- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Recommended Optimal Cross - border Remittance Apps: How to Compare Fees, Transfer Times, and Security

Image Source: unsplash

When choosing cross-border remittance app recommendations, you can prioritize Wise, PayPal, Venmo, and Airwallex. These platforms are known for low fees, fast transfers, and high security. Venmo currently has over 90 million active users, with rapid user growth in 2024. Airwallex’s international transfers cost approximately USD10-USD20 per transaction, while Wise uses the mid-market exchange rate without markups. You should also consider transfer time and platform security. Customer service, real-time exchange rates, and user experience are equally important.

Key Points

- When choosing a cross-border remittance app, focus on fees, transfer time, and security. These factors directly impact your remittance experience.

- Wise is known for low fees and transparent exchange rates, ideal for users seeking high transparency and low costs. PayPal is suitable for small urgent transfers but has higher fees.

- Transfer time varies by platform; digital remittance platforms like Wise and Airwallex often offer instant transfers, suitable for urgent needs.

- Security is a critical factor in platform selection; ensure the platform uses encryption and multi-factor authentication to protect your funds and information.

- Pay attention to platform promotions and exchange rate fluctuations to effectively reduce remittance costs.

Selection Criteria

When choosing cross-border remittance app recommendations, you need to focus on several core criteria. Fees, transfer time, and security directly affect your remittance experience. User experience and customer service are also important. Below, I will detail each criterion.

Fees

Fees impact the actual amount you send. Different platforms have varying fee structures. You can refer to the table below to understand common fee types:

| Fee Type | Description |

|---|---|

| Transfer or Service Fee | Basic service fees charged by remittance providers, varying by transfer method and country. |

| Currency Conversion Fee | Fees for currency exchange; some platforms inflate exchange rates, reducing the final received amount. |

| Intermediary or Correspondent Bank Fees | Fees deducted by multiple intermediary banks, increasing overall costs. |

| Recipient Fees | Fees some receiving banks may charge; digital remittance apps typically do not have this fee. |

| Platform-Specific Fees | Additional fees for extra services (e.g., instant transfers). |

When choosing, you can compare fees across platforms. For example, bank average fees can be as high as 11.8%, while mobile payment platforms have the lowest fees, around 4.5%. For larger transfers, the fee difference becomes more significant.

Transfer Time

Transfer time determines how quickly the recipient receives funds. Speed varies significantly by platform and country:

- Transfers within Europe or the same currency zone typically complete within 1 business day.

- Digital remittance platforms (e.g., Wise, Airwallex) can achieve instant transfers.

- International wire transfers may take 5 business days or more.

- SEPA payments in Europe complete within minutes.

You need to choose a cross-border remittance app recommendation based on urgency.

Security

Security is a must-consider factor when selecting a platform. Leading platforms use multiple security measures:

- End-to-end encryption protects your data.

- Multi-factor authentication enhances account security.

- Tokenization and data masking prevent information leaks.

- Secure APIs and zero-trust frameworks provide multi-layer protection.

- AI and machine learning monitor threats in real-time.

These measures effectively safeguard your funds and information.

User Experience and Service

A good user experience makes operations smoother. 73% of users say experience influences their choice. You can focus on:

- Whether the platform interface is intuitive and easy to use.

- Support for mobile operations, enabling transfers anytime, anywhere.

- Whether customer service is timely and reliable. Wise and Airwallex both have a customer service rating of 4.0/5.

Choosing a platform with good experience and service makes your cross-border remittance process more hassle-free.

Cross-Border Remittance App Recommendations and Comparison

Image Source: unsplash

When choosing cross-border remittance app recommendations, you need to understand each platform’s fees, transfer speed, security, and user experience. Below, I will compare seven major platforms in detail to help you make an informed choice based on your needs.

