Analysis of Discover Transfer Methods: Credit Card Remittance Process, Fees, and Security

Image Source: unsplash

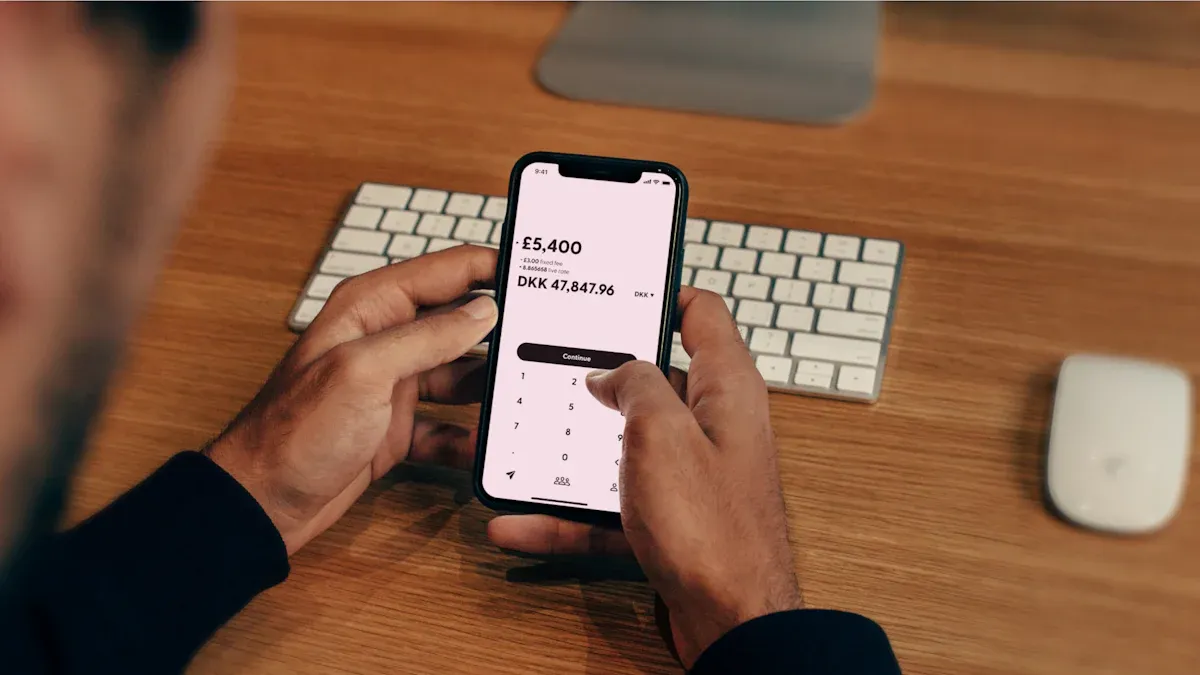

Answering your question about using a Discover credit card for money transfers is straightforward. You can indirectly send money to others, but this method is often costly. This blog, “Discover Money Transfer Guide,” will help you understand the process.

Many people think using a credit card for transfers is a smart way to earn rewards. However, most credit card companies, including Discover, treat these transactions as “cash advances.” This means you face high fees and interest rates.

💡 Did You Know? A typical cash advance fee is the greater of $10 or 5% of the amount. The Annual Percentage Rate (APR) for cash advances can be as high as 30%, with interest starting the day you make the transaction.

This is very different from using a Discover bank account, which offers low-cost or even free transfer options.

Key Takeaways

- Using a Discover credit card for transfers is usually very expensive. Discover bank account transfers are more economical.

- Credit card transfers are often treated as “cash advances.” They incur high fees and interest.

- Cash advances have no grace period. Interest starts accruing from the day of the transaction.

- Transferring money via third-party platforms with a credit card incurs platform fees. Discover may also charge cash advance fees.

- Protecting account security is crucial. Use Discover’s security features and personal safety practices.

