London’s Most Reliable Places to Exchange Currency in 2025

Image Source: unsplash

Looking for the best places to exchange currency in London in 2025? You can count on trusted names like Travelex, Eurochange, and John Lewis Bureau de Change. When you exchange currency in London, you want clear rates, strong regulation, and no hidden fees. Recent reports show a big jump in exchange currency transactions, with London’s daily turnover reaching $1,377.7 billion in April 2025. This growth means you have more options than ever, but you still need to pick reliable spots. The right choice helps you get the best rates and avoid surprises.

Key Takeaways

- Choose trusted currency exchange shops like Travelex or Eurochange for clear rates and reliable service.

- Banks offer safe exchanges but may charge higher fees and often require you to be an account holder.

- Use travel money cards or online services like Wise to get better rates and lower fees than airport kiosks.

- Always check live exchange rates and fees before exchanging to avoid hidden costs and scams.

- Stay safe by using licensed providers, showing valid ID, counting your cash, and avoiding street vendors.

Best Places to Exchange Currency in London

Image Source: pexels

Currency Exchange Shops

You will find many currency exchange shops across London. These shops, often called bureau de change, give you lots of choices. Some of the best money exchange in London includes Travelex, Eurochange, Victoria Street FX, Thomas Exchange Global, FX Currency London Ltd, Ace-FX, City Forex, and Best Foreign Exchange. These shops have built a strong reputation for clear rates and reliable service.

When you visit a bureau de change, you usually see the rates displayed up front. Most shops charge a spread of about 5% between the buy and sell rates for popular currencies. Some add a commission fee, but this often drops if you exchange a larger amount. You can compare the main costs in the table below:

| Service Type | Average Exchange Rate / Spread | Fees / Commissions |

|---|---|---|

| Money Exchange Bureaus | Approx. 5% spread for popular currencies | Extra commission fees, lower for bigger amounts |

| Bank ATMs | Market rates | No usage fees |

| Independent ATMs | N/A | Extra usage fees, best to avoid |

You might notice that the best places to exchange currency in London are often these dedicated shops. They offer better rates than airport kiosks or hotels. If you want the best place to exchange currency, look for a bureau with lots of positive reviews and clear fee information.

Banks

You can also exchange currency in London at major banks. HSBC, Barclays, and Lloyds are some of the top choices. Many banks only offer currency exchange to account holders, so you should check before you go. Banks usually have higher security and strong regulation, which makes them a safe choice.

Fees at banks can vary. You might pay a transfer fee from $0 to $45, depending on the bank and the currency. Banks add a markup to the exchange rate, usually between 0.25% and 4%. Some banks also charge extra fees if another bank helps with the transfer. If you use a bank ATM, you often get the market rate with no extra fee, but independent ATMs can charge more.

| Bank Service | Typical Fees (USD) | Notes |

|---|---|---|

| In-branch exchange | $0 - $45 transfer fee | Only for account holders at most banks |

| Exchange rate markup | 0.25% - 4% | Added to the mid-market rate |

| Correspondent bank fees | $8 - $25+ | For international transfers |

| Bank ATMs | Market rate, no usage fee | Use your own bank’s ATM for best rates |

If you want to exchange currency in London with peace of mind, banks are a solid option. Just remember to ask about all fees before you agree to the exchange.

Supermarkets and Department Stores

Supermarkets like Tesco and ASDA, and department stores such as John Lewis, also offer currency exchange services. These stores make it easy to pick up cash while you shop. You can order online and collect your money at the store. This is handy if you want to plan ahead.

However, the rates at supermarkets and department stores are not as good as those at a bureau de change. For example, if you exchange $1,300 at Tesco, you might pay over $14 in total fees, including conversion, delivery, and exchange rate markups. This is about $11 more than using a travel money card like Wise, which gives you the mid-market rate and fewer fees.

| Store | Total Fees for $1,300 Exchange | Notes |

|---|---|---|

| Tesco | $14+ | Includes conversion, delivery, and markup |

| ASDA | $12 - $14 | Similar fee structure to Tesco |

| Wise Card | $3 - $5 | Mid-market rate, free ATM up to $260/month |

Supermarkets have long hours, which helps if you need to exchange currency late or on weekends. For example, Tesco travel money desks often open from 6:00 AM to midnight on weekdays and Saturdays, and from 11:00 AM to 5:00 PM on Sundays.

