Essential Guide to Managing Expenses in Malaysia

Image Source: pexels

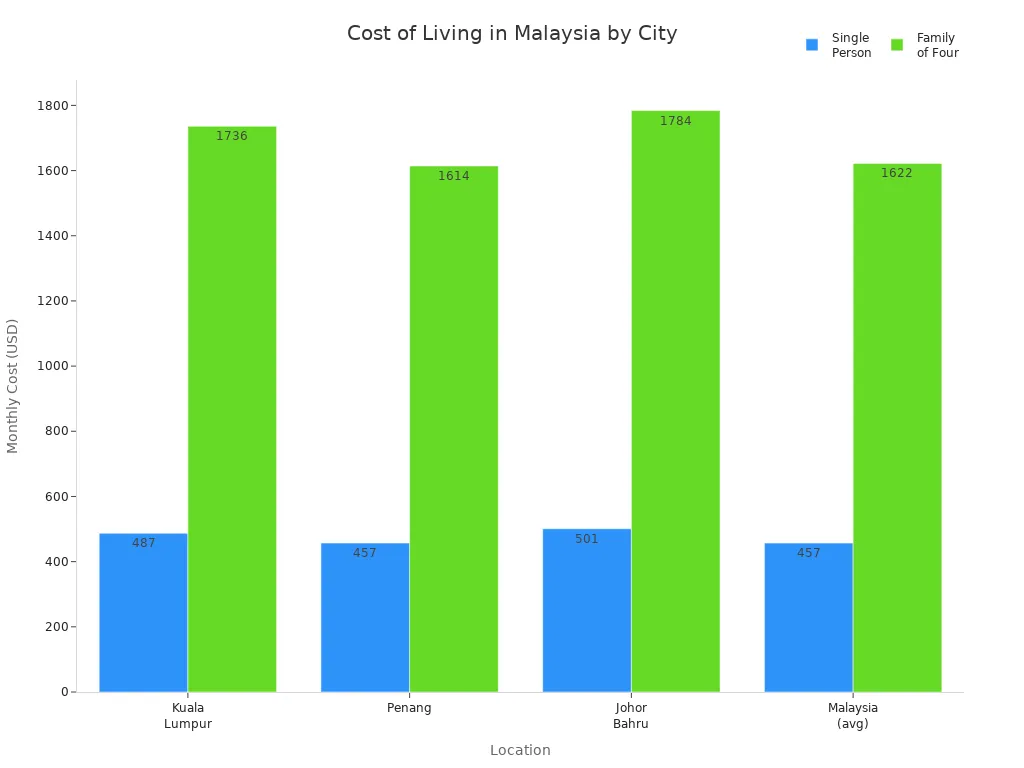

Managing the cost of living in Malaysia often challenges residents who want to balance comfort and financial security. You need to understand typical expenses to create a stable budget. The cost of living varies by city, as shown below:

| Location | Single Person (USD/month) | Family of Four (USD/month) |

|---|---|---|

| Kuala Lumpur | Around 487 | Around 1,736 |

| Penang | Around 457 | Around 1,614 |

| Johor Bahru | Around 501 | Around 1,784 |

| Malaysia (avg) | Around 457 | Around 1,622 |

You may notice that Kuala Lumpur has the highest cost of living. Financial knowledge helps you plan for food, rent, and transportation, even when salaries remain steady. Many people choose Malaysia for its low cost of living, but prices for basic needs can differ by region. Careful planning lets you maintain your lifestyle and avoid financial stress.

Key Takeaways

- Living costs vary by city; Kuala Lumpur is the most expensive, while Penang and Johor Bahru offer more affordable options.

- Plan your budget carefully by tracking expenses and including rent, food, transport, healthcare, and education costs.

- Save money by cooking at home, using public transport, and shopping at local markets.

- Public healthcare is very affordable but may have longer wait times; private care costs more but is faster.

- Use local resources like community centers and loyalty programs to stretch your budget and enjoy a good lifestyle.

Cost of Living in Malaysia

Average Monthly Expenses

You need to understand the main parts that make up the cost of living in Malaysia. These include:

- Housing: Rent, property prices, and sometimes housing benefits from employers.

- Transportation: Public transport fares, car costs, and sometimes company transport support.

- Food and Dining: Groceries, eating out, and meal allowances.

- Healthcare: Public and private services, insurance, and health benefits.

- Education: School fees, scholarships, and support for children’s schooling.

The average cost of living in Malaysia depends on your lifestyle and location. If you live in Kuala Lumpur, you can expect to spend about $547.40 per month as a single person, not including rent. For a family of four, the average monthly cost is around $2,000, also excluding rent. Many people find that a comfortable lifestyle for singles ranges from $1,000 to $1,500 per month. Couples often need about $2,500 per month to live comfortably.

