- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Practical Tips and Advice to Avoid Remittance Scams

Image Source: pexels

Globally, remittance scams have become a concerning form of crime. Each year, global remittance volumes reach hundreds of billions of dollars, attracting numerous scammers looking to exploit this massive transaction flow. Data shows that in 2014, China reported over 400,000 telecom fraud cases, causing economic losses of 10.7 billion yuan; by 2015, this number rose to 590,000 cases, with losses reaching 22.2 billion yuan.

You might wonder, are international remittances safe? The answer depends on whether you’ve mastered scam prevention techniques. Scammers often use fake identities or urgent requests to lure victims into transferring money, and a moment of carelessness can lead to falling into their traps. Learning to identify these schemes and taking effective measures can help protect your funds.

Are International Remittances Safe? Common Remittance Scam Tactics

Image Source: pexels

Fake Identity Scams

Fake identity scams are among the most common remittance fraud tactics. Scammers often pose as trustworthy individuals, such as friends, family, or business partners. They contact you via fake social media accounts, emails, or phone calls to gain your trust. Once your guard is down, they request transfers to a specific account, citing reasons like “urgent needs” or “business collaborations.”

Statistics show that while the number of fake identity scam victims is relatively low, the financial losses are significant. For example:

| Number of Victims | Scam Amount (10,000 Yuan) | Recovered Losses (10,000 Yuan) |

|---|---|---|

| 29 | 820 | 539 |

This indicates that scammers often target high-value victims, resulting in substantial losses per case. To avoid becoming a victim, carefully verify the identity of the other party, especially in financial transactions.

Urgent Remittance Requests

Scammers exploit people’s tendency to lose judgment in emergencies, fabricating urgent situations to trick you into transferring money. For instance, they may pose as a friend claiming to be in trouble abroad and needing immediate funds. Alternatively, they might impersonate your employer, requesting a transfer for “urgent company matters.”

When facing such requests, stay calm. Don’t act hastily due to the “urgent” tone. Try contacting the individual through other channels to verify the situation. Remember, genuine emergencies typically have alternative solutions beyond relying solely on remittances.

Impersonating Official Institutions

Impersonating official institutions is a rising scam tactic. Scammers often pose as government agencies, banks, or law enforcement, contacting you via phone, email, or text. They may claim your account has issues or that you’re involved in illegal activities, demanding immediate payment to avoid legal consequences.

Data highlights the severity of such scams:

- Impersonation of public security and judicial institutions accounts for 23% of scam-related losses.

- Telephone scams result in 1.6 billion yuan in losses, making them a primary fraud method.

- The top three scam types in Q2 caused over 2.99 billion yuan in total losses.

These figures show that impersonation scams are frequent and highly damaging. Remember, legitimate institutions never request direct transfers via phone or text. If you receive such a request, hang up immediately and verify through official channels.

High-Return Investment Lures

Scammers exploit the desire for high returns by designing investment frauds. These schemes often promise “low risk, high reward” to entice you to invest. For example, they may claim exclusive “insider information” or “guaranteed returns” for a project, promising significant profits in a short time. However, these opportunities are often outright scams.

Here are some notable cases:

- Zhejiang Wanjia Shopping Network: Involved 1.9 million people, with losses reaching 24.045 billion yuan.

- MMM Financial Mutual Aid Platform: Attracted over 5 million members, with losses in the tens of billions of yuan.

- Magic Farm Game Pyramid Scheme: Engaged over 120,000 players, with transactions totaling over 46 million yuan.

These cases show that high-return scams involve large numbers of victims and massive sums. Alarmingly, many victims struggle to recover losses due to the lack of recourse.

To avoid such traps, stay rational. Any promise of “high returns, low risk” should raise suspicion. Protect yourself by:

- Thoroughly verifying the legitimacy of investment projects.

- Avoiding opportunities recommended by strangers.

- Consulting professionals or institutions to ensure compliance.

Scammers exploit human weaknesses to design traps. Staying vigilant is key to avoiding becoming a victim.

