- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Cost of Living in Singapore: The Latest Guide for 2024

Image Source: unsplash

You will find the cost of living in Singapore among the highest in Asia, with the city ranking first globally for expats. In 2024, average living expenses in Singapore for a single person reach about $3,800 USD per month, while a family of four faces costs around $9,400 USD monthly. The table below highlights typical monthly costs:

| Category | Living Expenses (USD) | Rent (USD) | Total (USD) |

|---|---|---|---|

| Single Person | 1,100 | 2,700 | 3,800 |

| Family of Four | 3,900 | 5,500 | 9,400 |

You should consider factors like lifestyle, family size, location, and inflation trends, as these strongly affect your cost of living in Singapore. The expat population often pays more for private housing, luxury goods, and imported food, while locals benefit from government support and a low crime rate. Despite high prices, Singapore’s low crime rate and quality of life continue to attract expats worldwide.

Key Takeaways

- Housing is the biggest expense in Singapore, with rent varying widely by location and property type; choosing suburban areas or government-subsidized flats can save money.

- Food costs depend on your habits; eating at hawker centers and cooking at home helps reduce expenses significantly.

- Public transport is affordable and reliable, making it the best choice for most people to keep travel costs low compared to owning a car.

- Healthcare offers quality options, but expats should get private insurance to cover higher costs; using public clinics and preventive care lowers medical bills.

- Budgeting with clear goals and smart spending habits, like using cashback apps and energy-efficient appliances, helps manage the high cost of living and build savings.

Average Cost of Living in Singapore

Monthly Expenses Overview

You will notice that the average cost of living in Singapore remains high in 2024. Many people find that housing, food, transportation, and healthcare make up the largest part of their monthly expenses. If you plan your monthly budget estimates, you should look at each category closely.

Here is a summary table of typical monthly expenses for a family of four in Singapore:

| Expense Category | Typical Monthly Cost Range (USD) | Notes |

|---|---|---|

| Housing (Family of 4) | 1,850 - 6,300 | Rent varies by type, size, location; Utilities add 75 - 185 |

| Food (Family of 4) | 220 - 440 (groceries) | Hawker meals: 3 - 4.5 per meal; Cafes: 11 - 26 per meal |

| Transportation | 94 (public transport) to 2,200 (car ownership) | Taxi/private hire ~660; Car includes fuel, parking, road tax |

| Healthcare | 37 (GP consultation) to 1,100 (hospital per night) | Health insurance for expats: 370 - 740 monthly |

You can see that rent takes up the largest share of living expenses in Singapore. Food costs depend on whether you cook at home or eat out. Public transport is affordable, but car ownership can increase your monthly expenses sharply. Healthcare costs also vary, especially for expats who need private insurance.

Key Influencing Factors

Several factors shape the average cost of living in Singapore. You should consider these when planning your move or adjusting your lifestyle.

- Many young adults live with parents longer because of high property prices and housing affordability challenges.

- Rental costs for two-bedroom government apartments have increased in recent years, making it harder for families to find affordable options.

- High housing costs often lead people to delay having children or reduce family size.

- Raising children and caring for elderly parents adds financial pressure, which affects your overall living expenses in Singapore.

- Marriage is often necessary to secure affordable housing through government schemes.

- Central neighborhoods like Bukit Timah and River Valley cost more, but they offer proximity to jobs and amenities.

- East Singapore areas such as Joo Chiat, Katong, and Geylang are more affordable and offer a different lifestyle.

- International schools influence where expat families choose to live, as they want to reduce commute times for their children.

- Singapore’s public transportation system helps keep commuting costs low, no matter where you live.

- Your lifestyle choices, such as living in older buildings or choosing condos, also affect your housing costs.

Inflation has played a big role in shaping the cost of living in Singapore. Year-on-year inflation has ranged from 5.5% to 7.5% recently, driven mainly by housing prices. Housing and utilities now make up about 24.8% of the consumer price index. Government support measures, such as rebates, vouchers, and grants, help lower and middle-income households. However, these do not fully offset the impact of rising prices, especially for families needing larger homes or expats who do not qualify for all subsidies.

