Remitly Remittance Inquiry and Security: How to Manage Transaction Status and Enjoy Benefits

Image Source: pexels

You can always keep track of your transfer progress. With Remitly, you can simply open the app or visit the website to check your transfer status. The platform will notify you of transaction updates via email or SMS, helping you stay informed about the flow of funds. Data encryption and identity verification protect your account security, allowing you to operate with confidence. You can also manage every transaction with simple settings, enjoying a transparent service experience.

Key Points

- With Remitly, you can check your transfer status anytime via the app or website, ensuring transparent fund movement.

- The platform offers multiple receiving methods, including bank accounts, Alipay, and WeChat, making it convenient to receive funds in China.

- Remitly uses advanced encryption technology and two-factor authentication to secure your account, preventing unauthorized access.

- Registering a Remitly account grants exclusive rewards, and referring friends can also earn cashback discounts, saving on fees.

- Regularly check Remitly’s promotions to take advantage of fee waivers and other discounts, enhancing your transfer experience.

Transaction Tracking Methods

Image Source: pexels

Remitly provides multiple ways to track your transfers, allowing you to monitor fund movements at any time. You can choose the most convenient method based on your preferences, whether through the mobile app, website, or notification alerts, all tailored to meet your needs. The platform also supports various receiving methods, including bank accounts, Alipay and WeChat, facilitating easy receipt of funds in China/Mainland China. You can clearly understand each transaction’s fees and limits, enjoying a transparent service experience.

App Transaction Tracking

You can download and log in to the Remitly app to check your transfer status anytime.

- After entering the app, click on the “Transfers” or “Transfer History” page.

- You will see detailed information about all transactions, including date, amount, recipient, and current status.

- Each transfer has a unique tracking code, which you can use to track progress in real time. The app frequently updates transfer status, allowing you to receive the latest information instantly. You can also contact customer support directly within the app to resolve any issues.

Website Transaction Tracking

You can also track transfers through the Remitly website.

- After logging into your account, go to the “Transfers” or “Transfer History” section.

- You can view all historical transactions, including the amount, recipient, and status of each transfer.

- The website tracking process is simple, with clear information display. While both the website and app allow real-time transfer tracking, the app excels in convenience and update frequency. If you prefer operating on a computer, the website is a great option.

Tip: Regardless of the method you choose, remember to save the tracking code for each transaction to quickly locate any issues.

Notification Alerts

Remitly will send transaction status updates via email and SMS.

- You will receive real-time updates, including information on whether the transfer has been initiated, is in progress, completed, or delayed.

- Notification alerts enhance service transparency, keeping both you and the recipient informed of progress.

- The real-time tracking feature boosts trust, eliminating the need to frequently log into the app or website for updates.

Common Issue Resolution

During the transfer tracking process, you may encounter some common issues.

- Transfer under review

- Incorrect recipient information

- Payment method issues

- Transfer failure

In such cases, you can:

- Track the transfer status again via the app or website

- Verify and confirm the accuracy of recipient information

- Contact Remitly customer support for professional assistance. The platform will help you resolve issues, ensuring funds safely reach China/Mainland China.

Transfer Amount Limits and Receiving Methods

When tracking transfers, you should also pay attention to amount limits and receiving methods. Remitly supports multiple receiving channels to meet various needs:

| Transfer Method | Per Transaction Limit (USD) | Notes |

|---|---|---|

| Most Customers | $2,999 | Varies based on sending method and account verification status |

| Daily Limit | N/A | Specific limits vary by account |

| Weekly Limit | N/A | Specific limits vary by account |

| Monthly Limit | N/A | Specific limits vary by account |

You can choose bank accounts, Alipay, or WeChat as receiving methods, allowing flexible fund receipt for you or your family in China/Mainland China.

Fee Transparency

Remitly is highly transparent about fees.

- Exchange rate markups range from 0.5% to 3.0%, depending on the currency pair.

- Fees vary based on the transfer amount and delivery speed.

- No fees are charged for bank account payments exceeding $500.

- You can clearly see all fees and exchange rates before transferring, with no hidden costs. This transparency allows you to confidently compare transfer options and make the best choice.

Security Measures

Image Source: unsplash

Data Encryption

When you transfer money with Remitly, the platform uses industry-leading encryption technology to protect your data.

- Remitly employs AES256 and 2048-bit RSA encryption protocols, widely used in the financial industry.

