International Remittance Fees Explained: Practical Tips for Choosing the Best Platform

Image Source: pexels

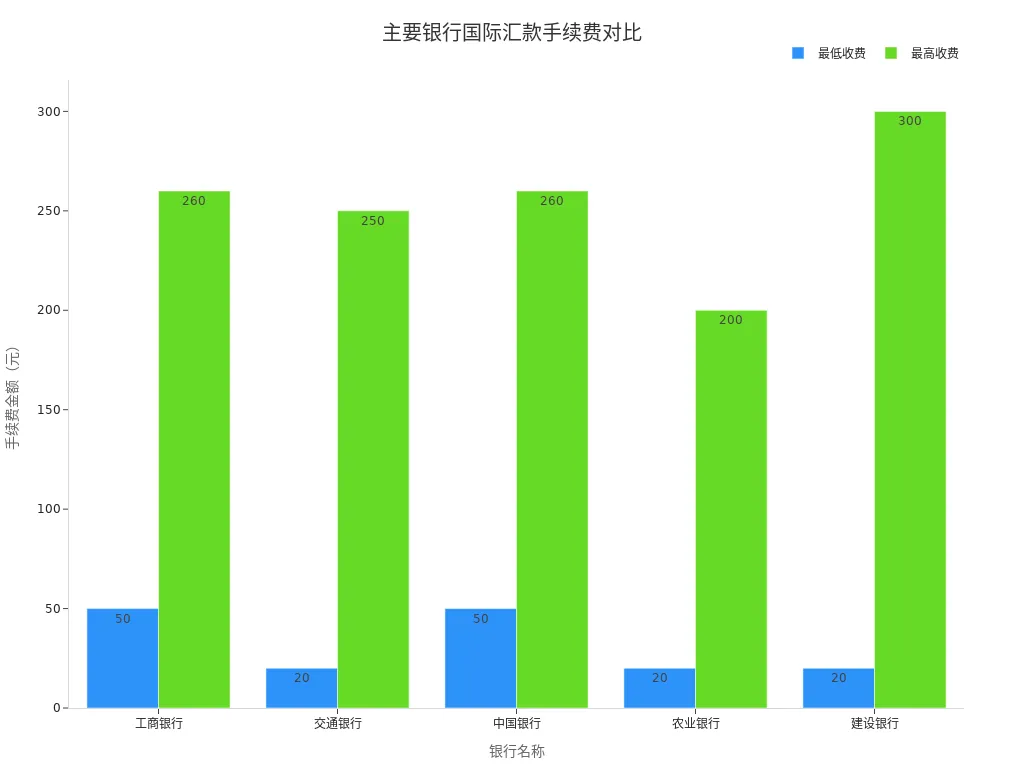

International remittance fees directly affect the actual amount received by the recipient. Different banks and platforms apply varying fee ratios, minimum, and maximum charge standards. For example, some Hong Kong banks typically charge a fee of 0.1% of the remittance amount, with minimum and maximum limits.

| Bank Name | Fee Ratio | Minimum Fee (USD) | Maximum Fee (USD) |

|---|---|---|---|

| ICBC | 0.10% | 7.1 | 37 |

| Bank of Communications | 0.10% | 2.8 | 35.7 |

| Bank of China | 0.10% | 7.1 | 37 |

| Agricultural Bank of China | 0.10% | 2.8 | 28.5 |

| China Construction Bank | 0.10% | 2.8 | 42.8 |

Some third-party platforms like Wise use transparent fees and market mid-rates, making the received amount more predictable. Users should focus on fees, exchange rate spreads, receipt speed, and hidden costs to avoid losses due to lack of transparency.

Core Points

- International remittance fees include not only fixed fees but also exchange rate spreads, telegraph fees, and intermediary bank fees; users need to understand these fully to avoid additional losses.

- When choosing a remittance platform, focus on comparing fees, exchange rate transparency, receipt speed, and service security to select the platform best suited to your needs.

- Avoid focusing solely on apparent fees while ignoring exchange rate spreads and hidden costs, and regularly assess fee changes to ensure the lowest remittance costs.

- Multi-currency accounts can reduce the frequency of currency conversions and fees, improving fund management efficiency, ideal for users with frequent cross-border payments.

- Rationally selecting remittance methods and staying informed about bank promotions can effectively reduce international remittance costs, improving receipt speed and security.

