should understand there’s no one-size-fits-all answer for US stocks. Sub-brokerage and overseas brokers each have strengths and weaknesses — the key is you.

Want to find your perfect fit? Answer these three questions:

- Do you trade frequently?

- Is your typical investment size large?

- How much effort are you willing to spend to save money (e.g., dealing with slower processing)?

Your answers map directly to the scenarios above. You now have all the information to make the smartest choice.

FAQ

Can I get a refund on the 30% dividend tax?

In theory yes — you can apply for a refund from the IRS. But the process is very complicated and requires special tax forms. For most investors, the time and effort aren’t worth it.

Is money really safe with overseas brokers?

Yes — funds are highly protected. Reputable US brokers are covered by SIPC. In the extremely unlikely event of broker bankruptcy, you get up to $500,000 protection per account — very safe.

I’m a complete beginner with very little money — what’s my first step?

We recommend starting with sub-brokerage “dollar-cost averaging” plans.

This is the simplest way to invest and avoids the high single international wire fees of overseas brokers. Focus on regular disciplined investing and easily build your first US stock position.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Why Is Canada's Country Code 1

Zelle Wire Transfer or ACH? Clearing Up the Confusion

The 18 Best Apps to Earn Real Cash This Year

What is the Dialing Code for the USA and How to Call?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.