- Your personal information and transaction data are strictly protected during transmission and storage. You can confidently enter recipient information and account details, as the platform automatically encrypts all sensitive data to prevent leaks.

Identity Verification

During registration and transfers, Remitly requires multiple layers of identity verification.

- The platform uses two-factor authentication (2FA), requiring a password and a second verification method.

- This authentication method significantly reduces the risk of account theft, protecting your funds even if your password is compromised.

- Remitly continuously monitors account activity, alerting you promptly to any suspicious behavior. You can manage transfers with confidence, without worrying about unauthorized access.

Regulatory Compliance

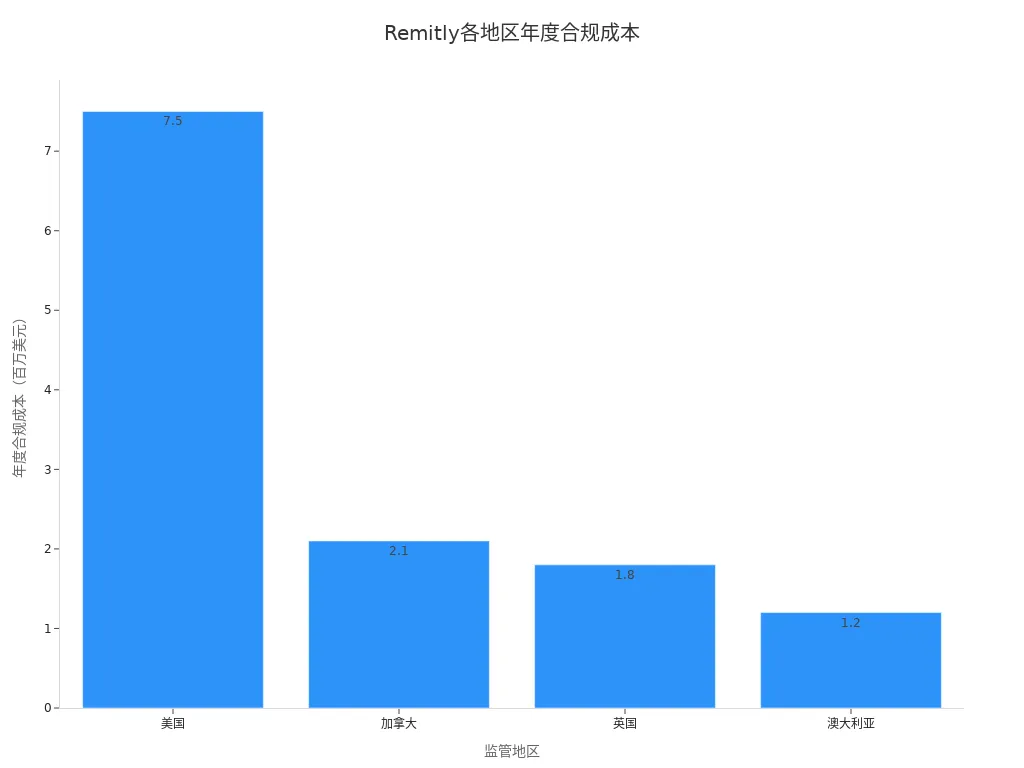

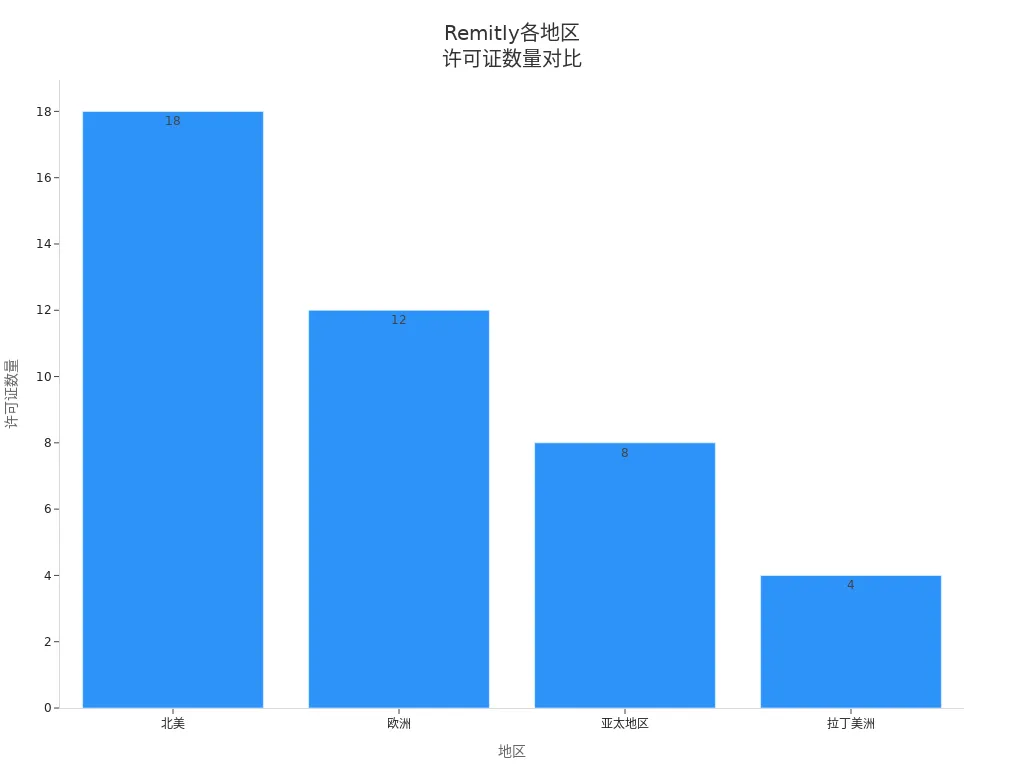

Remitly is licensed and certified by financial regulators in multiple regions worldwide. The table below outlines key regulatory regions and compliance status:

| Regulatory Region | Compliance Status | Annual Compliance Cost (USD) |

|---|---|---|

| United States | Fully Compliant | $7,500,000 |

| Canada | Fully Licensed | $2,100,000 |

| United Kingdom | FCA Registered | $1,800,000 |

| Australia | AUSTRAC Compliant | $1,200,000 |

| Region | Number of Licenses | Regulatory Authority |

|---|---|---|

| North America | 18 | FinCEN, State Regulators |

| Europe | 12 | FCA, Central Banks |

| Asia-Pacific | 8 | AUSTRAC, MAS |

| Latin America | 4 | Local Financial Regulators |

When transferring to China/Mainland China, Remitly complies with local and international regulations, ensuring every transaction is legal and compliant.

User Protection Tips

You can further enhance account security with the following measures:

- Use biometric verification (e.g., fingerprint or facial recognition) to log in.

- Regularly check transaction records and contact customer support promptly if anomalies are detected.

