How to Send Money Online via Ria? Understand the Process, Fees, and Advantages of Ria Money Transfer

Image Source: unsplash

You can choose Ria online remittance to easily send funds from mainland China to over 140 countries worldwide. You will find the delivery speed is very fast, sometimes completing within minutes. The fees are low, and the process is simple, making it suitable for those needing efficient international transfers.

Key Points

- Registering a Ria account is quick and simple; ensure you provide accurate information to protect your funds.

- Ria remittance supports multiple payment methods; choosing the most suitable method can enhance your remittance experience.

- Ria’s fees are transparent, typically lower than other providers, with more competitive exchange rates.

Ria Online Remittance Process

Image Source: unsplash

Ria online remittance allows you to easily transfer funds from mainland China to over 140 countries worldwide. You only need to follow the steps below to experience fast and simple international remittance services.

Register an Account

You need to register a Ria account first. You can complete registration through the Ria app or the official website. Here are the detailed steps:

- Download the Ria app and click the “Register” button, or visit riamoneytransfer.com and click “Register” in the top right corner.

- Select your current country or place of residence.

- Enter your email address and set a password.

- Agree to Ria’s terms and conditions.

- Fill in your full name, date of birth, and phone number, then click “Continue.”

- Choose whether to subscribe to promotions, discounts, and other special offers.

- Enter your mailing address and click “Continue.”

- Select and answer three security questions to protect your account.

Tip: During registration, ensure all information is accurate and valid to facilitate identity verification and secure your funds.

Enter Information

After registration, you need to complete your personal information. Ria online remittance requires you to provide the following details:

- First and last name

- Date of birth

- Email address

- Phone number

- Nationality and occupation information (if you reside outside Canada or the U.S.)

For identity verification, you also need to upload valid identification. The accepted document types by region are as follows:

| Region | Accepted Identification Documents |

|---|---|

| Europe | Passport, driver’s license, national ID, residence permit card |

| UK | Valid signed passport, UK photo driver’s license (full or provisional), valid EEA member state or Swiss driver’s license, valid EEA member state or Swiss ID |

Ria does not store your payment information on its servers, ensuring the security of your personal data.

Choose Amount

You can select the remittance amount based on your needs. The range of single transaction amounts supported by Ria online remittance is as follows:

| Minimum Amount | Maximum Amount |

|---|---|

| $2 USD | $15,000 USD |

You can flexibly choose the amount based on the recipient’s needs and your situation. The system will automatically display the corresponding exchange rate and fees, making decision-making easier.

