Beginner's Guide to US Certificates of Deposit: Comparing Rates and Flexible Options from the Four Major Banks

Image Source: pexels

If you are looking for stable returns in the US, a US certificate of deposit (CD) is an excellent option. You can lock in your funds for a period of time in exchange for higher fixed interest than a regular savings account.

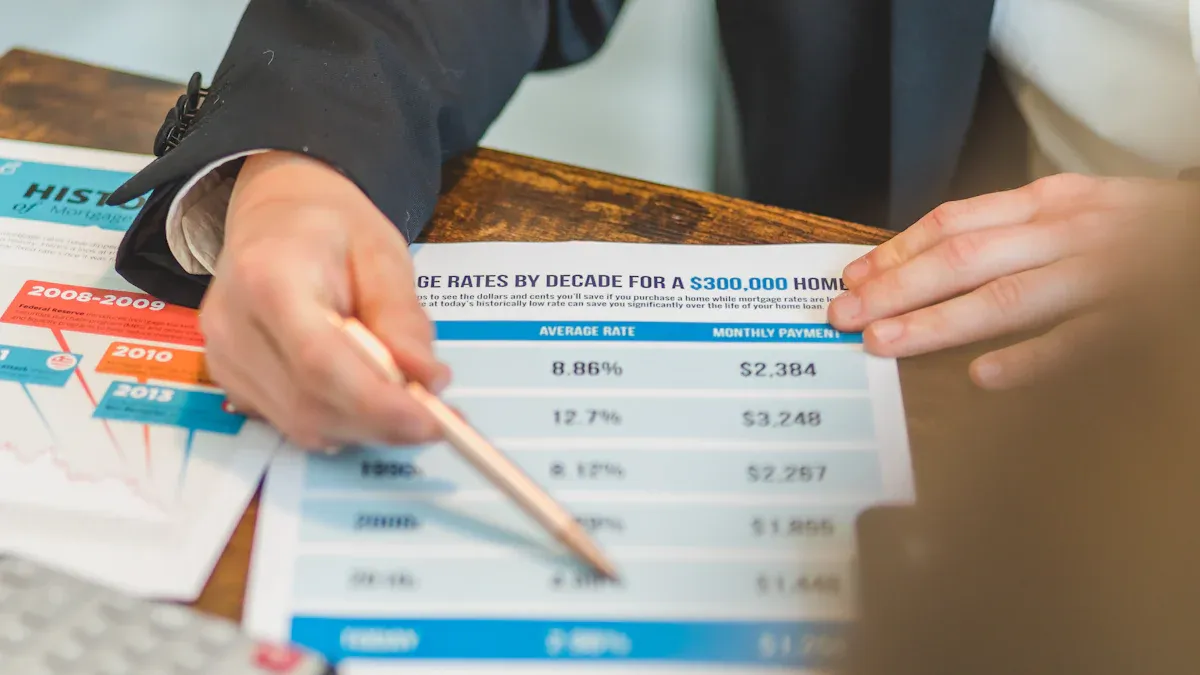

Here is an overview of standard CD rates from the four major US banks to give you a quick grasp of the market situation:

| Bank Name | Highest APY | Corresponding Term | Minimum Deposit Requirement |

|---|---|---|---|

| Chase | up to 4.00% | certain featured terms | $1,000 |

| Bank of America | up to 3.25% | certain featured terms | $1,000 |

| Citibank | around 3-4% | various terms | $500 |

| Wells Fargo | up to 3.75% | special fixed rate terms | $5,000 |

Expert Tip: Some banks’ standard CD rates can reach higher APY in promotions. If you have a checking account at the same bank, you may have the opportunity to get higher relationship rates.

In addition to traditional banks, online banks and credit unions also offer very attractive high-rate plans.

Key Points

- US certificates of deposit provide stable returns with rates higher than regular savings accounts, but funds are locked for a period.

- The four major banks offer different CD plans; you can get higher “relationship rates” by linking a checking account or through membership programs.

- Online banks and credit unions usually offer higher CD rates because their operating costs are lower.

- High-yield savings accounts provide fund flexibility but with variable rates; no-penalty CDs allow early withdrawal while locking in the rate.

- Prepare identification documents before opening an account, and understand that APY is the most accurate way to compare CD products; interest on CDs for non-US residents is usually tax-exempt.

US Certificates of Deposit: Rate Comparison of the Four Major Banks

Image Source: pexels

Although online banks offer higher rates, the four major traditional banks remain the first choice for many due to their convenience and extensive physical branches. As long as you make good use of their membership programs, you can also get rates up to around 4% APY or higher. Next, we will analyze each bank’s plans in depth.

Chase: Unlock Relationship Rates

Chase Bank offers competitive promotional rates, but you need to actively seek them and meet specific conditions. Its standard rates are usually very low, for example, standard rates for 6-month and 1-year terms are only 0.01% APY. However, by linking a qualifying checking account, you can unlock much higher “relationship rates”.