Tip: If you exchange more than $1,300, you must show a valid photo ID, such as a passport or driver’s license. Only the person who placed the order can collect the money.

Post Offices

Post Offices are another popular place to exchange currency in London. You can order cash or a travel money card online and pick it up at your local branch. The Post Office supports 23 different currencies and lets you use the travel card anywhere MasterCard is accepted. You can top up the card online, in the app, or at the branch.

The Post Office offers convenience, but the rates are not always the best. You might pay about $5 in conversion fees and $9 in delivery fees, plus a markup on the exchange rate. This means you could spend around $14 in total fees for a $1,300 exchange, which is higher than some other options.

| Provider | Total Fees for $1,300 Exchange | Notes |

|---|---|---|

| Post Office | $14 | Includes conversion, delivery, and markup |

| Wise Card | $3 - $5 | Mid-market rate, fewer fees |

You can collect your order at many locations, but you must pick it up within seven days. If you order a travel card online, you may need to wait two or three days for delivery. If you apply in person, you can get the card right away.

Note: The Post Office travel card has no spending fees in supported currencies, but you may pay ATM withdrawal fees and face some limits on use, such as at toll booths or gas stations.

Many travelers find that exchanging currency in London is cheaper than doing it before you travel. You get more options and better rates, especially if you compare offers from different bureau de change and avoid airport kiosks.

Why These Are the Best Places

Regulation and Trust

You want to feel safe when you exchange currency in London. The Financial Conduct Authority (FCA) watches over all major currency exchange providers. The FCA sets rules for fair treatment, clear information, and safe business practices. If a company breaks these rules, the FCA can freeze assets or ban products. This helps protect you from scams and unfair deals.

The Payment Services Regulations also play a big part. These rules make sure you get clear details about exchange rates in London and any fees. Providers must tell you about changes and give you time to react. This means you always know what you are paying for.

Many top-rated shops, like Sterling Consortium Ltd, register with the FCA and HMRC. They train their staff well and follow strict rules. You can trust these places to handle your money with care.

| Evidence Aspect | Details |

|---|---|

| FCA Registration | Yes (FCA no. 504439) |

| HMRC Registration | Yes (MSB no. 12120971) |

| Staff Qualifications | Fully trained, multilingual |

| Customer Satisfaction | Ranked 1st for speed, service, and value |

Rates and Fees

You want the best money exchange in London, so you need to look at both rates and fees. Banks like HSBC often charge higher transfer fees and add a bigger margin to the exchange rate. For example, you might pay $10 in fees and get a 3% margin on your exchange. This can make your transfer slower and more expensive.

Specialist providers, such as Wise and Revolut, offer lower fees and better exchange rates in London. Wise uses the mid-market rate and shows you all costs up front. You can see the difference in this table:

| Provider | Transfer Fee | Exchange Rate Margin | Delivery Time |

|---|---|---|---|

| HSBC | $0 to $10 | 1% to 3% | 1 to 5 business days |

| Cambridge Currencies | $0 | ~0.25% | Same day or next day |

| Wise | $0 to $5 | ~0.5% | Same day or next day |

| Revolut | $0 (limits apply) | ~0 to 0.5% | Instant to next day |

Specialist shops and travel money cards often give you better currency exchange rates and lower currency exchange fees. Always check the mid-market rate before you decide.

Tip: Airport kiosks and some ATMs can hide extra fees in their rates. Compare live rates online to save money.

Customer Reviews

You can learn a lot from other travelers. People praise providers like CurrencyTransfer for fast, safe service and helpful staff. Many reviews mention easy transactions, good rates, and friendly support. Customers often recommend these services for their reliability.

