My Real Pros and Cons Experience Sharing After Using US Stock Trading Apps for One Year

Image Source: pexels

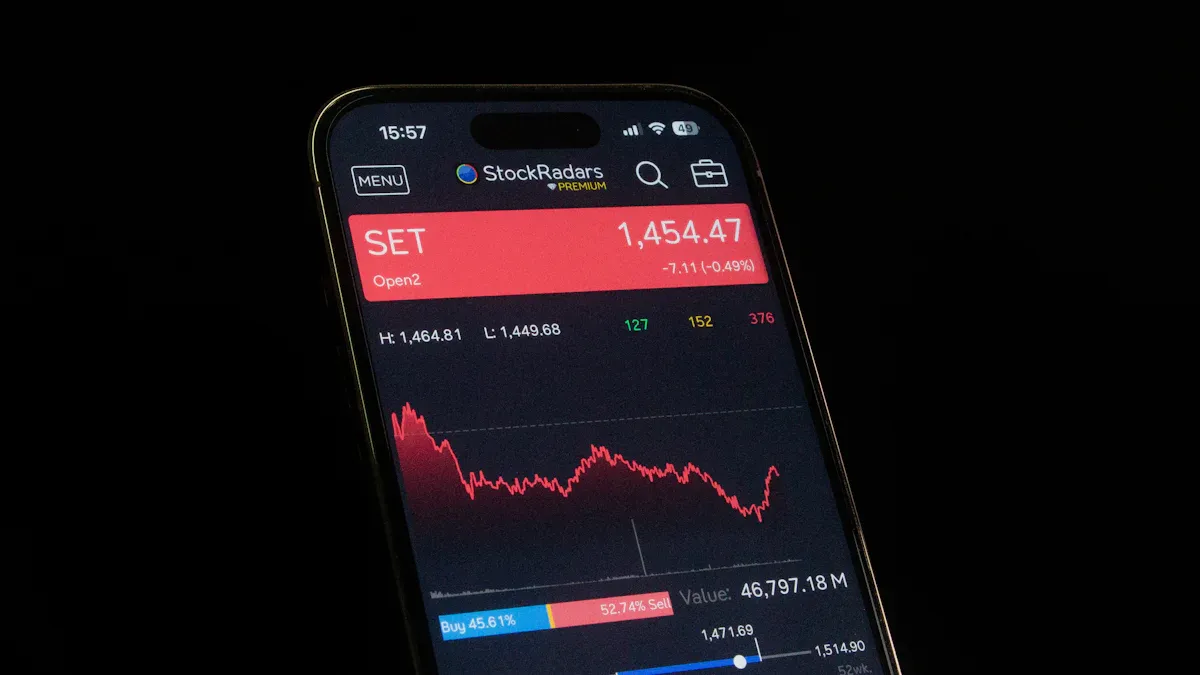

Have you ever wondered whether commission-free US stock trading apps are truly a “free lunch” or a “sweet trap”? You are not the only one with this question. The user growth of such apps is astonishing:

- In 2024, the global user count has reached 145 million, surpassing historical highs.

- The World Economic Forum once predicted that from 2016 to 2025, the compound annual growth rate of annual users would reach 20%.

After one year of real experience, my answer is: It is both a “powerful tool” that significantly lowers the investment threshold and a “trap” that may affect your trading decisions and ultimate costs.

Key Points

- US stock trading apps lower the investment threshold, making small investments and high-frequency trading easy.

- These apps provide community functions where investors can learn and exchange ideas.

- Zero-commission apps make money through payment for order flow, which may affect your trading prices.

- Gamification designs in the apps induce overtrading, increasing investment risks.

- Besides zero commissions, you still need to pay other fees, such as data subscription fees and wire transfer fees.

The “Pros” of Commission-Free: Three Major Benefits from Real Experience

Image Source: pexels

You might think that “free” always comes with a price, but in some aspects, the benefits brought by these apps are real and substantial. They have completely changed the way ordinary people participate in the market. Based on my one-year usage, I summarize these benefits into three aspects: cost, experience, and learning.

1. Cost Advantage: Liberation for Small and High-Frequency Trading

This is probably the first benefit that comes to mind, and its impact far exceeds your imagination. Zero commissions mean that the direct cost of each trade drops to zero.

In the past, traditional US brokerage firms mostly adopted a “commission-sharing model”. Brokerage firms take a portion from your trading commissions as income. This leads them to have incentives to maintain higher commissions because lower commissions mean less income for them. The new generation of US stock trading apps adopt a “fee-based model”, where their income is unrelated to your commission amounts, paving the way for zero commissions.

This is a complete liberation for small investors.

Suppose you plan to invest $200 monthly in dollar-cost averaging a certain exchange-traded fund. Under the traditional broker model charging $5 commission per trade, you would have already lost 2.5% of your principal before starting to profit. Over a year, commissions alone would cost you $60. But on zero-commission platforms, this fee completely disappears.

This cost advantage makes some strategies that were once difficult to implement due to high fees become feasible:

- Small Dollar-Cost Averaging: You can execute weekly or even daily $20 investment plans without pressure, smoothing costs.