Cost Comparison: Singles, Couples, Families

You will find that the average cost of living in Singapore changes based on your household size and lifestyle. Singles, couples, and families each face different challenges and expenses.

| Household Type | Average Monthly Expenses (USD) | Rent (USD) | Total (USD) |

|---|---|---|---|

| Single | 800 - 1,400 | 2,000 - 3,200 | 2,800 - 4,600 |

| Couple | 1,500 - 2,500 | 2,700 - 4,000 | 4,200 - 6,500 |

| Family of Four | 3,900 | 5,500 | 9,400 |

If you are an expat, you may pay more for private housing, international schools, and imported goods. Many expats choose to live in central locations, which increases their monthly expenses. Locals often benefit from government support and public housing, which helps reduce their average cost of living in Singapore.

Inflation and rising housing prices have made it harder for families to find affordable homes. Public housing resale prices have risen nearly 10% in 2024 after a 5% rise in 2023. Even with government support, many families and single parents feel the pressure of high living expenses in Singapore. Some people shop across the border for cheaper goods to manage their monthly expenses.

You should always review your monthly budget estimates and adjust your lifestyle to match your needs. Understanding the average cost of living in Singapore will help you make better financial decisions, whether you are single, part of a couple, or raising a family.

Housing Costs in Singapore

Image Source: unsplash

Rental Prices

You will see that rental prices in Singapore depend on location, property type, and size. If you want to live in the city center, you should expect higher average rental costs. For example, a two-bedroom condominium in the Central Business District costs between $2,950 and $4,400 USD per month. In suburban areas, similar apartments rent for about $1,850 to $2,600 USD monthly. The typical monthly rent for a one-bedroom apartment in central locations ranges from $1,850 to $2,950 USD, while suburban neighborhoods offer lower prices, often between $1,100 and $1,850 USD. HDB flats, which are public housing, start at $2,200 USD for a three-bedroom unit in the suburbs. Private rental properties such as landed houses are usually more expensive due to their size and privacy.

| Property Type | Central Area Rent (USD) | Suburban Area Rent (USD) |

|---|---|---|

| HDB Flats (3-Bedroom) | from 2,200 | 1,600 - 2,000 |

| Condominiums (2-Bedroom) | 2,950 - 4,400 | 1,850 - 2,600 |

| Larger Apartments (3-Bedroom) | 5,350 | 3,800 |

You should compare these options carefully to manage your monthly accommodation costs.

Buying Property

If you plan to buy real estate in Singapore, you will notice that prices vary by district and property type. Luxury condos in the city center, such as Marina Bay or Orchard Road, cost over $2,200 USD per square foot. Suburban condos in areas like Hougang or Punggol are more affordable, with prices between $950 and $1,300 USD per square foot. Real estate in up-and-coming districts may offer better value, but prices are rising across the country. Non-landed home prices increased by about 3–4% in 2024. You should also consider the gross rental yield, which averages around 3.1% to 3.6% depending on the region.

Affordable Options

You have several affordable housing options in Singapore. HDB flats are the most common choice for locals and permanent residents. These apartments come in different sizes, such as three-room, four-room, or five-room units. If you are a first-time buyer, you may qualify for grants and HDB home loans, which help reduce your real estate costs. The Build-To-Order (BTO) scheme lets you apply for new flats at subsidized prices. Executive condominiums offer more facilities and are available to those who meet government criteria. If you need to rent, public rental flats are available for lower-income households. You can also use your Central Provident Fund (CPF) savings for down payments and mortgage repayments.

Tip: To save on housing costs in Singapore, consider sharing an apartment, choosing a suburban location, or applying for government-subsidized flats. Always compare average rental costs and check eligibility for grants or loans.

Utilities and Internet

Utility Bills

You will notice that utility costs in Singapore depend on your household size, appliance efficiency, and housing type. Electricity makes up the largest part of your monthly utilities bill. The table below shows average monthly electricity costs for different households:

| Household Type / Size | Average Monthly Electricity Cost (USD) |

|---|---|

| Single-person household | $61.00 |

| Households with 3-tick appliances | $164.00 |

| Households with 5-tick appliances | $112.00 |

| Executive maisonettes, bungalows | $167.00 |

| Condominiums | $132.00 |

Note: Energy-efficient appliances (5-tick) can save you about $52.00 each month compared to less efficient models.

You can see that larger homes and less efficient appliances lead to higher bills. The cost rises with more people, but the increase slows as the household grows.

