Sending Remittances from the US to a GCash Account

Image Source: unsplash

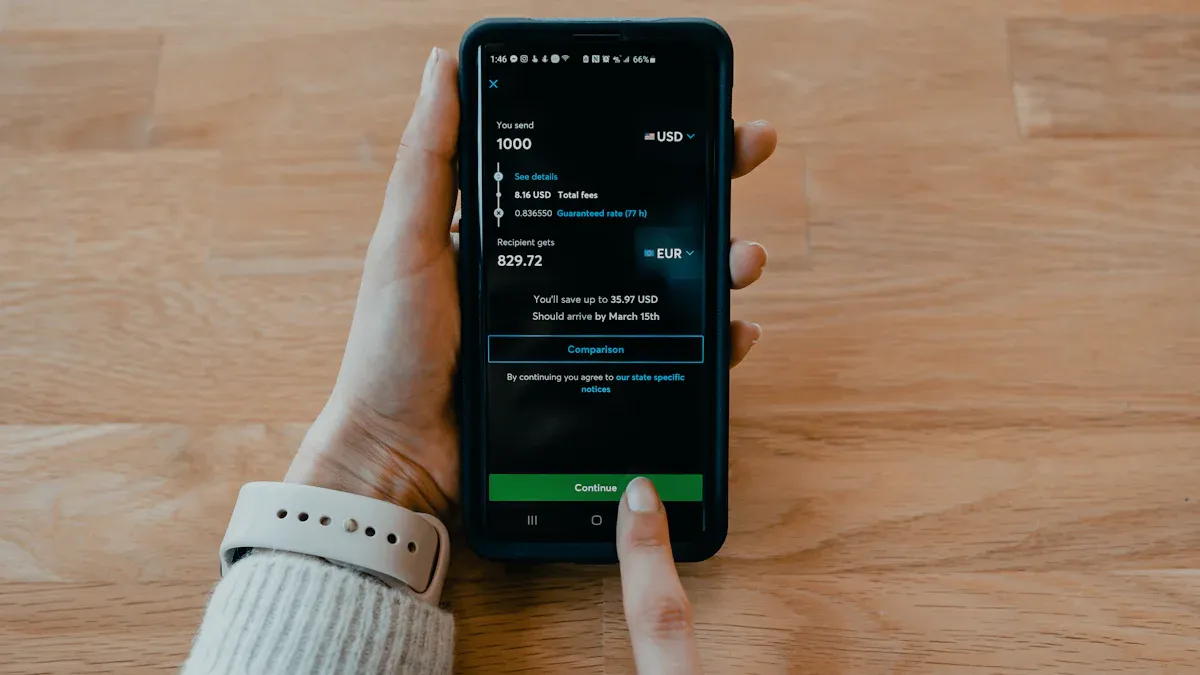

You can directly send remittances to a GCash account through various mainstream channels, such as Western Union, Remitly, PayPal, and more. You only need to prepare the recipient’s GCash mobile number and account details, select a suitable platform, enter the amount and reference information, and complete identity verification. GCash’s standard transaction fee is only 1%, significantly lower than the 3%-10% charged by traditional bank wire transfers. Bank transfers and international remittances are typically processed in real-time, while PayPal may take 24-48 hours. You can choose the most suitable method based on transfer speed and fees.

Key Points

- Choosing the right remittance platform can save on fees. GCash’s standard transaction fee is only 1%, much lower than the 3%-10% charged by traditional banks.

- Transfer speeds vary by platform. Most GCash partner channels can complete fund transfers within 10 minutes.

- Ensure accurate recipient information. Incorrect mobile numbers or account details may lead to transfer failures.

- Completing identity verification is a necessary step for remittances. You need to provide valid identification documents, such as a passport or driver’s license.

- Choosing a secure platform protects your funds and personal information. Use security measures like multi-factor authentication and SSL encryption.

Mainstream Remittance Methods

Image Source: unsplash

US users can choose from various mainstream channels to send funds to a GCash account. You can compare fees, transfer speed, and security to select the most suitable method based on your needs. Below are some common remittance channels and their features:

Western Union

Western Union has an extensive service network in the US market. You can send remittances through their online platform, mobile app, or by visiting an agent location. The process is as follows:

- Decide how to transfer: Choose online, agent location, or mobile app.