Here is a table showing the average monthly cost for different cities in Malaysia, excluding rent:

| Category | Kuala Lumpur (USD) | Penang (USD) | Johor Bahru (USD) |

|---|---|---|---|

| Single person | 547 | 457 | 501 |

| Family of four | 2,000 | 1,614 | 1,784 |

The cost of living in Penang is slightly lower than in Kuala Lumpur. The cost of living in Johor Bahru is also affordable, making these cities popular choices for people seeking a low cost of living. If you want to live comfortably, you should plan for extra expenses like entertainment, personal care, and travel.

The average monthly income in Malaysia is about $1,200, but this can vary by city and job. The average salary in Malaysia may not always match the rising cost of living, so you need to budget carefully. The average monthly cost for singles and families can change if you choose to live in smaller towns or if you receive employer benefits.

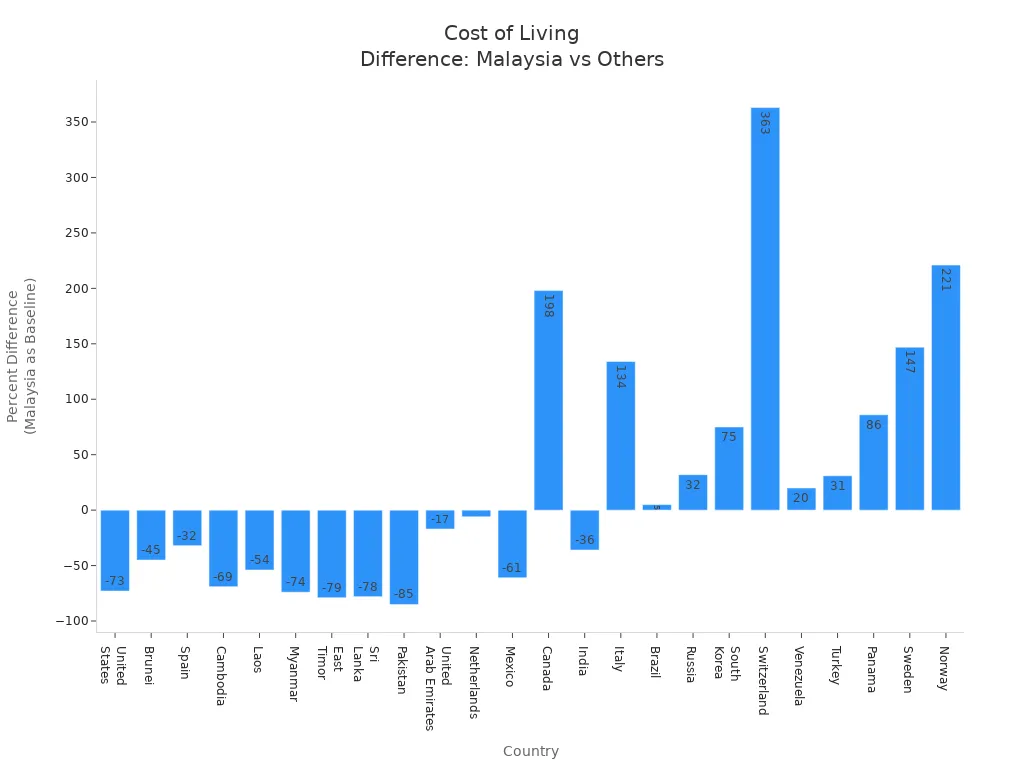

Comparison with Other Countries

When you compare the cost of living in Malaysia to other countries, you will see big differences. The cost of living compared to the US is much lower. For example, housing rent in Malaysia is about 74.5% less than in the US. Utilities, food, and entertainment also cost much less. Eating out in Malaysia is very affordable, with a typical lunch costing about $3 to $4. In the US and UK, you would pay much more for the same meal.

Here is a table comparing the cost of living in Malaysia with other countries:

| Country | Malaysia (USD) | Other Country (USD) | Percentage Difference |

|---|---|---|---|

| United States | 688 | 2,504 | Malaysia is 73% less expensive |

| Brunei | 1,115 | 2,504 | Malaysia is ~45% less expensive |

| Spain | 1,605 | 2,504 | Malaysia is ~32% less expensive |

| Cambodia | 777 | 2,504 | Malaysia is ~69% less expensive |

| South Korea | 1,202 | 688 | South Korea is ~75% more expensive than Malaysia |

| Switzerland | 3,189 | 688 | Switzerland is ~363% more expensive than Malaysia |

The cost of living compared to the US and UK is much lower in Malaysia. You will also find that the cost of living in Malaysia is lower than in many Asian countries, such as South Korea and Brunei. This makes Malaysia a good choice if you want to save money or enjoy a higher quality of life for less.

