Remitting from China to the US: Bank vs. Third-Party Platform Cost Showdown

Image Source: pexels

Sending the same $10,000 from China to the US, one user ended up with over $100 more in the recipient’s account using Wise compared to a bank wire. How did this happen?

Many people find that for remittances within the personal annual quota, choosing a compliant third-party platform is a shortcut to low-cost international remittances. These platforms not only cost less but are often faster. A smart choice maximizes every penny, delivering real surprises to the recipient.

Key Points

- Understanding remittance costs is crucial—they include fees, cable charges, exchange rate margins, and correspondent bank deductions.

- Third-party platforms like Wise are generally cheaper, faster, and more transparent in exchange rates than traditional bank wires.

- For small, frequent remittances, prioritize third-party platforms such as Wise, Panda Remit, or Alipay International Remittance.

- Large remittances must comply with State Administration of Foreign Exchange (SAFE) rules and may require written applications.

- Choose platforms with financial regulatory licenses to ensure remittance safety and compare real-time fees across channels before sending.

Full Breakdown of Remittance Cost Components

Image Source: unsplash

To achieve low-cost international remittances, you first need to unveil the mystery of remittance costs. Many focus only on the fees quoted at the bank counter, overlooking those hidden in exchange rates and intermediary links. In reality, total costs consist of three parts—understanding them is the first step to making a smart choice.

Visible Fees: Handling Fees and Cable Charges

These are the most straightforward fees, usually clearly stated by the bank when processing the remittance.

- Handling Fee (Commission Fee): The fee charged by the bank for processing the remittance service, typically a percentage of the remittance amount with minimum and maximum caps.

- Cable Charge: The communication fee for sending remittance instructions via the SWIFT network, usually a fixed amount.

Using two major Chinese banks as examples, their fee structures clearly illustrate these visible fees.

| Bank Name | Handling Fee (% of Transfer Amount) | Minimum Handling Fee | Maximum Handling Fee | Cable Charge | Full Amount Arrival Service Fee |

|---|---|---|---|---|---|

| Industrial and Commercial Bank of China (ICBC) | 0.1% | 30 USD | 150 USD | 15 USD | 25 USD |

| Bank of China | 0.1% | 50 USD | 200 USD | 20 USD | Not Applicable |

Hidden Costs: Exchange Rate Margin

This is the largest and most easily overlooked cost in international remittances. The exchange rate people see online is usually the “mid-market rate”—the benchmark for interbank transactions. However, banks offer individuals the “bank selling rate,” which is higher than the mid-market rate. The difference between the two is the bank’s profit and the hidden cost borne by the remitter. This margin seems small but accumulates into a significant expense for large remittances.

Additional Fees: Correspondent Bank Deductions

When remitting from China to the US, funds typically do not reach the recipient bank directly. They pass through one or more “correspondent banks” for clearing and routing. These correspondent banks deduct a service fee, usually between 15 USD and 25 USD.

Note: This fee is often unpredictable. It is deducted directly from the principal, meaning the recipient receives less than the initially sent amount—this is the main reason many are confused about the final arrival amount.

Real Case: Cost Comparison for Remitting $10,000

Theoretical knowledge is foundational, but real cases reveal the truth more clearly. Let’s follow one user’s remittance journey, simulating sending funds from China to ensure the US recipient receives exactly $10,000, and see the cost differences across channels. This comparison will clearly show how a smart choice creates more value for the recipient.

Channel 1: Traditional Bank Wire

One user plans to wire funds through a major commercial bank, aiming for the US recipient to receive a full $10,000.

The entire process is full of uncertainty.

- FX Purchase Cost: First, the user needs to buy USD with RMB. The bank’s rate is not the mid-market rate seen online. Assuming the mid-market rate is 1 USD = 7.25 CNY, the bank’s selling rate might be 1 USD = 7.28 CNY. At this step alone, exchanging $10,000 costs the user an extra 300 RMB (about 41 USD) in hidden costs compared to the market rate.

- Handling Fees: The bank clearly states handling and cable fees. Per its disclosure, fees include up to 260 RMB in handling fees and 150 RMB in cable charges, totaling 410 RMB.

Converted at 7.25, this visible fee is about 57 USD.

- Correspondent Bank Deduction: Bank staff remind that funds may pass through one or more banks before reaching the US bank, deducting service fees. This fee is unpredictable, typically 15 USD to 25 USD. We calculate an average of 20 USD.

To ensure the final arrival of $10,000, the user must send more to cover these fees.

- Total Sent Amount: 10,000 USD (target) + 57 USD (bank fees) + 20 USD (estimated correspondent fee) = 10,077 USD

- Total Time: The entire process is expected to take 3-5 business days.

Ultimately, to get $10,000 to the recipient, the user’s total cost reaches 77 USD, with ongoing concerns about the final arrival amount and timing.

