How to view BiyaPay licenses?

Currently, BiyaPay entities in the United States, Canada, and New Zealand have obtained securities and currency-related service qualifications. The names and query methods of entities in each country are as follows:

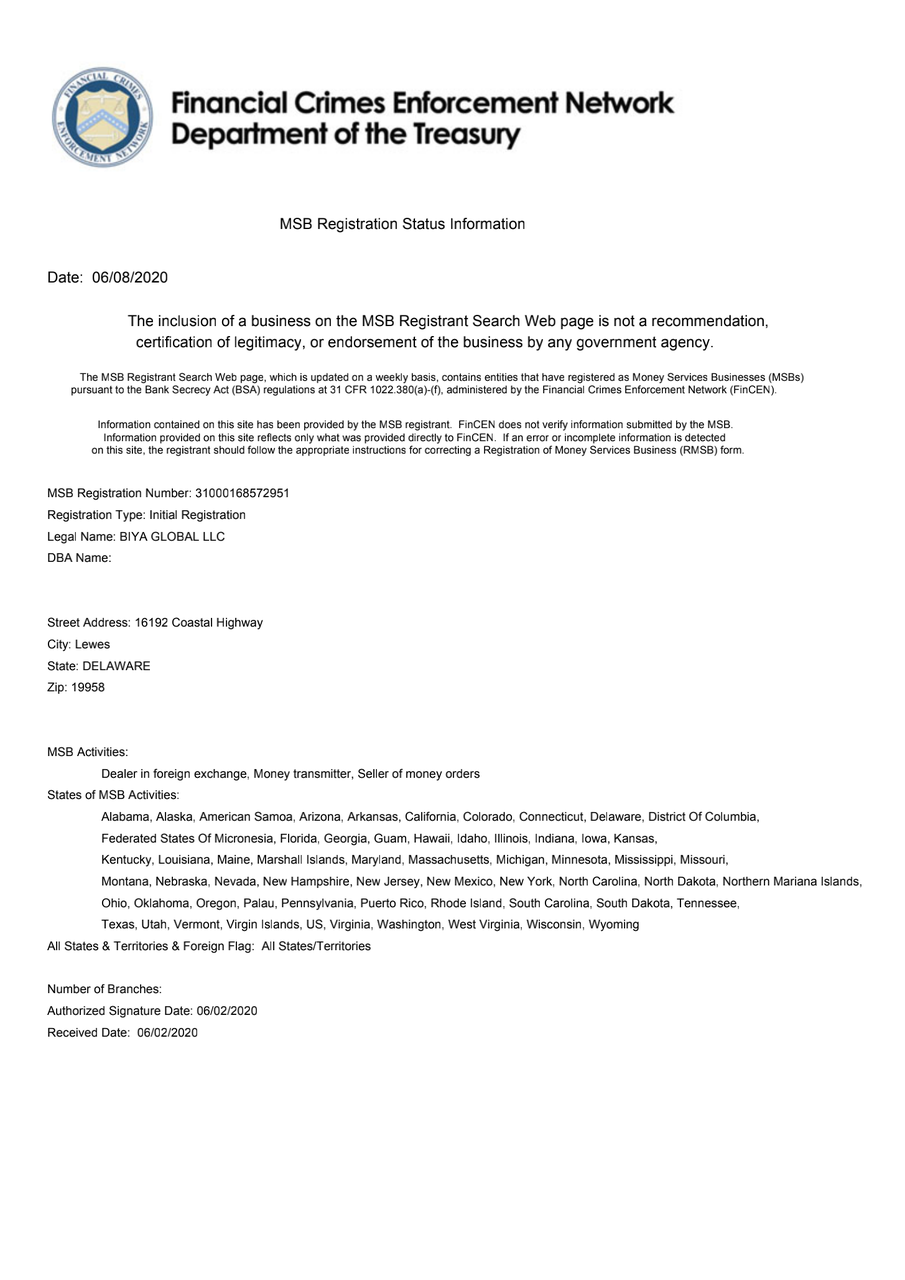

US Money Service Provider (MSB)

You can enter the company name at the following website: BIYA GLOBAL LLC to query.

https://www.fincen.gov/msb-state-selector

Canadian Money Service Provider (MSB)

You can enter the company name on the following website: BIYA GLOBAL LIMITED to query.

