What Exactly Is an Option? A Comprehensive Analysis from the Contract Concept to Key Terms

Understanding Options in One Sentence

You can think of an option as “a train ticket with a refund option”: you pay a fare (premium) upfront, and on the expiration date, if the route and timing suit you, you use it (exercise); if not, it expires, and you lose only the fare. The difference is that the option’s “counterparty” (seller) must fulfill the contract if you choose to exercise.

More formally: An option is a contract where the buyer, after paying a premium, gains the right to buy or sell an underlying asset at a predetermined price within a specified period; correspondingly, the seller collects the premium and bears the obligation to fulfill the contract if exercised. This “rights vs. obligations” structure is repeatedly emphasized in Chinese regulations and exchange rules, such as the China Securities Regulatory Commission’s descriptions of “premium payment, strike price, and cash settlement” in the contract elements of derivatives brokerage, clearly reflecting the legal and economic essence of options (2024). See CSRC Appendix: Futures Brokerage Contract Elements (2024).

To clarify: Options ≠ Futures. Futures involve mutual obligations for both parties, while options grant the buyer unilateral rights and impose potential obligations on the seller, with entirely different payoff profiles.

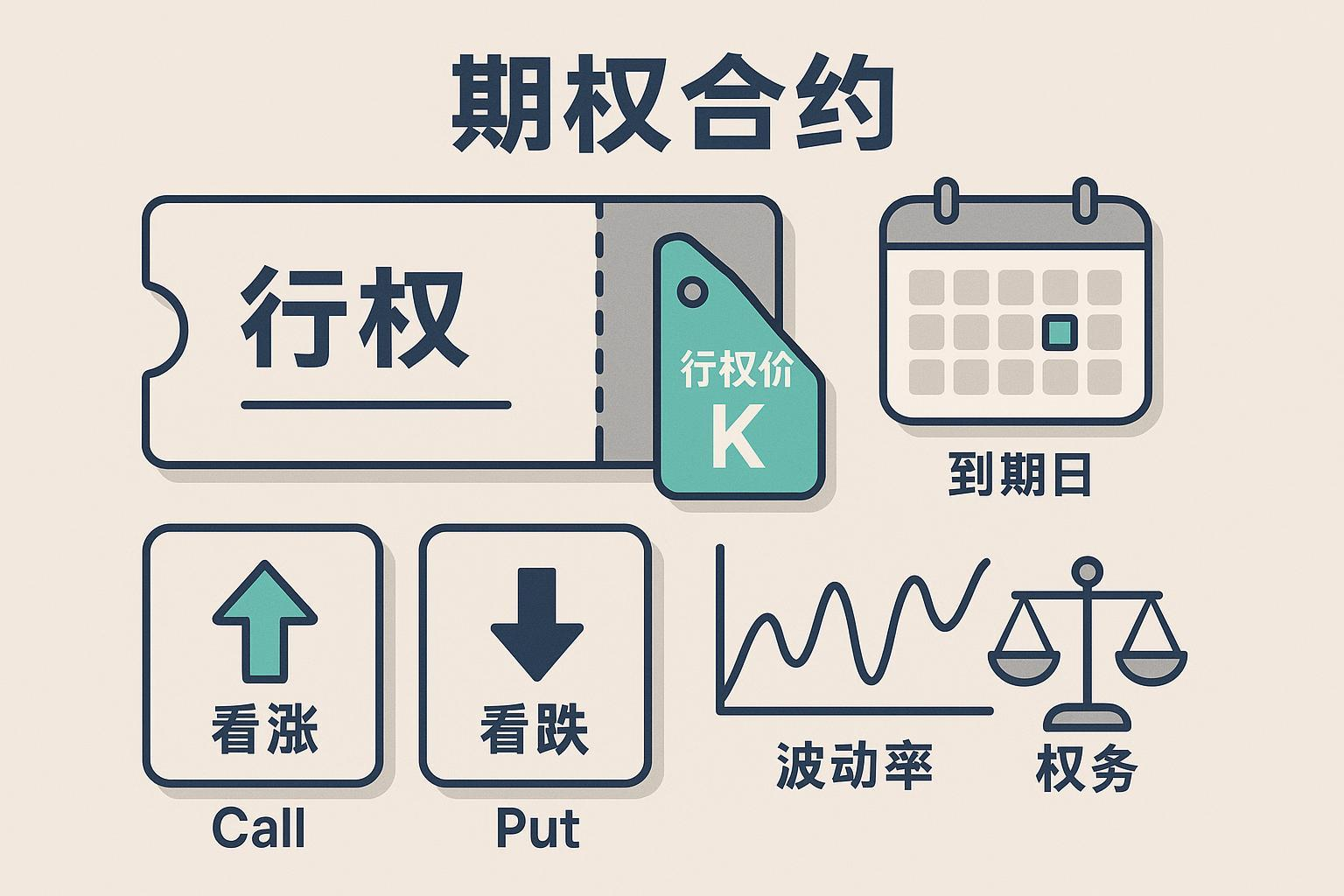

Contract Elements: What’s Written in an Option Contract?