Platform Selection Criteria

Selection Standards

When choosing an international remittance platform, users should focus on the following core standards:

- Fees and Exchange Rate Spreads: Fees and exchange rate spreads directly determine the cost of international remittances. For example, Airwallex offers low fees and exchange rates close to the market mid-rate, effectively reducing transaction costs. Platforms like Payoneer and WorldFirst also vary significantly in exchange rate spreads and fee transparency, requiring careful comparison.

- Receipt Speed: Receipt speed affects fund flow efficiency. Third-party payment platforms typically offer faster receipt, reducing waiting times. For instance, Airwallex waives fees and provides fast receipt via local payment networks, but using SWIFT incurs fixed fees and longer receipt times.

- Service Transparency: Platforms with clear fee structures allow users to understand every expense. WorldFirst offers transparent fee structures with clear details, while some platforms like Payoneer have hidden fees, impacting user experience.

- Security and Customer Experience: Platforms need advanced security measures to ensure fund safety. High-quality customer service and global network coverage also enhance the overall experience.

Tip: Innovative technology, transparent fees, global network coverage, and good customer experience collectively determine a platform’s competitiveness. Users should choose platforms based on their business type, fund size, and risk preferences.

| Factor | Payoneer | WorldFirst |

|---|---|---|

| Exchange Rate Spread | Hidden fees, non-transparent spread | Lower cost, transparent structure |

| Receipt Speed | Generally fast | Slightly slower, supports rate locking |

| Fee Transparency | Hidden fees present | Transparent structure |

| User Experience | Fast response, robust ecosystem | Professional support, ideal for large amounts |

Common Pitfalls

Many users fall into the following pitfalls when choosing an international remittance platform:

- Focusing only on apparent fees, ignoring exchange rate spreads and intermediary bank fees. Some platforms advertise low fees but charge additional costs through rate spreads or intermediary fees, leading to higher-than-expected international remittance costs.

- Ignoring receipt speed. Slow receipt affects cash flow, particularly for business users.

- Overlooking service transparency. Some platforms, like Airwallex, have unlisted fees in Hong Kong (e.g., 0.3% deposit fee), impacting user trust.

- Not considering minimum fee thresholds and real-time exchange rate fluctuations. Some platforms have minimum fee standards, and rate fluctuations can cause received amounts to differ from expectations.

- Ignoring multi-currency account management and receipt notifications, leading to inconvenient fund management.

Recommendation: Users should regularly assess platform fee changes, focus on receipt speed and service transparency, and avoid increased costs due to overlooked details.

Types of International Remittance Fees

Image Source: unsplash

Remittance Fees

Remittance fees are among the most common costs for international remittances. Banks typically charge a percentage of the remittance amount. For example, some Hong Kong banks charge 0.1% with minimum and maximum limits. For ICBC, the minimum fee is $7.1, and the maximum is $37. Users should focus on fee ratios and limits when choosing banks to avoid uneconomical fees for very small or large amounts.

| Bank Name | Fee Ratio | Minimum Fee (USD) | Maximum Fee (USD) |

|---|---|---|---|

| ICBC | 0.10% | 7.1 | 37 |

| Bank of Communications | 0.10% | 2.8 | 35.7 |

| Bank of China | 0.10% | 7.1 | 37 |

Exchange Rate Spreads

Exchange rate spreads refer to the difference when banks or platforms use rates below the market mid-rate, with the spread becoming their profit. The actual exchange rate users receive is typically lower than the public rate. Platforms like Wise use the market mid-rate, reducing losses from spreads. When comparing international remittance fees, users should not focus only on apparent fees but also consider exchange rate spreads.

Telegraph Fees

Telegraph fees are charged when banks use international payment networks like SWIFT to send remittance instructions. Hong Kong banks typically charge $100 per transaction for individuals, while corporate clients may face up to $2,500. Some banks adjust telegraph fees based on service type and client status. Telegraph fees are fixed and unaffected by the remittance amount.

Intermediary Bank Fees

Intermediary bank fees are deducted directly from the remittance amount by overseas intermediary banks. These fees vary, typically ranging from a few dollars to over ten dollars. When users choose SHA or BEN fee-sharing modes, the received amount is reduced by intermediary fees. These fees are set by intermediary banks, and senders cannot know the exact amount in advance.