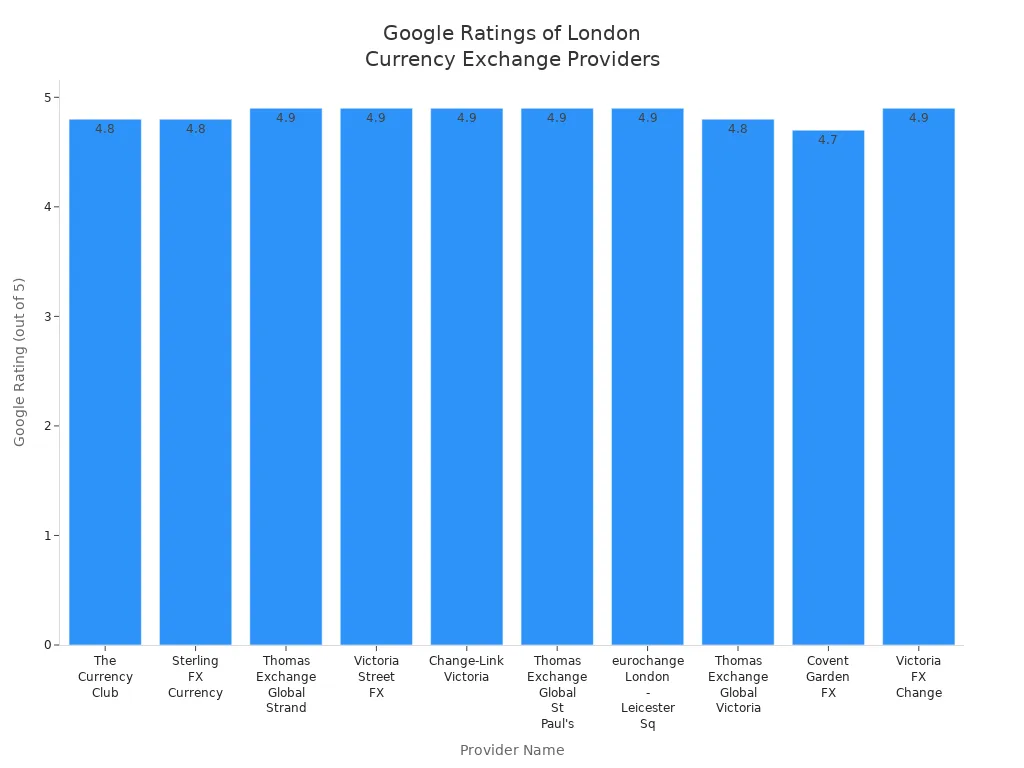

Here is how some top shops rate on Google:

| Provider Name | Google Rating (out of 5) |

|---|---|

| The Currency Club | 4.8 |

| Sterling FX Currency Exchange | 4.8 |

| Thomas Exchange Global Strand | 4.9 |

| Victoria Street FX | 4.9 |

| Change-Link Victoria | 4.9 |

| Thomas Exchange Global St Paul’s | 4.9 |

| eurochange London - Leicester Sq | 4.9 |

| Thomas Exchange Global Victoria | 4.8 |

| Covent Garden FX | 4.7 |

| Victoria FX Change | 4.9 |

You see high ratings for speed, value, and customer care. Many people say staff are patient and professional. Quick service and fair rates make these shops stand out. When you read reviews, you get a real sense of which places offer the best experience.

Comparing Exchange Currency Options

When you travel to London, you have several ways to get foreign currency. Each option has its own pros and cons. Let’s break down what you can expect from each choice.

Bureaux de Change

A bureau de change is a popular spot for travelers who want cash before heading out. You find these bureaus at airports, train stations, and even supermarkets. Here’s what you get:

- You can get cash right away, which helps if you visit places that don’t take cards.

- Many bureaus offer deals if you bring back unused currency.

- Locations are easy to find, but airport kiosks often charge the most.

But there are downsides:

- Bureaux de change usually have higher costs than ATMs or cards. You might see a big margin added to the exchange rate, sometimes up to 20%.

- Some bureaus charge extra commission fees.

