Essential Guide to Remitting Money to Bank of China: Fees, Limits, and Speed Fully Explained

Image Source: unsplash

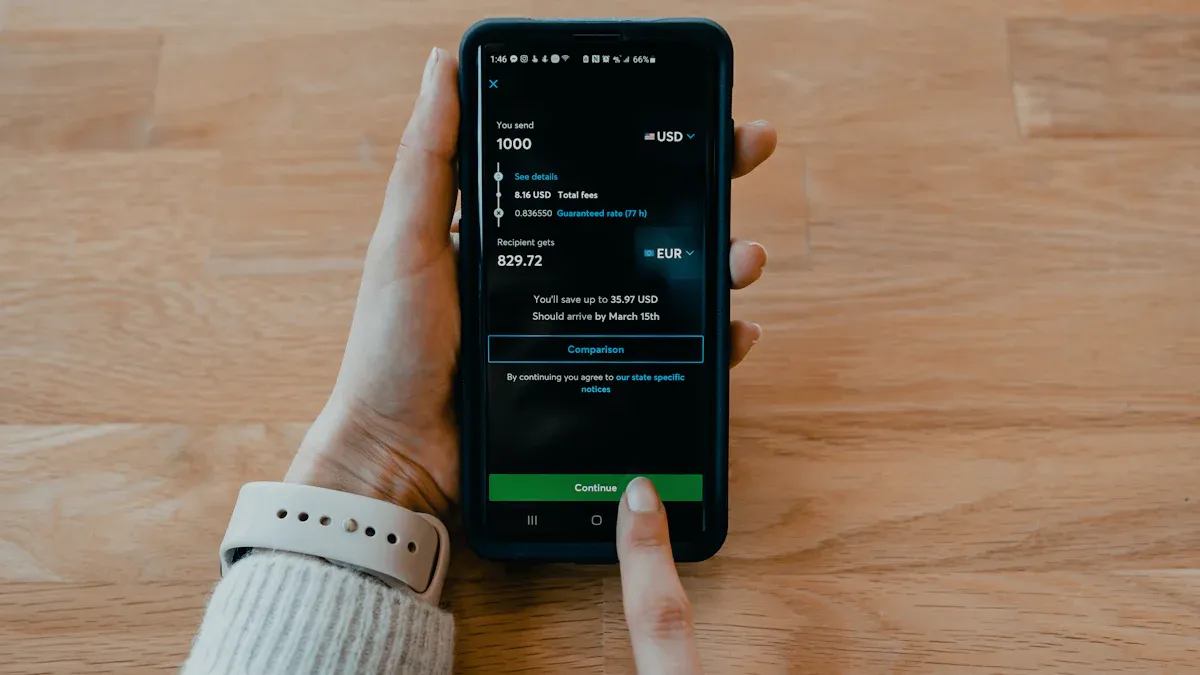

When you prepare to remit money from abroad to Bank of China, your main concerns are undoubtedly three issues: fees, limits, and speed. Here is a core suggestion: for small living expense remittances, prioritize online services like Wise or Remitly—they are usually faster and cheaper; for large amounts like home purchases, traditional bank wire transfers are a safer and more compliant choice. The global demand for remittances to China is huge.

- In 2023, China was the world’s third-largest remittance recipient country, receiving $50 billion.

- India and Mexico ranked first and second in received amounts.

This article provides you with a clear selection guide to help you make the best decision based on your situation.

Key Takeaways

- For small living expense remittances, choose online platforms like Wise or Remitly—they are usually faster and cheaper.

- For large fund remittances, traditional bank wire transfers are safer and more compliant, but fees are higher.

- When remitting to China, the personal annual foreign exchange settlement limit is $50,000—exceeding it requires an application.

- Before remitting, carefully verify recipient information, such as name pinyin and bank card number, to avoid errors.

- Understand the speed and fees of different remittance methods and choose the most suitable based on your needs.

Remittance Fee Breakdown: How to Avoid Hidden Charges?

Image Source: unsplash

When you plan a remittance, the initial handling fee you see is often just the tip of the iceberg. The real cost consists of three parts: explicit fees, hidden exchange rate losses, and possible intermediary bank fees. Understanding these can help you make the most cost-saving choice.

Explicit Fees: Handling Fees and Cable Charges

This is the fee you see first, usually a fixed amount.

- Traditional Banks: Wire transfers through banks usually have higher fees. For example, sending USD online from Chase Bank in the U.S. costs $40. A money-saving tip is that if you choose to remit in CNY (recipient currency), the fee may drop to $5.

