Free Real-Time Quotes Are Now Standard? Sina Finance App's Killer Features Go Far Beyond That

Image Source: unsplash

Free real-time quotes have long been the standard for US stock apps. This is no longer a decisive advantage. When everyone can see the same price movements, how do you gain an information edge?

The key to choosing an app lies in whether it can provide “decision-making added value” beyond quotes.

Gaining an information advantage allows you to spot opportunities first. The value of the Sina US Stocks app goes far beyond this; it truly helps you penetrate data and make wiser decisions.

Key Takeaways

- The Sina Finance app provides millisecond-level real-time quotes with fast speed, helping users seize trading opportunities.

- The app uses AI-powered investment research to quickly interpret earnings reports, turning complex data into clear investment insights.

- Users can track institutional fund movements through the app to understand position changes by investment giants like Buffett.

- The app provides 7x24-hour global news flashes and institutional research reports, helping users access comprehensive and authoritative market information.

More Than Free Real-Time Quotes: Building a Decision Foundation

Image Source: unsplash

Yes, free real-time quotes are the foundation. But there are decisive differences between foundations. While other apps still provide “second-precision” updates, the Sina US Stocks app has already elevated the standard to a new level, laying a solid foundation for your decisions.

Millisecond-Level Refresh Speed

You get truly “real-time.” We provide not only free Level 1 real-time quotes but also 0.03-second millisecond refresh speed. In the fast-changing market, this fraction of a second difference may be the key to seizing the best buy/sell points. This is not simple feature stacking but technical assurance that gives you a real edge.

- Industry Standard: Real-time data streams, updates precise to the second.

- Sina Standard: Millisecond-level refresh, letting you stay one step ahead.

Comprehensive Technical Analysis Tools

You need not only speed but also depth. The app includes dozens of mainstream technical analysis indicators, from classic MACD and KDJ to Bollinger Bands. All tools allow flexible parameter settings, helping you quickly validate your trading strategies and turn market feel into reliable signals.

Convenient Auxiliary Monitoring Features

For busy office workers, constant screen watching is a luxury. The Sina US Stocks app understands your pain points and provides powerful auxiliary features:

Multi-Stock Side-by-Side Comparison and Floating Window Monitoring features let you avoid frequent switching between apps. While handling work emails or browsing other webpages, you can place selected stocks in a floating window in the corner of your desktop, achieving seamless integration of work and investing.

These features together build a reliable and efficient decision infrastructure. It achieves “financial information equality,” allowing you, even if not a full-time trader, to have a professional-level monitoring experience and miss no market opportunities.

AI-Powered Investment Research: Simplifying Data Insights

Image Source: unsplash

If you think basic quotes and technical indicators are enough, you may be missing the biggest information dividend of this era—data insight. Facing massive earnings reports, research reports, and news, ordinary investors are like navigating in an information fog. The Sina US Stocks app’s AI-powered investment research engine is your “data sonar,” penetrating the fog and turning complex data into clear investment insights.

Intelligent Earnings Report Interpretation

A dozens-of-pages English earnings report full of professional terms is enough to deter 99% of individual investors. You no longer need to chew through it word by word. Sina Finance’s “Xina AI” feature can extract the most valuable core information for you in just 30 seconds after an earnings report is released.

This is not simple translation but intelligent in-depth analysis. AI automatically captures key financial indicators, business highlights, and future guidance, intelligently marking potential risks and opportunities.

For example, when NVIDIA (NVIDIA) releases earnings, you don’t need to search dense tables; AI directly tells you core growth points like “data center revenue up 126% year-over-year.” This is supported by advanced technologies like natural language processing (NLP) and machine learning, which can automatically complete data extraction and standardization like professional analysts.

| AI Technology | Application in Earnings Interpretation |

|---|---|

| Natural Language Processing (NLP) | Quickly understand human language, extracting key data and management views from reports. |

| Machine Learning | Identify abnormal patterns in data, such as spotting expense growth outside historical ranges. |

| Generative AI | Automatically generate easy-to-understand summaries and key points from complex financial data. |

This allows you to use AI to quickly analyze market sentiment and company dynamics like top institutions such as JPMorgan, seizing earnings season trading opportunities first.