- Carrying a lot of cash can be risky if you lose it or if it gets stolen.

- You need to plan ahead and compare rates to avoid paying too much.

If you want the best value, avoid the first bureau you see and shop around.

Banks

Banks in London offer currency exchange, but they often charge more than online services. You may face extra fees, like international processing charges or hidden transaction costs. Some banks only help account holders. If you use a bank ATM, you might get a better rate, but always check for extra fees.

| Provider Type | Exchange Rate Margin | Commission Fees | Extra Fees | Best For |

|---|---|---|---|---|

| Bank | Higher than online | Yes | Possible | Security |

ATMs

ATMs give you quick access to cash. If your bank is part of the Global ATM Alliance, like Barclays, you can avoid extra withdrawal fees. HSBC and Citibank also offer fee-free withdrawals at certain limits or locations. Always use ATMs from big banks or post offices to dodge hidden surcharges. Remember, your home bank may still charge a currency conversion fee, usually around 3%.

Tip: Always choose to be charged in the local currency at the ATM to get a better rate.

Online Services

Online currency exchange services, such as Wise, often give you the best rates. You can order cash online and pick it up at a bureau or have it delivered. These services have lower margins and often no commission fees. You also get linked debit cards that work like a travel money card, helping you save on fees when you spend in London.

- Online services are easy to use and show all costs up front.

- You avoid the high fees of a bureau de change at the airport.

- Risks include ATM fees and conversion charges, so check the rates before you withdraw.

Prepaid Travel Cards

A travel money card is a smart choice for many travelers. You load money onto the card before your trip and use it like a debit card. Wise’s travel money card, for example, gives you rates close to the mid-market rate and free ATM withdrawals up to $260 per month. You can hold several currencies and switch between them with low fees.

| Option | Exchange Rate | Fees (USD) | Notes |

|---|---|---|---|

| Travel Money Card | Mid-market | $0-$5 | Free ATM up to $260/month, low margin |

| Bureau de Change | Higher | Varies | Extra commission, less favorable rate |

| Bank | Higher | $0-$45 | Extra fees possible |

A travel money card is safer than carrying cash. You can block it if lost and reload it online. Compared to cash from a bureau, a travel money card usually saves you money and gives you more control.

How to Exchange Currency in London

Checking Rates

Before you exchange currency in London, always check the latest rates. You want to know if you are getting a fair deal. Cambridge Currencies gives you a live currency converter tool with mid-market rates for over 100 currencies. This company is based in London and regulated by the Financial Conduct Authority, so you can trust their numbers. You can also use Exchangeratesapi.io, which updates rates every minute and covers more than 200 currencies. Xe.com is another popular choice. It pulls real-time data from banks and financial providers, so you get accurate rates. Checking these sources helps you spot the best time to exchange currency and avoid overpaying.

Avoiding Hidden Fees

Hidden fees can sneak up on you when you exchange currency in London. Here are some ways to keep your costs low:

- Compare different providers using online tools to find the best rates.

- Negotiate better rates if you plan to exchange a large amount.

- Use travel cards like Wise, which offer low conversion fees and real mid-market rates.

- Always pay or withdraw in the local currency to avoid dynamic currency conversion fees.

- Withdraw larger amounts less often to cut down on fixed ATM fees.

- Use ATMs from partner banks to avoid extra charges.

- Choose FCA-regulated providers for safety and transparency.

Tip: Avoid high-street banks and tourist hotspot ATMs. They often have higher margins and extra fees.

Safety Tips

You want to stay safe when you exchange currency in London. Here are some expert tips:

- Use licensed money changers that clearly show their rates and give you a receipt.

- Count your cash before you leave the counter. Check for security features on larger bills.

- Carry only what you need. Keep backup cards and emergency cash in a separate place.

- Notify your bank before you travel. This helps prevent card blocks and lets you learn about partner banks.

- Test your online banking access before your trip. Store secure copies of your card details in case you lose your wallet.

Note: Always avoid street vendors or anyone offering rates that seem too good to be true.

