Stop Wasting Money: Master 5 Tips to Effectively Reduce Cross-BBorder Remittance Costs

Image Source: unsplash

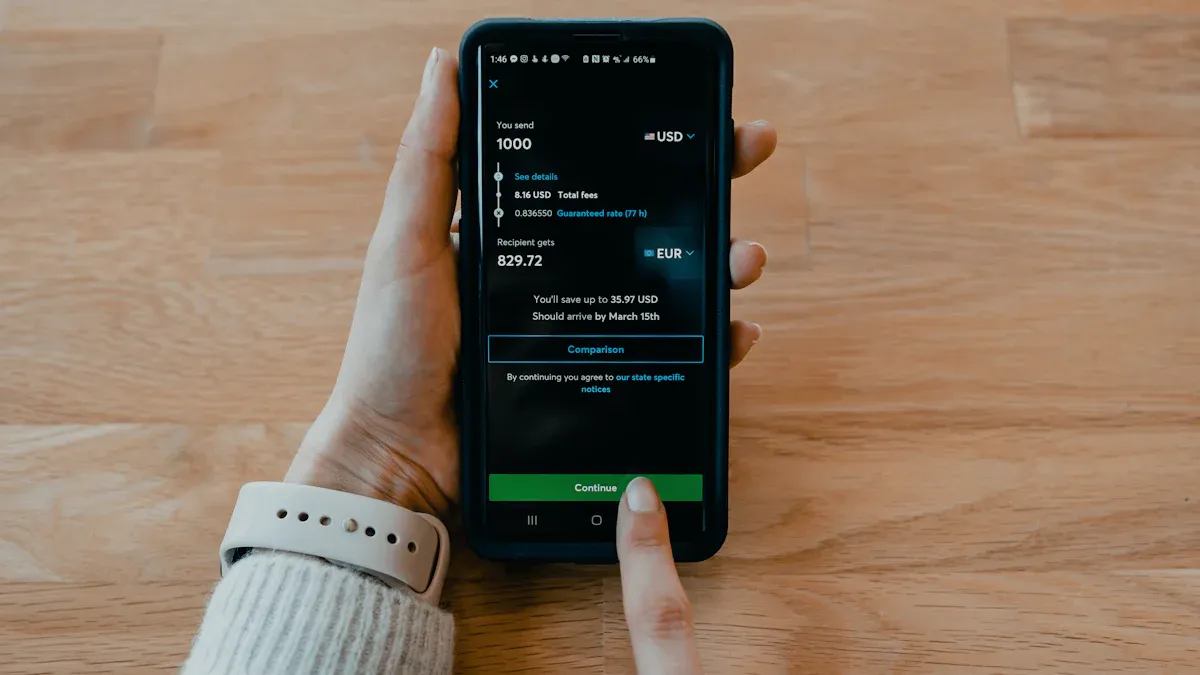

Have you ever considered that behind every cross-border remittance, there might be a significant “hidden expense”? In the global remittance market exceeding $900 billion annually, many people unknowingly pay high fees.

According to a World Bank report, the global average cost of sending $200 reaches 6.2%. Banks’ exchange rate markups and various handling fees can push the total cost beyond 5% of the transaction amount.

But rest assured, you can fully control these costs. By mastering a few simple tips, you can ensure every penny is well spent under the premise of fund security, without paying for unnecessary fees.

Key Takeaways

- Choose online remittance platforms—they typically have lower fees, better exchange rates, and faster arrival times than traditional banks.

- Monitor exchange rate changes and remit when rates are favorable to save a considerable amount.

- Consolidate small remittances whenever possible and send large amounts at once to reduce per-transaction fees.

- Carefully review all fees and beware of hidden charges, especially intermediary bank fees.

- Utilize bank premium memberships or platform loyalty programs to access exclusive remittance discounts.

Tip 1: Choose the Right Channel and Say Goodbye to Expensive Banks

Image Source: unsplash

If you’re still relying on traditional banks for cross-border remittances, you may be paying unnecessary “expensive” fees. Selecting the right remittance channel is the first and most critical step to saving money.

Emerging Online Platforms vs Traditional Banks

Traditional banks’ international wire transfer services typically take 3 to 5 business days to arrive. Their fee structures are also complex, with fixed handling fees plus potential additional markups in the exchange rate.