The effects of the cost of living crisis in Malaysia come from several factors. Inflation has stayed low, but new taxes and subsidy cuts have made prices rise. The government has reduced subsidies on fuel and basic goods, which has led to higher prices. To help, the government gives cash handouts and lowers fuel prices for citizens. These steps try to balance the effects of the cost of living crisis and support people who need help.

You should remember that the cost of living in Malaysia can change if the government changes taxes or subsidies. The effects of the cost of living crisis in Malaysia may continue if inflation rises or if subsidies are cut further. You need to watch for these changes and adjust your budget as needed. The average monthly income and average monthly cost may not always keep up with price increases, so careful planning is important.

If you want to enjoy a low cost of living, Malaysia offers many options. The living expenses in Malaysia are much lower than in most Western countries. The cost of living in Penang and the cost of living in Johor Bahru are both affordable, especially if you compare them to the US or UK. You can live well in Malaysia if you understand the average cost of living and plan your expenses.

Cost of Accommodation in Malaysia

Image Source: pexels

Finding a place to live is one of the biggest parts of your budget. The cost of accommodation in Malaysia changes based on where you want to stay and what type of home you choose. You need to know the price ranges in different areas to plan your spending.

Rent in Major Cities

If you want to live in Kuala Lumpur, you will see higher prices than in other cities. The cost of living in Kuala Lumpur includes rent that can reach about $857 per month for a three-bedroom apartment in the city center. If you look outside the city center, the price drops to around $563 per month for the same size. Many people choose smaller apartments or shared housing to save money. The cost of accommodation in Malaysia rises in popular areas like KLCC and Bukit Bintang. These places have better access to jobs, shopping, and public transport.

Many things affect rental prices in major cities:

- Economic growth increases demand and pushes prices up.

- Interest rates change how easy it is to buy homes, which affects rent.

- Government policies, such as affordable housing programs, shape the market.

- Foreign investment can drive up prices.

- New roads, trains, and business areas make some places more attractive.

- More people moving to cities increases demand.

- The type, location, and condition of the property matter.

Rent in Smaller Towns

You will find lower housing costs in Malaysia if you choose smaller towns. A single room in a smaller town often costs about $150 per month. Whole apartments or houses also cost less than in big cities. The cost of accommodation in Malaysia stays low in these areas because there is less demand and fewer new developments. You can enjoy a quieter lifestyle and save money on rent.

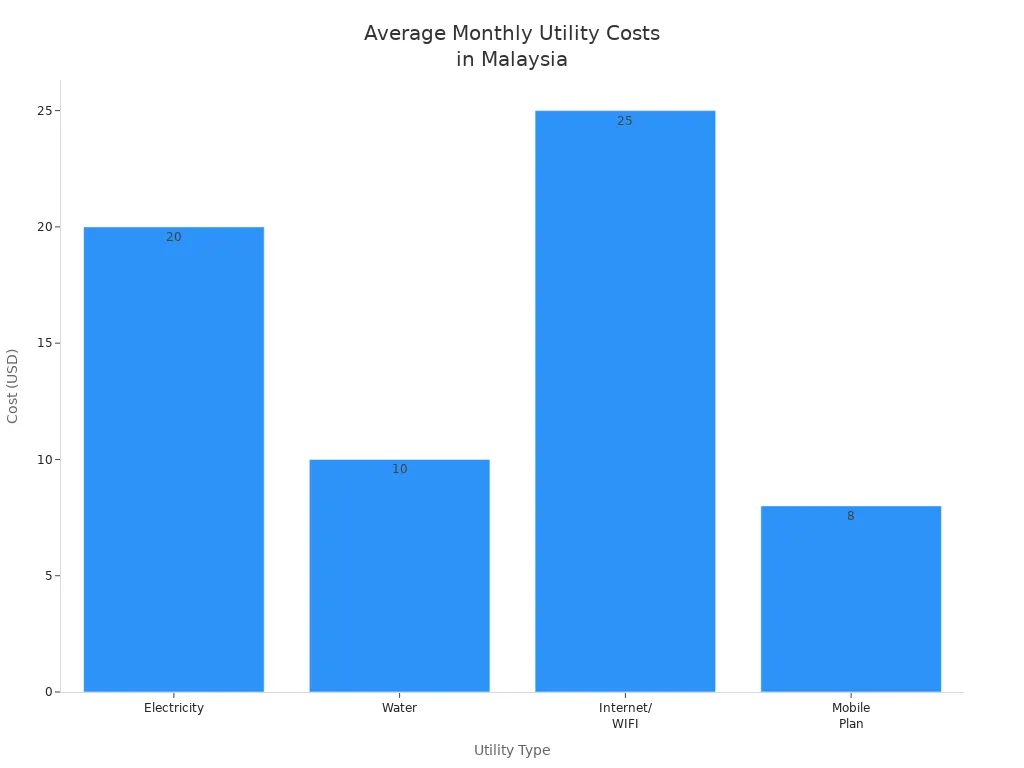

Utilities and Internet

When you plan your budget, remember to include utilities and internet. The average monthly cost for electricity is about $20, water is $10, and internet is $25. A mobile plan usually costs $8 per month. Most people pay between $40 and $65 each month for all utilities and internet, depending on usage.