- Set up transaction alerts to stay informed about fund movements. Remitly continuously monitors all transactions to prevent fraud. The platform promises no hidden fees, with all exchange rates and fees clearly displayed before transfers. You can visit the pricing page, select the sending country, and easily view all fees to ensure funds reach China/Mainland China smoothly.

Reminder: Before transferring, carefully verify recipient information to avoid delays or failures due to errors.

Transaction Management

Transaction Records

You can easily view and manage your transfer history. The Remitly app’s home screen displays your recent transactions and available balance. By navigating to the “Profile” section, you can manage account information, beneficiaries, and view detailed transaction history. The platform provides real-time transfer status monitoring, helping you stay informed about fund movements. Detailed transaction records also make it easy to save and organize for future reference or reconciliation.

- View recent transactions and balance on the app’s home screen

- Manage account and beneficiaries in the “Profile” section

- Monitor transfer status in real time

- Easily save and organize historical records

Modification and Cancellation

If you need to modify or cancel a transfer, Remitly offers a straightforward process:

- Log in to your Remitly account.

- Go to the “Transfer History” page.

- Select the transfer to cancel and click “View Receipt.”

- Scroll to the bottom of the page and select “Cancel Transfer.”

- If prompted, choose the reason for cancellation.

- Click “Submit.”

After canceling a transfer, the system will automatically process a refund. Refunds are typically processed instantly, but the time to receive funds may vary depending on the payment method. You don’t need to request a refund or file a claim—just wait for the funds to return to your account.

Progress Tracking

You can track the progress of every transfer at any time. Remitly will notify you of transfer status via the app, email, or SMS. Many users report that mobile notifications allow them to stay updated on fund movements instantly. You can easily check each transaction’s status in the app, with the platform’s real-time updates receiving high praise from users. Both you and the recipient can stay informed, enhancing the transfer experience and trust.

