Venmo Business Fees: What You Pay per Sale and How to Save on Costs

Image Source: pexels

When you accept venmo as a payment method for your business, you pay clear venmo business fees. Each sale on a venmo business account costs 1.9% plus $0.10 per payment. If you use instant transfer, venmo charges a 1.75% fee, with a minimum of $0.25 and a maximum of $15 per transfer. Credit card payments have a 3% fee. You never face hidden fees, as venmo business account fees are transparent, nonrefundable, and automatically deducted. The table below shows the main fees:

| Fee Type | Fee Amount | Notes |

|---|---|---|

| Business Transaction Fee | 1.9% + $0.10 per payment | Nonrefundable, applies to every sale |

| Instant Transfer Fee | 1.75% of transfer amount | $0.25 min, $15 max per transfer |

| Credit Card Payment Fee | 3% of payment amount | Applies to credit card as payment method |

| Standard Bank Transfer | Free | Takes 1-3 business days |

You must use venmo for business with a dedicated business profile to stay compliant. Understanding venmo business fees, payment limits, and business features helps you avoid risks when you accept venmo as a payment method.

Key Takeaways

- Venmo charges a clear business transaction fee of 1.9% plus $0.10 per payment, with no hidden fees or monthly charges.

- Using instant transfers costs 1.75% per transfer but delivers funds quickly; standard bank transfers are free but take 1-3 business days.

- Credit card payments have a higher fee of 3%, so using Venmo balance or debit cards helps reduce costs.

- Venmo only supports U.S. businesses and payments, so international transactions require other platforms.

- To avoid extra fees and stay compliant, use a dedicated Venmo business profile, keep good records, and provide accurate tax information.

Venmo Business Fees

Image Source: pexels

Venmo business fees are simple and easy to understand. You pay only for the services you use. There are no hidden charges or surprise costs. The table below shows the main venmo business account fees you might encounter:

| Fee Type | Fee Details |

|---|---|

| Account Setup | $0 (no setup fee) |

| Monthly Fee | $0 (no monthly fee) |

| Seller Transaction Fee | 1.9% of payment + $0.10 per transaction |

| Credit Card Payment Fee | 3% fee when sending money via credit card |

| Instant Transfer Fee | 1.75% of amount (min $0.25, max $25) |

| Electronic Withdrawal (Standard) | $0 (1-3 business days) |

| Cryptocurrency Purchase/Sale Fee | Starts at $0.50 for $1-$24.99 purchases/sales |

| Tap to Pay Fee | 2.29% + $0.09 per transaction |

| International Fees | Not supported |

Transaction Fees

You pay a seller transaction fee every time you receive a payment for goods or services through your venmo business account. This fee is 1.9% of the payment plus $0.10. For example, if you receive $100, venmo deducts $1.90 plus $0.10, so you get $98.00. This fee applies to all payments of $1.00 or more. Venmo automatically deducts the fee from each payment, so you never have to worry about paying it later. The fee is nonrefundable, even if you refund the customer.

Note: If you use Tap to Pay, the fee is slightly higher. You pay 2.29% plus $0.09 per transaction.

Instant Transfer Fees

Venmo lets you move money from your business account to your bank quickly. If you need your funds right away, you can use the instant transfer feature. The instant transfer fee is 1.75% of the amount you transfer, with a minimum of $0.25 and a maximum of $25 per transfer. Instant transfers usually arrive in your bank account within 30 minutes. If you do not need your money right away, you can use the standard transfer option, which is free and takes 1-3 business days.

| Transfer Type | Fee Structure | Transfer Time |

|---|---|---|

| Instant Transfer | 1.75% fee per transfer (min $0.25, max $25) | Typically within 30 minutes |

| Standard Transfer | Free | 1-3 business days |

Credit Card Fees

If your customer pays you using a credit card, venmo charges a 3% fee on the payment amount. This fee is higher than the regular seller transaction fee. The fee is automatically deducted from the payment you receive. If your customer pays with their venmo balance, debit card, or bank account, you only pay the standard seller transaction fee.

International Fees

Venmo does not support international payments. You and your customers must both be in the United States. You need a U.S. bank account and phone number to use venmo. Venmo does not charge international fees because it does not allow international transfers or currency exchange. If you need to send or receive money outside the U.S., you should consider other payment platforms.