Internet and Mobile

You will find many choices for internet and mobile plans in Singapore. Most plans are SIM-only and do not require a contract. The table below shows typical monthly costs for 2024:

| Plan Category | Monthly Cost Range (USD) | Data Allowance | Notes |

|---|---|---|---|

| Budget Plans | Under $11.00 | 3GB to 100GB | Good for light users |

| Mid-Range Plans | $11.00 to $22.00 | 50GB to 300GB | Balance of price and data |

| Premium Plans | $22.00 to $37.00 | 100GB to 1TB | Best for heavy users or families |

Most plans include talk time and SMS. Some offer roaming data. You may not find much difference in speed for daily use, but premium plans give you more data and faster connections.

Saving on Utilities

You can lower your utility bills by making smart choices at home. Try these tips:

- Switch off appliances at the power source when not in use.

- Choose energy-efficient appliances with higher tick ratings.

- Replace old bulbs with LED lights to cut energy use.

- Set air-conditioners to 77°F (25°C) and use fans when possible.

- Air-dry clothes instead of using a dryer.

- Take shorter showers and turn off the tap while brushing your teeth.

- Run washing machines only with full loads.

Tip: Using fans instead of air-conditioners can reduce your electricity use by over 90%.

You can also monitor your usage with smart meters and adjust your habits to save even more.

Food and Groceries

Groceries

You will find that grocery costs in Singapore can vary based on your household size and shopping habits. If you cook at home, you may spend less than those who eat out often. The table below shows the average monthly grocery expenditure for different household types, based on a recent survey. All amounts are converted to USD using the latest exchange rates.

| Household Type | Average Monthly Grocery Expenditure (USD) |

|---|---|

| Couples without kids | $580 |

| Families with kids | $745 |

Note: The survey focused on residents who cook most meals at home. Grocery costs for singles may differ.

You can lower your grocery costs by shopping at local markets or smaller supermarkets. Prices at large chain stores may be higher, especially for imported goods.

Dining Out

Singapore offers many dining options, from affordable hawker centers to high-end restaurants. You can enjoy a meal at a hawker center for as little as $2.20 to $4.40 USD. Local cafes and food courts usually charge between $4.40 and $11 USD per meal. If you choose fine dining, expect to pay $55 to $150 USD or more per person.

| Dining Category | Average Cost Range (USD) | Description |

|---|---|---|

| Hawker Centers | 2.20 - 4.40 | Local meals, generous portions |

| Cafes/Food Courts | 4.40 - 11 | Sandwiches, drinks, desserts |

| High-end Restaurants | 55 - 150+ | Fine dining, premium experience |

You will notice that eating at hawker centers and food courts helps you save money. Many locals and expats choose these places for daily meals.

Food Budget Tips

You can manage your food spending with a few smart habits:

- Use cashback and rewards apps like Grab, Fave, or Shopback to earn discounts on groceries and dining.

- Shop at supermarkets after 8pm to find reduced prices on meats and other products.

- Choose smaller local grocers to avoid higher prices and impulse buying.

- Eat before grocery shopping to reduce impulse purchases.

- Plan your weekly shopping and visit different stores for the best deals.

- Use credit cards that offer cashback or air miles for grocery and dining expenses.

- Eat at school canteens or hawker centers for cheaper meals.

- Look for eateries away from busy areas to find meals under $7 USD.

Tip: Planning your meals and shopping with a list can help you stick to your budget and avoid waste.

Transportation Costs

Image Source: unsplash

Public Transport

You will find Singapore’s public transport system reliable and affordable. The MRT and bus network covers most areas, making it easy to get around. Fares for MRT and buses usually range from $0.75 to $2.20 USD per trip, depending on the distance. If you take a round-trip commute, such as from Serangoon to Downtown Station, you pay about $2.20 USD each day. Over a month, your average monthly transportation expenses for regular commuting and social trips add up to about $97 USD. This estimate includes daily commutes, weekend travel, and extra trips for meetings or gatherings.

If you want unlimited rides, you can buy a monthly transportation pass for about $95 USD. This pass covers all MRT and bus rides, which helps you manage your monthly transportation expenses more easily. Taxis and ride-hailing services like Grab and Gojek cost more. Taxi flag-down fares start at $2.40 to $2.90 USD, and a typical ride from the city center to the airport costs between $15 and $22 USD.

Tip: Using public transport saves you money and avoids the high costs of car ownership.

Private Transport

Owning a car in Singapore is expensive. You must pay for a Certificate of Entitlement (COE), which allows you to own a car for 10 years. In 2024, the COE price for a standard car is about $62,000 USD. You also pay a registration fee, an Additional Registration Fee (ARF) based on the car’s value, and yearly road tax. Insurance premiums depend on your car’s value and driving history. Fuel costs vary, but you can expect to spend about $120 to $180 USD per month if you drive often. Road tax ranges from $150 to $750 USD each year, depending on your car’s engine size and age. These costs make private cars a luxury for most people.

