- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

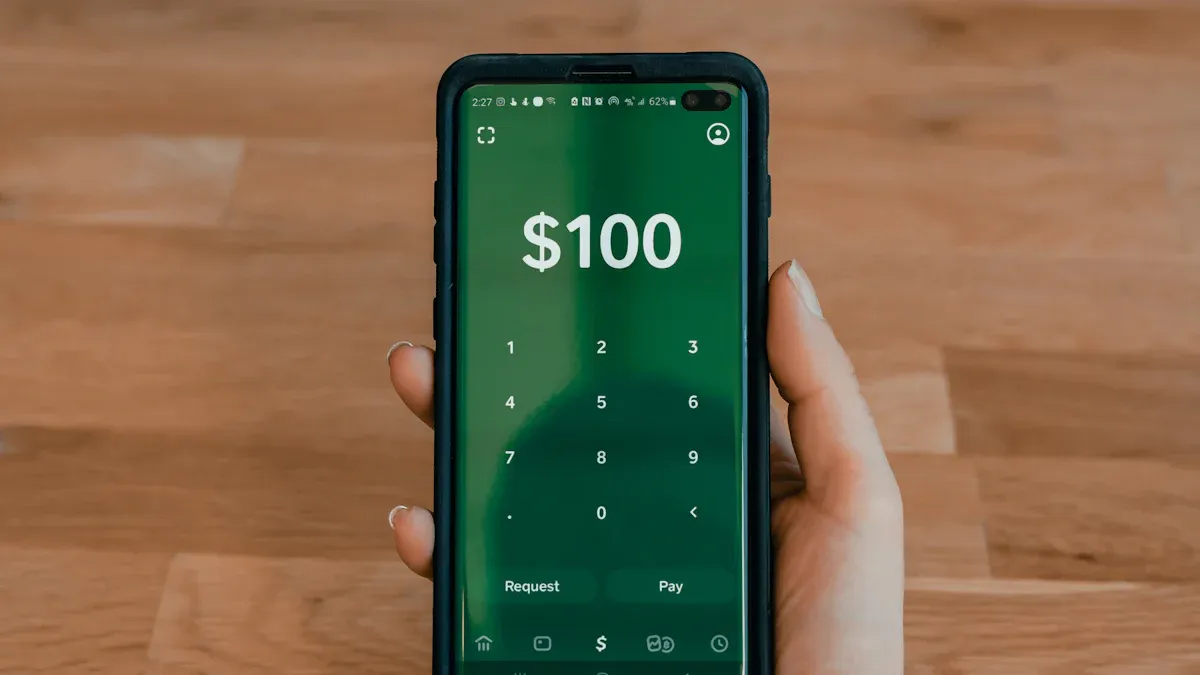

How to Add a Prepaid Card to Cash App: Steps and Key Considerations

Image Source: unsplash

The answer is yes, you can add a prepaid card to Cash App. This feature provides great convenience for many people. Data from 2023 shows that approximately 5.6 million U.S. households are unbanked, and nearly half of households rely on online payment services to handle core financial transactions.

Important Note: Not all prepaid cards are compatible with Cash App. The key to successful addition often lies in the card type. Prepaid cards with a Visa or Mastercard logo that support reloading have the highest success rate.

Key Points

- You can add a prepaid card to Cash App, but it needs to be a mainstream brand like Visa or Mastercard and must be reloadable.

- Before adding a prepaid card, you must register it on the issuer’s website, linking it to your name and address.

- In Cash App, click the profile icon, select “Linked Banks,” and then click “Link Debit Card” to add the prepaid card.

- When entering the card number, expiration date, CVV code, and ZIP code, double-check to ensure the information is correct.

- You cannot withdraw money from Cash App to a prepaid card; prepaid cards are primarily used for funding your Cash App account.

How to Add a Prepaid Card to Cash App

Image Source: unsplash

The process of adding a prepaid card to Cash App is very straightforward. You only need to follow a few clear steps. This process allows you to manage your funds more flexibly. Below, we provide a detailed step-by-step guide.

Preparation: Check Your Prepaid Card

Before starting, you need to complete a critical preparation step: registering your prepaid card. Many users fail to add their card because they overlook this step. Most prepaid cards require you to register them through the issuer’s official website or by calling the number on the back of the card to link your personal information to the card.

Why Is Registration Necessary? Federal law requires all financial institutions, including Cash App, to collect and verify the identity of account holders. This helps the government combat financial crimes. Therefore, you need to link the prepaid card to your real identity so Cash App can confirm you are the legitimate cardholder.