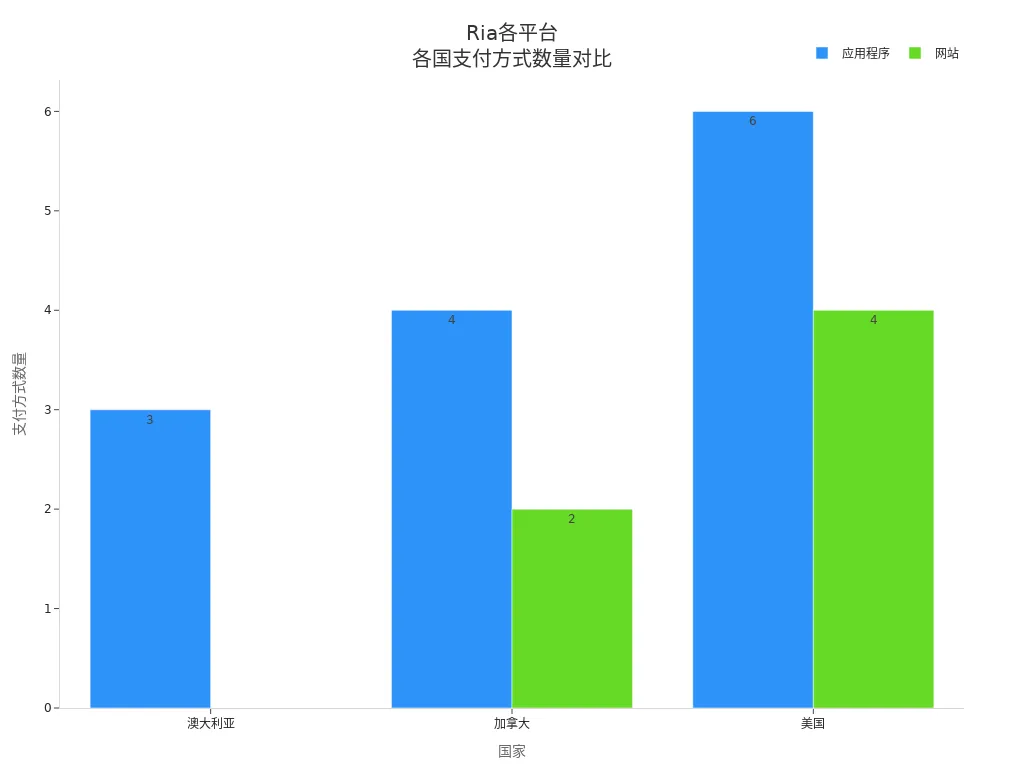

Choose Payment Method

Ria online remittance supports multiple payment methods, depending on your country and the platform used. The main payment methods are:

| Country/Region | Ria App Support | Ria Website Support |

|---|---|---|

| Australia | Credit card, debit card, PayID | - |

| Canada | Credit card, debit card, Apple Pay, Google Pay | Credit card, debit card |

| USA | Credit card, debit card, bank, cash, Apple Pay, Google Pay | Credit card, debit card, bank, cash |

You can choose the most convenient payment method based on your situation; some countries also support Apple Pay and Google Pay, enhancing the payment experience.

Submit Remittance

After filling in all information and confirming its accuracy, you can submit the remittance request. The system will prompt you to review the recipient information, amount, and payment method again. After submission, Ria will process your request immediately. In most cases, funds arrive within a few minutes to 15 minutes, especially when using the app for faster processing.

Ria online remittance supports automatic recurring transfers. If you have regular remittance needs, you can set up automatic transfers in the app to save time and effort.

Track Progress

You can track the remittance progress anytime via the Ria app or website. Key features include:

- View transfer history

- Find all transaction lists under the “Transfers” tab

- View detailed information for each transfer, including recipient, amount, and status

- Filter transaction history by date, amount, or recipient

With these features, you can monitor the status of every Ria online remittance in real time, ensuring funds arrive securely and on time.

Fee Structure

When using Ria online remittance, you’re likely most concerned about fees. Ria’s fee structure is highly transparent, mainly including service fees, exchange rate margins, and potential additional fees. Below, I’ll break down each component to help you understand the costs clearly before remitting.

Service Fees

Ria online remittance fees vary by recipient country. You can refer to the table below for fee details for common destinations:

| Recipient Country | Ria International Transfer Fees |

|---|---|

| Mexico | No upfront fees (exchange rate margin may still apply) |

| Canada | $4 USD + exchange rate margin |

| India | $1 USD + exchange rate margin |

| Brazil | No upfront fees (exchange rate margin may still apply) |

| Australia | $5 USD + exchange rate margin |

| UK | $5 USD + exchange rate margin |

| Bangladesh | No upfront fees (exchange rate margin may still apply) |

| China | $5 USD + exchange rate margin |

| Germany | $5 USD + exchange rate margin |

When selecting a remittance destination, you can estimate fees based on the table. Compared to other international remittance providers, Ria’s fees are generally lower. For example, Western Union’s fees range from $2 to $12, and their exchange rates are typically less favorable than Ria’s. You’ll find that Ria online remittance often saves you significant costs in most cases.