Currency Conversion Fees

Currency conversion fees are incurred when converting one currency to another. Banks typically charge 0.05% to 0.1% of the remittance amount, with minimum fees. For example, Japan’s ICBC charges a minimum of $15. Bank of China’s wire transfer fees range from a minimum of $7.1 to a maximum of $142. Currency conversion fees directly affect the actual received amount.

Tip: International remittance fee-sharing modes include SHA, BEN, and OUR. In OUR mode, the sender bears all fees, and the recipient receives the full amount. In BEN mode, the recipient bears all fees, reducing the received amount. In SHA mode, the sender covers domestic bank fees, and the recipient covers intermediary and receiving bank fees, also reducing the received amount. Users should choose the appropriate mode based on needs to ensure fund safety and maximize the received amount.

Platform and Bank Comparison

Image Source: unsplash

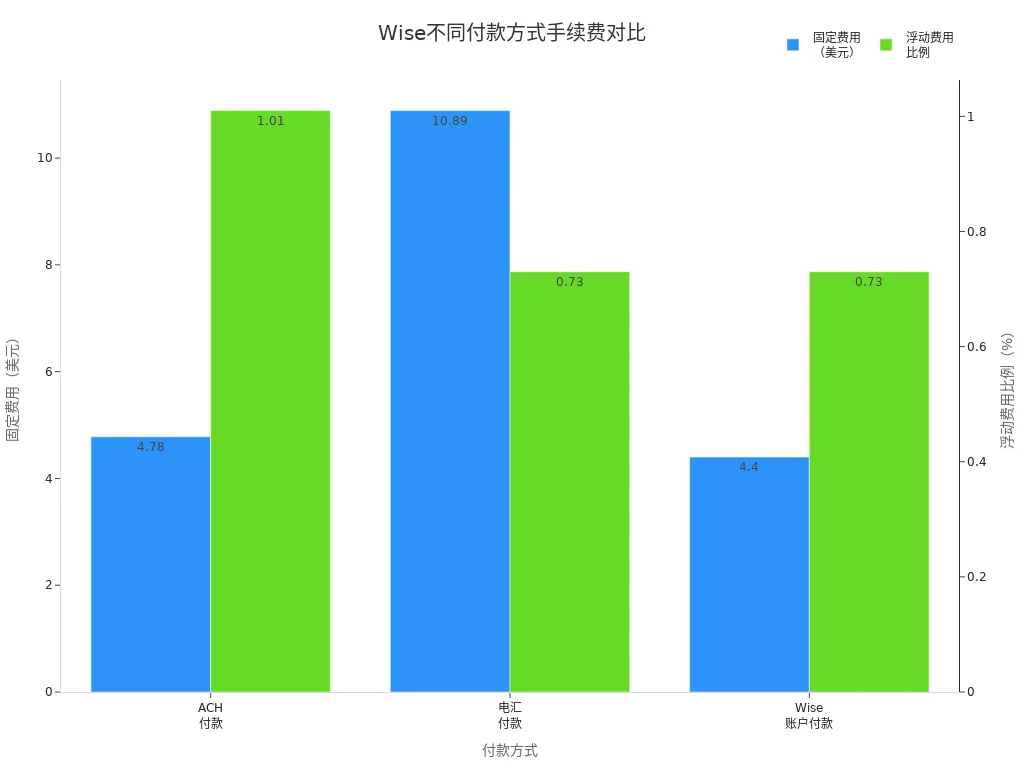

Wise Fees

Wise is known for transparency and low costs. When users remit via Wise, fees consist of fixed and variable components. For example, for remittances from the USA to China, ACH payments have a fixed fee of $4.78 and a variable fee of 1.01%; wire transfer payments have a fixed fee of $10.89 and a variable fee of 0.73%; Wise account payments have a fixed fee of $4.40 and a variable fee of 0.73%. Wise uses the market mid-rate with no hidden exchange rate spreads. Compared to Hong Kong banks’ typical 1-3% rate markups, Wise’s international remittance fees are lower, with a clear fee structure.

| Payment Method | Fixed Fee (USD) | Variable Fee Ratio |

|---|---|---|

| ACH Payment | 4.78 | 1.01% |

| Wire Transfer Payment | 10.89 | 0.73% |

| Wise Account Payment | 4.40 | 0.73% |

PayPal Fees

PayPal’s international remittance fees are relatively high. For example, withdrawing $10,000 incurs fees of $40-$42, with receipt times of 1-5 days. US clients paying via PayPal incur fees of about $12. PayPal’s exchange rates typically include a markup, reducing the actual received amount. PayPal is suitable for small, frequent cross-border transactions, but its fees and rate spreads are higher compared to other platforms.

| Platform/Case | Remittance Amount | Fee | Actual Received Amount | Receipt Time |

|---|---|---|---|---|

| PayPal Withdrawal | $10,000 | $40-42 | $9,958 | 1-5 days |

| US Client Payment via PayPal | $10,000 | ~$12 | N/A | N/A |

ICBC, Bank of Communications, etc.