Wise

Wise is known for low fees and transparent exchange rates. You can clearly see all fees and the final received amount before transferring. Wise uses the mid-market exchange rate with no hidden fees, making it suitable for users needing high transparency and low costs.

| Wise Remittance Service | Fees |

|---|---|

| Pay for Wise transfer via wire transfer | Variable fee starting at 0.33% + fixed fee starting at $6 (your bank may also charge a wire transfer fee) |

| Send funds from Wise account | Low fees, displayed before confirming the transfer |

| Receive wire transfer to Wise account | $6.11 |

Wise’s transfer speed is typically 1-2 business days, with instant transfers available in some countries. For security, Wise uses end-to-end encryption and multi-factor authentication to ensure fund safety.

| Platform | Exchange Rate Transparency | Fee Structure |

|---|---|---|

| Wise | Uses mid-market exchange rate, no hidden fees | Small fixed fee + percentage of transfer amount |

| PayPal | Sets its own exchange rate, may have hidden fees | Higher and less transparent fees |

| Remitly | Sets its own exchange rate, may have hidden fees | Higher and less transparent fees |

| Banks | Set their own exchange rates, may have hidden fees | Higher and less transparent fees |

If you need large transfers or frequent cross-border transactions, Wise is a highly recommended cross-border remittance app.

PayPal

PayPal has wide coverage, suitable for individuals and small businesses. You can transfer money directly via email or phone number. PayPal’s fee structure is more complex, especially for currency conversions.

| Transaction Fee Type | Fee Description |

|---|---|

| Transfer to another PayPal account | Fee: 5% of the transaction amount; Minimum fee: $0.99; Maximum fee: $4.99 |

| Transfer using credit or debit card | Fee: 5% of the transaction amount (minimum and maximum) + 2.9% + fixed fee (varies by currency) |

| Currency conversion fee | 4% conversion fee may apply |

Transfer times are typically a few minutes to 1 business day. PayPal offers high security with encryption, two-factor authentication, and early fraud detection. When using it, verify recipient information to avoid scams.

Tip: PayPal is suitable for small, urgent transfers, but its fees and exchange rate costs are higher, ideal for users prioritizing transfer speed.

Venmo

Venmo is very popular in the U.S. but does not support international transfers. If you need domestic transfers within the U.S., Venmo is convenient and has low fees. However, for transfers to China/Chinese Mainland or other countries, Venmo cannot meet your needs.

- Venmo is limited to U.S. domestic use and cannot handle international transfers.

- No international transaction fees because it does not support international transactions.

- If you have international transfer needs, you should choose other cross-border remittance app recommendations.

Airwallex

Airwallex focuses on businesses and cross-border e-commerce, supporting over 180 countries and more than 60 currencies. You can benefit from market-leading foreign exchange rates and flexible fee structures.

| Platform | Forex Markup | Monthly Fee | Domestic Transfer | International Transfer Fee |

|---|---|---|---|---|

| Airwallex | 0.3-0.6% | Free | Free in most cases | Varies by destination |

| Wise | 0.35%-2% | N/A | N/A | N/A |

| Atlantic Money | N/A | N/A | N/A | £3 or €3 (up to £1 million) |

Airwallex offers fast transfer speeds, with instant transfers available in some countries. You can manage expenses via a business debit card but cannot withdraw cash directly from ATMs. Airwallex has no physical branches, and some countries lack phone support. It’s suitable for businesses needing multi-currency management and large cross-border payments.

| Advantages | Disadvantages |

|---|---|

| Market-leading international forex rates | No phone support in the UK and some other countries |

| Supports over 180 countries | No physical branches |

| Supports over 60 currencies | Not available for all industries |

| Offers business debit card | Cannot withdraw cash directly from ATMs |

| Excellent expense management features | Transactions may be flagged, requiring extensive documentation |

| 24/7 customer support | Slow customer support response times |

Remitly

Remitly is suitable for individual users and supports multiple delivery methods. You can choose express or economy transfers, with fees and transfer times varying by country.

| Fee Type | Remitly Fees |

|---|---|

| Express Transfer | Varies by destination. Mexico: $19.89 + $3.99 (amounts under $500); South Africa: $4.99; India: ~$0.99. |

| Economy Transfer | Varies by destination. Mexico: $20.14 + $3.99 (amounts under $500); South Africa: $3.99; India: ~$0.99. |

| Other Fees | Credit card payments may incur an additional 3% fee. |

Remitly’s express transfers can arrive instantly, while economy transfers typically take 3-5 business days. Account verification is required during registration, and the platform uses 256-bit encryption and secure servers to ensure fund safety. Remitly is suitable for users needing flexible delivery options and multi-country transfers.