- Grid Trading: In small stock price fluctuations, you can perform multiple buy and sell operations to capture spreads without worrying about commissions eating your profits.

Compared to mainland China’s brokers with “exempt five” or “one in ten thousand” commissions, zero commissions have an absolute advantage in handling small trades of tens or hundreds of dollars. It truly lets you focus on investment strategies themselves rather than calculating trading costs.

2. Extremely Simple Experience: Significantly Lowering Investment Barriers

If you have ever tried opening a traditional brokerage account as a non-US resident, you must have a deep understanding of its complexity. The new generation of stock trading apps simplifies this process to the extreme.

You only need a smartphone, download the app from the app store, and follow clear instructions to upload identity proof and address proof documents. The entire process usually completes within 10 minutes, with approval possible on the same day at the fastest. In contrast, the traditional way may subject you to:

- Additional paperwork and reviews

- Requirements for US visa or work proof

- Filling complex W-8BEN forms

- Possibly needing in-person handling

After completing account opening, the funding process is equally simple. You can directly link your licensed Hong Kong bank account, easily exchange funds into USD and transfer to the trading account. From downloading the app to completing the first trade, the entire experience is smooth as silk with almost no obstacles. This extremely beginner-friendly design truly lowers the threshold for investing in US stocks from “professional level” to “mass level”.

3. Community Functions: Learning and Growing Through Interaction

Many US stock trading apps have built-in powerful community functions, which are not just chat tools but hubs for information and strategies. Here, you can gain value far beyond K-line charts.

These communities usually have the following features, allowing you to no longer be alone on your investment journey:

| Function | Value It Brings to You |

|---|---|

| Real-Time Market Information | Keeps you updated on the latest market dynamics and news anytime. |

| Expert-Led Discussions | Gain in-depth insights from experienced professionals. |

| Investor Interactive Learning | Share views with other investors and grow together. |

| Diversified Market Coverage | Explore different industries and investment strategies to broaden your horizons. |

| Portfolio Sharing | View experts’ holdings and learn their allocation ideas. |

This model is similar to what mainland Chinese investors are familiar with, “Xueqiu” (Xueqiu), deeply integrating trading and social features. Some platforms even offer “copy trading” functions, allowing you to copy successful investors’ operations with one click, which is extremely attractive for beginners.

Note: Communities are a double-edged sword. One study found that information on social media can not only explain markets but also influence them. When a certain stock experiences abnormally high discussion heat in the community, retail investors easily exhibit “herd behavior”. Another study on the Reddit community also shows that excessively high community attention stimulates irrational trading and significantly reduces holding period returns.

Therefore, communities can be a valuable source for obtaining information but may also become a “trap” inducing you to chase rises and kill falls. How to utilize its benefits while avoiding harms is a lesson you must learn.

The “Cons” of US Stock Trading Apps: Three Pits I Stepped Into

Image Source: pexels

While enjoying the convenience of zero commissions, you may not realize that platforms are still profiting from your trades. The business models of these “free” apps determine some hard-to-notice “pits”. Below are the three main drawbacks I personally experienced and summarized, which may be quietly affecting your investment returns.

1. Price Suspicion: The Hidden Side of Payment for Order Flow (PFOF)

Have you ever wondered how these US stock trading apps make money without commissions? The answer mostly points to a term you may not have heard: Payment for Order Flow (PFOF).

Simply put, PFOF is when your broker “sells” your trading orders to upstream large market makers and receives compensation in return.

- Your orders do not directly enter public exchanges like NYSE or NASDAQ.

- The broker bundles and sends orders to market makers willing to pay for them.

- Market makers profit from tiny spreads in buy/sell quotes on massive orders and share part of the profits with the broker.

This model allows brokers to earn stable income even with zero commissions. But what does this mean for you?

Core Issue: Is the execution price you get the best? In theory, market makers are obligated to provide “best execution” for your orders. SEC research also found that retail order execution quality is even better than exchanges in some aspects. But potential conflicts of interest always exist. Brokers may prioritize sending your orders to the highest-paying market maker, rather than the one providing the most favorable price for you. Although the difference may be only $0.01 per share, for large or high-frequency trades, this “hidden slippage” gradually erodes your profits.

To improve transparency, regulators require brokers to disclose their PFOF arrangements. But for ordinary investors, it is hard to judge during trading whether you got the absolute best price.

| Feature | PFOF Brokers | Conventional Brokers |

|---|---|---|

| Revenue Model | Direct orders to market makers in exchange for payment. | Primarily earn through client commissions, spreads, or fees. |

| Order Execution | Orders routed to third parties paying for order flow. | Orders executed through multiple market channels. |

| Conflict of Interest | Higher potential due to economic incentives. | Client-centered, lower potential. |

| Regulatory Stance | Banned in EU, UK, etc. | Standard and widely accepted brokerage model. |

2. Behavioral Trap: Gamification Designs Inducing Overtrading

When you open these apps, do you feel they are less like serious investment tools and more like mobile games? Colorful confetti celebrations, upgrade systems, achievement badges… These “gamification” designs are subtly influencing your trading behavior.

