Everything You Need to Know About Mailing Money in the US

Image Source: pexels

You may wonder if mailing money in the US is possible. You can mail money by using approved methods. The USPS allows you to send cash, but strict rules apply. Mailing money in the US carries risks, so you should use secure options like USPS money orders or checks. The USPS sets a $500 cash limit for regular mail. When you send larger amounts, you must use Registered Mail. Always choose safe methods to protect your funds.

Key Takeaways

- Mailing money in the US is legal but comes with risks, so use safe methods like USPS money orders or Registered Mail.

- You can send up to $500 in cash by regular mail; amounts over $500 require Registered Mail for insurance and tracking.

- USPS money orders are a secure, low-cost way to send money up to $1,000 per order with tracking and replacement options.

- Always keep receipts and tracking numbers to protect your money and help report problems if your mail is lost or stolen.

- Avoid scams by never sharing personal info with strangers and use traceable payment methods like money orders or cashier’s checks.

Mailing Money in the US

Image Source: pexels

Is It Legal?

You can legally send money through the mail in the US. The USPS allows you to mail cash, checks, and money orders for legitimate reasons. Federal laws like the Postal Accountability and Enhancement Act and the Postal Service Reform Act set rules for USPS operations. These laws do not directly ban mailing money in the US. You should know that mailing money in the US comes with risks. The USPS and the Postal Inspection Service warn about theft, loss, and damage. Sometimes, even postal employees have stolen cash from mail. The USPS strongly discourages sending cash and recommends using money orders instead. If you suspect mail theft, you can report it online to postal inspectors.

Here is a table that shows the main legal points about mailing money in the US:

| Aspect | Details |

|---|---|

| Legality | Mailing money is legal for legitimate purposes. |

| Restrictions | Cash over $500 must go by Registered Mail. |

| Insurance | Registered Mail insures up to $50,000 for cash. Other mail classes cover only up to $15. |

| Recommendations | USPS suggests using money orders for safety. |

| Reporting | Report suspected mail theft online. |

Cash Limits and Rules

When you think about mailing money in the US, you need to follow strict USPS rules. You can mail up to $500 in cash using regular mail. If you want to send more than $500, you must use Registered Mail. Registered Mail gives you insurance for amounts up to $50,000. If you try to use other mail classes, you only get a maximum of $15 in coverage for cash. You must declare the full amount if you send more than $50,000, but insurance still stops at $50,000.

Tip: The USPS recommends money orders as a safer way to send funds. Money orders have tracking, security features, and can be replaced if lost or stolen.

Here is a quick list of the main USPS rules for mailing money in the US:

- Mailing cash is legal but risky.

- Cash over $500 must use Registered Mail.

- Registered Mail insures up to $50,000.

- Other mail classes only insure up to $15 for cash.

- USPS recommends money orders for safety.

If you choose a money order, you can send up to $1,000 per order. You must pay with cash or a debit card at any USPS Post Office. You fill out the money order at the counter with a retail associate. Fees depend on the amount. For example, sending up to $500 costs $2.55, and sending $500.01 to $1,000 costs $3.60. Always keep your receipt to track your money order.

| Requirement/Step | Details |

|---|---|

| Maximum Amount per Money Order | $1,000 |

| Payment Methods | Cash or debit card only |

| Purchase Location | Any USPS Post Office |

| Filling Out Money Order | At the counter with a retail associate |

| Fees | $0.01-$500 = $2.55; $500.01-$1,000 = $3.60 |

| Receipt | Keep for tracking and proof |

| Replacement | $21 processing fee if lost or stolen; may take up to 60 days |

You should always consider safer alternatives when mailing money in the US. Money orders and checks offer better security and tracking than cash. The USPS has set these rules to protect you and your funds.

How to Send Money Safely

Image Source: pexels

When you want to send money in the US, you have several options. Each method has different steps, costs, and security features. You should always choose the safest way to mail a payment or transfer funds. Here is how to send money using the most common and secure payment methods.

USPS Money Order

A USPS money order is a prepaid way to send money. Many people use money orders to send money by mail because they are safe and easy to track. You can buy a USPS money order at any post office in the US. Here is how to send money with a USPS money order:

- Visit a USPS branch to purchase a money order.

- Fill out the money order. Write the recipient’s name in the “Pay to” field. Add your information in the “From” section. Sign the front of the money order.

- Pay for the money order using cash, debit card, or traveler’s check.

- Deliver the money order to the recipient. You can give it in person or mail it to their address.

- Keep the receipt. You can use it to track the money order or request a replacement if it gets lost.

Note: Always keep your receipt. It helps you track your money order and protects you if you need a replacement.