Discover Money Transfer Guide

Image Source: unsplash

Understanding different transfer options is the first step to making informed financial decisions. Using a Discover credit card for transfers is not limited to one method, but each method’s costs and use cases vary significantly. This section’s Discover Money Transfer Guide will detail three main approaches and clarify a key distinction.

Method 1: Through Third-Party Payment Platforms

You can link your Discover credit card to third-party payment platforms like PayPal or Venmo and then make payments to others. This method is convenient but usually incurs additional fees.

⚠️ Note: Using a credit card to transfer money to individuals through third-party platforms typically incurs a service fee from the platform (e.g., Venmo’s standard fee is 3%). More importantly, Discover may classify such transactions as “cash advances”, triggering high fees and interest.

Link Your Discover Credit Card on PayPal

You can add your card to PayPal with the following steps:

- Log in to your PayPal account and go to the “Wallet” page.

- Click “Link a debit or credit card.”

- Enter your Discover credit card information and follow the prompts to complete the process.

Link Your Discover Credit Card on Venmo

The process of adding a card in the Venmo app is equally simple:

- Open the app and go to the “Me” tab.

- Select the “Wallet” section.

- Click “Add bank or card,” then choose to add a credit card.

- Enter your card information and complete the verification.

Method 2: Obtaining a Cash Advance

A cash advance is the most direct but also the most expensive way to “transfer” money using a credit card. It allows you to withdraw cash directly from your credit card limit, which you can then use freely, including transferring to others.

You can obtain a cash advance in two main ways:

- Withdraw Cash via ATM: You can use your Discover credit card and personal identification number (PIN) at any ATM that supports the Discover network to withdraw cash. Keep in mind that your cash advance limit is typically much lower than your total credit limit, and the ATM itself may charge additional service fees.

- Request at a Bank Counter: You can bring your Discover credit card and a valid photo ID to any bank or credit union counter offering this service and request a cash advance. It’s recommended to call the bank in advance to confirm if they provide this service to non-customers.

The downsides of this method are obvious: the costs are extremely high. You not only have to pay fees but also face interest that starts accruing from the day of the withdrawal, with no grace period.

Method 3: Using Balance Transfer Checks

Discover sometimes mails balance transfer checks to cardholders. These checks look like regular personal checks but draw funds directly from your credit card account. You can write the check to anyone, including yourself, and deposit it into a bank account.

The main difference from a cash advance lies in the fee and interest rate structure.

| Transaction Type | Introductory APR | Fees |

|---|---|---|

| Cash Advance | Not applicable | $10 or 5% of the advance amount (whichever is greater) |

| Balance Transfer | May have 0% or low introductory rate | 3%-5% of the transfer amount |

As shown in the table, balance transfer checks often come with an introductory low rate (or even 0%), making them more cost-effective than cash advances during specific periods. However, they still require a transfer fee.

Distinction: Credit Card vs. Bank Account Transfers

Many people mistakenly believe that transferring money with a credit card is similar to using a bank account, or even think the former can earn cashback. This is a costly misconception. Let’s clarify the facts through this Discover Money Transfer Guide.

| Comparison Dimension | Transfer with Discover Credit Card | Transfer with Discover Bank Account (ACH) |

|---|---|---|

| Fees | High. Typically treated as a cash advance, incurring about 5% fees and up to 30% APR. | Free. ACH transfers between Discover bank accounts incur no fees. |

| Speed | Authorization is instant, but funds may take 1-2 business days to arrive. | Funds typically take 3-5 business days to arrive, sufficient for non-urgent transfers. |

| Cashback Eligibility | Not eligible. Cash advances, cash-equivalent transactions, and transfers via third-party platforms typically do not qualify for cashback rewards. | Not applicable. Bank account transfers do not involve spending rewards. |

In summary, using a Discover credit card for transfers should be considered an expensive emergency option. For routine or planned transfer needs, using your Discover bank account or another bank’s account for ACH transfers is by far the most economical and sensible choice.

Full Breakdown of Fees: How Much Do Transfers Cost?

