Why U.S. and Hong Kong stocks are reliable - throw order demo

Every BiyaPay U.S. & Hong Kong Stock Order Is Routed to the Exchange in Real Time

When trading U.S. or Hong Kong stocks, what investors care about most is often not short-term price moves, but a more fundamental question:

Was my order actually sent to the exchange for matching?

Or was it filled internally on the platform?

This concern is especially common in illiquid or low-volume stocks. If users cannot see their own orders reflected in the order book on other broker platforms, it’s easy to start doubting.

In this article, we will run a replicable, side-by-side demonstration to clearly show whether:

BiyaPay’s U.S. and Hong Kong stock orders are genuinely and instantly routed to the exchange for execution.

A Key Premise: Why Do Different Brokers Show the Same Market Data?

Whether you trade via Interactive Brokers (IBKR), Tiger Brokers, Futu, or BiyaPay, U.S. and Hong Kong stock trading follows the same principles:

1、All buy and sell orders are ultimately sent to the exchange for centralized matching.

2、Quotes, order book depth, and time & sales data come from the same source.

3、There is no such thing as “each platform matching orders internally” as a separate market.

So if an order truly reaches the exchange, then:

Your placed order and your cancellation should be visible in the order book on other major brokers.

Demonstration Method

To avoid the difficulty of observing order book changes in highly liquid, actively traded stocks (where orders get filled too quickly), we deliberately selected a Hong Kong stock with the following characteristics:

Almost no trading volume

No visible order book depth

No time & sales prints

This makes any newly placed order—or cancellation—clearly visible and easy to verify in the order book.

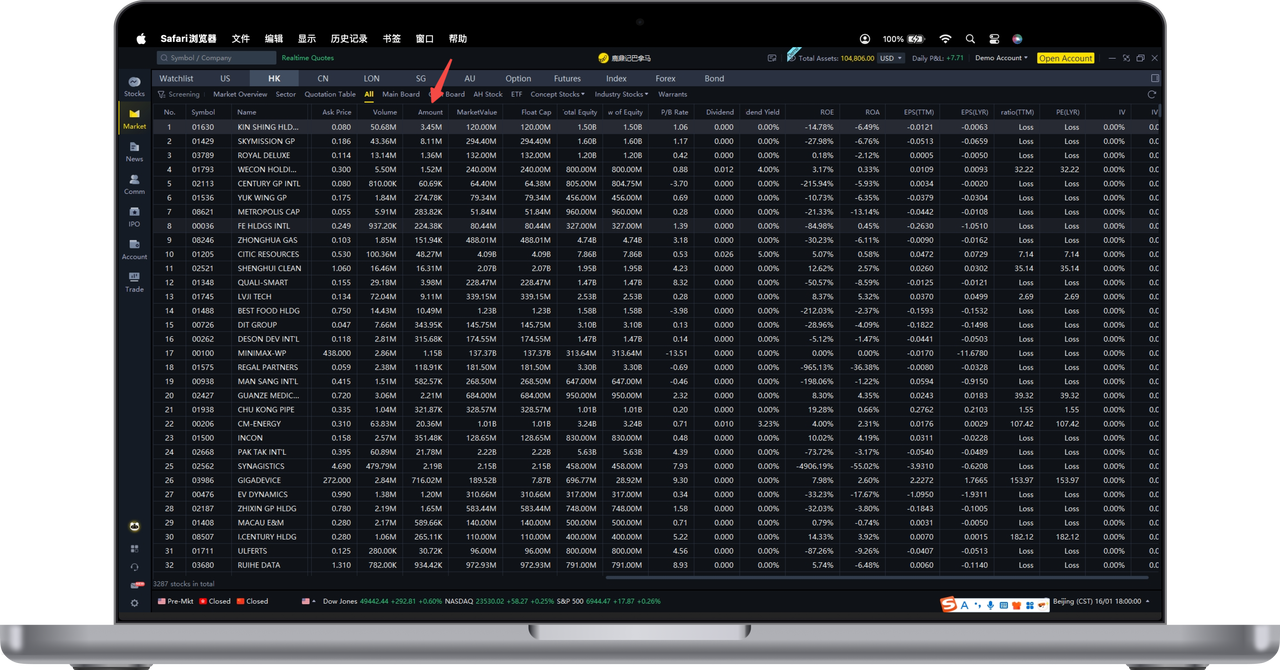

1. Before Placing the Order: No Trades, No Bid Orders in the Market

Before starting the demonstration, we checked the selected stock on both another brokerage platform and BiyaPay:

1.The price showed no change

2.The bid and ask order book was empty

3.There were no time & sales records

At this point, the market data on both platforms was completely identical, and the market was effectively in a “static” state.

