Complete Guide to Nasdaq Index ETFs: Fees, Dividends & Risks Explained

Image Source: pexels

When investing in the Nasdaq Index, you’ll most likely encounter two popular ETFs: Invesco QQQ Trust (QQQ) and Invesco NASDAQ 100 ETF (QQQM). Both track the exact same index but have different characteristics suited to different investors.

Key Highlights

- QQQ: Extremely high trading volume and liquidity — the top choice for short-term traders.

- QQQM: Offers a lower expense ratio of 0.15% — more attractive for long-term holders.

How should you choose between them? This article breaks down the key differences so you can make the best decision based on your investment goals.

Key Takeaways

- QQQ and QQQM both track the Nasdaq-100 Index but suit different investors.

- QQQ has massive volume — ideal for short-term trading; QQQM has lower fees — better for long-term holding.

- The Nasdaq-100 is heavily weighted toward tech companies — offering high growth potential but also higher volatility.

- Investing in Nasdaq ETFs carries concentration and market volatility risks — assess your tolerance before investing.

- Overseas brokers offer the lowest costs; domestic complex orders are more convenient but more expensive.

Why Invest in the Nasdaq Index?

Image Source: pexels

Before comparing QQQ and QQQM, you should first understand what the Nasdaq-100 Index they both track actually is and why it’s so attractive.

Understanding the Nasdaq-100: Focused on Non-Financial Tech Giants

The Nasdaq-100 Index selects the 100 largest “non-financial” companies listed on NASDAQ by market cap. You might wonder why financial stocks are excluded — the reason is straightforward:

- Historical Design: When the index was created in 1985, financial companies were deliberately excluded to differentiate it from indices focused on financial stocks.

- Innovation Focus: By excluding finance, the index better reflects leading companies in technology, healthcare, consumer, and other sectors — capturing the innovative forces driving the modern economy.

This index includes many globally recognized leaders. The table below shows these tech giants hold extremely high weightings and heavily influence index performance.