Cost Comparison

You will notice a big difference between public and private transport costs. Public transport offers the best value for most people, especially if you travel alone or in small groups. Your average monthly transportation expenses stay low with MRT and buses. Private cars cost much more because of high upfront fees, insurance, fuel, and taxes. However, if you travel with a large family or need more flexibility, private cars or ride-hailing services may suit you better.

- Public transport is best for cost-conscious travelers.

- Private cars offer comfort and flexibility but come with high costs.

- Ride-hailing services are more expensive than public transport but cheaper than owning a car.

| Transport Type | Typical Monthly Cost (USD) | Best For |

|---|---|---|

| Public Transport | 97 - 130 | Singles, small families |

| Monthly Pass | 95 | Frequent commuters |

| Private Car | 1,200 - 2,200 | Large families, groups |

You should choose the option that fits your needs and budget. Most people in Singapore prefer public transport to keep their monthly transportation expenses manageable.

Healthcare Expenses

Public vs. Private

You have access to both public healthcare options and private clinics in Singapore. Public hospitals and clinics offer subsidized rates for citizens and permanent residents. You pay less for services like doctor visits and specialist consultations at these facilities. Private clinics and hospitals provide faster service and more choices, but you pay higher fees. The table below shows typical out-of-pocket costs for different services:

| Service Type | Public (Subsidized) Cost (USD) | Private Cost (USD) | Notes |

|---|---|---|---|

| Annual Deductible | 1,100 – 2,200 | N/A | Applies under MediShield Life for inpatient care |

| Coinsurance (Inpatient) | 3% – 10% | N/A | Percentage of claimable amount after deductible |

| Primary Care Visit | 9.80 | N/A | Public clinics, subsidized patients |

| Specialist Consultation | 29.00 | 59.00 – 110.00 | Public facilities; subsidized vs private |

| Out-of-Pocket Bills | 70% fully paid | N/A | Most bills under $370 |

You receive high quality healthcare in both sectors, but your waiting time and costs will differ.

