- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Smartly Choose Fixed Deposits Under Interest Rate Fluctuations

Image Source: pexels

Are you hesitant due to frequent changes in deposit interest rates? When choosing a fixed deposit, you need to consider multiple factors. You can compare deposit terms, minimum thresholds, and early withdrawal penalties across different banks. You should also evaluate liquidity and safety. Based on your financial goals, flexibly applying different deposit strategies can help enhance fund efficiency.

Choosing Deposit Interest Rates

Fixed vs. Floating Rates

When choosing a fixed deposit, you first need to understand the difference between fixed and floating rates. A fixed rate means that the bank promises to keep the interest rate unchanged throughout the deposit term. This allows you to predict future returns without worrying about the impact of market rate fluctuations. A floating rate adjusts based on market conditions; when market rates rise, you may earn higher returns, but when they fall, your returns decrease.

Tip: You can use the interest rate calculators on various Hong Kong bank websites, inputting deposit amounts and terms to quickly compare rates and rate types across banks, helping you make smarter choices.

The following table summarizes the main advantages, disadvantages, and applicable scenarios of fixed and floating rates:

| Rate Type | Advantages | Disadvantages | Applicable Scenarios |

|---|---|---|---|

| Fixed Rate | Stable rates, unaffected by market rate hikes, avoids rising rate risks | Typically higher rates, cannot benefit from rate cuts | Suitable when rates are low or expected to rise in the future |

| Single Floating Rate | Simple and easy to manage, stable monthly payments | Higher pressure in early repayment, rates fluctuate with market | Suitable for those with stable long-term repayment ability |

| Tiered Floating Rate | Lower initial rates, reducing early repayment pressure | Higher rates later, increasing pressure in later stages | Suitable for those with tight funds early in the loan |

You can choose the most suitable rate type based on your financial goals and risk tolerance. If you prefer stable returns, a fixed rate is recommended. If you’re willing to bear market fluctuation risks, a floating rate may be more suitable.

Handling Rate Fluctuations

Deposit rates in the market often fluctuate. When market rates are on an upward trend, choosing short-term deposits or floating-rate products allows you to adjust your deposit strategy in the future to capture higher rates. If market rates are low or expected to rise, you can consider locking in a longer-term fixed rate to secure future returns.

