How to Send Money to Thailand: Currency Choices, Transfer Limits, and Processing Times

Image Source: pexels

When you send money to Thailand, you typically focus on three key questions: which currency to choose, whether there are restrictions on the amount and frequency, and how long it takes for the funds to arrive. You need to ensure the recipient is at least 18 years old and prepare identity documents and recipient details. The speed of the transfer varies by channel. The table below shows the average processing times for common channels:

| Channel | Average Processing Time |

|---|---|

| Bank Transfer | 1-5 business days |

| WorldRemit | 1-2 business days |

| Inpay | About 30 minutes |

| Western Union | Up to 5 days for first-time transfers |

You also need to comply with relevant regulations to ensure the remittance is compliant.

Key Points

- Choose the appropriate currency. Chinese Yuan (CNY) is suitable for users in China, US Dollar (USD) is an internationally accepted currency, and Thai Baht (THB) is convenient for use in Thailand.

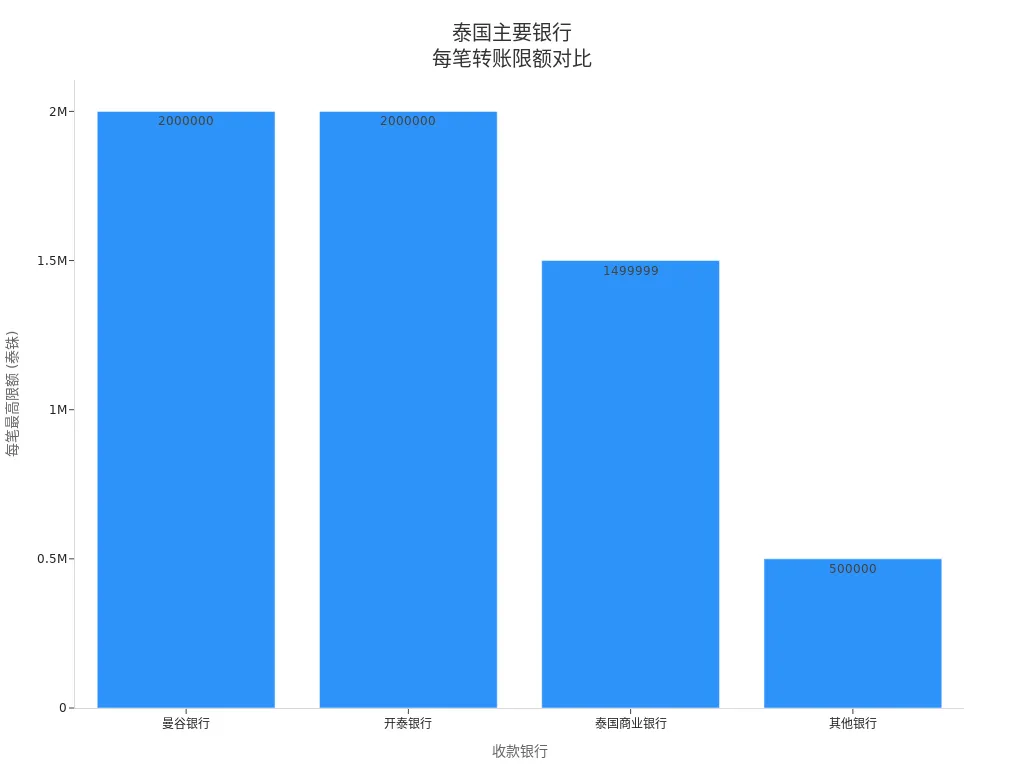

- Pay attention to remittance amount limits. Each transfer has an upper limit, typically 2,000,000 THB, and it’s advisable to check with your bank in advance.

- Understand processing times. Bank transfers usually take 1 to 5 business days, while online platforms can achieve same-day transfers, so choosing the right channel can improve efficiency.

- Prepare required documents. These include identity proof, address proof, and recipient information, ensuring the information is accurate and valid to avoid delays.

- Comply with regulations. When sending money, you must follow the legal requirements of China and Thailand to avoid fines and investigations.

Currency Options for Sending Money to Thailand

Image Source: pexels

Currency Types

When sending money to Thailand, you can choose Chinese Yuan (CNY), US Dollar (USD), or Thai Baht (THB). CNY is suitable for users in mainland China, but some international platforms do not support direct exchange. USD is an internationally accepted currency, supported by many licensed banks in Hong Kong and third-party platforms. THB is ideal for recipients who need to use the funds directly in Thailand, reducing the need for currency conversion. You should choose the appropriate currency based on the recipient’s needs and the platform’s support.