You can send up to $1,000 with a single USPS money order. If you need to send more, you can buy several money orders. The daily purchase limit is $10,000. If you buy $3,000 or more in one day, you must fill out a Funds Transaction Report and show a valid photo ID.

- The maximum amount for a single USPS money order is $1,000.

- You can buy multiple money orders if you need to send more than $1,000.

- The daily limit for buying money orders is $10,000.

- If you buy $3,000 or more in one day, you must show ID and fill out a report.

The cost for a USPS money order depends on the amount. For amounts up to $500, the fee is $2.55. For amounts from $500.01 to $1,000, the fee is $3.60. This makes money orders a low-cost and secure payment method for mailing money in the US.

Checks and Cashier’s Checks

You can also send money by mailing a check or a cashier’s check. A personal check is a slip from your bank account. A cashier’s check is a check that the bank writes and guarantees with its own funds. Many people use cashier’s checks for large or important payments.

Cashier’s checks are more secure than personal checks. The bank guarantees the funds, so the check will not bounce. Cashier’s checks have extra security features. They are less likely to be stolen or forged. Many people use cashier’s checks for big payments, like buying a car or paying a deposit. Personal checks can bounce if you do not have enough money in your account. This can cause delays or problems for the person receiving the money.

The cost for a cashier’s check is usually between $10 and $15. Some banks may waive the fee for certain account holders. Money orders cost less, usually between $0.35 and $5, depending on where you buy them. USPS money orders cost up to $3.60. Money orders are best for smaller amounts, while cashier’s checks are better for large payments.

| Instrument | Typical Fee Range (USD) | Notes |

|---|---|---|

| Cashier’s Check | $10 - $15 | Some banks waive fees for certain account holders; used for larger transactions |

| Money Order | $0.35 - $5 | USPS money orders up to $3.60; bank money orders around $5; used for smaller amounts |

Tip: Use a cashier’s check for large or important payments. Use a USPS money order for smaller amounts or when you want a low-cost option.

Registered Mail

Registered Mail is the most secure way to send money or valuable items through the USPS. When you use Registered Mail, the USPS tracks your package at every step. You can insure the shipment for up to $50,000. The recipient must sign for the package when it arrives. This adds another layer of security.

You should use Registered Mail when you need to send money, checks, or money orders that are very valuable. Registered Mail protects your funds and gives you peace of mind. The USPS recommends using traceable and insurable methods like Registered Mail, cashier’s checks, or money orders instead of cash.

- Registered Mail tracks your package at every step.

- You can insure your shipment for up to $50,000.

- The recipient must sign for the package.

- Registered Mail is the most secure service for mailing money in the US.

Note: Always use Registered Mail for large amounts or important payments. It is the safest way to send money by mail.

When you think about how to send money in the US, you should compare the security, cost, and process of each method. USPS money orders are a secure, low-cost option for small to medium amounts. Cashier’s checks offer more security for large payments. Registered Mail gives you the highest level of protection when mailing money, checks, or money orders.

Pros and Cons of Mailing Money Methods

Security and Tracking

When you send money in the US, you want to know your funds are safe. Each method for mailing money offers different levels of security and tracking. USPS uses strong security measures like visual screening, X-ray scanning, and background checks for staff. You can track packages with Registered Mail, which logs every step from drop-off to delivery. Money orders and cashier’s checks also give you proof of payment and tracking numbers. Personal checks are safer than cash, but they can get lost or stolen. Banks and the USPS both require signatures for valuable items, which adds another layer of safety.

Here is a quick look at how security and tracking work for each method:

- USPS money order: Tracking number, proof of payment, can be replaced if lost.

- Cashier’s check: Bank guarantees funds, tracking through the bank, hard to forge.

- Personal check: Safer than cash, but can be altered or stolen.

- Registered Mail: Highest security, full tracking, insurance up to $50,000.

Tip: Always keep your receipts and tracking numbers when you send money. This helps you follow your funds and report problems if needed.

Fees and Limits

You should always check the cost and limits before you mail money in the US. Each method has its own fees and maximum amounts. For example, a USPS money order costs up to $5 and lets you send up to $1,000 per transaction. If you need to send more, you can buy several money orders. Personal checks do not have a fee, but you need enough money in your account. Cashier’s checks cost about $10–$15 and usually have no upper limit. Wire transfers are fast but cost $25–$40 and let you send up to $100,000 per day.