https://www10.fintrac-canafe.gc.ca/msb-esm/public/msb-search/search-by-name/

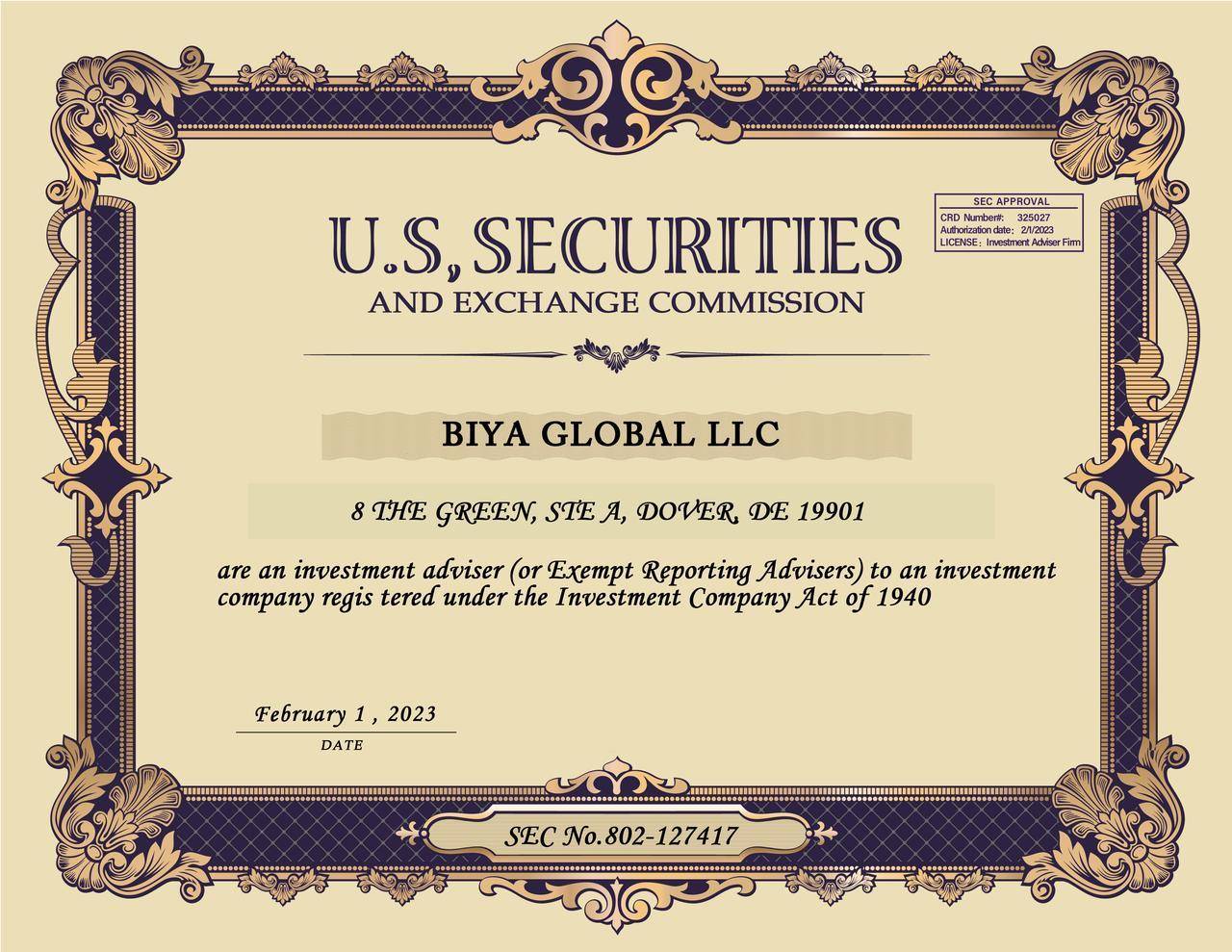

Registered Investment Advisor (RIA) under the U.S. Securities and Exchange Commission (SEC)

You can enter the company name on the following website: BIYA GLOBAL LLC to query.

