- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is IBAN the Same as an Account Number? Differences, Uses, and How to Check Explained

Image Source: unsplash

When making international transfers, are you always asked to provide an “IBAN” number? How does this relate to the bank account number you commonly use? The answer is clear: IBAN and account numbers are not the same thing. You can think of IBAN as the “international version” of your bank account number, but it contains far more information than the account number itself.

For example: If your local account number is like a “house number,” then IBAN is the complete postal address, including “country, city, street, and house number,” ensuring funds are delivered accurately.

Key Takeaways

- IBAN and bank account numbers are different. IBAN is an international bank account number used for international transfers. A bank account number is a local account number used for domestic transactions.

- IBAN includes a country code, check digits, and bank account number. It helps reduce errors in international transfers.

- International transfers typically require both IBAN and SWIFT/BIC codes. SWIFT codes identify the bank, while IBAN identifies the specific account.

- Not all countries use IBAN. For example, mainland China, the U.S., Canada, and others have their own account systems.

- You can find your IBAN on bank statements, online banking, or mobile banking apps. Do not use unofficial tools to generate IBANs.

Core Differences Between IBAN and Account Number

Although both IBAN and account numbers point to your funds, they fundamentally differ in definition, structure, and use cases. Understanding these differences is key to ensuring smooth financial transactions.

Definition and Structure

First, let’s look at what each is and how they are structured.

-

IBAN (International Bank Account Number) IBAN is not a new account number but rather your existing bank account number in an “international standardized format”. Its structure is defined by the international standard ISO 13616, aimed at standardizing global account formats to reduce errors in cross-border payments.

A complete IBAN consists of up to 34 alphanumeric characters, with the general structure as follows:

Country Code (2 letters)+Check Digits (2 digits)+Basic Bank Account Number (up to 30 characters)- Country Code: Represents the country where your bank is located, e.g.,

DEfor Germany,FRfor France. - Check Digits: These are two unique digits calculated through a specific algorithm, used to verify the accuracy of the entire IBAN before a transfer, effectively preventing transfer failures due to input errors.

- Basic Bank Account Number (BBAN): This part includes your local bank details, such as the bank code, branch code, and your personal account number. Each country’s BBAN structure is different.

For example, a German IBAN (22 characters) might look like

DE89370400440532013000, while a French IBAN (27 characters) could beFR1420041010050500013M02606. The variation in length and internal format is precisely the value of IBAN standardization. - Country Code: Represents the country where your bank is located, e.g.,

-

Bank Account Number A bank account number is a unique identifier for your account within a specific bank (e.g., an account opened at a bank in Hong Kong). It is typically a string of digits, with the length and format determined by the bank. This number is valid within the bank’s country or region, but it often cannot be accurately recognized by foreign banks when funds need to cross borders.

Uses and Scenarios

Due to their structural differences, the uses of IBAN and account numbers are distinctly different. You can refer to the table below to quickly understand their core application scenarios:

| Feature | IBAN (International Bank Account Number) | Bank Account Number (Local Account Number) |

|---|---|---|

| Primary Use | International transfers, especially in the European SEPA zone | Domestic transfers, deposits, withdrawals, bill payments |

| Recognition Scope | Global (between countries that use IBAN) | Limited to the bank’s country or region |

| Information Included | Country, bank, branch, account, check digits | Typically only the account identifier |

| Error Detection | Built-in check digits for automatic accuracy verification | Usually no built-in validation mechanism |

In simple terms, you’ll use them in the following scenarios:

- Scenarios for Using IBAN:

- Receiving International Transfers: When clients or friends from Europe, the Middle East, or other regions send you money, you need to provide an IBAN.

- Making Cross-Border Payments: When paying individuals or companies in countries that use IBAN (e.g., EU member states), IBAN is a mandatory field.

- SEPA Zone Transfers: In the Single Euro Payments Area (SEPA), IBAN is a mandatory standard for both international and domestic payments. This greatly enhances the efficiency of fund transfers within the Eurozone.

- Scenarios for Using Bank Account Number:

- Domestic Transfers: In mainland China or Hong Kong, when friends transfer money to you or you pay merchants, you only need to provide your bank account number and bank details.

- Linking Payment Apps: Linking your bank account to local payment apps.

- Salary Payments: Your company pays your salary locally.

It’s worth noting that not all countries have adopted the IBAN system. For example, major economies like the U.S., Canada, Japan, and mainland China still use their own domestic account systems (e.g., the U.S. uses ABA routing numbers + account numbers). Therefore, before making international transfers, always confirm with the recipient which format of account information is required.

Why Is IBAN Needed for International Transfers?

