Complete Guide to Remitting Money from China to Hong Kong with Operational Details

Image Source: unsplash

Are you considering how to safely and legally remit funds from China to Hong Kong? Chinese users can choose from various methods: bank wire transfers are suitable for large amounts, while platforms like Wise, Panda Remit, Paysend, and Xoom are ideal for those seeking transparent exchange rates and fast transfers. AlipayHK and FPS are great for daily expenses, while UnionPay card withdrawals and carrying cash suit temporary small-amount needs. You need to focus on compliance processes to avoid risks from non-compliance.

Key Points

- Chinese users have multiple options for remitting to Hong Kong; bank wire transfers are suitable for large funds, secure but slower.

- Emerging platforms like Wise and Panda Remit offer low fees and fast transfers, ideal for small and frequent remittances.

- AlipayHK and FPS are suitable for daily small transactions, with fast transfers and low fees.

- Carrying cash and UnionPay card withdrawals are suitable for temporary small needs but require attention to safety and declaration regulations.

- When choosing a remittance method, consider fund size, transfer speed, and compliance requirements to ensure accurate information and avoid risks.

Overview of Remittance Methods for Chinese Users

Image Source: unsplash

When remitting money from China to Hong Kong, you can choose from multiple methods. Each method suits different needs and scenarios. You need to select the most appropriate channel based on your specific situation. Below, I will detail each mainstream remittance method and compare their features.

Bank Wire Transfer

Bank wire transfer is the preferred choice for many Chinese users remitting to Hong Kong. You can use banks like Bank of China or Agricultural Bank of China to transfer funds directly to a Hong Kong bank account. Bank wire transfers are suitable for large fund transfers and offer high security. You need to provide detailed recipient information, including the Hong Kong bank’s account name, account number, and SWIFT code. The transfer time for bank wire transfers is generally 3 to 7 business days. The fee structure is complex, including foreign exchange fees, telegraph fees, and full-amount delivery fees. For a $5,000 remittance, the total cost is approximately 36,732.76 RMB (based on real-time exchange rates). If you are not concerned about transfer speed and are handling large amounts, bank wire transfers are a good choice.

Wise Platform

The Wise platform offers a more convenient option for Chinese users remitting to Hong Kong. You can use Wise to directly convert RMB to HKD or USD and transfer it to a Hong Kong bank account. Wise uses the real market exchange rate with transparent fees. You only need to pay a one-time fee, typically lower than traditional banks. The transfer speed is fast, with instant transfers possible in some cases. Wise supports Alipay and WeChat payments, making operations simple. If you prioritize low fees and fast transfers, Wise is an excellent choice.

Panda Remit

Panda Remit is an emerging cross-border remittance platform. You can complete registration and identity verification via its mobile app. Then, you can transfer funds directly to a Hong Kong bank account. Panda Remit charges a flat fee of 80 RMB, with exchange rates close to the market rate. The transfer speed is very fast, often within minutes. Panda Remit is suitable for users needing small, quick remittances. You don’t need complex documentation, and the process is straightforward. If you want to complete remittances from China at low cost and high speed, Panda Remit is worth considering.

AlipayHK and FPS

AlipayHK and FPS are suitable for daily expenses and small transfers. You can open an AlipayHK account in China and use its cross-border transfer function to send funds to a Hong Kong bank account or another AlipayHK user. FPS is Hong Kong’s local real-time payment system, supporting multiple banks and e-wallets. You can enjoy near-instant transfers. Fees are low, making it ideal for frequent small remittances. If you have daily spending needs in Hong Kong, these methods are very convenient.

Paysend and Xoom

Paysend and Xoom are international remittance platforms. You can register an account via their mobile app or website and link a bank card to transfer funds to Hong Kong. Paysend offers low fees, transparent rates, and fast transfers. Xoom supports multiple payment methods, catering to various needs. Both are suitable for users needing flexible remittance channels. If you prefer international platforms for remittances from China, try Paysend or Xoom.

