2025 Latest US Stock Account Opening Tutorial: Complete Online Application in 5 Steps

Image Source: unsplash

Investing in US stocks is much simpler than you might think. Now, you no longer need to deal with cumbersome paper documents or complicated processes. Completing an online US stock account opening actually takes just a few minutes.

Forget about complicated procedures—you only need to follow the 5 steps below to easily get it done!

- Step 1: Choose a broker

- Step 2: Prepare account opening materials

- Step 3: Fill out the online application

- Step 4: Complete account review

- Step 5: Fund the account and transfer money

Key Takeaways

- Opening a US stock account online is very simple and can be completed in just 5 steps.

- Choosing a broker is important; Firstrade is the most beginner-friendly because it has no commissions and no minimum deposit requirement.

- You need to prepare a passport and proof of address, such as a bank statement, to open an account.

- After opening the account, you need to set up two-factor authentication to protect your account security.

- You can fund the account via bank wire transfer, remembering to fill in the correct personal account information.

Step 1: Choose a Broker

Choosing the right broker is the first step in completing your US stock account opening and starting your investment journey. A good platform can make things twice as effective with half the effort. Faced with numerous options, you need to focus on a few core factors rather than being confused by complex promotional information.

Core Considerations

As a non-US resident, you need to pay special attention to the following when choosing a broker:

- Account Eligibility: Some US brokers do not offer services to non-US residents or require very high minimum deposits. You need to confirm whether the broker welcomes international investors.

- Tax Implications: You need to understand the withholding rules for dividend taxes. Typically, the US withholds 30% on dividends, but the rate may be reduced based on the tax treaty between your region and the US.

- Trading Costs: This includes trading commissions, platform fees, and potential fees from currency conversion.

- Chinese Language Support: A platform with a full Chinese interface and customer service can eliminate language barriers and make the investment process smoother.

- App Usability: For beginners, a clear and easy-to-operate app is crucial.

Comparison of Mainstream Brokers

To give you a more intuitive understanding, we compare three brokers very popular among Chinese investors: Firstrade, Interactive Brokers, and Tiger Brokers.

| Consideration | Firstrade | Interactive Brokers | Tiger Brokers |

|---|---|---|---|

| Trading Commission | $0 | $0.005 per share (minimum $1) | $0 (but with platform fees) |

| Minimum Deposit | $0 | $0 | $0 |

| Chinese Language Support | Excellent (full Chinese interface and customer service) | Average (limited Chinese support) | Excellent (full Chinese interface and customer service) |

| App Usability | Very beginner-friendly | Professional features, more complex for beginners | User-friendly interface with learning materials |

Beginner Broker Recommendation

Overall, Firstrade is the best choice for complete beginners.

Its biggest advantages are true $0 commissions and no minimum deposit requirement, allowing you to start with an extremely low threshold. At the same time, its comprehensive Chinese customer service and simple, easy-to-use app can help you get started quickly and avoid confusion due to complex operations.

Although Interactive Brokers is powerful, its complex interface and limited Chinese support may be more suitable for experienced professional investors.

Step 2: Prepare Account Opening Materials

After selecting a broker, the next step is to prepare the required electronic documents. Preparing these materials in advance will allow you to complete the online application smoothly and make the entire process much easier.

Valid Identity Proof

You need to provide a government-issued photo ID that is valid. This document is the core basis for the broker to verify your identity.

For non-US residents (such as investors from mainland China), a foreign passport is the required identity proof document. Please ensure your passport is within its validity period.

Although some platforms may list driver’s licenses as options, preparing a passport is the safest choice to avoid subsequent requests for additional materials.

Recent Proof of Address

In addition to identity proof, you need a document to prove your residential address. This document must clearly show your name and current address.

A qualified proof of address usually needs to meet the following conditions:

- The name on the document must match the name on your passport.

- The document must include your full current residential address.

- The document must be issued by an official institution such as a bank or government.

- The document must be within its validity period; for example, utility bills are usually required to be within the last 3 months, and bank statements within the last 6 months.

Common proof of address documents include bank statements, credit card statements, or utility bills. Please note that handwritten bills, expired documents, or mobile phone bills are generally not accepted.

Personal Basic Information

When filling out the application form, you need to provide some basic personal information. Preparing this information in advance can save you time during the application. Brokers collect this information to comply with regulations such as “Know Your Customer.”

To complete the online US stock account opening application, you usually need to prepare the following information:

- Employment Status: For example, employed, self-employed, or retired.

- Annual Income and Net Worth: Fill in an approximate range.

- Tax Identification Number: For mainland China residents, this is usually your ID number.

- Investment Experience and Objectives: Choose based on your actual situation, such as long-term growth or speculation.

This information helps the broker assess your risk tolerance and provide more suitable services.

Step 3: Fill Out the Online Application

Image Source: unsplash

After preparing the materials, you enter the core online application phase. We will use the most beginner-friendly Firstrade as an example to guide you through the entire process. The steps for most brokers are very similar.