Western Union

Western Union has the world’s largest remittance network, covering over 200 countries and 500,000 agent locations. You can choose online, offline, or app-based transfers, suitable for urgent transfers and cash pickup scenarios.

| Item | Fee Range | Speed |

|---|---|---|

| Send $1,000 to China/Chinese Mainland | Over $20 in fees | Hours to days |

| Offline Transactions | $10–40 | Varies by case |

| Exchange Rate | Unfavorable exchange rates | Depends on cash pickup or offline branches |

| Feature | Description | Use Case |

|---|---|---|

| Global Coverage | Allows transfers to over 200 countries and 500,000+ agent locations. | International transfers |

| Send and Receive Options | Offers online, app, and in-person transfer options. | Meets diverse user needs |

| Transfer Speed | Some transactions are processed instantly or within minutes. | Urgent transfers |

| Fees and Exchange Rates | High fees and less competitive exchange rates may impact small transfer users. | Less suitable for cost-sensitive users |

If you need urgent transfers or the recipient can only receive cash, Western Union is a suitable cross-border remittance app recommendation. However, its fees and exchange rate costs are higher, making it ideal for specific scenarios.

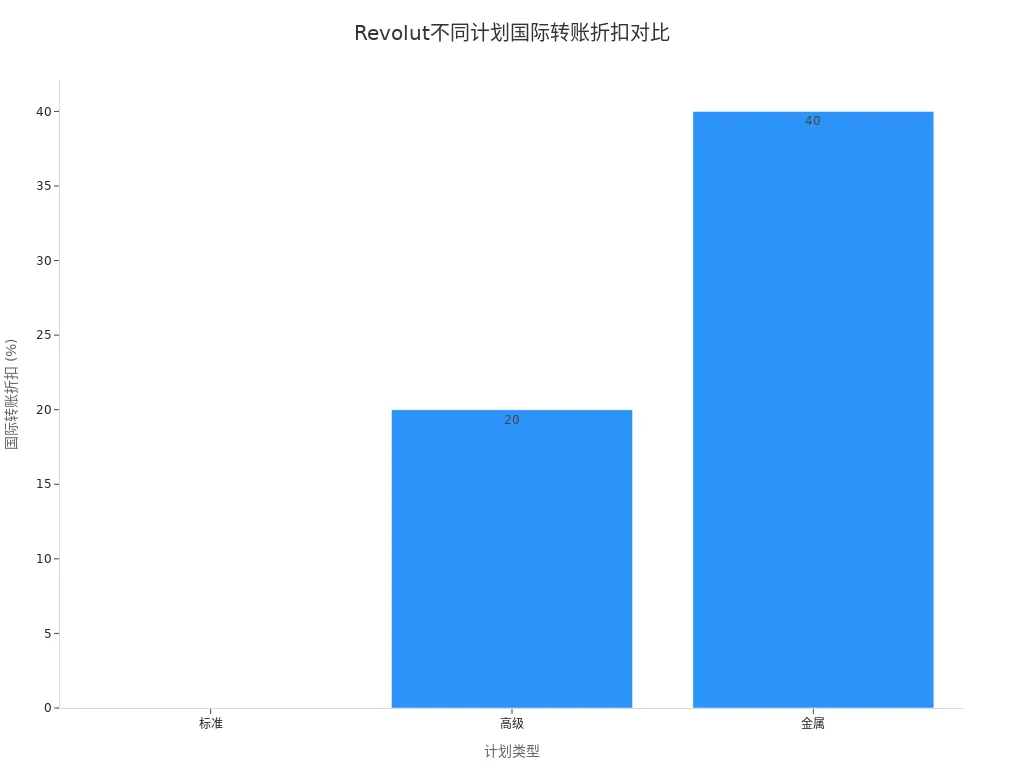

Revolut

Revolut supports multi-currency accounts and international transfers, suitable for frequent travelers or users with multi-currency needs. You can enjoy different fees and services based on membership plans.

