Using Overseas Credit Cards for Payment on JD: How to Bind and Fees

Image Source: pexels

You can use an overseas credit card to complete payments on JD. The checkout interface allows you to select “International Card Payment”, and you can bind it by entering your credit card information. JD Global supports various international credit cards, including Visa, MasterCard, JCB, China UnionPay, and American Express. You don’t need to worry about JD charging transaction fees, but the issuing bank may charge a transaction fee or foreign exchange fee of 1.95%-3%. It’s recommended to confirm your bank’s card policy before making a payment and choose the most suitable card type and payment method.

Key Points

- JD supports multiple overseas credit card payments, including Visa, MasterCard, JCB, and American Express, with a simple binding process suitable for first-time users.

- Orders of 28 USD or less are exempt from transaction fees, while a 3% fee applies to amounts exceeding this; it’s advisable to confirm the fee policies of your credit card and bank in advance.

- During binding, you must provide authentic and valid identity information, ensure the credit card has enabled online payment permissions in China, and avoid payment failures.

- Overseas credit card payments have single transaction and monthly limits, and some products are not supported; check JD and bank announcements before paying.

- For security, it’s recommended to set reasonable spending limits, protect passwords and verification codes, use a secure payment environment, and avoid information leaks.

Supported Card Types

Visa, MasterCard, JCB, etc.

When using an overseas credit card on JD, you can choose from multiple international credit card brands. The main supported card types include:

- China UnionPay cards

- Visa credit cards issued in China

- MasterCard credit cards issued in China

- American Express credit cards

- Some Visa, MasterCard, and JCB credit cards issued overseas

If you hold a Visa or MasterCard issued by a Hong Kong bank, you can also try binding it. Bank policies in different countries and regions may affect payment outcomes. It’s recommended to confirm with your issuing bank whether the card supports online shopping in China before making a payment.

Tip: Before binding, it’s best to consult your issuing bank to confirm that your credit card has online payment permissions in China. This can help avoid payment failures.

Applicable Scenarios and Restrictions

You can use an overseas credit card to complete payments when shopping on JD. Applicable scenarios mainly include:

- When shopping on platforms like JD Global or JD Self-operated, you can directly settle with an international credit card.

- WeChat Pay also supports binding Visa, MasterCard, JCB, and other international credit cards, which can be used at JD and some other merchants.

- You can complete payments through methods such as scanning codes or in-app payments.

However, you need to be aware of the following restrictions:

- Single transaction limit is approximately 850 USD (calculated at 1 USD = 7.1 CNY, 6000 CNY is approximately 850 USD).

- Monthly cumulative payment limit is approximately 7050 USD (50,000 CNY).

- Annual cumulative payment limit is approximately 8470 USD (60,000 CNY).

- Transactions of 200 CNY (approximately 28 USD) or less are exempt from transaction fees, while transactions exceeding 200 CNY incur a 3% fee.

- International credit cards cannot be used for non-shopping transactions such as red envelopes or transfers.

During actual operations, be sure to check the latest announcements from JD and payment platforms. Policies of different banks and credit card organizations may change at any time.

JD Overseas Credit Card Binding Process

Image Source: pexels

Checkout Interface Operations

When settling your shopping on JD, you can select “International Card Payment” to complete the binding of an overseas credit card. The process is very intuitive. First, you need to add items to your cart and proceed to the checkout page. At the checkout interface, you will see various payment methods. At this point, you can select the “International Card Payment” option. This option is usually located below the bank card payment section and applies to Visa, MasterCard, JCB, and other international credit cards.

After selecting “International Card Payment,” the system will display a credit card binding interface. You need to prepare your credit card information. For Visa or MasterCard credit cards issued by Hong Kong banks, JD also supports binding. You simply need to follow the on-screen prompts to complete the process. The entire process does not involve complicated steps and is suitable for users new to using overseas credit cards on JD.

Friendly Reminder: During the initial binding period, JD sometimes offers promotions such as transaction fee waivers. You can check JD’s announcements or event pages for the latest promotional information. This can save you around 3% in transaction fees, especially for orders exceeding 200 CNY (approximately 28 USD, calculated at 1 USD = 7.1 CNY), where the savings are more significant.