| Utility Type | Average Monthly Cost (USD) |

|---|---|

| Electricity | 20 |

| Water | 10 |

| Internet/WIFI | 25 |

| Mobile Plan | 8 |

You should always check if your rent includes utilities and bills costs in Malaysia. Some apartments offer packages that cover these expenses, which can help you manage your housing and accommodation budget.

Food and Dining Costs

Image Source: unsplash

Groceries

You will find that grocery shopping in Malaysia can be affordable if you plan your meals. The average monthly grocery cost for an individual is about $160 (RM750), based on a balanced diet and eating at home most of the week. This amount covers fresh produce, rice, noodles, eggs, and some meat. If you shop at local markets, you can save more compared to supermarkets. For families, the total cost will be higher, but you can still manage your budget by buying in bulk and choosing local products. Food and grocery costs in malaysia often depend on your eating habits and where you shop.

Eating Out

Eating out is a big part of life in Malaysia. You can enjoy a meal at a street food stall for $2–$4. Hawker centers and food courts offer meals for $3–$6. If you prefer a mid-range restaurant, expect to pay $8–$15 per person. High-end or international restaurants charge $25–$50 or more for each meal. The table below shows the average cost for different dining experiences:

| Type of Dining Experience | Average Cost per Person (USD) |

|---|---|

| Street Food | 2 – 4 |

| Food Court | 3 – 6 |

| Mall Restaurant | 8 – 21 |

| Upmarket Restaurant | 21 – 63 |

| Fine Dining | 63 – 189 |

You may spend about $12 for lunch and $15 for dinner at regular restaurants. Snacks and drinks can add to your daily spending. If you eat out often, your monthly food and entertainment costs will increase quickly.

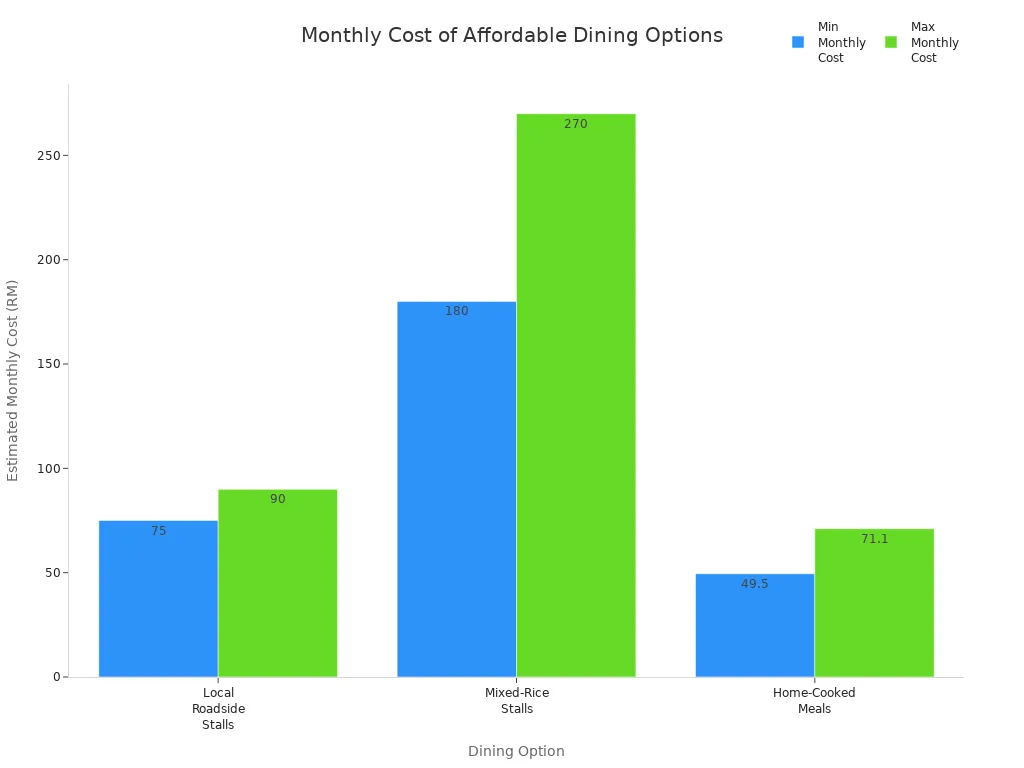

Affordable Options

You can save money by choosing affordable food options. Local roadside stalls and mixed-rice stalls offer meals for $1–$3. Indian and Chinese eateries provide filling dishes for $2–$6. Home-cooked meals cost even less, often under $2.50 per meal. The table below highlights some of the most budget-friendly choices:

| Food Option | Price Range (USD) | Examples of Dishes |

|---|---|---|

| Street Food | 1 – 3 | Nasi Lemak, Char Kway Teow, Laksa |

| Food Courts | 3 – 5 | Complete meals, desserts, iced coffee |

| Indian Eateries | 2 – 5 | Roti Canai, Nasi Kandar |

| Chinese Eateries | 3 – 6 | Chicken Rice, Wonton Noodles |

You can see how much you save by choosing local stalls or cooking at home. The chart below compares monthly costs for different meal options:

Tip: Try local markets and food courts to stretch your budget and enjoy a variety of flavors.

Cost of Transport in Malaysia

Public Transport

You will find that public transport in Malaysia is both affordable and widely available in major cities. Buses, MRT, and LRT trains connect many neighborhoods. A single ride on a MyRapid bus costs about $0.25, while MRT and LRT rides range from $0.65 to $0.85. If you use public transport daily, you can buy a monthly pass for around $15 to $16.5. This pass covers unlimited rides on most city routes.

| Transport Mode | Type | Average Fare per Ride (USD) |

|---|---|---|

| MyRapid Bus | Public bus | 0.25 |

| MRT (Mass Rapid Transit) | Subway | 0.65 |

| LRT (Light Rail Transit) | Subway | 0.85 |

A monthly public transport pass usually costs between $15 and $16.5. Students can get a 50% discount with a concession card. Kuala Lumpur also offers a free Go KL City Bus service that covers popular spots. Most low-cost housing in Kuala Lumpur is within a 15-minute walk to a bus stop, and many are close to train stations. However, some areas outside the city center have fewer options and less frequent service.

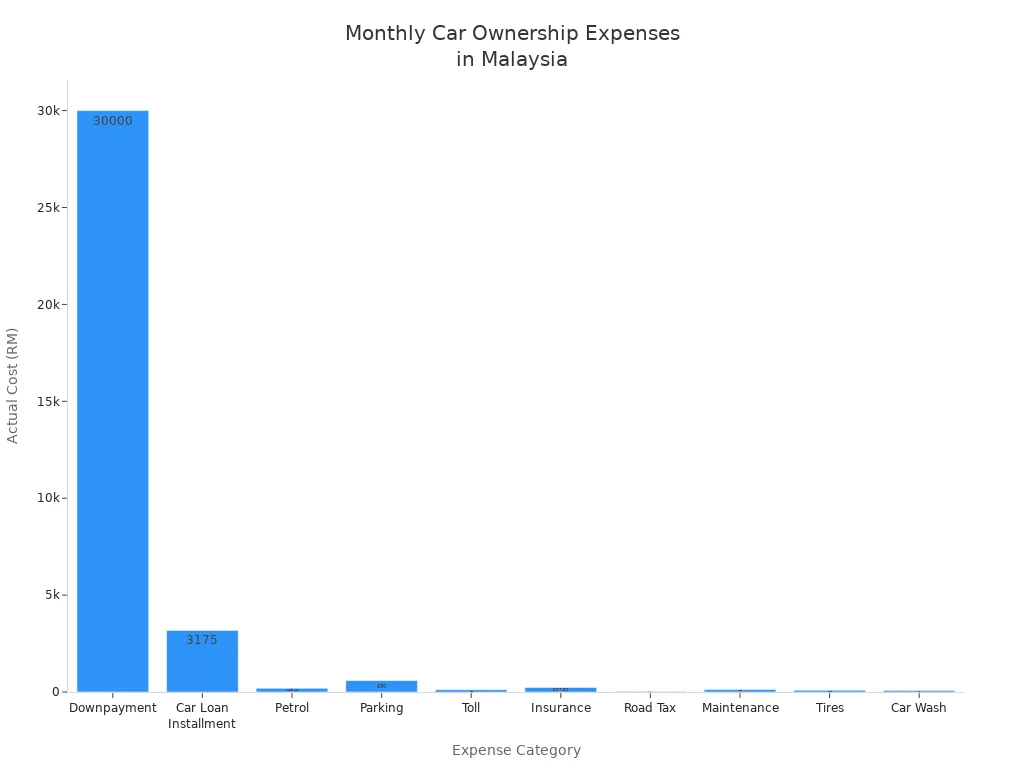

Car Ownership

If you plan to own a car, you need to budget for more than just the car loan. The main expenses include fuel, insurance, maintenance, parking, tolls, and road tax. For example, the monthly loan installment for a typical car makes up about 56% of your total car expenses. Fuel costs about 14%, and insurance is around 10%. Other costs, such as parking and tolls, add up quickly.