Recipient age requirements are as follows. You must confirm that the recipient is at least 18 years old before sending money; otherwise, parental or guardian consent is required.

| Age | Consent Requirement |

|---|---|

| Under 20 | Requires parental or guardian consent |

| 20 and above | Can consent independently |

Applicable Scenarios

Different currencies suit different scenarios. You can refer to the following common situations:

- Travel and Study: If you are a tourist or international student, you typically choose to convert USD to THB for paying tuition or daily expenses.

- Business and Investment: When investing in Thai real estate or stocks from the US market, you commonly use USD to send money to a Thai account.

- Family and Living Expenses: If you live in Thailand long-term, you may need to regularly transfer overseas income (e.g., USD) to a local account for rent, medical expenses, or family costs.

Exchange Rates and Fees

When choosing a currency, you need to consider exchange rates and fees. Exchange rates and transaction fees vary significantly across platforms and currencies. The table below shows common exchange rates and fees for USD to THB:

| Currency Pair | Exchange Rate | Transaction Fee |

|---|---|---|

| USD to THB | 32.24 THB to 1 USD | $1.99 |

You can compare exchange rates and fees across platforms to select the best option. USD typically has lower fees and flexible conversion. THB offers faster receipt but may have higher fees on some platforms. You should choose based on the recipient’s actual needs and the purpose of the funds.

Remittance Restrictions

Image Source: pexels

Amount and Frequency

When sending money to Thailand, you must pay attention to the limits on the amount per transfer and monthly remittance frequency. Different banks and platforms have specific rules for single transfer amounts. The table below shows the maximum per-transfer limits (in THB) for major Thai banks:

| Receiving Bank | Maximum Per-Transfer Limit (THB) |

|---|---|

| Bangkok Bank | 2,000,000 |

| Kasikornbank | 2,000,000 |

| Siam Commercial Bank | 1,499,999 |

| Other Banks | 500,000 |

If you choose a licensed bank in Hong Kong or an international online platform, you are typically limited to one or two remittances per month. This helps avoid high fees and compliance risks. Online platforms have lower initial deposit requirements and faster processing. Traditional banks may require higher initial deposits (e.g., $1,000) and take longer to process. You can refer to the table below to compare the features of different channels:

| Type | Online Platform | Traditional Bank |

|---|---|---|

| Initial Deposit Requirement | Usually none or low | Usually higher (e.g., $1,000) |

| Processing Time | Faster | Potentially longer |

| Account Type | Multi-currency accounts, convenient for receiving USD | Foreign currency deposit accounts (e.g., USD accounts) |

| Verification Requirements | Identity proof and address proof | Passport, visa, address proof, etc. |

| Withdrawal Options | Direct transfer to Thai bank accounts | May have additional withdrawal requirements and fees |

If you exceed the remittance limit, the bank will require approval. Thai tax authorities will review large transfers. You should note that gift tax is typically 10%, or 5% if the recipient is an immediate family member. Failure to declare or pay taxes may result in fines ranging from ฿1,000 THB (about $33) to ฿200,000 THB (about $6,700), with an additional 1.5% monthly interest. Banks are legally obligated to report all international fund transactions, and undeclared remittances may be investigated by tax authorities.

Regulatory Requirements

When sending money, you must comply with Thailand’s 1958 Currency Act and relevant international remittance regulations. Thailand has different requirements for declaring foreign exchange income for residents and non-residents:

- Residents (staying in Thailand for 180 days or more) must declare all foreign exchange income. Starting in 2024, foreign exchange income transferred to Thailand is taxable.

- Non-residents (staying in Thailand for less than 180 days) are not required to declare foreign exchange income, even if funds are sent to Thailand.

The table below compares the main requirements for residents and non-residents:

| Type | Resident Requirements | Non-Resident Requirements |

|---|---|---|

| Foreign Currency Account | Allowed to hold foreign currency accounts with conditions on deposits and withdrawals | Allowed to hold foreign currency accounts with no deposit restrictions |

| Deposit Limits | No upper limit on foreign currency deposits, with limits in specific cases | No upper limit on foreign currency deposits |

| Withdrawal Limits | Withdrawals subject to specific conditions | Free withdrawals, subject to related interest fees |

When choosing a remittance channel, you must ensure all operations comply with the legal requirements of mainland China and Thailand. Failure to comply may lead to investigations by banks or tax authorities and potential fines.

