Wise Account Registration and Activation Guide: Easily Handle Cross-Border Collections and Remittances

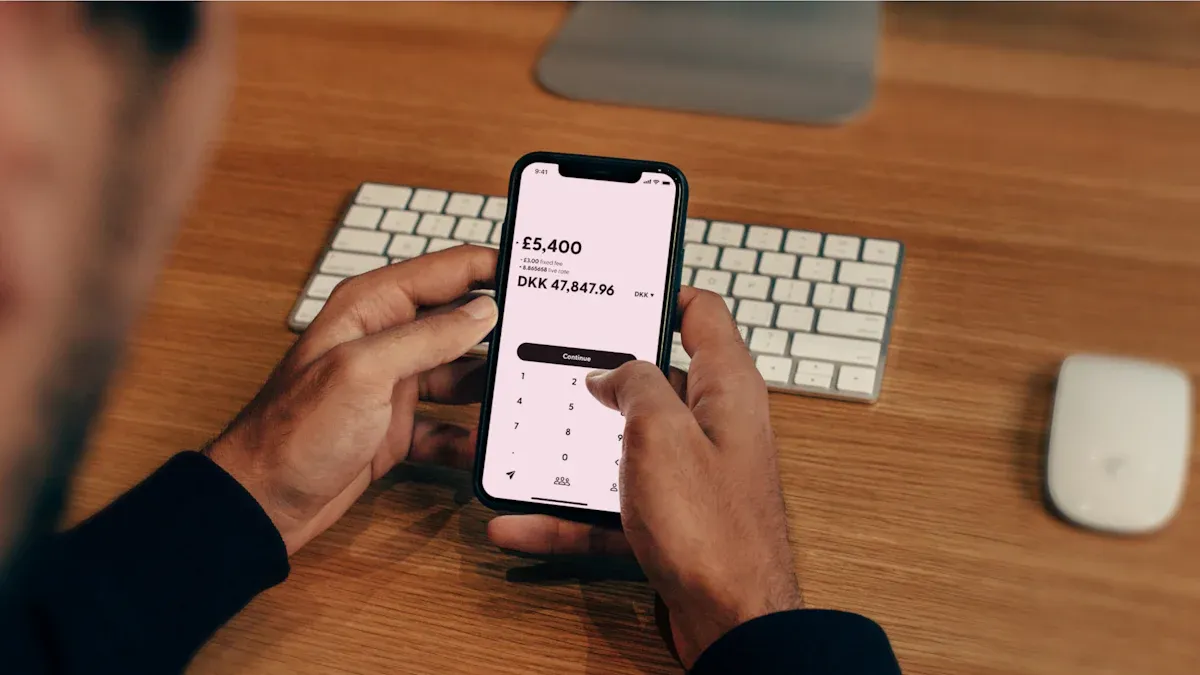

Image Source: unsplash

Wise (formerly TransferWise) is an international remittance platform. It provides you with real market exchange rates and transparent fees, effectively saving cross-border fund processing costs. Wise has served over 16 million customers worldwide, and its massive transaction volume proves its reliability.

Core Data Overview

Metric Data Annual Cross-Border Volume GBP 145.2 billion

For Chinese users, you can directly use your ID card to complete personal account registration. This Wise account opening tutorial will guide you through all key steps to easily handle cross-border collection and remittance needs.

Key Takeaways

- Wise provides real exchange rates and low fees, helping users save on cross-border remittance costs.

- Wise accounts support over 40 currencies, making global fund management convenient.

- Chinese users can register a Wise personal account with an ID card and activate it with HKD.

- Wise accounts can receive payments from around the world, such as sales proceeds from Amazon and Shopify.

- Wise remittances to mainland China support Alipay and UnionPay cards, but with limits.

Wise Core Advantages: Why It’s Worth Choosing

Before deciding to register, understanding why Wise stands out among many tools is crucial. Its core advantages are mainly in three aspects — these directly save you money and time.

Real Exchange Rates and Low Fees

Wise’s biggest appeal is that it uses the mid-market exchange rate — the real rate you see on Google, with no hidden markups. Traditional banks and many payment platforms add profit to the exchange rate, causing you to receive less. Wise is completely transparent, charging only a small, fixed service fee.

Fee Comparison: $1,000 USD Cross-Border Payment

Assuming you need to process a $1,000 USD payment, fees vary greatly across platforms. Wise’s cost advantage is very obvious.

Platform Estimated Total Fee Advantages and Notes Wise $4.88 Uses real exchange rate, completely transparent fee structure. PayPal $64.84 Includes receiving fee and higher currency conversion markup.

Through Wise, you can save up to 8 times the fees, ensuring every penny is well spent.