Here is a table that compares the main options:

| Method | Fee Range | Maximum Limit | Notes |

|---|---|---|---|

| Money order | Up to $5 | $1,000 per transaction | No bank account needed; safe for small amounts |

| Personal check | None | No limit (funds must be available) | Needs bank account; flexible amount |

| Cashier’s check | $10–$15 | Usually no upper limit | Guaranteed payment; good for large payments |

| Wire transfer | $25–$40 | Up to $100,000 per day | Fast, reliable, higher cost |

You should choose the method that fits your needs. If you want a low-cost way to send money, a USPS money order works well for small amounts. For large payments, a cashier’s check or wire transfer may be better.

Protecting Against Fraud and Loss

Insurance and Tracking Options

When you send a remittance in the US, you want to protect your funds from loss or theft. The USPS offers several insurance and tracking services to help you keep your remittance safe. You can choose from different options based on the value and type of your remittance. Here is a table that shows the main services you can use:

| Service Type | Description | Insurance Coverage | Tracking & Signature Options | Cost Range / Notes |

|---|---|---|---|---|

| Standard Shipping Insurance | Buy insurance up to $5,000 for loss or damage | Up to $5,000 | N/A | Starts at $2.70; ID for >$500 |

| Priority Mail Express | Includes $100 insurance; extra available | $100 included, more for fee | Tracking barcode; signature may be required | Included in price |

| Priority Mail | Includes $100 insurance; extra available | $100 included, more for fee | Tracking barcode | Included in price |

| USPS Ground Advantage | Includes $100 insurance; extra available | $100 included, more for fee | Tracking barcode | Included in price |

| Registered Mail | Maximum security; up to $50,000 insurance | Up to $50,000 | Receipt and electronic delivery verification | Starts at $19.70; ID required |

| Certified Mail | Proof of mailing and delivery with signature | N/A | Signature on delivery | $5.30; ID may be required |

| Return Receipt | Delivery record with recipient signature | N/A | Signature record | $4.40 (mail), $2.82 (email) |

| Certificate of Mailing | Official record of mailing date | N/A | N/A | $2.40 |

| Signature Confirmation | Confirms delivery with signature and ID | N/A | Signature required | $4.95 (Post Office), $3.95 (online) |

| USPS Tracking® | Tracking updates for delivery or attempt | N/A | Tracking updates | No charge |

| USPS Tracking Plus® | Extended tracking history | N/A | Extended tracking history | Starts at $2.50 |

| Hold For Pickup | Pick up items at Post Office | N/A | Email notification; ID required | No charge |

Tracking helps you follow your remittance as it moves through the USPS system. Insurance gives you financial protection if your remittance gets lost or damaged. If you need to file a claim, you must provide documents like tracking numbers and proof of value. The process can take time, but insurance helps you recover your money. Tracking systems work well, but sometimes labels get damaged or packages are lost. Using both tracking and insurance gives you the best chance to protect your remittance.

Tip: Always keep your receipts and tracking numbers when you send a remittance. This makes it easier to file a claim if something goes wrong.

Avoiding Scams

Scams can target anyone sending a remittance in the US. You need to know the most common scams and how to avoid them. Scammers use many tricks to steal your remittance, such as:

- Impostor scams: Someone pretends to be a trusted person or group.

- Lottery or prize scams: You are told you won a prize but must pay a fee.

- Mail fraud: Fake letters ask for money or personal details.

- Man-in-the-middle scams: Scammers intercept your remittance.

- Money mule scams: You are tricked into moving stolen money.

- IRS extortion scams: Threats to pay fake taxes.

- Refund scams: False claims of owed refunds.

- Disaster relief scams: Fake donation requests.

- Purchase scams: Selling fake goods or services.

- Romance scams: Building fake relationships to get money.

- Charity scams: Asking for donations to fake causes.

- Debt collection scams: Demanding payment for fake debts.

- Mortgage closing scams: Requesting funds for fake closings.

You can protect your remittance by following these steps:

- Block unwanted calls and texts to reduce scam attempts.

- Never share personal or financial information with unknown contacts.

- Avoid clicking links in emails or texts from strangers; contact companies directly.

- Take your time and do not rush decisions, even if someone pressures you.

- Use secure and traceable payment methods like a money order or USPS services.

- Always verify the recipient’s identity before sending a remittance.

- Do not send remittance by wire transfer or gift card to people you have not met face-to-face.

- Be careful with requests from people you meet online.

- Keep your personal information private on social media.

- Report suspicious requests to USPS or your remittance service.

Note: Scammers often ask for remittance using wire transfers, gift cards, or cryptocurrency because these are hard to trace. Always use secure USPS services when sending remittance in the US.