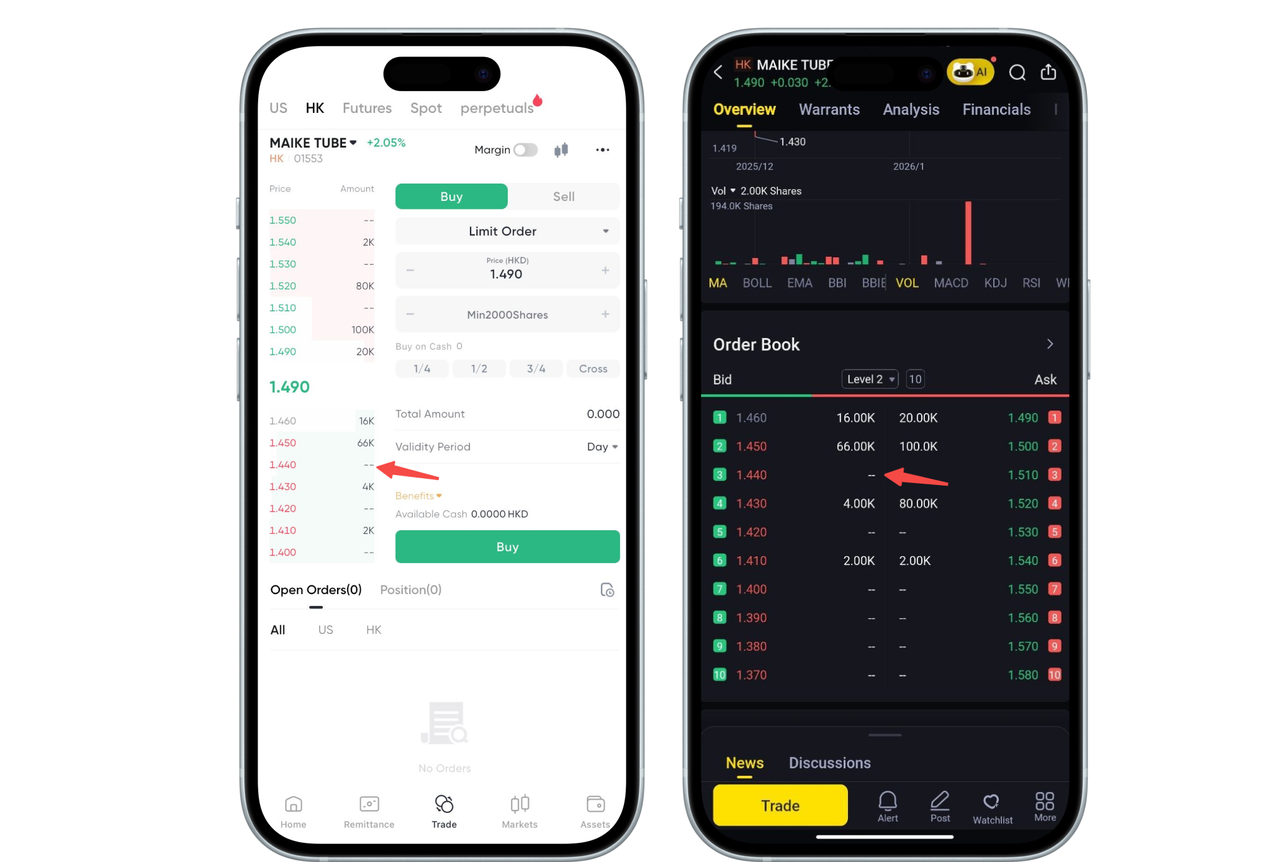

2. Placing the Order on BiyaPay: The Order Appears Simultaneously in the Order Book

Next, we placed a limit buy order on BiyaPay:

1.Price: HKD 1.44

2.Quantity: 2,000 shares

After the order was submitted, we switched to the order book on another brokerage platform and could clearly observe the following:

1.A best bid appeared at HKD 1.44 / 5,000 shares

2.The price and quantity exactly matched the order placed on BiyaPay

3.The time difference between the order book updates on both platforms was approximately 1 second

This confirms that the order was sent to the exchange’s matching system in real time.

