Xiaomi's Market Meltdown: When Vehicle Safety Concerns Shake Investor Confidence

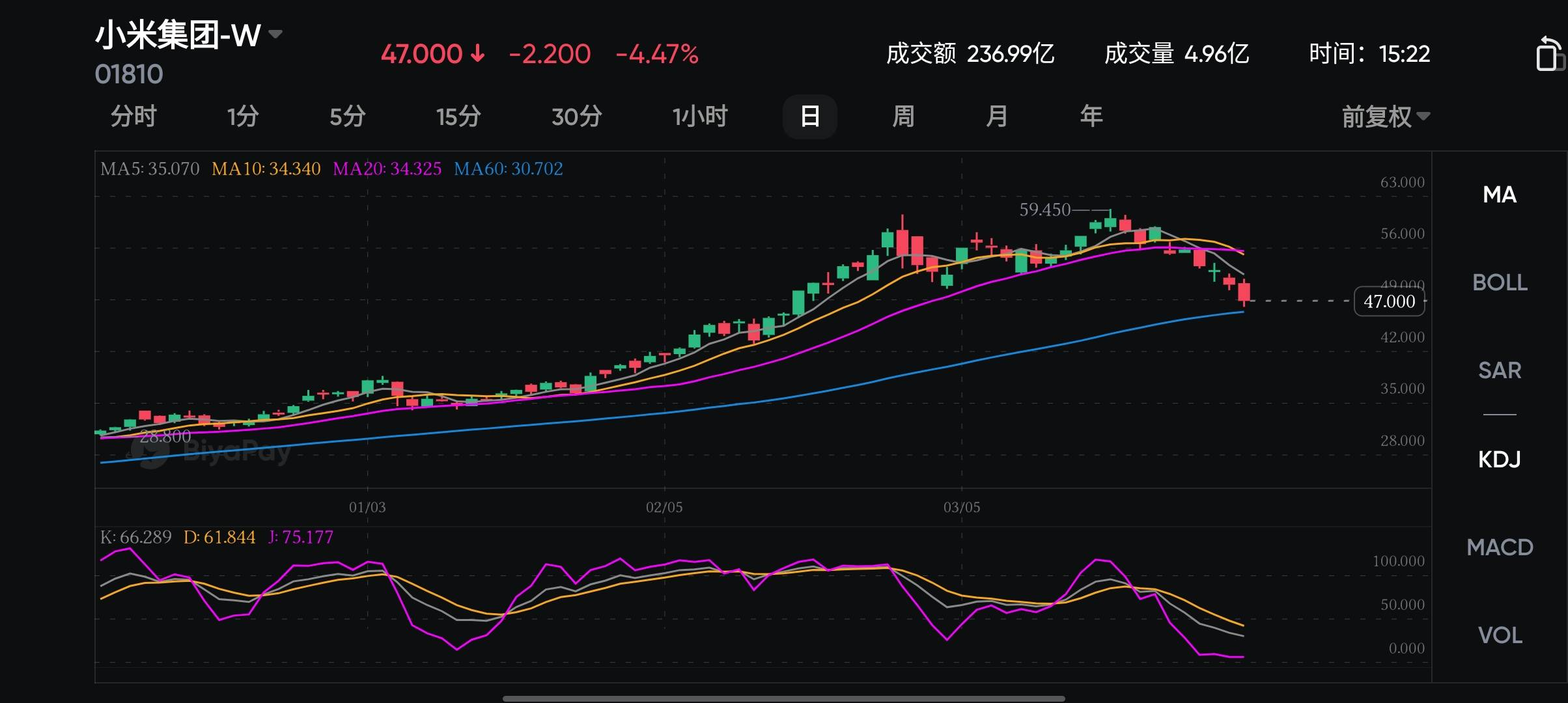

On April 1, 2025, a day that should have been filled with April Fools’ Day joy, turned into a nightmare for Xiaomi investors. In the afternoon trading session, Xiaomi Group’s (01810.HK) stock price plummeted like a kite with a broken string, with intraday losses exceeding 6% at one point, ultimately closing down over 5%. The trading volume of 20 billion Hong Kong dollars underscored the panic in the market. This sudden crash propelled Xiaomi to the top of Weibo’s trending list and left countless investors sleepless.

The Spark of the Crisis

The trigger was an unsettling announcement. At noon, Xiaomi released detailed information about the SU7 high-speed collision and explosion incident. Although the company stated it would fully cooperate with the police investigation and promised transparent handling, the capital market was clearly rattled by the word “explosion.” Ironically, earlier that same morning, Xiaomi Auto had just proudly announced March delivery figures surpassing 29,000 units and confidently raised its annual delivery target to 350,000 units. Unfortunately, even stellar sales data couldn’t offset the shockwaves of safety concerns.