To get Chase’s relationship rates, you must meet one of the following conditions:

- Have an associated JPMorgan personal checking account.

- Link a qualifying JPMorgan business checking account, such as Chase Business Complete Checking®.

Expert Tip: Chase’s relationship rates are particularly attractive in promotional activities for specific terms. Before opening an account, be sure to confirm with a bank specialist if there are current relationship rate offers for new funds—this is key to getting high yields.

Bank of America: Preferred Rewards Program Bonus

Bank of America’s strategy is similar to Chase, offering rate bonuses through its “Preferred Rewards” membership program. Your membership level is determined by your total assets at Bank of America and Merrill Lynch—the higher the level, the more rate bonus you get on CDs. This means that if you are a loyal customer of the bank, your savings will get better returns.

In addition, if you seek more fund flexibility than traditional US certificates of deposit, consider Bank of America’s Rewards Money Market Savings Account. This account combines the flexibility of a savings account with higher rates close to CDs, especially suitable for Preferred Rewards members.

Citibank: Different Deposit Tier Rates

One major advantage of Citibank is that many branches offer Chinese-speaking staff, which is very convenient for Chinese users with no communication barriers.

In terms of rate structure, Citibank’s CD rates vary by deposit term and amount. Generally, the minimum deposit requirement is $500, but higher in some regions. For example, opening an account in California requires at least $1,000. The chart below shows rates for different terms; you can see that rates for specific terms (such as 13 months) stand out.

Important Reminder: Citibank’s minimum deposit requirements vary by state. If your deposit amount exceeds $10,000, you usually need to visit a branch in person. It is best to confirm specific requirements with your local branch before opening an account.

Wells Fargo: Special CD Plans

Wells Fargo offers “special fixed rate CD plans” in addition to standard CDs, which usually provide higher rates than standard US certificates of deposit. Special CDs have unique terms, such as 4 months or 11 months, and also have relationship rates.

As long as you link a qualifying Wells Fargo checking account (such as Prime Checking), you can get higher relationship rates.

| Special Fixed Rate Term | Standard APY | Relationship APY |

|---|---|---|

| 4 months | around 4.00% | higher |

| 7 months | around 3.75% | higher |

| 11 months | around 3.50% | higher |

This plan is very suitable for depositors who want to lock in higher rates in the short term and are already Wells Fargo customers.

Seeking Higher Returns: Full Analysis of Flexible High-Yield Options

Image Source: unsplash

Although the four major banks offer convenience, if you are willing to explore other options, you can usually find plans with better rates. Institutions like online banks and credit unions often provide more attractive rates due to lower operating costs, passing the savings back to customers.

High Rates from Online Banks (e.g., Axos Bank)

Online banks are the top choice for finding high-rate CDs. With no physical branch operating costs, they usually offer rates far higher than traditional banks.

Take Axos Bank as an example; its CD rates have always been competitive in the market. You can complete the account opening entirely online, with a simple and fast process. For depositors who do not need in-person services and pursue the highest returns, online banks are an excellent choice.

Expert Tip: Before opening an online bank account, confirm if it is insured by the Federal Deposit Insurance Corporation (FDIC). This ensures your deposits up to $250,000 are safe.

Surprise High Rates from Credit Unions

Credit unions are another place that may hide high-rate treasures. They are non-profit organizations serving specific community members. Sometimes, to attract new funds, credit unions may launch short-term but extremely high-rate promotions, with annual percentage yields (APY) potentially reaching higher levels.

However, joining a credit union usually requires meeting specific membership qualifications, such as living in a certain area, working for a specific company, or belonging to an organization.

Fortunately, many credit unions offer very lenient joining methods. Take Alliant Credit Union as an example; you can become a member in the following ways:

- Charitable Support: Anyone can apply to join by supporting the Alliant Credit Union Foundation. Alliant will even pay the $5 donation for you, making almost all US residents eligible.

- Family Relationship: If you are an immediate family member or domestic partner of an existing member.

- Geographic Location: If you live or work in a qualifying community near Chicago.

Flexibility Advantage of High-Yield Savings Accounts (HYSA)

If you have idle money but are unsure if you will need it in the short term, a high-yield savings account (HYSA) may be a more suitable choice than a US certificate of deposit.

The core difference between HYSA and CD lies in “rate stability” and “fund flexibility”:

- High-Yield Savings Account (HYSA): Rates are variable and change with Federal Reserve interest rate policies. The advantage is that funds can be accessed anytime without term restrictions.

- Certificate of Deposit (CD): Rates are locked at opening and unaffected by market fluctuations. The disadvantage is that funds cannot be freely used before maturity, or penalties apply.

In recent years, Federal Reserve rate adjustments have directly affected HYSA yields. When the Fed raises rates, HYSA rates usually rise; conversely, if the market expects rate cuts, HYSA rates may fall.