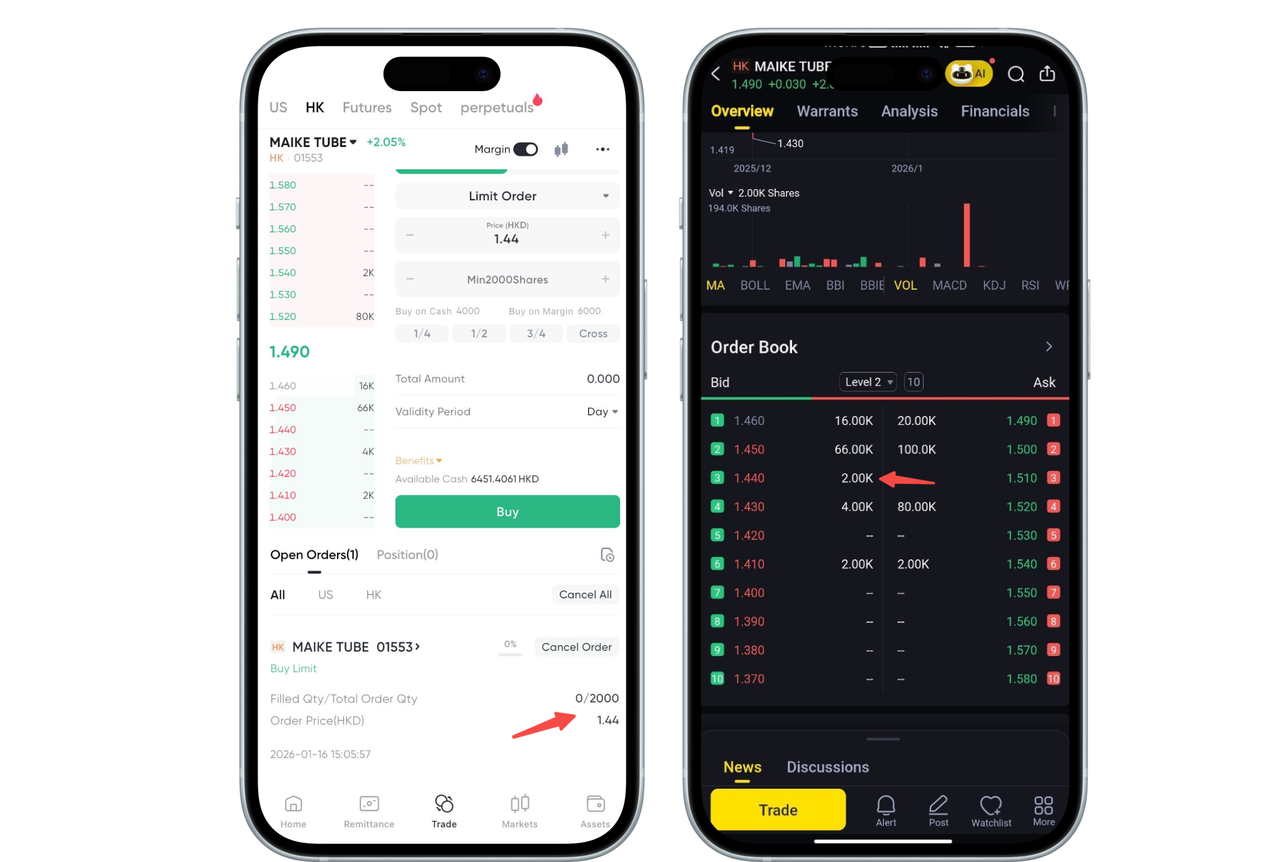

3. Order Cancellation Verification: Immediate Change in the Order Book

Next, we canceled the order on BiyaPay.

Almost simultaneously, on the order book of the other brokerage platform:

The original best bid order disappeared

The best bid price changed accordingly

This step serves as a critical reverse verification:

If the order had not been a real exchange-level order, the cancellation could not have simultaneously altered the order book structure on other brokerage platforms.

