- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Cash Account vs. Margin Account: Which Suits Your Investment Strategy Best?

Image Source: pexels

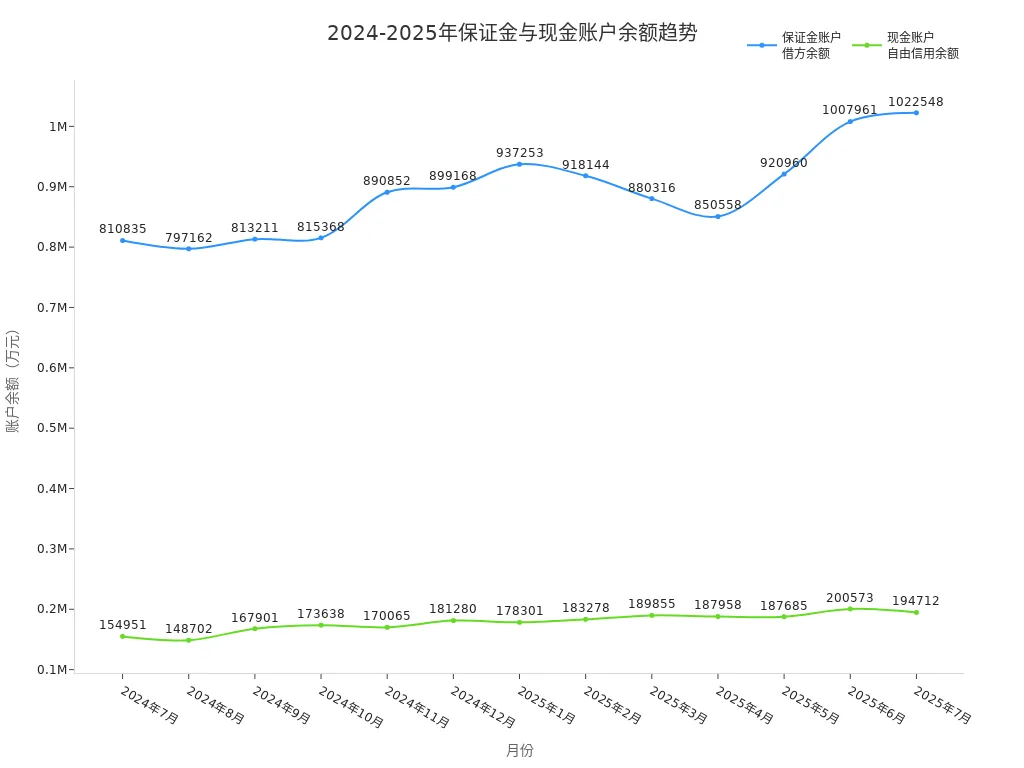

When choosing an investment account, you’ll encounter two main types: cash accounts and margin accounts. A cash account requires you to trade only with your own funds, while a margin account allows you to borrow from your broker to amplify your investment capacity. Recent data shows margin account debit balances significantly exceed cash account free credit balances, reflecting a preference for leverage among investors. The table below outlines the trend in account balances:

| Month/Year | Margin Account Debit Balance | Cash Account Free Credit Balance |

|---|---|---|

| Jul 2025 | 1,022,548 | 194,712 |

| Jun 2025 | 1,007,961 | 200,573 |

| May 2025 | 920,960 | 187,685 |

| Apr 2025 | 850,558 | 187,958 |

| Mar 2025 | 880,316 | 189,855 |

| Feb 2025 | 918,144 | 183,278 |

| Jan 2025 | 937,253 | 178,301 |

| Dec 2024 | 899,168 | 181,280 |

| Nov 2024 | 890,852 | 170,065 |

| Oct 2024 | 815,368 | 173,638 |

| Sep 2024 | 813,211 | 167,901 |

| Aug 2024 | 797,162 | 148,702 |

| Jul 2024 | 810,835 | 154,951 |

You must consider your risk tolerance and investment experience to determine which account type best aligns with your goals. The choice directly impacts your financial security and risk management.

Key Points

- Cash accounts use only your own funds, avoiding debt risk, ideal for conservative investors.

- Margin accounts allow borrowing to scale investments but carry higher risks, requiring careful management.

- Choose an account based on your risk tolerance and experience to align with your investment objectives.

- Cash accounts suit long-term investing; margin accounts are better for short-term trading and complex strategies.

- Regularly evaluate your portfolio, monitor market changes, and adjust account types and asset allocations as needed.

