Which Order Types Does Spot Leverage Support?

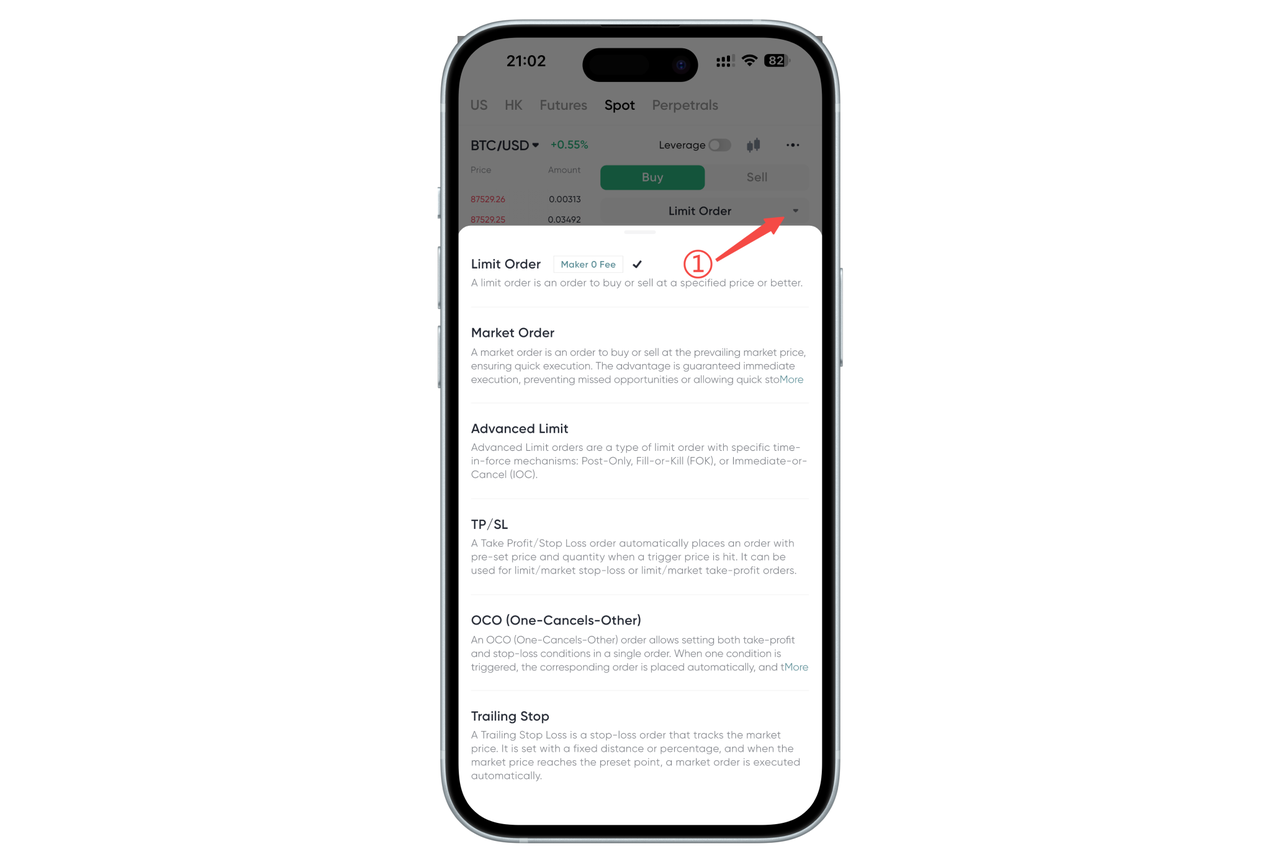

How to View Spot Leverage Order Types on the App:

To view the order types supported by BiyaPay’s spot leverage: click the arrow to the right of the order type to see the supported order types.