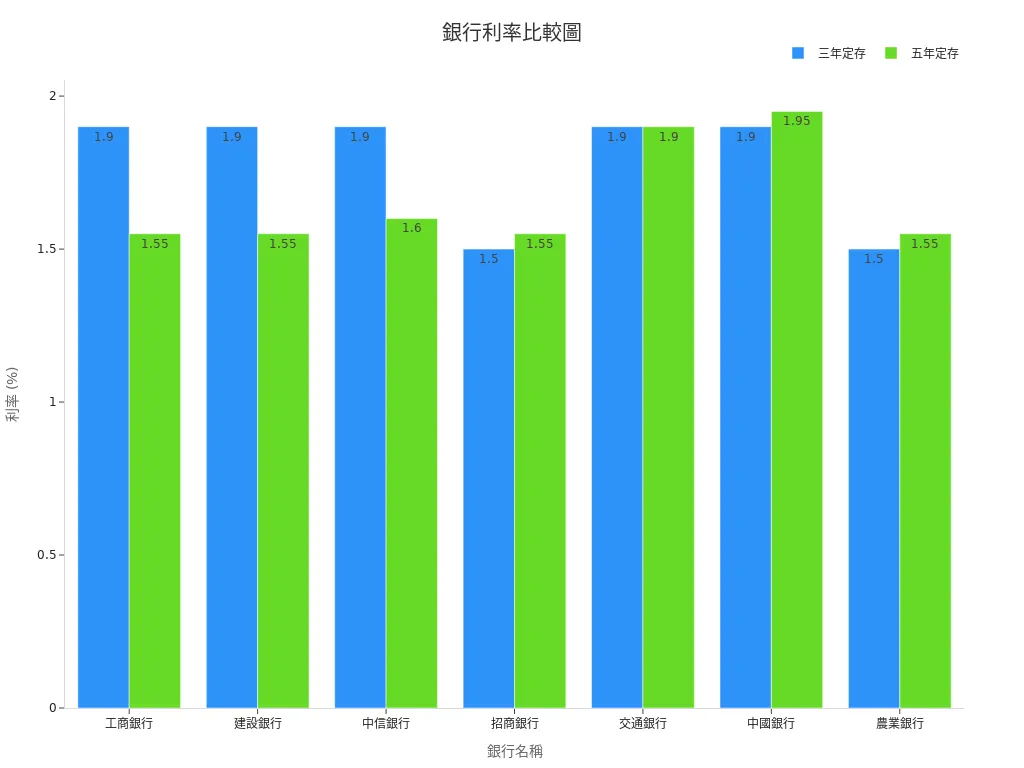

When choosing a bank, you should compare deposit rates across different banks. The table below shows fixed deposit rates for various terms across multiple Hong Kong banks (in annual percentage rates, data in USD, exchange rate 1 USD = 7.8 HKD):

| Bank Name | 1-Year Rate (%) | 2-Year Rate (%) | 3-Year Rate (%) | 5-Year Rate (%) |

|---|---|---|---|---|

| ICBC | 1.60 | N/A | 1.90 | 1.55 |

| China Construction Bank | N/A | N/A | 1.90 | 1.55 |

| China CITIC Bank | 1.60 | 1.70 | 1.90 | 1.60 |

| China Merchants Bank | 1.60 | 1.70 | 1.50 | 1.55 |

| Bank of Communications | N/A | N/A | 1.90 | 1.90 |

| Bank of China | N/A | N/A | 1.90 | 1.95 |

| Agricultural Bank of China | N/A | N/A | 1.50 | 1.55 |

You’ll notice significant differences in deposit rates across banks, with some even showing rate inversion (long-term rates lower than short-term rates). In such cases, you should pay close attention to the rate structure to avoid focusing only on high-rate promotions while overlooking overall returns.

Note: Some banks offer new funds promotions or short-term high-rate products to attract new accounts or fund transfers. These offers typically apply only for a short period, with rates dropping significantly afterward. When choosing, you should calculate overall returns to avoid chasing high rates while neglecting long-term benefits.

In summary, when selecting deposit rates, you should flexibly adjust your deposit strategy based on market trends, personal fund needs, and risk tolerance. Make full use of banks’ interest rate calculators and public information, and regularly review your deposit portfolio to maximize fund efficiency under rate fluctuations.

Comparing Deposit Methods

Image Source: unsplash

Fixed Deposits vs. Time Savings

When choosing a deposit method, you should first understand the difference between fixed deposits and time savings deposits. Fixed deposits typically require a lump-sum deposit, with principal and interest returned upon maturity. This method suits those with idle funds who want to ensure future cash flow or prepare for mortgages, education funds, or travel savings. Fixed deposit rates are generally stable but often lower than inflation, making them unsuitable for long-term investment. In case of early termination, you lose only interest, not principal, offering high safety.

Time savings deposits allow you to deposit a fixed amount monthly, suitable for those with stable income who want to build a savings habit. This method helps diversify liquidity risks, but overall deposit rates are usually similar to fixed deposits. According to a 2022 survey of Hong Kong and Asian markets, cash and deposits still account for about 40% of asset allocation, indicating high liquidity and market acceptance for short-term deposits and cash. However, for long-term wealth growth, regular ETF investments offer far better compound returns than bank deposits. For example, investing $10,000 monthly in ETFs could accumulate to about $21.6 million in 30 years, compared to only $4.54 million for bank deposits, a significant gap.

Tip: Based on your financial goals, flexibly choose between fixed deposits or time savings to balance safety and liquidity.

Interest Payout Methods

When choosing a deposit product, you should also consider interest payout methods. Common options include lump-sum principal and interest, monthly deposits with lump-sum payout, and principal retention with interest withdrawals:

- Lump-Sum Principal and Interest: You deposit the principal once and receive both principal and interest at maturity. Suitable for those with idle funds seeking simple management.

- Monthly Deposits with Lump-Sum Payout: You deposit a fixed amount monthly and receive principal and interest at maturity. Suitable for those with stable income aiming to gradually accumulate funds.

- Principal Retention with Interest Withdrawals: You deposit the principal and receive interest monthly, with the principal returned at maturity. Suitable for those needing regular cash flow, such as retirees.