Core Differences Comparison

Image Source: pexels

Funding Mechanism

When selecting an account, focus on how funds are used. A cash account restricts you to trading with your deposited funds, eliminating debt risk and extra fees. A margin account lets you borrow from your broker to expand your investment capacity. You use a portion of your funds as collateral, with the broker providing the rest, allowing you to trade larger amounts with less capital, but it increases risk.

| Feature | Cash Account | Margin Account |

|---|---|---|

| Leverage | No leverage allowed | Borrowing permitted |

| Funding Source | Only deposited cash | Broker loans available |

| Risk | Lower risk | Higher risk, potential margin calls |

| Minimum Deposit | Typically lower | Higher minimum deposit required |

| Trading Strategies | Suits classic strategies | Suits complex strategies |

| Margin Calls | None | May require additional funds or sales |

You’ll find cash accounts straightforward, with simple funding. Margin accounts offer flexibility but require constant monitoring of balances and margin call risks.

Leverage Mechanism

Cash accounts prohibit leverage, limiting your losses to your account balance. Margin accounts allow leverage, enabling you to control larger positions with less capital. For example, with USD 5,000 as margin, you could trade securities worth USD 10,000 or more. Leverage amplifies gains but also losses, and market volatility may trigger margin calls, requiring additional funds or forced sales.

Leverage offers higher potential returns but can lead to losses exceeding your initial capital. You need strong risk management to use margin accounts safely.

Tradable Assets

In a cash account, you can trade stocks, single-leg options, cryptocurrencies, cash-secured puts, and covered calls, but only with available cash, limiting strategies for conservative investors. Margin accounts allow trading stocks, options, futures, and more, with leverage for complex strategies like day trading and short selling.

| Account Type | Tradable Financial Instruments |

|---|---|

| Cash Account | Stocks, single-leg options, cryptocurrencies, cash-secured puts, covered calls |

| Margin Account | Stocks, options, futures, etc., with leverage |

Consider your investment goals and strategies when choosing. Cash accounts suit steady investing; margin accounts are ideal for flexibility and high returns.

Risk and Reward

In a cash account, risk is low, limited to your deposited funds, with no debt or margin call concerns, ideal for long-term investors. Margin accounts carry higher risks, with potential losses exceeding your capital due to leverage. Margin calls may force asset sales, amplifying losses. Interest charges apply, and profits must exceed these costs to be viable. Research shows frequent traders often underperform the market, with day traders facing high loss rates, so careful risk management is critical with margin accounts.

- Cash accounts limit trading to available cash, avoiding debt risk.

- Cash accounts are better for risk management, as leverage and borrowing are not allowed.

- Margin accounts’ high leverage offers greater returns but can double losses.

- Frequent trading often yields lower returns than the market, especially for day traders.

Balance safety and flexibility when choosing. Cash accounts offer high security for steady investing, while margin accounts require experience and risk control for higher returns.

Cash Account Overview

How Cash Accounts Work

When opening a cash account, you invest only with your own funds. You must pay the full amount for securities by the settlement date, governed by the Federal Reserve’s Regulation T. You can manage uninvested cash through cash sweep programs, transferring excess cash to bank deposits or money market mutual funds. You retain ultimate investment decision authority, whether trading independently or consulting professionals.

Suitable Investors

If you’re a beginner or prefer low risk, a cash account is ideal. You avoid borrowing risks and maintain clear visibility of cash flows, simplifying financial management. Many new investors choose cash accounts for their simplicity.

Advantages

Cash accounts offer several benefits: no leverage risk, no margin calls, and simple management. You can:

- Easily track cash balances

- Save time and effort on management

- Focus on actual cash flows without complex accounting

These features simplify financial decisions and enhance risk management.

Limitations

Cash accounts have drawbacks. If you seek higher returns, they may fall short, as you can’t use leverage to boost gains. Holding cash long-term risks inflation eroding purchasing power, and you may miss high-yield opportunities, incurring opportunity costs.

Margin Account Overview

How Margin Accounts Work

With a margin account, you use part of your funds as collateral and borrow the rest from your broker, avoiding full upfront payment. In the U.S., brokers typically allow borrowing up to 50% of the purchase price. You must monitor collateral value, as market fluctuations may require additional funds or asset sales to meet minimum requirements. The table below highlights key differences in funding and risk management:

| Feature | Margin Account | Cash Account |

|---|---|---|

| Funding Source | Borrowing allowed, no full payment needed | Only existing funds used |

| Investment Flexibility | Margin trading with higher leverage | Full-payment trades, limited flexibility |

| Risk Management | Requires careful leverage management | Lower risk, no excessive borrowing |

Suitable Investors

If you’re experienced, have substantial capital, and seek flexible strategies, a margin account suits you. Leverage allows quick market opportunity capture, ideal for short-term trading or diversified portfolios. Margin accounts also support short selling, unavailable in cash accounts. You need strong risk management to handle volatility and margin calls.