| Expense Category | Expected Cost (USD) | Notes / Details |

|---|---|---|

| Car Loan Installment | 690 | Based on a 9-year loan |

| Petrol | 41 | For 1,200 km/month |

| Parking | 128 | Office, home, and leisure |

| Toll | 26 | Daily work commute |

| Insurance | 51 | Comprehensive, monthly average |

| Road Tax | 7 | Annual fee divided monthly |

| Maintenance | 27 | Yearly average |

| Tires | 19 | Replacement every 3 years |

| Car Wash | 17 | Weekly cleaning |

The total monthly cost of car ownership can reach $1,000 or more, especially for larger vehicles. You should plan for all these expenses to avoid surprises.

Ride-Hailing

Ride-hailing services like Grab are popular in Malaysian cities. You can book a ride using a mobile app. The average fare for an 8 km trip is about $6.85. Ride-hailing is convenient if you do not travel every day or if you want to avoid parking fees. However, frequent use can make your transportation costs in malaysia higher than using public transport.

Tip: If you want to keep the cost of transport in malaysia low, use public transport for daily commutes and ride-hailing for occasional trips.

Healthcare Expenses

Public vs. Private

You will notice a big difference between public and private healthcare in Malaysia. The cost of healthcare in malaysia at public clinics is very low because the government pays most of the bill. You pay only about $0.20 (RM1) for a general doctor visit and $1 (RM5) for a specialist. Private clinics charge much more, with fees from $6.50 (RM30) to $27 (RM125) for general doctors and $17 (RM80) to $52 (RM235) for specialists. This makes public care much more affordable for most people.

Public clinics offer a wide range of services. You get health checks, disease prevention, and treatment all in one place. The Ministry of Health checks the quality of these clinics closely. Private clinics focus more on treating illnesses and often work alone. They are mostly in cities and serve people who can pay out-of-pocket or have insurance.

- Public clinics:

- Offer health promotion, disease prevention, and treatment.

- Use a team of doctors, nurses, and other health workers.

- Accept everyone, even if you do not have insurance.

- Have longer waiting times and can be crowded.

- Private clinics:

- Focus on treating sickness.

- Work longer hours and let you see specialists without a referral.

- Cost more and are less regulated.

- Give faster service but may not offer as many services.

You may find that the cost of healthcare in malaysia is lower at public clinics, but you might wait longer for care. Private clinics cost more, but you get faster and more flexible service.