Phishing Emails and Malicious Links

Phishing emails and malicious links are another prevalent scam tactic. These scams typically involve fake emails or texts that trick you into clicking links or downloading attachments. Once clicked, scammers may steal your personal information or even take control of your account.

Statistics show fluctuations in phishing email attacks across quarters:

| Quarter | Number of Phishing Email Attacks |

|---|---|

| Q1 | 1,624,144 |

| Q2 | Relatively fewer |

| Q3 | Relatively fewer |

| Q4 | 1,652,381 |

These figures indicate that phishing emails remain a constant threat, with spikes in Q1 and Q4. Scammers often exploit holidays or special periods, posing as banks, shopping platforms, or other institutions to send seemingly legitimate emails.

To protect against phishing emails and malicious links, take these steps:

- Avoid clicking links or attachments in unsolicited emails.

- Verify that the email address matches the official source.

- Use security software to scan email content for viruses or malicious programs.

Scammers are skilled at impersonation, but careful observation and cautious actions can help you avoid their traps. Protecting personal information and account security is critical to preventing such scams.

Basic Principles for Ensuring Fund Safety

Verify Recipient Identity

Verifying the recipient’s identity is the first step in preventing remittance scams. Scammers often impersonate trusted individuals or institutions to gain your confidence. Confirm their identity through reliable methods to avoid transferring funds to fraudulent accounts.

Effective verification strategies include:

- Direct contact: Confirm identity via phone or video call, not just email or text.

- Check account details: Ensure the bank account matches the recipient’s provided information.

- Leverage bank risk controls: Many banks, like China Merchants Bank, have advanced systems to identify risks. For example, China Merchants Bank successfully prevented a 980,000 yuan loss for a client. When client Mr. Wang faced a scam, the bank’s system issued a timely warning, and staff collaborated with an anti-fraud center to protect his funds.

These methods significantly reduce the risk of being scammed, ensuring your funds’ safety.

Use Two-Factor Authentication

Two-factor authentication (2FA) is a critical tool for securing funds. It adds an extra verification step, making it harder for scammers to bypass security. You can use 2FA in these scenarios:

- Online remittances: Enable SMS codes or dynamic passwords to ensure only you can complete transactions.

- Account logins: Use fingerprint or facial recognition to prevent unauthorized access.

- Large transfers: Require phone or video confirmation to verify transaction authenticity.

2FA enhances security and gives you more time to assess transactions. Institutions like Hong Kong banks widely use 2FA to provide safer remittance experiences. Consult your bank to enable these features for an added layer of protection.

Handle Urgent Remittance Requests Cautiously

Urgent remittance requests are a common scammer tactic. They exploit your anxiety to prompt rash decisions. Stay calm and follow these steps:

- Pause operations: Don’t transfer funds immediately; assess the request’s legitimacy.

- Contact the requester: Verify the situation via phone or other channels.

- Consult professionals: Seek advice from banks or anti-fraud centers if unsure.

For example, scammers may pose as a friend claiming distress abroad, urging an immediate transfer. Verify their identity or contact mutual acquaintances to confirm. Genuine emergencies typically have alternative solutions beyond remittances.

Handling urgent requests cautiously prevents emotional decisions and protects your funds.

Avoid Operating in Public Network Environments

Operating remittances in public networks poses significant risks. Scammers may intercept personal or account data via public Wi-Fi, enabling fraud. Understand these risks and take protective measures.

Public network risks primarily affect:

- College students: Vulnerable to job or brushing scams due to limited experience.

- Corporate finance staff: Susceptible to impersonation scams due to weak financial protocols.

- Pregnant women and new mothers: Targeted by online investment or shopping scams while at home.

- Small business owners: Prone to loan scams with “no collateral” or “zero interest” promises.

To avoid risks in public networks:

- Avoid public Wi-Fi: Don’t log into bank accounts or transfer funds in cafes or airports.

- Use a VPN: Encrypt your connection to prevent data theft.

- Disable auto-connect: Prevent your device from joining unsafe networks.

- Use mobile data: Opt for mobile data when public Wi-Fi is unavoidable.

