A Guide to Transferring Money from Canada to the United States via Interac

Image Source: pexels

You might want to directly send an Interac transfer to the US, but first, you need to understand an important fact. The standard Interac e-Transfer system does not support direct cross-border transfers to US bank accounts.

Core Solution: You can use an international money transfer service integrated with Interac. This method allows you to seamlessly utilize your familiar Interac payment method to easily send funds to the US.

Key Takeaways

- Interac cannot directly transfer money to the US; you need to use an international transfer platform that supports Interac.

- Choose platforms like Wise or Remitbee, which allow you to pay for international transfers directly with Interac.

- Before transferring, you need to create an account, verify your identity, and add the US recipient’s bank details.

- When initiating the transfer, select Interac payment and complete the payment request via your online banking.

- Compare the fees, exchange rates, and speed of different transfer methods to choose the best option for you.

How to Send Money to the US with Interac

Image Source: unsplash

Although you cannot directly use Interac from your banking app to send money to a US account, using an intermediary platform makes the process very simple. This method cleverly combines your familiar Interac payment with professional international transfer services, ensuring both convenience and secure, efficient delivery of funds to their destination.

Below is a detailed four-step guide, using a typical transfer platform as an example, to walk you through the entire process.

Choose a Transfer Platform That Supports Interac

The first step is to select a reliable international money transfer provider that supports Interac as a payment method. These platforms act as a “bridge” connecting your Canadian bank account to the US recipient’s account.

Several platforms are integrated with Interac, but their integration methods vary. You need to choose a platform that allows you to directly pay for international transfers with Interac.

| Service Name | Interac Integration Method |

|---|---|

| Wise | Pay for your transfer transaction via Interac e-Transfer |

| Remitbee | Supports using Interac e-Transfer to pay for international transfers |

| Western Union | Pay for Western Union transfers via Interac through some Canadian banks’ online banking |

| Skrill | Supports using Interac to fund its e-wallet, not direct transfer payments |

How to Choose? For direct transfers to US bank accounts, prioritize platforms like Wise or Remitbee that allow you to use Interac to pay for individual transfer transactions directly.

Create an Account and Set Up the US Recipient

After selecting a platform, you need to create a free account and complete identity verification. This is a standard procedure for all compliant financial services to ensure the security of your funds.

- Register a Personal Account: Visit the platform’s website or download the app, and register using your email and phone number.

- Verify Your Identity: To comply with financial regulations, you need to provide proof of identity and address.

Commonly Required Documents:

- Proof of Identity: Passport, Canadian driver’s license, or national ID card.

- Proof of Address: Recent bank statement, utility bill, or government letter.

- Add the US Recipient: In your account, go to the “Recipients” page and add the US recipient’s details.

You need to prepare the following recipient information:

- Recipient’s full name (must match the bank account name exactly)

- Recipient’s US bank account number

- Bank routing number for domestic US transfers

- Or SWIFT code for international wire transfers

Initiate the Transfer and Select Interac Payment

Once your account is set up, you can start the transfer process.

- Log in to your transfer platform account.

- Select the “Send Money” function.