Tap to Pay Fees

Venmo offers Tap to Pay for in-person payments. When you use Tap to Pay, you pay a fee of 2.29% plus $0.09 per transaction. This fee is slightly higher than the standard seller transaction fee. Tap to Pay makes it easy for your customers to pay you with their phone or card.

| Payment Type | Percentage Fee | Minimum Fixed Fee |

|---|---|---|

| Tap to Pay payments | 2.29% | $0.09 |

| Other digital payments | 1.9% | $0.10 |

Other Charges

Venmo business account fees do not include any account opening or monthly holding fees. You do not pay to set up your account or keep it open. Venmo does not charge hidden fees. All fees are published and easy to find. If you buy or sell cryptocurrency through venmo, you may pay extra fees starting at $0.50 for small transactions. Venmo also charges for ATM withdrawals and over-the-counter cash withdrawals, but these are not common for most business owners.

Tip: Always check the latest fee schedule in your venmo app or on the venmo website. Venmo updates its fees from time to time.

Venmo business fees are nonrefundable and automatically deducted from your payments. You always know what you will pay, and you never face surprise charges. This makes venmo a good choice for many small business owners who want simple, clear pricing.

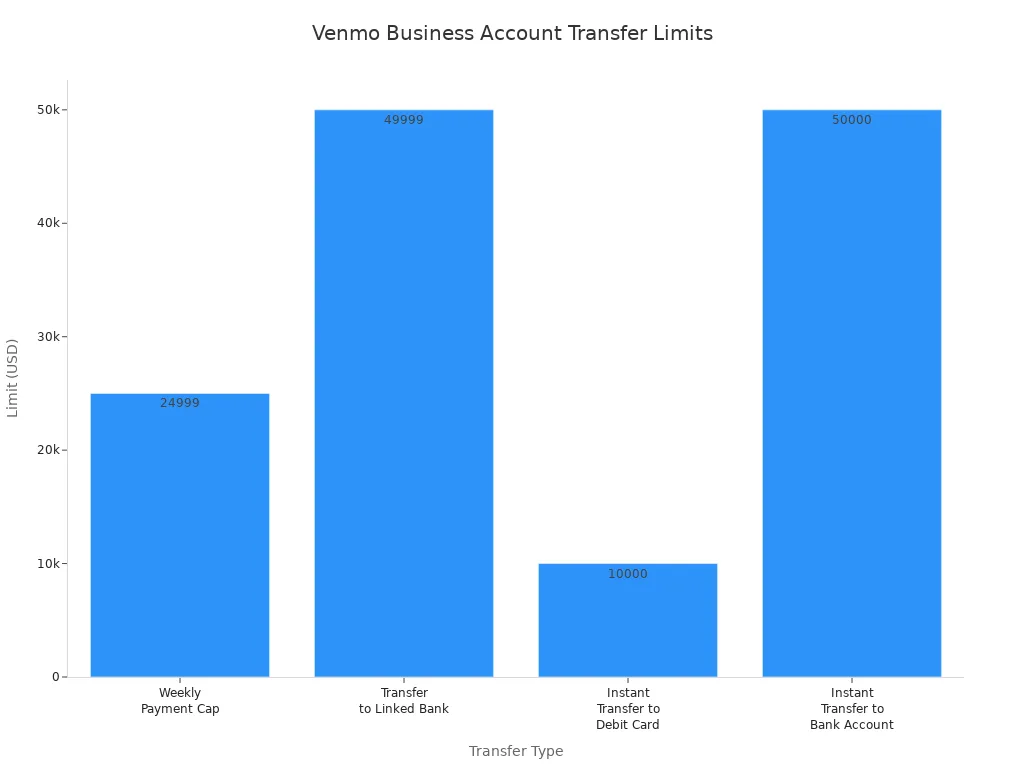

Venmo for Business Limits

Payment Limits

When you use venmo for business, you need to know your payment limits. Venmo sets these limits to help manage risk and follow regulations. If you verify your business account, you can send up to $60,000 each week. You can also send up to $5,000 in a single payment. Unverified accounts have much lower limits, only $299.99 per week. To verify your account, you must provide your legal name, date of birth, the last four digits of your Social Security Number, and business documents like your EIN or business license.