Different methods offer varying flexibility and returns. Lump-sum principal and interest typically have higher rates, monthly deposits help build savings habits, and principal retention with interest withdrawals provides stable cash flow. Choose the method that best suits your needs.

Deposit Amount and Term

Minimum and Maximum Thresholds

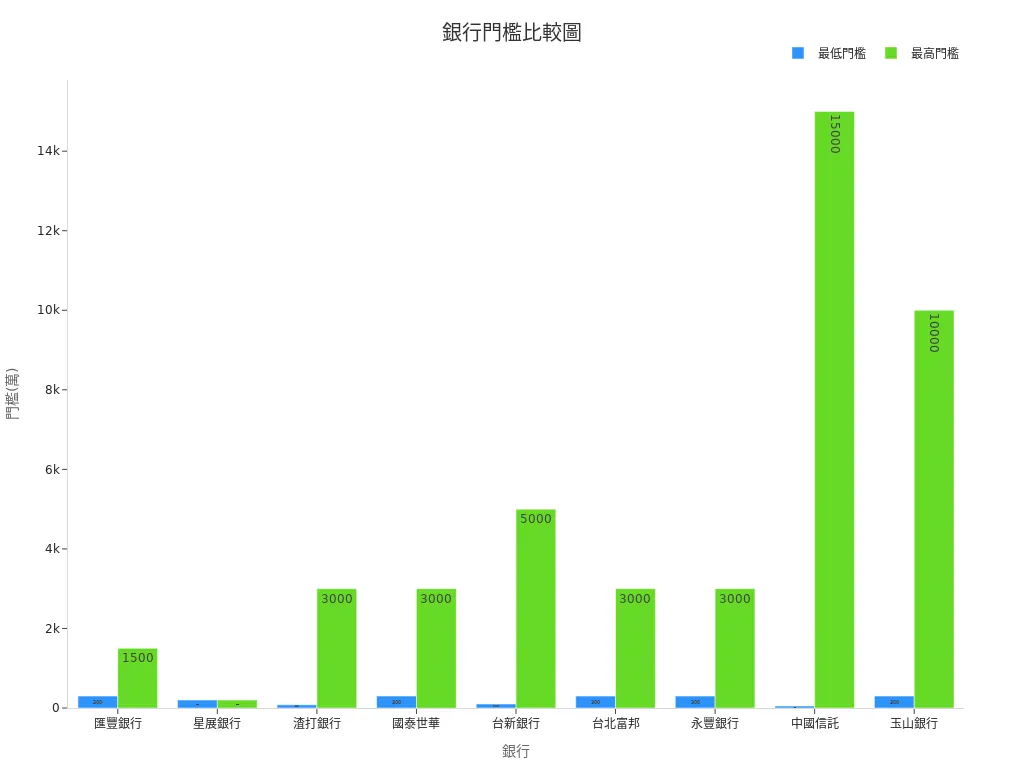

When choosing a fixed deposit, you should first understand the minimum and maximum deposit thresholds of different banks. Most Hong Kong banks set thresholds based on your total assets, including deposits, investment products, insurance, and trusts. Some banks also include loan balances to help you meet thresholds more easily. The table below lists the minimum and tiered thresholds of multiple banks (in USD, 1 USD = 31 TWD):

| Bank | Minimum Threshold (USD) | Tiered Thresholds (By Asset Size, USD) |

|---|---|---|

| HSBC | 9,677 | Premier: 9,677, Prestige: 48,387 |

| DBS | 6,452 | Treasures: 6,452 |

| Standard Chartered | 2,581 | Priority Banking: 2,581, Premium Banking: 9,677, Private Banking: 96,774 |

| Cathay United | 9,677 | Gold VIP: 9,677, Platinum VIP: 32,258, Diamond VIP: 96,774 |

| Taishin Bank | 3,226 | Wealth Member: 3,226, Prestige Member: 9,677, Million Member: 32,258, Diamond Member: 96,774, Emerald Member: 161,290 |

| Taipei Fubon | 9,677 | Stable Wealth Member: 9,677, Smart Wealth Member: 32,258, Constant Wealth Member: 96,774 |

| Bank SinoPac | 9,677 | Forever Member: 9,677, Wealth Member: 32,258, Legacy Member: 96,774 |

| CTBC Bank | 1,613 | Wealth Creator: 1,613, Premier Wealth: 9,677, Elite Wealth: 48,387, Legacy Wealth: 96,774, Ultimate Wealth: 4,838,709 |

| E.Sun Bank | 9,677 | New Wealth Member: 9,677, Elite Member: 32,258, Pinnacle Member: 96,774, Ultimate Member: 3,225,806 |