Requirements and Restrictions in the US

Age and ID

When you send a remittance in the US, you do not face any age restrictions. Anyone who lives in the US can send money by mail, no matter their age. The US government does not set a minimum age for sending a remittance. However, you must show a valid government-issued ID when you mail money. The USPS asks for this ID to confirm your identity and keep your remittance secure. You can use a driver’s license, passport, military ID, or state ID. The USPS may require a copy of your ID to go with your package, especially for larger remittance amounts or when you send money internationally. This rule helps prevent fraud and protects your funds.

Note: Always bring your ID when you visit the post office to send a remittance. This step makes the process smoother and safer for everyone.

- No age restriction for sending remittance in the US

- Valid government-issued ID required

- Accepted IDs: driver’s license, passport, military ID, state ID

- ID helps verify your identity and protect your remittance

Maximum Amounts

You need to know the maximum amounts allowed when you send a remittance in the US. The limits depend on the service you choose. For USPS money orders, you can send up to $1,000 per order. If you need to send more, you can buy several money orders, but the daily limit is $10,000. Banks and online services set their own limits for remittance. For example, PayPal lets you send up to $60,000 per transaction from a verified account. Wire transfer limits change by bank, with daily maximums ranging from $1,000 to $250,000 or more. Some banks have lower limits for new accounts or certain types of remittance.

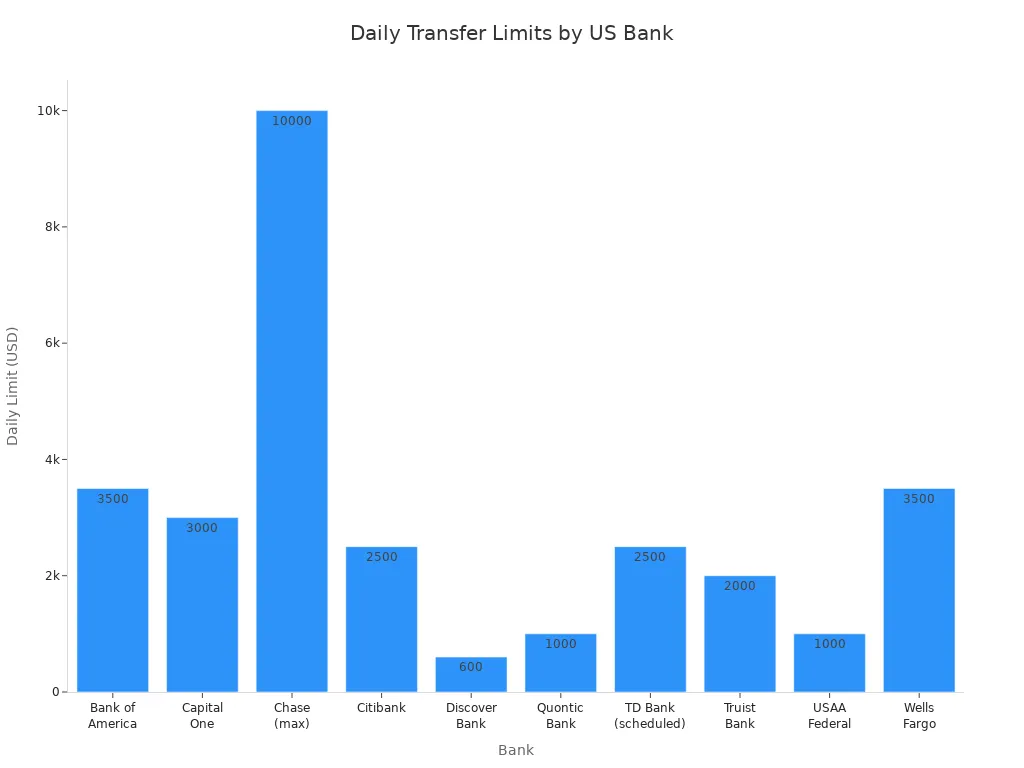

Here is a table showing the daily and monthly Zelle transfer limits implemented for individual customers by major US banks:

| Bank | Daily Transfer Limit | Monthly Transfer Limit |

|---|---|---|

| Bank of America | Around $3,500 | Up to $20,000 |

| Capital One | Around $3,000 | Not disclosed |

| Chase | $500 to $10,000 per txn | Not disclosed |

| Citibank | $2,500 (after 30 days) | $15,000 (after 30 days) |

| Discover Bank | $600 | Not disclosed |

| Quontic Bank | $500 per txn; $1,000 daily | Not disclosed |

| TD Bank | $1,000 instant; $2,500 scheduled | $5,000 instant; $10,000 scheduled |

| Truist Bank | $2,000 | $10,000 |

| USAA Federal | $1,000 | $10,000 |

| Wells Fargo | $3,500 | $20,000 |

You should always check with your bank or remittance provider for the latest limits. Limits can change based on your account type or how long you have used the service. Knowing these rules helps you plan your remittance and avoid delays.

