Say Goodbye to High Fees: Cheapest Ways to Send Money to the US Revealed

Image Source: unsplash

In 2025, the cheapest and fastest way to send money from China to the US is to choose modern online remittance platforms like Wise and BiyaPay. Are you still troubled by traditional bank remittances?

Traditional banks not only charge high fees but also offer unfavorable exchange rates, causing your funds to quietly shrink in transit. Long waiting times add even more uncertainty. These platforms were created precisely to solve these pain points.

Key Points

- Online platforms are cheaper and faster for sending money to the US. They offer better exchange rates and lower fees than traditional banks.

- For small remittances, Wise and BiyaPay are excellent choices. They provide transparent exchange rates and lower costs.

- For large remittances, consider platform limits and compliance. Traditional banks are safer but more expensive and slower.

- Before remitting, carefully verify recipient information. Incorrect bank account or name can cause remittance failure.

- You can use comparison tools to find the most cost-effective remittance method. This helps save money and choose the best platform for you.

Hidden Costs of Traditional Bank Remittances

When you choose traditional banks for international remittances, what you see may only be the tip of the iceberg. Beyond advertised fees, many “hidden costs” quietly erode your funds. Let’s uncover them one by one.

High Cable and Handling Fees

The handling fee shown at the bank counter or online banking is just the beginning. A standard international wire transfer has a far more complex fee structure than you might imagine.

First, banks charge a percentage-based handling fee on the remittance amount. In addition, you need to pay a fixed “cable fee.” If your remittance passes through one or more “intermediary banks” to reach the US recipient account, each bank may deduct a service fee.

This means that even if you pay all initial fees, the recipient may ultimately receive less than you sent. These midway fees are usually hard to predict and track.

| Fee Type | Description |

|---|---|

| Remittance Handling Fee | Usually a fixed percentage of the amount |

| Cable Fee | Fixed communication fee per remittance |

| Intermediary Bank Fee | Each passing bank may deduct a fee during transfer |

| Recipient Bank Incoming Fee | Some US banks charge for receiving international remittances |

Hidden Losses from Exchange Rate Spreads

This is the largest hidden loss in bank remittances. The exchange rate banks offer is not the real-time market rate but a “bank rate” with added profit. This spread (spread) is usually between 2% to 4%.

What does this mean? Suppose you want to send money to the US; if the real-time market rate is 1 USD = 7.20 RMB, the bank might use 1 USD = 7.35 RMB for your exchange. For a $10,000 USD remittance, exchange rate alone could cost you over a thousand RMB extra. This fee doesn’t appear on any bill, but it really happens.

Long and Uncertain Arrival Times

Time is also a cost. Traditional bank wire transfers rely on the SWIFT network, typically taking 1 to 5 business days. However, this time is not guaranteed.

Factors affecting arrival time include many:

- First-Time Remittance: First transfers to an account may require longer review time.

- Bank Processing Windows: Your remittance request may wait for specific bank processing periods.

- Holidays: Public holidays in China and the US can cause delays.

This uncertainty, especially for tuition payments or urgent needs, brings significant inconvenience and anxiety.

Best Platforms Comparison for Small Remittances to the US

Image Source: unsplash

When sending a few hundred or thousand dollars in small remittances, traditional banks’ high fixed fees and poor rates are especially uneconomical. Fortunately, modern online remittance platforms offer cheaper, faster alternatives.