https://adviserinfo.sec.gov/firm

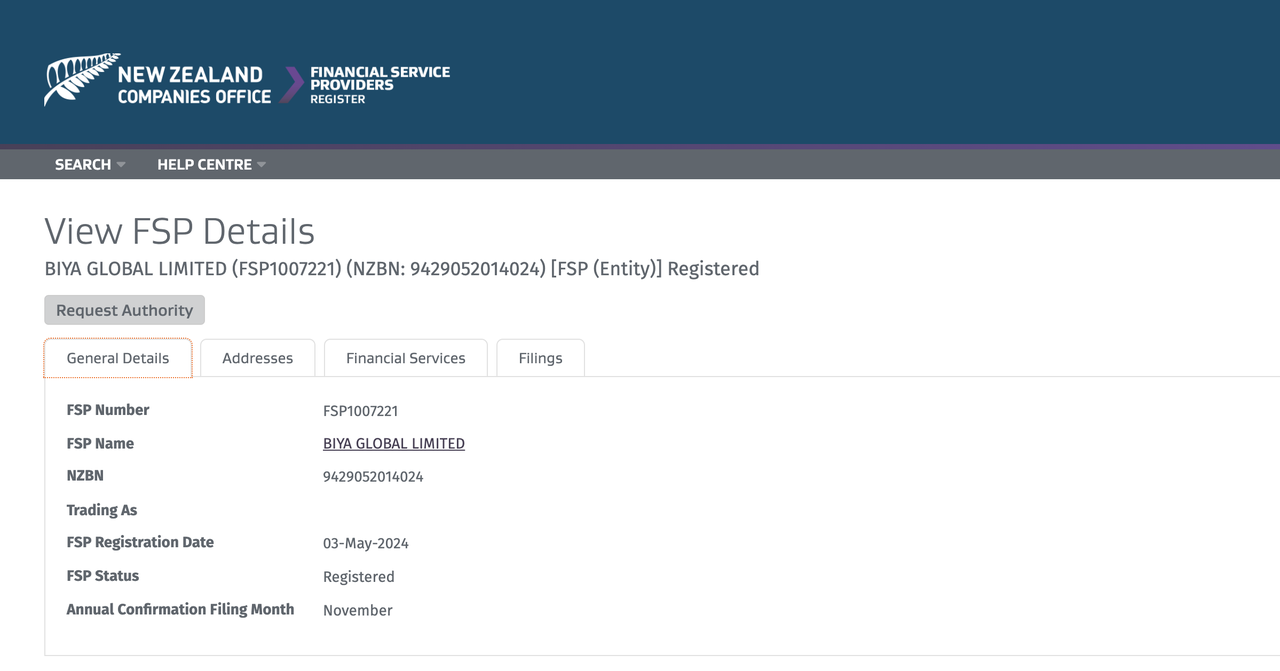

New Zealand Financial Services Provider (FSP)

Users can make inquiries on the New Zealand FSP official website:

Step 1: Open the FSP homepage: https://fsp-register.companiesoffice.govt.nz/

Step 2: Click Search for a financial service provider on the homepage, then enter BiyaPay’s FSP number: FSP1007221, and click Search

Step 3: Click on the search results to see detailed regulatory information.

7. Prevent Fraud (Complete)

*1. What are the common fraud behaviors (modified)

BiyaPay official customer service will only answer questions about user authentication, information supplementation, and business consultation, but will never ask for your account number, password, verification code, or any private information, nor will it perform account operations on your behalf. All transactions will only be conducted within the App. If anyone pretends to be BiyaPay customer service and asks for your account or asset information for transfers or private transactions, it is considered fraud. Please be alert immediately and contact customer service to send an email for verification!

You may be exposed to various forms of fraud. Here are some common scams and tips on how to protect against them:

- Phishing Emails and Websites

Behavior description

- Scammers use fake emails or websites to trick users into entering their login information, passwords, and other sensitive information.

- These phishing emails often look like official communications from BiyaPay and contain fake urgent messages or reward links.

Precautions

- Check Sender Address: Make sure the email is indeed coming from BiyaPay’s official domain.

- Do not click on suspicious links: Do not click on any suspicious links; directly enter the BiyaPay URL in the browser to visit.

-

Enable Two-Factor Authentication (2FA): Increase the security of your account and prevent unauthorized access.

-

Fake Customer Support

Behavior description

- Scammers pretend to be BiyaPay customer service and contact users via phone, email, or social media, asking for account information or transfers.

- These scams often claim to require verification of information or resolution of account issues.

Precautions

- Verify identity: Contact customer support through official channels (such as BiyaPay official website or official application) to verify the identity of the customer service staff.

-

Don’t provide sensitive information: Real customer service will never ask for passwords or 2FA codes.

-

Investment Scams

Behavior description

- Scammers claim to provide high-return investment opportunities and encourage users to transfer or invest through the BiyaPay platform.

- These scams are often promoted via social media, forums, or direct messages.

Precautions

- Doubt the promise of high returns: If an investment opportunity promises high returns with no risk, it is usually a scam.

-

Independent Verification: Conduct independent research and verification before investing and do not rely on a single source of information.

-

Fake Giveaways and Rewards

Behavior description

- Scammers post fake giveaways or rewards, asking users to provide personal information or transfer money to receive rewards.

- These events are often promoted through social media or fake websites.

Precautions

- Verify the authenticity of the activity: Verify the authenticity of the activity through BiyaPay’s official website or official channels.

-

No Sensitive Information: Do not provide passwords or transfer funds to participate.

-

Malware and Viruses

Behavior description

- Scammers infect users’ devices with malware or viruses to steal login information and other sensitive data.

- These malware are usually spread through downloading suspicious files or visiting unsafe websites.