To understand options, start with the “contract elements”:

- Underlying Asset: Stocks, ETFs, indices, commodities, etc.

- Strike Price (K): The agreed price for buying/selling at expiration.

- Expiration Date/Last Trading Day: The contract’s endpoint, when rights can be exercised.

- Contract Unit/Multiplier: The quantity of the underlying asset per contract.

- Exercise Style: European (exercisable only at expiration) or American (exercisable any trading day before expiration).

- Premium: The price paid by the buyer to the seller.

Take the SSE 50 ETF Option as an example: The contract uses European exercise; the expiration date is the fourth Wednesday of the expiration month, typically coinciding with the last trading day; it involves physical delivery; each contract corresponds to a fixed quantity of the underlying (contract multiplier) (subject to the latest announcement). These elements can be found in the SSE 50 ETF Option Contract Terms (2023).

You might ask: “Why is the fourth Wednesday important?” Because it determines how much time value remains, how automatic exercise and settlement are triggered, and thus affects pricing and risk exposure.

Basic Classifications: Call/Put, European/American

- Call Option: Grants the buyer the right to “buy the underlying at K,” bullish in direction.

- Put Option: Grants the buyer the right to “sell the underlying at K,” bearish in direction.

- European Exercise: Exercisable only on the expiration date; American Exercise: Exercisable on any trading day before expiration. Note that these are rules about exercise timing, not geography.

In the Chinese exchange market:

- Stock/ETF Options (SSE, SZSE): Predominantly European, with specific contract and business rules available at SZSE Option Products and Rules Portal (Continuously Updated).

- Index Options (CFFEX): European, cash-settled.

- Commodity Options (e.g., SHFE): Mostly European, primarily physical delivery, though some may use cash settlement, subject to specific contract rules.

Where Does the Price Come From: Intrinsic Value, Time Value, and “In-the-Money/At-the-Money/Out-of-the-Money”

Option prices can be broken into two parts:

- Intrinsic Value: The “certain” profit if exercised now. For calls, ≈ max(underlying price S − strike price K, 0); for puts, ≈ max(K − S, 0).

- Time Value: The remaining portion of the price after subtracting intrinsic value, reflecting the “potential” value of future uncertainty, which typically decays over time.

“In-the-Money/At-the-Money/Out-of-the-Money” (Moneyness) describes the relationship between S and K: for calls, S > K is in-the-money, S ≈ K is at-the-money, S < K is out-of-the-money; for puts, the reverse applies. This terminology is standard in global markets; see “Moneyness” Overview (Wikipedia Chinese).

For example:

- If the underlying price S = 52 CNY and the strike price K = 50 CNY for a call option, the intrinsic value = 2 CNY; if the market price of the option is 3.5 CNY, then the time value = 1.5 CNY.

- As expiration approaches, even if S remains unchanged, the time value “evaporates.” This is one reason why some people lose money despite predicting the direction correctly.

Implied Volatility (IV) and Greeks: The “Thermometer” of Options

- Implied Volatility (IV): The market’s expectation of future volatility, derived from the option price. When IV rises, option prices typically increase (other factors constant); when IV falls, the opposite occurs.

- Delta (Δ): Sensitivity of the option price to changes in the underlying price (“how much it follows the rise/fall”).

- Gamma (Γ): Sensitivity of Delta to changes in the underlying (“acceleration”).

- Theta (Θ): Sensitivity to the passage of time, usually negative, reflecting the daily “decay” of time value.

- Vega (ν): Sensitivity to implied volatility.

- Rho (ρ): Sensitivity to changes in the risk-free interest rate.

Two intuitive scenarios:

- With plenty of time to expiration, if the market “gets nervous” and IV rises, the option price may increase even if the underlying barely moves.

- Conversely, if the direction is correct but IV drops and time passes (negative Theta), the option’s gains may be smaller than expected or even turn into losses.

Trading, Exercise, and Settlement: What Happens on Expiration Day

- Stock/ETF Options: Mostly European exercise; in-the-money options are typically exercised at expiration, while out-of-the-money options are abandoned; post-exercise, the delivery process begins, usually completed by T+1. Specific details on automatic exercise/abandonment and “assignment” depend on the latest exchange rules and announcements.

- Index Options: European, cash-settled. The settlement price is generally based on the arithmetic average of the underlying index over the last two hours of the last trading day (typically the third Friday of the expiration month, postponed if it’s a holiday), as detailed in CFFEX Index Option Contract Trading Rules (2022).