- Determine the amount to send, noting exchange rate fluctuations.

- Enter the recipient’s GCash account details, including name, account number, address, and mobile number.

- Select a payment method: cash, credit card, debit card, bank account, or mobile wallet.

- Confirm and track the transfer, obtaining a Money Transfer Control Number (MTCN) to check the status.

Western Union’s transaction limit is up to USD 5,000 per transfer, with recipients able to receive up to PHP 100,000 monthly. Most transfers are processed in real-time, though security reviews may cause delays. Fees vary by service type, and recipients typically do not incur additional charges. Refer to the table below to compare Western Union’s fees and transfer speeds with other platforms:

| Service | Fees | Exchange Rate | Delivery Speed |

|---|---|---|---|

| Remitly | Variable - No fees for GCash transfers | Exchange rate includes markup | Varies by express or economy transfer |

| Western Union | Variable fees based on selected service | Exchange rate includes variable markup | Varies by selected service |

| MoneyGram | Variable fees based on selected service | Exchange rate includes variable markup | Varies by selected service |

Remitly

Remitly is popular among US users for its low fees and competitive exchange rates. You can complete remittances via the Remitly website or app with the following process:

- Create or log in to a Remitly account.

- Enter the currency (PHP), amount, and delivery speed.

- Select GCash as the receiving method.

- Enter the recipient’s name and GCash details.

- Review and confirm the transfer.

Remitly supports multiple payment methods, ideal for users seeking fast transfers or cost savings. You can enjoy lower transaction fees compared to traditional banks. Remitly offers different speed options based on transfer type. For commercial purposes, additional documents like business registration, import/export licenses, or tax compliance certificates may be required.

Remitly’s exchange rates and fees are generally better than traditional banks, while Wise is known for the lowest fees and best rates. Western Union offers a wide network and fast service but may have fluctuating exchange rates.

XRemit

XRemit focuses on secure and real-time remittances. You can send funds directly to a GCash account through its platform. XRemit employs multiple security protocols, including encryption, real-time fraud monitoring, regular security updates, and partnerships with reputable financial institutions. Recipient accounts also support two-factor authentication and biometric verification to ensure fund security. You can trust XRemit to protect your funds and personal information.

| Security Protocol Type | Description |

|---|---|

| Encryption | Personal and transaction data are encrypted to prevent unauthorized access. |

| Real-Time Fraud Monitoring | Real-time monitoring systems detect suspicious activity and may temporarily freeze accounts to protect funds. |

| Regular Security Updates | Regular updates to security protocols and software reduce cyberattack risks, ensuring platform safety. |

| Partner Financial Institutions | Collaboration with reputable banks and institutions adds an extra layer of security for cross-border transfers. |

| Two-Factor Authentication | Recipient accounts feature two-factor authentication, biometric verification, and secure account recovery for enhanced security. |

Skrill

Skrill offers convenient international remittance services for US users. You can transfer USD directly to GCash via a Skrill account. Skrill is ideal for users needing fast transfers and online operations. You simply link a GCash account, enter recipient details and amount, and complete identity verification. Skrill supports multiple payment methods, offers fast transfer speeds, and has variable fees based on amount and transfer method. The platform prioritizes user privacy and transaction security, making it suitable for frequent small remittances.

Xoom

Xoom, a PayPal-owned international remittance platform, supports US users sending funds to GCash accounts. You need a fully verified GCash account, and transfer amounts must not exceed account limits. The process is as follows:

- Log in to GCash and select “Cash In.”

- Choose “Global Partners and Remittance.”

- Navigate to “Online Remittance Claim” and select Xoom.

- Enter the required information and click “Next.”

- Funds are credited to the GCash account in real-time.