Information Filling Requirements

When binding an overseas credit card on JD, you need to provide a series of identity verification information. This information is used to verify your identity and establish a payment agreement. The specific steps are as follows:

1. Enter your bank card number. Ensure the card number is entered correctly to avoid payment failures. 2. Provide your phone number. It’s recommended to use the phone number registered with your bank to receive verification codes smoothly. 3. Read and agree to the “JD Payment Service Agreement.” You need to accept the terms to proceed. 4. Click the “Agree and Bind” button, and the system will display a window for entering the SMS verification code. 5. Enter the SMS verification code you receive to complete identity verification.

You also need to provide your name and ID number. JD will verify your identity based on this information to ensure account security. For credit cards issued by Hong Kong banks, some banks may require additional verification steps. You can contact your issuing bank in advance to confirm the required documents.

Note: When filling in information, ensure all details are accurate and valid. Inaccurate information may lead to binding or payment failures. It’s recommended to prepare all relevant documents and bank card information before binding.

If you encounter a transaction fee waiver promotion during the initial binding period, the system will automatically waive the relevant fees. You can check the actual deducted amount on the payment result page. This way, you can clearly understand the breakdown of each fee and plan your spending accordingly.

Fee Explanation

Image Source: pexels

JD Platform Fee Policy

When using an overseas credit card for payment on JD, the platform itself does not directly charge transaction fees. The actual transaction fees are mainly charged by third-party payment platforms (such as WeChat Pay). You can refer to the following policies:

- JD’s overseas credit card payments are mainly processed through WeChat Pay.

- WeChat Pay waives transaction fees for single transactions of 200 CNY (approximately 28 USD, calculated at 1 USD = 7.1 CNY) or less.

- For transactions exceeding 200 CNY (approximately 28 USD), WeChat Pay charges a 3% transaction fee.

- JD itself does not directly charge transaction fees; fees are primarily collected by third-party payment platforms like WeChat Pay.

- Some imported products cannot be paid for with overseas credit cards and require Chinese bank cards.

- Merchants face higher fees for overseas card payments (approximately 2.5%-3%), which affects support for overseas cards on some products.

Before making a payment, you can check the latest announcements from JD and WeChat Pay to stay informed about changes in fee policies.

Issuing Bank and Credit Card Organization Fees

In addition to fees charged by third-party payment platforms, you should also be aware of potential fees from the issuing bank and credit card organization. Visa, MasterCard, JCB, and other international credit cards issued by Hong Kong banks typically charge a cross-border transaction fee or foreign exchange fee of 1.95%-3% based on the transaction amount and currency. When using an overseas credit card on JD, the actual deducted amount may be slightly higher than the order amount. It’s recommended to consult your Hong Kong bank before making a payment to confirm the specific fee standards.

Tip: You can check the transaction fee details in your credit card statement. Fee standards may vary depending on the bank and credit card organization, and the actual fees are subject to the bank’s announcements.

Order Amount and Fee Examples

When using an overseas credit card on JD, the order amount directly affects the transaction fees. According to official statements from Alipay and WeChat Pay, transactions of 200 CNY (approximately 28 USD) or less are exempt from transaction fees. For amounts exceeding 200 CNY, a 3% transaction fee is charged. For example:

- An order of 200 CNY (approximately 28 USD) incurs a transaction fee of 0 USD.

- An order of 500 CNY (approximately 70 USD) incurs a 3% fee on 500 CNY, which is 15 CNY (approximately 2.1 USD).

- An order of 1000 CNY (approximately 140 USD) incurs a 3% fee on 1000 CNY, which is 30 CNY (approximately 4.2 USD).

You can refer to the table below to understand the fees for different order amounts:

| Order Amount (CNY) | Order Amount (USD, 1 USD = 7.1 CNY) | Fee Rate | Fee Amount (CNY) | Fee Amount (USD) |

|---|---|---|---|---|

| 200 | 28 | 0% | 0 | 0 |

| 500 | 70 | 3% | 15 | 2.1 |

| 1000 | 140 | 3% | 30 | 4.2 |

If you choose installment payments, the fee calculation becomes more complex. Although JD’s overseas credit card payments currently do not explicitly support installments, you can refer to the bank’s installment fee calculation rules. The table below shows information related to installment payments:

| Item | Description |

|---|---|

| Installment Support | Installment payments for JD overseas credit card payments are not explicitly supported; terms mainly apply to Tianjin Bank JD co-branded credit card bill installments |

| Installment Periods | 3, 6, 9, 12, 18, 24, 36 periods |

| Fee Calculation Method | Per-period fee = Total installment principal × Per-period fee rate; installment fees are charged per period and are non-refunded |