- Commodity Options: Primarily physical delivery, with processes and warehouse receipt systems governed by specific contract rules, as outlined in SHFE Futures/Options Operation Manual and Delivery Rules (2025 Edition).

Friendly reminder: For SSE stock and ETF options, key contract details such as expiration date, last trading day, exercise style, and delivery process can be found in the contract terms page (e.g., the SSE 50 ETF Option Contract Terms cited above). SZSE issues reminders or handling arrangements near expiration, accessible via the links provided. Rules may be adjusted per announcements, so always refer to the latest exchange publications.

Seller Margin and Combination Strategy Margin (Key Points Only)

- Seller margin covers potential fulfillment risks, calculated based on risk coverage principles, with specific formulas and parameters set by exchanges/settlement institutions, varying by underlying and strategy.

- Combination strategies (e.g., spreads, butterflies, straddles) may qualify for margin reductions under certain conditions to reflect net risk exposure; however, some combinations may be automatically unwound near expiration for exercise and settlement (subject to exchange announcements and settlement rules).

One sentence to remember: Selling options isn’t “collecting premiums for free” but involves exchanging margin for obligation exposure; rules, risk controls, and parameters are critical.

Chinese Market Highlights (2025 Context)

- SSE/SZSE: Stock and ETF options are European, primarily physically delivered, with contract terms and business rules centralized on exchange websites, e.g., SSE Contract Terms Page (2023) and SZSE Option Products Portal (Continuously Updated).

- CFFEX: Index options are European, cash-settled, with settlement prices based on the index average over a specific period on the last trading day, as detailed in CFFEX Index Option Contract Trading Rules (2022).

- SHFE: Commodity options are mostly European, primarily physically delivered, with significant variation by product; refer to specific contracts and the Operation Manual/Delivery Rules (2025 Edition).

Note: Specific parameters (e.g., contract multipliers, expiration arrangements, exercise, and delivery processes) may vary by underlying, product, or rule updates; always consult the latest exchange announcements and contract texts.

Common Pitfalls and Self-Check List

- Focusing only on direction, ignoring time and volatility: Even if the direction is correct, negative Theta and falling IV can lead to losses.

- Ignoring expiration: As expiration nears, time value decays rapidly; out-of-the-money options are more likely to expire worthless.

- Misinterpreting “European/American” as geographic: These refer only to exercise timing rules, not market geography.

- Assuming “sellers always profit from premiums”: Sellers face potential large losses, requiring margin and subject to risk controls and assignment mechanisms.

- Overlooking liquidity and slippage: Low liquidity can lead to execution difficulties or high costs.

Self-check questions:

- Can I accurately identify the underlying, K, expiration, multiplier, and exercise style of this contract?

- If the underlying rises/falls by 1%, how will my option likely move (Delta/Gamma/Theta/IV)?

- What’s the worst-case scenario before expiration? Do I have enough funds or underlying assets prepared?

Summary and Compliance Statement

The essence of options is “paying a premium for a time-limited right to choose.” Understanding contract elements, value structures, and IV/Greeks helps answer key questions like “Why did I lose money despite being right on direction?” or “Why did the price change so dramatically before expiration?” Please note: This article is for investor education and knowledge dissemination only and does not constitute investment or trading advice. All statements regarding rules and processes are subject to the latest announcements, contracts, and rules from exchanges and regulatory bodies (as of 2025-10-14).

Grasping options reveals how contract rights and obligations offer flexibility, yet real-world execution stumbles on capital flow hurdles: remittance fees eating into premium profits, exchange volatility spiking IV risks, tricky foreign account setups, and settlement delays during exercises or margin top-ups. These often turn in-the-money plays sour via cost slippage, critical for cross-market option traders where swift funding decides outcomes.

BiyaPay tackles this head-on: conversions between 30+ fiat currencies and 200+ cryptos, with remittance fees as low as 0.5%, same-day transfers to most global areas. Quick registration bypasses overseas accounts, enabling US and Hong Kong stock trades on-platform with zero-fee contract orders—aligning perfectly with Greeks dynamics and time decay handling.

Time to exercise your edge? Sign up via BiyaPay and harness Real-time Exchange Rates to pin USD and fiat sweet spots, buffering theta erosion plus FX hits. Dive into the Stocks area next, layering option tactics across borders. With compliance, encryption, and risk controls upfront, BiyaPay amplifies your premiums amid volatility. Skip remittance snags—register today, test with small stakes, and turn options savvy into funding firepower.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Want to Predict A-Share Market Moves? Understanding These 5 Macro Signals Is Enough

Volume-Price Rising Together or Diverging? Complete A-Share Practical Trading Strategy Guide

In-Depth Review: After ChiNext Dropped Over 1% and Rebounded, Who Will Be Tomorrow’s A-Share Leader?

Another Major Drop! Why Is the A-Share Index Falling Non-Stop – Where Exactly Is the Problem?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.