Reports from International Organization of Securities Commissions (IOSCO) and UK Financial Conduct Authority (FCA) clearly point out that gamification designs significantly affect investors’ decision processes, possibly leading you to make impulsive decisions, trade more frequently, and underestimate related risks.

These US stock trading apps utilize mature psychological principles to make you “addicted”:

- Instant Rewards: Celebration animations popping up after each successful trade stimulate dopamine release in your brain, giving pleasure and craving more.

- Social Comparison: “Leaderboards” and “portfolio sharing” functions let you see others’ gains, easily triggering your “fear of missing out” (FOMO), leading to chasing rises and killing falls.

- Frequent Notifications: Push notifications like “Certain stock up 5%” constantly attract your attention, shortening decision time and inducing unplanned trades.

One study found these strategies increase users’ trading frequency by nearly 40%. You may unknowingly shift from a long-term value investor to a short-term speculator seeking stimulation. This app design-induced overtrading not only increases decision errors but also makes it harder to stick to your original investment discipline.

3. Hidden Costs: Real Expenses and Function Limitations Beyond Zero Commissions

“Zero commission” only exempts trading commissions, but real investment costs go far beyond that. In my one-year usage, I discovered many charging items and function limitations hidden under the “free” halo.

1. Premium Data Subscription Fees

If you want more professional analysis, like viewing Level 2 market depth quotes, you need to pay for subscriptions. These fees are not cheap.

As shown above, even for non-professional users, monthly subscription fees may range from $8.00 to $11.00, adding up to a considerable expense over a year.

2. High Interest Rates for Margin Trading

If you want leverage using margin functions, you need to pay high interest.

| Broker Name | Margin Interest Rate (Annual) |

|---|---|

| Moomoo | 6.8% |

| Webull | 8.74% (Standard) |

| Robinhood | About 5.5% (Low Balances) |

These rates are much higher than bank mortgage rates; if you use margin long-term, interest costs severely drag down your portfolio performance.

3. Deposit/Withdrawal and Account Transfer Fees

This is the most easily overlooked cost. While ACH transfers are usually free, for users in mainland China, more common wire transfers and account transfers (ACATS) fees are high.

| Fee Type | Common Fee (USD) |

|---|---|

| International Wire Transfer Out | $25.00 - $30.00 |

| Full Account Transfer Out (ACATS) | $75.00 - $100.00 |

| Currency Conversion | Hidden in exchange rate spreads, up to 1.5% |

When you need to fund or withdraw from a licensed Hong Kong bank account, each wire transfer may cost dozens of dollars. If switching brokers, transferring all assets at once costs nearly $100. These friction costs significantly increase the difficulty of fund allocation.

In this area, finding a low-cost fund solution is crucial. For example, some emerging digital payment platforms Biyapay offer better exchange rates and lower cross-border transfer fees, serving as alternatives to traditional bank wires to effectively reduce your deposit/withdrawal costs.

4. Lack of Professional Tools and Software Ecosystem

Finally, these minimalist apps sacrifice professionalism. They are usually closed ecosystems; you cannot link the broker account to more powerful third-party software like Tonghuashun or Xueqiu in mainland China for unified management and analysis. For investors accustomed to advanced charting tools and multi-account management, this is a huge function limitation.

You now understand that commission-free US stock trading apps are a double-edged sword. Their value completely depends on how you use them.

My Advice to You 📝

- Beginners: You can use their low-threshold advantage to get started but must establish strict trading discipline.

- Veterans: You can use them as auxiliary tools, but core assets may be better placed on fully functional platforms.

For me personally, after one year of exploration, I learned to utilize their advantages and avoid traps. As long as you stay clear-headed and disciplined, it remains a valuable tool.

FAQ

Are these US stock trading apps safe?

Your funds and securities are protected by the Securities Investor Protection Corporation (SIPC). If the broker goes bankrupt, your account gets up to $500,000 insurance. Therefore, choosing compliant brokers regulated in the US is crucial.

Does zero commission really mean completely free?

Not entirely. While you are exempt from trading commissions, you may still face other fees.

For example, you need to pay premium data subscription fees, margin interest, or international wire transfer fees. These are the real costs beyond “free”.

What is Payment for Order Flow (PFOF)?

This is a business model where your broker bundles and sells your trading orders to large market makers in exchange for compensation. This may result in your execution price not being absolutely optimal, a hidden potential cost behind zero commissions.

How to fund the account if I am not in the US?

You can use international wire transfers. Usually, the most convenient way is to transfer funds from your licensed Hong Kong bank account to the trading account. Please note that both the bank and broker may charge certain handling fees.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Why Investing in US Stock ETFs Is Smarter Than Picking Individual Stocks

Stop Wasting Money: Master 5 Tips to Effectively Reduce Cross-BBorder Remittance Costs

Beginner's Guide to Investing in US Stocks: Everything You Need to Know About 2025 Trading Hours and Rules

2026 Ultimate Guide to Opening a US Stock Account: Step-by-Step Guide to Choosing Reliable Brokers

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.