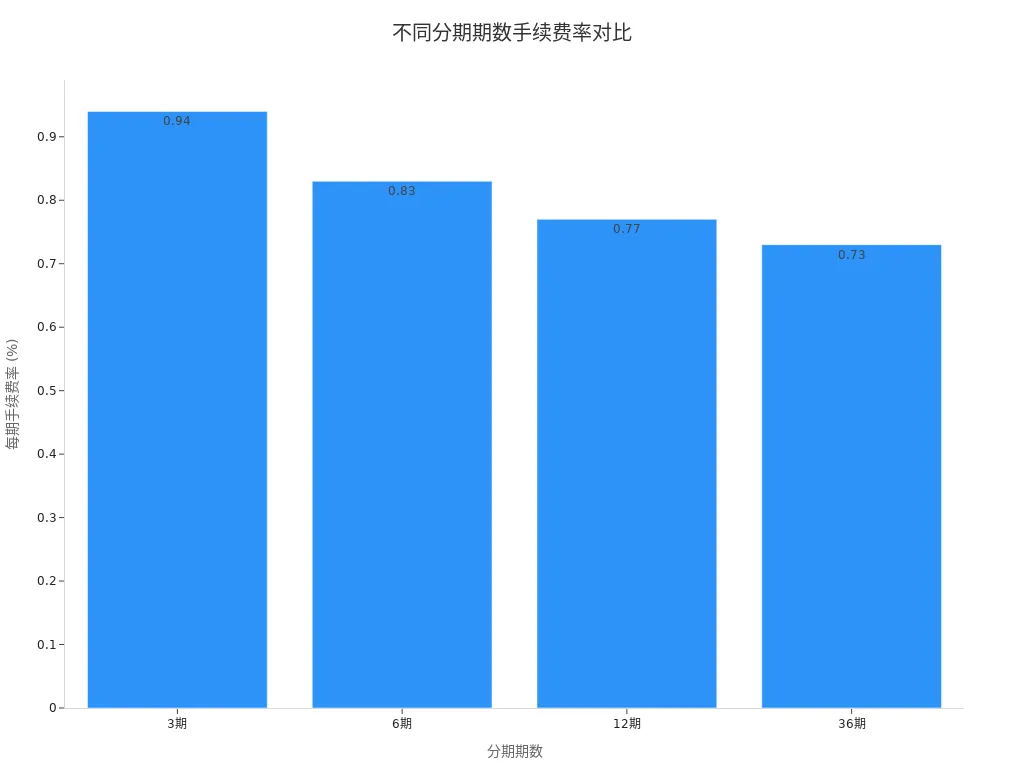

| Per-Period Fee Rate Example | Approximately 0.94% for 3 periods, 0.83% for 6 periods, 0.77% for 12 periods, 0.73% for 36 periods |

| Annualized Interest Rate Range | Approximately 15.84% to 16.88%, varying slightly based on installment periods and cardholder conditions |

| Other Restrictions | Installment total cannot exceed credit limit; temporary credit limits cannot be used for installments; some transaction types are ineligible for installments |

| Repayment Impact | Installment principal and fees are included in the minimum repayment amount; failure to repay on time incurs interest and penalties |

You can visually understand the fee rates for different installment periods through the chart below:

- ICBC credit card installment payments include consumption-to-installment, bill installment, merchant installment, customized installment, cash installment, and e-installment types.

- Installment payment interest rates are calculated based on the monthly internal rate of return, with annualized rates converted using simple interest.

- Early repayment incurs a penalty, up to 3% of the early repayment principal.

- Credit card overpayments and temporary credit limits cannot be used for installment payments.

- Specific fee and interest rate standards can be checked through the bank’s self-service channels.

During actual operations, be sure to check the latest announcements from JD and payment platforms. Fee standards may change due to policy adjustments. You can choose the optimal payment method based on your needs to avoid unnecessary expenses.

