What to Know About Using Euros Instead of Swiss Francs in Switzerland

Image Source: unsplash

You might wonder, can you pay in euro in Switzerland? The answer is yes, but only in some places. The official swiss currency is the Swiss franc (CHF), and most people use this for daily payments. Many shops and restaurants in tourist areas may let you use the euro, but they often set their own exchange rates, which can make things more expensive. When you use euros in Switzerland, you will likely get change back in Swiss francs. The Swiss National Bank manages the currency in Switzerland and keeps the franc stable. If you travel from other countries, you should know that while you can use the euro, using Swiss francs or cards usually gives you better value. Most international visitors who travel to Switzerland find that the best way to pay is by using the official currency.

Key Takeaways

- Switzerland’s official currency is the Swiss franc, and most places prefer it over euros for payments.

- You can use euros in some tourist areas, but shops often give change in Swiss francs and may charge poor exchange rates.

- Paying with euros can cost more due to hidden fees and unfavorable exchange rates set by businesses and banks.

- Using Swiss francs or cards that charge in francs usually saves money and works everywhere in Switzerland.

- Plan ahead by carrying some Swiss francs, using cards with no foreign fees, and choosing payment methods that offer the best value.

Can You Pay in Euro in Switzerland?

Image Source: unsplash

Switzerland sits in the heart of Europe, but it does not use the euro as its official currency. The Swiss franc (CHF) remains the main currency for all payments. Many international visitors ask, “Can you use euros in Switzerland?” The answer is yes, but only in certain places. You will find that some businesses accept euros as payment, but this is not true everywhere. The acceptance of euros depends on the type of business and its location.

Where You Can Use Euros

You can pay in euro in several places across Switzerland, especially in areas that see many tourists. Tourist-focused businesses want to make travel easier for visitors, so they often accept euros. Here are some of the most common places where you can use the euro:

- Major department stores

- Many shops in city centers

- Various businesses in tourist zones

- Hotels, especially those with international guests

- Restaurants in popular areas

- Souvenir shops near attractions

In these locations, you may notice that prices appear in both Swiss francs and euros. This helps you understand how much you will pay in either currency. When you use euros in Switzerland, the business will usually give you change in Swiss francs. This practice is common in retail and tourist-oriented areas. If you travel to Geneva, you will find that many major shops and hotels accept euros, making it easier for you to pay in euro during your stay. You can also use euros in Geneva at train stations and airports, which see many international travelers.

Tip: Always check with the cashier before you pay in euro. Not every business will accept euros, even in tourist areas. The exchange rate set by the business may not match the official rate, so you might pay more than expected.

Where Euros Are Not Accepted

You cannot use euros everywhere in Switzerland. Many small shops and businesses do not accept euros as payment. If you travel outside the main cities, you will find that the use of the euro becomes rare. Here are some places where you should expect to use Swiss francs instead:

- Small shops and local stores

- Rural areas and small mountain towns

- Mountain huts and lodges

- Small vendors and market stalls

- Public toilets that require coins

Even in places that accept euros, you will always receive change in Swiss francs. The exchange rate may not favor you, so you could lose value when you use the euro. If you plan to travel to less touristy regions or want to buy from small vendors, you should carry Swiss francs. Exchange places are mostly found in bigger cities, not in rural or mountain areas. When you use euros in Geneva, you will have more options, but outside the city, acceptance drops quickly.

Note: Carrying Swiss francs gives you more flexibility and better value. Many businesses in Switzerland prefer their own currency, and you will avoid confusion or extra costs if you pay in Swiss francs.

Drawbacks of Paying in Euros

Image Source: unsplash

When you travel in Switzerland, you may notice that using the euro for payments seems easy at first. However, there are several important drawbacks that can make your purchases more expensive and less convenient. Understanding these issues will help you make better choices when you pay for goods and services.

Exchange Rates and Fees

If you use the euro instead of the Swiss franc, you will almost always face unfavorable exchange rates. Most shops, hotels, and banks in Switzerland do not use the official interbank rate when converting your money. Instead, they set their own rates, which include hidden margins and extra fees. This means you pay more for the same item than if you used Swiss francs or a card that charges in the local currency.