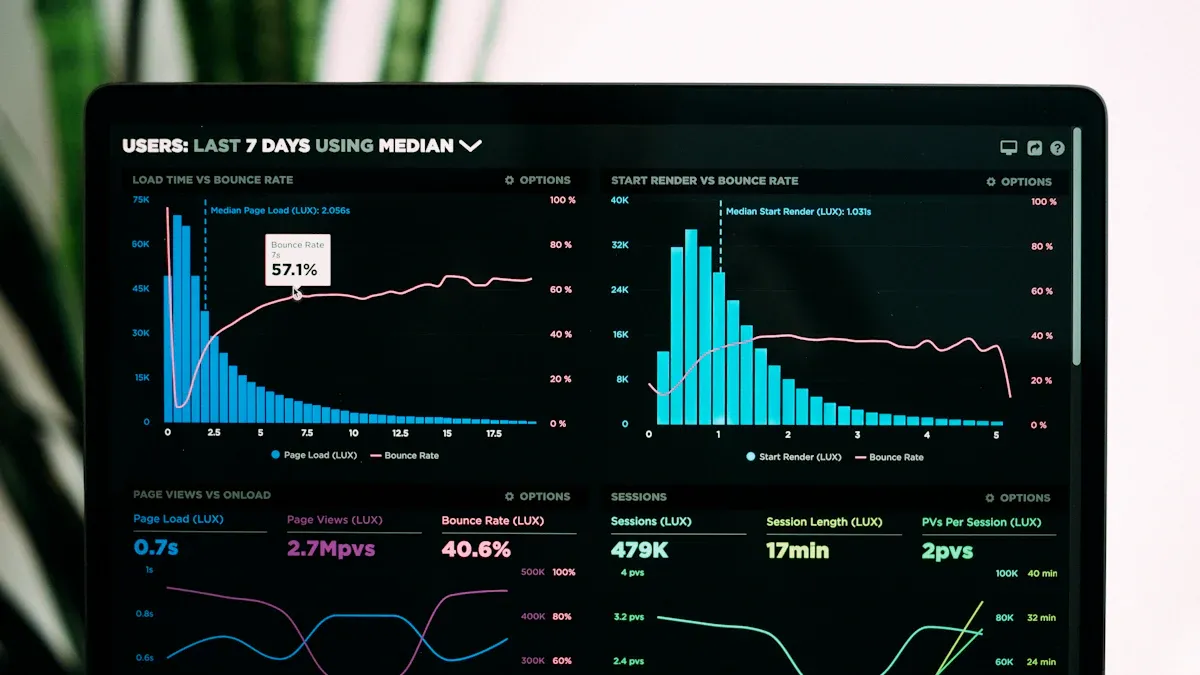

Key Data Visualization

Numbers are cold, but trends have temperature. Another killer feature of AI investment research is turning dull financial data into intuitive visual charts. You no longer need to manually organize spreadsheets; the Sina US Stocks app has prepared everything for you.

A picture is worth a thousand words. Through dynamic interactive charts, you can instantly see a company’s historical changes in revenue, profit, cash flow, and other core data.

Whether comparing peers or analyzing own growth, these visualization tools help you quickly form judgments. Research shows that intuitive, visually driven tools significantly improve analysis efficiency and decision quality. When Bloomberg integrated AI visual analysis for professional users, user performance improved by 30%. Now, you can enjoy this professional-level decision aid for free.

- Historical Financial Comparison: Clearly shows a company’s financial performance over the past 5-10 years—growth or decline at a glance.

- DuPont Analysis Chart: One-click breakdown of return on equity (ROE), letting you see core drivers of company profitability.

- Peer Data Showdown: Places target company and main competitors’ core indicators side by side, highlighting strengths and weaknesses.

These tools free you from heavy data processing, allowing focus on analysis and decision-making itself.

Industry Chain Mapping

Any company’s fate is closely tied to its industry chain. Are upstream suppliers stable? Is downstream customer demand strong? This information is often hidden in scattered announcements and news, hard to access.

The industry chain mapping feature draws a clear “business ecosystem map” for you. You can intuitively see all key suppliers, customers, and partners of a core company (like Apple or NVIDIA).