Insurance

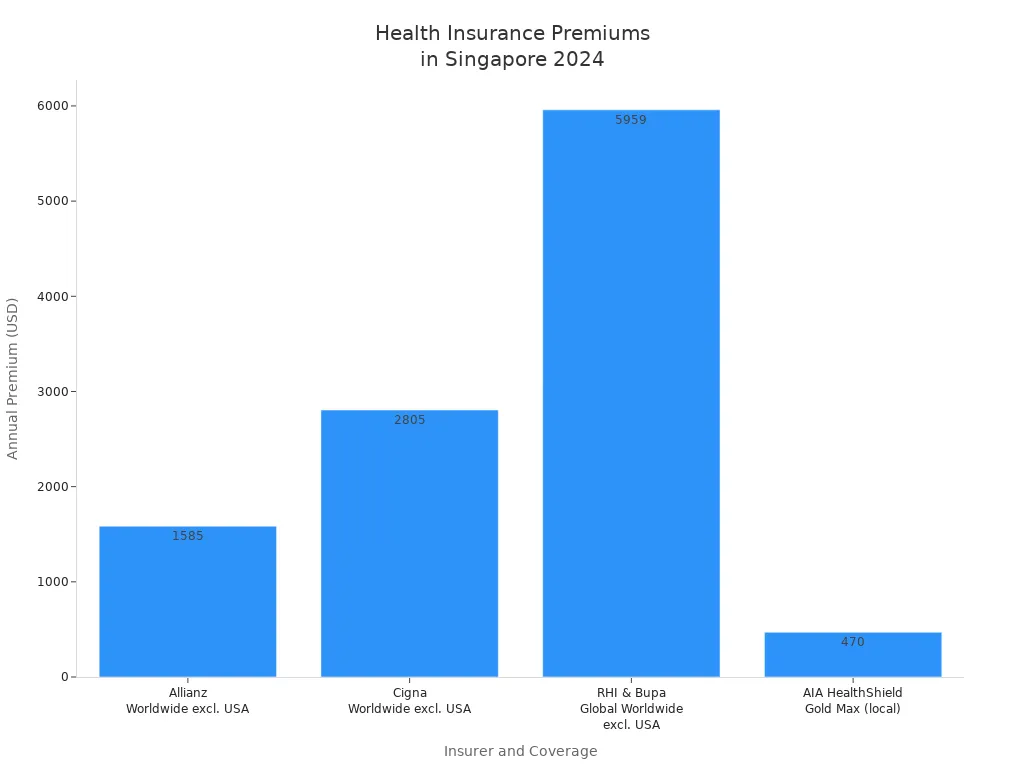

You must have basic health insurance in Singapore. MediShield Life covers large hospital bills and is required for all citizens and permanent residents. You can buy extra coverage through Integrated Shield Plans if you want to stay in higher-class wards or choose your doctor. Premiums depend on your age and the level of coverage. For example, a local plan for a 45-year-old costs about $98 per year, while international plans range from $740 to $1,480 per year. The chart below compares annual premiums for different insurers:

You should review your insurance plan each year to make sure it fits your needs and budget.

Managing Costs

You can manage your healthcare costs by using several smart strategies:

- Enroll with a regular doctor under Healthier SG to get personalized care and free first consultations.

- Visit polyclinics for subsidized treatment and medicine.

- Use digital health apps to track your health and get reminders for check-ups.

- Take advantage of free screenings and vaccinations.

- Keep your health records updated to avoid repeated tests.

| Strategy | Description | Benefit |

|---|---|---|

| Enroll with a GP (Healthier SG) | Build a long-term relationship with your doctor | Prevents costly hospital visits |

| Use Polyclinics | Get subsidized care and medicine | Lowers direct expenses |

| Digital Health Tools | Track health and access records with apps | Promotes healthy habits |

| Free Screenings & Vaccinations | Participate in national health programs | Reduces risk of serious illness |

Tip: Preventive care and regular check-ups help you avoid bigger medical bills later.

Education Costs

Public Schools

You will find that public school education in Singapore is very affordable for most families. The government subsidizes tuition, so you do not pay school fees for the six years of compulsory primary education. However, you pay standard miscellaneous fees of about $4.80 USD per month. Some schools may charge optional second-tier fees, which can double this amount. If your family qualifies for financial assistance, these fees may be waived. The average annual education costs for public primary school mainly come from these miscellaneous fees, totaling about $58 USD per year. Extra support, such as bursaries and school-level funds, helps students from low-income families.

International Schools

If you choose an international school, you will see much higher tuition fees. Singapore ranks among the most expensive cities in Asia for international education. Many international schools charge over $20,000 USD per year. The wide range in fees reflects the variety of schools and grade levels. The table below shows typical annual tuition fees for international schools in Singapore:

| School Type | Annual Tuition Fees (USD) |

|---|---|

| Lower Range | $10,700 |

| Upper Range | $42,500 |

These fees often include world-class facilities and a global curriculum. You should also budget for application fees, uniforms, and extra activities.

Saving on Education

You can lower your education costs by using several programs and strategies. The table below lists common options:

| Option/Program | Description | Key Features |

|---|---|---|

| Tuition Grant | Reduces university tuition for citizens | Covers large part of fees |

| Tuition Fee Loan Scheme | Borrow up to 90% of subsidized tuition | Repay after graduation |

| CPF Education Scheme | Use CPF savings for tuition | Repay with interest after graduation |

| Edusave Account | Annual credits for children aged 7-16 | Pays for enrichment and school fees |

| Scholarships/Bursaries | Awards for academic or financial need | Reduces financial burden |

| School Financial Assistance | Fee waivers and subsidies for activities | Apply through your school |

Tip: Always check with your school for available financial aid and plan early for future education expenses.

Entertainment and Lifestyle

Leisure Activities

You can enjoy many leisure activities in Singapore, whether you live here or visit as an expat. The city offers a wide range of options, from dining out to watching movies or exploring cultural sites. If you like to eat out, you will find meals at hawker centers for about $3.70 to $7.40 USD. Mid-range restaurants start at $14.80 to $29.60 USD per person. Cinema tickets usually cost $9.60 to $11.10 USD. You can also try karaoke, live shows, or food delivery services. Many expats choose to spend on these activities to relax after work or meet friends.