Account Settings

You can customize account settings to improve transaction management and security. Remitly allows you to set preferred payment methods and language preferences, as well as save frequently used recipient information for faster future transfers. You can enable two-factor authentication to further secure your account. The platform uses encryption technology to ensure data security. You can verify your identity with passwords, biometrics, or one-time codes to prevent unauthorized access.

- Set preferred payment methods and language

- Save frequently used recipient information

- Enable two-factor authentication

- Multiple identity verification methods to secure your account

If you encounter any issues during transaction management, you can contact Remitly customer service at any time. The platform supports multilingual services and uses AI technology to improve response efficiency. Statistics show that over 95% of transactions require no customer support, and over 90% of transactions are completed within an hour, placing service speed at the industry forefront.

| Customer Service Option | Description | Response Time |

|---|---|---|

| Self-Service Experience | Allows you to resolve most issues without contacting support | Over 95% of transactions require no support contact |

| Multilingual Support | Offers service in 15 languages, enhancing communication | Over 90% of transactions completed within an hour |

| AI-Enhanced Service | Real-time translation and response, improving efficiency | Highly competitive, meets industry standards |

Discounts and Promotions

Registration Rewards

When you register a Remitly account, you can receive exclusive rewards. The platform offers rewards based on the average daily balance in your Remitly wallet. As long as your account is in good standing, you can enjoy this benefit. The table below outlines the basics of registration rewards:

| Eligibility Requirement | Reward Value |

|---|---|

| Remitly account and wallet in good standing | Variable reward amount based on the average daily balance in the Remitly wallet |

You can check reward details via the app or website, strategically managing funds to increase reward amounts.

Referral Cashback

You can invite friends to register with Remitly, and both parties can enjoy cashback discounts. Simply use a referral link to register an account, and the first transfer of $100 or more earns a $20 discount. You can refer via email, Facebook, Twitter, WhatsApp, or personal links. Each successful referral grants both you and the referred user a discount on the first transfer, saving on fees while helping others experience convenient transfer services.

- Register with a referral link, and the first transfer of $100 or more earns a $20 discount

- Referral channels include email, social media, and personal links

- Both referrer and referee enjoy first-transfer discounts

Fee Waivers

Remitly offers fee-free promotions during special occasions and for new customers. You can enjoy no-transfer-fee promotions during holidays, cultural celebrations, or major global events. The platform will notify you of the latest promotions via app notifications, emails, or social media channels. By staying updated on these channels, you can access discounts promptly.