Carrying Cash

You can also carry cash to Hong Kong. According to Chinese regulations, carrying cash equivalent to more than $5,000 out of the country requires declaration. You need to be mindful of safety risks and declaration procedures. Carrying cash is suitable for temporary small needs but is not recommended for frequent use.

UnionPay Card Withdrawal

UnionPay card withdrawals are suitable for short-term fund turnover. You can use a China-issued UnionPay card to withdraw cash at ATMs in Hong Kong. The daily withdrawal limit per card is typically equivalent to $1,000. Fees are low, and the process is simple. If you only need small amounts of cash, UnionPay card withdrawal is a convenient option.

You can refer to the table below to understand the key differences in transfer speed and fees between bank wire transfers and emerging platforms:

| Remittance Method | Transfer Time | Fee Structure and Amount |

|---|---|---|

| Bank Wire Transfer | 3 to 7 business days | Complex fees, including forex fee (0.1%, min 50 RMB, max 260 RMB), telegraph fee (~150 RMB), full-amount delivery fee ($15-25). Total cost for $5,000 is ~36,732.76 RMB. |

| Emerging Platforms | Minutes to instant | Simple and low fees, e.g., Panda Remit charges a flat 80 RMB, rates close to market; Wise offers real market rates and one-time fees, supports instant Alipay/WeChat transfers, transparent and efficient. |

You can see that emerging platforms outperform traditional bank wire transfers in transfer speed and fees. If you prioritize efficiency and low costs, consider these emerging channels.

Bank Wire Transfer

Image Source: unsplash

Operational Process

You can handle bank wire transfers via counter, online banking, or ATM. Using Bank of China as an example, for counter transactions, follow these steps:

- Fill out the International Remittance Application Form, entering the recipient bank’s name, address, SWIFT code, bank code, account number, and account name.

- Pay the remittance principal and fees.

- Sign for confirmation and provide contact information.

- Obtain the remittance receipt to complete the process.

For online banking, log in, select “Transfer and Remittance,” then “International Remittance,” and follow the prompts to enter details. For ATM self-service, insert your card, verify, select “Overseas Remittance,” and input recipient details.

Required Documents

You need to prepare a valid ID, recipient bank account details (including account name, number, bank name, SWIFT code), and a completed remittance application form. Some banks may also require proof of fund sources.

Fees and Limits

Bank wire transfer fees are complex. You typically pay forex fees, telegraph fees, and full-amount delivery fees. For Bank of China, a $5,000 remittance incurs a fee of ~$15-25, a telegraph fee of ~$20, and a forex fee of 0.1% of the rate (min $5, max $30). Daily limits vary by bank. Refer to the table below:

| Bank Name | Remittance Direction | Single Transaction Limit | Daily Limit |

|---|---|---|---|

| HSBC | To overseas third-party accounts | Not specified | $50,000 |

| HSBC | To overseas same-name accounts | Not specified | $200,000 |

| CMBC Hong Kong Branch | RMB to Bank of China | Not specified | $11,000 |

Transfer Time

Bank wire transfers typically take 3 to 7 business days. Banks like HSBC and Standard Chartered can process transfers in 3 business days if all documents are complete. Delays may occur during holidays or if documents are incomplete.

Precautions

Ensure recipient information is accurate when filling out forms. Errors can cause delays or returns. You need to monitor per-transaction and daily limits to avoid exceeding them. For remittances from China to Hong Kong, check the bank’s compliance requirements to ensure legal fund sources. For large transfers, banks may request additional proof of funds.

Wise Platform

Account Opening and Verification

You can register an account on Wise’s website or app. During registration, provide your real name, email, and phone number. You must complete identity verification by uploading ID photos. Wise requires linking a bank card or Alipay account. You also need to upload proof of address, such as utility or bank statements. All information must be accurate to ensure smooth remittances from China.

Remittance Process

After logging into your Wise account, select “Send to Hong Kong.” Enter the recipient’s name, Hong Kong bank account details, and currency. Wise supports HKD and USD. You can pay via bank card, Alipay, or WeChat. The system displays real-time rates and fees. Confirm and submit, and Wise will process the remittance automatically.