- Verified business accounts:

- Weekly sending limit: $60,000

- Per payment limit: $5,000

- Unlimited incoming payments (fees apply)

- Unverified business accounts:

- Weekly sending limit: $299.99

Venmo includes all payments to other users and transfers to your bank in these limits. The weekly limit resets on a rolling basis, not at the start of each week. You can check your current limits in the Venmo app under Settings > Limits.

Note: Venmo’s limits are lower than those of other payment platforms. Some platforms allow much higher transaction amounts and faster settlement times.

IRS Reporting

You must report all business income you receive through venmo. In 2024, venmo will send you a Form 1099-K if you receive more than $5,000 in payments for goods and services. This is a change from past years, when the threshold was $20,000. The IRS delayed the $600 threshold until 2025. If you do not provide tax information, venmo may withhold 24% of your payments for backup withholding. Some states have lower reporting thresholds, so check your local rules.

- All business income must be reported, even if you do not get a 1099-K.

- Report your business income on Schedule C when you file your taxes.

- You can deduct business expenses related to venmo transactions.

Tip: Keep clear records of all payments and expenses to make tax time easier.

Compliance Tips

To stay compliant with venmo and IRS rules, follow these steps:

- Separate business and personal payments. Mark personal payments as “friends and family.”

- Keep detailed records of all business transactions.

- Provide accurate tax information to venmo to avoid backup withholding.

- Consult a tax professional if you have questions about your business taxes.

- If you get a 1099-K by mistake, contact venmo support right away.

These steps help you avoid penalties and keep your business running smoothly.

Venmo vs. Other Platforms

PayPal

When you compare Venmo to PayPal, you notice some important differences in business features and fees. Venmo charges a lower transaction fee of 1.9% plus $0.10 per payment, while PayPal charges 2.9% plus $0.30. PayPal supports international payments and offers strong buyer and seller protection, dispute resolution, and fraud detection. Venmo only works in the United States and provides basic encryption and optional two-factor authentication. PayPal allows you to set up recurring payments and manage subscriptions, but Venmo does not. If you need invoicing or tax documentation, PayPal has these tools built in, while Venmo does not.

| Feature | Venmo Business Account | PayPal Business Account |

|---|---|---|

| Transaction Fee | 1.9% + $0.10 per transaction | 2.9% + $0.30 per transaction |

| Recurring Payments Support | No direct support; manual payments required | Yes; supports automated billing, subscription management |

| International Transactions | US-only | Supports 200+ countries and multiple currencies |

| Business Profiles | Single user only; no invoicing or tax docs | Multiple users allowed; invoicing and tax documentation |

| Instant Transfer Fee | 1.75% of total amount | 1.75% of total amount |

| Integration with E-commerce | Limited; requires third-party tools | Native integration with platforms like Shopify |

| Security Features | Basic encryption, 2FA, limited purchase protection | End-to-end encryption, buyer/seller protection, dispute resolution |

| Setup/Monthly Fees | No setup or monthly fees | No setup fee; monthly fees depend on plan |

PayPal works better for larger businesses or those that need advanced business features, while Venmo fits a small business that wants simple fees and easy use.

Square

Square gives you a business-focused app with flat fees and more business features. Venmo charges 1.9% plus $0.10 per payment, but Square uses a flat rate of 2.6% plus $0.10 for in-person payments and 2.9% plus $0.30 for online payments. Square supports higher payment limits, faster fund settlement, and offers chargeback protection. You can send up to $20,000 per transaction with Square, which is much higher than Venmo’s limits. Square also provides invoicing and business management tools, making it a strong digital payment option for a small business that needs more than just peer-to-peer payments.

| Aspect | Venmo | Square |

|---|---|---|

| Fees | 1.9% + $0.10 per payment | 2.6% + $0.10 (in-person); 2.9% + $0.30 (online) |

| Usability | Simple, social feed, peer-to-peer focus | Business-focused, invoicing, higher limits |

| Payment Limits | $5,000 per payment, $60,000 weekly (verified) | $20,000 per transaction, $250,000 monthly |

| Security | Encryption, 2FA, no chargeback protection | Encryption, fraud and chargeback protection |