Global Multi-Currency Account Features

Having a Wise account is like having a global bank account. You can hold and convert over 40 different currencies for free. This means when a client pays you in USD, you can directly hold it in your Wise USD balance without immediate conversion. You can wait for a favorable rate and convert it to your needed currency at very low fees. This flexibility provides great convenience for managing global funds.

Wide Range of Personal and Business Scenarios

Whether you are an individual user or business owner, Wise meets your diverse needs.

- Personal Uses:

- Receive overseas work salary or service fees.

- Pay overseas tuition or living expenses.

- Manage overseas investment returns in markets like the US.

- Remit to family or friends abroad.

- Business Uses:

Wise Account Opening Tutorial: Registration and Verification Details

Image Source: unsplash

Now you understand Wise’s powerful advantages. Next, this Wise account opening tutorial section guides you step-by-step through account registration and identity verification. The process is very simple and takes only a few minutes.

Preparation Before Registration

Before starting registration, make sure you have the following items ready — this makes the entire process smoother:

- A valid email address: For receiving verification codes and account notifications.

- A mobile phone that can receive SMS: For secondary verification to secure your account.

- Your mainland China resident ID card: For the subsequent identity verification (KYC) step.

Important Reminder: Register Using Pinyin Name

When registering, fill in the name field with the standard Hanyu Pinyin of your ID card name, not Chinese characters. For example, if your name is “张三”, fill in “San Zhang”. This facilitates linking your Wise account with overseas platforms (like Amazon, Shopify, or payment platforms) for smooth fund receipt.

Account Registration Process

Wise offers multiple convenient registration methods. You can choose to use email, Google account, or Apple ID to create your personal account. We recommend email registration for better account management.

Here are the detailed Wise account opening tutorial steps:

- Visit the Wise official website and click the “Register” button in the top right.

- Choose to create a “Personal account”.

- Enter your email address, or choose to register directly via Google, Facebook, or Apple account.

- Select your country of residence. Choose “China”.

- Enter your mobile number and complete SMS verification.

- Set a secure login password.

After completing the above steps, your Wise account framework is set up. Next is the most critical step: identity verification.

Identity Verification (KYC) Key Points

According to global financial regulations, Wise must perform identity verification on all users — “Know Your Customer” (KYC). This is crucial for protecting your funds.

Note: Currently, Wise only supports using mainland China ID cards for verifying personal accounts of Chinese nationals. Business account verification does not support mainland China business licenses.

Identity verification is usually quick — most users complete it in a few minutes. In some cases, review may take up to 24 hours.

To ensure one-time success, follow these photo requirements:

- Provide ID front and back: Upload color photos of both sides separately.

- Ensure photos are clear and complete: All information, including your date of birth and ID number, must be clearly readable. Avoid glare, blur, or finger obstruction.

- Use live photos: The Wise system requires real-time camera capture — uploading old album photos or scans is not supported.

- Do not crop or edit: Ensure all four corners of the ID are fully visible.

If the system fails due to inability to recognize Chinese characters, don’t worry. Try reshooting in better lighting for clearer photos. If multiple attempts fail, contacting Wise customer service is the most efficient solution. The core of this Wise account opening tutorial is to help you smoothly pass each step.

Common Verification Failure Reasons include:

- Registered name does not match ID name.

- Uploaded ID is expired.

- Photos are blurry or obstructed.

- Created multiple personal accounts.

As long as you carefully follow the above guide, you can easily complete identity verification and unlock all Wise account features.

Account Activation and Fund Usage Guide

Image Source: unsplash

After completing identity verification, your Wise account is ready, but to fully unlock its powerful collection and remittance features, you need one final step: account activation. This section provides detailed activation tips and subsequent fund usage guide.

Activate Account by Adding HKD

For mainland China users, the simplest and most efficient way to activate a Wise account is to deposit a small amount to obtain your first multi-currency account details. We strongly recommend choosing to add HKD for this step.

Activation Tip

Why choose HKD? Because when verifying the country, you can directly select “China” — the system smoothly opens HKD account details for you without requiring additional address proof documents — very convenient.

Account activation usually requires depositing an amount equivalent to GBP 20. Complete this initial deposit through:

- Recharge via Wise app: In the Wise app, select “Add money”, enter the amount, then choose your preferred payment method.

- Direct bank transfer: Transfer directly from your bank account (e.g., Hong Kong bank account) to the account details provided by Wise.

Here are the specific account activation steps:

- Log into your Wise account and click “Open a balance” on the homepage.

- In the currency list, find and select HKD.

- Click “Get account details”.

- The system guides you through the deposit activation steps. Follow prompts to deposit a small amount of HKD (e.g., HKD 200) to complete activation.

After completing this deposit, your Wise account is fully activated. The money goes into your HKD balance and can be used anytime.