Channel 2: Third-Party Platform Wise

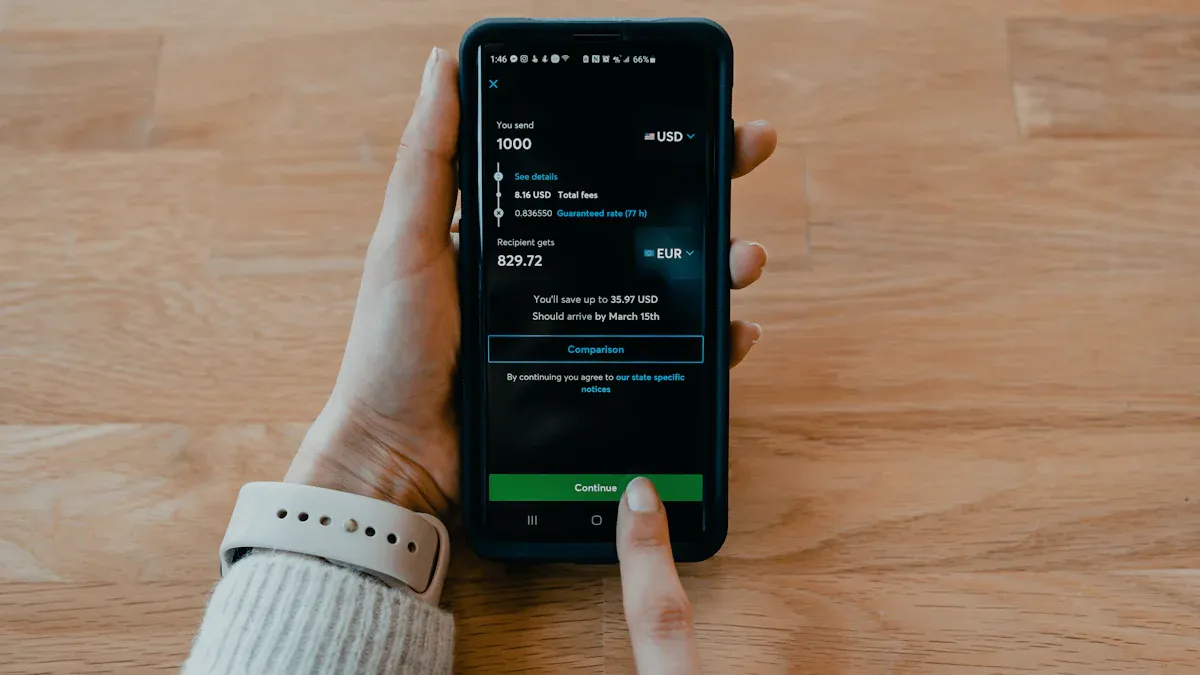

Another user chooses Wise for the same goal. They find the process transparent and efficient, with full control at every step.

Wise’s model completely changes the game.

- Transparent Exchange Rate: Wise uses the mid-market rate directly (i.e., 1 USD = 7.25 CNY) for calculations. The rate shown in the interface is the real rate with no hidden markups. This is Evidence 2, as Wise is committed to fair rates, starkly contrasting banks hiding fees in unfavorable rates.

- Clear Fees: Wise lists all fees upfront before remittance. Assuming a $10,000 transfer to the US, the fee is about 71 USD. This is the only cost, covering all processing.

- No Correspondent Fees: Wise clears funds through its global local account network, completely bypassing the traditional SWIFT network and correspondent banks. This means no additional, unpredictable deductions.

The user enters the desired recipient amount in Wise’s calculator: 10,000 USD. The system automatically calculates the total payment.

- Total Sent Amount: 10,000 USD (target) + 71 USD (Wise service fee) = 10,071 USD

- Total Time: Funds usually arrive in 1-2 business days, sometimes even faster.

This user not only precisely controls the arrival amount but enjoys faster speed and lower overall costs, successfully achieving low-cost international remittance.

Final Cost and Efficiency Comparison

Side-by-side comparison of the two channels makes the differences crystal clear. This is not just a numerical gap but a massive improvement in the remittance experience.

| Comparison Item | Traditional Bank Wire | Third-Party Platform Wise | Conclusion |

|---|---|---|---|

| Exchange Rate | Bank selling rate (with hidden costs) | Mid-market rate (no markup) | Wise wins |

| Total Fees | Approx. 77 USD (handling + cable + correspondent) | Approx. 71 USD (one-time service fee) | Wise wins |

| Arrival Time | 3-5 business days | 1-2 business days | Wise wins |

| Certainty | Arrival amount and time uncertain | Arrival amount and time precisely controllable | Wise wins |

| Total Cost for $10,000 Arrival | Approx. 10,077 USD | 10,071 USD | Wise lower cost |

This table clearly shows that choosing Wise not only saves about 6 USD in fees but, more importantly, eliminates uncertainty from exchange rate losses and correspondent deductions. For those pursuing efficiency and maximum fund value, this is undoubtedly an inspiring choice.