The value of this map far exceeds imagination. It helps you:

- Anticipate Risks: When the US restricts advanced AI chip exports to mainland China, you can quickly discover through the map that NVIDIA faces potential write-downs up to $5.5 billion, as the Chinese market accounts for a significant portion of its revenue.

- Discover Opportunities: When Apple shifts some production to India and Vietnam to mitigate risks, you can follow the chain map to dig for factories or component suppliers benefiting from the “China+1” strategy.

| Company | Industry Chain Risk | Investment Implications |

|---|---|---|

| NVIDIA | Geopolitical restrictions on exports to China. | Focus on expansion in high-profit markets like the US and Middle East, avoiding geopolitical risks. |

| Apple | Supply chain highly concentrated in China, vulnerable to tariffs. | Focus on supply chain diversification, seeking beneficiaries in emerging manufacturing bases like India and Vietnam. |

This feature gives you a macro perspective like institutional investors, no longer just staring at single stock K-line charts but finding higher-certainty investment opportunities from overall industry dynamics.

Track Smart Money: Sina US Stocks Decodes Institutional Movements

If AI investment research is your “data sonar,” then the smart money tracking feature is your “radar” for spotting market protagonists—institutional investors. In the US stock market, institutional fund flows often determine medium- to long-term stock price trends. Retail investors often lose because they go against the trend.

Your opponent is not the K-line chart but well-funded, well-informed professional institutions. Instead of fighting them, follow them.

The Sina US Stocks app provides two core “killer features,” letting you clearly see every move of smart money, transforming from a passive follower to an active strategy executor.

Giant Position Visualization

Do you know what Buffett, Soros, and Ray Dalio buy and sell each quarter? This information is actually public. According to US Securities and Exchange Commission (SEC) rules, institutions managing over $100 million in assets must file 13F position reports quarterly.

However, accessing and interpreting this information is difficult for individual investors:

- Hard to Find Data: You need to visit the SEC’s EDGAR database, manually searching massive files.

- Hard to Understand Reports: Reports are in pure English, complex format, full of professional codes.

- Lagged Information: Institutions have a 45-day window after quarter-end to file, so information you see may be outdated.

The Sina US Stocks app completely solves these pain points. It provides an authoritative data + Chinese visualization + free access perfect solution. We directly source data from authoritative channels like the SEC, then use powerful technical engines to turn dull reports into clear Chinese charts.

You no longer need to struggle with English reports. Just search “Berkshire Hathaway” in the app to instantly see Buffett’s full position changes last quarter—what was increased, reduced, or newly added.

| Traditional Method (Self-Research) | Sina US Stocks App |

|---|---|

| Visit SEC website, download English PDF | Open app, Chinese interface direct presentation |

| Manually compare two quarters’ positions | Automatically highlight “increase,” “reduce,” “new position” |

| Spend hours or days | Just seconds to insight into giants’ moves |

This feature gives you top hedge fund-level “intelligence capability” for free. You can easily “copy homework,” and more importantly, by observing these masters’ layouts, learn their investment logic, understand favored industries and companies, and elevate your investment cognition.

Major Fund Flow Analysis

If 13F reports are institutions’ “quarterly summaries,” then major fund flows are their “real-time ECG.” It tells you whether big money is flowing in or out of a stock on the current trading day or even right now.

What is “major funds”? It usually refers to large and super-large orders in the market.

Based on transaction amounts, orders are classified into levels. Typically, super-large orders over $200,000 and large orders over $50,000 are considered institutional behavior. Positive values indicate net inflows, negative values net outflows.

Tracking these fund flows is crucial. History has repeatedly proven that retail investors going against institutional funds often suffer heavy losses. For example, in the 2010 “Flash Crash”, algorithm-driven institutional selling evaporated nearly $1 trillion in minutes, catching countless retail off guard. High-frequency trading amplified market buy/sell pressure, disproportionately harming small traders.

The major fund flow analysis feature is your protective shield against becoming harvested “leeks.” It provides clear decision signals through real-time monitoring of large trades:

- Spot Accumulation Signals: When price consolidates at bottom but major funds continuously net inflow, this may be institutions quietly building positions.

- Beware Distribution Risks: When price at high but major funds continuously net outflow, this may signal an impending decline.

- Validate Upside Momentum: A healthy rally must have sustained major fund inflows as support.