Hong Kong banks like ICBC and Bank of Communications typically charge international remittance fees of 0.1% of the amount, with minimum and maximum fee standards. For example, ICBC’s minimum fee is $7.1, and the maximum is $37. Banks also charge telegraph and intermediary bank fees, making overall costs higher. Receipt times are generally 2-5 business days, with relatively complex fee structures. Some banks offer fee discounts for VIP clients, and certain branches have minimum fee policies.

| Bank Name | Fee Ratio | Minimum Fee (USD) | Maximum Fee (USD) |

|---|---|---|---|

| ICBC | 0.10% | 7.1 | 37 |

| Bank of Communications | 0.10% | 2.8 | 35.7 |

Western Union

Western Union is known for fast and convenient remittances. Fees are generally $15-$30, with receipt typically within 15 minutes. Western Union has extensive outlet coverage and transparent services, ideal for urgent small-amount remittances. When the USD exchange rate rises, users should note potential hidden costs.

| Item | Description |

|---|---|

| Fees | $15-$30, simple fee calculation |

| Receipt Speed | Typically within 15 minutes |

| Service Transparency | Extensive outlets, stable service, clear fee structure |

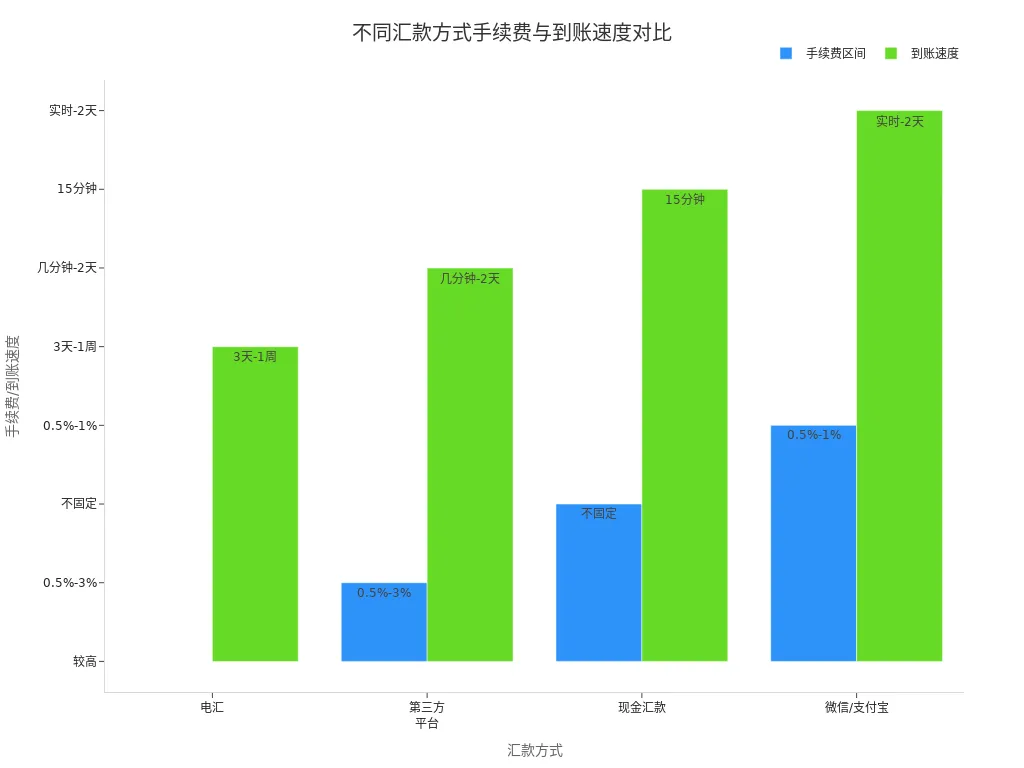

Transparency and Receipt Speed

Mainstream platforms and banks differ significantly in fee transparency and receipt speed. Platforms like Wise and PayPal have relatively transparent fee structures, allowing users to check fees and rates in real time. Bank international wire transfers have higher fees, slower receipt, and complex processes. Western Union offers the fastest receipt and transparent services. Users can choose channels based on needs to manage international remittance fees effectively.

