How to Use Revolut for Remittance: A Fast, Secure, and Economical Cross - border Transfer Option

Image Source: unsplash

Do you need a modern tool to easily handle international money transfers? Revolut money transfer allows you to do it all through a mobile app, with simple operations, transparent fees, and favorable exchange rates. Whether you’re a student abroad, an overseas worker, or a freelancer, this article will help you move away from the cumbersome and expensive transfer experiences of traditional banks.

The rapid growth of the global digital remittance market is changing everything. The market size is expected to grow from USD 24.48 billion in 2024 to USD 60.05 billion by 2030.

Attribute Statistics 2024 Market Size USD 24.48 billion 2030 Market Forecast USD 60.05 billion 2025-2030 Compound Annual Growth Rate (CAGR) 16.7%

Master this powerful tool, and you can embark on a smooth and enjoyable international transfer journey.

Key Takeaways

- Revolut money transfer is simple to operate; you can easily complete international transfers on the mobile app.

- Revolut money transfer has low fees and transparent exchange rates, making it more cost-effective than traditional banks.

- Revolut money transfer is fast; most transfers arrive within minutes or hours.

- Revolut ensures fund security with strict regulation and multiple security features.

- Revolut is more convenient than traditional banks, eliminating cumbersome steps and high fees.

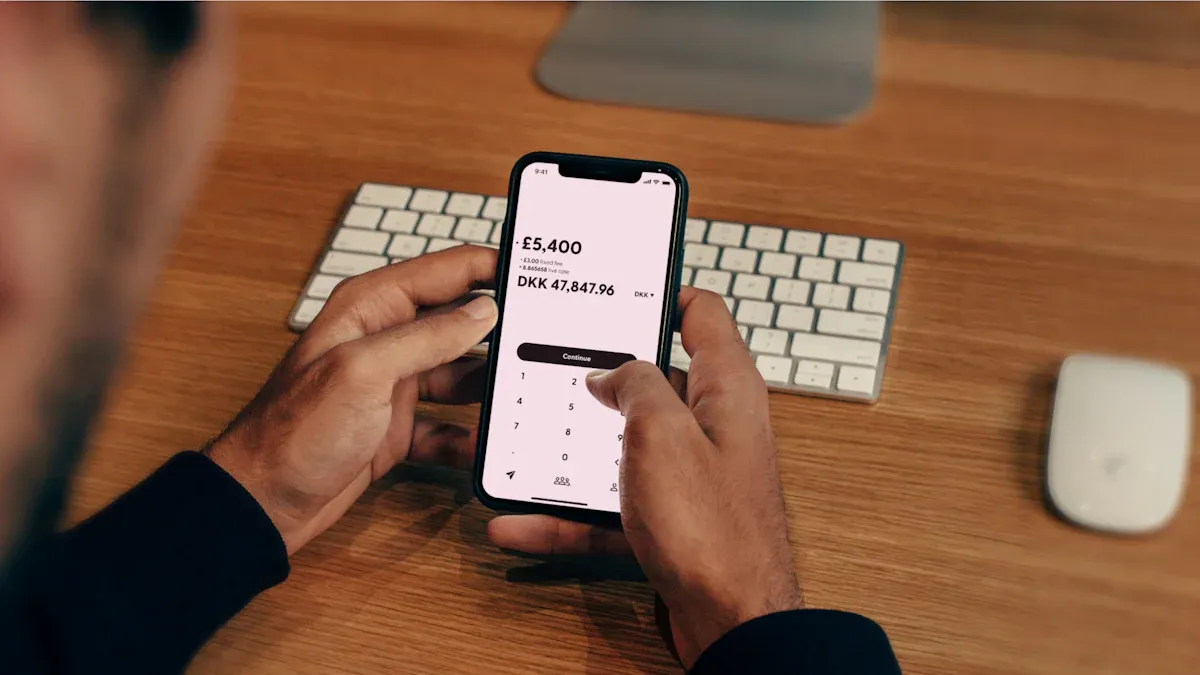

Revolut Money Transfer: Step-by-Step Guide

Image Source: unsplash

Now, you already understand the basic advantages of Revolut. Next, we will guide you step by step on how to complete the entire transfer process. You will find that the entire process is much simpler than you imagined.