Precautions

- Install antivirus software: Keep antivirus software and firewalls on your device turned on and updated.

-

Don't download suspicious files: Avoid downloading or opening suspicious email attachments or files.

-

Social Engineering Attacks

Behavior description

- Scammers use psychological manipulation or social skills to gain a user's trust and then request sensitive information or funds.

- These attacks can be carried out via phone calls, emails, or face-to-face interactions.

Precautions

- Be Alert: Be wary of requests from strangers, especially requests involving personal information or money.

-

Verify Identity: Verify the requester's identity through independent channels before providing information.

-

Account Takeover

Behavior description

- Scammers use various means to obtain user account information and control the account for illegal transactions or transfer of funds.

- Account hijacking is often accomplished through phishing, malware, or weak password attacks.

Precautions

- Use strong passwords: Set a strong password and change it regularly.

- Enable Two-Factor Authentication (2FA): Adds an extra layer of security to prevent account hijacking.

By understanding these common fraud behaviors, BiyaPay users can be more vigilant and take corresponding preventive measures to protect the safety of their accounts and funds. Always obtain information and support through official channels, do not trust promises of high returns, and maintain good security habits are effective ways to prevent fraud.

*2. How to prevent fraud

Preventing fraud requires vigilance and multiple layers of security measures. Here are some common ways to protect against scams:

-

Protect personal information

-

Don't leak personal information: Don't disclose sensitive personal information, such as ID number, bank account number, password, etc., on untrusted websites or social platforms.

-

Handle emails and phone calls with caution: Do not click on links or attachments in emails at will, and do not easily disclose personal information on the phone.

-

Use strong passwords and two-factor authentication

-

Create strong passwords: Use complex passwords that include uppercase and lowercase letters, numbers, and special characters, and avoid using personal information that is easily guessed.

- Change passwords regularly: Change passwords for important accounts regularly to prevent passwords from being exposed for a long time.

-

Enable Two-Factor Authentication (2FA): Where possible, enable two-factor authentication to provide additional security for your account.

-

Verify identity

-

Confirm Source: Confirm the identity of the other party before providing information or making a transaction. The identity of the other party can be verified through official channels or third parties.

-

Beware of Fake Customer Service: Official customer service will not ask for your password or verification code by phone or email.

-

Be wary of promises of high returns

-

Suspicious of High Returns: If an investment or trading opportunity promises high returns with no risk, it is usually a scam.

-

Independent Research: Before investing or trading, conduct independent research and verification and do not rely on a single source of information.

-

Protect equipment and networks

-

Install antivirus software: Install antivirus software on your computers and mobile devices and keep it updated.

-

Use a secure network: Avoid conducting sensitive transactions on public Wi-Fi networks and use an encrypted private network or a VPN.

-

Monitor Account Activity

-

Check accounts regularly: Check bank accounts and credit card statements regularly to detect and report suspicious transactions in a timely manner.

-

Set notifications: Set up account activity notifications to keep abreast of all transaction activities on your account.

-

Education and Awareness

-

Keep information updated: Understand the latest fraud methods and preventive measures, and improve prevention awareness.

-

Share Experience: Share your fraud prevention experience and knowledge with family and friends to raise awareness together.

-

Be cautious with Internet links and downloads

-

Don’t click on links at will: Don’t click on links from unknown sources or download suspicious attachments.

-

Use official channels: Download apps through official app stores and avoid using third-party sources.

-

Important operations for double verification

-

Large-value transfer verification: When making large-value transfers or important operations, verify the identity of the other party through multiple channels.

-

Confirm transaction details: Before confirming any transaction, carefully check the transaction details to ensure they are correct.

-

Report suspicious activity

-

Contact Official: When encountering suspicious activities, promptly contact the official customer service of the relevant platform or organization to report it.

- Call the police: If you find that you have become a victim of fraud, call the police immediately and provide relevant evidence.

By taking the above measures, you can effectively prevent various types of fraud and protect the security of personal information and property. Vigilance and good security habits are key to preventing scams.

*3. How to file a complaint

If you encounter problems or fraud when using BiyaPay or other services, you can contact BiyaPay customer service to make a complaint:

Online Customer Service

- Official website or in-app: Visit BiyaPay’s official website or open the BiyaPay app and find the customer service support option.

- Official Email: Send a detailed complaint email to BiyaPay’s customer service email. Be sure to include your account information, description of the problem, and relevant screenshots or files in the email.

- Customer service email: service@biyapay.com

The validity of your complaint depends on the detail and accuracy of the information you provide. Through the above steps, you can clearly express your problem and seek a fair and timely solution. If you need further help or advice during the complaint process, please feel free to seek support from friends, family, or legal counsel.

8. Close account (completed)

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.