Fees and Limits

Wise uses the mid-market exchange rate, ensuring transparency. Fees are as low as 0.41%. For a $1,000 remittance, the fee is ~$4.1. Actual fees vary by payment method and destination. Single transaction limits are typically $5,000, subject to Wise’s on-screen prompts.

Transfer Speed

Wise remittances are fast. 50% of transfers are instant, and 90% arrive within 24 hours. Some cases may take longer. You can track progress in real-time on the Wise platform.

Common Questions

Wise Platform Advantages:

- Uses mid-market exchange rate, transparent rates

- Low fees, controllable costs

- Fast transfers, wide coverage

- Supports cashless payments, user-friendly

Disadvantages:

- No physical branches for in-person services

- Fees and transfer speeds vary by situation

When using Wise, ensure recipient details are accurate. Contact Wise’s online support for issues. Wise suits Chinese users seeking efficient, low-cost remittances.

Panda Remit

Registration and Identity Verification

You can register on Panda Remit’s app or WeChat mini-program. Provide your real name, phone number, and email. The system requires uploading ID photos for verification. Panda Remit uses multi-layer encryption to protect your information. You must complete verification to proceed with remittances from China.

Remittance Steps

After logging in, select “Send to Hong Kong.” Enter the recipient’s name, Hong Kong bank account details, and amount. Panda Remit supports payments via bank card, Alipay, and WeChat. After confirming details, the system shows real-time rates and fees. Click confirm, and Panda Remit processes the remittance automatically. The entire process is online, with no need for physical branches.

Fees and Exchange Rates

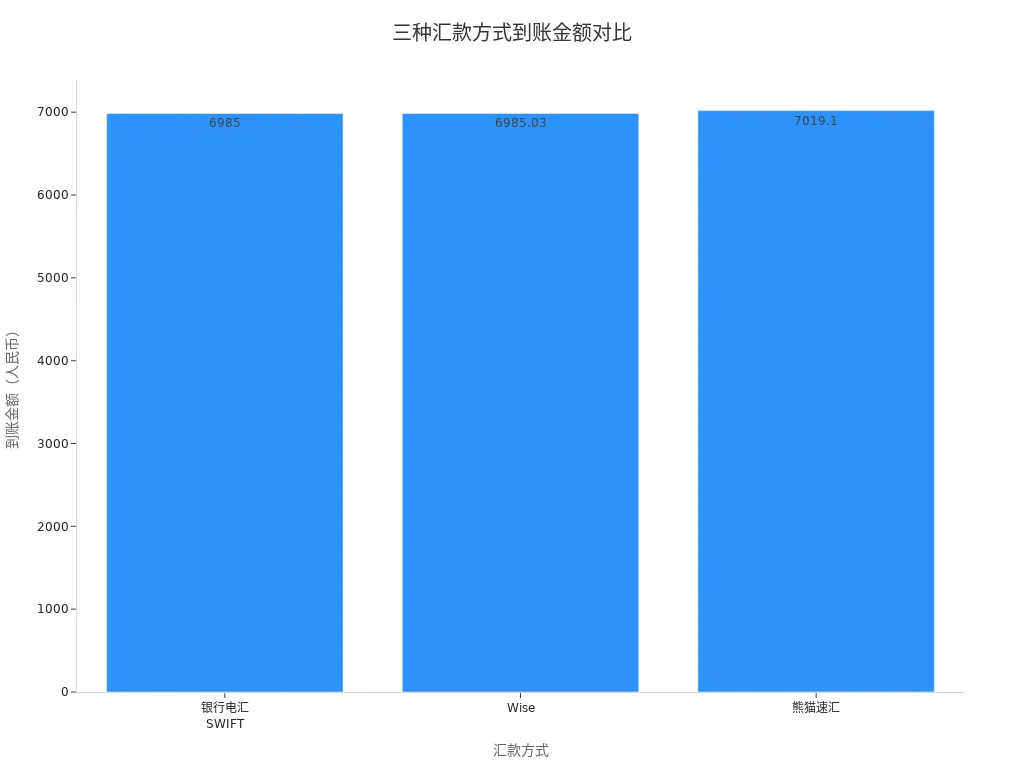

Panda Remit’s fees are transparent. You pay a flat 80 RMB (~$11) per remittance, regardless of amount. Exchange rates are typically 0.125% above Hong Kong banks’ forex selling rates, offering low conversion costs. Refer to the table below for a comparison of fees and received amounts:

| Remittance Method | Fee Structure | Rate Advantage | Received Amount ($1,000) | Remarks |

|---|---|---|---|---|

| Bank Wire (SWIFT) | Fixed, high, tens to hundreds of dollars | No significant advantage | ~6,985 RMB | Suitable for large remittances ($50,000+) |

| Wise | Percentage-based, higher for large amounts | Fairly objective rates | 6,985.03 RMB | Fast, suitable for small/medium remittances, not supported for outbound from mainland China |

| Panda Remit | Low fees for small amounts, as low as zero | Rates better than Wise, profits from spread | 7,019.1 RMB | Fully online, fast (15-30 min), supports 33 countries, ideal for small/medium remittances |

Transfer Time

Panda Remit offers very fast transfers. You can typically receive funds within 15-30 minutes. In practice, some users see transfers arrive in 15 minutes. Panda Remit’s automated processing greatly enhances efficiency. You can track progress in the app.

Risks and Precautions

Panda Remit holds an MSO license, is backed by Sequoia Capital, and has legal services from King & Wood Mallesons. Your funds are secure during use. It collaborates with Alipay, supporting multiple payment methods. Ensure recipient information is accurate to avoid transfer failures. Panda Remit supports remittances up to $50,000, suitable for small to medium amounts. Avoid frequent large transactions and comply with legal regulations.

AlipayHK and FPS

Account Opening

You can download the AlipayHK app on your phone. Register with your phone number and basic information. The system requires identity verification. You can choose mid-level or high-level verification. Higher verification levels grant larger remittance limits. FPS requires a Hong Kong bank account. You can activate FPS via the bank’s app or counter. The process is simple and takes a few minutes.

Cross-Border Transfer Process

To use AlipayHK for remittances from China, select “Cross-Border Transfer” in the app. Enter the recipient’s Hong Kong bank account details and amount. The system displays real-time rates. Confirm and submit the request. For FPS, use the Hong Kong bank app to enter the recipient’s FPS ID or phone number. Input the amount, and the system completes the transfer. The process is straightforward, ideal for daily small fund transfers.

Fees and Limits

AlipayHK fees are low, typically ~$1-2 per transfer (based on real-time rates). Your remittance limit depends on verification level. See the table below:

| Verification Level | Single Transaction Limit | Daily Limit |

|---|---|---|

| Unverified | No remittances | No remittances |

| Mid-Level | 7,999 HKD (~$1,025, at 1 HKD = 0.128 USD) | 7,999 HKD (~$1,025) |

| High-Level | 20,000 HKD (~$2,560) | 20,000 HKD (~$2,560) |

With high-level verification, you can remit up to $2,560 per transaction and daily. FPS fees are typically charged by Hong Kong banks, with some offering free small transfers. Check specific fee standards in the bank’s app.

Transfer Speed

AlipayHK transfers to Hong Kong bank accounts typically arrive within minutes. FPS, as Hong Kong’s real-time payment system, achieves near-instant transfers. You can track progress in the app. The high speed is ideal for urgent fund needs.

Precautions

Ensure recipient information is accurate during operations. Errors can cause failures or delays. Monitor your verification level and remittance limits to avoid exceeding them. For remittances from China, check Hong Kong bank policies in advance. Ensure fund source compliance to avoid risks from non-compliant operations.

Paysend and Xoom

Platform Registration

You can quickly register on Paysend or Xoom’s website or app. Paysend requires your phone number, email, and ID information. Xoom needs your email, phone number, and identity verification. Both offer multi-language interfaces, with simple registration processes.

