How to Transfer Money from Vietnam to the US via Remitly?

Image Source: pexels

You can transfer funds from Vietnam to the US through Remitly. You only need to register an account and complete identity verification, without requiring the recipient to register. Prepare the recipient’s full name and Visa debit card number. The process is simple, supporting operations via the website or app, and the recipient can directly receive US dollars.

Key Points

- After registering a Remitly account, the recipient does not need to register; providing their full name and Visa card number is sufficient to complete the transfer.

- Ensure the recipient holds a compliant Visa or Mastercard debit card to smoothly receive international remittances.

- Be aware of transfer amount limits, with a maximum of $10,000 per transaction; confirm account limits in advance to avoid transaction failures.

- Choose US dollars as the receiving currency to minimize exchange rate losses, ensuring the recipient receives the exact amount needed.

- When using Remitly, pay attention to fees and delivery times, selecting the appropriate transfer speed to meet funding needs.

Remitly Transfer Process

Image Source: unsplash

Account Registration

You need to first register an account on the Remitly platform. You can choose to operate on the official website or download the app. During registration, the system will ask you to provide basic information, including your name, email, and contact details. You, as the sender, must complete registration, while the recipient does not need to register an account. You only need to prepare the recipient’s full name and Visa debit card number. This way, the recipient can directly receive US dollars without additional steps. Below are common receiving options:

- The recipient can pick up cash at a nearby physical location. This method is suitable for recipients without bank accounts.

- The recipient can also receive funds via a mobile wallet, depending on their location.

You can choose the most suitable method based on the recipient’s actual needs. Remitly’s transfer process is flexible, supporting multiple receiving channels, making it convenient to send money to the US for family or friends.

Identity Verification

After registering an account, you need to complete identity verification. The platform will require you to upload identification documents, such as a passport or ID card photo. You will also need to provide address information. Identity verification is a critical step in ensuring fund security. Only after passing verification can you officially proceed with Remitly transfers. You can upload the required documents via the app or website, and the system will complete the review in a short time. Once verified, you can choose the transfer speed and currency type, typically settled in USD. The entire process is straightforward, suitable for users new to international remittance services. You just need to follow the prompts to complete the transfer smoothly.

Recipient Information

Visa Card Requirements

When making a Remitly transfer, the recipient needs a compliant Visa or Mastercard debit card. Not all bank cards can directly receive international remittances. You need to confirm in advance whether the recipient’s card meets the following conditions:

| Requirement | Description |

|---|---|

| Card Type | Must be a Visa or Mastercard debit card issued by a bank that supports debit card deposits |

| Bank Confirmation | The recipient needs to confirm with their bank whether debit card deposits are allowed |

| Card Number | Requires the recipient’s 16-digit Visa debit card number |

You can suggest that the recipient contact their issuing bank to confirm whether the card supports international remittance deposits. Only if the above conditions are met can the funds be successfully received. Most mainstream Visa debit cards issued by banks in the US typically support this service, but the actual situation depends on the bank’s response.

Information Entry

When entering recipient information, ensure all details are accurate. The accuracy of the information directly affects the delivery speed and fund security. You need to prepare the following details:

- The recipient’s full name (must match the bank account information)

- Bank account number

- Bank name (if applicable)

- Branch name (if applicable)

- Branch code (if applicable)

- International Bank Account Number (IBAN) or Bank Identifier Code (SWIFT/BIC)

- The recipient’s contact phone number

When filling out the information, carefully verify each item, especially the recipient’s name and card number. Any errors may lead to transfer failure or delays. It is recommended to confirm all details with the recipient in advance to ensure a smooth Remitly transfer.

Transfer Amount

Amount Limits

When using Remitly for transfers, you need to be aware of the transfer amount limits. The platform has clear regulations for single transactions and periodic remittances. The table below shows the main limits for transfers from Vietnam to the US:

| Sending Limit Type | Maximum Per Transaction | 24-Hour Total | 30-Day Total | 180-Day Total |

|---|---|---|---|---|

| Tier 1 | $2,999 | $10,000 | $18,000 | |

| Tier 2 | $6,000 | $20,000 | $36,000 | |

| Tier 3 | $10,000 | $30,000 | $60,000 |

You can choose the transfer amount based on your needs. The maximum per transaction is $10,000, but actual limits may vary depending on your account verification level. The platform will automatically adjust the limit based on your identity information and transfer history. If you need to send larger amounts, it is recommended to complete higher-level identity verification in advance.