| Remittance Method | Fee Transparency | Receipt Speed | Fee Level | Other Features |

|---|---|---|---|---|

| Bank International Wire Transfer | Moderate transparency, higher fees | Days | Higher fees | Secure, complex operations, affected by rate fluctuations |

| Platforms like PayPal | Relatively transparent fee structure | Fast receipt | Higher fees and rate conversion costs | Convenient, ideal for small transactions, account risks |

| Western Union | Clear fee structure | Within 15 minutes | Moderate fees | Extensive outlets, ideal for urgent remittances |

Tip: Banks and platforms often offer fee discounts for VIP clients, specific regions, or large transactions; users should stay informed about promotions to further reduce international remittance fees.

Cost-Saving Practical Tips

Compare Fees and Exchange Rates

When choosing an international remittance service, users should first compare fees and exchange rates across platforms and banks. Fees directly impact each remittance’s cost, while exchange rates determine the actual received amount. Some platforms like Wise use the market mid-rate with fees of about 0.5%-1%, while PayPal’s fees are typically 2%-3%. Hong Kong bank wire transfer fees are generally $35-$50, with receipt times of 1-5 business days. WeChat Pay and Alipay International Remittance fees range from 0.5%-7%, suitable for small transfers. Users can refer to the table below for a clear comparison of fees and receipt speeds:

| Remittance Method | Fee Range | Receipt Time | Applicable Scenarios and Notes |

|---|---|---|---|

| Wire Transfer | $35-50, possible intermediary fees | 1-5 business days | Ideal for large payments, higher fees, multiple charges possible |

| Wise | 0.5%-1% | Minutes to 1-2 business days | Reasonable fees, fast, ideal for small cross-border payments |

| PayPal | 2%-3% | Minutes to 1-2 business days | Ideal for small, frequent transactions, noticeable rate markups |

| Western Union | $15-30 | ~15 minutes | Ideal for urgent small remittances, variable fees |

| WeChat/Alipay | 0.5%-7% | Real-time or 1-2 business days | Ideal for small US-China personal transfers, amount limits |

Recommendation: Users should flexibly choose the optimal channel based on remittance amount, receipt speed needs, and fee structure to avoid increased international remittance fees due to rate spreads.

Watch for Hidden Fees

Many users focus only on apparent fees, overlooking hidden fees. Common hidden fees include account management fees, account opening fees, annual fees, minimum deposit requirements, account maintenance fees, and forex conversion fees. Some online anonymous remittance services have high fees and amount limits due to lack of identity verification. Users can identify hidden fees in advance by:

- Carefully reading all terms in account opening agreements, focusing on fee disclosures.

- Actively inquiring with banks or platforms about all potential fees, including account management and transfer fees.

- Comparing fee structures across banks and platforms to choose cost-effective services.

- Reviewing fine print in service terms to avoid missing critical information.

Tip: Users should proactively ask about all possible fees before choosing a service to avoid reduced received amounts due to hidden costs.

Multi-currency Accounts

Multi-currency accounts offer an effective way to save on international remittance fees and exchange rate losses. Users can hold USD, EUR, CNY, and other currencies in one account, directly sending and receiving different currencies to reduce frequent conversion losses. Multi-currency accounts also offer:

- Support for multi-currency deposits and withdrawals, avoiding repeated conversions and multiple fees.

- Multi-currency remittances and forex conversions via online banking, saving time and fees.

- Fee waivers for the first incoming remittance during proxy account opening, reducing initial costs.

- No account management fees or minimum balance requirements, lowering maintenance costs.

- Debit cards for local spending and withdrawals, reducing conversion steps and fees.

Multi-currency accounts are ideal for users with frequent cross-border payment needs, enhancing fund management efficiency.

