- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What is the Currency of Benin? Exchange Rates, Denominations, and Remittance Guide

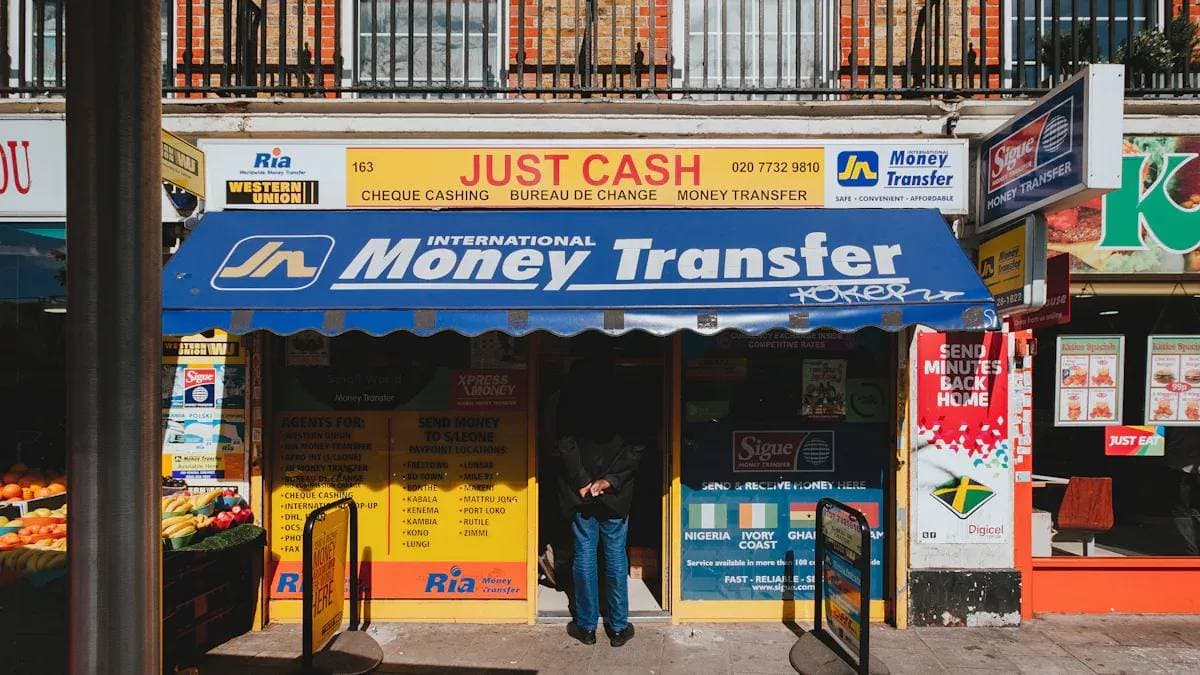

Image Source: pexels

If you’re planning a trip to Benin, you need to know that Benin’s currency is the West African CFA Franc (XOF). You’ll also find that this currency isn’t exclusive to Benin. It serves the entire West African Economic and Monetary Union (UEMOA). This union has a significant economic scale.

| Region | Annual GDP (USD) |

|---|---|

| UEMOA Total | $221,993M |

The most critical feature of this currency is its peg to the Euro at a fixed exchange rate. This provides great convenience for rate calculations.

Key Points

- Benin uses the West African CFA Franc (XOF), which has a fixed exchange rate with the Euro, making rate calculations simple.

- The CFA Franc has various banknote and coin denominations, and since cash dominates daily transactions, familiarity with them is important.

- There are multiple ways to remit money to Benin: banks are secure but slow, professional remittance companies are fast but costly, and online platforms balance cost and convenience.

- When remitting, carefully verify recipient information, compare total costs, and understand transfer limits and delivery times.

Understanding Benin’s Currency: West African CFA Franc (XOF)

Image Source: pexels

The history of the West African CFA Franc (XOF) dates back to 1945, when France introduced it to replace the French West African Franc. Today, it’s not just Benin’s currency but the shared currency of the West African Economic and Monetary Union (UEMOA) eight member states. These countries include:

- Benin

- Burkina Faso

- Côte d’Ivoire

- Guinea-Bissau

- Mali

- Niger

- Senegal

- Togo

This unified currency system facilitates economic activities across the region.