This tool gives you “X-ray” vision, seeing through price fluctuation appearances to the core driver—funds. When combined with technical analysis and AI earnings interpretation, you build a three-dimensional decision system far surpassing ordinary investors.

Authoritative Information Matrix: Building a Panoramic Information Moat

Data and AI are your weapons, but weapons need intelligence support. If your information sources are lagged or one-sided, even the strongest analysis tools cannot help correct decisions. The Sina Finance app builds a panoramic information moat of speed, depth, and breadth, ensuring you never miss key information.

7x24 Global News Flashes

Major market turns are often triggered by breaking news. You need not next-morning summaries but instant alerts at event occurrence. The app provides 7x24-hour uninterrupted global financial news flashes, covering everything from Fed rate decisions to major corporate mergers.

Just as Reuters is the choice of professional traders for its speed and accuracy, our news flash system aims to give you the same level of information advantage. When a price-moving message is released, you will be among the first to know.

Institutional Research Report Aggregation

Top investment bank research reports are “information gold mines” hard for ordinary investors to access. These reports condense weeks of professional analyst work, profoundly influencing market expectations. The Sina US Stocks app aggregates latest report summaries from dozens of top institutions like Goldman Sachs and Morgan Stanley.

You no longer need expensive subscriptions or struggle in massive information. We extract core views and target prices, letting you stand on giants’ shoulders to quickly understand institutional views on a company and make wiser decisions.

Expert Views and Community Sentiment

Data is rational, but markets are full of emotion. Even with great earnings, pessimistic market sentiment can cause price drops. Therefore, insight into “human hearts” is as important as data. The app uses advanced AI to analyze massive news and social platforms (like StockTwits) for sentiment tendencies.

- Natural Language Processing (NLP): AI automatically reads news and comments, judging market sentiment toward a stock as positive, negative, or neutral.

- Sentiment Index: Quantifies complex emotions into intuitive indices, letting you see current market heat and direction at a glance.

This feature gives you “mind-reading.” When technical indicators and market sentiment resonate, your trading decisions gain higher certainty.

The Sina Finance app builds a four-in-one investment ecosystem of “extreme quotes + AI analysis + institutional tracking + authoritative information.”

Unlike apps like Tiger Brokers (TIGR) excelling in trade execution, the true value of the Sina Finance app lies in “pre-trade research,” making it an ideal tool for information-driven investors.

Separating “research” from “execution” often makes your workflow cleaner: use a research-first app for screening and validation, and a different tool for placing orders and keeping consistent records, so you’re not pulled around by the content feed inside one interface.

If you want a relatively neutral execution-side reference, BiyaPay is a multi-asset wallet that offers a unified Trading Entry for viewing trades and holdings. For ticker checks, its Stock Info Lookup helps confirm symbol, listing venue, and basic data quickly.

For cross-market pricing or cost estimation, you can use the FX Converter & Comparison. If you need full access, start from the Official Site and complete Registration.

Whether you are a beginner needing AI to simplify earnings or an experienced trader using professional tools, it empowers you “scenario-based.”

Download and experience it now, personally feel these “killer” features, and base every investment decision on deep insights.

FAQ

Are these powerful features really free?

Yes, you can use them completely free. The millisecond-level quotes, AI earnings interpretation, institutional position tracking, and other core features mentioned are all provided free. You pay nothing to get professional-level decision support.

As an investing beginner, are these features too complex?

Not at all. We prepare both easy-to-use AI smart tools and deep professional features. You can start with “AI earnings interpretation” to easily understand company fundamentals and gradually grow into an investing expert.

Is the source of institutional position data reliable?

Absolutely reliable. Our data comes directly from official channels like the US Securities and Exchange Commission (SEC). All 13F position reports you see undergo technical parsing and Chinese visualization processing, ensuring authority and readability.

How is this different from my broker app?

Broker apps focus on “trade execution,” while the Sina Finance app’s killer lies in “pre-trade research.” We provide deep decision aids to help you make wiser judgments before trading, an ideal partner for information-driven investors.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Zelle Wire Transfer or ACH? Clearing Up the Confusion

How to Fill Out a CVS Money Order A 2026 Guide

What Are the Daily Limits for Chase Accounts?

The Easiest Way to Find the Code for Calling France

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.