- Fee-free promotions during holidays, cultural celebrations, or global events

- Exclusive promotions for new customers

- Access the latest offers via app, email, or social media

Using Discounts

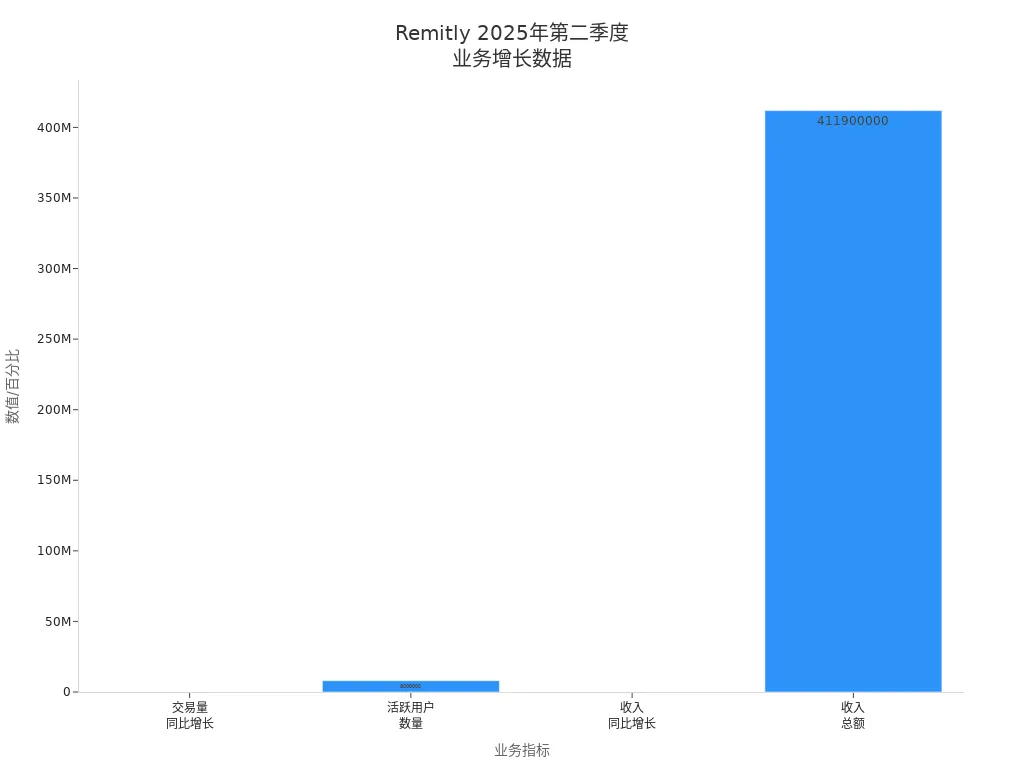

To use Remitly discounts, simply follow the platform’s instructions. If a transaction fails, the platform will notify you of the reason via email or app, such as incorrect recipient information, insufficient funds, or technical issues. You can correct the issue and retry the transaction. Remitly also introduced a subscription service, Remitly One, for $9.99 per month, offering fee-free global spending and credit-building tools. In Q2 2025, the platform’s transaction volume grew 41% year-over-year, active users reached 8 million, and revenue grew 34%. The chart below shows business growth details:

You can compare promotion frequency and fees across platforms to choose the best transfer service:

| Platform | Promotion Frequency | Fees |

|---|---|---|

| Remitly | Frequent | Low fees |

| Taptap Send | Attractive | Competitive pricing |

| Paysend | Attractive | Competitive pricing |

Tip: Regularly check Remitly’s app and website to stay updated on the latest promotions and enjoy more benefits.

You can easily track transfer status with Remitly, enjoying efficient transaction management and multiple security measures.

- Remitly uses advanced encryption technology and two-factor authentication, monitoring account security around the clock.

- You should regularly check account information, stay vigilant against phishing and scams, and report suspicious activity promptly.

- The platform updates promotions monthly, with first-time users enjoying maximum discounts, saving more during annual events.

- Users generally find Remitly’s fees low, delivery fast, and operations convenient.

| Feature | Advantage Description |

|---|---|

| Exchange Rate Lock | Avoid market fluctuations, transparent fees |

| Anti-Money Laundering Compliance | Ensures every transfer is legal and compliant |

| Diverse Promotions | Exclusive offers for different countries and periods |

You can follow the app and website to stay updated on the latest discounts, enhancing your international transfer experience.

FAQ

How do I check transfer status?

You can log in to the Remitly app or website and go to the “Transfer History” page. You will see detailed status and tracking codes for each transaction. The platform also notifies you of updates via email and SMS.

How long does it take for a transfer to arrive?

When choosing bank accounts, Alipay, or WeChat for receipt, funds typically arrive in minutes to hours. Some banks may take 1-2 business days. You can check progress in real time via the app.

How is transfer security ensured?

During transfers, the platform uses AES256 encryption and two-factor authentication. Remitly also complies with international standards, monitoring account activity in real time to protect your funds and personal information.

Are transfer fees and exchange rates transparent?

You can clearly see all fees and exchange rates before transferring, all displayed in USD. Remitly promises no hidden fees, with fees and rates clearly shown on the transaction page.

How do I access the latest discounts?

You can follow the Remitly app and website, where the platform regularly announces fee waivers, registration rewards, and referral cashback promotions. Staying updated on notifications ensures you enjoy the latest benefits.

Remitly enables real-time tracking (via app/website with tracking code) and robust security (AES256 encryption, 2FA), but 0.5%-3.0% rate markups and limits ($2,999/24 hours) can add costs, especially in 2025’s $80+ trillion remittance market, where traditional providers’ verifications slow transactions. For a cost-effective, seamless cross-border solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Another Major Drop! Why Is the A-Share Index Falling Non-Stop – Where Exactly Is the Problem?

Beginner’s Guide: What to Do When a Stock Hits Limit-Down? Can You Still Trade?

How to Wire Transfer USD from Industrial and Commercial Bank of China to OCBC Singapore? This Guide is All You Need

Volume-Price Rising Together or Diverging? Complete A-Share Practical Trading Strategy Guide

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.