Here is a table showing average monthly expenses for leisure and entertainment, based on your lifestyle:

| Category | Frugal (USD) | Mid-range (USD) | High life (USD) |

|---|---|---|---|

| Dining out / Cafe | 74 | 185 | >185 |

| Food delivery | 74 | 185 | >185 |

| Gym | 0 | 44 | 222 |

| Entertainment (Movies, Karaoke, Live Shows) | 0 | 37 | >74 |

*Exchange rates: 1 SGD ≈ 0.74 USD

Fitness and Wellness

You have many ways to stay fit in Singapore. Gym memberships range from $74 to $133 USD per month, depending on the facility. Some gyms offer flexible passes, such as ClassPass, which costs about $44 USD monthly. If you want to save money, you can use public fitness centers for $2.40 per entry. Badminton courts cost about $7.20 per hour during peak times. Many expats join gyms or fitness classes to meet new people and maintain a healthy lifestyle. You can also jog in parks, swim at public pools, or join yoga groups. These options help you balance work and wellness.

Tip: Public parks and free outdoor fitness stations let you exercise without spending much.

Budget Entertainment

You can find many budget-friendly entertainment options in Singapore. Free or low-cost sights include Chinatown, Little India, and Kampong Glam, where you can visit temples and markets. Parks like Gardens by the Bay and Singapore Botanic Gardens offer free entry. Outdoor movie nights, such as drive-in cinemas, provide free fun under the stars. You can explore Pulau Ubin for a $2.20 USD boat ride and enjoy hiking or nature walks. Many expats use public transport, which starts at $0.61 USD per ride, to reach these attractions. Museums and cultural tours often have free admission days. You can also save money by using happy hour deals, shopping at local markets, and looking for seasonal discounts during festivals.

| Category | Description |

|---|---|

| Affordable Dining | Hawker centers and local cafes offer cheap, authentic meals. |

| Free or Low-Cost Sights | Historic neighborhoods, parks, and gardens with free entry. |

| Budget Transportation | Public buses and MRT with low fares and tourist passes. |

| Seasonal Deals | Discounts during major festivals and sales events. |

Note: Many expats discover that Singapore’s free attractions and public spaces help them enjoy city life without overspending.

Taxes and Contributions

Income Tax

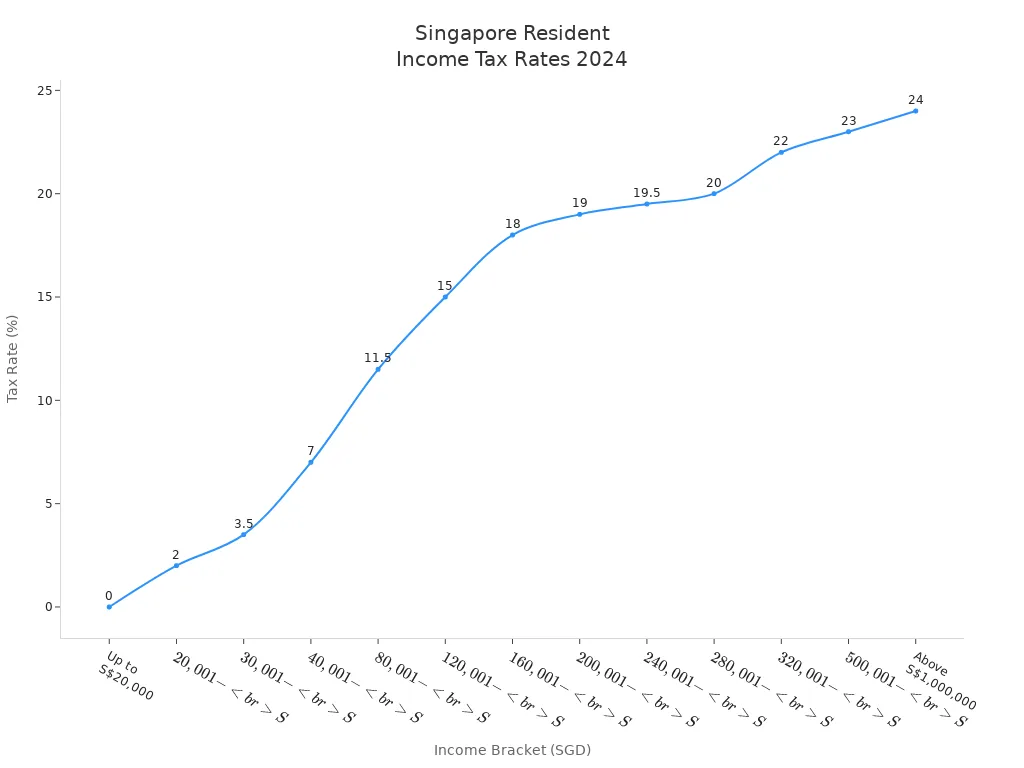

You will find that Singapore uses a progressive income tax system. This means you pay a higher tax rate as your income increases. In 2024, the tax rate starts at 0% for the first S$20,000 of chargeable income. The rates then rise step by step, reaching up to 24% for income above S$1,000,000. If you earn between S$500,000 and S$1,000,000, your income is taxed at 23%. The government also gives a 50% tax rebate (capped at S$200) for the Year of Assessment 2024, which helps lower your tax bill.