| Plan | Conversion Limit | Fees |

|---|---|---|

| Standard | $1,000/month | 0.5% fair usage fee |

| Premium | $10,000/month | 0.5% fair usage fee |

| Metal | Unlimited | No fair usage fee |

| Plan | Monthly Fee | Free ATM Withdrawal | Free Currency Exchange | Non-Business Hours Exchange Rate | International Transfer Discount |

|---|---|---|---|---|---|

| Standard | $0 | Up to $400/month, 2% fee thereafter | Up to $1,000/month, 0.5% fair usage fee thereafter | 1% on weekends | — |

| Premium | $9.99 | Up to $800/month, 2% fee thereafter | Up to $10,000/month, 0.5% thereafter | No weekend fees | 20% discount on standard transfer fees |

| Metal | $16.99 | Up to $1,200/month, 2% fee thereafter | Unlimited free exchanges | No weekend fees | 40% discount on standard transfer fees |

Transfers within Revolut or card payments typically arrive within minutes, while international transfers generally take 3-5 business days. Revolut is suitable for users needing multi-currency management and flexible fee structures.

Summary: When choosing a cross-border remittance app recommendation, consider transfer amount, speed, fee transparency, and delivery method. Wise is ideal for low-cost and transparent transfers, PayPal for small urgent transfers, Airwallex and Revolut for businesses and multi-currency needs, Western Union for urgent cash pickups, and Remitly for flexible multi-country transfers. Venmo is limited to U.S. domestic use and unsuitable for international transfers.

Scenario-Based Choices

Small Transfers

For small transfers to China/Chinese Mainland, prioritize Wise and PayPal. Wise offers transparent exchange rates and low fees, ideal for frequent small transfers. PayPal supports email or phone number recipients with fast delivery, suitable for urgent small transfers. You can also opt for mobile remittance services from licensed Hong Kong banks, which typically have low fixed fees, ideal for amounts between USD100-USD500.

Tip: For small transfers, choose platforms with simple fee structures to avoid high cumulative costs from multiple transfers.

Large Transfers

For large cross-border transfers, security and cost savings are critical. You can compare pricing structures of different providers to select the most cost-effective platform. Consolidating transfers into a single large transaction can reduce total fees. Some platforms offer fee waivers or exchange rate discounts for new clients or large transfers. Sending funds directly in the recipient’s currency avoids additional conversion costs. Many global platforms support batch payments and API integration, ideal for businesses or e-commerce users automating large transfers.

- Pay attention to seasonal promotions to leverage platform discounts and reduce fees.

- Licensed Hong Kong banks typically support large transfers with high security, suitable for amounts exceeding USD10,000.

Urgent Transfers

For urgent situations, transfer speed is the top priority. The table below shows transfer speeds of major apps:

| App | Speed Description |

|---|---|

| Zelle | Typically instant within 30 minutes |

| Western Union | Express: Minutes; Economy: 3-5 days |

| Remitly | Minutes to 5 days |

| Wire Transfers | Domestic same-day; International up to 3-5 days |

Choose Western Union or Remitly’s express options for transfers arriving in minutes. Azimo and Afriex also focus on fast transfers, suitable for urgent family remittances. If speed is a priority, select platforms supporting instant or same-day transfers.

Family and Tuition Payments

For family or tuition payments, fee transparency and diverse payment methods are key. Panda Remit offers low or no transfer fees, transparent exchange rates, fast processing, multiple payment options, and 24/7 customer support. The table below shows the pros and cons of relevant platforms:

| Platform Name | Advantages | Disadvantages |

|---|---|---|

| Panda Remit | Low or no transfer fees, transparent exchange rates, fast processing, multiple payment options, 24/7 customer support | Less well-known than global giants, payment options vary by region |

Choose a platform based on recipient needs to ensure secure and timely delivery. Licensed Hong Kong banks also support tuition and family remittances, ideal for users needing high security and compliance.

