How to Go Long in Leveraged Trading?

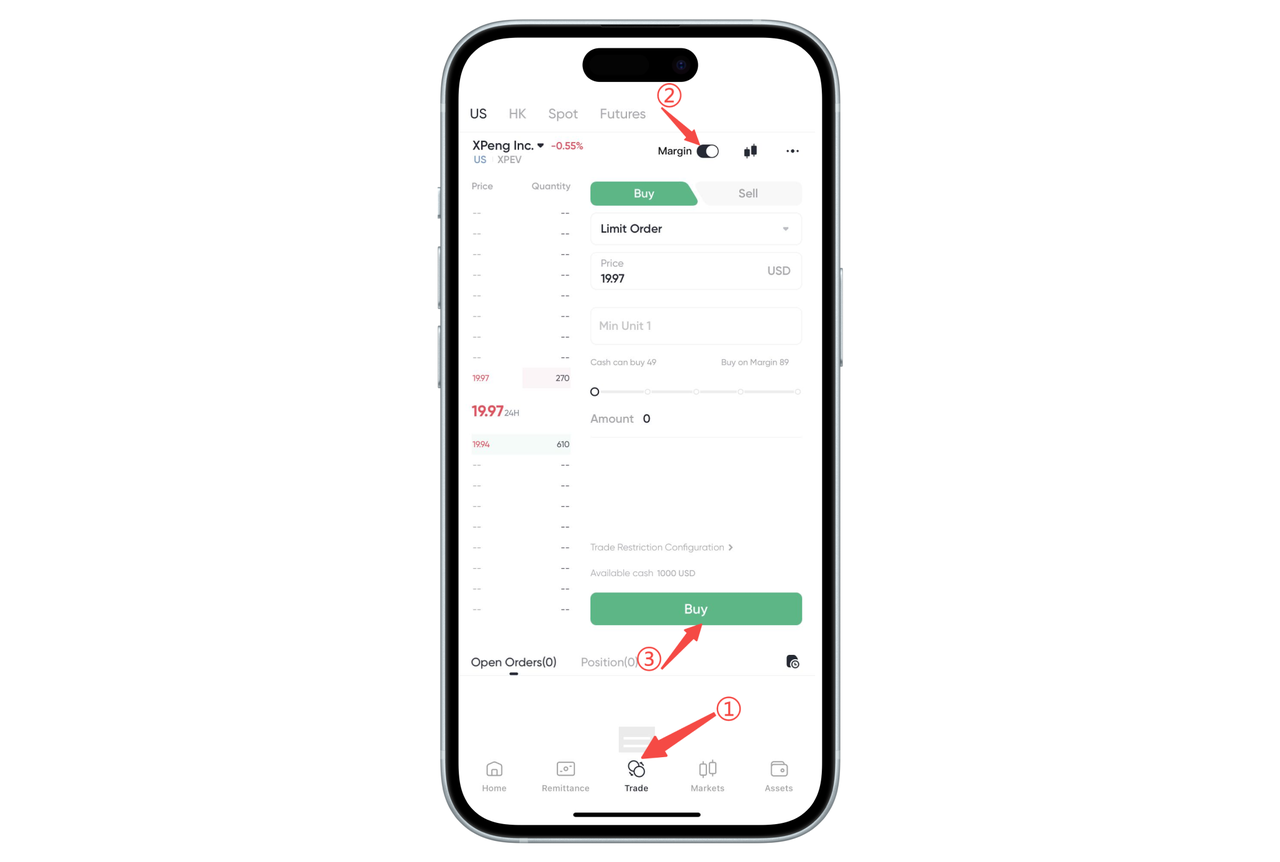

How to go long in leveraged trading on the App:

In leveraged trading, a "long" position means buying an asset at a low price and then selling it at a higher price. This way, you can earn profits from the price difference.

For example: If you believe the price of BTC will rise in the future, you can borrow USDT in your BTC/USDT margin trading to buy BTC at a relatively low price now. If the BTC price goes up, you can sell BTC to repay the USDT debt. Compared to regular spot trading, you can earn more profit. You can go long by borrowing and buying on the [Trading] page.

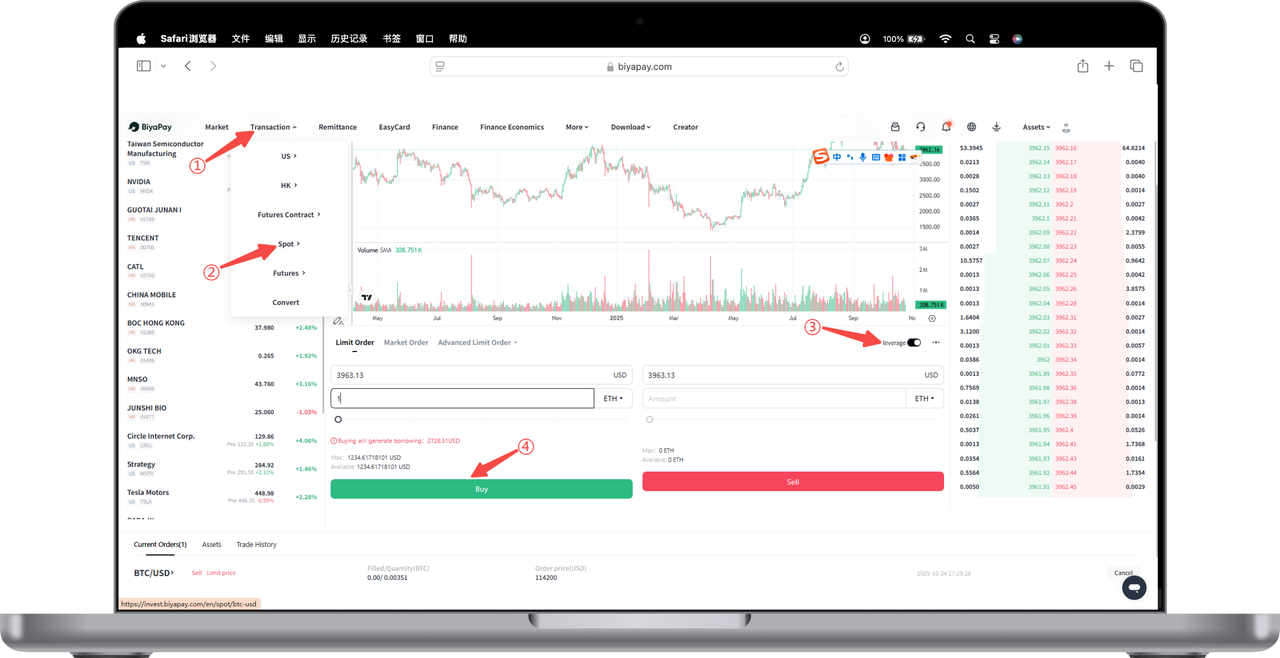

How to go long in leveraged trading on the Web:

In leveraged trading, a "long" position means buying an asset at a low price and then selling it at a higher price. This way, you can earn profits from the price difference.

For example: If you believe the price of BTC will rise in the future, you can borrow USDT in your BTC/USDT margin trading to buy BTC at a relatively low price now. If the BTC price goes up, you can sell BTC to repay the USDT debt. Compared to regular spot trading, you can earn more profit. You can go long by borrowing and buying on the [Trading] page.

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.