| Company | Weight (%) |

|---|---|

| Nvidia | 13.19% |

| Apple Inc. | 12.27% |

| Microsoft | 10.57% |

| Amazon | 7.25% |

| Alphabet Inc. (Class A) | 5.88% |

| Alphabet Inc. (Class C) | 5.48% |

| Broadcom Inc. | 5.32% |

| Meta Platforms | 4.93% |

| Tesla, Inc. | 4.47% |

| Netflix | 1.29% |

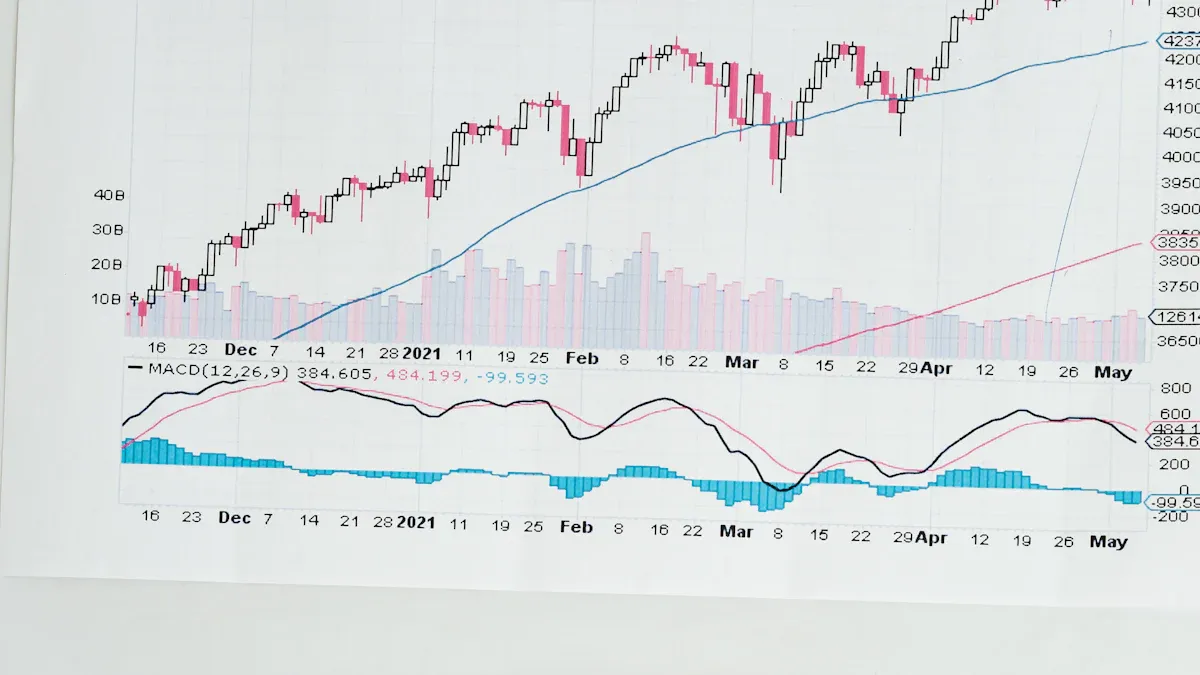

Long-Term Historical Performance & Growth Potential

The biggest appeal of investing in the Nasdaq Index is its strong historical growth potential. While short-term markets fluctuate, over the long term, innovation-driven growth is very clear.

Note: High returns come with high volatility Past performance does not guarantee future results. The index can also experience sharp declines during corrections — such as the 2008 financial crisis and the 2022 bear market. You must assess your risk tolerance and diversify properly before investing.

Core ETF Deep Comparison: QQQ vs. QQQM

After understanding the benefits of the Nasdaq Index, the next key question is: between QQQ and QQQM — two nearly identical ETFs — which should you choose?

They are issued by the same company, track the exact same index, and hold identical stocks. However, the devil is in the details. Their small differences in fees, size, and price lead to completely different investment strategies. Let’s break down the three key differences.

Expense Ratio: The Key to Long-Term Returns

The expense ratio is the annual management fee charged by the ETF issuer — deducted directly from your investment’s net asset value. Though it seems small, over time it snowballs and significantly erodes final returns.

- Invesco QQQ Trust (QQQ): Expense ratio 0.20%

- Invesco NASDAQ 100 ETF (QQQM): Expense ratio 0.15%

What does this 0.05% difference mean? A simple example illustrates.

Assume you invest US$100,000:

- Holding QQQ, you pay $200 annually in fees.

- Holding QQQM, you pay $150 annually.

$50 per year seems minor, but over 20–30 years with compounding, this fee significantly impacts your portfolio. For long-term “buy-and-hold” investors looking to benefit from tech growth, the lower-fee QQQM is clearly the smarter choice.

Size & Liquidity: Critical for Traders

Assets under management (AUM) and average daily volume measure an ETF’s market popularity. Here, QQQ demonstrates absolute dominance as the market veteran.

| Metric | Invesco QQQ Trust (QQQ) | Invesco NASDAQ 100 ETF (QQQM) |

|---|---|---|

| AUM | Over US$280 billion | ~US$28 billion |

| Average Daily Volume | Over 45 million shares | ~6 million shares |

Why does this matter?

- Outstanding liquidity: QQQ’s massive volume means constant buyers and sellers — you can execute quickly at tight spreads with minimal slippage.

- Active options market: For advanced investors using options for hedging or income, QQQ has the most liquid and active options chain available.

Therefore, if you are a short-term trader or need options strategies, QQQ’s unmatched liquidity makes it the clear winner.

Entry Barrier: Friendly for Small Investors

For beginners or budget-conscious investors, per-share price is a practical concern. QQQM was designed with this in mind.

- QQQ typically trades above US$400 per share.

- QQQM has a much friendlier price (usually below US$200).

Lower per-share price means you can buy whole shares with less capital — very convenient for dollar-cost averaging on a fixed monthly budget.

Investment Tip: Use Fractional Shares

If your overseas broker supports “fractional shares,” share price becomes irrelevant. You can invest any dollar amount (e.g., US$50) and the broker automatically converts it to the correct fraction of a share.

Many major US brokers now support this:

- Interactive Brokers

- Firstrade

- Charles Schwab

- Fidelity

- Robinhood

- Webull

Even with fractional shares available, QQQM’s lower price remains psychologically and operationally more appealing for small investors.

Summary: Should You Choose QQQ or QQQM?

By now you should have your answer. Your choice depends entirely on your investment goals and style.