Remittance Process

After logging in, select “Send to Hong Kong.” Paysend supports payments via bank card, credit card, or mobile wallet. Enter the recipient’s Hong Kong bank account details and amount; the system shows real-time rates and fees. Xoom’s process is similar, allowing bank transfers, credit, or debit card payments. Enter recipient details, and the system calculates fees. The entire process is online, suitable for remittances from China to Hong Kong.

Fees and Transfer Speed

Paysend’s fees are much lower than traditional banks, typically $2-3 per transfer. Xoom’s fees vary by amount and region, with some small transfers offering no fees. Both platforms are fast, with transfers arriving in minutes, usually within 24 hours. You can track progress on the platform.

Advantages and Disadvantages

Refer to the table below for key differences in user experience and security between Paysend and Xoom:

| Aspect | Paysend Features | Xoom Features |

|---|---|---|

| Founded | 2013, rapid growth | 2001, long history |

| Security | ID verification, encryption, fraud detection, advanced security | ID verification, encryption, regulated by U.S. FinCEN |

| User Experience | Website, app, and agent networks, flexible operations | User-friendly interface, 24/7 multilingual support |

| Payment Methods | Bank transfer, credit/debit card, mobile wallet | Bank transfer, credit/debit card, mobile wallet |

| Receipt Methods | Bank account, mobile wallet, cash pickup | Bank account, mobile wallet, cash pickup |

| Fees | Lower than traditional banks, clear cost advantage | Low fees, supports no-fee promotions |

| Unique Advantages | Low fees and flexibility | Established brand and strong customer service |

Paysend suits those seeking low costs and flexibility. Xoom is ideal for users valuing brand history and customer service. Choose the best channel based on your needs for remittances from China.

Carrying Cash

Declaration Requirements

When carrying cash out of China, you must comply with Chinese customs regulations. Different cash amounts have specific declaration and approval requirements. Refer to the process below:

- If carrying RMB, the limit is 20,000 RMB per trip.

- For foreign currency (including HKD), amounts up to $5,000 equivalent require no declaration, and customs will clear you.

- For foreign currency between $5,000 and $10,000, apply for a Carry Permit from a bank in advance and declare to customs for verification.

- Foreign currency exceeding $10,000 equivalent is generally not allowed. For special cases, apply for a Carry Permit from SAFE and declare to customs.

Limit Regulations

When carrying cash to Hong Kong, comply with both Chinese and Hong Kong laws. The table below summarizes key limits and declaration requirements:

| Item | Limit | Declaration Requirement |

|---|---|---|

| Carrying RMB Outbound | Up to 20,000 RMB per person per trip | Excess requires People’s Bank of China approval and declaration |

| Carrying Foreign Currency (incl. HKD) First Trip | Up to $5,000 equivalent | Excess requires declaration and Carry Permit |

| Second+ Trip within 15 Days | Up to $1,000 equivalent | Excess requires declaration |

| Second+ Trip Same Day | Up to $500 equivalent | Excess requires declaration |

| Hong Kong Entry with Cash (incl. equivalent foreign currency) | Over 120,000 HKD | Mandatory declaration, or face up to 500,000 HKD fine and 2 years imprisonment |

Tip: When carrying cash, adhere to the lower limit of China and Hong Kong regulations, plan amounts carefully, and avoid violations.

Risk Warnings

Carrying cash out of China is simple but carries risks. Note the following:

- Cash is prone to loss or theft, with low security.

- Undeclared excess amounts are illegal, potentially leading to fines or criminal penalties.

- Hong Kong strictly enforces cash declaration rules; undeclared amounts over 120,000 HKD face heavy penalties.

- Frequent cash crossings may attract customs scrutiny, affecting your credit record.

During operations, stay updated on policies, secure cash properly, and declare as required to ensure safety and compliance.

UnionPay Card Withdrawal

Operational Steps

Withdrawing cash in Hong Kong with a UnionPay card is convenient. Find an ATM with the UnionPay logo. Insert your UnionPay debit or credit card, select the language, and enter the withdrawal amount. Confirm, and the ATM dispenses cash. You can use ATMs at most Hong Kong banks, like HSBC or Hang Seng. Choose UnionPay-logo ATMs to avoid multiple currency conversions and save on fees.