Advantages

Margin accounts provide multiple benefits: increased purchasing power, rapid opportunity capture, portfolio diversification, short selling, and flexible cash flow management. They enable higher profits. The table below summarizes key advantages:

| Advantage | Description |

|---|---|

| Increased Purchasing Power | Borrow to buy more securities, scaling investments |

| Investment Flexibility | Seize market opportunities without waiting for funds |

| Portfolio Diversification | Invest in broader assets for diversified strategies |

| Short Selling Capability | Profit from declining stocks via short selling |

| Liquidity Management | Access funds without selling securities, managing cash flow |

Risks

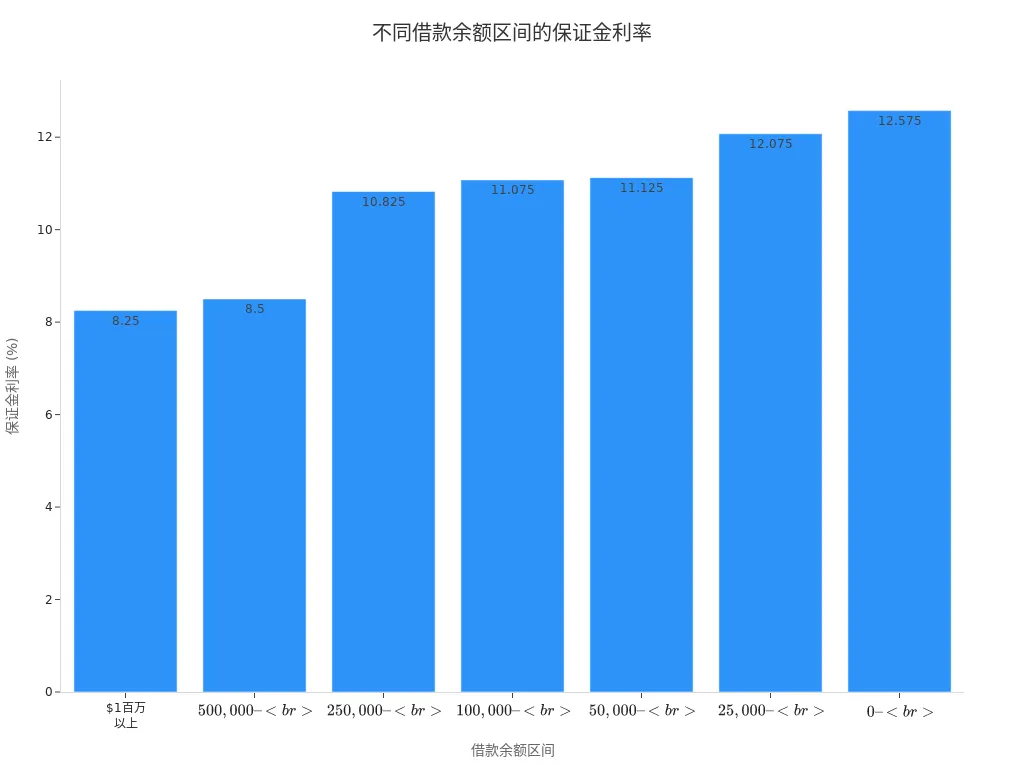

Margin accounts carry complex risks. Leverage can lead to losses exceeding your capital. Market declines amplify losses, and margin calls may force asset sales. In the U.S., margin loan rates vary, reaching up to 12.575%. The chart below shows margin rates by loan balance:

You must comply with U.S. regulatory rules, like FINRA and Federal Reserve requirements, maintaining sufficient collateral to avoid forced liquidation. Carefully manage leverage and liquidity to prevent significant losses from market volatility.

Investment Strategy Recommendations

Conservative Strategy

If you’re a conservative investor prioritizing safety and risk control, a cash account is better. You invest only your own funds, avoiding borrowing and margin calls. The simple structure aids management, letting you track cash flows easily and avoid amplified losses from leverage.

Cash accounts suit those building portfolios gradually, offering high safety. While returns are limited, you avoid forced funding or interest costs, maintaining control.

- Cash accounts prioritize safety, ideal for avoiding borrowing.

- They limit risk, suitable for steady long-term investing.

- Their simplicity aids management and planning.