Registration and Identity Verification

The first step to start using Revolut is to create an account. You need to download the Revolut App from your phone’s app store and follow the on-screen instructions to complete registration. You will need to provide some basic personal information.

Next is the identity verification (KYC) process. You might think this process will be lengthy, but Revolut has greatly optimized this experience. With advanced electronic identity verification technology, many users’ verification time has been reduced from over an hour in the past to just a few minutes. For example, in the UK, eligible customers’ verification time can be as fast as 2 minutes, and no cumbersome documents need to be uploaded.

Account Funding

After your account is verified, you need to fund your Revolut account. This is a necessary preparation before initiating a transfer. Revolut offers multiple flexible funding methods, and you can choose the most convenient one:

- Bank Card Funding: This is the quickest method. You can directly link your Visa or Mastercard debit or credit card in the app and enter the amount for instant funding.

- Bank Transfer: You can also transfer from your local bank account (for example, your account with a licensed bank in Hong Kong) to your Revolut account. The app will provide you with dedicated recipient account information.

- Apple Pay or Google Pay: If you’re used to mobile payments, you can directly fund your account via Apple Pay or Google Pay, with a very smooth operation.

- Cash Deposit: In some regions, Revolut even supports cash deposits. You can select this option in the app and then deposit cash at designated partner locations.

Initiating an International Transfer

Once your account has funds, you can start a Revolut money transfer. The entire process is completed within the app, with a clear and intuitive interface.

Tip: Open the Revolut App, find and tap the “Transfers” button at the bottom of the home screen. Here, you can choose to transfer to a bank account or to another Revolut user.

Select “New Transfer”, then choose “Send International” to proceed to the next step.

Filling in Recipient Information

Accurately filling in recipient information is a key step to ensure funds arrive safely. You need to enter the following information:

| Information Category | Specific Details |

|---|---|

| Country and Currency | The recipient’s country and the currency you want them to receive. |

| Personal Information | The recipient’s full name (must match the bank account name). |

| Bank Information | Bank code (such as SWIFT/BIC) and the recipient’s bank account number (such as IBAN). |

To make frequent transfers easier, Revolut allows you to save recipient details. The next time you send money to the same person, you just need to select from the list, eliminating the need to re-enter information and greatly saving your time.

Reviewing Information and Confirming the Transfer

Before clicking the send button, be sure to carefully review all information. Revolut will clearly display the following key details:

- The amount you are sending.

- The real-time exchange rate and the exact amount the recipient will receive.

- Any possible handling fees (usually zero within the free allowance).

- The estimated arrival time.

Note: Once a transfer is sent, it usually cannot be canceled. But if the transfer fails due to incorrect information or other reasons, you will receive a notification. You can view details in the “Failed” list under “Transfers” records and choose to retry or delete the failed transaction.

After confirming all information is correct, click the “Send” button, and your Revolut money transfer journey is complete!

Three Core Advantages of Choosing Revolut

Image Source: unsplash

You have already learned how to operate Revolut for transfers, but what makes it stand out from numerous options? Understanding its three core advantages will help you see why more and more people choose it as their preferred tool for cross-border payments.

Cost-Effective: Low Fees and Favorable Exchange Rates

Traditional bank international transfers are often accompanied by high fees and opaque exchange rate markups. Revolut money transfer is committed to providing you with a more economical solution.

First, transfers between Revolut users are completely free, which is very convenient for financial interactions with friends or family who also use Revolut. For transfers to external bank accounts, its fee structure is also highly competitive.

One of Revolut’s highlights is its exchange rate policy. It uses near real-time interbank exchange rates with no hidden markups. This means the rate you see is the closest to the true market level.