You can choose a suitable bank and wealth management tier based on your fund size. When comparing, note whether loan balances can count toward thresholds and any additional benefits or services offered by the bank.

Tip: Most banks’ wealth management thresholds are around $9,677. You can flexibly select different tiers based on your needs to enjoy more wealth management services.

Deposit Term Planning

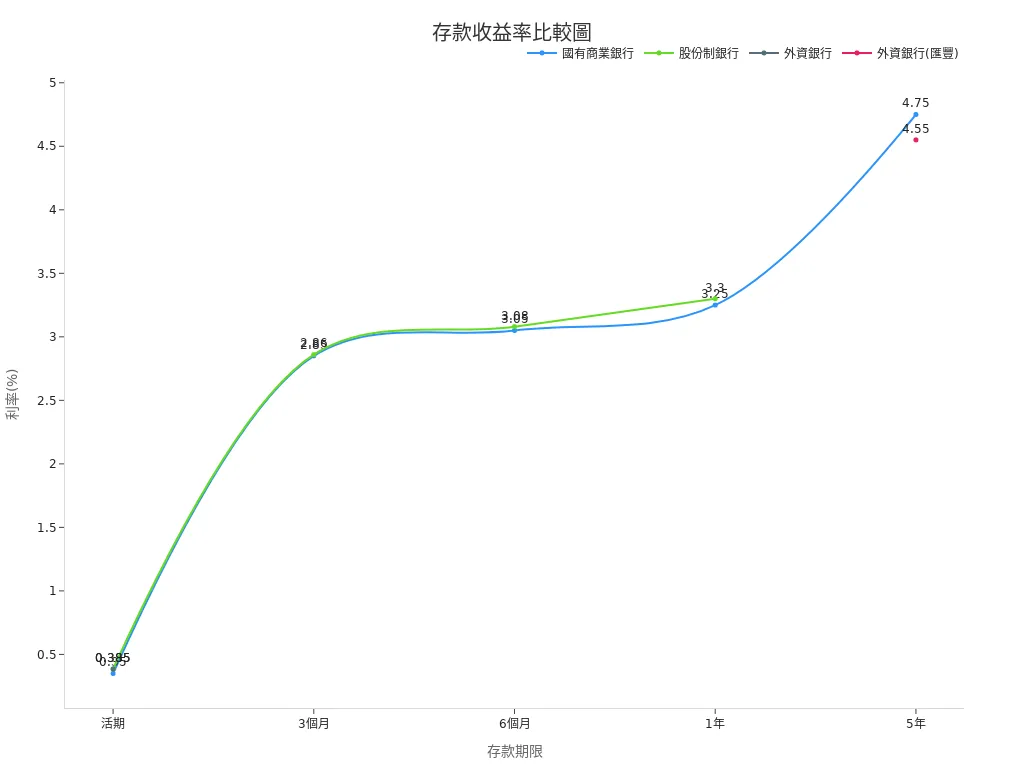

When planning deposit terms, you should choose based on your liquidity needs. Short-term deposits (e.g., 3 or 6 months) offer greater flexibility, suitable for those with short-term fund needs. Long-term deposits (e.g., 1 or 5 years) typically have higher rates but lock up funds for longer. Refer to the table below for rates and returns across different terms:

| Bank Type | Deposit Term | Rate (%) | Interest on $10,000 Deposit (USD) |

|---|---|---|---|

| State-Owned Commercial Bank | Demand | 0.35 | 35 |

| Joint-Stock Bank | Demand | 0.385 | 38.5 |

| State-Owned Commercial Bank | 3 Months | 2.85 | 71.25 |

| Joint-Stock Bank | 3 Months | 2.86 | 71.5 |

| State-Owned Commercial Bank | 6 Months | 3.05 | 152.5 |

| Joint-Stock Bank | 6 Months | 3.08 | 154 |

| State-Owned Commercial Bank | 1 Year | 3.25 | 325 |

| Joint-Stock Bank | 1 Year | 3.30 | 330 |

| State-Owned Commercial Bank | 5 Years | 4.75 | 475 |

| Foreign Bank (HSBC) | 5 Years | 4.55 | 455 |

If you choose long-term deposits, while rates are higher, early withdrawal incurs penalties. Most banks will cancel all or part of the interest, or only offer demand deposit rates. You should carefully read contract terms to avoid losing interest due to urgent fund needs.

Note: You can stagger funds across different terms to enhance flexibility and reduce losses from early termination.

Liquidity and Staggered Deposits

Image Source: pexels

Staggered Deposit Strategy

You can use a staggered deposit strategy, dividing a sum into several portions and depositing them with different maturity dates. This offers several benefits:

- You maintain liquidity, as funds become available when portions mature, allowing flexible use.

- You can adjust the next deposit’s rate based on market changes to capture higher returns.

- You reduce the chance of early termination due to urgent needs, minimizing interest losses.

For example, with $10,000, you can split it into four portions, depositing one every three months, so a deposit matures each quarter. This prevents all funds from being locked, preserving flexibility.

Tip: Avoid automatic rollover functions. At each maturity, manually adjust your deposit strategy based on the latest rates and market conditions.

Avoiding Early Termination

Early termination of fixed deposits results in financial losses. According to the Consumer Foundation, early termination during the contract term incurs penalties or only earns demand deposit rates, causing you to lose high-rate benefits. If you don’t actively adjust after maturity, banks may automatically revert to standard rates, increasing costs. You should review contract terms before maturity, adjusting or switching plans to avoid unnecessary losses.

- If a contract expires without termination, you still pay monthly fees or continue the original plan; services don’t stop automatically.

- You can adjust plans or switch banks before promotional periods end to reduce losses.

By using staggered deposits and proactive management, you can flexibly handle rate fluctuations and ensure fund safety.

Protection and Risks

Deposit Protection Scope

When choosing a fixed deposit, you should first understand the deposit protection scheme. Hong Kong’s deposit protection scheme offers up to HK$500,000 (about $64,100, exchange rate 1 USD = 7.8 HKD) per depositor. This means even if a bank fails, your deposits within this limit are protected. If you have funds exceeding the protection limit, consider spreading them across different banks to reduce risk.

Tip: You can split large funds across multiple banks, ensuring each bank’s deposits are within the protection limit, enhancing safety if a bank fails.

Bank Safety

When choosing a bank, don’t focus only on rates; evaluate the bank’s safety. You can refer to the following key indicators to assess a bank’s financial health:

- Risk-Adjusted Return on Capital (RAROC): Reflects the bank’s capital efficiency.

- Probability of Default (PD): Indicates the likelihood of borrower default.

- Credit Borrower Rating: Assesses repayment ability.

- Collateral Valuation and Management: Ensures sufficient asset backing.

- Non-Performing Loan Management: Tracks overdue and collection status.

- Early Warning Indicators: Identifies potential risks early.

You can check a bank’s annual report or website for the latest data on these indicators. Large Hong Kong banks like HSBC, Standard Chartered, and Hang Seng typically have robust risk management systems and high credibility. Choosing such banks further reduces fund risks.

Note: Regularly review a bank’s financial status and credit ratings. If a bank shows financial anomalies or negative news, adjust your deposit strategy promptly to ensure fund safety.

Advanced Techniques

Foreign Currency Deposits

If you want to boost deposit returns, consider foreign currency deposits. However, you must be cautious of exchange rate fluctuation risks. Foreign currency deposit rates are sometimes higher than HKD deposits, but exchange rate changes may offset or exceed interest gains. For example, the CNY fell 2.79% against the USD from January to March 20 this year, dropping from 6.04 to 6.22, nearly offsetting its full-year appreciation in 2013. In 2008, high AUD Australian dollar rates attracted investors, but during the financial crisis, the AUD depreciated sharply against the CNY, resulting in currency losses exceeding interest gains.