Common Issues and Precautions

Binding Failures and Payment Issues

When binding an overseas credit card, you may encounter failures or unsuccessful payments. Common reasons include:

- The bank card has not enabled online banking payment functions; it’s recommended to contact your Hong Kong bank to confirm international payment permissions.

- The bank card exceeds the supported regional scope; some Hong Kong bank credit cards are limited to specific regions.

- The bank card is expired, reported lost, or canceled, requiring timely replacement.

- Insufficient account balance, with payment amounts exceeding the credit card limit.

- Abnormal bank system data transmission; try again later.

- Quick payment issues, such as expired or replaced bank cards not being re-bound.

- Payment amounts exceeding limits, such as single transactions over approximately 28 USD (200 CNY, calculated at 1 USD = 7.1 CNY), which may be rejected.

- High system load during peak promotional periods, leading to payment failures.

- Restrictions on applying for JD co-branded credit cards in different regions; verify the application region.

If a payment is unsuccessful, you can troubleshoot as follows:

- Check if the account has sufficient credit limit to ensure it is not exceeded.

- Verify if the account has overdue payments or poor credit records.

- Ensure the account is not locked by the system’s risk control, avoiding frequent device changes or logins from different locations.

- Check the network connection and payment platform status to ensure a normal payment environment.

- Confirm that the bound payment tool has not expired.

- Check if the system is under maintenance or upgrade, which may temporarily prevent payments.

- If JD White Bar is locked, contact JD Finance customer service to unlock it.

- If the above methods fail, contact JD’s official customer service for assistance.

Cost Avoidance and Security Tips

You can reduce unnecessary costs through the following methods:

- Use JD Global’s proxy payment function; proxy payments do not incur transaction fees, and you only pay the product price.

- Proxy payments are suitable for cases with insufficient credit limits or restricted accounts, effectively avoiding extra fees from overseas credit card payments.

- Choose reliable proxy payers, verify proxy payment information, operate cautiously, and understand relevant policies to avoid losses.

To ensure payment security, you can follow these tips:

- Set a daily spending limit, recommended at around 700 USD (5000 CNY) for regular card users.

- Manage passwords hierarchically; JD login passwords, payment passwords, and bank card passwords should be set independently.

- Keep SMS verification codes confidential and never disclose them to others.

- Regularly clear unfamiliar login devices to ensure device security.

- Enable WeChat real-time alerts for transactions of 500 CNY (approximately 70 USD) or more.

- Temporarily lower payment limits during major promotions and restore them afterward.

- Stay vigilant against new scam tactics and build anti-fraud awareness.

- Ensure the credit card has enabled international payment functions and sufficient credit limit, contacting the Hong Kong bank to activate if necessary.

- Ensure a secure payment environment with URLs starting with https and displaying a lock icon.

- Protect the CVV code from being leaked and regularly update firewalls and antivirus software.

When using a Visa card for payment, ensure the payment environment is secure, verify payment information accuracy, and promptly update firewalls and antivirus software on your phone and computer to prevent data leaks. JD’s payment system ensures your funds’ safety through PCI DSS international certification and an intelligent risk control system.

Comparison of Alternative Payment Methods

WeChat Pay, Octopus, etc.

When shopping on JD, you can choose various alternative payment methods. In addition to overseas credit cards, JD supports WeChat Pay, Octopus, JD Flash Pay, White Bar Flash Pay, and other diverse payment tools.

- WeChat Pay: You can bind Visa, MasterCard, JCB, and other international credit cards, suitable for daily small-amount consumption. WeChat Pay is widely accepted by Chinese merchants, applicable in many online and offline scenarios.

- Octopus: If you hold a Hong Kong Octopus card, you can use it at some JD partner merchants, convenient for Hong Kong users shopping cross-border.

- JD Flash Pay: You can use UnionPay’s “Cloud Flash Pay” NFC technology to complete payments at JD’s online store and offline merchants by tapping your phone on a POS machine.

- White Bar Flash Pay: You can bind Apple Pay, Xiaomi Pay, Huawei Pay, etc., to enable UnionPay Flash Pay POS payments, enjoying a credit payment experience.

- Other Methods: You can also choose bank card payments, White Bar payments, Small Treasury payments, face-scanning payments, etc., to meet different scenario needs.