Aggressive Strategy

If you seek higher returns and accept greater risk, consider a margin account. Borrowing amplifies investment scale, letting you seize market opportunities and diversify. The table below shows the effectiveness and investor sophistication needed for strategies:

| Strategy | Predictive Effectiveness for Future Returns | Investor Sophistication |

|---|---|---|

| Margin Trading | Not effective | Lower |

| Short Selling | Effective | Higher |

With margin accounts, try short selling or complex strategies, but you need high sophistication to manage volatility and margin calls. Monitor loan rates and liquidity to avoid significant losses.

Margin accounts suit experienced investors with ample capital. They offer flexibility for higher returns but require strict risk control to prevent forced liquidations.

Short-Term Strategy

If you prefer short-term trading, focusing on market fluctuations and quick profits, a margin account is ideal. It supports day trading and high-frequency operations, leveraging small capital for short-term gains.

- Short-term investing favors conservative strategies, like investment-grade bond funds.

- For investment horizons over three years, include stocks for higher returns.

Monitor market dynamics and adjust positions quickly in short-term trading. Manage margin ratios to avoid forced liquidations. Short-term trading suits experienced investors due to its high risk.

Long-Term Strategy

For long-term investing, focusing on asset growth and compounding, choose cash accounts or U.S. long-term accounts like 401(k) or IRA, which offer tax advantages. Invest in stocks, bonds, or index funds.

- 401(k) and IRA contributions are tax-deductible, reducing taxable income.

- Roth 401(k) and Roth IRA contributions are after-tax, but withdrawals are tax-free.

- These accounts restrict penalty-free withdrawals before age 59½, supporting long-term goals.

Diversify investments to reduce single-asset risk and leverage tax benefits for better returns. Cash accounts suit long-term wealth accumulation.

Risk Considerations

Image Source: unsplash

Cash Account Risks

Cash accounts have low risk, but you must manage funds carefully. Over-concentration in one asset can lead to losses from volatility. Holding cash long-term risks inflation eroding purchasing power. Diversify portfolios with stocks, long-term bonds, or money market funds to enhance liquidity and safety. Work with advisors to align funds with goals.

Margin Account Risks

Margin accounts involve complex risks. Leverage can reduce equity rapidly during market declines, and failing to meet minimum margin requirements triggers forced sales. Brokers sell securities to protect their interests, potentially causing losses beyond your initial funds. Interest accrues immediately, requiring higher returns to break even. Even brief downturns can trigger liquidations, leading to significant losses. Monitor balances closely to avoid forced sales.

Margin accounts’ leverage amplifies gains but also losses. Strong risk awareness and management are essential.

Risk Management

Protect investments with strategies like stop-loss orders, automatically selling securities at set levels to limit losses. Diversify across asset classes to reduce exposure. Monitor margin accounts to ensure equity meets requirements. For cash accounts, combine money market funds and U.S. Treasuries for liquidity and safety. Use tiered management for large cash amounts to ensure availability and reasonable returns. Scientific risk management helps navigate market changes and protect assets.

When choosing an account, align with your risk tolerance and experience:

- Cash accounts suit beginners and low-risk investors. Ensure sufficient cash to avoid violations.

- Margin accounts fit experienced, high-risk-tolerant investors but require vigilance against amplified losses and liquidations.

- Regularly assess portfolios, monitor market changes, and adjust account types and allocations to align with goals.

FAQ

How do cash and margin account opening processes differ?

For a cash account, submit identification and funds. Margin accounts require additional risk disclosure forms and broker risk assessments.

What’s the minimum deposit for a margin account?

Typically, at least USD 2,000 is required for a margin account, though some brokers may demand more. Check specific requirements.

What investments can margin accounts support?

Margin accounts allow trading stocks, options, futures, and more, with leverage and short selling for flexible strategies.

What happens if a margin account faces a forced liquidation?

If you can’t meet margin calls, brokers sell your securities, potentially causing losses beyond your capital, requiring additional compensation.

Can cash accounts earn interest?

Uninvested cash can earn interest via sweeps to money market funds or bank deposits. Check rates and rules for specific products.

Choosing between a cash account and a margin account significantly impacts your investment strategy and risk management. Many investors face challenges in global markets, such as high remittance fees, exchange rate uncertainties, and complex platform navigation, which can increase costs or reduce efficiency.

BiyaPay offers a seamless financial platform to address these issues. Our real-time exchange rate queries provide instant access to fiat and digital currency conversion rates across various currencies, ensuring transparency and efficiency. With remittance fees as low as 0.5%, covering most countries globally and enabling same-day transfers, BiyaPay ensures swift fund availability for your investments. Plus, you can trade US and Hong Kong stocks via our stocks feature without needing an overseas account, perfectly aligning with cash or margin account strategies. Sign up with BiyaPay today to enhance your global investment experience and drive more efficient wealth growth!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.