These steps significantly reduce risks in public network environments, safeguarding your funds and information.

Regularly Monitor Account Activity

Regularly monitoring account activity is a key defense against remittance scams. By tracking transactions, you can quickly detect anomalies and act to prevent further losses.

Modern technology supports account monitoring:

- Big data analytics: Identifies suspicious activity by analyzing transaction patterns.

- AI algorithms: Detects anomalies in transaction data and generates alerts.

- Account risk monitoring systems: Enhances compliance and risk management across the account lifecycle.

Monitor accounts through:

- Transaction alerts: Enable SMS or email notifications for real-time updates.

- Regular logins: Check transaction records weekly or monthly for anomalies.

- Balance checks: Contact the bank immediately if balances drop unexpectedly.

- Bank security tools: Use services like Hong Kong banks’ account monitoring for enhanced safety.

Regular monitoring helps detect issues early and boosts security awareness, protecting your funds from scams.

Practical Tips and Advice to Prevent Scams

Image Source: pexels

Choose Secure Remittance Channels

Selecting secure remittance channels is critical for fund safety. Scammers often exploit insecure platforms or fake channels. Prioritize reputable banks or institutions, like Hong Kong banks, which offer secure services with multiple verification layers to prevent fraud.

When choosing channels:

- Opt for established banks: They have robust risk controls and customer protections.

- Avoid unknown third-party platforms: These may have security vulnerabilities exploited by scammers.

- Understand the process: Familiarize yourself with the channel’s operations to ensure secure transactions.

Secure channels significantly reduce the risk of fund theft, ensuring reliable transactions.

Set Strong Passwords and Update Regularly

Strong passwords are essential for account security. Weak or reused passwords are easily cracked, giving scammers access. Use unique, complex passwords and update them regularly.

Tips for strong passwords:

- Combine letters, numbers, and symbols: Turn “Password123” into “P@ssw0rd!23”.

- Avoid personal information: Exclude birthdays, names, or phone numbers.

- Update regularly: Change passwords every three months to mitigate risks.

Use password managers to generate and store complex passwords, reducing memorization burdens. These steps make accounts harder to breach.

Enhance Employee Anti-Fraud Awareness

In corporate settings, employee anti-fraud awareness impacts fund safety. Scammers often impersonate executives or send fake emails to trick employees into erroneous transfers. Training and awareness campaigns can strengthen defenses.

Data shows that improved employee awareness boosts scam detection rates:

| Year | Cases Solved | Suspects Arrested | Telecom Fraud Case Decline | Public Loss Decline |

|---|---|---|---|---|

| 2017 | Up nearly 50% | Up nearly 30% | Down 25% | Down 18% |

| 2023 | Up over 20% | Up nearly 20% | Data unavailable | Data unavailable |

Enhance awareness through:

- Regular training: Educate on common scams and prevention techniques.

- Simulated scenarios: Conduct drills to improve response skills.

- Reporting mechanisms: Encourage reporting suspicious activities to foster a vigilant culture.

These measures protect corporate funds and enhance employee responsibility.

Use Encryption to Protect Sensitive Information

Encryption is a vital tool for safeguarding sensitive data. It converts information into unreadable formats, preventing unauthorized access. Use encryption for bank accounts, personal details, and business secrets.

Common encryption methods:

- End-to-end encryption: Secures chats and emails, ensuring only intended recipients access content.

- File encryption: Protects stored files via encryption software.

- Disk encryption: Secures entire drives to prevent data theft if devices are lost.

Many banks, like Hong Kong banks, use advanced encryption protocols for transaction security. You can also install encryption software or use built-in features to protect data. Combine encryption with other security measures for optimal protection.

Regularly Update Security Software

Updating security software is critical to countering cyber threats. Outdated software is vulnerable to attacks. Ensure antivirus, firewall, and operating systems are up to date.