Tip: Before submitting a transfer, be sure to check your account limits to avoid transaction failures due to exceeding limits.

Currency Selection

When making a Remitly transfer, you can choose US dollars (USD) as the receiving currency. US recipients typically prefer receiving USD directly, as this reduces losses from currency conversion. When filling out transfer details, the system will automatically display available currency options. After selecting USD, the recipient will receive USD directly without needing additional conversion. You can also choose the transfer speed based on your needs. Express delivery typically incurs higher fees but ensures faster arrival in the recipient’s account. Standard delivery has lower fees but takes slightly longer. When choosing the currency and transfer speed, you can make the best decision by considering fees and delivery times.

Tip: Choosing USD as the receiving currency allows US recipients to use funds directly, avoiding losses due to exchange rate fluctuations.

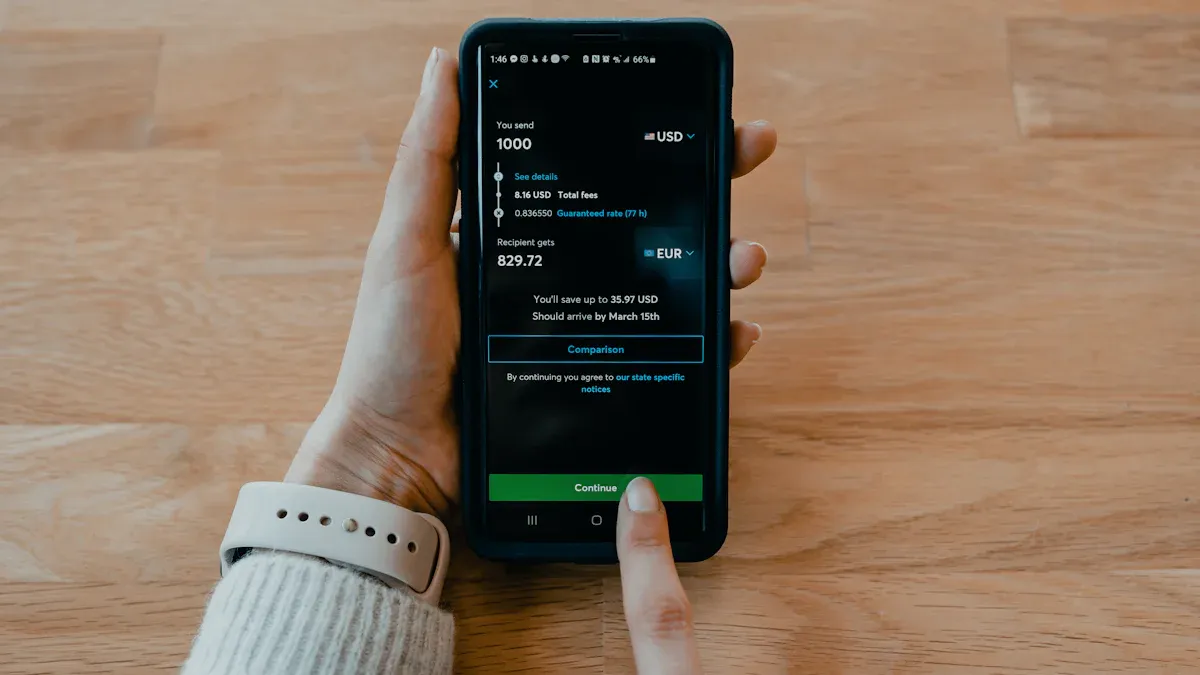

Fees and Exchange Rates

Image Source: pexels

Fee Details

When using Remitly for transfers, the platform charges fees based on the transfer amount and speed. Typically, fees range from $3 to $6 per transfer. If the transfer amount exceeds $1,000, Remitly waives the fee, which is highly beneficial for large transfers. The table below compares Remitly’s fees with other mainstream remittance services:

| Service | Fee Range | Notes |

|---|---|---|

| Remitly | $3 to $6 per transfer | Zero fees for transfers over $1,000 |

| Revolut | $4 to $6 per transfer | One free transfer per month for basic plans |

| Wise | Fees start at 0.41% | No subscription fees, suitable for large transfers |

You can see that Remitly has a clear advantage for large transfers. When choosing a remittance service, you can make an informed decision based on your needs and transfer amount. The platform will clearly display all fees before you submit the transfer, helping you plan your budget.