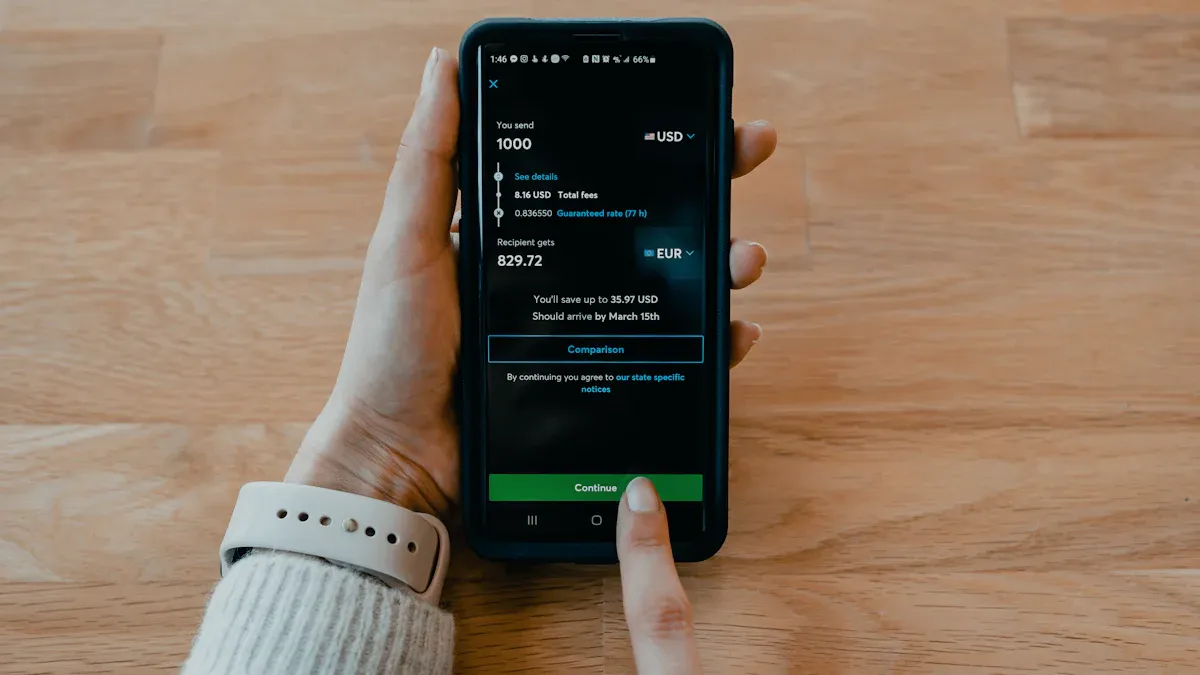

To illustrate differences intuitively, we simulated a comparison of mainstream platforms and traditional banks for “sending 1000 USD from mainland China to a US bank account.”

Important Note: Fees and rates in the table below are examples; actual costs fluctuate in real time. Always use each platform’s official calculator for the most accurate quote before remitting.

| Remittance Method | Handling Fee (USD) | Exchange Rate (Example) | Estimated Arrival Amount (USD) | Estimated Arrival Time |

|---|---|---|---|---|

| BiyaPay | ~$5 | Real-time market rate | $995 | Minutes to hours |

| Wise | ~$7 | Real-time market rate | $993 | 1-2 business days |

| Remitly | ~$3 (new user discount) | Rate with spread | $985 | Minutes (Express) |

| Panda Remit | ~$6 | Rate with spread | $988 | As fast as 2 minutes |

| Traditional Bank | $20 - $40 | Rate with spread | $950 - $970 | 1-5 business days |

The table clearly shows online platforms have absolute advantages in cost and efficiency. Next, let’s explore each platform’s features in depth.

Best Overall Cost: Wise

Wise (formerly TransferWise) has revolutionized international remittances. Its biggest advantage is committing to the mid-market rate, the real rate you see on Google, completely transparent with no hidden markups. Wise only charges a small, transparent service fee.

However, note that while Wise is popular, some users have encountered issues. Understanding other users’ experiences is crucial when choosing a service.

According to 2024-2025 user feedback, some reported cumbersome verification processes, temporary fund freezes, and slow customer service. For example, users faced blocked payments due to document reviews or unexpected delays. Of course, many long-term users say most transactions go smoothly, and issues are eventually resolved.

This reminds you to test with a small amount first before large initial transactions.