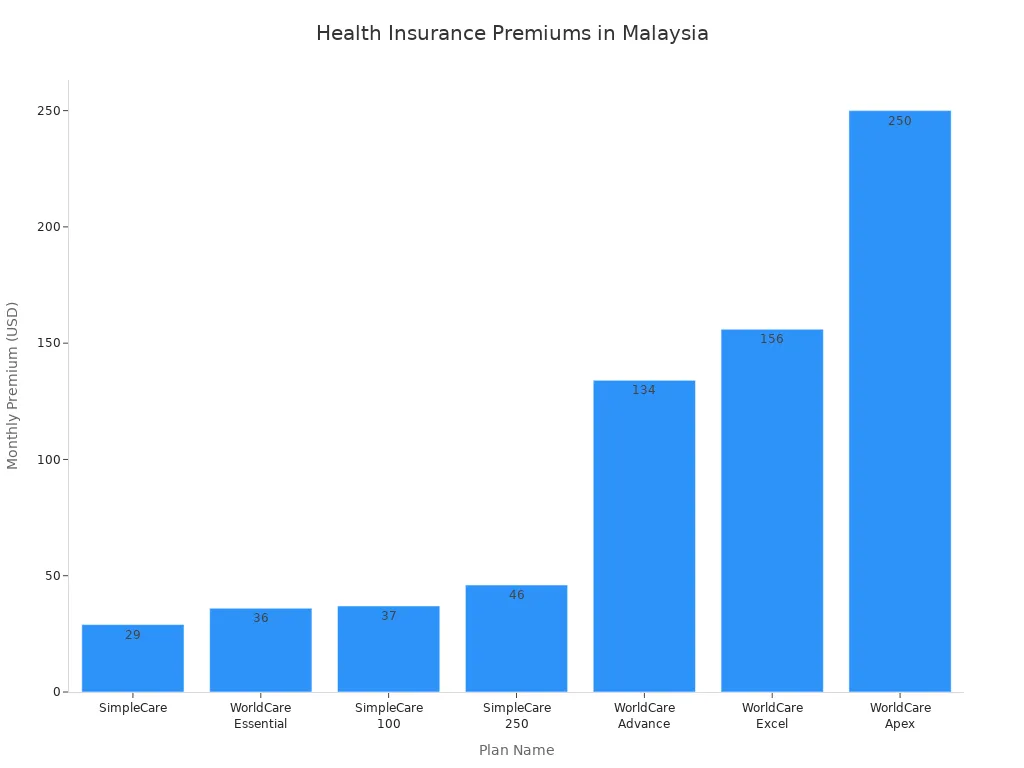

Health Insurance

Health insurance helps you manage the cost of healthcare in malaysia, especially if you use private clinics or hospitals. Many people buy insurance to cover hospital stays, surgery, and specialist visits. The price depends on the plan and the coverage you choose.

| Plan Name | Starting Monthly Premium (USD) |

|---|---|

| SimpleCare | $29 |

| WorldCare Essential | $36 |

| SimpleCare 100 | $37 |

| SimpleCare 250 | $46 |

| WorldCare Advance | $134 |

| WorldCare Excel | $156 |

| WorldCare Apex | $250 |

You can see that basic plans start at about $29 per month. More complete plans can cost up to $250 per month. Most individual plans cost between $29 and $205 each month. Family plans can reach up to $4,240 per year. The cost of healthcare in malaysia for insurance depends on your age, the coverage you want, and the company you choose.

If you are an expat, you need private insurance because you do not qualify for public subsidies. Insurance helps you pay for private care, which is faster and offers more choices. You should compare plans and think about your needs before you buy. Healthcare expenses in malaysia can be high if you use private hospitals without insurance. Health insurance protects you from unexpected healthcare costs in malaysia.

Cost of Education in Malaysia

Public Schools

You can send your child to public schools in Malaysia for a very low cost. The government covers most of the expenses. You only pay small fees for registration, uniforms, books, and school supplies. These fees usually add up to about $50–$100 per year. Public schools teach in Malay, but some offer classes in English or Chinese. You will find that public schools provide a good education for most children. If you want to save money, public schools are the best choice.

Private and International Schools

If you want your child to learn in English or follow a different curriculum, you can choose private or international schools. These schools charge much higher fees. Private school tuition ranges from $2,000 to $10,000 per year. International schools can cost $5,000 to $25,000 per year, depending on the grade and location. The cost of education in malaysia rises quickly if you pick these options. You also pay extra for uniforms, books, and activities. Many expats and some local families choose international schools for their global curriculum and smaller class sizes.

| School Type | Annual Tuition (USD) | Language of Instruction |

|---|---|---|

| Public School | 50 – 100 | Malay/English/Chinese |

| Private School | 2,000 – 10,000 | English/Malay/Chinese |

| International School | 5,000 – 25,000 | English/Other |

Note: Some schools offer scholarships or sibling discounts. You should ask about these options when you apply.

Childcare

You may need childcare if both parents work. Childcare centers and kindergartens charge $100–$400 per month for each child. Prices depend on the location, hours, and services. Some centers offer meals and learning activities. Nannies and babysitters cost more, usually $400–$800 per month. The cost of education in malaysia for young children includes these early learning expenses. You should compare different centers to find the best fit for your family.

Leisure and Lifestyle

Entertainment

You can find many entertainment options in Malaysia. Movie tickets cost about $3 to $5 per person. Bowling, karaoke, and arcade games are popular and usually cost $2 to $8 per session. If you like concerts or theater, ticket prices start at $10 and can go up to $50 for big events. Many shopping malls have free events and performances. You can also visit museums and art galleries for $2 to $6. If you want to save money, look for student discounts or weekday deals.

| Activity | Average Cost (USD) |

|---|---|

| Movie Ticket | 3 – 5 |

| Bowling/Karaoke | 2 – 8 |

| Concert/Theater | 10 – 50 |

| Museum/Gallery | 2 – 6 |

Tip: Check online for special promotions before you go out.

Fitness and Hobbies

You have many ways to stay active in Malaysia. Gym memberships cost about $25 to $50 per month. Yoga or dance classes range from $8 to $15 per session. If you prefer outdoor activities, public parks and hiking trails are free. Sports clubs, such as badminton or futsal, charge $3 to $10 per session. You can also join hobby groups for photography, painting, or music. These groups often meet in community centers or cafes and may charge a small fee.

- Gym membership: $25–$50/month

- Yoga/dance class: $8–$15/session

- Sports club: $3–$10/session

Travel

Traveling within Malaysia is affordable. Bus tickets between cities start at $5. Train rides cost $7 to $20, depending on the distance. Domestic flights can be as low as $20 if you book early. Many people take weekend trips to islands or highlands. Budget hotels charge $15 to $30 per night. If you want to explore nearby countries, you can find flights to Thailand, Singapore, or Indonesia for under $50. Always compare prices online before booking.