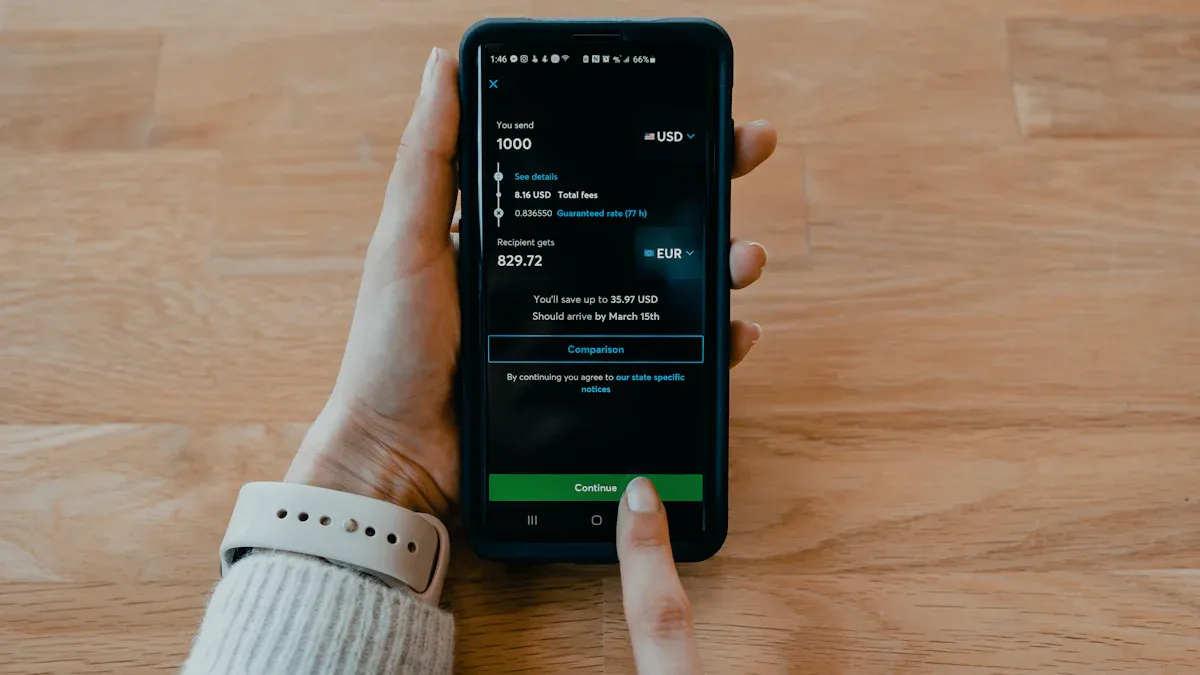

- Enter the amount in Canadian dollars (CAD) you wish to send, and the platform will automatically calculate the US dollar (USD) amount the recipient will receive, clearly displaying the exchange rate and fees.

- Choose the US recipient you just set up from the recipient list.

- On the Payment Method page, select “Interac e-Transfer”.

- Review all details and submit your transfer request.

Important Tip: Watch for Transfer Limits Your bank sets a daily limit for Interac transfers. Before initiating a large transfer, confirm your bank’s limit.

Bank Name Interac e-Transfer Daily Limit (Reference) Royal Bank of Canada (RBC) $2,500 CAD National Bank of Canada (NBC) $3,000 CAD

Complete the Payment Request via Online Banking

After submitting the transfer request, you’re one step away from success. The transfer platform will send an email to your registered address with payment details.

You simply need to complete the payment as you would for a regular Interac transfer:

- Log in to your Canadian online banking or mobile banking app.

- Navigate to the “Interac e-Transfer” section.

- You’ll see a payment request from the transfer platform; verify the amount and recipient name.

- Approve the Interac transfer request.

Once you approve the payment, the transfer platform will receive your funds and immediately begin processing your USD transfer. The funds typically arrive in the designated US bank account within 1-2 business days. The process is now complete!

Other Efficient Canada-to-US Transfer Methods

Image Source: unsplash

Besides using Interac through third-party platforms, you have several other mainstream transfer methods to choose from. Understanding their features can help you make the best decision based on your needs.

Online Transfer Services

There are many online services specializing in international transfers, such as Remitly and XE. These platforms are typically experts in cross-border transfers.

- Key Advantages: They often offer more competitive exchange rates than traditional banks, with more transparent fees.

- Speed: Many services excel in speed. For example, RemitBee and Xe Money Transfers can deliver funds in minutes.

These services are ideal for those seeking cost-effectiveness and efficiency.

Traditional Bank Wire Transfers

Sending money directly through your Canadian bank via wire transfer is the most traditional method. Its biggest advantage is security and reliability, as funds remain within the banking system.

However, you need to be aware of its costs and time. Bank wire transfers are typically the most expensive and slowest option. Fees vary significantly across banks.

| Bank | International Wire Transfer Fee (Reference) |

|---|---|

| CIBC | $30 for transfers under 10,000 CAD |

| BMO | 0.2% of the transfer amount + $10 communication fee |

| TD Bank | $50 |

Special Case: Some banks offer discounts. For example, if you have both RBC Canada and US accounts, under certain conditions, you can transfer funds instantly and for free between the two accounts.

PayPal E-Wallet

PayPal is well-known for its convenience, but when used for international transfers, you need to pay close attention to its fee structure. While the transfer process is simple, costs can be high.

PayPal’s main fees are hidden in currency conversion.

- Currency Conversion Fee: When sending money from Canada to the US, PayPal charges up to 4% for currency conversion.

- Poor Exchange Rates: This fee is added on top of PayPal’s already uncompetitive exchange rates.

While PayPal offers an instant transfer option (for an additional fee), standard transfers take 1-3 business days. Overall, it’s better suited for small, non-urgent transfers rather than large, cost-sensitive ones.

Key Considerations: Fees, Exchange Rates, and Speed

Once you’ve chosen a transfer method, the next step is to thoroughly compare the costs and efficiency of each option. Total fees, actual exchange rates, and delivery speed are the three most important factors that shape your transfer experience.