In addition, Revolut provides monthly free currency exchange allowances for different user tiers. During market trading hours on weekdays, you can enjoy free exchanges within the following limits:

| Revolut Plan | Monthly Free Exchange Allowance |

|---|---|

| Standard | 1,000 USD |

| Premium | 10,000 USD |

| Metal | Unlimited |

Friendly Reminder: After exceeding the free allowance, Revolut charges a small fee (1% for Standard plan, 0.5% for Plus plan). Additionally, during weekends (when forex markets are closed), all plans incur a 1% fee for currency exchange to manage market volatility risks. Therefore, choosing to exchange large amounts on weekdays is a wiser choice.

Fast Arrival: Say Goodbye to Long Waits

Traditional bank international transfers may take 3-5 business days or even longer to arrive. Revolut, through its modern payment network, greatly shortens the waiting time.

Revolut supports transfers to over 200 countries and regions worldwide. More importantly, it leverages local payment networks in over 120 countries, making many transfers as fast as local ones and achieving “0 fees”. Data shows that over 95% of payments arrive on the same day, with many transactions completing in just minutes.

Of course, you need to be aware of some objective factors that may affect arrival speed:

- Bank holidays in the sending or receiving country.

- Bank processing cutoff times for transfers.

- Necessary compliance reviews (such as anti-money laundering checks).

- The specific currency you are sending and the destination country.

Despite these variables, Revolut’s overall speed and efficiency still far surpass traditional channels.

Secure and Reliable: Regulated Protection Measures

Fund security is your top concern when conducting any financial operation. Revolut takes multiple measures in this area to protect your funds and account security.

First, Revolut is a strictly regulated financial institution. It holds licenses and is supervised in multiple major global markets, ensuring its operations comply with local laws and regulations.

| Country/Region | Regulatory Authority |

|---|---|

| United Kingdom | Financial Conduct Authority (FCA), Prudential Regulation Authority (PRA) |

| European Union | Bank of Lithuania |

This regulation requires Revolut to completely segregate client funds from the company’s own operational funds. This means that even in extreme cases where the company faces financial issues, your funds are held in separate bank accounts and are protected.

Second, the Revolut App has built-in powerful security features, giving you full control over your account:

- Real-time Notifications: Any suspicious transactions are instantly flagged by the system and notified to you immediately. If your card is frozen, you can quickly unfreeze it through the app after confirming the transaction is safe.

- Advanced Account Controls: You can customize various security settings in the app, such as freezing/unfreezing bank cards, enabling or disabling contactless payments, setting location-based security protections, etc.

Important Note: You need to clearly understand that although Revolut is an FCA-regulated electronic money institution in the UK and elsewhere, your funds are not protected by the Financial Services Compensation Scheme (FSCS) deposit insurance. Therefore, we recommend using Revolut primarily as an efficient payment and transfer tool, rather than a bank account for long-term storage of large savings.

Revolut vs. Traditional Bank Transfers

You have already mastered the operation of Revolut, but how does it compare to the traditional bank transfers you are familiar with? Through direct comparison, you will clearly see its revolutionary advantages in convenience, cost, and speed.

Operational Convenience Comparison

Imagine the traditional process of making an international transfer through a licensed bank in Hong Kong. You usually need to:

- Log in to online banking and use a physical security device to generate a verification code.

- Navigate through multiple menus to find the “Wire Transfer” or “Overseas Transfer” option.

- For the first transfer, you need to add a new recipient and perform security verification again.

- Accurately fill in a series of complex information such as the recipient’s name, address, bank name, bank address, SWIFT/BIC code, and IBAN account number.

In contrast, Revolut greatly simplifies this process. Its user interface is very intuitive, with key operations clearly visible. You can even transfer directly to friends who also use Revolut via phone number, completely eliminating cumbersome bank codes. The entire experience is as simple as sending a message.