You should include food and entertainment costs in your travel budget. Planning ahead helps you enjoy more activities without overspending.

Budgeting Tips for Malaysia

Tracking Expenses

You need to track your expenses to understand where your money goes each month. Start by writing down every purchase, no matter how small. Use a notebook, a spreadsheet, or a free budgeting app. Many people find that apps help them see spending patterns. You can set categories like rent, food, transport, and entertainment. Review your expenses weekly. This habit helps you spot areas where you spend too much. If you want to know how to budget as an expat in malaysia, tracking your expenses is the first step.

Tip: Set a reminder on your phone to record your spending each day. This keeps you on track and helps you avoid surprises.

Saving Strategies

You can save money in Malaysia by making smart choices. Cook at home instead of eating out often. Shop at local markets for fresh produce at lower prices. Use public transport when possible. If you need a bank account, consider Hong Kong banks for international transfers. They often offer better exchange rates and lower fees. Set a monthly savings goal and treat it like a bill you must pay. Try to save at least 10% of your income each month. If you want to learn how to budget as an expat in malaysia, focus on needs before wants.

| Saving Tip | Estimated Savings (USD/month) |

|---|---|

| Cook at home | 50 – 100 |

| Use public transport | 40 – 80 |

| Shop at local markets | 20 – 40 |

Using Local Resources

You can use many local resources to stretch your budget. Look for community centers that offer free or low-cost classes. Join local social media groups to find deals on housing, food, and events. Many supermarkets have loyalty programs that give discounts or points. Public libraries offer free internet and books. If you need help, ask neighbors or coworkers for advice on the best places to shop or eat. These resources help you live well without spending too much.

Note: Always compare prices and ask locals for recommendations. This helps you find the best value in your area.

You can manage the cost of living in Malaysia by understanding local expenses and making informed choices. The table below highlights key takeaways:

| Cost Component | Details & Tips |

|---|---|

| Rent | Kuala Lumpur is most expensive; Penang and Johor Bahru are more affordable. |

| Utilities | Save 15–25% by using energy-saving appliances and setting AC at 24–26°C. |

| Monthly Budget | Plan for hidden costs with a 10–15% extra allocation. |

| Lifestyle Tips | Eat local food and choose cities that fit your lifestyle and budget. |

To optimize your cost of living, follow these steps:

- Conduct a cost analysis to spot savings.

- Reallocate resources to maximize value.

- Monitor expenses and adjust your plan regularly.

Start by researching the cost of living in your chosen city and use local resources to stretch your budget.

FAQ

How can you create a realistic monthly budget in Malaysia?

Start by listing your fixed costs, such as rent and utilities. Track your daily spending on food, transport, and entertainment. Use a budgeting app or a simple spreadsheet. Review your expenses every week. Adjust your budget if you notice overspending.

What are some affordable cities to live in besides Kuala Lumpur?

You can consider Penang, Johor Bahru, or Ipoh. These cities offer lower rent and food prices. The table below shows average monthly living costs for a single person:

| City | Average Cost (USD) |

|---|---|

| Penang | 457 |

| Johor Bahru | 501 |

| Ipoh | 400 |

Which banks are best for expats to open an account in Malaysia?

You can open an account with Hong Kong banks like HSBC or Standard Chartered. These banks offer international transfers and online banking. Bring your passport, visa, and proof of address. Ask about fees and minimum balance requirements before you choose a bank.

How do you access affordable healthcare in Malaysia?

Visit public clinics for low-cost care. You pay about $0.20 for a general visit. Private clinics cost more but offer faster service. Consider health insurance if you want to use private hospitals. Always compare plans to find the best coverage for your needs.

Managing everyday expenses in Malaysia is already a balancing act — but hidden transfer fees and poor exchange rates can make it even harder for expats and families to stretch their budgets. That’s where BiyaPay comes in. With real-time transparent exchange rates, multi-fiat and crypto conversions, and transfer fees as low as 0.5%, you keep more of your money when sending funds across borders.

Plus, BiyaPay supports same-day settlement in most countries worldwide, so whether you’re paying rent, supporting family, or moving savings, your transfers are efficient and reliable. Financial control isn’t just about cutting daily costs — it’s also about choosing smarter tools for global payments.

Take charge of your budget today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

2025 Latest US Stock Account Opening Tutorial: Complete Online Application in 5 Steps

In-Depth Analysis of US Stock Pre-Market Trading: Unveiling the Secrets of the Market Before Opening

Overcoming Human Weaknesses: Detailed Guide to Beginner-Friendly Automated US Stock Trading Strategies

Profit Expansion is the Core Driver: Analyzing the Growth Engines of the US Stock Market in 2026

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.