In the previous Discover Money Transfer Guide, we explored different methods. Now, it’s time to dive into the most critical issue: costs. The fees for using a credit card for transfers are far more complex and expensive than you might imagine. This section will break down these costs one by one, so you can clearly see every potential expense.

💰 Cost Calculation Example: The Cost of Transferring $1,000

To give you a clearer sense of the costs, let’s calculate how much it costs to transfer $1,000.

- Via Cash Advance:

- Fee: Discover charges $10 or 5% of the transfer amount, whichever is greater. Thus, the fee is $1,000 * 5% = $50.

- Interest: Starting from the day of withdrawal, an APR of up to 28.99% applies. Even if you pay off the $1,050 (principal + fee) within a month, the interest on this amount will be approximately $25.

- Total Cost: Your total cost is at least $75.

- Via Third-Party Platforms like PayPal:

- Platform Service Fee: PayPal charges 2.9% + $0.30 for credit card payments. Thus, the platform fee is $1,000 * 2.9% + $0.30 = $29.30.

- Potential Discover Fees: This is the biggest risk. Discover is likely to classify this transaction as a cash advance, charging an additional $50 fee and 28.99% interest.

- Total Cost: In the worst case, your total cost could be as high as $79.30 + interest, potentially exceeding a direct cash advance.

Conclusion: Regardless of the method, the direct cost of transferring $1,000 with a credit card is very high. In contrast, using your Discover bank account for an ACH transfer is typically free.

Cash Advance Fees

When you use a Discover credit card for a cash advance, the first fee is the transaction fee. You’ll pay 5% of the advance amount or $10, whichever is greater. This means even if you withdraw just $100, you’ll pay a $10 fee. For $1,000, the fee is $50. This fee is immediately added to your credit card bill.

High Cash Advance Interest Rates

The second, and more expensive, cost of a cash advance is the interest. According to Discover’s terms, the standard variable cash advance APR is 28.99%. This rate is much higher than that for regular purchases.

The critical point is that cash advances have no grace period.

- Regular purchase transactions typically have a grace period, meaning no interest is charged if you pay the full balance by the due date.

- Cash advances and balance transfers do not have this benefit.

This means interest starts accruing from the day of the transaction. The issuer multiplies your outstanding balance by the daily interest rate, adding the interest to your account daily, creating compound interest. The longer you delay repayment, the larger the interest snowballs.

Third-Party Platform Service Fees

If you choose to use a credit card for transfers through platforms like PayPal or Venmo, you’ll first face the platform’s service fees. These fees are charged to process credit card transactions. For PayPal, the fee structure is as follows:

| Transaction Type | Funding Source | Fee (Domestic US) |

|---|---|---|

| Personal Payment | Linked Credit or Debit Card | 2.9% + $0.30 fixed fee |

This fee is borne by either the sender or recipient, depending on your settings. But this is just the first layer of fees. As shown in the cost example, Discover may still classify the transaction as a cash equivalent, triggering its own cash advance fees and high interest rates.

International Transfer Fees

When transferring money outside the US, the fees become even more complex. Using third-party platforms for international transfers, you may face multiple charges. For example, sending money via PayPal from a US account to friends or family abroad typically includes:

- International Transfer Fee: A fixed percentage fee, such as 5% (with minimum and maximum limits).

- Funding Source Fee: When paying with a credit card, you still face about 2.9% transaction processing fee.

- Currency Conversion Fee: If the transfer involves different currencies, the platform adds a currency conversion fee on top of the exchange rate.

Adding these fees together, the total cost of an international transfer could account for 10% or more of the transfer amount, making it a very uneconomical transaction.

If your use case involves cross-border payments and FX, consider an alternative path with BiyaPay: estimate costs via its exchange-rate comparison, then initiate delivery with the remittance service with online tracking.

BiyaPay is a multi-asset trading wallet supporting flexible fiat-to-digital conversions and operating with U.S. MSB and New Zealand FSP registrations, improving compliance and predictability for cross-border transfers.

Security Measures and Risk Prevention

Image Source: unsplash

While using a credit card for transfers can be costly, understanding how to protect your account security is crucial. Fortunately, Discover provides robust security features and tools to help you prevent fraud risks.