Choose Remittance Methods Wisely

Different remittance methods vary significantly in fees and receipt speeds. Users should choose the most suitable method based on needs. For example, large urgent payments can use wire transfers, which have higher fees but strong security. Small, frequent payments can use Wise or PayPal, with lower fees and fast receipt. Western Union is ideal for urgent small remittances, arriving in 15 minutes. WeChat Pay and Alipay International Remittance are suitable for small US-China personal transfers, with low fees and fast receipt. The table below shows the features of different methods:

| Remittance Method | Fee Details | Receipt Speed | Applicable Scenarios and Notes |

|---|---|---|---|

| Wire Transfer | Comprises sender bank, intermediary, and recipient bank fees, higher costs | 3 business days to a week, affected by intermediary banks | Ideal for large transactions, slower, recommend commercial banks like SPD Bank |

| Wise/PayPal | Wise: 0.5%-1%, PayPal: 2%-3% | Minutes to 1-2 business days | Lower fees, fast, convenient, ideal for small cross-border payments |

| Cash Remittance (Western Union) | Sender bears fees, varies by country | ~15 minutes | Ideal for small, fast remittances, simple, variable fees |

| WeChat/Alipay | Fees 0.5%-1% | Real-time or 1-2 business days | Ideal for small US-China personal transfers, amount limits |

Recommendation: Users should choose remittance methods based on amount, receipt speed, and fee structure, regularly assess platform fee changes, and ensure fund safety and cost optimization.

Stay Informed About Promotions

Banks and platforms periodically offer fee discount promotions to help users reduce international remittance costs. For example, Hong Kong banks offer discounts based on client tiers: Gold Osmanthus clients get 60% off fees, Wealth clients get 40% off, and Diamond and Dingfu clients enjoy fee waivers (excluding telegraph fees). Some banks also provide free overseas ATM withdrawals and debit card annual fee waivers for VIP clients. The table below shows common promotions:

| Client Tier | Remittance Fee Discount | Online Banking Discount | Overseas Interbank ATM Withdrawal Discount | Other Promotions |

|---|---|---|---|---|

| Gold Osmanthus | 60% off (excl. telegraph fees) | Additional discount | No discount | 60% off interbank counter transfers, online interbank remittances |

| Wealth | 40% off (excl. telegraph fees) | Additional discount | No discount | 40% off interbank counter transfers, online interbank remittances |

| Wealth (Diamond) | Fee-free (excl. telegraph fees) | Additional discount | Free | Free interbank counter transfers, online interbank remittances |

| Dingfu | Fee-free (excl. telegraph fees) | Additional discount | Free | Free interbank counter transfers, online interbank remittances |

Recommendation: Users should regularly monitor banks and platforms for the latest promotions, schedule remittances strategically, and maximize cost savings.

When choosing an international remittance platform, users should rationally analyze each platform’s fees and services based on their needs. Best practices include:

- Identify remittance frequency, amount, and involved countries to select the appropriate solution.

- Compare fees, exchange rates, and receipt speeds across multiple Hong Kong banks and third-party platforms.

- Implement system integration to automate payment instructions and improve receipt efficiency.

- Continuously monitor payment status to optimize processes and ensure fund safety.