| Chargeable Income (SGD) | Tax Rate (%) |

|---|---|

| First 20,000 | 0 |

| Next 10,000 | 2 |

| Next 10,000 | 3.5 |

| Next 40,000 | 7 |

| Next 40,000 | 11.5 |

| Next 40,000 | 15 |

| Next 40,000 | 18 |

| Next 40,000 | 19 |

| Next 40,000 | 19.5 |

| Next 40,000 | 20 |

| Next 40,000 | 22 |

| 500,000 – 1,000,000 | 23 |

| Above 1,000,000 | 24 |

You should always check the latest tax brackets and rebates before filing your taxes.

GST

Singapore charges a Goods and Services Tax (GST) on most goods and services. The GST rate increased to 9% from January 1, 2024. This tax helps fund public services and future needs, such as healthcare for an aging population. The government gives offset packages, rebates, and subsidies to help lower-income households manage the higher GST. You will also pay GST on imported goods, which keeps the system fair for local and overseas sellers.

| Aspect | Details |

|---|---|

| Current GST Rate | 9% (from Jan 2024) |

| Purpose | Fund infrastructure and social spending |

| Support Measures | Rebates, direct transfers, subsidies |

| GST on Imports | Applies to low-value imported goods |

Note: Many lower-income families receive more in support than they pay in extra GST.

CPF

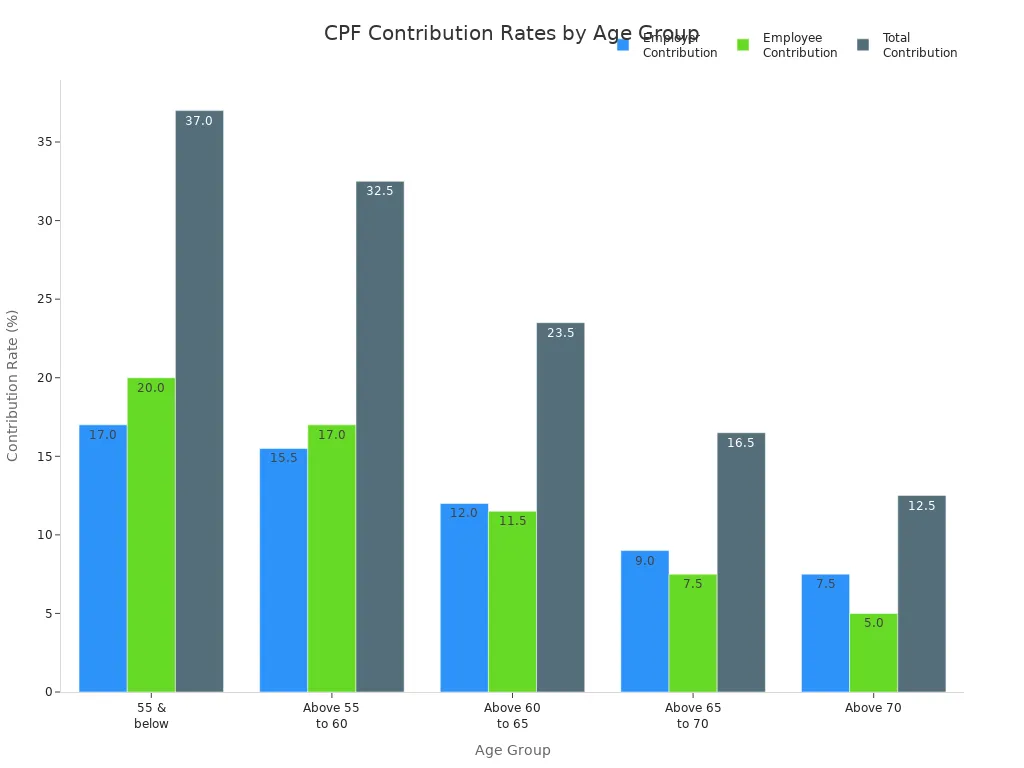

The Central Provident Fund (CPF) is Singapore’s main social security savings plan. Both you and your employer must contribute a percentage of your monthly wages to CPF. The rates depend on your age. If you are 55 or younger, your employer pays 17% and you pay 20%, for a total of 37%. As you get older, the rates decrease.