Discover’s Security Features

Discover is committed to protecting your account security. You’ll first benefit from the “$0 Fraud Liability Guarantee”. This policy ensures you’re not responsible for any unauthorized transactions. Additionally, Discover continuously monitors your account activity and immediately sends fraud alerts if anything unusual is detected.

You can also proactively set up various free alerts to better manage your account activity:

- Purchase Alerts: You’ll receive notifications when a single transaction exceeds your set amount.

- Security Alerts: The system will alert you to unusual logins or suspicious spending patterns.

- Cash Advance Alerts: You’ll be notified immediately when your card is used for a cash advance.

💡 Useful Feature: Freeze it® If you temporarily misplace your card, you can use the “Freeze it” feature through the mobile app or online account center. It acts like a switch to instantly freeze new transactions and ATM withdrawals, giving you valuable response time.

PIN Usage Scenarios

A personal identification number (PIN) is another important layer of security for your account. You’ll need to use a PIN in two main scenarios:

- Obtaining a Cash Advance: When withdrawing cash from an ATM using a credit card, you must enter a PIN.

- Certain International Transactions: When traveling in some countries, vending machines or unattended ticket kiosks may require a PIN to complete transactions.

User Security Guidelines

In addition to relying on Discover’s protections, your own security practices are equally important.

When Using Third-Party Payment Platforms:

- Transfer Only to Known Contacts: P2P transfers via platforms like PayPal or Venmo are typically instant and irreversible. Only send money to people you know and trust, avoiding transactions with strangers.

- Enable Multi-Factor Authentication (MFA): Set a strong password for your payment platform account and enable multi-factor authentication for an extra layer of security.

- Monitor Security Notifications: Pay attention to any security alerts about suspicious activity sent by the platform.

Preventing Phishing Scams: Be cautious of emails or texts impersonating Discover. These scams often have the following characteristics:

- Use generic greetings like “Dear Customer.”

- Create a sense of urgency, urging you to click a link immediately.

- The link address looks strange and doesn’t match the official domain.

If you receive an email claiming an “unsuccessful login attempt” and asking you to click a link to verify your identity, ignore and delete it immediately. Never click any links or provide personal information.

The core conclusion of this Discover Money Transfer Guide is clear: You can use a Discover credit card for transfers, but it’s usually expensive and suitable only for emergencies. For routine money transfers, we strongly recommend using a Discover bank account.

💡 Smart Choice Compared to the up to 5% fees for credit card transfers, ACH transfers using a bank account are typically free, saving you significant costs.

Before making any credit card transfer, carefully read the terms and confirm all potential fees to avoid unnecessary financial losses.

FAQ

Can I earn cashback rewards by transferring money with a credit card?

No. Discover typically classifies credit card transfers as cash advances or cash-equivalent transactions. These transactions are not eligible for cashback rewards. Not only will you not earn rewards, but you’ll also incur additional fees and interest.

Is there a way to avoid cash advance fees?

There’s almost no way to avoid them. As long as the funds come from your credit card limit rather than a bank deposit, the transaction is highly likely to be treated as a cash advance. The most reliable way to save money is to use your Discover bank account for transfers directly.

Will credit card transfers affect my credit score?

Yes. Cash advances increase your credit utilization ratio, which can negatively impact your credit score. Frequent large cash advances may also be seen by the issuer as a sign of financial instability.

How much money can I transfer with a credit card?

The amount you can transfer is limited by your cash advance limit, which is typically much lower than your total credit limit. You can check your specific cash advance limit on your Discover statement or online account.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

2026 Latest US Stock Broker Review: Which is Better in Features and Fees - IB, Futu, or Tiger Securities

Must-Read for Investing in US Stocks in 2025: 5 Technical Indicator Tips for Analyzing Real-Time Quotes

US Stock Index Futures Trading Secrets: Master the Four Major Indices to Unlock Wealth Opportunities

2025 Advanced Guide to US Stock Trading: What is Level 2 Data and Software Choices

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.