Many banks and currency exchange services add hidden costs to every transaction. For example, if the official interbank rate is 0.96512 CHF per euro, a Swiss bank or card might offer you only 0.9623 CHF per euro. They may also charge a fixed fee, such as $1.50 USD, or a percentage fee, like 2% of the transaction amount. These extra costs add up quickly, especially if you make several cash payments in Switzerland.

Here is a table that shows how the rates and fees can differ:

| Aspect | Official Interbank Rate (Mid-Market) | Typical Swiss Bank/Card Rate | Additional Fees/Mark-ups |

|---|---|---|---|

| Date & Time | March 19, 2024, 11:00-15:00 CET | Same day, various banks | Hidden margins, 2% fee, $1.50 USD fixed fee |

| Rate Range | 0.9624 to 0.9640 CHF per euro | 0.9623 to 0.9637 CHF per euro | Mark-ups and fees lower your value |

| Rate Application Timing | Real-time or day average | Payment or booking day | Timing differences affect rate |

You should also know that many credit cards charge foreign transaction fees when you pay in euros in Switzerland. Even if you buy foreign currency before your trip, banks often charge you extra for this service. These fees make cash payments in Switzerland with euros less attractive.

Tip: If you want to avoid these extra costs, use a card that offers the real mid-market rate with transparent fees, or withdraw Swiss francs from an ATM.

Getting Change in Swiss Francs

Another drawback appears when you use the euro for cash payments in Switzerland. Most businesses accept euro banknotes but always give you change in Swiss francs (CHF). This practice is common in shops, hotels, and even at Geneva Airport. You cannot expect to receive change in euros, even if you pay with a large euro bill.

- Shops often use a fixed or poor exchange rate, sometimes even a 1:1 rate, which makes your purchase more expensive.

- Billing machines and cashiers convert your euro payment into Swiss francs before giving you change.

- Businesses profit from the currency conversion, so you lose value each time you use the euro.

There is no law in Switzerland that requires businesses to give change in Swiss francs, but this is the standard practice. Since Switzerland is not part of the Eurozone, it controls its own currency policy. The Swiss National Bank manages the Swiss franc, not the European Central Bank.

Note: Using the euro in Switzerland usually costs more than paying with Swiss francs or using a card. You may also end up with small amounts of Swiss francs in coins, which can be hard to use up if you leave the country soon after.

If you plan to travel outside major cities or tourist areas, you will find it even harder to use the euro. Most small shops and local businesses only accept the Swiss franc. For the best value and convenience, always try to pay in the local currency.

Why Use Swiss Francs in Switzerland

Better Value and Acceptance

You will find that using the Swiss franc gives you the best value when you travel in Switzerland. The Swiss franc is the official currency in Switzerland and is accepted everywhere. Shops, restaurants, hotels, and even small market stalls use this currency for all payments. When you pay with Swiss francs, you avoid hidden fees and poor exchange rates that often come with using euros.

The Swiss franc is a strong and stable currency. Switzerland manages its own currency policies, which keeps the franc steady even when other European currencies change in value. This stability protects your money from sudden drops in value. When you use Swiss francs, you do not have to worry about losing money through exchange rate markups. Prices stay more stable, and you get better purchasing power.

Using Swiss francs is cheaper than using euros. You avoid extra costs and get more for your money. The Swiss franc also helps keep prices fair for everyone, especially for people who watch their spending closely.

How to Get Swiss Francs

You have several easy ways to get Swiss francs during your travel. The most cost-effective way is to use your ATM card at a Swiss bank-operated ATM. These ATMs give you the best exchange rates and lower fees compared to currency exchange offices or banks. Always choose to be charged in Swiss francs, not your home currency, to avoid Dynamic Currency Conversion scams.

- Use ATMs from major Swiss banks for the best rates.

- Avoid exchanging cash at banks or currency exchange offices, as they often add fees and markups.

- Credit and debit cards work in most places, but carry some cash for small purchases.

- Tell your bank about your travel plans to prevent card blocks.

- For large transfers, online platforms like CurrencyTransfer can save you money on fees.