Xoom’s exchange rate is 1 USD = 57.4829 PHP, with transfers typically completed in minutes. The platform does not directly charge high fees and occasionally offers promotional discounts. You can receive funds via GCash, PayMaya, or other platforms, ideal for users needing fast transfers.

| Item | Details |

|---|---|

| Exchange Rate | 1 USD = 57.4829 PHP |

| Transaction Fees | Not directly specified, but promotional discounts may apply |

| Transfer Time | Typically completed within minutes |

| Available Platforms | GCash, PayMaya, Coins, GrabPay, U-mobile |

Alipay

You can send funds to a GCash account via AlipayHK. You need a verified AlipayHK account and can switch to the English interface. The process is as follows:

- Open the AlipayHK app and select “Remittance.”

- Click “New Remittance” and choose the Philippines as the destination.

- Select GCash e-wallet as the remittance method; the system will display the HKD to PHP exchange rate.

- Enter the amount, recipient’s GCash ID, and name, then click “Next.”

- Review payment details and click “Pay Now.”

- Funds arrive in real-time, with Alipay sending a confirmation and the recipient receiving a notification.

Alipay Plus has a vast network of over 1.7 billion consumers, supporting multiple e-wallets and banking apps. The unified platform simplifies cross-border transactions, enabling merchants and individuals to send remittances easily without multiple integrations. You can enjoy an efficient and convenient service experience.

| Advantage | Description |

|---|---|

| Extensive Network | Alipay Plus has a vast network of over 1.7 billion consumers, supporting multiple e-wallets and banking apps. |

| Unified Platform | The unified platform simplifies cross-border transactions, allowing merchants to accept payments from various regions without multiple integrations. |

Tip: When choosing a remittance channel, prioritize mainstream platforms like Western Union, Remitly, or MoneyGram. These platforms have a high market share in the US, extensive service networks, and guaranteed security and transfer speeds. Compare fees and exchange rates based on your needs to select the most suitable remittance method.

Remittance Process

Account Linking

Before sending a remittance, you need to complete account linking. The process varies slightly by platform but follows similar steps. You can choose online remittance services like Remitly, PayPal, or TransferWise, linking your bank account or credit card to the platform. Alternatively, use international remittance operators like Western Union to send funds directly to the recipient’s GCash wallet. For bank transfers, ensure your bank account is successfully linked to the GCash account.

Common errors during account linking include:

- Entering incorrect bank information. Verify username, account number, and password carefully.

- Abnormal bank account status. Confirm your bank account is active and unrestricted.

- Network issues. Try switching networks, such as from mobile data to WiFi.

- Bank maintenance. Contact your bank to check for maintenance or system upgrades.

- Unverified GCash account. Ensure the GCash account has completed the full verification process.

When linking accounts, prioritize licensed Hong Kong or US local banks to enhance remittance security and success rates.

Information Entry

After linking accounts, you need to enter remittance-related information. Prepare the recipient’s GCash mobile number and account details, the most critical information for the process. You also need to provide the recipient’s name, transfer amount (in USD), and receiving method.

The typical information entry process is:

- Enter the recipient’s GCash mobile number and account details.

- Provide the recipient’s name, ensuring it matches the GCash account.

- Select the transfer amount and currency, typically USD.

- Choose the receiving method, such as GCash wallet or another e-wallet.

- Review all information and submit.

Tip: Double-check the recipient’s mobile number and account details multiple times to avoid transfer failures due to incorrect information.

Identity Verification

When sending a remittance, the platform will require identity verification. GCash only allows fully verified users to send international remittances. You need to provide valid identification documents, such as a passport, US driver’s license, or Hong Kong ID. The platform will review your identity through the KYC (Know Your Customer) process.

The identity verification process typically includes:

- Uploading identification documents, such as a passport or driver’s license.

- Providing basic personal information, including name, date of birth, and address.

- Waiting for platform review, after which you can proceed with the remittance.

Once identity verification is complete, you can freely use GCash for international remittances. Verification ensures account security and complies with international financial regulations.