Fees and Limits

Fees and rates are critical for ATM withdrawals in Hong Kong. Most banks charge a 1% fee for UnionPay debit card withdrawals. For example, a $1,000 withdrawal incurs ~$10 in fees. Some banks offer free withdrawals for the first few transactions monthly. UnionPay credit card withdrawals have higher fees, typically 1.5%-3%, plus overdraft interest. Rates follow Bank of China’s daily foreign currency to RMB selling rate, with no extra conversion fees. The daily withdrawal limit is ~$10,000, with some banks imposing stricter limits. Refer to the table below:

| Card Type | Fee (Per Transaction) | Rate Standard | Daily Withdrawal Limit |

|---|---|---|---|

| UnionPay Debit Card | 1% (some free) | Bank of China daily selling rate | ~$10,000 |

| UnionPay Credit Card | 1.5%-3% | Bank of China daily selling rate | ~$10,000 |

Tip: Use UnionPay debit cards at UnionPay-logo ATMs for optimal rates and fee discounts.

Precautions

Ensure safety when withdrawing in Hong Kong. Avoid ATMs in remote or low-traffic areas. Secure cash and cards after withdrawal. Monitor bank promotions to reduce fees by planning withdrawal frequency. Avoid frequent large withdrawals to prevent bank risk controls. Check daily and per-transaction limits to avoid failed withdrawals. If an ATM swallows your card or fails, contact the issuing bank’s customer service promptly.

Method Comparison

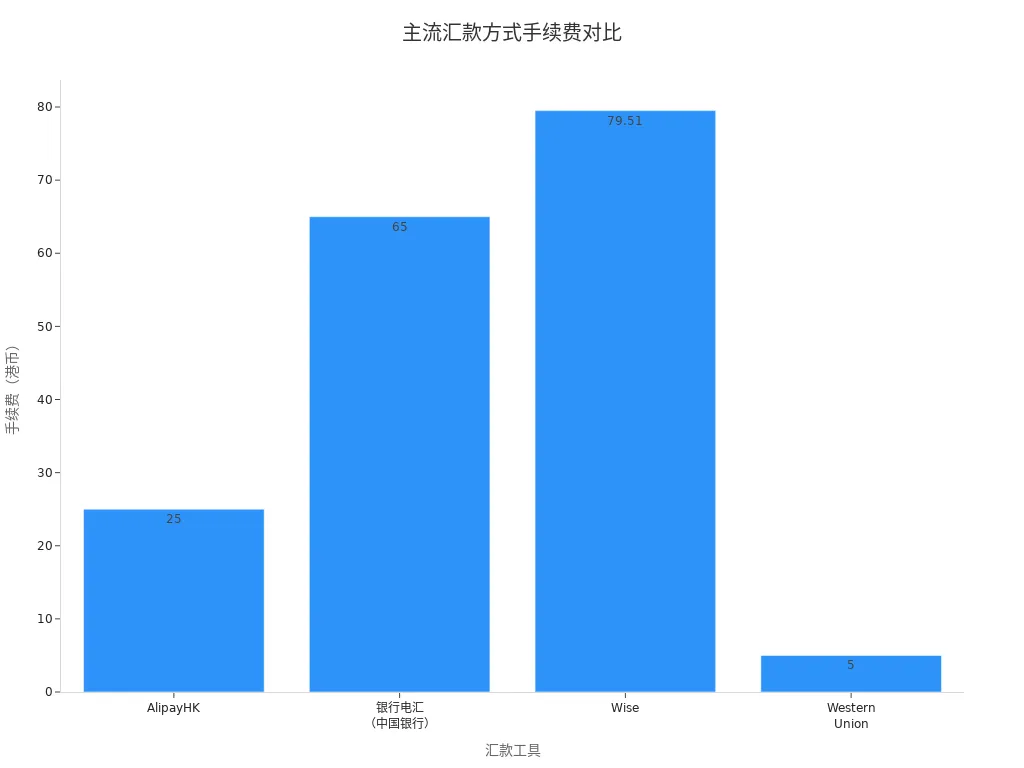

Fee Comparison

When choosing a remittance method from China to Hong Kong, fees are the most direct cost. Fee structures vary significantly. The table below shows fees and received amounts for remitting 5,000 HKD (~$640, at 1 HKD = 0.128 USD) using major methods (based on 1 USD = 7.2 RMB) fees and received amounts:

| Remittance Method | Fee (USD) | Received Amount (RMB) | Transfer Time |

|---|---|---|---|

| AlipayHK | 3.2 | ~4,604.61 | ~15 minutes |

| Bank Wire (Bank of China) | 8.3 | ~4,553 | Same day at earliest |

| Wise | 10.2 | ~4,565.56 | Within seconds |

| Western Union | 0.64 | ~4,572.42 | Same day at earliest |

Western Union has the lowest fees, AlipayHK and Wise offer fast transfers, and bank wire transfers have higher fees. Panda Remit and Paysend also have low fees, but amounts depend on real-time rates and platform announcements.

Tip: Consider both fees and exchange rate costs; some platforms with low fees may have larger rate spreads.

Limit Comparison

Different methods have strict single-transaction and daily limits. Choose a channel based on your fund needs:

- Bank Wire Transfer: High single and daily limits, suitable for large transfers. Some Hong Kong banks allow over $50,000 daily.

- Wise: Single transaction limit typically $5,000, suitable for small/medium remittances.

- AlipayHK: High-level verification allows $2,560 per transaction and daily.

- Panda Remit, Paysend: Generally support up to $50,000 per transaction, suitable for small/medium amounts.

- Carrying Cash: Up to $5,000 equivalent per trip, excess requires declaration.

- UnionPay Card Withdrawal: Daily limit ~$10,000, with some banks stricter.

For large remittances, prioritize bank wire transfers or Panda Remit; for daily small amounts, choose AlipayHK or Wise.

Transfer Speed

Transfer time impacts fund availability. Refer to the table below:

| Remittance Method | Average Transfer Time |

|---|---|

| Bank Wire Transfer | 1+ business days |

| Wise | ~30 minutes |

| Panda Remit | Within 1 hour |

| AlipayHK | Within 15 minutes |

| Western Union | Within minutes |

| UnionPay Card Withdrawal | Instant |

| Carrying Cash | Available after crossing border |

For high transfer speed needs, prioritize Wise, Panda Remit, or AlipayHK.

Applicable Users

Different methods suit various remittance needs for Chinese users:

- Bank Wire Transfer: Suitable for business professionals, large family transfers, or property purchases.

- Wise, Panda Remit: Ideal for students, freelancers, or frequent small transfers.

- AlipayHK, FPS: Suitable for daily expenses in Hong Kong, like shopping or living costs.

- Paysend, Western Union: Ideal for users needing speed and flexibility.

- UnionPay Card Withdrawal, Carrying Cash: Suitable for short-term travel or temporary small fund needs.

Choose a method based on your fund size, transfer speed, and compliance needs for the best solution.

Selection Recommendations

Fund Size

When choosing a remittance method from China, first consider fund size. For large amounts (e.g., over $5,000), bank wire transfers, Wise, and Panda Remit are suitable. Ensure the remittance account is in your name to avoid forex scrutiny. For large transfers, banks often require proof of fund sources, like payslips or tax records. Avoid exceeding $5,000 per transaction or splitting amounts across multiple people to bypass regulations, as this may lead to account freezes. Platforms like Panda Remit hold legal licenses, offering higher fund security.

Frequency and Urgency

For frequent small remittances to Hong Kong, such as monthly tuition or living expenses, choose fast, low-fee channels. Cross-Border Payment Pass, AlipayHK, and Wise support real-time transfers and are user-friendly, ideal for high-frequency small transfers. Traditional bank wire transfers have high fees and long transfer times, unsuitable for frequent operations. Use emerging channels like Cross-Border Payment Pass for low-cost, efficient daily fund transfers.