Emerging Option: BiyaPay

BiyaPay, as a powerful emerging payment platform, offers more choices beyond traditional fiat. Its key feature is bridging fiat and digital currency exchange channels, especially suitable for users wanting to use stablecoins (like USDT) for asset allocation or payments.

BiyaPay’s core advantages include:

- Flexible Fund Channels: Directly use stablecoins for payments; the platform converts to USD and deposits into the recipient’s US bank account, effectively bypassing traditional bank restrictions in some cases.

- Competitive Fees: Committed to low-cost solutions, with rates usually close to market, minimizing exchange losses.

- Efficiency and Security: Leverages blockchain for near real-time transfers in many cases. Uses bank-level encryption for fund security.

- Convenient Mobile Operations: Complete everything from creating remittances to tracking status easily via mobile app.

For users seeking efficiency, flexibility, and new payment methods, BiyaPay offers a highly attractive solution.

Other Popular Platforms: Remitly and Panda Remit

Beyond Wise and BiyaPay, other excellent platforms deserve attention.

Remitly: Focuses on speed and flexibility. Usually offers two options:

- Express Service: Slightly higher fee, but funds often arrive in minutes.

- Economy Service: Lower fee, but takes 3-5 business days. Remitly often has fee discounts for new users, worth considering for first remittances to the US.

Panda Remit: Specializes in serving overseas Chinese, with user-friendly interface and support. Main advantages: simple process and supports various mainland China payment methods, such as through Hong Kong licensed bank accounts. Arrival often very fast, claiming as quick as 2 minutes.

How to Optimize Large Remittances (e.g., Tuition)

When paying tuition, investing, or large family support, considerations differ completely. It’s no longer just saving tens of dollars in fees. For remittances over $10,000, prioritize three core factors: platform single-transaction limits, compliance and tax implications, and customer support.

Important Note: Large cross-border flows are strictly regulated by both China and the US. Ensure you understand all relevant laws before initiating to avoid fund freezes or unnecessary tax issues.

Online Platforms for Large Remittances

Many think online platforms suit only small amounts, but some reliably handle large transactions.

First, check limits. For Wise:

- Single transaction limit from mainland China is 100,000 RMB (about $14,000 USD).

- If funding Wise via Alipay, single limit is 50,000 RMB (about $7,000 USD).

For higher limits or flexibility, BiyaPay offers a unique solution. It bridges digital currencies (like USDT stablecoins) and fiat, facilitating large remittances. Convert assets to USD and deposit directly into US bank accounts. This excels beyond traditional limits, with robust compliance framework for security.

Compliance Notes for Large Remittances to the US

Large funds face US tax and compliance realities. Banks or institutions must report certain transactions to the IRS.

- Automatic Reporting: Any single or related transfers over $10,000 USD are automatically reported to IRS, mainly to prevent money laundering.

- Foreign Bank Account Report (FBAR): If overseas financial accounts total over $10,000 USD at any point in a year, submit FinCEN 114 form.

- Gift Tax Return (Form 709): Gifts over annual exemption ($18,000 in 2024) to one non-spouse US recipient require filing. Usually just reporting; tax only if lifetime gifts exceed very high limit (over $12 million).

Especially for tuition, while mainland China has $50,000 USD annual purchase limit, tuition and study expenses are often exceptions. However, direct wires to schools may fall short due to intermediary fees. Many schools recommend services like Flywire to ensure full tuition arrival.

Traditional Banks’ Security and Process

For life’s most important large transactions, traditional banks shine. Core advantage: unmatched security and mature processes.

Banks use SWIFT network for international remittances. Trusted globally for decades, with proven security and stability. Strictly regulated, providing solid protection for large funds.

Of course, banks require rigorous procedures. Typically:

- Enable Permissions: First large cross-border remittance may require in-person visit with ID and card to apply for U-shield or similar and enable outbound transfer.

- Prepare Documents: Need multi-currency current account and detailed recipient info, including name, address, bank name, SWIFT code, and account. Any error can cause failure or delay.

- Follow Timing: Online systems not true 7x24. Usually process only business days specific hours (e.g., Monday-Friday 09:00-16:00).