| Settlement Speed | 1-3 business days | Usually 1 business day |

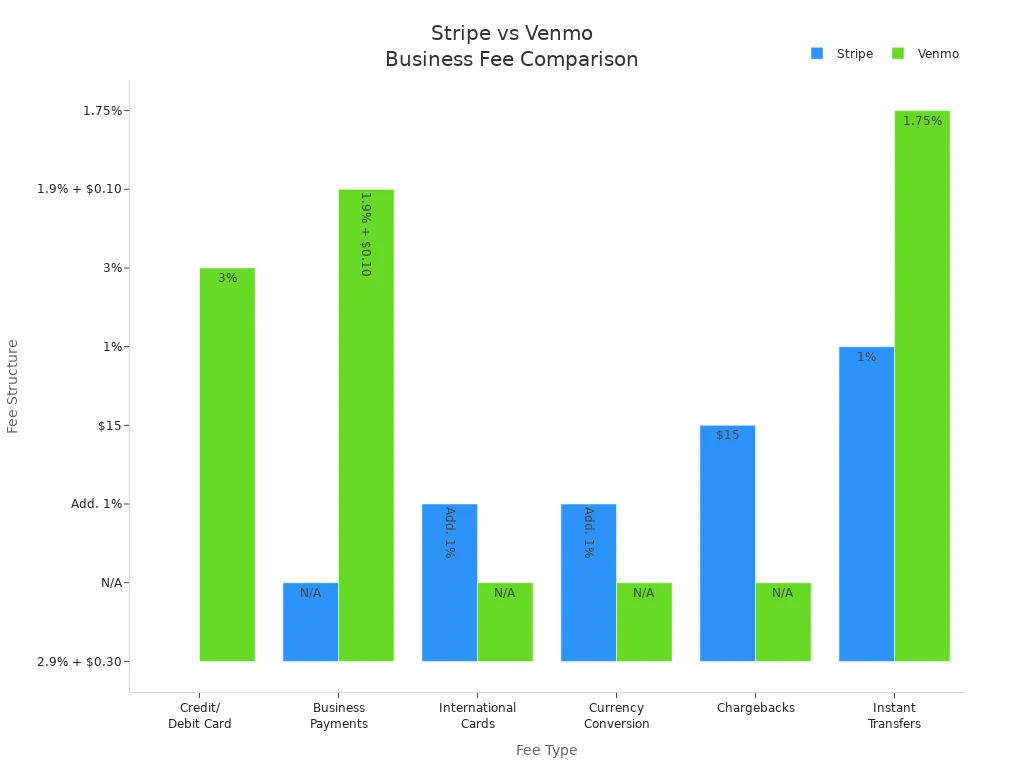

Stripe

Stripe uses a fee of 2.9% plus $0.30 per transaction for credit and debit cards. Venmo charges 1.9% plus $0.10 for business payments and 3% for credit card payments. Stripe adds extra fees for international cards and currency conversion, which Venmo does not support. Stripe offers advanced business features like subscription billing, invoicing, and a customizable API. You can use Stripe for international payments, but Venmo only works in the United States. Stripe fits a small business that needs to accept payments online, manage subscriptions, or sell to customers outside the U.S.

| Fee Type | Stripe Fee Structure | Venmo Fee Structure |

|---|---|---|

| Credit/Debit Card | 2.9% + $0.30 per transaction (US cards) | 3% fee on credit card transfers |

| Business Payments | N/A | 1.9% + $0.10 per transaction |

| International Cards | Additional 1% fee | N/A |

| Currency Conversion | Additional 1% fee | N/A |

| Chargebacks | $15 per chargeback | N/A |

| Instant Transfers | 1% of transaction amount | 1.75% for instant bank transfers |

Key Differences

- Venmo offers the lowest fees for business payments, but only supports U.S. transactions.

- PayPal and Stripe both support international payments and advanced business features, but charge higher fees.

- Square provides flat fees, higher payment limits, and business tools that help you manage your small business.

- Venmo works best if you want to accept Venmo payments for simple sales and need a low-cost solution.

- If you need recurring billing, invoicing, or international support, PayPal, Square, or Stripe may fit your business better.

If you run a small business and want to accept Venmo, you get simple fees and easy setup. For more complex business needs, compare the cost and business features of each platform before you choose your digital payment option.