Fixed Exchange Rate with the Euro

The most notable feature of the CFA Franc is its fixed exchange rate with the Euro. This mechanism brings high stability and credibility, effectively reducing inflation risks.

Fixed Exchange Rate

1 Euro = 655.957 CFA Franc (XOF)

This rate is constant, unlike other currencies that fluctuate daily. Thus, as long as you know the Euro’s price, you can accurately calculate the CFA Franc’s value. This stability creates favorable conditions for international trade and investment.

Conversion to CNY and USD

Since the CFA Franc isn’t directly pegged to CNY or USD, you need to use the Euro as an intermediary for conversions. The process is straightforward:

- Step 1: Check the real-time exchange rate of your currency (e.g., USD or CNY) to Euro.

- Step 2: Multiply the converted Euro amount by 655.957 to get the equivalent CFA Franc amount.

For example, if 1 USD currently converts to 0.92 Euro, then 1 USD equals approximately: 0.92 Euro * 655.957 = 603.48 CFA Franc

Note: USD and CNY to Euro rates fluctuate in real-time. The above calculation is an example. You must use the latest real-time rate for conversions.

Real-Time Exchange Rate Checking Methods

To obtain the most accurate rate information, use these reliable online tools and mobile apps:

- XE.com: A well-known global currency information site offering real-time rate checks for over 130 currencies.

- Wise (formerly TransferWise): Renowned for transparent fees and real-time market rates, its website and app provide convenient rate-checking functions.

- Mobile Apps: Search for “US Dollar to CFA Franc” in app stores or use rate tracking features from remittance apps like Western Union to stay updated.

Checking real-time rates before any transaction or remittance is a wise habit.

Circulating Denominations of the CFA Franc

Image Source: pexels

In Benin, daily transactions primarily rely on cash. Whether shopping at markets, taking taxis, or dining at small restaurants, cash is the preferred payment method. Familiarizing yourself with CFA Franc denominations in advance will greatly aid your trip.

Banknote Denominations

When exchanging currency, you’ll most often encounter banknotes. CFA Franc notes are beautifully designed, vibrant, and easy to recognize. Currently circulating denominations include:

- 500 Francs

- 1,000 Francs

- 2,000 Francs

- 5,000 Francs

- 10,000 Francs

These notes are not only transaction tools but also carry West African cultural symbols. For example, the 5,000 Franc note features the elegant West African kob antelope (Kobus kob kob), while the highest denomination, the 10,000 Franc note, displays a sawfish-shaped brass weight, a traditional Ashanti symbol of wealth and prosperity.

How to Identify Authenticity? Using the 10,000 Franc note as an example, verify authenticity with these key features:

- Windowed Holographic Strip: An 8mm-wide holographic strip with a sawfish pattern and “10000” text.

- Security Thread: A 1mm-wide solid security thread embedded in the note.

- Watermark: When held to light, a clear sawfish watermark is visible.

Coin Denominations

Besides notes, you’ll encounter various coins during change. Familiarity with them helps with small payments.

| Denomination | Common Usage |

|---|---|

| 500 Francs | Common |

| 200 Francs | Common |

| 100 Francs | Very common |

| 50 Francs | Very common |

| 25 Francs | Less common |

| 10 Francs | Less common |

| 5 Francs | Rare |

| 1 Franc | Rare |

Practical Tip: 1, 5, and 10 Franc coins are rarely seen in circulation. Most prices are rounded to the nearest 25 or 50 Francs. Focus on familiarizing yourself with 50, 100, and 500 Franc coins.

Remittance to Benin Practical Guide

When sending money to family, friends, or business partners in Benin, choosing the right channel is critical. Different methods vary greatly in fees, speed, and convenience. Understanding these options saves you money and time.

Traditional Bank Channels

International wire transfers through your bank are a time-tested, reliable method, typically using the SWIFT network for cross-border payments.

- Advantages: High security. Funds move within the banking system with full records, ideal for large transactions.