The table below helps compare banks’ pros/cons for large remittances:

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Security | Extremely high, strictly regulated, uses SWIFT | |

| Process | Mature, clear paper records traceable | Cumbersome, may require in-person |

| Fees | High fees, obvious exchange rate losses | |

| Time | Slow arrival, usually multiple business days |

In summary, if absolute fund security is priority and you don’t mind higher time/cost, traditional banks remain very reliable.

General Online Remittance Operation Guide

Image Source: unsplash

Regardless of chosen online platform, processes are similar. Familiarizing with this general guide lets you quickly start on any platform and complete remittances smoothly.

Preparation: Registration and Identity Verification

Before starting, first complete account registration and identity verification. This is mandatory for compliant financial platforms to protect your funds.

Prepare personal information and documents in advance. Per mainland China regulations, platforms usually require:

- Your name, address, and occupation

- Valid Chinese resident ID number and photo

- Bound mainland China mobile number

After registration, platform guides identity verification. This usually takes 1 to 2 business days. If additional documents needed, notified via App or email. Wait patiently for approval.

Core Steps: Create Remittance and Lock Rate

After verification, create first remittance. Core is locking a favorable rate.

Online platforms’ advantage is “guaranteed rate”. When entering amount, platform shows rate and promises to lock it for a period (usually 30 minutes to 24 hours). As long as you pay within time, unaffected by market fluctuations.

Tip: If unsatisfied with current rate, don’t create yet. Many platforms allow rate alerts; notify when rate hits your target.

Key Information: Fill US Recipient Account

This is the most error-prone and critical step. Any wrong information can delay or fail remittance. Carefully verify following US recipient account details:

| Information Type | Description |

|---|---|

| Recipient Full Name | Must exactly match bank account name |

| ABA Routing Number | 9-digit code identifying recipient bank |

| Bank Account Number | Usually 8 to 12 digits identifying specific account |

| Recipient Address | Complete US street address |

Avoid Common Errors: Double-check every digit and letter before confirming. Confusing ABA routing and account number is common. Misspelling recipient name can cause bank rejection.

Final Step: Payment and Tracking

After filling information, choose payment method to complete. After success, track fund status in real-time on platform website or App.

Most platforms provide clear tracking interface showing every node:

- Funds Received

- Converting Currency

- Funds Sent

- Recipient Received Funds

You and recipient usually receive email or SMS notifications, keeping you fully informed and at ease.

You now understand: for small daily remittances to the US, online platforms like Wise or BiyaPay maximize cost benefits. For large like tuition, balance fees, security, and service.

Action Suggestion: Before each remittance, use professional comparison tools for current best deal.

- FXcompared: Real-time comparison of providers’ rates, fees, and speeds.

- Xe: Real-time rate queries, helping seize best timing.

FAQ

How much can I send annually from China to the US?

Per mainland China rules, personal annual foreign exchange purchase quota is $50,000. For tuition exceeding this, provide proof to banks for additional quota.

What if I accidentally enter wrong recipient information?

Immediately contact your platform’s customer service. If funds not sent, they can cancel or modify. If sent, recovery is complex, so double-check before.

Do I need to pay tax sending money to family in the US?

Usually no. If annual gifts to one person below exemption ($18,000 in 2024), no filing needed. Over requires filing, but tax only if lifetime gifts exceed very high limit.

How to choose the best platform for me?

Decide based on:

- Lowest Cost: Prioritize Wise or BiyaPay using market rates.

- Fastest Speed: Consider Remitly Express or Panda Remit.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Beginner’s Guide: Easily Understand the Shanghai Composite Index and Its Investment Value

Guide to Remitting Money from Abroad to China and RMB Exchange

Want to Invest in US Stocks from Taiwan? Complete Guide to Popular Brokers: Account Opening Process & Pros/Cons Analysis

Data-Driven Analysis: Shanghai Stock Index 2026 Earnings Growth Forecast

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.