Fees and Exchange Rates

Image Source: unsplash

Platform Fees

When choosing a remittance platform, the fee structure is a key consideration. Different platforms charge varying fees based on transfer speed and service type. Refer to the table below for common transfer options’ fees and processing times:

| Transfer Option | Fees (USD) | Processing Time |

|---|---|---|

| Economy | Lower | Longer |

| Express | Higher | Faster |

When using Remitly, you’ll typically find lower fees than traditional banks. Remitly provides a transparent pricing structure, allowing you to know the exact cost before transferring. You can choose economy mode to save on fees or express mode for faster delivery to the GCash account. Real-time transfers ensure funds arrive quickly.

Tip: Compare fees and transfer speeds before choosing a platform to avoid high transaction fees impacting your remittance amount.

Exchange Rate Details

When sending a remittance, the exchange rate directly affects the final amount received. Exchange rates vary significantly by platform, with GCash typically offering competitive rates. Refer to the table below to compare exchange rates across mainstream platforms:

| Platform | Exchange Rate Comparison | Notes |

|---|---|---|

| GCash | Competitive rates | Generally more favorable than traditional banks |

| Traditional Banks | Possible hidden fees | Compare rates and fees |

| Wise | Transparent fees | May have higher overall costs |

When using licensed Hong Kong or US local banks, you may encounter exchange rate markups and hidden fees. GCash and Wise are known for transparent fees and published rates. Prioritize platforms with transparent exchange rates to maximize your remittance value.

Tip: Before sending a remittance, check real-time exchange rates to choose the best option and avoid losses due to rate fluctuations.

Transfer Speed and Restrictions

Transfer Time

When sending remittances from the US to a GCash account, transfer speed is a key concern. Most GCash partner channels can complete fund transfers within 10 minutes. In special cases, such as incorrect information or system maintenance, platforms will resolve non-delivery issues within two business days. Refer to the table below for average transfer times across channels:

| Sending Channel | Average Transfer Time |

|---|---|

| GCash Partner Channels | Within 10 minutes |

| Non-Delivery Processing Time | 2 business days |

When choosing a fast channel, funds typically arrive within minutes. If delays occur, contact platform customer service to resolve issues promptly.

Amount and Age Restrictions

When sending remittances, pay attention to amount and age regulations. Platforms impose minimum and maximum transfer limits. GCash accounts also have age requirements for registration. Key restrictions include:

- The minimum age to register a GCash account is 18.

- Minors aged 6 to under 18 require parental or legal guardian consent.

- Children aged 6 and below are not allowed to register or use GCash services.

Before sending a remittance, confirm the recipient’s age meets requirements. Check the platform’s minimum and maximum transfer amounts (in USD) to avoid transaction failures due to exceeding limits.

Holiday/Weekend Availability

When sending remittances from the US to a GCash account, holiday and weekend availability is important. Most mainstream platforms support 24/7 automated processing systems. Remittances initiated on holidays or weekends via GCash partner channels typically achieve fast delivery. Bank channels may experience delays due to bank closures. Prioritize platforms supporting real-time transfers to ensure funds reach the recipient’s account promptly.

Tip: For holiday or weekend remittances, check platform service hours in advance and choose automated processing channels to avoid delays.

Handling Failures and Security

Failure Reasons

When sending remittances from the US to a GCash account, you may encounter transaction failures. Common reasons include:

- Incorrect account information. Errors in the recipient’s mobile number or account identifier are common. Double-check all information before submission.

- Technical glitches or system errors. Electronic payment systems may face server issues. Wait for system recovery and retry.

- Fraudulent transactions or scams. Fraudsters may forge transaction records. Avoid non-official platforms and use authorized channels.

- Compliance freezes or verification requirements. Platforms may temporarily freeze transactions due to suspicious activity. Cooperate with identity verification to ensure smooth transactions.

- Administrative or regulatory delays. External regulators may impose restrictions on certain transactions. Stay updated via platform announcements.

If a remittance fails, check account information and platform status first, then contact customer support for assistance.

Customer Support

When facing issues, you can seek help through the following channels. Average response times are:

| Customer Support Channel | Average Response Time |

|---|---|

| Official Social Media Accounts | 24 hours |

| 24 hours |

You can reach out via official social media or email. Platforms typically respond within a day. When describing issues, provide details like transaction time, amount (USD), and recipient GCash account to help customer service resolve issues quickly.