- Online Platforms: Services like Wise or Remitly typically have lower and more transparent fees.

Hidden Costs: Detailed Explanation of Exchange Rate Losses

This is the largest and most easily overlooked cost. Many banks and remittance services do not use the “mid-market exchange rate” you find on Google. They add a 2% to 4% markup to this rate, which becomes their profit and your loss.

What is the mid-market exchange rate? This is the “wholesale rate” used for interbank currency trading and the fairest rate. When a service claims “zero fees,” you especially need to be wary of whether its exchange rate includes a high markup.

For example, when the market rate is 1 USD to 7.25 CNY, a certain institution might offer 7.10. For every $1,000 you send, you lose 150 CNY (about $20.7).

Intermediary Bank Fees: Overlooked Extra Expenses

If your remittance needs to pass through one or more “intermediary” banks, these banks will charge a transit fee, usually $20 to $50. This fee is often discovered only after the remittance is complete, deducted directly from your remitted amount, resulting in the recipient receiving less than expected.

Comprehensive Cost Comparison: Example with $1,000

To give you a clearer view of total costs, we compare the expenses of different methods for remitting $1,000 to mainland China.

| Remittance Method | Handling Fee (USD) | Exchange Rate Loss (USD) | Estimated Total Cost (USD) |

|---|---|---|---|

| Traditional Bank (e.g., Hong Kong or U.S. Bank) | $25 - $45 | $20 - $40 (based on 2-4% markup) | $45 - $85+ (excluding intermediary fees) |

| Wise | About $13.42 | $0 (uses mid-market rate) | About $13.42 |

| Remitly | About $0 - $3.99 (new users or promotions) | Exists, amount varies | $2 - $4 + rate difference |

| Biyapay | About $5 (based on 0.5% rate) | Confirm real-time rate at transaction | About $5 + rate difference |

Conclusion: In terms of total cost, online platforms like Wise that use mid-market rates have a clear advantage for small and medium remittances. Traditional banks appear safe but have the highest comprehensive costs.

Remitting from Abroad to Bank of China: All About Limits

Understanding remittance limits is crucial. This not only affects whether your single remittance succeeds but also involves complying with regulations in China and the sending country to avoid funds being frozen or unnecessary scrutiny. When planning to remit from abroad to Bank of China, you need to pay attention to the following limit levels.

China Personal Foreign Exchange Settlement Limit: Annual $50,000 Red Line

The most important rule you need to know clearly is: Individuals in mainland China have an annual limit of equivalent $50,000 USD for converting foreign currency to CNY. This is a hard indicator set by China’s State Administration of Foreign Exchange (SAFE).

This limit has several key points you need to understand:

- For Individuals: This limit applies to every Chinese citizen.

- Settlement Limit: It restricts the amount of received foreign currency you can “settle” into CNY, not how much foreign exchange you can “receive.” In theory, your Bank of China account can receive foreign exchange exceeding $50,000, but the excess cannot be settled into CNY for use in that year.

- Excess Application: If you do need to settle over $50,000, such as for paying large goods or services, the recipient cannot handle it directly at the bank counter. You must submit a written application to the local foreign exchange administration and provide documents proving the transaction’s authenticity, such as:

- Signed contract between both parties

- Payment request or invoice

- Tax proof, etc.

Note: This annual $50,000 personal settlement limit is unrelated to regulations on large overseas cash withdrawals with bank cards and does not affect your normal consumption abroad. It is specifically for regulating foreign exchange conversion after entering mainland China.

Large Remittance Reporting: Compliance Requirements Over $10,000

When conducting large cross-border remittances, financial institutions are responsible for reporting to regulators. This is mainly for anti-money laundering and preventing financial crimes.

Typically, when a single or cumulative daily remittance exceeds $10,000, the bank or remittance platform you use will automatically report to its country’s regulator (e.g., FinCEN in the U.S.). This process is seamless for you and handled by the institution. However, the bank may require additional information from you to ensure compliance.

You may need to prepare:

- Valid government-issued ID

- Simple explanation of fund source

- Specific purpose of the remittance

- Recipient details

This step is standard procedure—as long as your fund source and purpose are legitimate, there is no need to worry.

Sending Country Restrictions: Example with U.S. IRS Rules

In addition to recipient country regulations, you must comply with the tax and reporting requirements of the sending country. Taking the U.S. as an example, the Internal Revenue Service (IRS) has clear rules for large international fund flows.

If you are a U.S. taxpayer, you need to note the following:

- Bank Reporting: Any international wire transfer exceeding $10,000 must be reported by the bank to the IRS by law.