When benchmarking options, consider pre-validating both FX cost and delivery time. If you want transparent rates and clear total costs before you commit, compare with BiyaPay: use its free exchange-rate comparison tool to preview the real-time rate, then initiate an online remittance. BiyaPay supports seamless fiat–digital conversions, real-time rate display, fees as low as 0.5%, same-day credit supported, and coverage across most countries and regions—all under regulated operations (e.g., U.S. MSB, NZ FSP). It’s useful when funding starts via Interac but your priority is a balanced mix of cost and speed.

Fee Structure Breakdown

The total cost of an international transfer typically consists of two parts: explicit fees and hidden costs in exchange rates.

- Fixed or Percentage-Based Fees: These are the fees the platform clearly discloses, such as a fixed $2 per transfer or 1% of the transfer amount.

- Exchange Rate Markup: This is the most easily overlooked hidden cost. The exchange rate offered by the provider is typically worse than the “mid-market exchange rate” they use internally. This difference is their profit.

Beware of the “Zero Fee” Trap: Many services claim “zero fees,” but they often make more profit through worse exchange rates. This means in a $10,000 CAD transfer, you could lose $100 to $300 just due to exchange rate differences.

How to Get the Best Exchange Rate

To make every penny count, you need to learn how to identify and secure the best exchange rate.

- Use Exchange Rate Comparison Tools: Before transferring, use free tools provided by platforms like Wise or XE, enter your transfer amount, and view the real-time exchange rates and final received amounts offered by different providers.

- Lock in the Exchange Rate: Market rates fluctuate constantly. Some services, like Wise, allow you to lock in the exchange rate for a period when initiating the transfer. As long as you pay on time, the recipient’s amount won’t be affected by rate changes.

- Set Exchange Rate Alerts: If you’re not in a rush, use rate tracking features. The system will notify you when the exchange rate reaches your desired level, helping you seize the best transfer opportunity.

Illustration: A transfer comparison example showing how, even with zero fees, different exchange rates can lead to significant differences in the final received amount.

Comparison of Delivery Times

Speed is another critical factor, especially in urgent situations. Delivery times vary greatly across transfer methods.

| Transfer Method | Typical Delivery Time | Notes |

|---|---|---|

| Wise (via Interac) | 30 minutes - 2 business days | Wise processes immediately after you approve the payment. |

| Other Online Services (e.g., XE) | Minutes - 5 business days | Offers multiple speed options; faster options may cost more. |

| Traditional Bank Wire Transfer | 1 - 5 business days | Longer process, typically processed only on business days. |

| PayPal | Minutes - 3 business days | Instant delivery requires an additional fee. |

While you cannot directly send a cross-border Interac transfer from your banking app, using Interac payments through platforms like Wise is an ideal choice that balances convenience, cost, and speed.

Your Decision Guide:

- Prioritize Low Costs: Choose platforms offering the mid-market exchange rate, transparent fees, and avoid high markups hidden in exchange rates.

- Need Maximum Speed: Prioritize online services offering instant or near-instant delivery options.

- Value Convenience: Using familiar Interac payments can simplify the payment process.

International transfers are no longer complicated. With the right tools, you can easily and confidently send funds to their destination.

FAQ

Can I Use Interac Directly from My Banking App to Send Money to a US Account?

You cannot do this directly. Interac is a Canada-only system. You need to use a transfer platform that supports Interac (e.g., Wise) as a bridge to send funds to a US bank account.

Are Third-Party Platforms Safe for Transfers?

Yes, choosing a compliant platform is very safe. These platforms are regulated by financial authorities and use bank-level encryption to protect your funds and personal information, so you can use them with confidence.

Is Interac via a Platform Cheaper Than a Bank Wire Transfer?

Typically, using Interac through a platform is more cost-effective. Traditional bank wire transfers have higher fees and often include significant hidden markups in exchange rates. Online platforms offer more transparent fees and competitive rates.

What’s the Fastest Way to Send Money from Canada to the US?

The fastest way is usually through online transfer services. Many platforms (e.g., Remitly or Wise) offer delivery within minutes. In contrast, traditional bank wire transfers take 1 to 5 business days to complete.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

2026 China Stock Market Investment Guide: Spotlight on 5 Must-Watch Leading Tech Stocks

Ultimate Guide to Applying for a Schengen Visa in the USA in 2025: Understand the Process, Documents, and Timeline in One Article

What Does Price-to-Earnings Ratio (PE) Mean? Master It to Navigate the Chinese Stock Market

Want to Invest in the Chinese Stock Market? Start by Understanding the Shanghai Composite Index

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.