When choosing foreign currency deposits, you should:

- Monitor major currency trends and economic indicators like interest rates, GDP, and non-farm payrolls, which impact currency prices.

- Note that forex markets are highly volatile, and sudden economic events can cause sharp rate swings in short periods.

- Assess your risk tolerance and avoid investing all funds in one currency.

Tip: High-net-worth investors diversify across USD, CNY, and other assets, using various instruments to hedge exchange rate risks. You can adopt a similar diversification strategy.

Digital Bank Demand Deposits

If you prioritize liquidity, consider high-yield demand deposit accounts from digital banks. These products typically have no minimum deposit thresholds, allow anytime access, and offer higher rates than traditional demand deposits. For example, some Hong Kong digital banks provide annual rates of 2% to 3%, far above typical bank demand rates.

Digital bank demand deposits are suitable for:

- Those needing anytime access to funds or with short-term financial needs.

- Those wanting simplified management, using mobile apps to check and manage accounts.

- Those avoiding traditional banks’ high thresholds or complex procedures.

Note: When choosing a digital bank, check its deposit protection scope and credibility to ensure fund safety. Regularly review rate changes and adjust your deposit strategy flexibly to balance returns and liquidity.

When choosing fixed deposits, you can refer to the table below to compare rates and strategies across banks:

| Bank Type | 1-Year Rate (%) | 3-Year Rate (%) | 5-Year Rate (%) |

|---|---|---|---|

| ICBC | 1.60 | 1.90 | 1.55 |

| China Construction Bank | 1.60 | 1.90 | 1.55 |

| China Merchants Bank | 1.60 | 1.50 | 1.55 |

| Bank of Communications | - | 1.90 | 1.90 |

| Bank of China | - | 1.90 | 1.95 |

- Many banks show rate inversion, with three-year rates higher than five-year rates.

- Experts recommend flexibly adjusting deposit terms to diversify risks.

- You should regularly review your deposit portfolio, adjusting strategies based on market changes to enhance fund safety and returns.

FAQ

Are Fixed Deposits Suitable for Everyone?

Fixed deposits suit those seeking safe funds and stable returns. If you pursue high returns or can tolerate risks, other investment tools may be more suitable. Fixed deposits’ advantages lie in low risk and simple operation.

Tip: Choose a deposit method based on your financial goals.

What Are the Impacts of Early Termination?

Early termination usually results in losing part or all of the interest, or only earning a demand deposit rate. Some banks may also charge penalties. Review contract terms carefully to avoid unnecessary losses.

Note: A staggered deposit strategy can reduce early termination risks.

How to Choose a Suitable Deposit Term?

When choosing a deposit term, consider liquidity needs. Short-term deposits offer flexibility, suitable for short-term fund needs. Long-term deposits have higher rates but lock funds for longer.

Tip: Spread funds across different terms to enhance flexibility.

Are Foreign Currency Deposits Worth Considering?

Foreign currency deposits may offer higher rates, but exchange rate fluctuation risks are significant. If you can tolerate potential losses from rate changes, they’re an option. Diversify investments to reduce risks.

Tip: Monitor exchange rate trends and choose stable currencies for deposits.

How to Compare Fixed Deposit Rates Across Banks?

Use bank websites’ interest rate calculators, inputting deposit amounts and terms to compare rates quickly. Note conditions for new funds promotions and short-term high-rate products to avoid chasing rates that harm long-term returns.

Tip: Regularly review market rates and adjust your deposit strategy flexibly.

Navigating fixed deposit choices amidst fluctuating interest rates requires balancing returns and liquidity, and a digital financial platform can enhance your wealth management efficiency. BiyaPay offers a one-stop solution, enabling trading in U.S. and Hong Kong stocks without offshore accounts, allowing flexible use of USD, HKD, and other assets to complement fixed deposit returns.

Supporting USD, HKD, and 30+ fiat and digital currencies with real-time exchange rate transparency, plus global remittances to 190+ countries with remittance fees as low as 0.5%. A 5.48% annualized yield savings product with no lock-in period ensures flexibility. Sign up for BiyaPay today to combine fixed deposit strategies with BiyaPay’s versatile financial tools for secure, maximized returns!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.