- Personal Reporting Obligations: In some cases, you need to proactively report to the IRS. This is usually not for the remittance itself but for your overseas asset holdings.

- Foreign Bank Accounts: If at any time the total value of all your foreign financial accounts exceeds $10,000, you need to file FinCEN Form 114 (FBAR). Your receiving Bank of China account is also included.

- Large Gifts: If you receive gifts or inheritance exceeding $100,000 from non-U.S. residents, you need to file Form 3520.

Important Reminder: Honestly reporting your overseas accounts to the IRS is crucial. Failure to disclose may lead to high fines or even audits or criminal investigations. Ensuring tax compliance is a prerequisite for large international remittances.

Per-Transaction and Daily Limit Comparison Across Channels

Different remittance channels have very different per-transaction and daily limits. Understanding these restrictions can help you choose the method best suited to your amount needs.

| Remittance Method | Per-Transaction/Daily Limit (USD) | Notes |

|---|---|---|

| Traditional Bank Wire Transfer | Usually high, up to $50,000 or more | Specific limits depend on your bank and account type. Large remittances usually require in-branch handling. |

| Wise | Up to $1,000,000 | Limits vary by currency and payment method. Limits via bank account transfer (ACH) are usually lower than wire. |

| Remitly | Lower for new users, can increase to $30,000 - $60,000 after verification | Remitly uses tiered limits—you need to provide additional documents to raise your 24-hour, 30-day, and 180-day limits. |

Conclusion: For regular remittances from abroad to Bank of China, online platforms’ limits are already very flexible, sufficient for most living expenses and small business payments. If you need a single large remittance far exceeding $50,000, traditional bank wire transfer remains the more reliable and compliant choice, but be sure to confirm the process and required documents with the bank in advance.

Remittance Arrival Speed: Which Method Is Fastest?

Remittance speed determines when your funds can be used. Different remittance methods have arrival times ranging from minutes to a week. Understanding these differences helps you handle various situations, whether emergency aid or regular living expenses.

If your priority is getting money into a Bank of China account with fewer surprises on FX and fees, it helps to do a quick cost check before you place the transfer. On the BiyaPay website, the FX rate converter & comparison tool lets you reference real-time rates, so you can compare them against the quoted rate of your chosen channel and consider whether there may be hidden markups or intermediary deductions before deciding the amount and timing.

When you’re ready to send, you can review the send money page for fee expectations and estimated arrival windows, which is useful for planning around holidays and avoiding last-minute delays. For larger transfers where documentation matters, keeping your transaction record and a simple purpose description together can also make follow-ups smoother.

BiyaPay is positioned as a multi-asset trading wallet for cross-border payments, investing, trading, and cash management, supporting conversions between multiple fiat and digital currencies, and operating under compliance frameworks such as U.S. MSB and New Zealand FSP. If you prefer to prepare early, you can start from the registration page and then choose the most suitable route using the same fee/limit/speed logic outlined in this article.

Instant Arrival: Advantages of Alipay and WeChat

If you need funds to arrive immediately, remitting through online platforms supporting Alipay or WeChat Pay is your best choice.

You need to operate through a third-party remittance service that cooperates with Alipay or WeChat. When your recipient in mainland China is very accustomed to using these e-wallets, this method is extremely convenient.

- Nearly Instant: Once the remittance service processes your transaction, funds almost immediately appear in the recipient’s Alipay or WeChat wallet balance.

- Convenient and Fast: Recipients do not need to go to the bank and can directly receive and use on their phone.

You need to note that the fees you pay are to the third-party remittance service, not Alipay itself. This cost usually includes service fees and exchange rate differences.

1-3 Business Days: Standard Timeframe for Online Platforms

For most online remittance platforms like Wise or Remitly, directly remitting to a Chinese bank account has a standard timeframe of 1 to 3 business days.

This timeframe is the industry standard. It includes the time for the platform to verify your funds, process the cross-border transfer, and for Bank of China to receive and credit the recipient’s account. For non-urgent regular remittances like paying monthly bills or sending living expenses, this is a good balance between speed and cost.

3-5 Business Days: Traditional Bank Wire Transfer Process

Wire transfers through traditional banks (such as Hong Kong or U.S. banks) are the slowest method. Usually takes 3 to 5 business days, sometimes longer.

Wire transfers are slow because funds need to go through a complex path:

- Your bank initiates the remittance.

- Funds may pass through one or more intermediary banks for clearing.

- Finally arrive at Bank of China and credit the recipient’s account.

If any party encounters a holiday during the process, the entire flow will be further delayed. Therefore, when choosing bank wire transfer, be sure to allow ample time for fund arrival.