Tip: Before transferring, carefully check the fees and delivery times to avoid unexpected costs affecting your financial plans.

Promotional Exchange Rates

When using Remitly for transfers, the platform often offers promotional exchange rate activities. During promotions, you can enjoy better USD exchange rates, reducing transfer losses. On the transfer page, you can directly view the current exchange rate, and the system will automatically calculate the actual amount received. Promotional rates are typically available for first-time transfers or specific holidays, helping you save more. You can follow platform announcements to stay updated on the latest exchange rate offers. When choosing transfer speed, check whether promotional rates apply to different delivery methods. The platform will clearly indicate promotional rates on the checkout page, making it easy to compare options.

Tip: Transfer during promotional periods to enjoy higher received amounts and improve fund efficiency.

Delivery Time

Transfer Speed

When using Remitly for transfers, you can choose different transfer speeds based on your needs. The platform typically offers two main services: standard delivery and express delivery. Standard delivery is suitable for non-urgent needs, with lower fees. Generally, standard service completes the transfer within 1 to 3 business days. When submitting a transfer, the system will automatically display the estimated delivery time, allowing you to plan the recipient’s fund usage. Express delivery offers higher efficiency, with funds typically arriving in minutes to hours. The platform will determine whether express delivery is supported based on the recipient’s bank and card type. You can view the specific fees and estimated delivery times for each option, enabling flexible choices based on your needs.

Tip: Transfers during holidays or weekends may experience delays. It’s recommended to operate on business days to ensure timely delivery.

Express Delivery

If you need the recipient to receive funds quickly, you can choose Remitly’s express delivery service. Simply select the “express delivery” option on the transfer page, and the system will prioritize your transaction. In most cases, the recipient will receive funds within minutes. Note that some banks or cards may not support instant deposits, and actual delivery times depend on the system’s prompts. Express delivery incurs a service fee, which is slightly higher but significantly reduces waiting time. You can review all fees and delivery times before transferring to make the best choice. Express delivery is ideal for urgent transfers or temporary funding needs.

Tip: When choosing express delivery, verify the recipient’s card details to ensure the bank supports this service, avoiding delays due to mismatched information.

Security Measures

Fund Security

When making a Remitly transfer, the platform employs multiple security measures to ensure your funds are protected during international transfers. It uses SSL and 256-bit encryption to prevent unauthorized access to sensitive data. Your information is automatically encrypted each time you log in or perform operations. The platform also strictly complies with European financial regulations, including anti-money laundering laws and GDPR, requiring monitoring of every transfer to prevent illegal fund flows. You can rest assured that all operations are conducted within a compliant framework. When logging into your account, the platform requires multi-factor authentication. In addition to a password, you’ll need to enter an SMS verification code or use another authentication method, ensuring funds remain secure even if the password is compromised. The table below summarizes Remitly’s key security measures:

| Security Measure | Description |

|---|---|

| Encryption Technology | Uses SSL and 256-bit encryption to protect sensitive data from unauthorized access. |

| Compliance | Fully complies with European financial regulations, such as anti-money laundering laws and GDPR, ensuring secure and transparent transfers. |

| Multi-Factor Authentication | Requires more than just a password for verification, ensuring funds remain secure even if the password is compromised. |

When choosing a transfer platform, you can prioritize these security measures to ensure every transaction safely reaches the US recipient’s account.

Privacy Protection

When using Remitly’s transfer service, the platform strictly protects your personal information. All data is encrypted, and only authorized personnel can access it. The platform will not disclose your information to third parties. Recipient details, bank card numbers, and contact information are considered sensitive and managed per GDPR and other international standards to prevent privacy breaches. You can view and manage your privacy settings in your account at any time. The platform regularly updates its security policies to enhance data protection. If you have privacy concerns, you can contact customer support for assistance. By choosing Remitly, you not only enjoy efficient fund transfers but also comprehensive privacy protection.

Operational Notes

Bank Account Requirements

When using Remitly to transfer money from Vietnam, you don’t necessarily need a bank account issued in mainland China or Hong Kong. The platform supports multiple payment methods, allowing you to choose based on your situation. The table below outlines common payment methods:

| Payment Method | Description |

|---|---|

| Direct Debit | Direct debit from a bank account |

| Debit Card | Payment via debit card |

| Credit Card | Payment via credit card (not recommended, as transfers are often treated as cash advances) |

You can choose to pay via debit card or direct bank account debit. While credit cards are accepted, they are typically treated as cash advances, which may incur additional fees. When selecting a payment method, prioritize debit cards or bank accounts to ensure fund security and cost control.