Image Source: unsplash

You may wonder, since you already have a bank account number, why is IBAN required for international transfers? This is mainly to make cross-border fund transfers more efficient and secure. IBAN’s design addresses several key pain points in traditional international transfers.

Improving Accuracy and Reducing Errors

One of IBAN’s biggest advantages is its built-in automatic validation feature. Every IBAN includes two unique “check digits,” acting like an anti-counterfeit label, capable of detecting input errors before the transfer.

When processing your transfer request, the banking system verifies the IBAN’s validity using an algorithm called MOD-97. The process is roughly as follows:

- The system first checks if the IBAN’s length matches the country’s standard.

- Next, it moves the first four characters (country code and check digits) to the end of the number.

- Then, it replaces all letters with numbers (A=10, B=11…).

- Finally, it calculates the remainder when this large number is divided by 97. If the remainder is 1, the IBAN format is correct, and the transfer can proceed; otherwise, the system will immediately flag an error.

This small design significantly reduces the risk of transfer failures or delays due to manual input errors.

The Relationship Between IBAN and SWIFT/BIC Codes

During international transfers, you may also encounter SWIFT codes (also called BIC codes). IBAN and SWIFT codes are complementary partners, not competitors. You can understand it this way:

- SWIFT/BIC Code: Identifies the bank. It tells the global financial network which bank institution the money should be sent to, like the city and street address on an envelope.

- IBAN: Identifies the specific account. It specifies which customer’s account the funds should be deposited into after reaching the bank, like the recipient’s name and house number on an envelope.

| Function | IBAN | SWIFT/BIC Code |

|---|---|---|

| Role | Tells the bank who gets the money | Tells the bank where the money goes |

| Identifies | Individual or company’s specific account | Bank or financial institution |

Therefore, when transferring to countries that use IBAN, you typically need to provide both the IBAN and SWIFT/BIC code to ensure the funds are delivered accurately. Confusing IBAN with an account number is a common reason for transfer failures.

Not All Countries Use IBAN

Despite IBAN’s efficiency, it is not a global standard. You need to be aware that some major economies do not use the IBAN system.

For example, when transferring to the following countries, you need to provide their respective account system information:

- United States: Use

ABA Routing Number+Account Number - Canada: Use

Transit Number+Account Number - Australia: Use

BSB Code+Account Number - Mainland China: Use

Bank Account Number+Bank Branch Information

When transferring to friends or merchants in these countries, always confirm the exact format of the required information with the recipient. However, regardless of whether the recipient country uses IBAN, a SWIFT/BIC code is still necessary for most international wire transfers to identify the receiving bank.

How to Quickly Check Your IBAN?

Image Source: pexels

If you need to provide an IBAN to receive international transfers, accuracy is critical. Fortunately, there are several official and reliable channels to obtain this number. Below are the three most common and secure methods.

Checking Official Bank Channels

This is the safest and most recommended way to obtain your IBAN. Information provided directly by your bank ensures 100% accuracy.

You can find it in the following places:

- Bank Statement Whether you receive a paper or electronic statement, the IBAN is typically clearly printed on it. Many banks’ official guidelines state that you can find the full IBAN and BIC code on bank statements. This is usually located in the account summary or header information section.

- Online Banking Log in to your bank’s online portal. Typically, under “Account Details,” “Account Information,” or similar pages, you can find the IBAN associated with your account.