Here’s a quick comparison table to help you decide:

| Consideration | QQQ | QQQM |

|---|---|---|

| Target Investor | Short-term traders, options users | Long-term holders, small-capital investors |

| Expense Ratio | 0.20% (higher) | 0.15% (lower) |

| Liquidity | Extremely high | Good |

| Entry Barrier | Higher share price | Lower share price |

In simple terms, these two ETFs are like the “performance” and “economy” versions of the same car. If you want ultimate trading performance and flexibility — choose QQQ. If you prioritize long-term cost efficiency and accumulation — QQQM is your best bet.

More Nasdaq-Related ETF Options

Besides the mainstream QQQ and QQQM, other ETFs track or relate to the Nasdaq Index. Understanding these can help in different scenarios and even offer tax advantages.

High-Risk Tools: Leveraged & Inverse ETFs

You may have heard of TQQQ (3x long) or SQQQ (3x short) — these offer multiplied daily returns of the Nasdaq-100. They sound tempting but are extremely risky.

⚠️ Warning: Extremely dangerous — not suitable for long-term holding Leveraged ETFs suffer from “volatility decay.” Due to daily rebalancing, even if the index ends flat after ranging, your position can still lose value. They are tools for professional short-term traders — absolutely not for beginners or long-term investors.

These ETFs also have high fees — e.g., TQQQ charges 0.82% — severely eating into returns if held long-term.

Taiwan Market Options: 00662 & 00757

If you prefer trading in TWD, Taiwan offers related choices:

- Fubon NASDAQ-100 (00662): Directly tracks the Nasdaq-100 — holdings nearly identical to QQQ/QQQM. Advantages: convenient trading, no FX needed. Disadvantages: higher fees and lower liquidity than US ETFs.

- Yuanta/P-shares FANG+ (00757): Tracks the “NYSE FANG+ Index” — only 10 mega-cap tech stocks, more concentrated and thus more volatile than 00662.

Tax-Advantaged Alternatives: Ireland-Domiciled ETFs

For non-US investors, taxes matter. Ireland-domiciled ETFs tracking US indices (often called Ireland-domiciled ETFs) offer excellent tax benefits — e.g., iShares NASDAQ 100 Ireland-domiciled ETF (CNX1).

Two major advantages of Ireland-domiciled ETFs:

- Dividend tax halved: The US withholds 30% on dividends paid to foreigners. Through the US-Ireland tax treaty, Ireland-domiciled ETFs reduce this to 15%.

- No US estate tax: Under US law, non-US residents holding over US$60,000 in US-situs assets (including US-domiciled ETFs) face up to 40% estate tax upon death. Ireland-domiciled ETFs are not considered US-situs — legally avoiding this large tax.

For long-term, high-net-worth investors, Ireland-domiciled ETFs are far more tax-efficient.

Key Metrics & Risk Assessment Before Investing

Before committing capital, understand these ETFs’ dividend policies and potential risks. This helps set realistic expectations and prepare for volatility.

Dividend Policy & Yield Analysis

First, realize that the primary goal of Nasdaq-related ETFs is “capital gains” (price appreciation), not dividend income. These tech companies tend to reinvest profits into R&D and expansion, so dividends are generally low.

Using QQQM as an example:

| ETF Name | Current Dividend Yield | Payout Frequency |

|---|---|---|

| QQQM | 0.49% | Quarterly |

Investment Mindset Reminder Do not treat QQQ or QQQM as high-dividend income stocks. Their core value is participating in the long-term growth of tech giants.

Potential Risks of Investing in the Nasdaq Index

Higher returns come with higher risks. Be fully aware of and assess these potential risks:

- Over-concentration in sectors: The index is heavily weighted toward a few large tech companies. Current concentration has surpassed levels seen before the 1999 dot-com bubble and 2008 crisis. This means if the tech sector faces headwinds — such as stricter regulation or a sector downturn — the index can suffer sharp declines.

- Interest rate environment challenges: Rising rates generally hurt growth stocks by discounting future cash flows more heavily. However, impact varies by company size:

- Mega-cap tech giants: Companies like Apple and Alphabet hold over US$500 billion in cash — higher rates actually increase their interest income, giving them strong resilience.

- Smaller tech companies: Face higher refinancing risk — rising rates increase operating costs, making them more vulnerable.

- High market volatility: Tech stocks are known for high growth and high swings. During corrections, you may see larger drawdowns than the broader market. Confirm your risk tolerance can handle intense volatility.