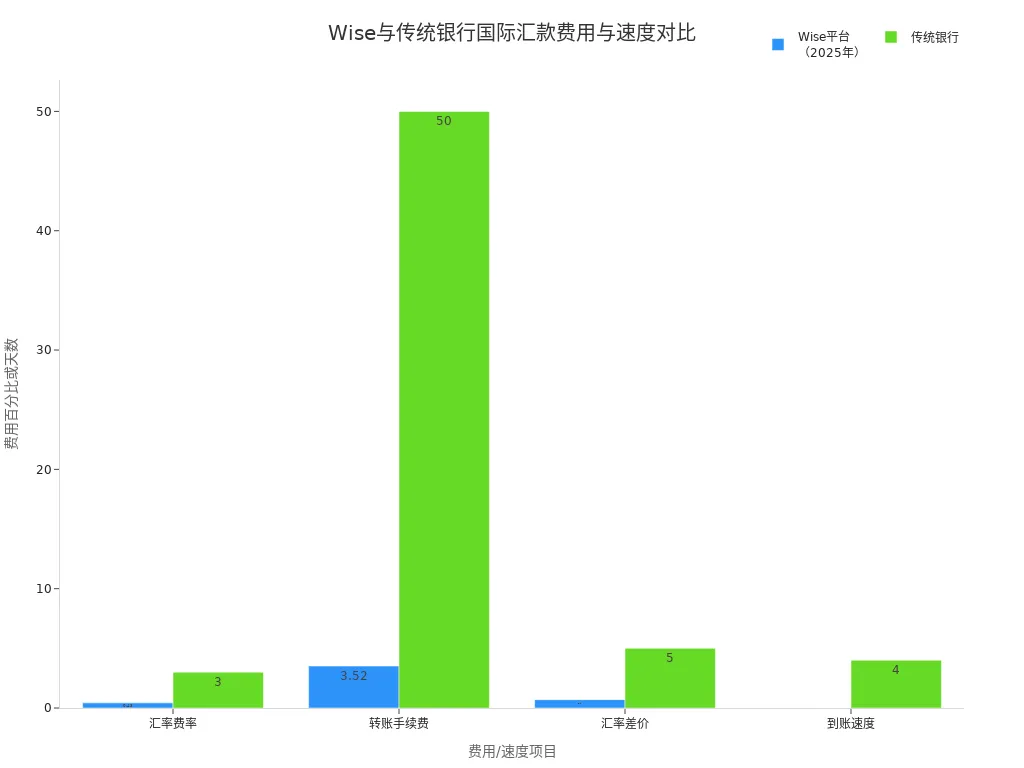

| Item | Wise Platform (2025) | Traditional Banks |

|---|---|---|

| Exchange Rate Fees | Starting ~0.43% | 1.5%-3% |

| Transfer Fees | ~0.13% (ACH) + $3.52 fixed | $20-50 fixed + 1%-2% proportional |

| Exchange Rate Spread | Hidden 0.3%-0.7% | Explicit 1%-5% |

| Receipt Speed | Over half of transactions within 20 seconds | 3-5 business days |

Platform policy changes affect fee structures and receipt speeds. Users should stay informed about the latest policies, adjust remittance strategies flexibly, and ensure maximum received amounts.

FAQ

What do international remittance fees include?

International remittance fees typically include transfer fees, exchange rate spreads, telegraph fees, intermediary bank fees, and currency conversion fees. Fee components vary across Hong Kong banks and third-party platforms, so users should understand them in advance.

How long does it take for remittances to arrive?

Receipt time depends on the platform and bank. Wise and similar platforms can deliver in minutes, Hong Kong bank wire transfers typically take 2-5 business days, and Western Union is fastest at 15 minutes.

How to choose a fee-sharing mode (SHA, BEN, OUR)?

In SHA mode, the sender and recipient each bear some fees. In BEN mode, the recipient bears all fees. In OUR mode, the sender bears all fees, ensuring the recipient receives the full amount.

Do exchange rate spreads affect the received amount?

Exchange rate spreads directly impact the received amount. Some platforms use the market mid-rate to reduce losses. Hong Kong banks and PayPal typically include rate markups, reducing the received amount.

What are the advantages of multi-currency accounts?

Multi-currency accounts support USD, EUR, CNY, and more. Users can directly send and receive different currencies, reducing conversion frequency, saving on fees and rate losses, and improving fund management efficiency.

This article provides a comprehensive analysis and practical advice on international remittance fees. It meticulously breaks down the components of these fees, including remittance fees, exchange rate spreads, telex fees, intermediary bank fees, and currency conversion fees. The article also compares the fee structures, transfer speeds, and transparency of different platforms (like Wise and PayPal) against traditional Hong Kong banks. It offers practical tips for choosing a platform, such as watching out for hidden costs, leveraging multi-currency accounts, and paying attention to promotional offers, all aimed at helping users make informed decisions and minimize their international remittance costs.

However, despite the detailed content of the article, a core challenge for many Chinese investors remains: the flow of cross-border funds. Traditional funding methods, such as international bank wire transfers, are not only complex and time-consuming but also come with high fees and opaque exchange rate spreads. These issues can directly impact investment returns and increase transaction costs.

BiyaPay was created to solve these cross-border financial pain points. We offer a smoother, more cost-effective channel for your investments. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and provide a real-time exchange rate query feature to ensure you always get the best rates. What’s more, our remittance fees are as low as 0.5% with same-day delivery, significantly cutting down your transaction costs and time. Now, you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform. Say goodbye to the hassle of cross-border payments and start your efficient financial journey. Register with BiyaPay today to make fund management as smooth as trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

The Easiest Way to Find the Code for Calling France

The 18 Best Apps to Earn Real Cash This Year

How to Fill Out a CVS Money Order A 2026 Guide

What Are the Daily Limits for Chase Accounts?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.