What are the spot trading fees and leverage fees for digital currencies?

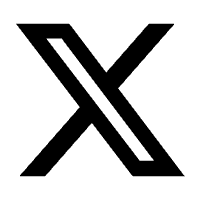

How to check digital currency spot trading fees and leverage fees on the App:

Tap 【Trade】-【Spot】, then tap the three-dot icon at the top right corner of the page to view the digital currency spot trading fees.

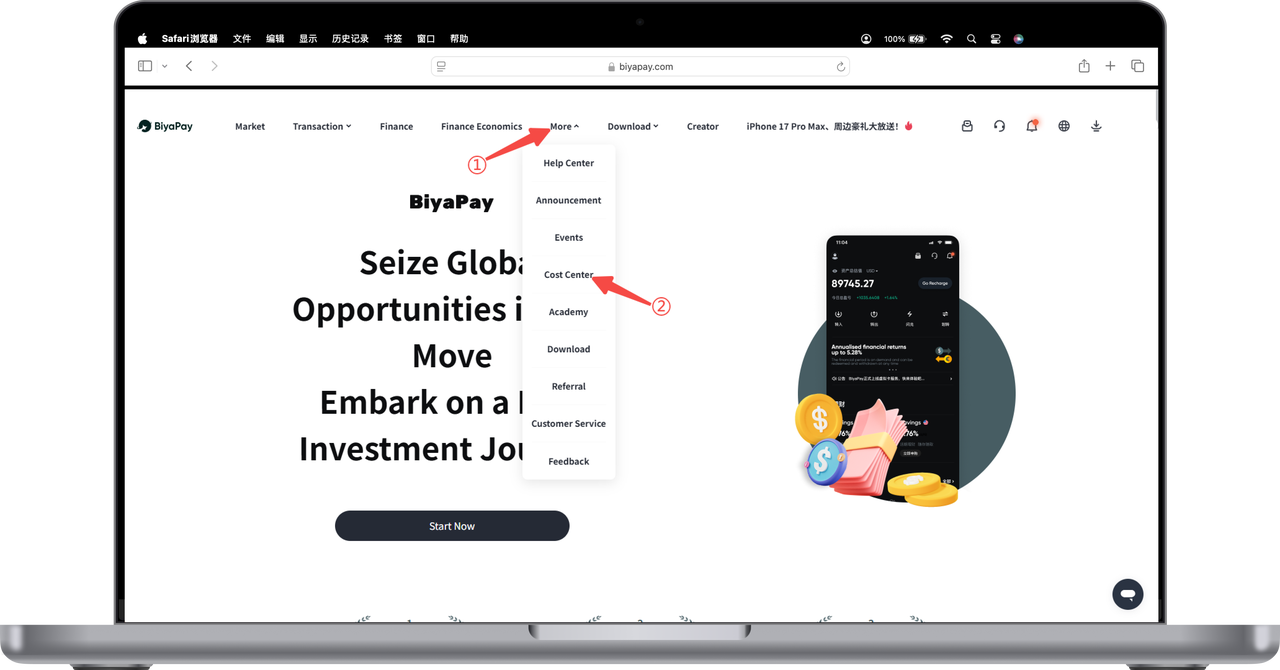

Maker: 0

Taker: 0.08%

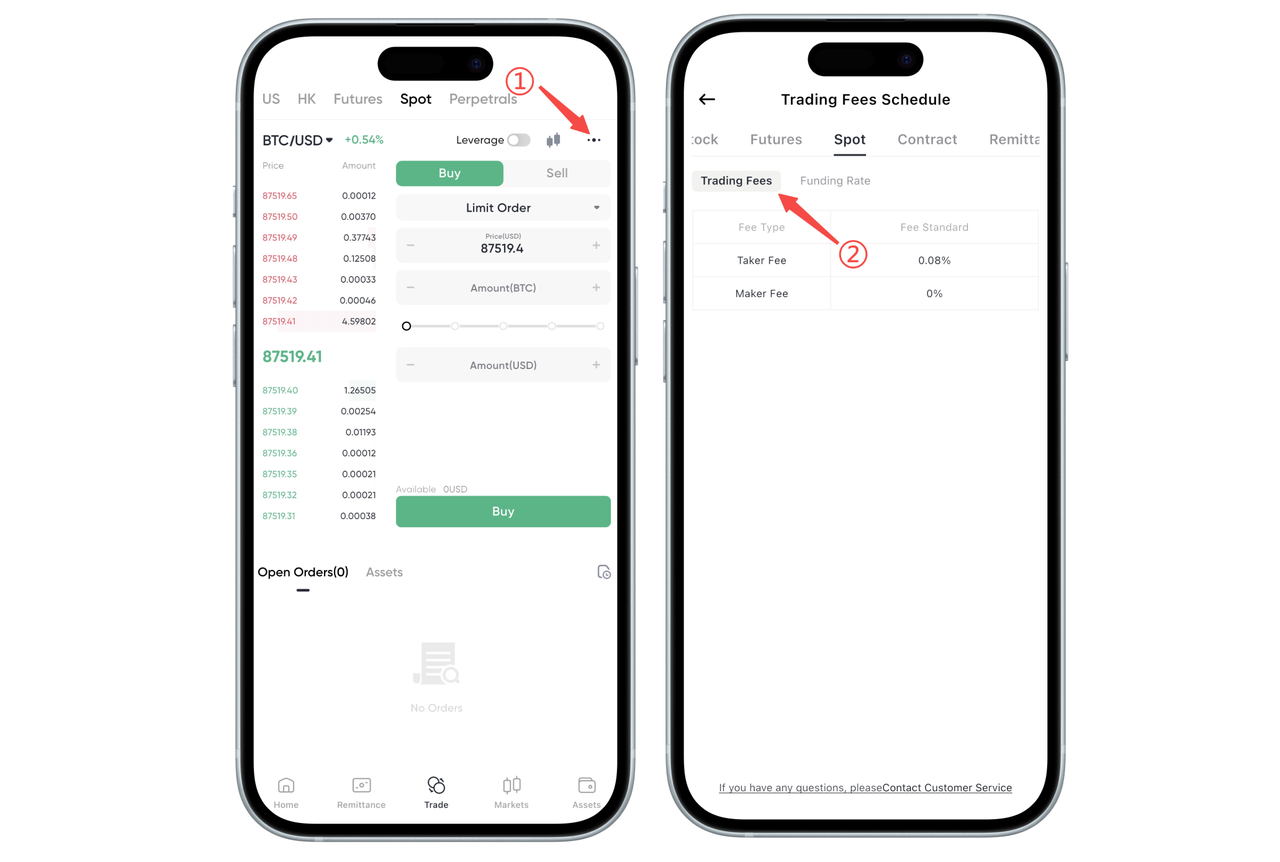

How to check digital currency spot trading fees and leverage fees on the Web:

The trading pairs and fee currencies listed below are all denominated in US dollars.

- Click on 【More】 at the top of the webpage - 【Fee Center】

- Click 【Spot】 - 【Trading Fees】 to view the digital currency spot trading fees and leverage fees.

In digital currency trading, "Maker" and "Taker" are two different trading roles representing liquidity providers and liquidity consumers respectively. Understanding these two roles is crucial for comprehending trading fees and the trading process. Below are their definitions and examples:

Maker

Definition: A Maker is a user who places orders on the trading platform that do not execute immediately but enter the order book waiting to be matched with other orders. Because these orders add liquidity to the market, users who place such orders are called Makers. Typically, Makers enjoy lower trading fees or sometimes even fee discounts to encourage more users to place orders.

Characteristics:

Provides liquidity: Maker orders enter the order book and wait to be matched with other orders, increasing market depth and liquidity.

Lower fees: Since Makers help maintain and enhance liquidity on the platform, trading platforms usually charge Makers lower fees.

Example:

If you place a limit sell order on an exchange at a price higher than the current market price for Bitcoin, the order will not execute immediately but will enter the order book. When the market price reaches or exceeds your set price, the order will be executed. At this point, you are a Maker.

Taker

Definition: A Taker is a user who accepts orders on the trading platform by immediately matching with existing orders in the order book. Because these orders reduce market liquidity, users who accept such orders are called Takers. Takers usually pay higher trading fees because they consume market liquidity.

Characteristics:

Consumes liquidity: Taker orders immediately match with existing orders in the order book, reducing market liquidity.

Higher fees: Since Takers consume market liquidity, trading platforms usually charge Takers higher fees.

Example:

If you place a market buy order on an exchange to buy Bitcoin immediately at the current market price, the order will execute instantly by matching with sell orders in the order book. At this point, you are a Taker.

Summary

Maker: Places orders that do not execute immediately, increasing market liquidity, and usually enjoys lower trading fees.

Taker: Immediately matches with existing orders in the order book, consuming market liquidity, and usually bears higher trading fees.

Understanding the roles of Maker and Taker is important for optimizing trading strategies and cost control. Different trading platforms may have different fee structures for these two roles, so it is wise to understand the relevant fees before trading.

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.