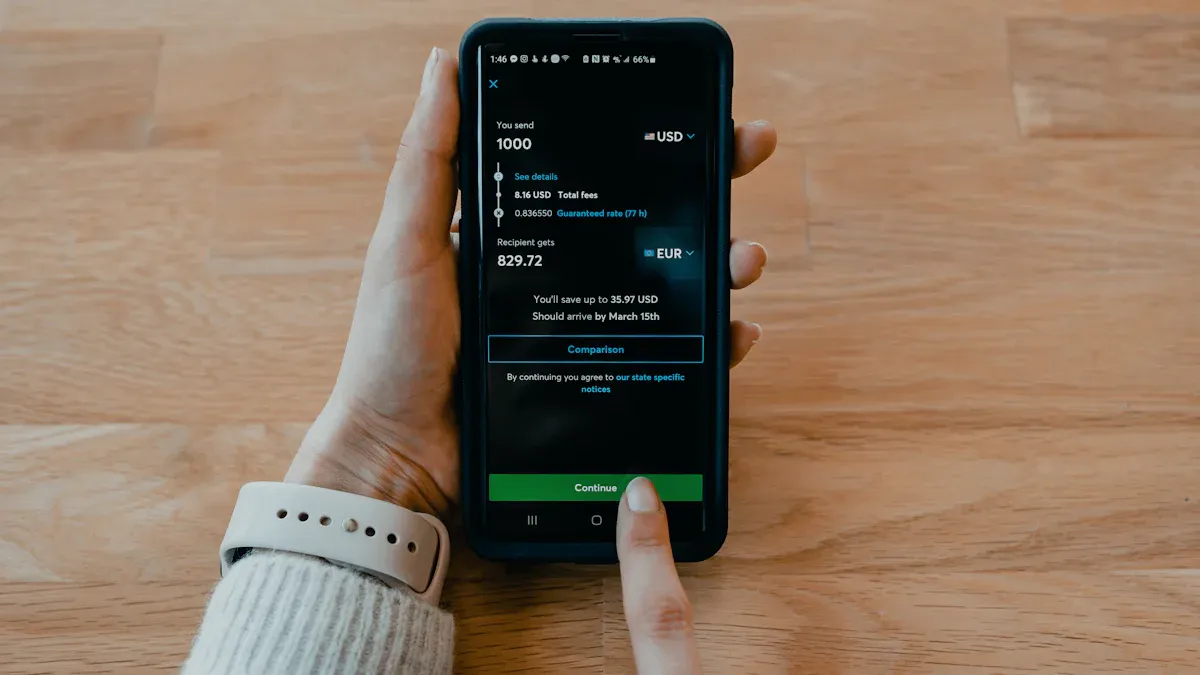

- Mobile Banking App Checking via a mobile banking app is also very convenient. The specific steps may vary by bank, but they generally follow this process:

- Log in to your bank’s app.

- Tap the account you want to check.

- Select “Account Settings” or “Account Details” option.

- Tap “View or Share Account Details” to display your IBAN and BIC code.

Using Online Tools for Validation

If you’ve obtained an IBAN from some source but are unsure if its format is correct, you can use online IBAN validation tools.

⚠️ Important Note: These tools are only for validating the format of an IBAN and cannot generate an IBAN from your local account number. Never enter your local account information on non-official websites to attempt generating an IBAN, as this poses significant security risks.

These validation tools work based on the MOD-97 algorithm mentioned earlier. They check:

- Whether the IBAN’s check digits are correct.

- Whether the IBAN’s length matches the country’s standard.

- Whether the country code and bank code format are valid.

A reliable validation tool does not store your personal data, and all operations are performed in memory solely to confirm the number’s structure validity. It cannot verify whether the account actually exists or belongs to someone. Therefore, after validation, you still need to confirm through official channels.

Contacting Bank Customer Service Directly

If you can’t find your IBAN online or on your statement, or if you have doubts about the information you found, the most direct method is to contact your bank.

You can call the bank’s customer service hotline or reach them via online chat. After verifying your identity, the customer service team will provide you with the accurate IBAN information.

Customer service hours vary by bank, but many major international banks offer extensive support:

- For example, some large international banks’ retail banking services are typically available during specific hours on weekdays and weekends (e.g., 7 AM to 9 PM Eastern Time).

- If you hold a premium account (e.g., a Premier account), you are likely to have access to 24/7 dedicated customer support.

Before contacting customer service, prepare your identification documents and account information so the bank can quickly verify your identity and assist you.

Now, you should clearly understand that IBAN and account numbers are not the same. IBAN is a standardized account identifier designed for international transfers, integrating country, bank, and account information to significantly improve the efficiency and security of cross-border payments.

Using the correct IBAN ensures funds arrive smoothly within 1 to 5 business days, while incorrect account information can lead to significant delays or even transaction failures.

Final Tip 💡

The next time you make or receive a cross-border payment, be sure to carefully verify and provide the full IBAN instead of your local bank account number. This ensures your funds reach their destination quickly and accurately.

FAQ

Can IBAN Be Used to Receive Payments in Mainland China?

No. Mainland China’s banking system does not use IBAN. For cross-border payments, you should provide the sender with your bank account number, bank name, address, and the bank’s SWIFT/BIC code.

Must IBAN and SWIFT Codes Be Provided Together?

Yes, typically both are required.

SWIFT Code: Helps the sending bank locate your receiving bank. IBAN: Specifies which account at that bank the funds should be deposited into. Together, they ensure accurate delivery of funds.

Does an IBAN Expire or Change?

An IBAN is directly linked to your bank account. As long as your bank account remains active and unchanged, your IBAN will not change or expire. If you close an old account and open a new one, you will receive a new IBAN.

Why Can Online Tools Only Validate IBANs, Not Generate Them?

For your financial security. IBANs contain sensitive personal account information. Official IBANs can only be generated by your bank. Any third-party tool claiming to “generate” an IBAN poses a significant risk of leaking your personal information, so please remain vigilant.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.