Tip: JD’s cross-border payment platform provides a one-stop payment solution for scenarios like international trade, study abroad payments, and tourism services, enhancing payment convenience and security.

Fees, Advantages, and Disadvantages

When choosing a payment method, you need to consider fees and user experience. The table below compares the advantages, disadvantages, and fee details of several common payment methods (using 1 USD = 7.1 CNY as an example):

| Payment Method | Advantages | Disadvantages and Restrictions | Fee Details |

|---|---|---|---|

| JD Overseas Credit Card | Suitable for large purchases, rich reward points, supports installments, high security. | 3% fee for transactions over 28 USD (200 CNY), some products not supported. | Free for 28 USD or less, 3% for amounts exceeding. |

| WeChat Pay | Convenient, suitable for small and daily purchases, widely accepted, free withdrawals under 1000 USD. | Limited withdrawal amounts, some small merchants pose security risks. | Free for 28 USD or less, 3% for amounts exceeding. |

| Octopus | Convenient for Hong Kong users, good cross-border shopping experience. | Limited to select partner merchants, complex recharge and refund processes. | Fees subject to Octopus announcements. |

| JD Flash Pay | Supports UnionPay Cloud Flash Pay POS, secure and formal, offers discounts and rebates. | Requires activation in JD App, some users need to adapt to new processes. | Subject to UnionPay and JD announcements, some promotions offer fee waivers. |

If you prioritize reward points and installments, overseas credit cards are preferable. For convenience and daily consumption, WeChat Pay and JD Flash Pay are more suitable. Octopus offers cross-border payment convenience for Hong Kong users. Before actual operations, it’s recommended to thoroughly understand the fee policies and applicable scope of each payment method and choose the best option based on your needs.

When using an overseas credit card on JD, you can easily complete binding and payments. You need to stay informed about the latest announcements from the platform and Hong Kong banks to understand fee policies. You can choose the optimal payment method based on your shopping needs and order amounts (e.g., whether 28 USD is fee-free). Understanding related fees in advance can effectively avoid unnecessary expenses.

FAQ

Which overseas credit card brands does JD support?

You can use Visa, MasterCard, JCB, American Express, and other international credit cards on JD. You can also try binding credit cards issued by Hong Kong banks. Before making a payment, confirm that your credit card has enabled online payment functions in China.

How are fees calculated for overseas credit card payments?

When using an overseas credit card on JD, orders of 28 USD or less are exempt from transaction fees. For amounts exceeding 28 USD, third-party payment platforms typically charge a 3% fee. Hong Kong banks may also charge a 1.95%-3% cross-border transaction fee.

Why did my overseas credit card binding fail?

Binding failures may occur if the credit card has not enabled online payment permissions in China or has expired. Contact your Hong Kong bank to confirm the card’s status and ensure the entered information is accurate.

How can I avoid unnecessary fees?

You can keep orders below 28 USD or use JD Global’s proxy payment function. You can also take advantage of promotional activities from JD and Hong Kong banks, plan payments wisely, and reduce extra costs.

What should I do if I encounter payment issues?

If you face payment issues, first check your credit card limit and status. You can also contact JD customer service or your Hong Kong bank’s customer service for professional assistance. Ensure a secure network environment to prevent information leaks.

When using an overseas credit card on JD.com, high and opaque fees are a major pain point. While you can control your spending to avoid some costs, the 3% service fee and uncertain bank charges are unavoidable for large purchases. This not only increases your shopping expenses but also limits your choices in cross-border e-commerce.

To solve this problem, we recommend BiyaPay, a financial platform designed for cross-border payments and fund management. BiyaPay’s key advantage is its low transfer fees, as low as 0.5%, which is significantly lower than traditional banks and third-party payment platforms. Additionally, BiyaPay offers real-time exchange rate lookup and seamless conversion between fiat and cryptocurrencies, giving you more flexibility for cross-border spending. Register now to experience a more efficient and transparent cross-border payment service and say goodbye to high fees.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Zelle Wire Transfer or ACH? Clearing Up the Confusion

What Are the Daily Limits for Chase Accounts?

SoFi Checking and Savings A Deep Dive Review

The 18 Best Apps to Earn Real Cash This Year

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.