No-Penalty CDs

Want to lock in high rates while retaining fund flexibility? “No-penalty CDs” provide the best of both worlds. They are essentially CDs that let you enjoy fixed rates but allow early withdrawal under specific conditions without penalties.

For example, Ally Bank’s no-penalty CD has an 11-month term with no minimum deposit requirement. You can withdraw the full principal and interest anytime starting the sixth day after funding, with no penalty.

However, when using no-penalty CDs, note the following common rules:

- Waiting Period: Usually, you need to wait a period (e.g., seven days) after initial deposit before penalty-free withdrawal.

- Full Withdrawal: In most cases, you must withdraw the entire account balance at once, partial withdrawals not allowed.

- Account Closure: Early withdrawal may cause the CD account to close automatically.

This option is especially suitable for depositors who expect rates may fall, want to lock in current high rates first, but do not want to completely lose fund liquidity.

CD Account Opening Practice: Requirements, Process, and Tax Matters

After understanding each bank’s plans, the next step is actual account opening. This process is not complicated; as long as you prepare documents and understand a few key terms, you can complete it smoothly.

Required Documents Checklist for Opening an Account

Whether opening online or in-branch, the bank needs to verify your identity. Prepare corresponding documents based on your status:

- US Citizens or Residents:

- Personal Information: Including name, date of birth, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Government-Issued Valid ID: Such as driver’s license or passport.

- Funding Source: Bank account and routing number for transfer.

- Foreigners (Non-Resident Alien, NRA):

- Two Forms of Identification: Such as passport and another government-issued photo ID.

- US Tax Number: SSN or ITIN (if available).

- Valid Visa or Related Documents: Such as I-20 or I-797 form.

Difference Between APY and Interest Rate

When comparing US certificate of deposit products, you will see two terms: Interest Rate and Annual Percentage Yield (APY).

- Interest Rate is the base interest ratio paid by the bank.

- Annual Percentage Yield (APY) is the real return rate you get in a year.

The key difference lies in “compounding”. APY includes the effect of interest on interest. The more frequent the compounding (e.g., daily vs. monthly), the slightly higher the APY. Therefore, when comparing different products, directly looking at APY is the most accurate way.

Early Withdrawal Penalty Calculation

CD funds are locked before maturity. If you must withdraw early, the bank charges a penalty, usually deducting a certain number of days’ interest.

How is the penalty calculated? The penalty is typically:

Deposit Amount × (Annual Rate / 365) × Penalty Days. For example, if you deposit $10,000 with 4% APY and a 90-day interest penalty, the penalty is about $98.63 ($10,000 × 0.04 / 365 × 90).

Tax Reporting Notes for Foreigners (NRA)

For non-US residents (NRA), there is good news: Interest earned on US bank accounts (including CDs) is usually tax-exempt.

To prove your non-resident status to the bank and enjoy tax exemption, fill out the W-8BEN form when opening an account. This document declares your foreign status to the IRS, ensuring the bank does not withhold tax on your interest income.

When choosing a CD plan, decide based on your needs. The four major banks suit existing customers seeking convenience; online banks and credit unions offer higher rates. The key is balancing “locked rate stability” and “fund liquidity”.

Your Decision Checklist

- If you are a major bank customer, first check relationship rates.

- If you pursue the highest returns and do not mind online operations, online banks are the top choice.

- If you need anytime access to funds, high-yield savings accounts are more suitable.

- If you have specific savings goals and want to avoid interest rate fluctuation risks, fixed CD returns are ideal.

FAQ

What happens to my money after the CD matures?

After maturity, the bank usually automatically renews the principal and interest into a new CD of the same term. You can also choose to transfer funds to your checking or savings account.

The bank will send a notice before maturity. You need to decide within the specified period; otherwise, the bank will handle it by default.

Should I choose a CD or high-yield savings account?

It depends on your fund liquidity needs.

- Certificate of Deposit: Suitable for idle funds not needed short-term, locking in fixed high rates.

- High-Yield Savings Account: Suitable for emergency reserves needing anytime access, with variable rates.

Is my CD deposit safe?

Yes, very safe. As long as your chosen bank is a member of the Federal Deposit Insurance Corporation (FDIC), your deposits (including CDs) at that bank are insured up to $250,000. Confirm FDIC insurance before opening an account.

As a foreigner, do I need to pay tax on CD interest?

No. As a non-US resident (NRA), deposit interest at US banks is usually tax-exempt. Simply fill out the W-8BEN form when opening an account to prove your foreign status and enjoy tax exemption.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

It's Finally Here: Mainland China Users Can Now Register Wise with ID Card Only

PayPal Payment Process Tutorial: All Fees Explained Clearly

How Mainland Chinese Can Apply for a Hong Kong Bank Card: In-Depth Analysis of HSBC and BOC Hong Kong Account Opening Requirements

Avoid These Pitfalls: Tips for Successfully Registering and Using a U.S. PayPal Account

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.