Promotions and Money-Saving Tips

Image Source: pexels

Promotions

When choosing a cross-border remittance app, look for the latest promotions and first-transfer discounts. Many apps offer free transfers or fee reductions for new users. The table below summarizes promotion details for major apps:

| App Name | Minimum Limit | Maximum Limit | Fees | Other Promotions |

|---|---|---|---|---|

| BOSS Money App | $10 | $2,999 | From $0, first 5 transfers free, monthly promo code for fee-free Tuesdays | Referral bonuses, regular fee-free promotions |

| World Remit | $1 | $9,000 | From $1.99, first three transfers free | Multiple payment methods, lower transfer fees |

| Remitly | No minimum/New users $2,999 | $30,000 (with verification) | From $3.99, offers express options | Multiple delivery options, refund for delayed delivery, referral program |

Leverage these promotions to reduce fees for first or multiple transfers. If you transfer frequently, look for referral rewards and regular promotions to further save costs.

Exchange Rates and Comparison

Exchange rate fluctuations directly impact the received amount during cross-border transfers. You can reduce exchange rate losses by:

- Monitoring exchange rate changes and choosing favorable timing for transfers.

- Using exchange rate tracking tools to stay updated on rates.

- Choosing platforms with exchange rate lock-in services to avoid losses from rate fluctuations.

Managing foreign exchange risk is like holding an umbrella before a storm. Understanding exchange rate patterns can protect your funds during international transfers, ensuring secure and cost-effective transactions. You can also use multi-platform comparison tools to compare real-time exchange rates and fees, selecting the best option to save more on every cross-border transfer.

When choosing a cross-border remittance app, consider fees, transfer time, and security. The table below shows how different fee types affect transfer amounts:

| Fee Type | Impact |

|---|---|

| Fixed Fees | More cost-effective for large transfers |

| Percentage Fees | More cost-effective for small, frequent transfers |

- Timely payments help maintain good supplier relationships.

- Choosing fast delivery options avoids payment delays.

Security determines whether you can prevent fraud and track issues. Based on your needs, prioritize platforms with transparent fees, fast transfers, and high security. Continuously monitor the latest promotions and USD exchange rate changes to optimize every remittance experience.

FAQ

How to choose the most suitable platform for cross-border remittances?

Compare fees, transfer time, and security first. Then, based on your transfer amount and delivery method, choose a platform with transparent fees and fast transfers.

What information is needed for remittances to China/Chinese Mainland?

You need the recipient’s name, bank account number, and bank details. Some platforms also require the recipient’s ID number. Prepare these details in advance.

Are there limits on transfer amounts?

Most platforms have limits on single or daily transfer amounts. For example, Wise allows up to USD1,000,000 per transfer. Check platform regulations in advance to avoid transfer failures.

How long does it take for funds to arrive after a transfer?

Transfer time varies by platform and country. Wise and Airwallex can offer instant transfers. PayPal and Remitly typically complete within 1 business day. Bank wire transfers may take 3-5 days.

How to ensure remittance security?

Choose regulated platforms. Enable two-factor authentication. Avoid sharing account information casually. Contact platform customer service promptly if issues arise.

When evaluating cross-border remittance apps, you may notice that while platforms like Wise and PayPal offer strengths, challenges persist: high fees (e.g., PayPal’s up to 5%), exchange rate markups (e.g., Remitly’s custom rates), and inconsistent delivery times (e.g., bank wires taking 3-5 days). For frequent remitters or those needing multi-currency management, these issues can increase costs and complexity. Additionally, some platforms lack international support (e.g., Venmo) or investment options, limiting fund flexibility.

BiyaPay delivers a comprehensive cross-border financial solution. With our real-time exchange rate query, you can access the best rates instantly, minimizing conversion losses. Remittance fees start at just 0.5%, supporting conversions between multiple fiat and digital currencies, covering most countries globally with same-day delivery for urgent needs. Uniquely, BiyaPay lets you trade US and Hong Kong stocks without an overseas account, with zero fees for contract orders, enabling wealth growth. Sign up at BiyaPay today to enjoy low-cost, efficient remittances and investments, simplifying your global financial management with secure, transparent transactions!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.