Required Documents

When you exchange currency in London, you need to show the right documents. Most providers ask for a government-issued photo ID. Here is a quick guide:

| Document Type | Accepted Examples | Not Accepted Examples | Requirements |

|---|---|---|---|

| Proof of Identity | Passport, Driver’s License, National ID Card, Residency Permit | Student ID, Non-photo IDs | Must be valid, not expired, with clear photo, name, and date of birth |

| Proof of Address | Bank statement, Utility bill, Rental agreement, Tax return | Mobile phone bills, screenshots | Not older than 6 months, matches your name and address, clear and unobscured |

You may need both types if you exchange more than $1,300. Always bring originals, not copies, to avoid delays.

What to Avoid When Exchanging Currency

Airport Kiosks

Airport currency exchange kiosks in London might seem convenient, but you often pay much more than you expect. These kiosks add big markups to the exchange rate and pile on extra fees. You could lose a lot of value before you even leave the airport. Here’s a quick look at the typical charges you might face:

| Service Type | Typical Fees and Markups Description |

|---|---|

| Exchange Rate Markup | Extra spread added to the mid-market rate, making your money worth less |

| Collection Fee | $6.30 for exchanges under $127, $3.15 for $127-$381, free over $381 |

| Card Processing Fee | Your card provider may add more fees |

| Buy-Back Guarantee Fee | $5.00 to sell back unused currency at the original rate |

| Travel Money Cards - Card Issuance | First card free, $6.35 for extra cards |

| Travel Money Cards - Loading Fees | Free for foreign currency, 2% fee for loading with USD |

| Travel Money Cards - ATM Usage | Fees vary, often $1.90 or €2.20 per withdrawal |

| Travel Money Cards - Foreign Exchange Fee | 5.75% fee if you spend in a currency not loaded on the card |

| Travel Money Cards - Inactivity Fee | $2.50 per month after 12 months of no use |

Tip: You can save money by planning ahead and avoiding airport kiosks. Look for better rates in the city or order online for pickup.

Tourist Traps

Tourist hotspots in London often have flashy signs promising “no commission” or “best rates.” These places usually hide their real costs in poor exchange rates or extra service fees. You might see these shops near famous attractions or busy shopping streets. They count on travelers who need cash fast and don’t have time to compare options.

- Always check the rate before you agree to exchange.

- Ask for the total amount you will receive after all fees.

- Don’t let anyone rush you into a decision.

If you want to know where to exchange money safely, skip the shops that pressure you or seem too eager for your business.

Unlicensed Outlets

Some places offer currency exchange without a proper license. These unlicensed outlets might give you counterfeit bills or shortchange you. You risk losing your money and have no way to complain if something goes wrong.

- Use only official exchange offices or banks with visible licenses.

- Look for clear signs showing regulation by the Financial Conduct Authority.

- Never exchange money with someone on the street.

Note: Licensed providers must display their credentials. If you don’t see them, walk away.

Common Scams

Scams can happen anywhere, but you can avoid most of them with a few smart habits. Watch out for these tricks:

- Slow-counting or sleight-of-hand to shortchange you.

- Counterfeit bills mixed in with real currency.

- Strangers offering to “help” with your exchange.

- High-pressure tactics from street money changers.

- Digital scams like dynamic currency conversion, where paying in your home currency leads to hidden fees.

- Rigged calculators or computers showing the wrong totals.

To protect yourself:

- Count your money out loud before you leave the counter.

- Learn what local bills look and feel like.

- Avoid exchanging money with strangers or on the street.

- Always pay in local currency when using your card.

- Use ATMs from major banks and check for card skimmers.

- Keep all receipts and check your transactions.

Stay alert and trust your instincts. If an offer seems too good to be true, it probably is.

How to Find the Best Exchange Rates

Image Source: unsplash

Mid-Market Rate

If you want to know where to get the best exchange rates in London, you need to understand the mid-market rate. This rate sits right in the middle of what banks pay to buy and sell currencies. It is the fairest rate you can find. Most currency exchange providers in London do not offer this rate to you. They add a margin or markup, which means you get a little less for your money. Even if a shop says “no commission” or “0% fee,” the real cost often hides in the rate they give you. Wise is one of the few providers that shows you the mid-market rate and lets you compare it to their offer. If you want the best exchange rate, always check the mid-market rate before you exchange.