The timing of this crisis was uncanny. Just the day before, S&P had upgraded Xiaomi’s credit rating to BBB with a “stable” outlook. This should have been good news but unexpectedly became the perfect excuse for some institutions to cash out. The broader context was also unfavorable: the Hong Kong tech sector was sluggish overall, market liquidity was tightening, and risk aversion was rising—all factors that combined to create a perfect storm.

Deep-Seated Crisis: A Crack in Trust

On the surface, this appeared to be a stock price fluctuation triggered by a single incident. But a deeper analysis reveals that market concerns about Xiaomi Auto had been brewing for some time. As the new pillar of the group’s business, Xiaomi Auto carries all of investors’ hopes for the future. However, this explosion incident was like a sledgehammer, shattering market confidence in Xiaomi’s ability to manufacture cars. Even with the company’s swift response and promise of a thorough investigation, it will be difficult to soothe investors’ unease in the short term.

Another factor that can’t be ignored is the pressure of valuation correction. On March 19, Xiaomi’s stock price had just hit a historic high of 59.45 Hong Kong dollars, only to plummet nearly 20% in just nine trading days. Behind this volatility lies widespread concern about the prospects of the new energy vehicle industry. Since 2024, industry giants like Tesla and BYD have slashed prices to boost sales, putting sustained pressure on profit margins across the sector. Although Xiaomi Auto’s delivery numbers exceeded expectations, its long-term profitability in such a fiercely competitive environment inevitably raises doubts.

Investors’ Crossroads

Faced with this crisis, different types of investors need to adopt vastly different strategies. Short-term traders are at the eye of the storm—they must closely monitor the latest developments in the accident investigation, watch the key support level around 45 Hong Kong dollars, strictly control their positions, and avoid blindly buying the dip before the situation clarifies. For them, this is both a crisis and a potential opportunity for a short-term rebound.

Medium- to long-term investors have a broader perspective. They need to look beyond the short-term noise and assess whether Xiaomi’s fundamentals have materially changed. The smartphone business remains robust, the IoT ecosystem continues to expand, and the 35% revenue growth and 41.3% net profit growth in 2024 all indicate that the core business is still healthy. The key is evaluating the long-term potential of the auto business—if the SU7 can maintain its delivery pace and this safety incident proves to be an isolated case, then the current downturn might actually present a golden buying opportunity.

For cautious value investors, patience may be the best approach. If the stock price continues to fall to the 40–45 Hong Kong dollar range, corresponding to a price-to-earnings ratio of about 15 times 2024 earnings, the investment value will become even more apparent. They can wait for market sentiment to stabilize before making calculated moves. For risk-averse investors, allocating some funds to defensive assets or using smart risk control tools provided by platforms like BiyaPay for hedging could be viable options.

A Future of Both Risk and Opportunity

In the short term, Xiaomi’s stock price still faces significant pressure. But history often repeats itself. The Ford-Firestone tire crisis in 2000, Toyota’s brake scandal in 2010, and the Samsung Note7 explosion incident in 2016 all demonstrate an unchanging truth: stock price crashes triggered by single events often create excellent investment opportunities. As long as the company can manage the crisis effectively and maintain solid fundamentals, the stock price will eventually reflect its intrinsic value.

For Xiaomi investors today, maintaining rational judgment is crucial. In this uncertain investment environment, wise investors need to manage their portfolios more flexibly. Those who believe in Xiaomi’s long-term prospects may find that the current market panic offers a rare opportunity to position themselves. Platforms like BiyaPay, with their global asset allocation capabilities and smart risk control tools (such as one-click stop-loss/take-profit and conditional orders), can help investors better manage risks and seize opportunities amid market volatility. Founded in 2019, BiyaPay is a global multi-asset trading wallet that embodies the innovative concept of “one account, one pool of capital to invest globally,” providing diversified solutions for investors.

Conclusion

The flash crash of Xiaomi’s stock price, triggered by a safety crisis, serves as a vivid lesson for investors. Historical experience shows that short-term crises for high-quality companies often breed long-term investment opportunities. The current market panic over Xiaomi, to some extent, obscures its solid business fundamentals and diversified growth potential. In these uncertain times, professional trading platforms like BiyaPay offer essential tools for investors. Their global asset allocation capabilities and smart risk control features can help investors better navigate risks and capitalize on opportunities.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Zelle Wire Transfer or ACH? Clearing Up the Confusion

The Easiest Way to Find the Code for Calling France

What is the Dialing Code for the USA and How to Call?

What Are the Daily Limits for Chase Accounts?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.