Typical ATM withdrawal fees in Switzerland for foreign cards range from $5 to $11 USD. Some ATMs may not charge a fee, but always check the screen before you confirm. Airport ATMs often have higher fees, so use city ATMs when possible. If you need to exchange money in Switzerland, make sure your banknotes are clean and undamaged.

Tip: Always withdraw or pay in Swiss francs to get the best value and avoid extra charges. This makes your travel in Switzerland smoother and more affordable.

How to Pay in Switzerland

When you plan your travel, knowing how to pay in Switzerland helps you save money and avoid stress. Today, card payments in Switzerland and digital options are more common than ever. You will find that most payment methods in Switzerland are easy to use and widely accepted, especially in cities and tourist spots.

Credit and Debit Cards

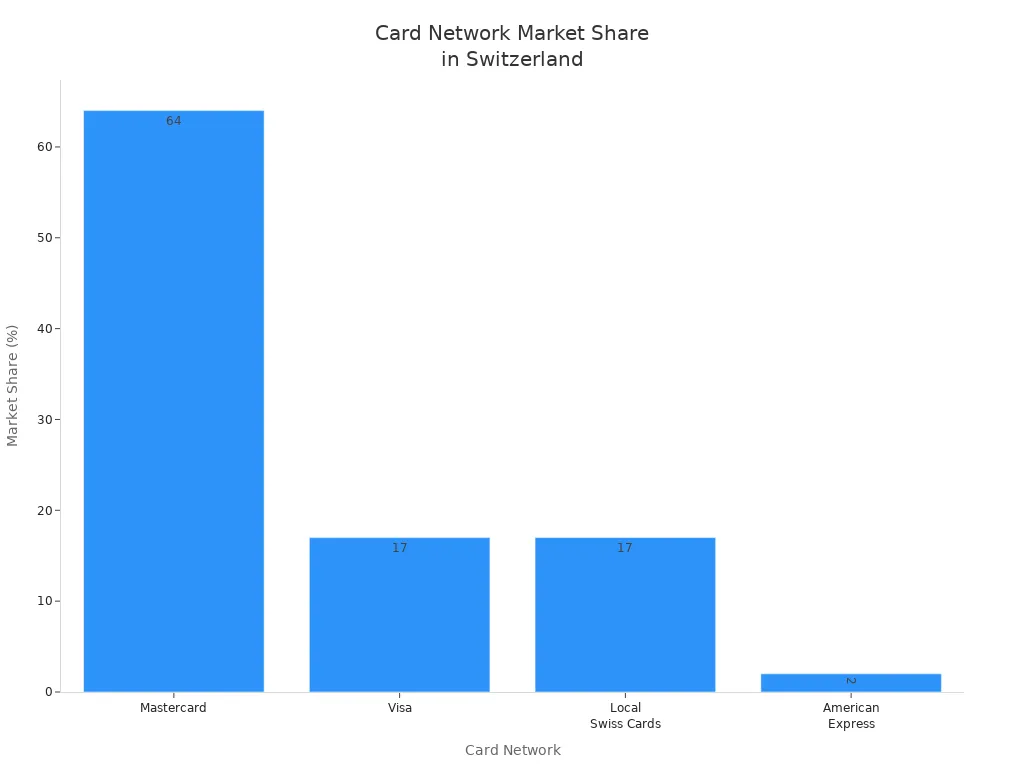

You can use credit and debit cards almost everywhere in Switzerland. Debit cards are the most popular, making up about 40% of all payments, while cash payments have dropped below 30%. Most shops, restaurants, and hotels accept cards, but you may need cash for small expenses or tipping. Visa and Mastercard are the most accepted networks, while American Express is less common.

| Card Network | Market Share / Popularity Indicator |

|---|---|

| Mastercard | 64% market share |

| Visa | 17% market share |

| Local Swiss Cards | 17% market share (PostFinance cards) |

| American Express | 2% market share |

Many Swiss banks now offer Visa Debit or Debit Mastercard, which work well for both in-store and online payments. Always choose to pay in Swiss francs to avoid extra fees from dynamic currency conversion. Before you travel, check if your card charges foreign transaction fees. Some cards from Hong Kong banks or international issuers like Chase or Capital One do not charge these fees.