Tip: Always compare the rate you see at the counter with the mid-market rate online. This helps you spot hidden costs and find the best exchange rates in London.

Review Sites and Apps

You can use review sites and apps to find where to get the best exchange rates in London. Sites like CurrencyTransfer let you compare rates from different providers. You see the price, delivery time, and customer reviews all in one place. This makes it easy to pick the best option for your needs. Many travelers also use apps like XE or Wise to track live exchange rates in London. These tools help you avoid bad deals and save money.

Here are some popular tools:

| Tool/App | What It Does |

|---|---|

| CurrencyTransfer | Compares rates and services from many shops |

| XE | Shows live exchange rates and trends |

| Wise | Offers mid-market rates and low fees |

Note: Always read recent reviews. Shops can change their rates or service quickly.

Timing Your Exchange

Timing can make a difference when you look for the best exchange rates in London. The forex market in London runs from 8 a.m. to 4 p.m. UK time. The busiest time is when London and New York markets overlap, from 12 p.m. to 4 p.m. UK time. During these hours, you often see tighter spreads and better rates. Big economic news, like UK data releases at 8:30 a.m., can cause rates to move fast. Most shops update their rates during these busy times.

- The best times to exchange are weekdays, especially during high trading hours.

- Avoid weekends, as the market is closed and rates may be less favorable.

- Exchange rates in London can change quickly, so check rates before you go.

If you plan ahead, you can catch a good rate. But remember, rates move for many reasons, and no one can predict them perfectly.

You have many great options for exchanging money in London. Trusted shops, banks, supermarkets, and post offices all offer safe ways to get cash. If you want the best rates, compare a few places before you decide. Need quick service? Try a supermarket or post office. Want to save more? Use a travel card or online service.

Always check rates and fees before you exchange. Services and rates can change, so look for updates before your trip.

FAQ

Where can you find the best rates in London?

You want to know where to exchange money for the best rates. Try comparing rates at trusted shops, banks, and online services. Always check live rates before you go. This helps you spot the best deal and avoid hidden fees.

Is it better to exchange money before or after arriving in London?

You might wonder where to exchange money for the best value. Many travelers get better rates after arriving in London. Shops and online services in the city often beat airport kiosks and banks back home. Always compare rates before making a choice.

What documents do you need to exchange money in London?

When you decide where to exchange money, bring a valid photo ID. Most places accept a passport or driver’s license. If you exchange over $1,300, you may need proof of address. Always check requirements before you go.

Can you use ATMs to get cash in London?

You can use ATMs if you want to know where to exchange money quickly. Bank ATMs usually offer fair rates. Always choose to be charged in local currency. Avoid independent ATMs, as they often add extra fees.

How do you avoid scams when exchanging money?

You want to stay safe when deciding where to exchange money. Use only licensed providers. Check reviews and look for clear rate displays. Never exchange money with strangers or street vendors. Always count your cash before leaving the counter.

When exchanging currency in London, you’ll notice that banks, supermarkets, and bureaus often hide fees in the exchange rate or add commissions that eat into your money. Convenience comes at a cost, and even “no commission” signs may not mean true savings.

With BiyaPay, you don’t need to compromise. Enjoy real-time mid-market exchange rates, transaction fees as low as 0.5%, and same-day transfers to most countries. Whether you’re preparing for travel, managing business payments, or supporting family abroad, BiyaPay gives you transparency and speed that local money changers simply can’t match.

Start exchanging smarter today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Why Did the Three Major US Stock Indices Fall? Challenging Your Investment Common Sense

Why Investing in US Stock ETFs Is Smarter Than Picking Individual Stocks

US Stock Futures Fluctuate Narrowly as Investors Weigh Employment Data and Fed Easing Signals

My Real Pros and Cons Experience Sharing After Using US Stock Trading Apps for One Year

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.