Best Strategies for Low-Cost International Remittances

Image Source: unsplash

After mastering cost components, users can tailor the best remittance strategy to their specific needs. Different scenarios require different solutions. A smart plan helps users maximize fund efficiency under compliance, making every cross-border transfer confident.

Scenario 1: Small to Medium, High-Frequency Remittances

For student tuition payments, family living expense transfers, and other small but frequent remittances, third-party platforms are undoubtedly the top choice for low-cost international remittances.

- Wise, with its transparent mid-market rate and low fees, is ideal for users maximizing fund value.

- Panda Remit is popular among students and overseas Chinese, offering fast, secure experiences with funds arriving in as little as 2 minutes and waiving fees for first-time remittances.

- Alipay International Remittance provides great convenience—users complete operations directly in the familiar app with clear fee structures, perfect for daily small payments.

These platforms simplify complex processes, letting users easily control funds and provide stable support for overseas life.

Scenario 2: Large Compliant Remittances

When remittance amounts exceed the personal annual $50,000 quota, such as for US real estate investments, compliance becomes the top priority. Here, banks’ compliance assurance stands out.

Users need to submit a written application to the local State Administration of Foreign Exchange (SAFE) for approval. This typically requires detailed documentation, such as:

- Proof of fund source (e.g., income tax returns, property sale proofs)

- Contracts with foreign companies

- Recipient’s tax documents

Though the process is more complex, it ensures the legality and safety of large fund transfers—an essential step for major financial goals.

Scenario 3: Other Remittance Method Choices

Beyond choosing the right platform, mastering practical tips can further optimize the low-cost international remittance experience. A key tip is “timing the remittance.”

Users should note that banks stop processing on weekends and public holidays (in both China and the US). To avoid unnecessary delays, the best practice is to initiate remittances early on business days. Additionally, platforms like Biyapay and CurrencyFair may offer competitive rates through different models. Spending a few minutes comparing options before remitting always yields surprises.

If you care not only about cost but also about managing “FX purchase–sending–receiving” in one place, it’s worth looking at platforms like BiyaPay that combine account management with cross-border remittance. Within a single multi-currency wallet, users can view balances, initiate international remittances, and assess overall costs across different payout scenarios.

Before confirming a transfer, you can also use BiyaPay’s free fiat exchange rate converter to run test calculations and compare expected arrival amounts and implied FX rates versus banks and other providers. For families or students with recurring remittance needs, this “simulate first, send later” approach helps optimize the use of the annual USD 50,000 quota while staying compliant with local FX rules.

From a safety and compliance perspective, BiyaPay operates under financial licenses in multiple jurisdictions, including U.S. MSB registration and New Zealand FSP authorization, and positions itself as a multi-asset transaction wallet for cross-border payments and fund management. For users who remit abroad regularly, adding such a regulated digital solution into the comparison mix—alongside banks and specialist remittance platforms—can make the flow of funds more transparent and easier to track over time.

For regular remittances within the $50,000 quota, prioritizing compliant third-party platforms like Wise maximizes arrival amounts and saves time. A smart move is to open both the bank app and platform calculator before the next remittance and use real-time data to make the best decision. This ensures every penny delivers maximum value.

Safety First: Users must confirm the chosen platform holds relevant financial regulatory licenses. For example, in the US, registration with the Financial Crimes Enforcement Network (FinCEN) is required; in China, People’s Bank of China approval is needed to ensure absolute fund safety.

FAQ

Are third-party platforms safe for remittances from China?

Users can be completely assured with compliant platforms. Platforms like Wise hold financial regulatory licenses in multiple countries or regions. They adhere to strict fund safety rules. Every remittance is protected, providing a solid guarantee for fund security.

Do these platforms have amount limits?

Yes, all personal remittances from mainland China must comply with foreign exchange regulations.

Each person has an annual FX purchase and remittance quota of 50,000 USD. Compliant third-party platforms operate within this framework, ensuring every operation is legal and compliant, making the remittance process worry-free.

Why are third-party platforms faster than banks?

These platforms optimize remittance paths through innovative methods. They maintain local bank account networks globally, so funds do not require multiple hops through the traditional SWIFT network. This peer-to-peer clearing model greatly shortens in-transit time, allowing recipients to receive funds faster.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

PayPal Payment Process Tutorial: All Fees Explained Clearly

Wise Account Registration and Activation Guide: Easily Handle Cross-Border Collections and Remittances

How Mainland Chinese Can Apply for a Hong Kong Bank Card: In-Depth Analysis of HSBC and BOC Hong Kong Account Opening Requirements

Exclusive for Chinese Users: Longbridge Securities Account Opening Process and Permanent Commission-Free Strategy

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.