Best Practices for Mailing Money

Tips for Safe Mailing

When you want to send money in the US, you should always follow safe mailing practices. These steps help protect your funds and make sure your payment arrives at the right place.

1. Take your letter or package to a secure postal collection point. Use an official postal box, a uniformed mail carrier, or the Post Office. Do not leave it in an open mailbox.

2. Choose Certified Mail® or Registered Mail for important payments. These services give you tracking and delivery confirmation.

3. If you use a check, write “For deposit only to account of payee” on the back. This step helps prevent someone else from cashing it.

4. Hide the check or money order inside a folded sheet of paper. This keeps the contents private and less visible through the envelope.

5. Double-check the recipient’s address before you mail anything. A small mistake can send money to the wrong person.

6. If your check or money order gets lost, contact your bank or the USPS right away. You can ask for a stop payment or a replacement.

7. Think about using wire transfers or digital payment services if you need extra security. These options may offer faster delivery and better tracking.

Tip: Always keep your receipts and tracking numbers. These records help you follow your payment and solve problems if they happen.

Common Mistakes

Many people make simple mistakes when they send money in the US. Knowing these errors can help you avoid trouble and keep your funds safe.

1. Entering the wrong recipient details, such as name or account number, can cause delays or lost payments.

2. Not having enough funds to cover both the payment and any fees may lead to failed transfers.

3. Forgetting about timing, like bank holidays or exchange rates, can slow down delivery or change the amount received.

4. Sending money to someone you do not know or trust can lead to scams or fraud.

5. Picking the wrong transfer method may cost you more or take longer than needed.

6. Using a regular bank instead of a specialized service can mean higher fees and less favorable rates.

You should always double-check every detail before you send money. Choose the right method for your needs, and use a money order or other secure option when possible. These steps help you avoid common problems and keep your funds safe in the US.

You have several secure ways to mail money in the US. The table below shows the safest options:

| Mailing Service | Security Level | Insurance Coverage | Tracking | Key Notes |

|---|---|---|---|---|

| Registered Mail | Highest | Up to $50,000 | Yes | Most secure; signature required |

| Certified Mail | Proof of delivery | None | Yes | Receipt and delivery confirmation |

| Priority Mail | Fast, less secure | $100 | Yes | Good for speed, not for sensitive items |

| First-Class Mail | Least secure | None | No | Not for mailing money |

You should always follow USPS rules and use traceable methods. To protect your funds in the US, avoid mailing cash and use best practices like tracking, insurance, and address verification.

FAQ

Can you send a remittance from the US to another country?

Yes, you can send a remittance from the US to many international locations. You can use banks, online services, or the USPS for this purpose. Always check the rules for international transfers before you send money overseas.

What is the safest way to send a remittance internationally from the US?

You should use a trusted bank or a well-known online service for international remittance. Many people choose international money transfer services because they offer tracking and support. These services help you send money overseas safely from the US.

Are there limits on international remittance from the US?

Yes, you will find limits for international remittance. Banks and services set daily or monthly caps. You should ask your provider about their rules before you send money overseas. Some services may also require ID for large international transfers.

How long does an international remittance take from the US?

The time for an international remittance depends on the service you use. Some banks and online services deliver funds in one to three days. Other international transfers may take up to a week. Always ask your provider for an estimated delivery time.

What documents do you need for international remittance from the US?

You need a valid ID, such as a passport or driver’s license, to send an international remittance from the US. Some services may ask for proof of address or the recipient’s details. Always prepare your documents before you start an international transfer.

While mailing money in the US is possible, the process often feels outdated—cash limits, extra fees, and long waiting times make it less secure and more stressful. Instead of worrying about whether your funds will arrive safely, you can choose BiyaPay. With remittance fees as low as 0.5%, real-time exchange rates, and the ability to convert between multiple fiat and digital currencies, BiyaPay offers a faster, more transparent way to move money. Registration takes only minutes, and you can enjoy same-day delivery across most countries and regions worldwide.

Skip the risks of mailing money—opt for a modern, secure solution that works wherever you are. Start using BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Say Goodbye to Currency Exchange Hassles: In-Depth Review of the Best Channels for Converting RMB to USD

Guide to Remitting Money from Abroad to China and RMB Exchange

Want to Invest in US Stocks from Taiwan? Complete Guide to Popular Brokers: Account Opening Process & Pros/Cons Analysis

US Index ETF Investing 2025: From Beginner to Pro – Strategies and Top Recommendations

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.