Security Tips

Protecting funds and personal information during remittances is critical. The following security measures can reduce risks:

| Security Measure | Description |

|---|---|

| SSL Encryption | Protects personal and financial information from hackers and cyberattacks. |

| Multi-Factor Authentication | Enhances account security, ensuring only authorized users can access it. |

| Biometric Verification | Uses facial recognition or other methods to verify identity, preventing unauthorized access. |

| One Device, One Account Policy | Only registered devices can access the account, reducing hacking risks. |

| Prevent Jailbroken or Modified Devices | GCash apps cannot be accessed on jailbroken or modified devices, protecting information security. |

| Refund Guarantee | Unauthorized transactions can be refunded within 15 days, offering extra protection. |

When using GCash, consider:

- Logging into the GCash app with non-jailbroken or unmodified devices.

- Regularly updating device security software to counter malicious attacks.

- Ensuring device security settings remain unchanged to prevent information leaks.

Before sending remittances, choose official platforms, enable multi-factor authentication, and regularly check account security settings to effectively protect your funds and personal information.

When selecting a remittance platform, consider:

- Fees: Costs vary significantly; compare to choose the most cost-effective USD transfer method.

- Speed: For fast transfers, prioritize platforms supporting real-time transfers.

- Security: Choose providers with 24/7 customer support, transparent fees, and real-time tracking for fund safety.

Select a suitable channel based on your needs, complete identity verification, and ensure account security. Contact platform customer service promptly if issues arise.

FAQ

How long does it take for a remittance to reach a GCash account?

You can typically receive USD remittances within minutes. If system maintenance or errors occur, platforms will resolve non-delivery issues within two business days.

What are the remittance fees?

Fees vary by service type when using mainstream platforms. Generally, GCash’s standard fee is 1% (in USD), much lower than traditional banks.

How are exchange rates calculated?

When sending a remittance, platforms convert based on real-time USD to PHP exchange rates. Check the latest rates before transferring to choose the best option.

What identity verification documents are needed for remittances?

You need valid identification, such as a passport or US driver’s license. Platforms require KYC processes to ensure account security and compliance.

Can I send remittances on holidays or weekends?

You can use automated processing systems for remittances on holidays or weekends. Most mainstream platforms offer 24/7 services, with funds typically arriving in real-time.

Upon reviewing the options for sending remittances from the US to GCash accounts, you may have encountered frustrations with conventional providers: exorbitant fees (such as 3%-10% from banks), inconsistent arrival times (up to 48 hours), limited compatibility across borders, and recurring security checks that cause unnecessary delays. These hurdles often make cross-border money transfers cumbersome and costly, disrupting your financial planning and support for loved ones. The good news is, a smarter solution exists to streamline everything. BiyaPay, a premier global finance platform, is engineered for remittance users like you, offering an all-in-one gateway for swift transfers from the US to Philippine GCash wallets.

BiyaPay stands out with its standout features: access real-time exchange rate queries to instantly check and secure the optimal USD-to-PHP rates, dodging market volatility; remittance fees as low as 0.5%, with zero fees on contract orders, slashing your expenses; effortless swaps between fiat currencies and digital assets for versatile portfolio handling; a registration that takes just minutes to activate services spanning most countries worldwide, including the Philippines, with same-day send and receive for prompt GCash crediting. Plus, it uniquely enables US and Hong Kong stock participation on one integrated platform, eliminating the need for separate overseas accounts and merging remittances with investing seamlessly.

Adhering to rigorous international financial regulations, BiyaPay employs state-of-the-art encryption and live monitoring to ensure transaction integrity. Whether for routine family support or business flows, it boosts your efficiency while cutting costs.

Act now! Head to BiyaPay to sign up and launch your streamlined cross-border journey. Join a worldwide community, ditch the steep charges and lags, and relish hassle-free GCash remittances. Your financial empowerment begins today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Zelle Wire Transfer or ACH? Clearing Up the Confusion

How Safe Is Your Money With Ally Bank in 2026?

What Are the Daily Limits for Chase Accounts?

What is the Dialing Code for the USA and How to Call?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.