- Disadvantages: Expensive and slow. You typically pay a fixed wire fee, and intermediary banks may charge extra. The process can take 3-5 business days or longer.

Process: Provide the bank with the recipient’s details, including name, bank name, account number, and SWIFT code. You can visit a bank branch or use online banking if supported.

Professional Remittance Companies

Companies like Western Union and MoneyGram have extensive agent networks globally, including widespread coverage in Benin.

- Advantages: Fast with many locations. Transfers can arrive in minutes, and recipients can collect cash at local agents with ID and a transfer control number (MTCN), especially convenient for those without bank accounts.

- Disadvantages: Higher fees, with potential rate markups.

Industry data shows some modern services claim 99% of transactions complete in seconds, while others note standard times of 1-4 business days, with many wallet transfers being nearly instant.

Online Remittance Platforms

Recently, online platforms (fintech companies) like Wise, Remitly, and Lemfi have gained popularity for transparency, low costs, and convenience.

- Advantages: Transparent fees, better rates, user-friendly. Complete operations on your phone or computer, with clear visibility of fees and final amounts received.

- Disadvantages: Recipients typically need a bank account or mobile wallet. Transfer times range from minutes to days.

Wise (formerly TransferWise) Wise is known for its transparent pricing and use of the mid-market rate.

Wise Fee Structure Example (From U.S.)

Fee Type Details Transfer Fee 1.17 USD + 0.8% of amount Payment Method Direct debit from bank account Receiving Method Direct deposit to recipient’s bank account Maximum Limit Up to 8,890 USD per transfer Estimated Time About 4-5 days

Remitly Remitly focuses on immigrant remittances, often offering promotions for new users.

- New User Promotions: First-time users can look for official promo codes, such as Remitly’s past offer of $20 off transfers over $100, significantly reducing initial costs.

Key Remittance Considerations

Regardless of the method, keep these points in mind to ensure safe and efficient fund delivery:

- Carefully Verify Recipient Information Before confirming, double-check the recipient’s name, bank account, and phone number. A small error can cause failures or delays.

- Compare Total Costs, Beware Hidden Fees Don’t focus only on handling fees. True cost is “fees + rate margin.” Some providers offer low fees but add hidden markups in rates.

What is an Exchange Rate Markup? It’s the profit margin added to the mid-market rate (e.g., Google’s rate). For example, if the market rate is 1 USD = 600 XOF, a provider might offer 1 USD = 585 XOF. The 15 XOF difference is a hidden fee, reducing the recipient’s final amount.

- Understand Transfer Limits Platforms and channels have varying limits. For example, Western Union’s online transfers to Benin may cap at 6,000 EUR (~6,500 USD) per transaction. Confirm your amount is within limits before transferring.

- Confirm Estimated Delivery Time Choose based on urgency. For immediate needs, select fast professional remittance companies or online platforms. For less urgent transfers, opt for cheaper, slower options.

You now understand that Benin’s currency is the West African CFA Franc (XOF), pegged to the Euro. Cash transactions dominate in Benin.

Key Recap

- Exchange Rate: Calculate indirectly via Euro.

- Denominations: Familiarize with common notes and coins.

- Remittance: Banks are secure but slow, remittance companies are fast but costly, and online platforms balance cost and convenience.

With knowledge of Benin’s currency and remittance options, you can choose the most suitable method based on your needs for speed, cost, and ease.

FAQ

Can I use credit cards in Benin?

You’ll need cash in most places in Benin. Large hotels and upscale restaurants in major cities may accept credit cards, but for daily convenience, carry sufficient CFA Franc cash.

Is it better to bring USD or EUR to Benin?

Carrying Euros is more convenient. With the CFA Franc’s fixed rate to the Euro, exchanges are direct and stable. USD exchanges require an extra conversion step with fluctuating rates.

Where is the best place to exchange currency in Benin?

Exchange at banks or officially authorized Bureaux de Change in major cities like Cotonou. For safety and fair rates, avoid street or unofficial exchanges.

Can I use international bank cards at ATMs in Benin?

Yes, Visa or Mastercard can be used at ATMs in cities like Cotonou, but machines may be unreliable or low on cash. Don’t rely solely on ATMs; prepare backup cash.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.