Minimize Fees

Image Source: pexels

Best Practices

You can lower your business fees on Venmo by following a few simple steps. First, always link your bank account to your Venmo business profile. This lets you move money easily and helps you avoid extra fees. Use your Venmo balance or a debit card for payments instead of a credit card, since credit card payments have a 3% fee. Choose standard bank transfers when you move funds out of Venmo. These transfers are free, but you may need to wait one to three business days. If you want to explore other options, some services like Gerald offer fee-free transactions and instant cash advances, which can help reduce your overall cost.

Tip: Provide your tax ID to Venmo. This can help you avoid backup withholding and keep your business in good standing.

Transfer Options

Venmo gives you two main ways to transfer money from your business account to your bank. Standard transfers are the most cost-effective. They take one to three business days and do not charge any fees. Instant transfers move your money in about 30 minutes, but you pay a 1.75% fee for this speed. If you want to keep your costs low, use standard transfers whenever possible. Always check your linked bank account details to make sure your payment method works smoothly.

Avoiding Pitfalls

Many business owners pay more fees than they expect because they make common mistakes. The table below shows some actions that can lead to higher costs and how you can avoid them:

| Mistake/Action | Resulting Fee/Consequence | How to Avoid |

|---|---|---|

| Using a credit card for payments | 3% fee per payment | Use Venmo balance or debit card |

| Choosing instant transfer every time | 1.75% fee per transfer | Use standard transfer when possible |

| Not knowing which activities trigger fees | Unexpected charges | Review Venmo’s fee schedule |

| Using personal Venmo for business transactions | Account suspension or penalties | Use a business profile only |

When to Use Venmo

Venmo works best for your business if you want a simple payment method and your customers are mostly Millennials or Gen Z. The social feed lets users share their purchases, which can help you with free marketing. Venmo is easy to set up and does not charge monthly fees. If you run a business that collects payments through mobile forms or QR codes, Venmo is a strong choice. You should use Venmo when you want a fast, social, and mobile-first payment method, but remember that it does not support international payments and has some privacy concerns.

Venmo charges a business transaction fee of 1.9% plus $0.10, which is lower than many competitors. You receive 1099-K tax forms for business income, making tax reporting easier. Venmo supports QR code payments and works with e-commerce platforms, but lacks advanced business tools like automated tax calculations. Always check your business payment limits and IRS requirements. When you want simple fees and easy setup, venmo fits your business. Review your business needs and compare fee structures before choosing venmo or another payment platform.

FAQ

What types of payments can you accept with venmo for business?

You can accept payments for goods and services using venmo. Customers can pay you with their venmo balance, debit card, bank account, or credit card. You cannot use venmo for international transactions.

How do you set up a venmo business profile?

You open the venmo app and tap on your profile. Select “Create a business profile.” Enter your business details and follow the prompts. You must provide your legal name, business name, and tax information.

Are venmo business fees tax-deductible?

Yes, you can deduct venmo business fees as a business expense. Keep records of all fees paid through venmo. Report these expenses on your tax return to lower your taxable income.

Can you refund a customer through venmo?

You can send money back to your customer using venmo. However, venmo does not refund the original transaction fee. You pay the fee even if you return the payment.

What happens if you use a personal venmo account for business?

Venmo may freeze or close your account if you use a personal profile for business. Always use a venmo business profile to stay compliant and avoid problems.

When using Venmo for your business, cross-border payment needs may require additional payment flexibility. BiyaPay offers an ideal complementary solution with real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies, remittance fees as low as 0.5%, and coverage across over 200 countries and regions with same-day remittance delivery. Its quick registration, no-overseas-account-needed US/HK stock investment features, and the launched Easy Card (supporting convenient payments on eBay, Amazon, PayPal, and more) enhance your Venmo business transactions. Experience these benefits now to optimize your payment process! While Venmo is limited to the U.S., BiyaPay helps you manage international payment needs, boosting overall financial efficiency.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

The Relationship Between Fed Rate Cuts and New York Stock Market Fluctuations Is No Longer a Simple Cause-and-Effect

After Over 100 Billion in Buybacks, Has Tencent's Long-Term Investment Logic Changed?

Say Goodbye to Panic: Master the Winning Rules for Stock Investing in a Bear Market

2026 China Stock Market Investment Guide: Spotlight on 5 Must-Watch Leading Tech Stocks

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.