How to Buy Nasdaq ETFs? Step-by-Step Guide

Image Source: unsplash

After choosing your ETF, the next step is opening an account and placing orders. You can buy through “overseas brokers” or “domestic complex orders.”

Once you’ve decided on QQQ, QQQM, or another Nasdaq-related ETF, it’s worth estimating the FX cost first. BiyaPay’s FX rate converter helps you compare quotes across time points and approximate the effective exchange rate for your planned funding amount.

When doing your ETF homework, you can also use Stock quotes & info to check tickers, prices, and basic data before choosing between lump-sum investing and staggered buys. If you prefer a single place to manage multi-asset actions, you can enter via the unified trading entry.

For cross-border fund allocation, review supported routes and currencies on Send Money; if you don’t have an account yet, start with registration.

BiyaPay is positioned as a multi-asset wallet spanning cross-border payments, investing, trading, and fund management, operating under compliance frameworks such as US MSB and New Zealand FSP; announcements and updates are available in the Event Center.

Buying Through Overseas Brokers

Opening an account directly with an overseas (usually US) broker is preferred by many investors for the lowest costs.

Cost Comparison Many major US brokers offer zero-commission stock and ETF trading — significantly reducing long-term costs.

| Broker | Stock/ETF Commission | Minimum Deposit |

|---|---|---|

| Firstrade | US$0 | US$0 |

| Charles Schwab | US$0 | US$0 |

| Interactive Brokers (Lite) | US$0 | US$0 |

Purchase Process Overview:

- Choose broker & open account online: Prepare passport and proof of address — most brokers allow fully online applications.

- Wire funds to broker: After approval, the broker provides dedicated wiring instructions.

- Convert currency: Change TWD to USD.

- Wire transfer: Use online banking or visit your bank to send USD to the broker’s designated account.

- Place order: Once funds arrive (usually 1–3 business days), log in and enter the ETF ticker (e.g., QQQM) to buy.

Buying Through Domestic Complex Orders

If overseas account opening and wiring feel too complicated, use your domestic broker’s “complex order” service. You simply delegate your local broker to place the order on the US market.

- Advantages: Convenient — use your familiar broker app; funds deducted directly from TWD or foreign currency settlement account — no separate wiring needed.

- Disadvantages: Higher costs — complex orders typically charge ~0.5–1% commission plus a minimum fee (e.g., US$15–35 per trade).

In summary, if you want the lowest costs and don’t mind the setup process — overseas brokers are best. If you prioritize simplicity and are willing to pay more for convenience — domestic complex orders are a viable option.

This guide breaks down multiple ETF choices. The summary table below helps you review quickly.

| ETF | Key Feature | Best For |

|---|---|---|

| QQQ | Extremely high liquidity & active options | Short-term traders |

| QQQM | Lower expense ratio & friendly price | Long-term holders & small investors |

| 00662 | TWD trading & easy operation | Taiwan market investors |

| CNX1 | Dividend & estate tax advantages | Large long-term portfolios |

Your investment goals and risk tolerance determine the right tool. Now you can take the first step into global tech growth. Remember — long-term holding is the key to unlocking potential.

FAQ

QQQ vs. QQQM — which should I pick?

Your investing style decides. If you want maximum liquidity as a short-term trader — choose QQQ. If you prioritize long-term cost savings as a buy-and-hold investor — the lower-fee QQQM is best.

Are dividends from QQQ or QQQM taxed?

Yes. As a non-US investor, dividends are subject to 30% withholding tax. To reduce this, consider Ireland-domiciled ETFs like CNX1 — dividend tax drops to 15%.

What is the biggest risk of investing in the Nasdaq Index?

The biggest risk is over-concentration in sectors. The index is heavily weighted toward a few mega-cap tech companies. If the tech sector faces headwinds — such as stricter regulation — the index can suffer sharp declines.

Should I invest a lump sum or dollar-cost average?

For most investors, dollar-cost averaging is the safer strategy. It spreads your entry price, reduces the risk of buying at a peak, and builds disciplined investing habits regardless of short-term volatility.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

How to Fill Out a CVS Money Order A 2026 Guide

SoFi Checking and Savings A Deep Dive Review

How Safe Is Your Money With Ally Bank in 2026?

The Easiest Way to Find the Code for Calling France

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.