Fees and Exchange Rate Transparency

Traditional bank fees are another pain point. A single international wire transfer fee is usually between USD 35 and USD 50. In addition, banks add a hidden markup of 1% to 5% on the exchange rate, meaning your currency exchange cost is much higher than it appears.

| Bank Name | International Outgoing Fee (USD) |

|---|---|

| Bank of America | USD 45 |

| Chase Bank | USD 40 (or USD 50) |

| Wells Fargo | USD 25 (or USD 40) |

| U.S. Bank | USD 50 |

| Citibank | USD 35 |

Note: The table above shows fees from some major U.S. banks, reflecting the generally high fee structure of traditional banks.

Revolut is completely different. It provides near real-time interbank exchange rates with a fully transparent fee structure, so you know exactly where every penny goes before transferring.

Arrival Speed and Tracking Experience

When using traditional banks for international transfers, you may need to wait 1 to 5 business days for funds to arrive. If weekends or holidays are involved, the wait is even longer. During this process, it is difficult to get real-time updates on the exact status of the transfer.

Revolut, with its modern global payment network, completes most transfers in minutes or hours. More importantly, you can track your transfer progress in real time within the app, with every step from sending to the recipient receiving clearly visible, completely eliminating the anxiety caused by long waits and lack of transparency.

Revolut money transfer is a modern cross-border remittance solution that combines speed, economy, and security. You have already mastered the step-by-step guide in this article and are fully capable of operating it easily. Now, it’s time to experience this change yourself.

Take action now and join the ranks of over 70 million users worldwide! Download the Revolut App, follow this tutorial to complete your first transfer. Not only will you enjoy a convenient experience, but you also have the chance to earn up to USD 50 in bonuses by referring friends. Start your easy and enjoyable international transfer journey!

FAQ

We have compiled some common questions to help you use Revolut better.

Can users in mainland China use Revolut for money transfers?

Currently, Revolut has not yet opened registration for mainland China residents. However, if you have a Revolut account in other supported countries or regions (such as Hong Kong, Singapore, the UK, etc.), you can send money to bank accounts in mainland China.

Does Revolut money transfer have amount limits?

Yes, Revolut sets transfer limits. Specific limits depend on your account type, verification status, and the recipient country. When initiating a transfer in the app, the system will clearly display the specific limit applicable to that transaction.

What should I do if I fill in the recipient information incorrectly?

Once a transfer is sent, it is difficult to cancel.

You need to immediately contact the Revolut customer service team through the Help Center in the app.

If the transfer fails due to incorrect information, the funds will automatically be returned to your account. Afterward, you can correct the information and initiate a new transfer.

After mastering Revolut’s step-by-step remittance guide, cost-effective rates, and robust security, it’s clear how it tackles traditional banking woes like steep transfer fees, cumbersome verifications, and slow arrivals—ideal for global digital nomads and students. Yet, for demands spanning more currency swaps, crypto integrations, or broader regions, a more versatile, budget-friendly platform can elevate your experience seamlessly. BiyaPay, the innovative cross-border finance expert, delivers real-time exchange rate queries and conversions for over 30 fiat currencies and 200+ cryptocurrencies, guaranteeing zero hidden markups and precise, transparent rates.

Just register in moments to unlock remittance fees as low as 0.5%, serving most countries worldwide with same-day delivery speeds. This outpaces Revolut’s quota caps and weekend surcharges, backed by multi-layer encryption and regulatory compliance for worry-free fund flows in international trade or family support. Whether battling market swings or platform hops, BiyaPay’s global network maximizes your returns and sidesteps avoidable losses.

Don’t miss out! Visit the real-time exchange rate query now to view top rates and set up your free account. Join BiyaPay and embrace a smart, swift era of global payments where cross-border money management feels effortless.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

In-Depth Analysis of US Stock Pre-Market Trading: Unveiling the Secrets of the Market Before Opening

2025 Latest US Stock Account Opening Tutorial: Complete Online Application in 5 Steps

Best Free Real-Time US Stock Quote Websites Besides Yahoo Finance

Weekly US Stock Index Futures Review and Outlook: What Investors Should Focus On

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.