Obtain Multi-Currency Collection Details

After account activation, you have a true global multi-currency account. You can generate exclusive local bank account details for major currencies like USD, EUR, GBP to receive payments from worldwide.

Obtaining collection details is very simple:

- On the Wise account homepage, click “Open a balance” to add the currency you want to receive, e.g., USD.

- Select the newly added USD balance.

- Click “Get account details”.

- Wise immediately generates a set of exclusive USD bank account details for you.

This set usually includes:

- USD Account: Includes ACH routing number, wire routing number, account number, and account holder name.

- EUR Account: Includes your International Bank Account Number (IBAN) and Bank Identifier Code/SWIFT code. Wise EUR account details use Belgium-based BIC code

TRWIBE*****.

Fee Explanation: Is Receiving Free?

Obtaining and holding these account details is completely free. In most cases, receiving local bank transfers is also free. But note fees in specific cases.

| Receipt Type | Fee |

|---|---|

| Obtain Multi-Currency Details | Free |

| Receive Local Transfer (e.g., USD ACH, EUR SEPA) | Free |

| Receive USD Wire | Fixed $6.11 per transaction |

| Receive International SWIFT | Corresponding currency fixed fee |

This means if your client pays your Wise USD account via ACH, you pay no fees. This is very beneficial for receiving proceeds from platforms like Amazon and Shopify.

Initiate Cross-Border Remittance Operation

When you need to send funds outward — whether paying overseas suppliers or transferring back to mainland China — Wise provides a simple and fast process.

You can directly initiate remittance from your currency balance:

- Log into Wise account, select the currency balance you want to send from on the homepage, e.g., USD balance.

- Click “Send”.

- Enter the remittance amount and add recipient bank details. If first time to this person, enter their name, account number, bank code, etc.

- Check exchange rate and fees — Wise clearly displays all fees for transparency.

- Confirm details are correct, then click “Confirm and send”. You may need to enter password or use facial/fingerprint recognition to authorize.

Remittance to Mainland China: Supports Alipay and UnionPay

You can easily remit Wise balance funds to mainland China Alipay or UnionPay card accounts. Note that according to State Administration of Foreign Exchange regulations, such remittances have limits.

- To Alipay: Single transaction limit RMB 50,000.

- To UnionPay Card: Single transaction limit usually RMB 33,000, with annual receipt total limit for recipient.

After completing remittance, track the real-time status on Wise’s “Transactions” page to know when funds reach the recipient.

Wise is an efficient, low-cost tool for handling cross-border funds. Financial experts recognize its core advantages:

- Scalability: Helps you make localized collections and payments with multi-currency accounts.

- Cost Reduction: Offers better real market rates than banks.

Trustpilot User Ratings

Wise Entity Trustpilot Score Number of Reviews wise.com 4.3 / 5 Over 278,000

Through this Wise account opening tutorial, you have mastered the full process from registration to activation, especially the key tip of activating with HKD deposit. Now you can confidently start managing your global funds.

Visit the Wise official site to register now and begin your convenient cross-border remittance journey!

FAQ

We have compiled some common questions you may encounter when using Wise. We hope these answers help you use Wise better.

Is Wise safe?

Wise is a very safe platform.

It is strictly regulated by financial authorities in multiple countries worldwide, such as the UK Financial Conduct Authority (FCA). At the same time, Wise uses bank-level security measures to protect your funds, including mandatory two-factor authentication (2FA) and a professional anti-fraud team.

Can I get a Wise physical card in mainland China?

Currently, Wise does not provide physical or virtual debit cards to users residing in mainland China. Your Wise account’s core functions are for receiving, holding, and sending multi-currency funds. You can easily remit account balances to your mainland China bank account or Alipay.

What if my identity verification fails?

Don’t worry — this is usually resolvable.

- First, ensure uploaded ID photos are clear, complete, without glare or obstruction.

- Try reshooting and uploading in better lighting.

- If multiple failures, directly contact Wise customer service. They provide manual support to help you complete verification.

Are there limits on remittances to mainland China?

Yes, remittances to mainland China have limits mainly determined by the receiving channel.

| Receiving Channel | Single Transaction Limit (RMB) |

|---|---|

| Alipay | 50,000 RMB |

| UnionPay Card | 33,000 RMB |

Note: The recipient also has an annual receipt total limit. Before initiating large remittances, confirm the recipient’s limit status to ensure smooth transaction.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

It's Finally Here: Mainland China Users Can Now Register Wise with ID Card Only

Beginner's Guide to US Individual Income Tax Rates: Understanding Minimum Filing Income Requirements

PayPal Payment Process Tutorial: All Fees Explained Clearly

How Mainland Chinese Can Apply for a Hong Kong Bank Card: In-Depth Analysis of HSBC and BOC Hong Kong Account Opening Requirements

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.