Mainstream Remittance Method Comparison and Selection Guide

Image Source: unsplash

After understanding all aspects of fees, limits, and speed, it’s time to integrate them and provide you with a clear action guide. Choosing which method ultimately depends on your specific needs. Below, we use a comprehensive comparison table and specific scenario analysis to help you make the wisest decision.

Fee and Exchange Rate Comparison,Speed and Limit Comparison,Operation Convenience and Applicable Scenarios

To give you a clear overview, we created a comprehensive comparison table. This table summarizes the performance of several mainstream methods for remitting from abroad to Bank of China on key dimensions.

| Comparison Dimension | Traditional Bank Wire Transfer (e.g., Hong Kong Licensed Bank) | Wise | Remitly | Biyapay |

|---|---|---|---|---|

| Fee Structure | Fixed handling fee ($25 - $45) + intermediary fees ($20 - $50) | Transparent fixed + percentage fees (total ~$13.42/$1,000) | Fixed fees (usually $0 - $3.99), promotions for new users | Proportional charge (e.g., 0.5%), simple structure |

| Exchange Rate Transparency | Opaque, usually includes 2% - 6% markup | Fully transparent, uses mid-market rate, no markup | Opaque, rate includes markup but shown before transaction | Locks rate before transaction, high transparency |

| Arrival Speed | Slower (3-5 business days) | Fast (usually 1-3 business days, fastest hours) | Very fast (fastest minutes, especially with express) | Fast (usually within 1 business day) |

| Per-Transaction/Daily Limit | High (up to $50,000 or more) | Very high (up to $1,000,000, varies by payment method) | Tiered limits (can increase to $30,000 - $60,000 after verification) | Flexible, meets most personal needs |

| Operation Convenience | Complex, may require in-branch visit and complex forms | Simple, online operation, clear interface, detailed first-time verification | Very simple, excellent mobile experience, designed for fast remittances | Simple and direct, beginner-friendly registration and operation |

Core Findings:

- Cost: Wise and Biyapay are most competitive in fees and rates, either using mid-market rates or having simple transparent structures.

- Speed: Remitly has a clear speed advantage, especially suitable for emergencies.

- Large Amounts: Traditional bank wire transfers remain the most compliant for ultra-large funds.

Scenario Recommendations: How to Send Tuition or Living Expenses?

After understanding the characteristics of different tools, let’s see how to choose in specific scenarios.

Scenario 1: Paying Child’s University Tuition in China

Tuition is usually a large amount with a clear deadline. You need to balance cost, speed, and reliability.

- Preferred Option: Wise or Biyapay

- Reason: Every penny counts for tuition payments. Wise uses mid-market rates to maximize savings from exchange rate differences. Biyapay, with its low rates and simple operation, is a highly cost-effective choice. These methods usually arrive in 1-3 days, sufficient for most school payment deadlines.

- Alternative: Traditional Bank Wire Transfer

- Reason: If the university explicitly requires bank wire transfer or you are uneasy about online platforms, bank wire transfer is the most traditional and reliable method. Although more expensive and slower, its complete process and documentation provide strong proof for large payments.

Scenario 2: Regularly Sending Living Expenses to Family in China

Living expense remittances are usually small and frequent. In this case, convenience, speed, and low cost are your top priorities.

- Preferred Option: Remitly

- Reason: Remitly’s mobile app is designed to be very simple, allowing you to complete remittances anytime, anywhere. Its “Express” option usually delivers funds to the recipient’s account (e.g., Alipay) in minutes, perfect for temporary money needs.

- Alternative: Wise or Biyapay

- Reason: If you value long-term total cost savings more, Wise’s transparent rates are unmatched. Biyapay is also very suitable as a regular living expense remittance tool due to its low rates and convenience.

Scenario 3: Providing Large Family Support (e.g., Home Down Payment)

Such remittances are huge, far exceeding ordinary living expenses—compliance and safety are overriding considerations.

- Preferred Option: Traditional Bank Wire Transfer

- Reason: When single amounts exceed tens of thousands of dollars, banks are the best channel for handling compliance issues. Banks will require proof of fund source per anti-money laundering regulations and generate complete transaction records to handle possible scrutiny from China’s foreign exchange administration. Although cumbersome, this is the most secure method to ensure large funds enter legally.

Important Reminder: Never split large funds into multiple small remittances to evade the annual $50,000 settlement limit. This behavior may be seen by regulators as “splitting settlements,” leading to frozen funds or even fines.