In contrast, channels represented by emerging online platforms like Biyapay offer better solutions. They generally provide:

- Lower fees: Handling fees are usually transparent percentages, for example starting from 0.48%, with no hidden markups.

- Better exchange rates: Many platforms use mid-market rates, giving you fairer conversion prices.

- Faster speeds: Most transfers complete in minutes or hours, significantly reducing wait times.

| Transfer Method | Average Arrival Speed |

|---|---|

| Traditional Bank Wire | 3-5 business days |

| Online Remittance Platform | Minutes to hours |

Research shows that for a $1,000 transfer via traditional banks, higher fees and unfavorable rates can result in the recipient receiving tens or even hundreds of dollars less than with digital platforms.

Smart Use of First-Transfer Promotions and Special Offers

Competition among online remittance platforms is fierce. To attract new users, they often launch highly attractive promotions. Before your first remittance, be sure to check these “benefits.”

Common promotion types include:

- First transfer with zero handling fees: Many platforms waive all fees for your first transaction.

- Exclusive rates for new users: Platforms may offer new users a rate better than standard.

- Cashback or discount vouchers: After completing the first transfer, you may receive discounts for future remittances.

These promotions often activate automatically upon registration, requiring no complex steps. For example, some platforms offer new users a $3.99 fee waiver for transfers from the US, or $15 discounts during specific periods (such as June 16 to July 7, 2025). Seizing these can reduce your first remittance cost to zero.

Tip 2: Closely Monitor Exchange Rates and Act at the Right Time

Image Source: unsplash

Besides handling fees, exchange rates are another key factor affecting the final amount received. The forex market changes constantly, and catching a good rate can save you a substantial sum.

Impact of Exchange Rate Fluctuations on Received Amounts

You might think small rate fluctuations don’t matter, but for larger remittances, the impact is amplified. A seemingly minor percentage change can mean tens or hundreds of dollars difference.

For example, suppose you remit $5,000 to Europe. At a rate of 1 USD to 0.8587 EUR, the recipient gets 4293.5 EUR. But if the rate fluctuates by just 1%, the amount differs by about 43 EUR. That could cover a lavish dinner or a short train ticket.

Therefore, learning to observe rates and act when favorable is essential for cross-border remittances.

Set Rate Alerts to Lock in the Best Timing

You don’t need to constantly refresh rates on your computer. Many online platforms and apps now offer convenient rate alert tools to automatically monitor the market.

You can easily set a target rate. When the market reaches your desired level, the system notifies you via email or push notification. This allows you to complete the transfer at the optimal time.

Some useful rate alert tools include:

- Wise: Offers free rate alerts and even auto-conversions, executing trades automatically at your target rate.

- OFX: Allows unlimited market rate alerts with notifications via email or SMS.

- Xe: Create a free account to set multiple alerts for monitored currency pairs.

Setup is usually simple: select the currency pair, enter your target rate, and enable notifications. This “set it and forget it” tip helps you effortlessly seize savings opportunities.

Tip 3: Consolidate Transfers to Lower Per-Transaction Cross-Border Remittance Costs

Do you habitually send small amounts whenever needed? This seemingly convenient habit may quietly erode your funds. Like paying multiple shipping fees for separate online orders, frequent small remittances cost you extra unnecessary fees.

Avoid the “Trap” of Multiple Small Remittances

Many services charge a fixed handling fee regardless of whether you send $200 or $2,000. For small amounts, this fixed fee becomes a high percentage of the total—highly uneconomical.

For example: Assume a fixed fee of $15 per transaction.

- For a $300 transfer, the fee is 5% of the amount.

- For a $3,000 transfer, it drops to 0.5%.

That’s a 10x difference! Consolidating scattered needs into one large transfer is one of the most direct ways to cut costs.

Plan Funds to Qualify for Large-Transfer Discounts

Beyond diluting fixed fees, handling large amounts at once can unlock exclusive discounts from many platforms that encourage big transactions with lower rates.

Planning your needs in advance helps you easily meet these thresholds. Some platforms even discount based on your monthly total volume.

- Wise uses tiered fee discounts. The more you send in a calendar month, the lower the rate on amounts exceeding thresholds (e.g., $25,000), automatically calculated.

- OFX specializes in high-value transfers. It often waives fixed fees for transfers over $10,000, and for amounts exceeding $100,000, negotiates even better rates.