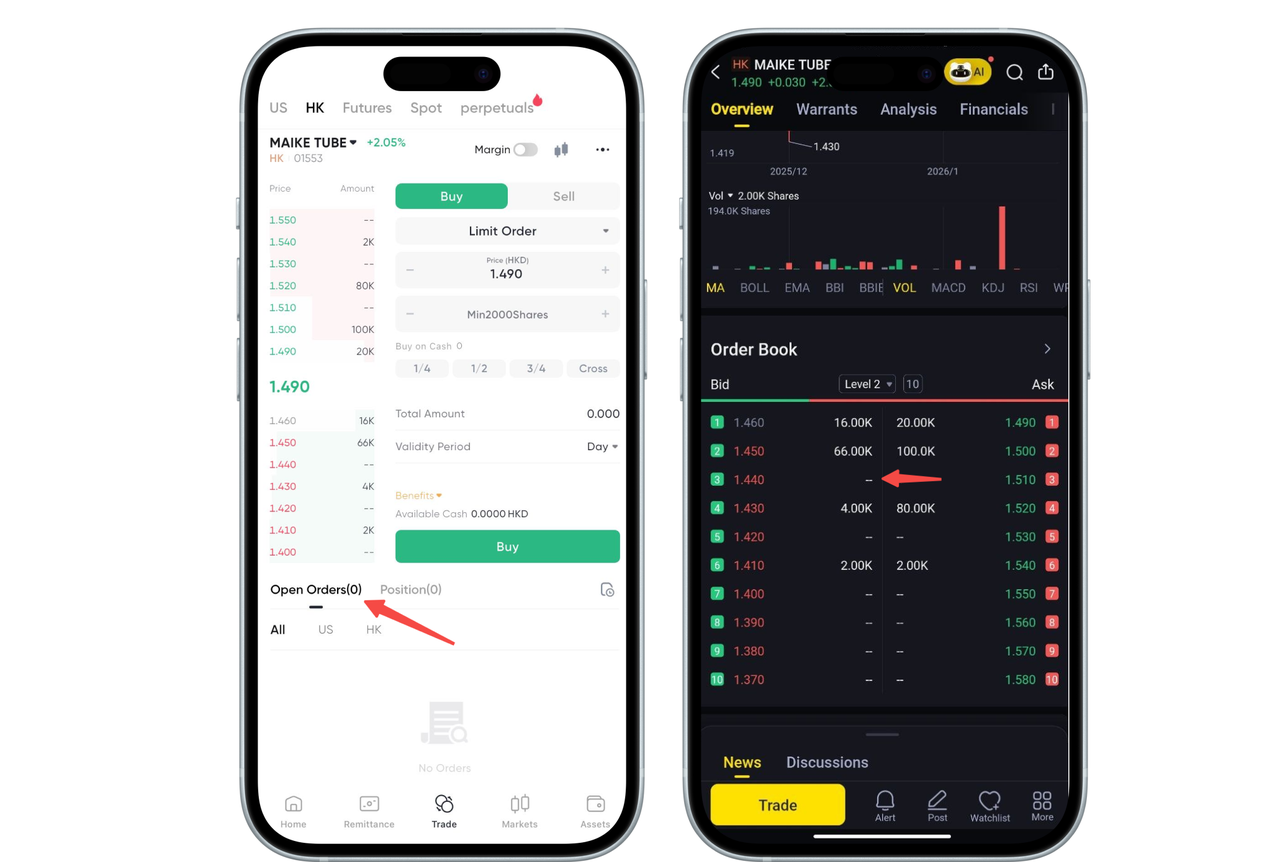

Demonstration Conclusion

Based on the above demonstration, we can clearly confirm that:

BiyaPay’s U.S. and Hong Kong stock orders are genuinely routed to the exchange

Order placement and cancellation are synchronized in real time

Orders enter the centralized exchange matching system, rather than being filled internally

There is no dealing-desk, internal matching, or “platform versus user” mechanism

Any user can replicate this process to verify it independently.

Friendly Reminder

When testing with highly liquid stocks such as Apple or Tesla, individual orders may be quickly absorbed due to heavy trading activity, making order book changes difficult to observe.

For clearer verification, we recommend choosing thinly traded stocks with clean order books when conducting your own tests.

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.