During registration, you typically need to provide the following information:

- Name

- Date of birth

- Physical address (not a P.O. box)

- Email address

- Social Security Number (in some cases)

Once registered, the prepaid card is linked to your personal profile and can be used for online verification seamlessly.

Step 1: Access “Linked Banks”

First, open Cash App on your phone. You need to navigate to the account settings to add a new card.

- Open the Cash App application.

- Click the profile icon in the top right corner of the screen to access your account homepage.

- Scroll down the menu, find, and click the “Linked Banks” or “Linked Accounts” option.

This page will display all the bank accounts and cards you have already linked.

Step 2: Select “Link Debit Card”

After entering the “Linked Banks” page, you will see options to add a new card or bank account. Since prepaid cards are recognized by the system as debit cards, you need to select the corresponding option.

On the page, click the “Link Debit Card” button directly. If your account already has a linked card, you may need to select “Replace Card” to swap it out.

Step 3: Enter Card Details

Next, the app will prompt you to enter the details of your prepaid card. Make sure you have the physical card on hand to input the information accurately.

You need to fill in the following:

- Card Number: The 16-digit number on the front of the card.

- Expiration Date: Usually in the format MM/YY.

- CVV Code: The 3-digit security code on the back of the card.

- ZIP Code: The ZIP code associated with the billing address used when registering the prepaid card.

Tip: Double-check the information when entering it. A single digit or letter error can lead to a failed addition.

Step 4: Complete Verification and Confirmation

After entering all the information and submitting it, Cash App will attempt to verify the card with the issuing institution. This process is usually instant. The system may initiate a small temporary charge (typically less than $1.00) to confirm the card is valid and has an available balance. This fee will be refunded shortly.

If the card information is correct, the card is successfully registered, and there is sufficient balance for verification, you will see a success message. The prepaid card will now appear in your “Linked Banks” list. At this point, you have successfully added the prepaid card to Cash App and can start using it to fund your account or perform other operations.

Supported and Unsupported Prepaid Cards

Image Source: pexels

While adding a prepaid card to Cash App is feasible, not all cards will work successfully. The key to success lies in the card’s type and functionality. Knowing which cards are supported can save you significant time and effort.

Supported Prepaid Card Types

Cash App primarily supports reloadable prepaid cards associated with major credit card networks. If your card bears the following logos, it has a high likelihood of success:

- Visa

- Mastercard

- American Express

- Discover

These cards function similarly to traditional debit cards because they are linked to your personal identity information. Some user-verified prepaid cards that can be successfully added include Netspend Prepaid Visa, Brink’s Prepaid Mastercard, and American Express Serve. As long as you complete the card registration and link it to your name and billing address, it can usually be added smoothly.

Unsupported Prepaid Card Types

The most common unsupported card type is “non-reloadable gift cards.” Additionally, some business-specific cards or cards with restricted uses may also fail to be added.

Notably, even some reloadable prepaid cards may have compatibility issues with Cash App. For example, Green Dot prepaid card users have reported that while direct deposits can be set up, adding the card for funding operations may encounter problems.

Why Gift Cards Often Fail

You may wonder why gift cards, which are also prepaid cards, consistently fail to be added. The main reason is anonymity.

Most Visa or Mastercard gift cards purchased in stores are anonymous at the time of sale, not linked to your name or address. As mentioned in the preparation section, Cash App needs to verify that you are the legitimate cardholder. Since anonymous gift cards cannot be matched to your identity, the verification process naturally fails.

Special Considerations for Government Benefit Cards

Government-issued cards, such as unemployment benefit cards or EBT cards, have unique considerations. You typically cannot add these cards directly to “Linked Banks” as debit cards to fund your Cash App account. This is because these cards have strict usage restrictions, limiting them to specific types of purchases.

However, this does not mean you cannot receive government funds through Cash App. Cash App explicitly supports direct deposit functionality, allowing you to receive various payments.

This means you can provide your Cash App account and routing numbers to the relevant government agency to have benefit funds deposited directly into your balance, rather than through adding a card.

Common Reasons for Adding Failures

When attempting to add a prepaid card, you may sometimes encounter a failure message. This is usually not a major issue, as most cases are caused by common minor errors. Understanding these reasons can help you resolve the issue quickly.

Incorrect Card Information

The most common and easily fixable issue is entering incorrect information. A small mistake can lead to verification failure.

Please carefully verify that the following information is completely correct:

- 16-digit card number

- Card expiration date (MM/YY)

- 3-digit CVV security code on the back

- ZIP code matching the card’s registered information

Prepaid Card Not Registered or Activated

This is a critical step many users overlook. Most prepaid cards require you to complete a simple registration process before use.