Exchange Rates

When remitting, exchange rates significantly affect the final amount received. Ria provides real-time exchange rates based on the recipient country, remittance amount, and payment method. Factors affecting Ria’s exchange rates include:

- Remittance amount

- Recipient country

- Payment method

- Exchange rate fluctuations

You can view the current exchange rate in real time on the remittance page. Ria typically adds a 1.5% to 2.5% margin above the interbank rate. For commonly used currencies, the margin is as low as 0.25%; for less common currencies, it can reach up to 4%. You can compare market rates before remitting to ensure a reasonable exchange rate.

| Service Provider | Fee Range | Exchange Rate Margin |

|---|---|---|

| Ria | Minimum $5 | 1.5% - 2.5% above interbank rate |

| Western Union | $2 - $12 | Generally less favorable than Ria |

Tip: Exchange rates fluctuate with the market, so check real-time rates before remitting and choose the optimal timing for your transfer.

Other Fees

When using Ria online remittance, you rarely need to worry about hidden fees. Ria is highly transparent, charging only the displayed fees, which depend on the remittance amount and destination country. Ria does not impose additional surcharges or hidden fees. However, when choosing a payment method, note that some options (e.g., credit cards) may incur extra fees from your financial institution, not Ria. For example, if you use a credit card, your bank may charge a cash advance fee. It’s recommended to consult your bank before using a credit card to avoid unexpected costs.

- Ria does not charge cash advance fees.

- Different payment methods may incur additional fees charged by financial institutions.

- Ria offers competitive exchange rates with no hidden fees.

You can see all fee details clearly during the remittance process, ensuring transparency and security of your funds.

Benefits Analysis

Delivery Speed

When using Ria online remittance, you can experience very fast delivery times. The delivery speed varies by payment method. Refer to the table below for average delivery times for common methods:

| Payment Method | Average Time |

|---|---|

| Credit/Debit Card | 15 minutes to 3 hours |

| Cash Pickup | Usually available the same day |

| Bank Transfer | Up to 4 business days |

| International Transfer | A few minutes to 1-2 business days |

When you pay with a credit or debit card, funds can arrive in as little as 15 minutes. Cash pickups are typically available the same day. If you choose a bank transfer, it may take up to 4 business days. Delivery speed also depends on the recipient country and the receiving bank’s processing time. You can flexibly choose the most suitable method based on your needs.

Security Measures

Your primary concern during remittance is likely fund security. Ria online remittance employs multiple security measures to protect your transactions. The table below outlines the main security technologies:

| Security Measure | Description |

|---|---|

| Encryption Technology | Uses SSL and TLS encryption to ensure secure data transmission. |

| Multi-Factor Authentication | Requires multiple identity verifications to enhance account security. |

| Real-Time Monitoring | Security team monitors transactions 24/7 to detect and prevent suspicious activity. |

Each time you log in or remit, the system requires multi-factor authentication. All data is encrypted to prevent leaks. Ria’s security team monitors every transaction in real time to ensure your funds are safe.

Coverage

You can use Ria online remittance globally. Ria has over 500,000 service locations in more than 190 countries. Whether you’re in the U.S. or elsewhere, you can easily make international remittances. Ria’s extensive network ensures recipients can access funds even in remote areas. You can choose cash pickup, bank deposits, or other methods to meet various needs.

- 190+ countries globally

- Over 500,000 service locations

- Multiple payout methods for flexible selection

User Experience

When using Ria online remittance, you’ll find the process very simple. You can complete remittances via the website, app, or agent locations. The system interface is clear and the process is straightforward. You can set up automatic recurring transfers to avoid repetitive tasks. Ria also provides real-time transaction tracking, allowing you to monitor fund status anytime. Compared to traditional bank transfers, Ria online remittance offers lower fees, better exchange rates, and faster delivery. You can enjoy an efficient, convenient, and secure international remittance experience.

| Benefit | Description |

|---|---|

| Speed | Offers fast delivery, with some methods completing in minutes. |

| Convenience | Supports online, app, and agent location operations; recipients can collect at global locations. |

| Competitive Fees | Low service fees and favorable exchange rates to save costs. |

| Accessibility | Extensive network coverage, enabling payouts in remote areas. |

| Security | Uses encryption and multi-factor authentication to ensure transaction safety. |

| Multiple Payment Methods | Supports cash, bank deposits, and mobile wallets for flexible selection. |