Next time before remitting, ask yourself: “Any other needs in the next month or two?” If yes, consolidate them—you’ll save far more than expected.

Tip 4: Understand Fees Clearly and Beware of “Hidden” Charges

The fees displayed by remittance platforms are often only part of the total cost. Without careful review, some “hidden” charges may deduct unknowingly. Learning to break down fees ensures your hard-earned money arrives fully.

Break Down Handling Fees: Fixed vs Percentage

Remittance handling fees typically come in two forms: fixed fees and percentage fees. Understanding the difference helps you choose economically based on amount.

| Feature | Fixed Transfer Fee | Percentage Transfer Fee |

|---|---|---|

| Definition | A fixed amount, usually $5 to $50. | Charged as a percentage of the transaction, typically 0.5% to 3%. |

| Advantages | Predictable, suitable for large transfers. | Suitable for small transfers, scales with amount. |

| Disadvantages | Very uneconomical for small transfers. | Higher amounts mean higher absolute fees. |

| Example | $3,000 transfer pays $20 fixed fee. | $1,000 transfer at 2% pays $20. |

Simply put, fixed fees are better for large amounts; percentage fees for small ones.

Identify Intermediary Bank Fees in Cross-Border Remittances

You may have experienced the sent amount not matching the received—something missing in between. This “mysteriously disappeared” money is likely the intermediary bank fee.

The global banking system is not a unified network. When your bank has no direct relationship with the recipient’s, funds pass through one or more intermediary banks. These charge $15 to $50, deducted directly from principal, reducing the final amount.

How to avoid intermediary bank fees?

- Choose platforms offering “full amount arrival”: Modern services like Biyapay optimize networks to guarantee full arrival—no extra deductions.

- Consult the recipient’s bank: Before transferring, have the recipient check for any receiving fees. Consider all sender and receiver fees for true cost.

Tip 5: Leverage Your Status to Unlock Exclusive Benefits

You may not realize your “status” at a bank or platform is a money-saving ace. Many institutions offer hidden exclusive benefits for specific customers—actively seeking them can save significantly.

Fee Waivers for Bank Premium Members

If most of your funds are with one bank, you likely qualify for premium membership. Banks retain high-value clients with remittance perks.

Qualification typically requires:

- Maintaining a high minimum deposit.

- Holding multiple products like savings or investments.

- Setting up direct deposits.

As a premium member, you unlock privileges. For example, HSBC Premier clients enjoy:

- Waived HSBC fees on daily transactions.

- Free transfers between same-name HSBC accounts globally.

- Shared benefits for family members.

Tip: Institutions like Citibank offer high-net-worth clients (e.g., Citigold) exclusive overseas account services and fee waivers. Some apps even allow real-time transfer tracking for clear fund visibility.

Remittance Discounts Between Partner Banks

Beyond single-bank status, watch banks’ “friend circles.” Partner banks offer greatly reduced or free transfers.

This extends to online platforms with loyalty programs.

- Points rewards: Each transfer earns points redeemable for fee discounts or cashback.

- Tier upgrades: Higher volume or frequency unlocks lower rates.

Before next transfer, check your bank account tier or platform for usable benefits. This simple step may bring unexpected savings.

Now you’ve mastered five core tips: choose the right channel, time it well, consolidate, understand fees, and leverage status. Cross-border remittance costs are controllable. Many have successfully saved by carefully comparing service fees and security.

Before your next remittance, spend a few minutes making the smartest choice. You’ll save not just money, but peace of mind.

FAQ

Should I choose fixed fee or percentage fee services?

It depends on your transfer amount. For larger amounts, fixed fees are usually more cost-effective. For small remittances, percentage-based services result in lower fees.

Is my money safe using online platforms?

You can verify platform security in several ways. Prioritize regulated platforms, such as those holding a Hong Kong Money Service Operator (MSO) license. Also check user reviews and confirm features like two-factor authentication.

Why does the recipient receive less than expected?

This is likely due to intermediary bank fees deducted directly from principal. To avoid it, choose services offering full amount arrival to ensure the recipient gets the complete sent amount.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

US Financial Dynamics: Key Factors Influencing Today's Stock Market

2025 US Stock Pre-Market Trading Essential Guide: Master the Latest Rules and Hours

Must-Watch US Stock Market Signals: Don't Miss These Important Indicators

2025 Best US Stock Trading Apps Ranking: Full Comparison of Fees and Features

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.