Identity Verification

When processing remittances to Thailand, you must complete identity verification. Whether you choose a licensed bank in Hong Kong or an international online platform, you need to submit identity proof and address proof. Traditional banks typically require a passport, visa, and detailed address proof. Online platforms require you to upload an ID and proof of residence, with a simpler verification process.

Tip: When submitting documents, ensure the information is accurate and valid. Banks and platforms strictly review all documents, and false information will result in the rejection of the remittance application.

For large remittances, banks may require additional proof of the source of funds. You should prepare relevant documents in advance to avoid delays. All international remittances must comply with anti-money laundering regulations, and banks will periodically check account and transaction records.

Processing Times

Influencing Factors

When sending money to Thailand, the processing time is affected by various factors. Different remittance methods, platforms, and currencies lead to different processing speeds. The table below summarizes the main factors affecting processing times:

| Factor | Impact Description |

|---|---|

| Intermediary Banks | International payments often require intermediary banks for high transaction volumes and currency conversions, which may cause delays. |

| Time Zones | Different working hours in mainland China, Thailand, and the US may affect payment processing speed due to time differences. |

| Anti-Fraud Processes | Banks conduct anti-fraud reviews, especially for international transfers involving multiple banks, increasing verification time. |

| Country Differences | Different countries’ banking infrastructure and regulations result in varying processing speeds. |

| Bank Holidays | Bank holidays in mainland China and Thailand affect processing times, as banks suspend international remittances during holidays. |

If you choose a bank transfer, it typically involves intermediary banks and multiple reviews, leading to longer processing times. Online platforms streamline the process and improve speed.

Common Methods

You can choose bank transfers or online platforms to send money to Thailand. The processing times for different methods are shown in the table below:

| Method | Processing Time |

|---|---|

| Bank Transfer | 1 to 5 business days |

| Online Platform | 70% of transactions arrive on the same day |

Traditional bank transfers (e.g., via licensed banks in Hong Kong) generally take 1 to 5 business days, with some banks requiring 3-5 days. Online remittance services and mobile apps (e.g., Wise, Remitly, Sendwave) can process transfers in minutes to 24 hours. Some platforms like Xe and Remitly support same-day or next-day transfers, depending on the payment method and recipient preferences. If you choose mobile wallets or cash pickups, the funds arrive even faster.

Tip: When choosing a platform, prioritize services that support same-day transfers to improve fund utilization efficiency.

Tips to Speed Up Transfers

If you want to accelerate the transfer process, consider the following suggestions:

- Prioritize online remittance platforms like Wise, Remitly, or Xe, which support same-day or next-day transfers, with some transactions completed in minutes.

- Avoid bank holidays and weekends, and choose weekdays for remittances to reduce delays caused by holidays.

- Prepare all identity and recipient documents in advance, ensuring accuracy to avoid delays due to failed verification.

- Choose USD as the remittance currency, as some platforms process USD faster with lower fees.

- Understand the recipient’s bank and payment system, as differences between systems (e.g., Singapore and Thailand) may lead to transaction failures or delays.

When performing the transfer, you can flexibly choose the channel and currency based on the purpose of the funds and the recipient’s needs to ensure a safe and efficient remittance to Thailand.

Operational Considerations

Document Preparation

When sending money to Thailand, you must prepare the necessary documents in advance. Different banks and online services have specific requirements. You typically need the following types of documents:

- Identity Proof: Such as a passport, driver’s license, or government-issued ID.

- Address Proof: Recent utility bills, bank statements, or lease agreements.

- Bank Details: Including account numbers and routing numbers.

- Recipient Information: Full name, address, and bank account details.

Before sending money, carefully check the specific requirements of the service provider. For large remittances, banks may require a valid passport or national ID. If using a licensed bank in Hong Kong, it’s advisable to contact the bank in advance to confirm whether additional documents are needed. When sending money to Thai businesses, you may also need to prepare commercial invoices or other documents.