- Reason: When single amounts exceed tens of thousands of dollars, banks are the best channel for handling compliance issues. Banks will require proof of fund source per anti-money laundering regulations and generate complete transaction records to handle possible scrutiny from China’s foreign exchange administration. Although cumbersome, this is the most secure method to ensure large funds enter legally.

- Alternative: Contact Wise or Other Platform Customer Service

- Reason: Although platforms like Wise support up to million-dollar remittances, the bottleneck is the recipient’s settlement limit in China. Before such remittances, be sure to contact platform customer service to understand specific processes and document requirements for large amounts, and ensure the recipient has applied for excess settlement permission with local foreign exchange administration.

Practical Operation Checklist: Must-Do Checks Before Remitting

The final step before completing a remittance is careful checking. A small oversight can cause delays, returns, or even extra fees. This checklist helps you ensure every remittance is smooth.

Verify Recipient Information: Name Pinyin and Bank Details

Accuracy of information is the foundation of successful remittance. A single letter or number error can cause failure. Be sure to repeatedly confirm the following with the recipient:

- Recipient Name: Must provide pinyin exactly matching the recipient’s bank account name.

- Bank Card Number: Provide the complete Bank of China card number.

- Detailed Address: Provide the recipient’s accurate address.

- Account Status: Ensure the recipient’s Bank of China account has activated “cross-border payment receipt service”.

Tip: The more accurate the information, the faster your transfer.

Understand Fee Bearing Methods: OUR, SHA, BEN

When using bank wire transfer, you will encounter these three code options. They determine who bears intermediary bank fees, directly affecting the final amount received by the recipient.

| Code | Fee Bearer | Explanation |

|---|---|---|

| OUR | You (sender) | You bear all fees, ensuring recipient receives full amount. |

| SHA | Shared | You pay sending bank fees, recipient pays receiving bank fees. |

| BEN | Recipient | All fees deducted from remittance amount, recipient receives less. |

Choosing OUR avoids disputes over fees but increases your initial cost.

Prepare Crediting Materials: Communicate with Recipient in Advance

For certain specific-purpose remittances, Bank of China may require the recipient to provide proof materials for crediting. You should communicate with the recipient in advance to prepare. For example, if the purpose is “salary,” the recipient may need to prepare:

- Employment contract

- Payslips

Preparing these documents in advance avoids issues with funds arriving but unable to settle smoothly.

Allow Remittance Time: Avoid Holiday Delays

International remittances are not real-time because they are affected by holidays of banks in both your country and mainland China. For example, during U.S. Thanksgiving or China’s National Day (Golden Week), bank systems pause processing, delaying the flow.

To avoid delays, check both countries’ holiday calendars before remitting and operate at least a week in advance, especially before long holidays like Spring Festival.

Monitor Policy Changes: Prepare for the Future

Foreign exchange policies are not set in stone. China’s State Administration of Foreign Exchange (SAFE) adjusts relevant regulations based on economic conditions. You should develop a habit of regularly checking official information to prepare for future remittances.

You can visit the official website of China’s State Administration of Foreign Exchange https://www.safe.gov.cn/en/ for the latest and most authoritative policy information.

Choosing the best remittance method comes down to balancing fees, speed, and amount. Your core strategy should be very clear:

Small, frequent living expenses prioritize online platforms; large compliant funds choose bank wire transfers.

Finally, before any operation to remit from abroad to Bank of China, be sure to visit official websites or consult customer service to verify the latest information again. Foreign exchange policies and rates change from time to time—pay special attention to possible new regulations in 2026 to ensure every step is accurate.

FAQ

What to do if the remittance is returned?

Remittance failure is usually due to information errors. The bank deducts handling fees and returns the remainder. You may also bear losses from exchange rate fluctuations. Therefore, carefully verify all information before remitting.

Can I use a friend’s account to remit?

No. To comply with anti-money laundering regulations, the sender’s name must exactly match the name of the bank account used. Remitting using someone else’s account will be rejected. This is a standard process to ensure legitimate fund sources.

Is the $50,000 limit calculated per family or per person?

This limit is calculated per person. Every recipient with a mainland China ID card has an independent equivalent $50,000 annual settlement limit. This limit cannot be transferred or shared among family members.

What if the recipient’s name pinyin is wrong?

Name pinyin errors will cause remittance failure. You need to immediately contact your remittance institution to apply for correction. This process may incur additional fees and cause delays. Correct name is key to smooth crediting.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

How to Fill Out a CVS Money Order A 2026 Guide

Zelle Wire Transfer or ACH? Clearing Up the Confusion

SoFi Checking and Savings A Deep Dive Review

The 18 Best Apps to Earn Real Cash This Year

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.