Visit the Official Website to Start Registration

First, you need to visit the broker’s official website to initiate the application. Be sure to enter through official channels to ensure your information security.

Important Tip: The application links provided for international investors (non-US residents) are usually specific. You can find the correct entrance through the following official pages:

- International Accounts Homepage:

https://www.firstrade.com/accounts/international- Direct International Account Application Link:

https://signup.firstrade.com/create2/www/#/intro

After clicking the link, you will enter the account registration interface and officially start filling in the information.

Fill in Personal and Financial Information

This is the core part of completing your online US stock account opening application. You need to truthfully fill in personal information, contact details, employment status, and financial information. Brokers collect this information to fulfill regulatory requirements.

When filling in “Investment Experience and Objectives”, please choose based on your actual situation. Common investment objectives include “growth," “income,” or "speculation”.

Please answer your investment experience honestly. If you are a beginner or cannot afford significant losses, state it directly. This helps the broker understand your risk tolerance and will not affect your account opening eligibility.

Online Sign the W-8BEN Form

As a non-US resident, you will sign a form called W-8BEN online. This form is very important.

Its main purpose is to prove to the US tax authorities that you are not a US tax resident. After submission, you can enjoy corresponding tax benefits. Without this form, the broker must withhold dividends at the default maximum rate of 30%.

For investors from China, under the China-US tax treaty, after filling out the W-8BEN form, your US stock dividend tax rate can be reduced from 30% to 10%.

Upload Identity and Address Documents

The final step is to upload the documents you prepared in Step 2. You need to upload electronic versions or clear photos of your passport and proof of address (such as a recent bank statement) to the application system.

Please ensure the uploaded documents are complete, clear, and not expired. This is the final basis for the broker to verify your identity and address. After submitting all documents, your application is complete, and you just need to wait for the broker’s review.

Step 4: Complete the US Stock Account Review

After submitting the application, you enter the waiting period for review. This process is usually much faster than you might think, as the broker’s backend system automatically handles most verifications.

Account Review Duration

The speed of account review depends on the broker you choose.

Most modern online brokers (like Firstrade) are very efficient, with reviews typically completed within 1-3 business days.

However, for a more professional platform like Interactive Brokers, since the application may need to be submitted to the New York Stock Exchange (NYSE) for approval, the entire process can sometimes take 2-3 weeks. Therefore, patience is necessary.

Check Review Status

While waiting, you can check your application progress in the following ways:

- Check Emails: The broker will notify you of the latest review status via email, including application received, approved, or needing additional materials.

- Log In to Account: Try logging into your registered account; the system usually displays the current review progress directly.

If the review takes longer than expected, it may be due to the following reasons. The brokerage industry is strictly regulated, and all applications undergo rigorous review; sometimes the system requires additional documents to verify your information. Especially when applying for complex trading permissions like options, the broker must conduct due diligence under FINRA rules to ensure the permission is suitable for you.

Activate Account and Initial Setup

Once you receive the approval email, congratulations! Your account has been successfully opened. Before depositing and trading, you need to complete a crucial step: activate the account and set up security options.

After logging in, the first thing you should do is set up two-factor authentication (2FA). This is an additional security layer that greatly protects your funds.

Usually, you can find it in the app or website’s “Settings” or “Account & Security” menu. You can choose to verify via SMS code or an authenticator app each time you log in. Completing this simple setup marks the basic completion of your US stock account opening process, providing a solid foundation for subsequent fund operations.