Important Note: Visit the website listed on the back of the card or call the customer service number to link your name and billing address to the card. Unregistered cards cannot verify your identity, so Cash App will reject them.

Mismatch Between Account and Card Region

Cash App’s services have clear regional restrictions. You must be in the U.S. to create and use an account. This means the region of your Cash App account and the issuing region of your prepaid card must match. If you try to add a prepaid card issued outside the U.S., the system is likely to reject it due to a region mismatch.

Insufficient Balance for Verification

To confirm your card is valid, Cash App performs a small temporary charge (usually less than $1.00 USD). This fee is refunded quickly. If your prepaid card is newly activated with no balance or has a balance below the verification fee, the addition process will fail. Ensure your card has at least a small amount of funds.

Triggering Security System Alerts

Cash App has an automated security system designed to protect your account. Certain actions may inadvertently trigger alerts, preventing you from adding a new card.

Possible reasons include:

- Your Cash App account has not completed full identity verification.

- The system detects unusual login attempts or suspicious transaction activity.

How to Resolve? If you believe there’s an error, contact the Cash App support team directly. You can reach them in the app via “Profile” > “Support” > “Start a Chat” or call 1 (800) 969-1940 between 9 AM and 7 PM Eastern Time.

Using and Managing Your Prepaid Card After Adding

Once you successfully add a prepaid card, you unlock more ways to manage your funds. The card now serves as a funding source for your Cash App account. Below, we explore how to use it and highlight some restrictions and fees to note.

How to Fund Your Cash App with a Prepaid Card

The most straightforward use is to fund your Cash App balance. This process is simple and can be completed in a few steps.

- Open Cash App and click the balance or bank icon in the bottom left corner of the main screen.

- Select the “Add Cash” option.

- Enter the amount you want to add.

- Click the payment source at the bottom of the screen to ensure you’ve selected the newly added prepaid card.

- Click “Add” to confirm the transaction.

The funds typically appear in your Cash App balance immediately, ready for use.

Sending and Receiving Funds

Your prepaid card primarily serves as a “funding pool.” You can use it to add money to your Cash App balance, then use the balance to pay friends or settle bills. When you receive funds from others, the money goes into your Cash App balance, not directly to your prepaid card.

Important Process: Prepaid Card ➔ Fund Cash App Balance ➔ Use Balance to Send Funds

Restrictions on Functionality

While prepaid cards are convenient, they come with important functional limitations. Understanding these restrictions can help you avoid unnecessary issues.

Key Limitation: Cannot Withdraw to Prepaid Card You cannot “Cash Out” (withdraw) your Cash App balance to your prepaid card. Withdrawals typically require a linked traditional bank account, or you can use the Cash App Card to withdraw cash at an ATM.

Additionally, certain advanced features, such as purchasing stocks or Bitcoin, may not be available solely through a prepaid card.

Potential Fees Involved

When using a prepaid card, be aware of two potential types of fees. Understanding these fees helps you manage expenses better.

| Fee Type | Description |

|---|---|

| Cash App Withdrawal Fee | If you choose “Instant Transfer” to withdraw funds to a linked debit card, Cash App charges a fee (typically 0.5%–1.75%). Standard withdrawals (1–3 business days) are free. |

| Prepaid Card Issuer Fees | Your prepaid card may have its own fees, such as monthly maintenance or transaction fees. These are charged by the card issuer, not Cash App. Be sure to review the card’s user agreement. |

In summary, adding a prepaid card to Cash App is entirely feasible. You just need to choose the right card type and complete the necessary registration steps. This feature provides a flexible supplementary tool for managing your funds.

Final Reminder: Before adding a card, ensure it is supported and that you have linked your personal information to it.

Pay attention to the usage restrictions and potential fees to make the most of this feature.

FAQ

Can I withdraw my Cash App balance to a prepaid card?

You cannot withdraw your Cash App balance to a prepaid card. The withdrawal function only supports linked traditional bank accounts or standard debit cards. You’ll need to use other methods to access your funds.

Is there a fee to add a prepaid card?

Adding a card itself is free. Cash App may perform a temporary charge of less than $1.00 USD to verify the card. This amount is refunded within a few days and is not an actual fee.

Can I link multiple prepaid cards to Cash App?

You can only link one debit or prepaid card to Cash App at a time. If you want to add a new prepaid card, you need to remove or replace the currently linked card.

What if my prepaid card doesn’t have a ZIP code?

Most prepaid cards require online registration. Visit the website on the back of the card or call the number to link your name and billing address (including ZIP code) to the card. Only then can you add it successfully.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.