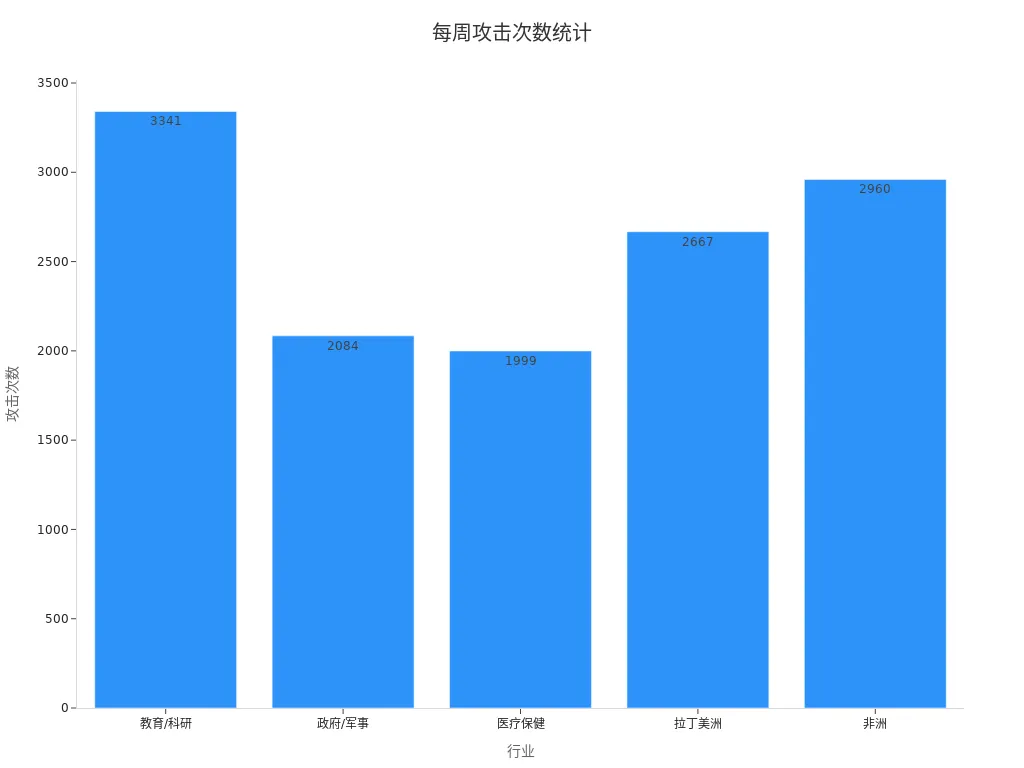

Data shows varying cyberattack frequencies across industries and regions:

| Industry | Weekly Attacks | Year-on-Year Growth |

|---|---|---|

| Education/Research | 3,341 | - |

| Government/Military | 2,084 | - |

| Healthcare | 1,999 | - |

| Latin America | 2,667 | +53% |

| Africa | 2,960 | +37% |

| Europe | N/A | +35% |

| Manufacturing | N/A | +56% |

Education, research, and government sectors are prime targets, with rising attack rates signaling escalating threats. Regular updates reduce vulnerabilities.

Tips:

- Enable auto-updates: Ensure software updates automatically.

- Check update status: Manually verify software versions.

- Install trusted software: Use reputable antivirus and firewall solutions.

Regular updates protect against known and emerging threats, securing your devices and data.

Guide to Handling Remittance Scams

Immediately Stop Transactions and Contact the Bank

If you suspect a remittance scam, stop the transaction immediately and contact your bank. Banks can freeze accounts via risk control systems to prevent further losses. Call the bank’s hotline promptly, explain the situation, and request assistance. Hong Kong banks, for example, offer 24/7 services for urgent cases.

Swift bank action can curb scams. For instance, Bank of China Fujian Branch has successfully mitigated fraud in multiple cases:

| Year | Case Description |

|---|---|

| 2013 | Reported suspicious mass account openings, issuing money laundering alerts to prevent losses. |

| 2014 | Identified a fund management company scam, reported to regulators, protecting over 80 people’s assets. |

| 2016 | Staff detected a client using a fake ID, coordinating with police to prevent fraud. |

These cases show that timely bank intervention reduces losses. Time is critical—contacting the bank early maximizes recovery chances.