Payout Methods

Image Source: unsplash

Cash Pickup

You can choose cash pickup as a payout method. Ria has over 500,000 cash pickup locations in more than 190 countries. You only need to carry a valid ID and the sender-provided personal identification code (PIN) to collect cash at any Ria location. Some countries also offer ATM withdrawal services, allowing you to use the PIN to withdraw cash 24/7 at ATMs without a bank card. Certain regions provide home delivery, where funds are delivered directly to the recipient’s home. The table below outlines the main cash payout options:

| Option | Description |

|---|---|

| Cash Pickup | Quickly collect cash at multiple global locations, convenient and fast. |

| Home Delivery | In some countries, funds can be delivered directly to the recipient’s home. |

| ATM Withdrawal | Use the PIN to withdraw cash at ATMs, available 24/7. |

| Cash Pickup Locations | Provide ID and PIN to collect cash at any Ria location. |

Bank Deposit

You can choose bank deposit as a payout method. Ria supports direct deposits to most bank accounts worldwide, including licensed banks in Hong Kong. You only need to provide the recipient’s bank account details, and the funds will arrive securely. Bank deposits are ideal for scenarios requiring direct account deposits, with fast delivery and high security. You can use this method in mainland China or other countries to meet various needs.

Other Methods

You can also choose emerging payout methods like mobile wallets. Ria partners with multiple mobile wallet platforms, covering various countries and regions. You can select the appropriate mobile wallet service based on the recipient’s location. Common partner platforms include:

- In Colombia, Ria supports DaviPlata, Nequi, and MOVii.

- In Peru, Ria supports Yape.

- In the Philippines, Ria supports GCash, Coins.ph, PayMaya, GrabPay, Palawan Pay, and ShopeePay.

- In Ghana, Ria supports MTN MoMo, Vodafone, and AirtelTigo.

- In Bangladesh, Ria supports bKash, ROCKET, Upay, and Nagad.

- In China, Ria supports AliPay and WeChat.

- In Senegal, Ria supports Orange Money, Free Money, and Wave.

You can flexibly choose a payout method based on the recipient’s situation to enhance fund transfer efficiency and convenience.

You can use Ria online remittance to meet the international remittance needs of immigrants, family members, and workers. The process is simple, fees are transparent, and delivery is fast. Users rate it highly on platforms like Trustpilot, with robust security measures. You can also check the latest promo codes to enjoy additional discounts.

FAQ

What Payout Methods Does Ria Online Remittance Support?

You can choose cash pickup, bank deposit, or mobile wallet. Bank deposits support licensed bank accounts in Hong Kong, with funds arriving in USD.

How Long Does It Take for a Remittance to Arrive?

When you pay with a credit or debit card, funds can arrive in as little as 15 minutes. Bank deposits typically take 1-4 business days.

How to Ensure Remittance Security?

Each time you remit, the system uses encryption and multi-factor authentication to protect your funds and personal information.

Ria Money Transfer offers an efficient option for international fund transfers, with its vast network covering 190+ countries, diverse payout methods—including cash pickup, bank deposits, and mobile wallets like Alipay and WeChat Pay—and fast delivery times (as quick as 15 minutes). Its transparent fee structure and multi-layered security measures also enhance user trust.

When evaluating remittance services, cost efficiency and the utility of funds after arrival are as important as speed and convenience. BiyaPay presents a cost-effective alternative: Fees as low as 0.5% with same-day transfers—send and receive on the same day. Users can check exact costs in advance using the real-time exchange rate calculator. Furthermore, once funds arrive, they can be directly used to invest in stocks, seamlessly connecting remittance with wealth management—without the need for separate overseas accounts.

For users seeking efficiency, transparency, and greater value from their transferred funds, integrated financial platforms like this are worth considering. Learn more at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Like a Snowball: Let Shanghai Stock Market Index Make Your Money Work for You

Another Major Drop! Why Is the A-Share Index Falling Non-Stop – Where Exactly Is the Problem?

Beginner’s Guide: What to Do When a Stock Hits Limit-Down? Can You Still Trade?

Stop Relying Only on the Shanghai Composite: How the Shenzhen Component and ChiNext Indices Reveal New A-Share Opportunities

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.