Tip: Carry a mix of cards and some cash for the best way to pay in Switzerland.

Mobile and Digital Payments

Mobile and digital payments are now standard in Switzerland. Most retailers accept Apple Pay, Google Pay, and TWINT. These options use contactless technology, making payments quick and secure. By 2023, about 74% to 80% of Swiss online shops accept TWINT, and Apple Pay and Google Pay are widely accepted in stores and public places.

You should know that mobile payments depend on working networks and devices. If you travel to remote areas, keep some cash as a backup. Digital payments also create data traces, so protect your privacy and watch for scams.

Multi-Currency Cards

Multi-currency cards offer a smart way to manage your spending when you travel. These cards let you hold and spend in several currencies, such as Swiss francs, euros, and US dollars. Multi-currency cards often avoid the 1.4% exchange rate margin and 2% transaction fee that traditional credit cards charge. For example, Alpian’s multi-currency card gives you zero commissions on payments abroad and better exchange rates than most banks.

To minimize fees, always pay in Swiss francs and use cards with no foreign transaction fees. Inform your bank about your travel plans to avoid card blocks.

If you want to know how to pay in Switzerland with the least hassle, use a mix of card payments in Switzerland, mobile apps, and a multi-currency card. This approach covers all payment methods in Switzerland and keeps your travel smooth.

You can pay in euro at some places in Switzerland, but you face higher costs and limited acceptance. Experts recommend using the Swiss franc or payment cards for most transactions because merchants often apply poor exchange rates and give change only in the local currency.

- Carry a small amount of euros as backup, but keep about $110 USD (100 CHF) in Swiss franc cash for emergencies.

- Plan your payment methods before your trip. Apply for cards with no foreign transaction fees and use multi-currency cards to save money.

Using the right currency in Switzerland helps you avoid extra fees and makes your travel smoother.

FAQ

Can you use euro coins in Switzerland?

You cannot use euro coins in most places in Switzerland. Shops and hotels usually accept only euro banknotes. If you try to pay with euro coins, most cashiers will refuse them. Always carry Swiss franc coins for small purchases.

Will you get a better exchange rate with a card or cash?

You usually get a better exchange rate when you use a credit or debit card. Banks often use the real mid-market rate. Cash exchanges at airports or hotels often include extra fees. Always check your card’s foreign transaction fees before you travel.

How much cash should you carry in Switzerland?

Carry about $110 USD (100 CHF) in Swiss franc cash for emergencies or small purchases. Most places accept cards. You do not need to carry large amounts of cash. Use ATMs in cities for the best rates.

Which cards work best in Switzerland?

| Card Type | Acceptance Level | Notes |

|---|---|---|

| Mastercard | Very High | Widely accepted |

| Visa | High | Accepted in most locations |

| American Express | Low | Limited acceptance |

| Hong Kong Banks | High | Use cards with no foreign fees |

Tip: Always choose to pay in Swiss francs at checkout to avoid extra charges.

When traveling in Switzerland, paying with euros may look convenient but often costs more because of poor exchange rates and limited acceptance. The smarter choice for international payments is to rely on secure, transparent platforms.

With BiyaPay, you get real-time exchange rates with fees as low as 0.5%, plus the freedom to convert between multiple fiat currencies and cryptocurrencies. Whether you’re sending money abroad or covering travel expenses, BiyaPay supports transfers to most countries and regions worldwide — and for most corridors, same-day delivery means your money arrives the day you send it.

Don’t let hidden markups eat into your funds. Register with BiyaPay today and experience faster, cheaper, and safer global payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Overcoming Human Weaknesses: Detailed Guide to Beginner-Friendly Automated US Stock Trading Strategies

Profit Expansion is the Core Driver: Analyzing the Growth Engines of the US Stock Market in 2026

Weekly US Stock Index Futures Review and Outlook: What Investors Should Focus On

2025 Latest US Stock Account Opening Tutorial: Complete Online Application in 5 Steps

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.