Preserve Evidence (Chat Logs, Emails, etc.)

Preserving evidence is crucial when handling scams. Scammers often use chats, emails, or texts, which serve as key evidence for investigations. Save all relevant communications and ensure they’re clear for later use.

Tips for preserving evidence:

- Take screenshots: Capture chat logs and texts, storing them securely.

- Back up emails: Forward scam emails to a secondary account to avoid accidental deletion.

- Record details: Note the time, place, and contact details of the scam.

These records aid police investigations and provide legal support, enhancing case resolution.

Report to Local Police or Relevant Authorities

Reporting scams protects yourself and others. Submit preserved evidence to local police or anti-fraud centers. Authorities can investigate and apprehend suspects based on your report.

Data shows high success rates for reported cases:

| Case Type | Resolution Rate | Average Resolution Time | Related Changes |

|---|---|---|---|

| Homicide | 100% | 7.6 hours | Cases down 32.5% |

| Burglary | N/A | N/A | Incidents down 38.2% |

| Robbery | N/A | N/A | Resolution rate up 29.6 points |

Homicide cases achieve a 100% resolution rate. Report promptly with detailed evidence to aid swift action and protect others’ assets.

Seek Professional Legal Assistance

Seeking legal assistance is vital for protecting your rights after a scam. Lawyers or legal institutions can analyze your case, offer advice, and help recover losses. Act quickly to avoid missing critical windows.

Tips:

- Consult specialized lawyers: Choose those experienced in financial fraud.

- Access legal aid: Many organizations offer free or low-cost services for victims.

- Understand relevant laws: Familiarity with fraud-related regulations strengthens your case.

Legal assistance not only aids recovery but also supports police with stronger evidence, enhancing anti-fraud efforts.

Stay Vigilant to Avoid Secondary Scams

After a scam, stay alert to avoid further victimization. Scammers may exploit your anxiety with new schemes. Stay calm and take these steps:

- Verify information: Check suspicious messages and avoid impulsive payments.

- Enhance cybersecurity: Avoid unsafe websites for shopping or job searches.

- Clean social groups: Educational institutions should manage groups, monitor content, and remove suspicious members.

During the pandemic, scams surged, exploiting demand for protective gear and the rise in online shopping and job searches. Be cautious of:

- Unverified product or service recommendations.

- Urgent payment requests—verify identities first.

These measures prevent secondary scams, with caution and vigilance as your strongest defenses.

Preventing remittance scams is critical. Scammers employ diverse tactics, and a single lapse can lead to losses. Adopt measures like verifying recipient identities, using two-factor authentication, and monitoring account activity to safeguard your funds.

Staying vigilant is everyone’s responsibility. By learning prevention techniques, you protect yourself and help others avoid scams. Let’s work together to combat fraud and create a safer financial environment.

FAQ

1. How can I tell if an email is a phishing scam?

Phishing emails often contain spelling errors, mismatched sender addresses, or unreasonable urgent requests. Verify the email address against official sources and avoid clicking suspicious links or attachments.

Tip: Use security software to scan emails for added safety.

2. What should I do if I accidentally click a malicious link?

Disconnect from the internet immediately to prevent data leaks. Scan your device with antivirus software to remove malicious programs. Change account passwords and contact your bank to check for unusual activity.

3. Why is two-factor authentication so important?

Two-factor authentication adds an extra security layer, making it harder for scammers to access your account even if they have your password. Enable it via SMS codes or biometric verification for secure transactions.

4. How should I handle calls from supposed official institutions?

Hang up and don’t share personal information. Verify through official channels, like calling the bank or agency’s official hotline. Legitimate institutions don’t request direct payments via phone.

5. How can I choose secure remittance channels?

Prioritize reputable banks like Hong Kong banks, which offer multiple verification layers and robust risk controls. Avoid unknown third-party platforms and verify recipient details before transferring.

Note: Always confirm recipient information to ensure error-free transactions.

See Also

V2 Digital Remittance: Streamlining Electronic Funds Transfers with Digital Currency Services

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.