Compliance and Security

Compliance is critical for remittances from China. Ensure every transfer complies with Chinese and Hong Kong regulations. Common risks include illegal forex arbitrage, fraudulent forex purchases, and incorrect account details. Choose platforms with legal financial licenses, like Panda Remit’s Hong Kong MSO license and PCI DSS certification, to ensure fund safety. For failed remittances, platforms should have robust refund mechanisms. For large or unusual transfers, banks and platforms may require additional proof to verify fund legitimacy.

Tip: Double-check recipient details to avoid errors causing failures or delays.

Personal Needs Matching

Choose a remittance method based on transfer speed, fees, compliance, and your specific needs. The table below compares common methods to aid decision-making:

| Remittance Method | Transfer Speed | Fee Rate | Compliance and Risk | Use Cases |

|---|---|---|---|---|

| Bank Wire Transfer | 3-5 days | ~1% | High, strict regulation | Large, business remittances |

| Wise/Panda Remit | 15 min-1 day | As low as 0.5% | High, platform compliance | Small/medium, urgent remittances |

| AlipayHK/Payment Pass | Instant | Very low | High, policy-supported | Frequent small, living expenses |

| UnionPay Card Withdrawal | Instant | 1%-3% | High, limit awareness needed | Travel, temporary funds |

Choose the best method based on your fund size, transfer speed needs, and compliance requirements to ensure safety and efficiency.

You can select bank wire transfers, Wise, Panda Remit, or AlipayHK based on your needs. Bank wire transfers suit large amounts, are slower but secure. Emerging platforms offer low fees and fast transfers, ideal for small, frequent needs. Prioritize compliance to avoid errors and risks. In 2025, Hong Kong will implement the Stablecoin Ordinance, making cross-border payments more digital and compliant. Stay updated on policy changes and adjust remittance strategies accordingly.

FAQ

How long does it take for a remittance to Hong Kong to arrive?

Transfer time depends on the method. Bank wire transfers take 3-5 business days. Wise, Panda Remit, and AlipayHK can arrive in minutes. Choose based on urgency.

What documents are needed for remittances?

You typically need an ID, recipient Hong Kong bank account details (account name, number, SWIFT code). Some platforms require proof of address or fund sources. Prepare documents in advance for smoother processing.

Are there limits on remittance amounts?

Yes. Bank wire transfers can reach $50,000 per transaction. Wise and Panda Remit typically limit to $5,000 per transaction. AlipayHK’s high-level verification allows $2,560 daily. Check platform rules.

What to do if a remittance fails?

First, verify recipient details. If correct, contact the platform or Hong Kong bank’s customer service. Most platforms refund automatically. Keep remittance receipts for follow-up.

How are exchange rates calculated?

Platforms calculate based on real-time rates. For example, at 1 USD = 7.2 RMB, remitting $1,000 requires 7,200 RMB. Check the platform’s displayed rate before remitting.

Whether it’s the cumbersome process and high fees of bank wire transfers or the varying limits and speeds of emerging platforms, managing cross-border funds is a major pain point in Hong Kong stock investing. When choosing a platform, in addition to focusing on the broker’s commissions and features, the convenience and cost of fund deposits and withdrawals are equally crucial. BiyaPay is committed to providing a seamless cross-border financial solution that makes your global asset allocation more efficient. We support the conversion between various fiat and digital currencies, allowing you to easily complete global remittances with a remittance fee as low as 0.5% and same-day delivery. You don’t need a complex overseas bank account to invest in both U.S. and Hong Kong stocks on one platform, and you can use our real-time exchange rate query to seize the best conversion opportunities. Say goodbye to the hassle of traditional remittances, and register with BiyaPay today to start your smart investment journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Why Is Canada's Country Code 1

How Safe Is Your Money With Ally Bank in 2026?

Zelle Wire Transfer or ACH? Clearing Up the Confusion

The Easiest Way to Find the Code for Calling France

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.