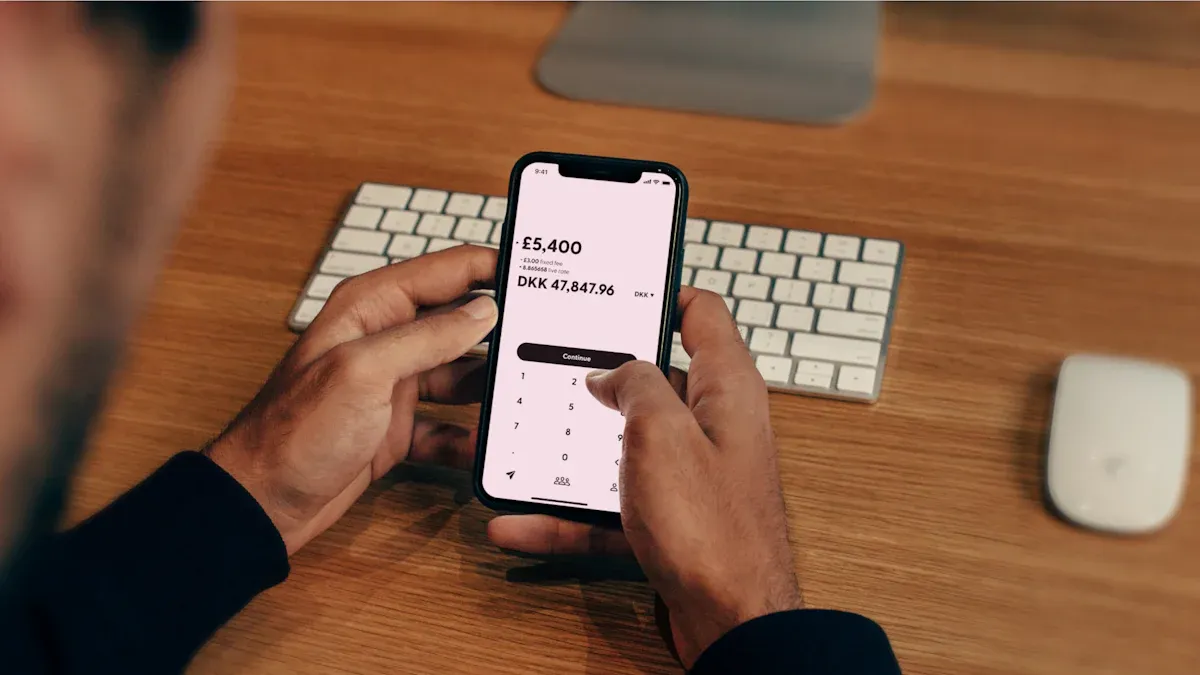

Step 5: Fund the Account and Transfer Money

Image Source: pexels

After successfully activating the account, you reach the final step before starting trading: injecting funds into the account. For most non-US investors, the most common method is bank wire transfer. Additionally, some emerging digital payment apps offer convenient solutions.

Obtain Broker Receiving Information

Before any transfer operation, you first need to obtain the receiving bank information from the broker. This information is usually available in your account backend.

You can follow these general steps:

- Log in to your broker account.

- Look for menus like “Transfer,” “Deposit,” or “Fund Management.”

- Select “Wire Transfer” or “Wire” option.

- The system will display all required receiving information, including SWIFTcode, bank name, bank address, and your exclusive receiving account number.

Be sure to accurately copy or screenshot this information for safekeeping.

Bank Currency Purchase and Wire Transfer Operation

After obtaining the receiving information, you can go to the bank to handle currency purchase and remittance. If you are in mainland China, you need to comply with the annual foreign exchange purchase limit of equivalent to $50,000 USD per person.

When operating a traditional bank wire transfer, filling out the remittance application form is key.

Important Tip: In the remittance note (note/reference) field, you must accurately fill in the personal account number and pinyin name provided by the broker. This is the only credential for the broker to identify fund ownership. Any errors in the information may cause the transfer to fail or be severely delayed.

In addition to traditional bank channels, you can also consider using digital payment apps like Biyapay. Such platforms usually integrate currency exchange and international transfer processes with a more modern interface, potentially providing a more efficient funding option.

Remittance Fees and Arrival Time

Cross-border wire transfers incur certain fees, mainly including the sending bank’s handling fee and intermediary bank fees, totaling approximately $25 - $50 USD. The good news is that many US brokers (such as Firstrade) do not charge any deposit fees, helping you save some costs.

In terms of arrival time, an international wire transfer usually takes 2-3 business days to be credited to your broker account. You need to note that the bank’s daily cutoff time and public holidays may affect the final arrival speed. If all information is filled correctly, the entire US stock account opening and funding process is smoothly completed.

Reviewing the entire process—from choosing a broker, preparing materials, to online application, waiting for review, and finally completing funding—these five steps are clear and straightforward. You will find that the threshold for completing a US stock account opening is now very low; the most important thing is to take the first step.

Congratulations! By completing the above steps, you have officially embarked on your global investment journey. Remember, investing is a marathon. It is recommended to start with index funds, build a diversified portfolio, and hold long-term. Wishing you successful investing!

Frequently Asked Questions

Is investing in US stocks safe? Is my money protected?

Your investment is safe. Legitimate US brokers are regulated by the US Securities and Exchange Commission (SEC).

Your account is also protected by the Securities Investor Protection Corporation (SIPC). This institution provides up to $500,000 in protection for your securities and cash, allowing you to invest with peace of mind.

How much money do I need to invest in US stocks?

You don’t need a lot of money to start. Many brokers (like Firstrade) have no minimum deposit requirement. You can start by buying one share or an ETF, for example, with $100 or $200. The important thing is to take the first step and gradually build your portfolio.

Can I invest in US stocks without knowing English?

Absolutely. Many brokers now offer fully Chinese trading apps and website interfaces. They also have Chinese customer service teams, and you can resolve any issues via phone or online chat. Language is no longer a barrier to investing in US stocks.

What taxes do non-US residents need to pay?

As a non-US resident, your biggest tax advantage is capital gains tax exemption. This means the profits from buying and selling stocks are tax-free.

You only need to pay 10% dividend tax on dividends from held US stocks (provided the W-8BEN form is filled out).

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

US Penny Stock Gold Rush: The Most Promising Potential Stocks to Watch in 2026

Weekly US Stock Index Futures Review and Outlook: What Investors Should Focus On

Overcoming Human Weaknesses: Detailed Guide to Beginner-Friendly Automated US Stock Trading Strategies

Want to Invest in US Stocks but Can't Read Financial Reports? Keep This Super Detailed Guide

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.