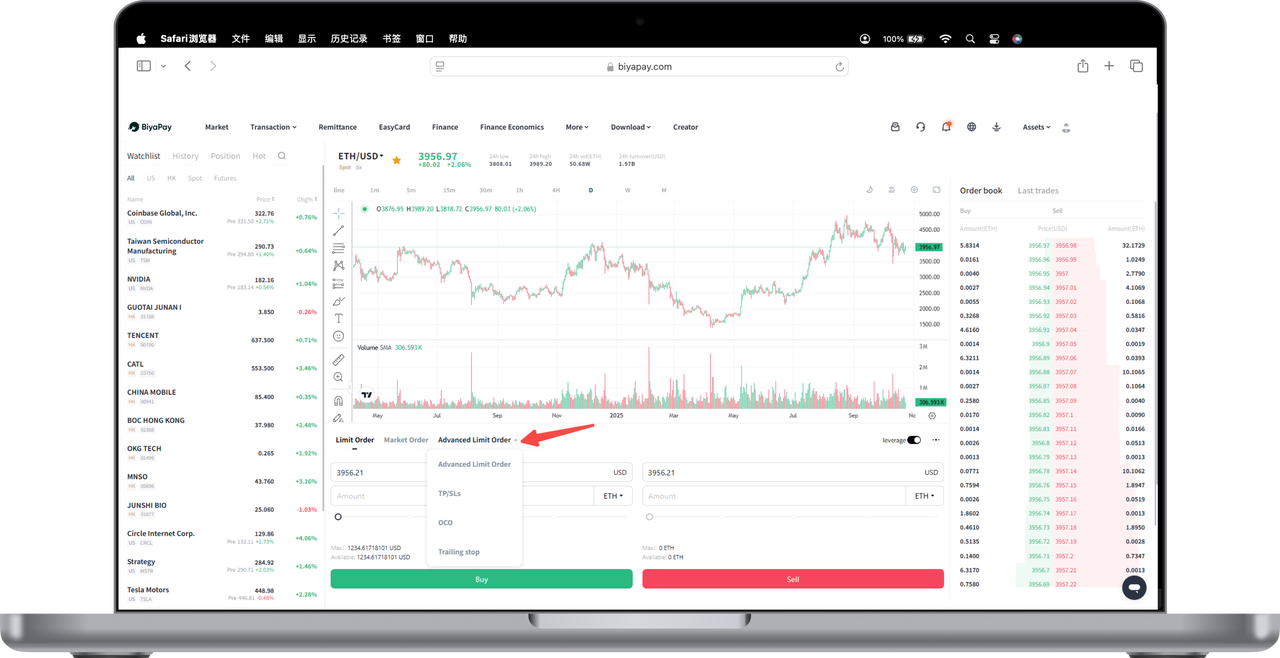

How to View Spot Leverage Order Types on the Web:

To view the order types supported by BiyaPay’s spot leverage: click the arrow to the right of [Advanced Limit] to see the supported order types.

In cryptocurrency trading, different order types allow traders to execute trades in various ways, each with its unique functions and applicable scenarios. Below are six common order types along with their definitions and examples:

- Limit Order

Definition: A limit order is when a trader sets a specific price to buy or sell cryptocurrency at that price or better. A buy limit order executes when the market price is at or below the set price; a sell limit order executes when the market price is at or above the set price.

Example:

- If the current Bitcoin price is $50,000 and you want to buy when the price drops to $49,000, you can set a buy limit order. The order will execute when the market price reaches $49,000 or lower.

- Market Order

Definition: A market order is when a trader buys or sells cryptocurrency immediately at the current market price. Market orders prioritize speed of execution over price.

Example:

- If you want to buy 1 Bitcoin immediately regardless of the current market price, a market order will execute the trade at the best available market price instantly.

- Advanced Limit Order

Definition: Advanced limit orders include additional conditions or trigger mechanisms, such as stop-limit orders. These orders automatically convert to limit orders when a specified trigger price is reached.

Example:

- You can set a sell stop-limit order that triggers a limit order to sell at $47,500 when Bitcoin’s price falls to $48,000. This helps limit losses during a market downturn.

- Take Profit and Stop Loss

Definition: Take profit and stop loss orders allow traders to set price levels at which to automatically sell to lock in profits (take profit) or minimize losses (stop loss). These orders help manage trading risk during market fluctuations.

Example:

- Suppose you bought Bitcoin at $50,000. You can set a take profit order to sell at $55,000 to lock in profits, and a stop loss order to sell at $48,000 to reduce potential losses.

- OCO (One Cancels the Other)

Definition: OCO orders allow traders to set both take profit and stop loss orders simultaneously. When one order is triggered, the other is automatically canceled. This order type helps protect trades within a specific price range.

Example:

- If you bought Bitcoin at $50,000, you can set an OCO order to sell at $55,000 to lock in profits or at $48,000 to limit losses. Once the market price hits one of these levels, the other order is canceled automatically.

- Trailing Stop Order

Definition: A trailing stop order is a dynamically adjusting stop loss order. As the market price moves, the stop loss price automatically adjusts based on a set trailing amount or percentage. It helps traders lock in more profits during trending markets while limiting potential losses.

Example:

- If you bought Bitcoin at $50,000 and set a 5% trailing stop order, when the price rises to $52,500, the stop loss price automatically adjusts to $50,375. If the market continues to rise, the stop loss price keeps moving up; if the market reverses and falls to the stop loss price, the order executes.

Understanding and mastering these order types can significantly improve trading efficiency and risk management. Each order type has specific use cases and advantages, so traders should choose the appropriate order type based on market conditions and personal strategies.

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.