Tip: Before transferring, confirm that your bank card or account supports international payments to avoid transaction failures due to incompatible payment methods.

Mobile Support

You can complete all transfer operations via Remitly’s mobile app or website. The mobile app supports both Android and iOS, with a clean interface and clear process. Simply download the app, register an account, and follow the prompts to enter recipient details and payment methods to complete the transfer. The mobile app supports real-time exchange rate queries and delivery time estimates, allowing you to track fund status anytime.

- The mobile app supports on-the-go operations, ideal for frequent travelers or users needing flexible transfers.

- The website is suitable for detailed information or bulk operations.

You can choose the operation method based on your preferences. Whether on mobile or desktop, the transfer process is seamless.

Other Common Questions

When using Remitly for transfers, you may encounter common questions. Below are some of the most frequently asked concerns:

- Remitly charges certain fees and exchange rate markups. While the platform claims no hidden fees, the actual exchange rate is typically higher than the mid-market rate.

- Transfer amounts and delivery times vary depending on payment methods and receiving banks. Verify all details before submitting a transfer.

- The platform supports multiple payment methods, including debit cards, credit cards, and direct bank account debits, allowing flexible choices based on your needs.

Tip: Before transferring, compare fees and exchange rates across platforms to choose the best option, ensuring fund security and delivery efficiency.

You can easily transfer funds from mainland China to the US via Remitly. Simply register an account, provide the recipient’s Visa card details, and choose the appropriate transfer speed and currency. The platform offers competitive exchange rates and zero fees for new users, with express delivery completing in minutes.

- Remitly receives high ratings among global users, with a smooth mobile experience and multiple receiving options.

- You can lock in favorable exchange rates and track funds in real-time for security.

- Exchange rates are typically better than banks, with transparent fees. When operating, carefully verify recipient details, set a strong password, enable two-factor authentication, and beware of online scams. Choose the right transfer method and consider delivery speed and fees to make your international transfers more efficient and secure.

FAQ

What payment methods does Remitly support?

You can choose debit cards, credit cards, or direct bank account debits. It’s recommended to prioritize debit cards or bank accounts for lower fees and faster delivery.

Will funds be refunded if a transfer fails?

If a transfer fails, the platform will automatically refund the funds to the original payment account, typically within 3-5 business days.

Can recipient information be modified during a transfer?

You can modify recipient information before submitting the transfer. After submission, changes are not allowed; you’ll need to cancel the order and resubmit.

How can I check transfer progress?

You can track transfer progress in real-time via the Remitly app or website account. The system displays each step’s status, keeping you informed of fund movements.

Is there a minimum transfer amount?

Remitly has no mandatory minimum transfer amount. You can choose the transfer amount based on your needs, offering flexibility in fund arrangements.

After exploring Remitly’s process for transferring money from Vietnam to the US, you may find that while it offers straightforward operations and various receipt options, fees ($3-$6 or waived for large amounts with rate markups), transfer limits (up to $10,000 per transaction), and unpredictable delivery times (1-3 days) can raise costs and inconvenience. This is especially true for frequent or urgent transfers. Despite security measures, verification delays and exchange rate fluctuations can still impact the experience.

BiyaPay offers a more efficient cross-border financial solution. Our real-time exchange rate query helps you secure the best rates, minimizing losses. With remittance fees as low as 0.5%, support for multiple fiat and digital currency conversions, and coverage across most countries with same-day delivery, BiyaPay meets urgent needs seamlessly. Uniquely, you can trade US and Hong Kong stocks without an overseas account, with zero fees for contract orders, enabling wealth growth. Sign up now at BiyaPay to experience low-cost, high-efficiency global remittances and investments, simplifying your financial management with secure, transparent transactions!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Must-Read for Investing in US Stocks in 2025: 5 Technical Indicator Tips for Analyzing Real-Time Quotes

2026 Latest US Stock Broker Review: Which is Better in Features and Fees - IB, Futu, or Tiger Securities

US Stock Index Futures Trading Secrets: Master the Four Major Indices to Unlock Wealth Opportunities

In-Depth Analysis of US GDP: Comprehensive Insights from Consumption to Investment

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.