| Age Group | Employer Contribution (%) | Employee Contribution (%) | Total Contribution (%) |

|---|---|---|---|

| 55 & below | 17.0 | 20.0 | 37.0 |

| Above 55 to 60 | 15.5 | 17.0 | 32.5 |

| Above 60 to 65 | 12.0 | 11.5 | 23.5 |

| Above 65 to 70 | 9.0 | 7.5 | 16.5 |

| Above 70 | 7.5 | 5.0 | 12.5 |

You can use your CPF savings for housing, healthcare, and retirement. Always check your CPF contributions to plan for your future needs.

Cost of Living Tips

Budgeting Advice

You can take control of your finances in Singapore by setting a clear budget. Start by listing your monthly income and all expenses. Use the 50/30/20 rule to guide your spending. This means you spend 50% of your income on needs like rent, groceries, and transport. You use 30% for wants, such as dining out or hobbies. The last 20% goes to savings and investments. This method helps you see where your money goes and spot areas where you can cut back. Write down your goals, like saving for a house or paying off debt. Break big goals into smaller steps. Tracking your progress with a budgeting app or a simple spreadsheet keeps you motivated and on track.

Money-Saving Strategies

You can learn how to reduce the cost of living in singapore by making small changes. Shop at local markets for groceries instead of large supermarkets. Use public transport instead of owning a car. Choose energy-efficient appliances to lower your utility bills. Eat at hawker centers or cook at home to save on food costs. Build an emergency fund that covers three to six months of living expenses. This fund protects you from unexpected events. Open a high-yield savings account to grow your money faster. If you want to know how to reduce the cost of living in singapore further, review your spending every month and look for unnecessary expenses to cut.

Tip: Consistency matters more than perfection. Small, regular savings add up over time.

Financial Planning

You should set clear, measurable financial goals. For example, aim to save $40,000 USD for a house deposit in two years. Write your goals down and review them often. Adjust your plan if your income or expenses change. Consider opening a Supplementary Retirement Scheme (SRS) account to enjoy tax relief and invest for the future. Diversify your investments to manage risk and focus on long-term growth. Seek advice from financial experts if you feel unsure. Understanding Singapore’s tax rules helps you optimize your finances, especially if you have income from other countries. Good planning and regular reviews help you succeed in saving money in singapore.

You now have a clear picture of the cost of living in Singapore for 2024. You see that housing, food, and transport make up most expenses. Careful budgeting helps you manage your cost of living and reach your goals. Make informed choices about where you live, how you travel, and what you spend. Use this guide to plan your finances and explore more resources for a better future.

FAQ

What is the biggest expense for an expat living in Singapore?

You will find that rent is usually the largest monthly cost for an expat. Most expats choose private apartments or condos. These options cost more than public housing. Rent in central areas can reach $4,400 USD per month for a two-bedroom unit.

How much does an expat need to live comfortably in Singapore?

You should budget at least $3,800 USD per month as a single expat. This amount covers rent, food, transport, and basic entertainment. If you want a more luxurious lifestyle, you may need $5,000 USD or more each month.

Can an expat save money while living in Singapore?

You can save money as an expat by choosing public transport, eating at hawker centers, and shopping at local markets. Many expats also share apartments or live in suburban areas to lower rent. Careful budgeting helps you reach your savings goals.

Do expats need private health insurance in Singapore?

You should get private health insurance as an expat. Public healthcare is high quality, but expats do not receive the same subsidies as citizens. Insurance helps cover hospital bills and specialist visits. Many employers offer health plans for expats.

Are international schools expensive for expat families?

You will see that international schools in Singapore charge high tuition fees. Most expat families pay between $10,700 USD and $42,500 USD per year. These schools offer global curriculums and modern facilities. You should plan for extra costs like uniforms and activities.

Living in Singapore comes with high costs, from housing to healthcare, making it essential to manage your money wisely. When it comes to moving funds internationally, traditional banks often add high fees and hidden exchange rate markups, leaving you with less value. With BiyaPay, you can send money worldwide with international remittance fees as low as 0.5%, real-time exchange rates across multiple fiat and digital currencies, and same-day delivery. Registration is quick and secure, so you can take control of your cross-border finances without delays.

Make smarter, faster, and more affordable transfers—get started today at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.