Risk Prevention

During the remittance process, you must prioritize information security. Thai banks have implemented multiple measures to prevent financial fraud. For example, banks restrict daily transfer amounts to $50,000 and require biometric authentication for large transfers. When using mobile banking, the system allows only one username to prevent account theft. Banks also notify you before transactions to remind you to verify information. In Q2 2025, financial losses due to fraud reached $6 billion, with over 3 million accounts suspended. When sending money, you must verify recipient information and avoid clicking links in unfamiliar texts or emails.

| Security Measure | Purpose |

|---|---|

| Daily Transfer Amount Limit | Reduce fraud risk and protect funds |

| Biometric Authentication | Ensure secure identity verification |

| Pre-Transaction Notifications | Increase vigilance |

Compliance Tips

When sending money to Thailand, you must comply with the regulations of mainland China and Thailand. You need to submit tax declarations and pay taxes on time, register a tax identification number, and promptly notify tax authorities of any personal information changes. Banks and platforms will require legally mandated documents, such as receipts, income statements, and balance sheets. Failure to declare or pay taxes may result in asset seizure by tax officials. The Anti-Money Laundering Office also has the authority to freeze accounts if funds are involved in illegal activities. When choosing a platform, prioritize those with high user ratings and transparent processes. For example, Wise is rated 4.7 for low fees and strong security, while OneSafe is praised for its simple process and excellent customer support. Choosing a reputable platform can effectively reduce remittance failures and legal risks.

When sending money to Thailand, you need to focus on currency selection, amount restrictions, and processing times. The table below summarizes the key points:

| Key Point | Details |

|---|---|

| Currency Selection | THB is freely convertible but requires relevant proof. |

| Remittance Restrictions | No amount restrictions. |

| Processing Time | Depends on the chosen digital service platform. |

You should prepare documents, comply with anti-money laundering regulations, and choose a compliant and secure platform. Digital wallets and real-time transfer systems are very popular in Thailand and can improve remittance efficiency.

FAQ

Which currencies can I choose when sending money to Thailand?

You can choose Chinese Yuan (CNY), US Dollar (USD), or Thai Baht (THB). USD is suitable for international transfers, while THB is convenient for direct use in Thailand. You should decide based on the recipient’s needs and platform support.

Are there limits on remittance amounts?

Each remittance has an upper limit. Licensed banks in Hong Kong typically cap single transfers at 2,000,000 THB. Monthly remittance frequency is also limited, so it’s advisable to consult your bank in advance.

What documents are needed for remittances?

You need to prepare identity proof, address proof, and recipient bank information. For large amounts, you may also need proof of the source of funds. Preparing documents in advance can speed up the verification process.

How long does it take for the funds to arrive?

When using bank transfers, the processing time is 1 to 5 business days. Online platforms are faster, with some transactions arriving on the same day. You can choose the appropriate channel based on urgency.

Do I need to declare or pay taxes on remittances?

For large remittances, you need to declare them. Thai tax authorities may require gift tax payments. You should proactively understand the regulations to avoid fines for non-compliance.

You have mastered all the critical information for sending money to Thailand, including currency options, transfer limits, processing times, and compliance requirements. You clearly know that traditional bank transfers can lead to high intermediary bank fees, hidden exchange rate losses, and delays of up to 5 business days. When dealing with international remittances, efficiency and cost are the two main challenges to ensuring funds reach the recipient securely and quickly.

Facing the strict scrutiny of Thai banks on large transfers and anti-money laundering regulations, you need a FinTech platform that can bypass traditional barriers, offer real-time exchange rates, and ensure same-day fund arrival.

BiyaPay is your ideal solution for efficient and low-cost remittances to Thailand. We provide real-time exchange rate inquiry and conversion for fiat currencies, with remittance fees as low as 0.5%, and zero commission for contract limit orders, helping you maximize cost control and avoid the complex fee traps of traditional banks. With BiyaPay, you can seamlessly convert between various fiat and digital currencies and trade global markets, including Stocks, all on one platform. There is no need for a complex overseas bank account, and you can enjoy same-day fund remittance and arrival. Click the Real-time Exchange Rate Inquiry now, and BiyaPay for quick registration, and use peak capital efficiency and transparent fees to make your cross-border remittance secure, fast, and compliant!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

The Easiest Way to Find the Code for Calling France

What Are the Daily Limits for Chase Accounts?

Zelle Wire Transfer or ACH? Clearing Up the Confusion

SoFi Checking and Savings A Deep Dive Review

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.